The Effect of Sustainability Report Disclosure on Financial

Performance

Linda Agustina

1

, Kuat Waluyo Jati

1

and Dhini Suryandari

1

1

Faculty of Economics, Universitas Negeri Semarang, Semarang -Indonesia

Keywords: Sustainability Report Disclosure, Financial Performance, Current Ratio

Abstract: The purpose of this study was to analyse the effect of sustainability report disclosures on

financial performance. Sustainability report disclosures can be seen from economic performance,

environmental performance and social performance in accordance with the Global Reporting

Initiative (GRI) index. The population of this study are all companies that were nominated for the

Sustainability Reporting Award (SRA) in 2013-2016 as much as 69 companies. The sample was

obtained by 13 companies using purposive sampling technique, so that the numbers of analysis

units were 39. Data are collected by documentation techniques, by downloading the annual report

and sustainability reporting through the company's website, IDX and the National Centre for

Sustainability Reporting (NCSR). The data analysis used in this study is descriptive statistical

analysis and multiple regression analysis. The results of this study show partially that social

performance disclosure variables affect financial performance, while the disclosure of economic

performance and social performance is not able to influence. Simultaneously, sustainability

report disclosures affect

financial performance. Future research is expected to use a wider sample, not

limited to companies listed on the IDX. It is hoped that in the future more companies will make and issue

sustainability report.

1 INTRODUCTION

Good financial performance is one basis for

investors in making investment decisions (Ganto et

al., 2008). Investors need financial performance

information because they can describe the real

condition of the company. Putri (2013) states that

investors need information to see the company's

prospects associated with the costs they will incur to

invest. Investors prefer companies that disclose a lot

of company information because they are considered

to be lower risk companies. One of the information

sources for external parties in assessing company

performance is Sustainability Reporting (SR).

Elkington (1997) defines sustainability report as

a report that contains financial and non-financial

information consisting of information on social and

environmental activities that enable companies to

grow sustainably. The importance of drafting the

sustainability report is because it contains disclosure

principles and standards that reflect the overall level

of company activity, not just focusing on financial

aspects. The disclosure of sustainability report can

be used as a strategy for companies to improve the

company's financial performance (Burhan and

Rahmanti, 2012). Hastuti (2005) states that there

are several factors that influence the high and low

performance of a company, which are concentrated

or not concentrated ownership, profit manipulation

(income smoothing), and level of disclosure.

The development of sustainability report in

Indonesia, in 2005-2006 was only 5 companies that

published it. In 2011 Ali Darwin, Chairman of the

National Centre for Sustainability Report (NCSR)

revealed, of the 438 companies listed on the

Indonesia Stock Exchange (IDX) only 25 companies

issued sustainability reports (Gunawan, 2011).

1050

Agustina, L., Jati, K. and Suryandari, D.

The Effect of Sustainability Report Disclosure on Financial Performance.

DOI: 10.5220/0009502610501055

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1050-1055

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Based on data from the Global Reporting Initiatives

(GRI) in December 2016, as many as 120 companies

have made and published their reports. This shows

that the sustainability report disclosure in Indonesia

is not optimal. Adams et al. ( 2010) said that one of

the factors that caused a company not to compile the

sustainability report was due to the uneven

viewpoint of the executives in looking at the

sustainability report.

Previous research on sustainability report on

financial performance has mixed results.

Soelistyoningrum (2011), Handayani ( 2014), Putri,

(2015) and Safitri (2015) stated that sustainability

report disclosure had a positive effect on financial

performance. Arjowo (2013) and Wibowo and

Faradiza (2014) show that disclosure of

sustainability report does not significantly influence

the company's financial performance. Muallifin and

Priyadi (2016) show that sustainability report

influences financial performance measured using the

current ratio.

The existence of sustainability report makes the

trust of investors to invest in companies will

increase. Investors prefer to invest in companies that

are transparent because their trust in the

management higher that will forecast analysis more

accurately and lower asymmetry information (Ernst

& Young, 2013). Research on the effect of

sustainability report on financial performance has

yet to get a constant conclusion, so it is interesting to

be analysed again. This research refers to the latest

Global Reporting Initiative, namely Global

Reporting Initiative 4.0.

2 THEORICAL FRAMEWORK

The theory underlying this research is legitimacy

theory and stakeholder theory. Legitimacy Theory is

stated by Deegan (2000) as a theory that assumes

that companies continually strive to ensure the

operations they carry out are under existing social

norms and rules. They want to make sure that the

business they run is a legitimate and legal business.

Legitimacy theory believes in the existence of a

social contract between the company and the social

environment in which they operate. The concept of

legitimacy theory assumes that society has

expectations of company performance. Companies

will be considered to have carried out their

operations according to social rules and norms if

they can meet the expectations of the community.

Therefore, companies must consider the rights of the

community at large such as social and environmental

rights of the community as a form of corporate

responsibility towards them. This reflects that the

company will disclose voluntary reports to show that

the operations they carry out are in accordance with

what is expected by the community (stakeholders) as

a whole. For this reason, companies need to develop

sustainability reporting.

The basic concept of Stakeholder theory built by

Freeman (1984) defines that stakeholder as

individuals or organizations that influence the

company in achieving its objectives and also

influenced by activities carried out by the company.

The parties that can be said as company stakeholders

include shareholders, creditors, government,

employees, the surrounding community, and future

generations (Burhan and Rahmanti, 2012). In simple

terms, stakeholder theory describes which parties the

company must be responsible for. Therefore,

companies must maintain good relationships with all

stakeholders by accommodating the wants and needs

of their stakeholders. One good step to maintain

relationships with stakeholders is by disclosing the

sustainability report. Sustainability report reveals not

only economic performance, but environmental and

social performance. The complexity of the substance

contained in sustainability reports is expected to be

able to meet all information needs of stakeholders.

Meeting these information needs is expected to be

able to establish harmonious relations between the

company and its stakeholders (Adhima, 2013).

Sustainability reporting based on GRI 4.0

consists of three types of disclosures, namely

economic performance disclosure, environmental

performance disclosure, and social performance

disclosure. Sustainability reporting is an

embodiment of the three types of disclosures

incorporated into one whole unit. In this study each

of these disclosures is independently standing

variables in accordance with Nofianto and Agustina

(2014). The Economic Performance Disclosure

shows the impact of the company's operations on the

micro and macroeconomic environment. Companies

that have a major influence on improving the micro

and macro economy will attract investors and

customers to join as fund advocates and users of

company products. The higher support given by the

company to macroeconomic conditions shows the

more vital and significant role of the company in the

economy. By disclosing the company's economic

performance on sustainability reporting, it will affect

the company's financial performance. This is in

accordance with Putri (2017) which shows that

economic dimension variables have a positive effect

on financial performance.

The Effect of Sustainability Report Disclosure on Financial Performance

1051

Environmental performance disclosure is a

disclosure of the impact of the company's operations

on the environment and the steps taken by the

company to improve the quality of the surrounding

environment. Disclosure of this environmental

performance is important for the community so that

the company will strive to disclose more in

sustainability reporting to minimize existing risks.

This will make the community, including investors,

believe in investing so that it will increase the

company's financial performance. Adhima (2013)

also states that environmental performance

disclosure has a positive influence on the company's

financial performance.

Social Performance Disclosure reveals the social

impacts caused by company activities and the steps

taken by the company to overcome this. This

disclosure will create a positive impression in the

public. The impact of this disclosure will be the

higher stakeholder trust in the company so that

company performance will continue to improve,

including the company's financial performance.

Burhan and Rahmanti (2012) prove that social

performance disclosure has a significant influence

on the company's financial performance. Based on

the description, the hypotheses in this study are:

H1: Economic Performance Disclosure has a

positive effect on financial performance

H2: Environmental Performance Disclosure has a

positive effect on financial performance

H3: Social Performance Disclosure has a positive

effect on financial performance

H4: The Disclosure of Economic Performance,

Environmental Performance and Social

Performance Disclosure simultaneously affect

the financial performance

3 RESEARCH METHOD

This research is a quantitative research where the

data used is quantitative data obtained from

sustainability reporting, and annual reports issued by

the company. The population in this study were all

companies that were nominated for the

Sustainability Reporting Award (SRA) during the

2014-2016 period of 69 companies. The research

sample was obtained using purposive sampling

technique with the criteria (1) companies listed on

the Indonesia Stock Exchange (IDX) and published

Sustainability Reports and Anual Reports in 2014-

2016 and can be accessed through company

websites, (2) companies publishes Sustainability

Report with the latest guidelines from the Global

Reporting Initiative (GRI), GRI-G4, (3) companies

provide complete information regarding the

variables studied, namely the current ratio (CR).

Based on these criteria obtained a sample of 13

companies with a three-year observation period, so

that the analysis unit was 39. Most of the companies

that were nominated for SRA were not listed on the

IDX which amounted to 71% (49 companies).

The variable of this study consisted of one

dependent variable namely financial performance

and three independent variables, namely three

dimensions of sustainability reporting disclosure

(Economic Performance Disclosure, Environmental

Performance Disclosure and Social Performance

Disclosure). Financial performance is proxied by

liquidity ratios, which is a ratio that measures a

company's ability to meet its short-term obligations.

The liquidity ratio in this study uses the current ratio

(CR), which is current asset divided by current debt.

Sustainability reporting is measured using the

Sustainability Report Disclosure Index (SRDI), both

the overall score index and the respective

performance. Overall, there are 91 sustainability

report assessment items based on the GRI G4

Guidelines. Environmental Performance Disclosure

consists of 34 and the Social Performance

Disclosure consists of 48 items. SRDI calculation is

done by giving a score of 1 if an item is disclosed,

and 0 if not disclosed. After scoring all items, the

score is then added to get the total score for each

company. The formula for calculating SRDI is the

number of items disclosed by the company divided

by the number of items expected in the GRI G4

Guidelines.

The data used in this study is secondary data in

the form of annual reports and the company's

sustainability report with documentation techniques.

These data are obtained by downloading the annual

report and sustainability report on the ISRA website

(http://sra.ncsr-id.org) or can be accessed directly on

the website of each company. The data collected was

analysed by descriptive statistical analysis and

multiple regression analysis.

4 RESULTS AND DISCUSSION

The results of the descriptive statistical analysis are

presented in the following Table 1:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1052

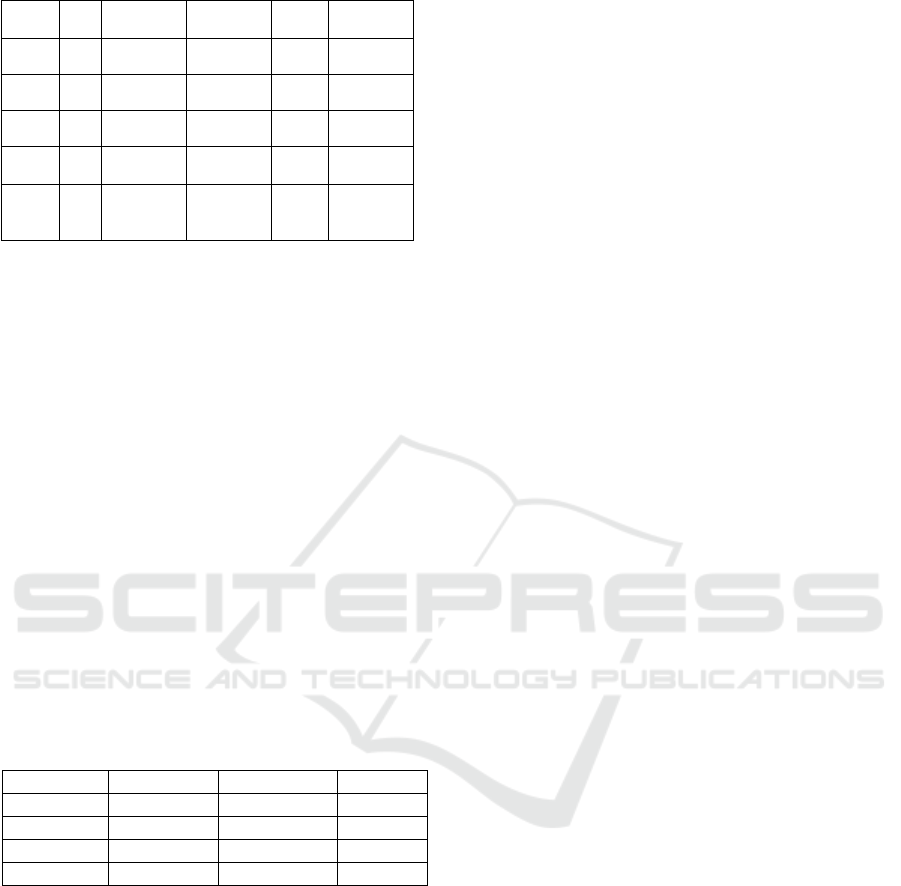

Table 1: Results of Descriptive Statistics Analysis

N Minimum Maximum Mean

Std.

Deviation

CR

39 1,23 40,30 9,23 4,66

EC

39 0,22 0,78

0,32 ,024

EN

39 0,03 0,97

0,32 ,034

SO

39 0,08 0,98

0,32 ,020

Valid

N (list

wise)

39

Table 1 shows that the number of units analysed is

3 9. Financial performance measured by the current

ratio has a good average of 9.23 where the company

in this study sample has sufficient current assets to

pay its short-term debt. Disclosure of economic

performance, environmental performance and social

performance in the SR in this study had almost the

same average of 0.32. This shows that companies

are still lacking in disclosing their performance in

the SR because the average figure is still below

50%, although there are high disclosures but most

are still less than 50%.

Data that will be tested for multiple regressions

previously must be tested classic assumptions with

normality test, multicollinearity test,

heteroscedasticity test and autocorrelation test. The

data in this study have been tested for classical

assumptions and have met the BLUE (Best Linear

Unbiased Estimator) requirements. The recap of

the results of the regression analysis is as follows:

Table 2: Results of Multiple Regression Analysis

H

ypotheses Coefficient Significance Result

H1 7,933 0,799 rejected

H2 33,538 0,109 rejected

H3 111,661 0,002 accepted

H4 0,001 accepted

Table 2 shows that only two hypotheses are

accepted, namely the disclosure of social

performance partially and testing simultaneously

able to influence financial performance (CR).

The first and second hypotheses of this study

show that disclosure of economic performance and

environmental performance in sustainability

reporting has no effect on financial

performance. Economic performance disclosure

does not have a significant influence on the

company's financial performance because this

research is conducted in the short term. Adams et al.

(2010) states that the sustainability report will have a

significant influence in the long run. While if the

research is conducted in the short term

it will not have a significant effect. The second

reason underlying the rejection of the hypothesis is

that the average financial performance of the

company studied is quite high (9.22%) so that

disclosure of economic performance does not have a

significant impact on the company's financial

performance.

Jin et al. (2010) revealed that environmental

performance disclosure will affect the market

response in a long period of time. After the market

reaction moves in a positive direction, the

company will develop and its financial performance

will improve. However, in the short term, the impact

cannot be seen because the effect of disclosing

environmental performance on the company's

financial performance does not occur instantly. The

results of this study are in line with Putri (2018)

which states that economic performance and

environmental performance have no effect on

liquidity. Burhan and Rahmanti (2012) and Putri

(2017) who stated that environmental performance

disclosure does not have a significant effect on the

company's financial performance.

Disclosure of social performance in this study

has a positive effect. Companies that disclose social

performance on sustainability reporting will increase

their financial performance. This is in accordance

with the legitimacy theory where the community has

a lot of expectations for the company's performance.

Companies will be considered to have carried out

their operations according to social rules and norms

if they can fulfil these expectations. Companies need

to consider social rights of the community as a form

of corporate responsibility. For this reason,

companies disclose voluntary reports, namely

through disclosure of social performance, to show

that the operations they carry out are in accordance

with what is expected by the community as a whole.

Burhan and Rahmanti (2012) state that disclosure of

social performance influences company

performance.

Disclosure of performance in sustainability

reporting simultaneously affects financial

performance. This is in accordance with the

stakeholder theory in which the company must

maintain good relations with all its stakeholders to

accommodate their wishes and needs. One good way

to keep that relationship is to reveal the

sustainability report. Sustainability report reveals not

only economic performance, but environmental and

social performance. The complexity of the

substances contained in the sustainability reporting

expected to be able to satisfy all the information

needs of stakeholders. Adhima (2013) suggests that

The Effect of Sustainability Report Disclosure on Financial Performance

1053

the fulfilment of information needs is expected to

establish a harmonious relationship between the

company and its stakeholders. These results are in

accordance with Pratiwi and Sumaryati (2014)

which prove the sustainability report influences

financial performance. Muallifin and Priyadi (2016)

prove sustainability report influences financial

performance as measured by the current ratio.

5 CONCLUSIONS

The conclusions of this study based on the results

are only two of four hypotheses which are accepted,

namely the disclosure of social performance and

disclosure of performance in sustainability report

simultaneously. Future studies are expected to use a

sample not limited to companies listed on the IDX

because some of the companies that were nominated

for SRA for the 2014-2016 period were 71% not

listed on the IDX. Further research is expected in a

longer period of time to fully illustrate the effect of

sustainability report on financial performance and

add moderating variables. Sustainability report for

companies is very important, especially for go

public companies and listed on the IDX, it is hoped

that in the future more companies will make and

issue sustainability report.

REFERENCES

Adams, M., Barry, T. and Sepheri, M. (2010) ‘The Impact

of Pursuit of the Sustainability on the Financial

Performance of the Firm’, Journal of Sustainability

and Green Business.

Adhima, M. F. (2013) ‘Pengaruh Pengungkapan

Sustainability Report Terhadap Profitabilitas

Perusahaan Studi Kasus Pada Perusahaan Manufaktur

Yang Terdaftar Dalam Bursa Efek Indonesia’, Jurnal

Ilmiah Mahasiswa Feb, 1(1), pp. 1–22.

Arjowo, I. S. (2013) Pengaruh Pengungkapan

Sustainability Report Terhadap Kinerja Keuangan

Perusahaan (Studi Empiris pada Perusahaan

Manufaktur yang Terdaftar dalam Bursa Efek

Indonesia. Universitas Kristen Satya Wacana.

Available at:

http://repository.uksw.edu/handle/123456789/3705.

Burhan, A. H. N. and Rahmanti, W. (2012) ‘the Impact of

Sustainability Reporting’, Journal of Economics,

Business, and Accountancy Ventura, 15(2), pp. 257–

272.

Deegan, C. (2000) Financial Accounting Theory. Mc

Graw Hill.

Elkington, J. (1997) Canibals with Forks : The Triple

Bottom Line of 21st Century. Business, New Society.

Ernst & Young LLP and the Carroll School of

Management Center for Corporate Citizenship (2013)

‘Value of sustainability reporting.’

Freeman, R. E. (1984) Strategic Management. A

Stakeholder Approach. Pitman Publishing Inc.

Massachusetts.

Ganto, J. et al. (2008) ‘PENGARUH KINERJA

KEUANGAN PERUSAHAAN MANUFAKTUR

TERHADAP RETURN SAHAM DI BURSA EFEK

INDONESIA’, Media Riset Akuntansi, Auditing &

informasi, 8(1). Available at:

http://dx.doi.org/10.25105/mraai.v8i1.744.

Gunawan, H. (2011) ‘Dari 438 Emiten hanya 25

perusahaan yang membuat laporan berlanjutan.’

Available at: . http://investasi.kontan.co.id/news/dari-

438-emiten-hanya-25-perusahaan-yang-membuat-

laporan-berlanjutan.

Handayani, T. (2014) Pengaruh Pengungkapan

Sustainability Repor terhadap Likuiditas Perusahaan

yang Termasuk dalam Daftar Efek Syariah Tahun

2010-2012. Universitas Islam Negeri Sunan Kalijaga

Yogyakarta.

Hastuti, T. D. (2005) ‘Hubungan Antara Good Corporate

Governance dan Struktur Kepemilikan dengan Kinerja

Keuangan ( Studi Kasus Pada Perusahaan yang Listing

di Bursa Efek Jakarta )’, Simposium Nasional

Akuntansi VIII.

Jin, Y., Wheeler, D. and Wang, H. (2010) ‘The impact of

environmental performance rating and disclosure: an

empirical analysis of perceptions by polluting firms’

managers in China’, China.

Muallifin, O. R. and Priyadi, M. P. (2016) ‘Dampak

Pengungkapan Sustainability Report Terhadap Kinerja

Keuangan dan Kinerja Pasar’, Jurnal Ilmu dan Riser

Akuntansi, 5(5), pp. 1–20.

Nofianto, E. and Agustina, L. (2014) ‘Analisis Pengaruh

Sustainability Report Terhadap Kinerja Keuangan

Perusahaan’, Accounting Analysis Journal, 3(3).

Available at:

https://journal.unnes.ac.id/sju/index.php/aaj/article/vie

w/4205/3871.

Pratiwi, R. D. and Sumaryati, A. (2014) ‘Dampak

Sustainability Reporting terhadap Kinerja Keuangan

Dan Risiko Perusahaan (Studi Empiris Perusahaan

Yang Masuk Ke Srikehati Tahun 2009-2010)’, Jurnal

Dinamika Akuntansi, 6(2), pp. 153–167.

Putri, D. R. (2013) ‘Analisis Faktor-faktor yang

Mempengaruhi Indeks Pelaporan Keuangan Melalui

Internet’, Jurnal Reviu Akuntansi dan Keuangan, 3(1),

pp. 383–390.

Putri, I. M. (2017) Pengaruh Sustainability Report

Terhadap Kinerja Keuangan Dan Pasar (Studi Empiris

Pada Perusahaan Non Keuangan Yang Terdaftar Di

BEI Tahun 2014-2015). Available at:

http://digilib.unila.ac.id/28656/3/skripsi tanpa bab

pembahasan.pdf.

Putri, R. . (2015) Analisis Pengaruh Pengungkapan

Sustainability Report Terhadap Tingkat Profitabilitas,

Likuiditas, Dan Pertumbuhan Pendapatan Perusahaan.

Universitas Gajah Mada. Available at:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1054

http://etd.repository.ugm.ac.id/index.php?mod=penelit

ian_detail&sub=PenelitianDetail&act=view&typ=html

&buku_id=88169&obyek_id=4.

Putri, R. . (2018) ‘[ No Title ]’, Jurnal Akuntansi Unesa,

6(2), pp. 1–19.

Safitri, D. A. (2015) ‘Sustainability Report Terhadap

Kinerja Keuangan Dan Pasar’, Jurnal Ilmu & Riset

Akuntansi Vol. 4 No. 4 (2015), 4(4), pp. 1–15.

Soelistyoningrum, J. . (2011) Pengaruh Pengungkapan

Sustainability report terhadap Kinerja Keuangan.

Universitas Diponegoro Semarang.

Wibowo and Faradiza, S. A. (2014) ‘Dampak

Pengungkapan Sustainability Report Terhadap Kinerja

Keuangan dan Kinerja Pasar Perusahaan’, Simposium

Nasional Akuntansi XVII Mataram.

The Effect of Sustainability Report Disclosure on Financial Performance

1055