Analysis of Fundamental Factors Affecting Stock Prices in

Automotive Companies Listed on the Indonesia Stock Exchange

Period 2014-2017

Iqbal Firdausi

1

, Ibrahim Daud

1

, Riswan Lutfi

1

and M. Fajar Ansari

1

1

STIE Indonesia Banjarmasin

Keywords: Price to Book Value (PBV), Debt to Equity Ratio (DER), Earning Per Share (EPS), Return on Assets

(ROA), the stock price

Abstract: This study aimed to analyse the effect of variable Return on Total Assets (ROA), Return on Equity (ROE),

Price to Book Value (PBV), Debt to Equity Ratio (DER), and Earning per Share (EPS) simultaneously to

the stock price of companies automotive listed on the Indonesia Stock Exchange and analyse the effect of

variable Return on Total Assets (ROA), Return on Equity (ROE), Price to Book Value (PBV), Debt to

Equity Ratio (DER), and Earning per Share (EPS) partially on stock prices of automotive companies listed

in Indonesia stock Exchange. The number of samples in this study as many as nine companies. Mechanical

analysis using multiple linear regression analysis. The analysis showed that the Return on Assets(ROA),

Return on Equity (ROE), Price To Book Value (PBV), Debt to Equity Ratio (DER), Earning Per Share

(EPS) simultaneously affect the stock price on the automotive company listed on the Indonesia Stock

Exchange. The analysis showed that partially Price to Book Value (PBV), Debt to Equity Ratio (DER), and

Earning Per Share (EPS) Return on Assets (ROA) effect on the stock price on the automotive company

listed on the Indonesia Stock Exchange. Price to Book Value (PBV), and Earning Per Share (EPS) positive

impact on stock prices and Debt to Equity Ratio (DER) negative impact on stock prices. While Return on

Assets (ROA) and Return on Equity (ROE) has no effect on stock prices.

1 INTRODUCTION

Unit price movement of shares by the stock

exchange is a very interesting phenomenon for

investors to do an analysis. For a reasonable stock

price movements will foster a belief in themselves

investors in the investment to buy or sell existing

shares. Generally, the purpose of investors invest

their funds in securities (securities) among others, is

to get a return (yield) is maximal at particular risk or

obtain certain results with minimum risk.

Stock market prices as a reflection of a company's

value, an increase or decrease a lot. Because stock

prices reflect both fundamental information,

technical, social and political. The share price on the

stock exchange is generally determined by the law

of supply and demand. More and more people buy

stocks, then the stock price will tend to rise,

otherwise more and more people

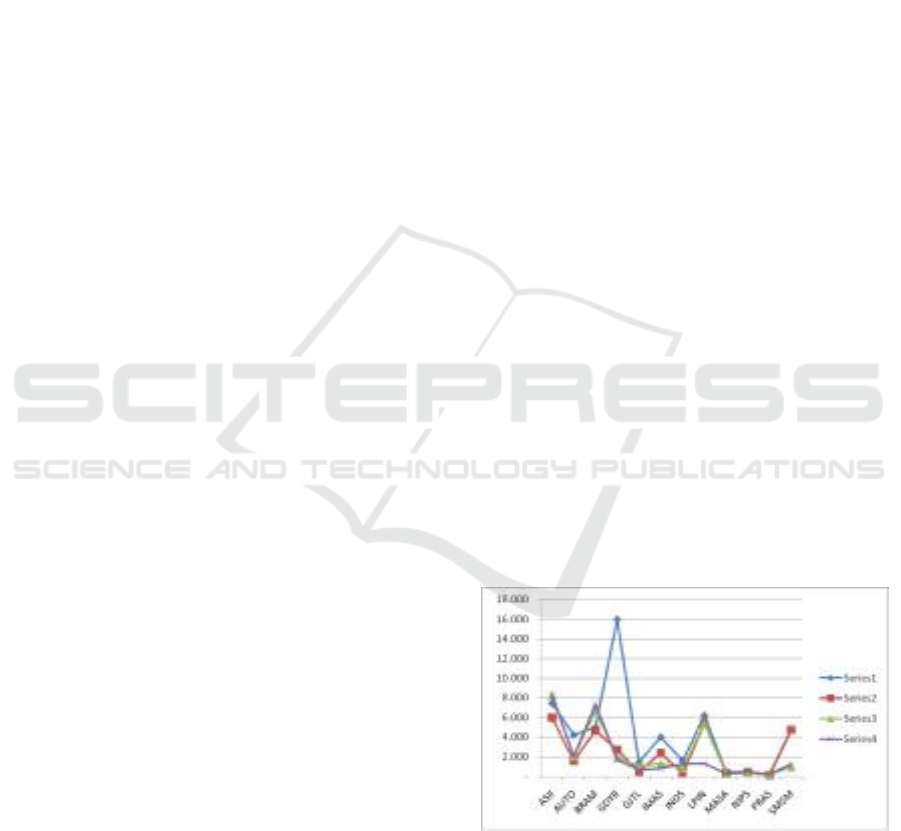

Figure 1: Development of Automotive Company

Stock Price

Fundamental strength can be seen from the financial

ratios that can be seen on a periodic basis such as

return on equity, return on investment, dividend

payout ratio and other ratios. For companies with

Firdausi, I., Daud, I., Lutfi, R. and Ansari, M.

Analysis of Fundamental Factors Affecting Stock Prices in Automotive Companies Listed on the Indonesia Stock Exchange Period 2014-2017.

DOI: 10.5220/0009501912571264

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1257-1264

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1257

strong fundamentals, these financial ratios would be

significant enough to be analyzed.

Stock investors have an interest in the information

related to the dynamics of stock prices in order to

make decisions about stocks eligible to be selected.

Jogiyanto (2012: 88) observes that the stock price as

an indicator of the company's value will be affected

directly or indirectly by fundamental factors and

technical factors. Basically, the value of a stock is

determined by a company's fundamentals. Investors

make decisions to grow their money by buying

shares of the issuer after considering earnings,

growth in sales and assets for a certain period. In

addition, the future prospects of the company is very

important to be considered. The indicators taken into

consideration, among others, earnings per sare

(EPS), dividend per share (DPS) book value (BV)

return on equity (ROE),

Based on some of these needs, the researcher is

necessary to examine the influence of several factors

fundamental to the stock price, which is the object of

this research are companies engaged in the

automotive field are listed in the Indonesia Stock

Exchange. This caused that as one company of many

companies faced with the reality of efficiency at this

time, but was very large automotive company

contribution to the state economy as a whole for

building the infrastructure to facilitate the

development of various sectors. Sectors of the

automotive industry is a sector that is expected to

support the role of other sectors in promoting

economic growth.

This study followed up on the findings of previous

research results, found in this study combines a

range of variables that have been raised previous

investigators, particularly the independent variables

that have a significant effect on stock prices. This

study refers to or inspired by previous researchers

that examines some of the variables that affect stock

prices. As research Yanti and Safitri (2013), shows

that the Earning Per Share (EPS), Return on Assets

(ROA) and Book Value (BV) significantly affects

stock prices, while Return on Equity (ROE), the

Current Ratio (CR), price Earning Ratio (PER) and

Operating Profit Margin (OPM) has no effect on

stock prices. Another researcher,Indira and

Dwiastutiningsih (2014) shows that Net profit

margin and return on equity has no effect on stock

prices, while the earnings per share effect on stock

prices. Sari and Suhermin (2016), Argued that Net.

Profit Margin, Earnings Per Share significant effect

on stock prices, while Return on equity, price

earning ratio, and Price To Book Value no

significant effect on stock prices.

This study is a replication of the study Sari and

Suhermin (2016). The variables used by researchers

is the Return on Total Assets, Return on Equity,

Price to Book Value, Debt Equity Ratio and Earning

per Share in predicting stock prices.

2 THEORICAL FRAMEWORK

The investment decision is a matter of how the

financial manager should allocate funds into other

forms of investment which will bring benefits in the

future. Shape, manner, and the composition of the

investment will affect and support the level of

profits in the future. According Sutrisno (2001: 5)

future profits expected from the invested capital can

not be predicted with certainty. Therefore the

investment will involve risks or uncertainties. Risk

and expected return on investment that will greatly

affect the achievement of the objectives, policies,

and values of the company.

According Jogiyanto (2012: 200) the stock price can

be determined based on the book value (book value),

the market value (market value), and intrinsic value

(intrinsic value). Book value is the value of the

issuer's shares according to the company's books.

The market value is the value of shares on the stock

market and intrinsic value is the actual value of the

shares. The market value of a stock price that

occurred in the stock market at the appropriate time

determined by market participants (Jogiyanto, 2012:

201).

Fundamental factors measured by the ratio of return

on assets, return on equity, earnings per share, the

share price earnings and price to book value (Jackie

and Safitri, 2013). These five fundamental factors

such as return on equity, debt to equity ratio,

earnings per share, price earnings ratio and price to

book value simultaneously have a significant

influence on stock prices. Fundamental factors

according to (Weston, 2010: 199) consists of five

variables, namely ROA (Return on Total Assets),

ROE (Return on Equity), PBV (Price to Book

Value), b (Payout Ratio), DER (Debt Equity Ratio)

EPS (Earnings per Share). Natarsyah (2000)

explains that the variable return on assets, debt to

equity ratio and book value have an effect on stock

prices. In this research.

3 RESEARCH METHODS

This research is quantitative descriptive research

type ekplanasi, which is an object or purpose is to

explain the causal relationship or variables that are

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1258

hypothesized. According Sugiyono (2015: 36)

quantitative descriptive research is research that is

based on data that can be calculated to produce a

solid quantitative assessment. Variables used to

affect the stock price is Return on Assets (ROA),

Return on Equity (ROE), Price to Book Value

(PBV), Debt to Equity Ratio (DER), and Earning

per Share (EPS) automotive company registered in

Indonesia Stock Exchange period 2014-2017. The

population in this study are all automotive

companies listed on the Stock Exchange as many as

13 companies. The sample in this study were taken

using non-random sampling method is purposive

sampling or based on certain considerations. The

number of samples that meet the criteria (purposive

sampling) in this study amounted to nine

automotive companies. Mechanical analysis using

multiple linear regression analysis.

4 ANALYSIS

Statistical data descriptive variable financial

statements Automotive seven companies listed in

Indonesia Stock Exchange the sample in this study

are shown in Table 1.

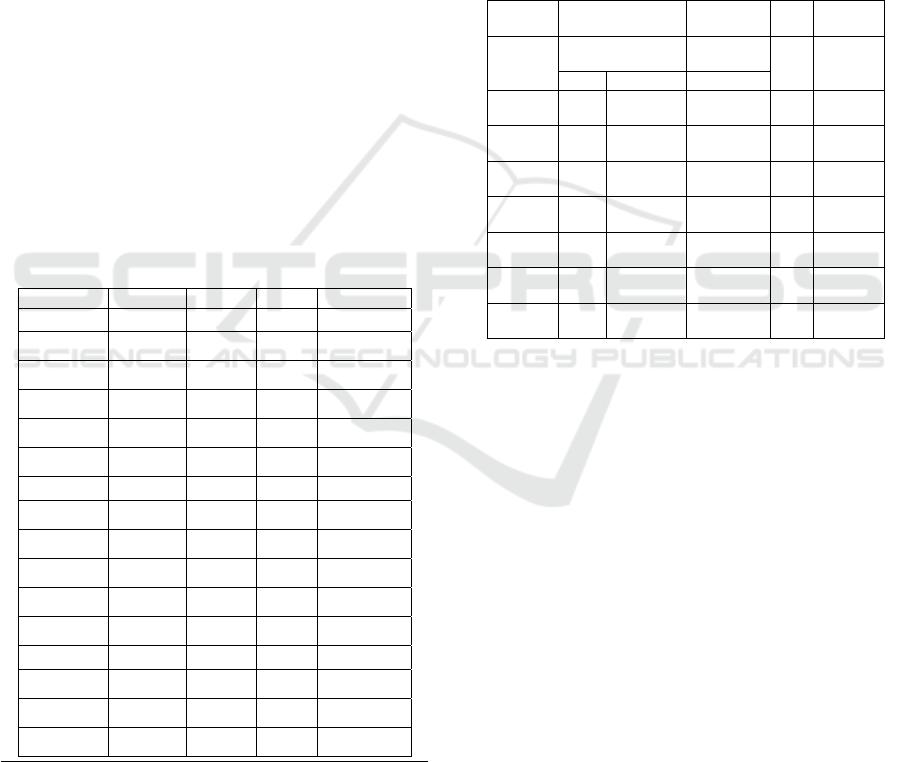

Table 1: Descriptive Statistics Data Years 2014-

2017

variables

Minimum maximum mean Std. deviation

ROA '2014 1.00 14,00 6.5967 4.07517

ROE

1.78 18.00 8.0073 5.72768

PBV 0.58 4.82 1.9133 1.27919

DER

10,00 220.00 93.7767 72.64915

EPS

69.44 701.67 332.86 200.56088

Stock price)* 204 7425 2965.67 2464.902

ROA '2015 0.10 23.00 7.2344 8.59986

ROE

1.10 32.00 7.7827 9.70541

PBV 0.14 2.65 1.1367 0.87450

DER

9.00 220.00 77.0300 71.29975

EPS

29,48 768.33 233.14 235.47264

Stock price)* 125 6000 2355.00 2270.216

ROA '2016 1.92 22.00 6.6433 6.27163

ROE

3.00 14.05 7.4567 4.39658

PBV 0.14 2.40 , 8889 0.72433

DER

9.00 111.01 55.4778 39.26427

Note: * = In rupiah

Source: Processed Data.

From Table 1 it appears that the average value of

the highest stock price in 2014 amounted to

2965.67,while the lowest average occurred in 2015

amounted to2,355, This shows that the general

condition of the economy in 2015 is not so good. In

2016 and 2017, the average stock price began to

rise, means that the performance of the economy

has begun to improve. Under these conditions, it

can be concluded that the business of automotive

companies listed in Indonesia Stock Exchange is

experiencing a rise in overall performance.

Multiple Linear Regression Analysis

The test results of multiple linear analysis

using

SPSS version 18 is as follows:

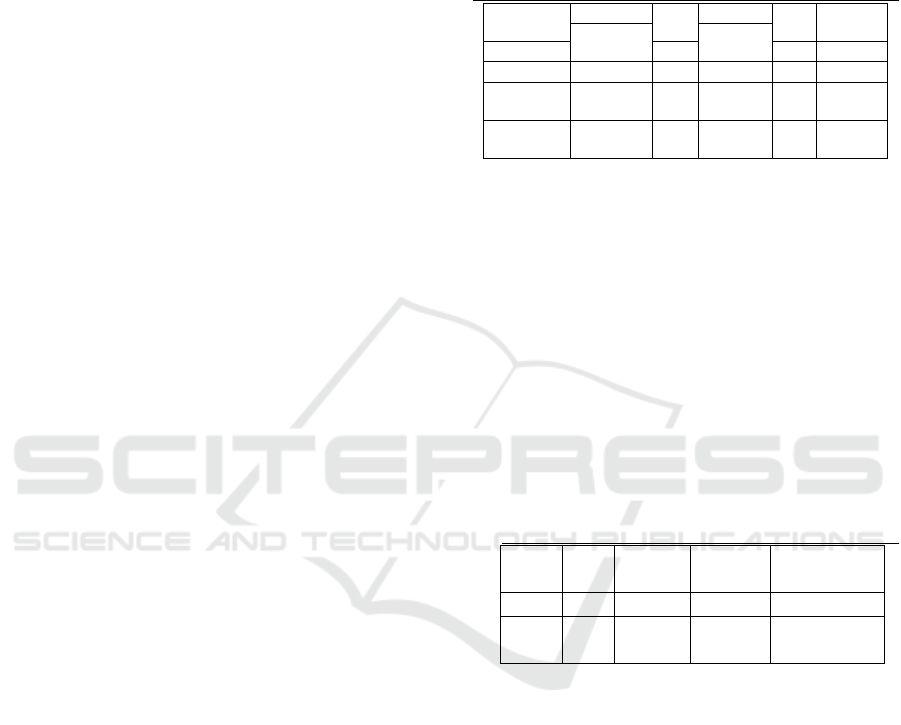

Table 2: Results of Multiple Linear

Regression

Testing

Coefficient

s

standardized

variables

unstandardiz

ed

Coefficients

t

Sig

.

B

Std.

Error

beta

constants

6,

690 .340

19.66

5 0,000

ROA

0,

005 0,0240,031 .220 0.827

ROE

0,

012 0,0220.081 0.554 .584

PBV

0.

555 0.1360,495 4.071 0,000

DER

-

0.005

0,002.280 2,312 0,028

EPS

0,

002 0,0010,365 2,553 0,016

Source: Data processed writer

Based on Table 2 above, the share price can be

entered into the multiple regression equation as

follows:

HS = 6,690 + 0,005.ROA + 0,012.ROE +

0,555.PBV - 0,005 0,002.EPS DER + + e

From equation The above regression can be

interpreted that:

1.

Constants (a)

In the multiple linear regression equation above

is known to a constant value (a) of 6.690 means that

if the variable Return on Assets, Return on Equity,

Price To Book Value, Debt to Equity Ratio and

Earning Per Share is equal to 0, then the stock price

(Closing Price ) amounting to Rp 6,690.

2. The regression coefficient Return on Assets

(b1) 0,005

B1 coefficient is 0.005, indicating a positive

correlation direction (unidirectional) between the

Return on Assets with a share price (Closing Price).

A positive sign indicates the influence of Return on

Assets direction of the share price (Closing Price),

ie if the variable Return on Assets increased share

price (Closing Price) will rise, assuming variable

Analysis of Fundamental Factors Affecting Stock Prices in Automotive Companies Listed on the Indonesia Stock Exchange Period

2014-2017

1259

Return on Equity, Price To Book Value, Debt to

Equity Ratio, and Earning Per Share constant.

3. The regression coefficient Return on Equity

(b2) amounted to 0,012

B2 coefficient is 0.012, indicating a positive

correlation direction (unidirectional) between the

Return on Equity at stock price (Closing Price).

A positive sign indicates the influence of Return

on Equity in the direction of the share price

(Closing Price), ie if the variable Return on

Equity increased share price (Closing Price) will

rise by assuming the variable Return on Assets,

Price To Book Value, Debt to Equity Ratio, and

Earning Per Share constant.

4. The regression coefficient Price To Book Value

(b3) of 0.555

B3 coefficient is 0.555, indicating a positive

correlation direction (unidirectional) between

Price To Book Value at stock price (Closing

Price). A positive sign indicates the influence

Price To Book Value direction of the share price

(Closing Price), ie if the variable Price To Book

Value increases then the stock price (Closing

Price) will rise by assuming the variable Return

on Assets, Return on Equity, Price To Book

Value, debt to Equity Ratio and Earning Per

Share constant.

5. The regression coefficient Debt to Equity Ratio

(b4) of -0.005

B4 coefficient is -0.005, indicating a

negative correlation direction (opposite) of the

Debt to Equity Ratio at stock price (Closing

Price). The negative sign indicates the effect of

Debt to Equity Ratio opposite to the stock price

(Closing Price), ie if the variable Debt to Equity

Ratio increased share price (Closing Price) will

fall by assuming the variable Return on Assets,

Return on Equity, Price To Book Value, and

Earning Per Share constant.

6. The regression coefficient Earning Per

Share (b5) of 0.002

B5 coefficient is 0.002, indicating a positive

correlation direction (unidirectional) between

Earning Per Share with stock prices (Closing

Price). A positive sign indicates the influence

Earning Per Share direction of the share price

(Closing Price), ie if the variable earning per

share increased share price (Closing Price) will

rise by assuming the variable Return on Assets,

Return on Equity, Price To Book Value and

Debt to Equity Ratio constant.

Hypothesis testing

1.

Test F (Testing Simultaneous / Concurrent)

This test is performed to examine the effect of

the Return on Assets (ROA), Return on Equity

(ROE), Price To Book Value (PBV), Debt to Equity

Ratio (DER), Earning Per Share (EPS)

simultaneously to the stock price. Simultaneous test

results can be seen in Table 3 below:

Table 3: Model Eligibility Test Result (Test F)

Model

Sum of

d

f

mean

F

Sig.

Square

s

Squar

e

Regression

24.721 5 4.944

8.408 0,000

residual

17.641

3

0 0.588

Total

42.362

3

5

Source: Data processed writer

based on F test results in Table 3 is known that

the significant value of 0.000, it can be seen Return

on Assets (ROA), Return on Equity (ROE), Price To

Book Value (PBV), Debt to Equity Ratio (DER),

Earning Per Share (EPS) simultaneously significant

effect on stock prices on automotive companies

listed in Indonesia Stock Exchange (BEI).

2. Simultaneous Determination coefficient (R2)

The coefficient of determination or R-square

shows the percentage of how much influence the

independent variable on the dependent variable

simultaneously (Ghozali, 2012: 97). Here is rated R

- square obtained from the analysis.

Table 3. Calculation Results The coefficient of

determination R2 Model Summary

Model R

R

Square

Ad

j

usted

R

Std. Error of

S

q

uare the Estimate

1 0.764

.58

4

.514 0.76683

Source: Data processed writer

Based on Table 3 obtained R2 of 0.584 or 58.4%

means that the variability of the variable share price

can be explained by the variability of Return on

Assets (ROA), Return on Equity (ROE), Price To

Book Value (PBV), Debt to Equity Ratio (DER ),

Earning Per Share (EPS) amounted to 76.4%, while

the remaining 41.6% is explained by other variables

not included in this regression model.

While the correlation coefficient (R) is used to

measure the closeness of the relationship

simultaneously between independent variables

consisting Return on Assets (ROA), Return on

Equity (ROE), Price To Book Value (PBV), Debt to

Equity Ratio (DER), Earning per Share (EPS) jointly

to the stock price. Multiple correlation coefficient

indicated by (R) of 0764, or 76.4%, which means

that the correlation or relationship between the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1260

independent variables consisting of Return on Assets

(ROA), Return on Equity (ROE), Price To Book

Value (PBV), Debt to Equity Ratio (DER), Earning

Per Share (EPS) jointly to the stock price has strong

relations / strong.

3.

Test t (Testing Partial)

The t-test is used to determine whether each

independent variable such as Return on Assets

(ROA), Return on Equity (ROE), Price To Book

Value (PBV), Debt to Equity Ratio (DER), Earning

Per Share (EPS) partially have influence the

dependent variable is the stock price. Here are the

results of calculation t test, which are shown in the

following table:

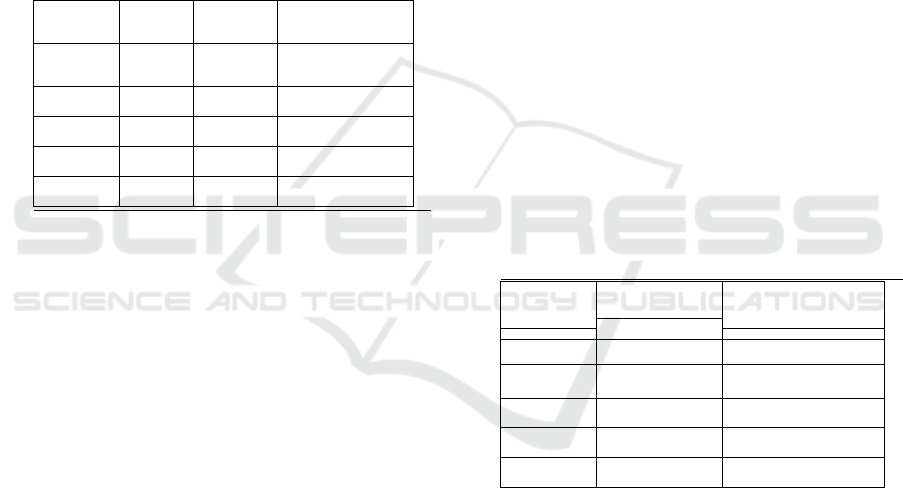

Table 4: Results of t-test and Level

Significant

varia

bles t

Sig

.

Information

ROA

.220 0.827

N

ot significant

ROE 0.554 .584

N

ot significant

PBV

4.071 0,000 Significant

DER 2,312 0,028 Significant

EPS

2,553 0,016 Significant

Source: Data processed writer

Based on Table 4 above can be explained as

follows:

a. Test the Effect of Variable Return on Assets

Against share price

By using a significance level α = 0.05 was

obtained t value of 0.220 with sig. Return on

Assets 0827 variable that is greater than the

significance level α = 0.05, this means that the

variable Return on Assets no effect on stock

prices.

b. Test the Effect of Variable Return on Equity

Share Price

By using a significance level α = 0.05 was

obtained t value of 0.554 with sig. the

variablereturn on equity amounted to 0.584

greater than the significance level α = 0.05, this

means that the variable return on equity has no

effect on stock prices.

c. Test the Effect of Variable Price To Book Value

Of Shares price

By using a significance level α = 0.05 was

obtained t value of 4.071 with sig. variable Price

To Book Value 0,000 smaller than the

significance level α = 0.05, this means that the

variable Price To Book Value effect on stock

prices.

d. Test of Variables Influence Against Debt to

Equity Ratio Shares price

By using a significance level α = 0.05 was

obtained t value of -0.312 with sig. Debt to

Equity Ratio variable of 0.028 which is smaller

than the significance level α = 0.05, this means

that the variable Debt to Equity Ratio effect on

stock prices.

e. Test of Variables Influence Earning Per Share

Share Price

By using a significance level α = 0.05 was

obtained t value of 2.553 with sig. variable

Earning Per Share amounted to 0,016 less than

the significance level α = of 0.05%, this means

that the variable earning per share effect on

stock prices.

f. Partial determination coefficient (r2)

Coefficient determination is partially used to

determine which factor most influential of the

independent variables consisting of Return on

Assets (ROA), Return on Equity (ROE), Price

To Book Value (PBV), Debt to Equity Ratio

(DER), Earning Per Share (EPS) of the

company's stock price of automotive listed in

Indonesia stock Exchange (BEI). The level of

the coefficient of determination of each of these

variables are as follows:

Table 5: Partial Correlation Coefficient and

Determination

variab

les

The

correlation

Partial determination

(r2)

coefficient (r)

ROA

0,040 0,002

ROE .101 0,010

PBV

0,597 .356

DER .389 0.151

EPS

0.423 0.179

Source: Data processed writer

Based on Table 5 obtained partial determination

coefficient with the following explanation:

1) The coefficient of determination partial, Return

on Assets (ROA) of 0,002, this means that

approximately 0.2% which shows the

contribution of variable Return on Assets (ROA)

to the stock price on Automotive companies

listed in Indonesia Stock Exchange (BEI).

2) Partial determination coefficient variable Return

On Equity (ROE) amounted to 0,010 this means

that approximately 1% which indicates the

contribution of variable Return on Equity (ROE)

to share price Automotive companies listed in

Indonesia Stock Exchange (BEI).

Analysis of Fundamental Factors Affecting Stock Prices in Automotive Companies Listed on the Indonesia Stock Exchange Period

2014-2017

1261

3) The coefficient of determination partially Price

To Book Value (PBV) of 0.356 this means that

around 356 shows the magnitude of the

contribution of Price to Book Value (PBV) to

share price Automotive companies listed in

Indonesia Stock Exchange (BEI).

4) The coefficient of determination partially Debt to

Equity Ratio (DER) of 0.151 this means that

about 15.1% which shows the magnitude of the

contribution of Debt to Equity Ratio (DER) to

the stock price on Automotive companies listed

in Indonesia Stock Exchange (BEI).

5) The coefficient of determination partially

Earning Per Share (EPS) of 0.179 this means that

approximately 17.9% which shows the

contribution of variable Earning per Share (EPS)

to share price Automotive company listed on the

Indonesia Stock Exchange (BEI).

From the test results of determination

partially (r2) above it can be concluded that the

variables that have a dominant influence on stock

prices in companies Automotive contained in the

Indonesia Stock Exchange (IDX) is Price to Book

Value (PBV) because it has a coefficient of

determination of partial greatest that is equal to

0.356 or 35.6% compared with the others.

5 RESULTS

Effect of Return on Total Assets (ROA), Return

on Equity (ROE), Price to Book Value (PBV), Debt

to Equity Ratio (DER), and Earning per Share

(EPS) simultaneously on stock price.

Based on the results of research conducted,

showed that the Return on Assets (ROA), Return on

Equity (ROE), Price to Book Value (PBV), Debt to

Equity Ratio (DER), Earning Per Share (EPS)

influence simultaneously to the stock price ,

Variable Return on Assets (ROA), Return on Equity

(ROE), Price to Book Value (PBV), Debt to Equity

Ratio (DER), Earning Per Share (EPS) obtained R2

of 0.838, or 83.8%, meaning that the variability of

the variable stock prices can be explained by the

variability of Return on Assets (ROA), Return on

Equity (ROE), price to Book Value (PBV), Debt to

Equity Ratio (DER), Earning Per Share (EPS)

amounted to 83.8%, while the remaining 16.2% is

explained by other variables not included in this

regression model.

One of the factors that affect stock prices is the

condition of the company in which these conditions

could be interpreted as the financial performance of

the company. The financial performance of the

company is something that is very important,

because the financial performance of a company can

influence and be used as a tool to determine whether

the company is experiencing growth or decline. The

share price is the selling price prevailing in the

market of securities determined by market forces

within the meaning depends on the strength of

demand (supply) and offer (sell request). According

Jogiyanto (2012: 200) the stock price can be

determined based on the book value (book value),

the market value (market value), and intrinsic value

(intrinsic value). Book value is the value of the

issuer's shares according to the company's books.

The market value is the value of shares on the stock

market and intrinsic value is the actual value of the

shares. Basically, the value of a stock is determined

by a company's fundamentals.

Return on Assets Influence on Stock Prices

Influence Return on Assets are tested on stock

prices shows that the t value of 0.220 to 0.827,

which means significantly at significantly> 0.05.

This indicates that the variable Return on Assets not

affect the company's share price on Automotive.

This may imply that the Return on Assets can not be

used as a basis for determining the rise and fall of

stock prices. The results of this study are not

consistent with research Hasthoro and Jepriyanto

(2011) and Mary and Safitri (2013) which states that

the Return on Assets significant effect on stock

prices. Return on assets connecting net income by

total assets measure the level of profitability of the

company over the use of assets. ROA also illustrates

the extent to which the ability of assets owned by

the company can generate profit (Weston, 2010:

Return on Equity Influence on Stock Prices

Effect of Return on Equity tested on stock prices

shows that the t value of 0.554 to 0.584, which

means significantly at significantly> 0.05. This

indicates that the variable return on equity has no

effect on the company's stock price Automotive.

This may imply that the return on equity can not be

used as a basis for determining the rise and fall of

stock prices. The results are consistent with research

Sari and Suhermin (2016), Indira and

Dwiastutiningsih (2014), Jackie and Safitri (2013)

which states that the Return on Equity partially no

significant effect on stock prices. But not in line

with the results of research and Jepriyanto Hasthoro

(2011) which states that the return on equity is

partially significant effect on stock prices.

Return on Equity(ROE) could serve as the basis

for making investment decisions stock. Return on

Equity (ROE)describe the rotation or the level of

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1262

efficiency in the use of capital (equity). This shows

how much capital (equity) is able to generate a

profit, so it can be used as a stock investment

decisions. According to (Weston, 2010: 199), return

on equity shows the profits derived from (or be

right) own capital, and are often used by investors in

the purchase of shares of a company (as capital

itself becomes part owner).

Price to Book Value Influence on Stock Prices

Influence Price To Book Value tested on stock

prices shows that the t value of 4.071 with

significant significant significant 0.000 <0.05. This

indicates that the variable Price to Book Value

influence the stock price on the company's

Automotive. It is understood that Price To Book

Value can be used as a basis for determining the rise

and fall of stock prices. Price to Book Value can

show how much the company is able to create value

for the company. Companies that went well

generally have PBV above 1, indicating a higher

market value than its book value. Hasill is in line

with research that has been done by Yanti and Safitri

(2013), that the Price to Book Value effect on stock

prices. But not according to Sari and Suhermin

research (2016),

Price to book value is the ratio between the

market price and the book value of shares. For

company-the company that runs well, generally this

ratio reached above one, which shows the stock

market value is greater than its book value. PBV is

another indicator used to assess the performance of

the company. The greater the ratio the higher PBV

companies rated by investors relative to the funds

that have been invested in the company (Weston,

2010: 199).

Debt to Equity Ratio Influence on Stock Prices

Effect of Debt to Equity Ratio tested on stock

prices shows that the t value of -2.312 with a

significant amounting to 0,028, which means a

significant <0.05. This indicates that the variable

Debt to Equity Ratio influence the stock price on

the company's Automotive. This may imply that the

Debt to Equity Ratio can be used as a basis for

determining the rise and fall of stock prices. This is

in line with research that has been done by Hasthoro

and Jepriyanto (2011), that the Debt to Equity Ratio

partially significant effect on stock prices.

Debt to equity ratiois the ratio between total debt

(long-term debt and current debt) to equity (capital

of ordinary shares and preference shares). A high

ratio indicates that the company uses a large debt to

finance its assets, whereas a low ratio indicates that

more companies use their own capital to finance its

assets. Debt to equity ratio also reflects the

company's financial structure, which also shows the

financial risk. The higher the percentage, it means

that the higher the financial risk faced by the

company (Weston, 2010: 199).

Per Share Earing Influence on Stock Prices

Earing influence Per Share were tested on stock

prices shows that the t value of 2,553 to 0,016,

which means significantly by significant <0.05. This

indicates that the variable earing Per Share influence

the stock price on the company's Automotive. This

may imply that the earing Per Share can be used as a

basis for determining the rise and fall of stock

prices. Increased Earning Per Share will boost the

share price. Earning Per Share is a ratio that

measures how much net profit generated

Automotive company for each share outstanding.

Hasill is in line with research that has been done by

Sari and Suhermin (2016) and Mary and Safitri

(2013), that earing Per Share effect on stock prices.

Earning per shareis a measure of a company's

ability to generate profit per share for the owner.

The greater the company's ability to generate profit

per share for the owner, it will affect the company's

stock price and vice versa. Information about a

company's EPS indicates the amount of net income

that the company is ready to share to all

shareholders of the company (Weston, 2010: 199).

6 CONCLUSIONS

Based on the results of the analysis indicate that

the Return on Assets (ROA), Return on Equity

(ROE), Price To Book Value (PBV), Debt to Equity

Ratio (DER), Earning Per Share (EPS)

simultaneously affect the stock price on the

automotive company listed on the Indonesia Stock

Exchange.

Based on the results of the analysis showed that

partially Price to Book Value(PBV), Debt to Equity

Ratio (DER), and Earning Per Share (EPS) Return

on Assets (ROA) effect on the stock price on the

automotive company listed on the Indonesia Stock

Exchange. Price to Book Value (PBV), and Earning

Per Share (EPS) positive impact on stock prices and

Debt to Equity Ratio (DER) negative impact on

stock prices. While Return on Assets (ROA) and

Return on Equity (ROE) has no effect on stock

prices.

Analysis of Fundamental Factors Affecting Stock Prices in Automotive Companies Listed on the Indonesia Stock Exchange Period

2014-2017

1263

REFERENCES

Ghozali, Imam, (2012). Aplikasi Multivarite dengan

Program SPSS, Badan Penerbit Universitas

Diponegoro, Semarang.

Hasthoro, Handoko A. dan Endra Jepriyanto, (2011),

Pengaruh Faktor-Faktor Fundamental Keuangan dan

Risiko Sistematik Terhadap Harga Saham Perusahaan

Yang Tergabung Dalam Jakarta Islamic Index (JII).

Jurnal Bisnis dan Ekonomi, Vol. 2, No. 1, Juni 2011,

17 - 30

Indira, Christera Kuswahyu dan Rini Dwiastutiningsih,

(2014), Pengaruh Faktor-Faktor Fundamental

Terhadap Harga Saham Pt Unilever Indonesia Tbk

Tahun 2004-2013. Jurnal Ekonomi Bisnis Volume 19

No. 3, Desember 2014

Sari, Yuni Indra dan Suhermin, (2016), Pengaruh Faktor -

Faktor Fundamental Terhadap Harga Saham Pada

Perusahaan Telekomunikasi. Sekolah Tinggi Ilmu

Ekonomi Indonesia (STIESIA) Surabaya. Jurnal Ilmu

dan Riset Manajemen : Volume 5, Nomor 7, Juli 2016,

ISSN : 2461-0593

Sugiyono. (2015). Metode Penelitian Bisnis. Bandung:

Penerbit CV. Alfabeta.

Weston, Fred J., (2010). Dasar-Dasar Manajemen

Keuangan, Edisi Kesembilan (Terjemahan), Salemba

Empat, Jakarta.

Yanti, Oktavia Dewi dan Ervita Safitri, (2013), Pengaruh

Faktor-Faktor Fundamental Terhadap Harga Saham

LQ45 di Bursa Efek Indonesia (BEI). STIE MDP.

Jurnal Ekonomi dan Bisnis,vol.2,No.2:101-113.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1264