The Influence of Audit Experience and Gender on Audit Judgment

Indah Fajarini Sri Wahyuningrum

1

, Subowo

1

, Badingatus Solikhah

1

and Indah Anisykurlillah

1

1

Faculty of Economics, Universitas Negeri Semarang, Semarang -Indonesia

Keywords: Audit Experience, Gender, Audit Judgment

Abstract: Audit judgment is a consideration of perceptions in responding to financial statement information obtained,

added by factors from within an auditor. This study aims to analyze the influence of audit experience and

gender on audit judgment. The population in this study were all auditors working in Semarang City Public

Accounting Firm (KAP). The sample in this study was taken by convenience sampling method. From the

population of 17 KAP, 10 KAPs were chosen as the study sample. The collected data was analyzed using

regression and Multiple Regression Analysis. The results of this study indicate that audit experience and

gender have a positive effect on audit judgment. Experience has a role in determining judgment for an auditor.

The results of this study also indicate that audit judgments made by female auditors tend to be better than

male auditors.

1 INTRODUCTION

Nowadays, the need for auditor services as an

independent party cannot be denied, because these

services are a necessity for users of financial

statements to make a decision. Auditing work

conducted by public accountants is not only for the

benefit of their clients but also for other parties who

use the audit report. In this case the auditor must have

sufficient competence in order to maintain the trust of

the clients and the users of the financial statements

(Reheul et al., 2013).

One of the big cases involving fraud has been

experienced by Price Waterhouse Coopers (PwC) in

India in 2009. A big case hit the audit profession,

"Satyam" which is the fourth largest outsourcing

information technology company in India. It has 50

thousand employees spread across various IT

development centers in Asian countries. In March

2008, Satyam reported a revenue increase of 46.3

percent to 2.1 billion US dollars. In October 2008,

Satyam said that its revenue would increase by 19-21

percent to 2.55-2.59 billion dollars in March 2009.

Ironically, on January 7, 2009, Ramalinga Raju

suddenly said that around 1.04 billion dollars of

Satyam's cash and bank balances were fake (that

amount was equivalent to 94% of Satyam's bank cash

value at the end of September 2008). In his letter sent

to Satyam's board of directors, Ramalinga Raju also

admitted that he falsified the value of interest income

received in advance, recorded liabilities lower than it

should and inflated the value of receivables. On

January 14, 2009, Satyam's auditor for the past 8

years - Price Waterhouse India announced that the

audit report was potentially inaccurate and unreliable

because it was based on information obtained from

Satyam's management (Brown et al., 2014).

With regard to the scope of testing, determination

of sample size and which items to test, judgment

made by the auditor would have a great influence.

The auditor's consideration in this case covers

materiality, risk, costs, benefits, size and

characteristics of the population. Therefore, if the

auditor is not careful in determining their judgment,

an error in the opinion statement can occur. Many

factors can influence auditor judgment, including

audit experience and gender (Ittonen et al., 2013).

Based on the previous explanation, the author was

motivated to carry out this study with reasons (1) the

adoption of International Standards on Auditing

(ISA) in financial report audits beginning on or after

January 2013. This adoption is intended to increase

global investor confidence in the quality of financial

information in Indonesia, (2) the issued of No.5

Public Accountants Law 2011 which makes auditors

more careful in making judgments, (3) the

implementation of Minister of Finance Regulation

(PMK) Number 25 / PMK.01 / 2014 concerning

Wahyuningrum, I., Subowo, ., Solikhah, B. and Anisykurlillah, I.

The Influence of Audit Experience and Gender on Audit Judgment.

DOI: 10.5220/0009501804550459

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 455-459

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

455

Country Registered Accountants. This regulation will

become a new foundation for the accounting

profession in building more reliable and capable

professional quality, to compete in the global arena.

These regulations include the mechanism of re-

registration, fostering Indonesian professional

accountants, professional accounting education and

professional accountant certification examinations, as

well as the mechanism of the founders of the

accounting services office (KJA). (5) Various

previous studies on audit experience such as the study

conducted by Sofiani (2015) which stated that the

audit experience variable provides a parameter

coefficient value of 0.004 with a significance level of

0,000, this indicates the influence of audit experience

on audit judgment but the coefficient between the two

variables had a very weak relationship which was

0.004. The similar result reported by Praditaningrum

and Januarti (2012) that audit experience variable

gave parameter coefficient value of 0.075 with a

significance level of 0.018. (6) previous research on

client preferences such as the results of study by

Arum (2008) that client preference variable provided

a parameter coefficient of 0.290 with a significance

level of 0.001, indicating that the coefficient between

the two variables had a fairly weak relationship.

Previous research on audit judgment also shows

inconsistent results and the coefficient between

variables is still not strong, therefore author added the

client credibility variable as a moderating variable in

order to strengthen the correlation coefficient

between variables.

2 THEORICAL FRAMEWORK

a. Cognitive Theory (Piaget)

Cognitive theory views learning as a process that

provides functions of elements of cognition,

especially the mind to recognize and understand the

stimulus that can be obtained from the outside.

Cognitive theory explains that changes in perceptions

and understanding of each person occur after having

experience and knowledge in them. Based on

cognitive theory, a person's learning process covers

the stimulus settings received and adapts to the

cognitive structure that has been owned and formed

in a person's mind based on previous understanding

and experience. There are three main principles of

learning for humans, namely: active learning,

learning from social interactions and learning from

their own experience (Piaget, 1970). The application

of cognitive theory can be used to examine how the

auditor does a consideration based on their experience

and expertise in carrying out audit tasks.

b. Hypothesis Development

Cognitive theory says that there are three main

principles of learning for humans, one of which is

learning through one's own experience. The

application of cognitive theory can be used to

examine how the auditor does a consideration based

on their experience and expertise in carrying out audit

tasks. Every time the auditor conducts an audit, the

auditor will learn from previous experience,

understand and increase accuracy in carrying out the

audit. The auditor will integrate his audit experience

with the knowledge they already have. The process of

understanding and learning is the process of

increasing auditor expertise, such as increasing audit

compliance and increasing the auditor's ability to

make judgment audits.

H_1 : Audit Experience Influences Audit Judgment

Judgment made by an auditor can differ between men

and women given the psychological differences. Men

in general do not use all available information in

processing information, therefore decisions taken are

less comprehensive. While women in processing

information tend to be more thorough and use more

complete information. Women have a sharp memory

of new information and have higher moral

considerations than men (Bobek et al., 2015). This is

in accordance with the findings of cognitive

psychological and marketing literature that women

are more efficient and effective in processing

information when facing the complexity of tasks in

decision making.

H_2 : Gender Influences Audit Judgment

3 RESEARCH METHOD

The type of research in this study is quantitative

research to test the hypothesis. The population in this

study were all auditors working in Semarang City

Public Accounting Firm (KAP). Authors determined

the sample size taken using the convenience sampling

method. From the population of 17 KAP, 10 KAPs

were chosen as the research sample. Respondents in

this study were 51 auditors in KAP in Semarang City.

Before being used for data retrieval, the

instrument is first tested for validity and reliability.

The data analysis technique used is descriptive

analysis and inferential analysis consisting of classic

assumption tests (normality, multicollinearity, and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

456

heterocedasticity. Hypothesis is tested using t test

with multiple regressions).

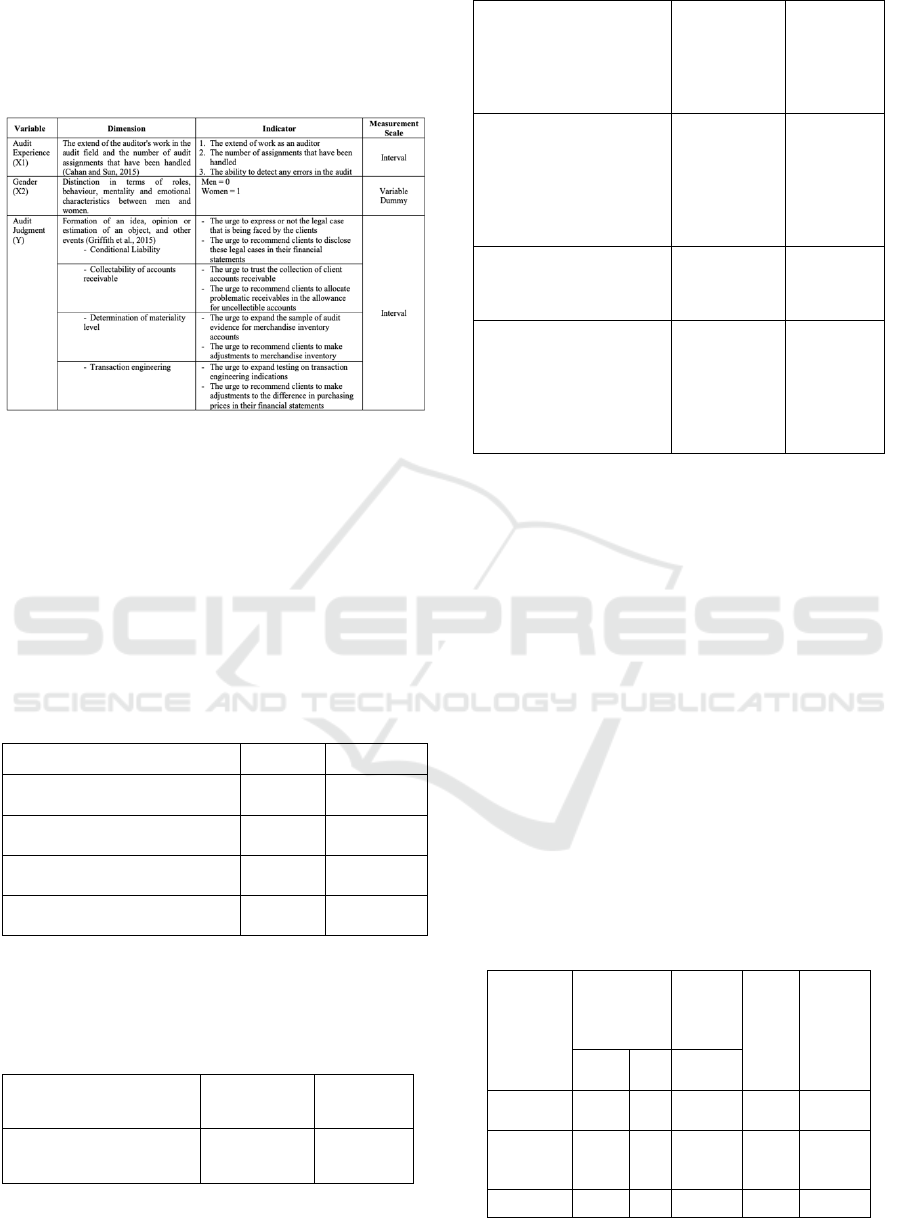

Table 1 shows the variable measurement used in this

study.

Table 1: Variable Measurement

4 ANALYSIS AND RESULTS

The research data was collected by sending 80

questionnaires. The numbers of questionnaires

returned through the survey were 55 questionnaires,

while the unreturned questionnaires were 25

questionnaires. The numbers of incomplete

questionnaires were 4 so that 51 can be processed or

the rate of return is 63.75%. The sent and return rates

are shown in table 2.

Table 2: The Sent and Return Rate

Notes

Number

Percentage

Number of distributed

questionnaires

80

100%

Number of unreturned

questionnaires

25

31,25%

Number of questionnaires that

can’t be processed

4

5%

Number of questionnaires that

can be processed

51

63,75%

The profile of 51 respondents who participated in

this study is shown in table 3.

Table 3: Respondents Profile

Number

Percenta

ge

Gender : Men

Women

16

35

31,4%

68,6%

Age: 21 – 25 Years

26 – 30 Years

31 – 35 Years

41 – 45 Years

46 – 50 Years

39

6

4

1

1

76,5%

11,8%

7,8%

2%

2%

Last Position :

Junior

Auditor

Senior

Auditor

Supervisor

42

7

2

82,4%

13,7%

3,9%

Education: D3

S1

S2

8

40

3

15,7%

78.4%

5,9%

Work Extend : 3 to 5

years

6 to 10

years

< 20

Years

45

5

1

88,2%

9,8%

2%

Regression analysis was conducted to test the

hypothesis by carrying out the t test. The t test in this

study was used to determine the direct effect of audit

experience variable, and gender on audit judgment.

5 RESULTS

a. Audit Experience Influences Audit Judgment

The hypothesis result is presented in table 4. The H1

test results, namely the influence of the audit

experience on audit judgment show a t test equal to

0.043. These results indicate that the significance

value was 0.043 <0.05, then H_0 is rejected and H_1

is accepted. This result means that with a 95%

confidence level the audit experience variable has a

positive effect on audit judgment. Therefore the first

hypothesis that is audit experience influences audit

judgment is accepted.

Table 4: Hypothesis Results

Model

Unstandar

dized

Coefficien

ts

Standar

dized

Coeffi

cients

T

Sig.

B

Std.

Error

Beta

(Constan

t)

29.797

.805

37.019

.000

Audit

Experien

ce

.883

.423

.273

2.087

.043

Gender

1.224

.360

.378

3.404

.001

The Influence of Audit Experience and Gender on Audit Judgment

457

The auditor's experience has a role in determining

judgment as the basis for expressing decent and

appropriate opinions given to the circumstances of the

audited financial statements. For auditors who lack

audit experience, usually they tend to experience

difficulties in determining judgment, so the opinions

given are less precise. The results of testing the first

hypothesis indicate that the auditor's experience

influences audit judgment. This influence shows a

positive direction which means that the more

experience the auditor has, the better judgment given

by the auditor. This shows that for auditors who have

a lot of experience, both the extend of work in

conducting audit checks and the number of

assignments that have been done in the audit field will

have no difficulty in giving judgment precisely to

clients.

This finding is in line with the study conducted by

Cahan and Sun (2015) which explained that auditor

experience is one of the factors that greatly influences

consideration in making audit judgment. For

practitioners it is expected to be a trigger of

enthusiasm to continue to improve their experience so

that the resulting work becomes better. For the

general public, the increased audit judgment quality

is expected to increase public confidence in the

profession of auditors. Aldamen et al. (2018) stated

that audit experience plays an important role in

processing information and producing audit

considerations. The amount of experience in the audit

field can help auditors to understand and solve

problems that tend to have the same pattern. As

explained in Piaget's theory, the auditor can learn

from their own experience. Every time the auditor

conducts an audit, the auditor will learn from previous

audit experience and increase accuracy in conducting

audits. Therefore the judgment taken by the auditor

will be more qualified.

However, this study is not in line with the study

conducted by Kang et al. (2015) which stated that

audit experience has no effect on audit judgment.

Therefore the auditor in giving a judgment is not

influential because the respondents are generally

senior auditors and junior auditors whose duties are

as members of an audit team, while those who will

provide a consideration are supervisors, managers

and partners. Brown-Liburd et al. (2015) stated that

other reasons the auditor's experience does not affect

judgment because in the auditor's context of her study

sample, the number of cases handled did not reflect

the auditor's experience, they were only in terms of

quantity and not quality, because she did not examine

the quality of the assignment, hence she can’t present

about the auditor’s experience.

b. Gender Influences Audit Judgment

H2 test results, namely the influence of the audit

experience on audit judgment shows the t test of

0.001. These results indicate that the significance

value was 0.001 <0.05, then H_0 is rejected and H_1

is accepted. This result means that with a 95%

confidence level the gender variable has a positive

effect on audit judgment. Therefore the second

hypothesis that is gender influences audit judgment is

accepted.

Gender is assumed to be one of the individual

level factors that also influence audit judgment.

Gender is the inherent nature of men and women

formed by social and cultural factors in which there

are some opinions about the social and cultural roles

of women and men. The results of testing this

hypothesis indicate that judgment taken by female

auditors can be more comprehensive than male. This

can be caused by differences in the nature and

character of each individual. Female auditors are

more sensitive and careful in processing information

therefore the judgment taken is more comprehensive.

Women are known to be more painstaking and have

high moral considerations in carrying out their duties,

so the results can be more comprehensive. Female

auditors will reevaluate the information they obtain,

this allows female auditors to get more and better

information to support making an audit judgment.

The results of this study are consistent with the

study of Bobek et al. (2015) which stated that gender

has a significant effect on audit judgment when

interacting with the complexity of the task. This result

also supports the research from Hardies et al. (2015)

that male and female auditors give significantly

different judgment when under pressure of

compliance, besides that women have higher moral

considerations than men, so that audit judgments

made by female auditors tend to be better than male

auditors.

But the results of this study are not in line with the

research of Gul et al. (2013) which said that gender

does not significantly influence the judgment of

auditors who are under pressure. Brown-Liburd et al.

(2015) indicate that there was no difference in auditor

performance seen from gender differences between

men and women when viewed from equality of

organizational commitment, professional

commitment, motivation and employment

opportunities, except for job satisfaction which

showed a difference between the performance of male

and female auditors.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

458

6 CONCLUSIONS

The results of this study indicate that audit experience

has a positive effect on audit judgment. Gender also

has a positive effect on audit judgment. However, this

study has several limitations, including: First, this

research was only conducted on auditors working in

the city of Semarang with a small sample so that the

results may not be able to generalize the behavior of

the entire auditor. Second, this research was only

carried out by survey methods so that data processing

was only based on the answers to the respondents'

questionnaires without any control from the

researchers. For further research, it is expected to

consider other variables to be used as moderating

variables, such as the complexity of tasks and audit

fees. This is interesting to be studied in order to find

out whether the auditor can still maintain its

independence when under pressure.

REFERENCES

Aldamen, H., Hollindale, J. & Ziegelmayer, J. L.

(2018). Female Audit Committee Members

And Their Influence On Audit Fees.

Accounting & Finance, 58, 57-89.

Arum, E. D. P. (2008). Pengaruh Persuasi Atas

Preferensi Klien Dan Pengalaman Audit

Terhadap Pertimbangan Auditor Dalam

Mengevaluasi Bukti Audit. Jurnal

Akuntansi Dan Keuangan Indonesia, 5, 156-

181.

Bobek, D. D., Hageman, A. M. & Radtke, R. R.

(2015). The Effects Of Professional Role,

Decision Context, And Gender On The

Ethical Decision Making Of Public

Accounting Professionals. Behavioral

Research In Accounting, 27, 55-78.

Brown-Liburd, H., Issa, H. & Lombardi, D. (2015).

Behavioral Implications Of Big Data's

Impact On Audit Judgment And Decision

Making And Future Research Directions.

Accounting Horizons, 29, 451-468.

Brown, V. L., Daugherty, B. E. & Persellin, J. S.

(2014). Satyam Fraud: A Case Study Of

India's Enron. Issues In Accounting

Education, 29, 419-442.

Cahan, S. F. & Sun, J. (2015). The Effect Of Audit

Experience On Audit Fees And Audit

Quality. Journal Of Accounting, Auditing &

Finance, 30, 78-100.

Griffith, E. E., Hammersley, J. S., Kadous, K. &

Young, D. (2015). Auditor Mindsets And

Audits Of Complex Estimates. Journal Of

Accounting Research, 53, 49-77.

Gul, F. A., Wu, D. & Yang, Z. (2013). Do Individual

Auditors Affect Audit Quality? Evidence

From Archival Data. The Accounting

Review, 88, 1993-2023.

Hardies, K., Breesch, D. & Branson, J. 2015. The

Female Audit Fee Premium. Auditing: A

Journal Of Practice & Theory, 34, 171-195.

Ittonen, K., Vähämaa, E. & Vähämaa, S. (2013).

Female Auditors And Accruals Quality.

Accounting Horizons, 27, 205-228.

Kang, Y. J., Trotman, A. J. & Trotman, K. T. (2015).

The Effect Of An Audit Judgment Rule On

Audit Committee Members’ Professional

Skepticism: The Case Of Accounting

Estimates. Accounting, Organizations And

Society, 46, 59-76.

Piaget, J. (1970). Piaget's Theory.

Praditaningrum, A. S. & Januarti, I. 2012. Analisis

Faktor-Faktor Yang Berpengaruh Terhadap

Audit Judgment (Studi Pada Bpk Ri

Perwakilan Provinsi Jawa Tengah).

Fakultas Ekonomika Dan Bisnis.

Reheul, A. M., Van Caneghem, T. & Verbruggen, S.

(2013). Auditor Performance, Client

Satisfaction And Client Loyalty: Evidence

From Belgian Non‐Profits. International

Journal Of Auditing, 17, 19-37.

Sofiani, M. M. O. L. (2015). Pengaruh Tekanan

Ketaatan, Pengalaman Audit, Dan Audit

Tenure Terhadap Audit Judgement. Tax &

Accounting Review, 4, 270.

The Influence of Audit Experience and Gender on Audit Judgment

459