The Correlation between Trading Friction and Trading

Characteristic in Indonesian Stock Exchange

Immas Nurhayati

Faculty of Economics and Business, Universitas Ibn Khaldun Bogor, Jawa Barat - Indonesia

Keywords: Trading friction, Trading Characteristics, Implicit Transaction Cost, High Market Capitalization

Abstract: The main purpose of this research is to measure the correlation trading friction and some variabel that affect

it for high frequency financial data in Indonesian Stock Exchange. Trading friction define as the difficulties

faced by investors in the stocks trading which is sourced from implicit transaction cost. Using research

result of trading friction calculation generated in previous studies by Nurhayati, Ekaputra and Husodo

(2018), that the average trading friction of high market capitalization and relatively liquid stocks, scattered

in various fractions price is equal to 1% per year and the highest trading frictions derived from the

information, correlation test will be carried out between trading friction to characteristics of trading. The

result can prove that trading friction measures are negatively and highly correlated with stock price, market

capitalization and number of transactions, and uncorrelated with the volume of transactions as parameters

proved to be insignificant.

1 INTRODUCTION

Liquidity is one of the most important factors to be

considered by investors when investing in stocks

that are trading through stock exchange. Simply,

liquidity can be defined as the facility in trading

asset (Black, 1971). The previous understanding

concerning liquidity was started by the presence of

the equilibrium concept from Walras that known as

“Walrasian Friction Auctioneer”, where equilibrium

market formed from the power side of supply and

demand by some assumptions that the market is

always in the balance condition, perfectly liquid, has

no transaction cost, no tax of balance result and

there is the same information received by investor

(systematic information). The next development

regarding the formation of balance price stated that

balance in reality does not always happen (Demsetz,

1968). The balance can be obtained by agreeing on a

certain price as cost of immediacy. Cost of

Immediacy is cost associated with immediate

execution of tradings. Demsetz’s analysis is

regarded as the beginning of the market

microstructure theory. Demsetz suggested two

things that are not stated in the previous view which

were the cost of trading both explicit and implicit

costs and dimension of time (the time in which the

number of seller is equal to the number of

buyer).Therefore, some assumptions that stated

previously can’t be fulfilled.

The view of the transaction cost continues to

grow with the discovery of the composition of

transaction cost which includes order processing

cost, inventory holding cost and cost dues to

asymmetric information (adverse information cost).

These transaction costs are the obstacles for

investors to reach the balance in market. Stoll called

it a friction in trading (Stoll, 2000). Friction is

devided into real friction and informational friction.

Real friction is sourced from order processing cost

and inventory holding cost while informational

friction is sourced from adverse information cost.

Some other literatures categorized transaction costs

into implicit transaction cost and explicit transaction

cost. Implicit transaction cost is an invisible cost and

its existence cannot be felt, such as bid-ask spread,

while explicit transaction cost is a visible cost and its

existence can be felt directly by investors such as

broker fee, fee of stock manager and government tax

(Harris, 2002) .

Nurhayati, I.

The Correlation between Trading Friction and Trading Characteristic in Indonesian Stock Exchange.

DOI: 10.5220/0009501612511256

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1251-1256

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1251

This research will analyze the correlation

between trading friction as implicit cost in

Indonesian Stock Exchange with some trading

characteristics such as stock prices, trading volume,

transaction amount and market capitalization that is

estimated to affect friction. Average trading friction

and characterictic data used in this reasearch is the

result of trading friction calculated in generated

research in previous studies by Nurhayati, Ekaputra

and Husodo (2018).

2 THEORICAL FRAMEWORK

Trading friction, which is defined in this research, is

implicit transaction cost that investors cannot feel its

existence. As market risk (systematic risk), although

friction cannot be felt but its existence can affect the

market and lead to changes in prices, it can be seen

from the increase in beta (Nurhayati, Ekaputra and

Husodo, 2018). Besides implicit transaction costs,

there are other type of friction, namely explicit

transaction cost. This fee is clearly known by all

investors such as brokerage comission, fee exchange

and government tax.

The static measure standard, which is used to

measure total friction that can be observed in trading

are quoted and effective half spread, which reflects

total trading cost that covers real friction and

informational friction (Stoll, 2000). Half spread term

is used when friction measurement is done in every

transaction, while quoted spread measures spread in

round trip trading. Quoted half spread can be noted

as:

2/

)

(

B

A

S

(1)

Where :

A: ask price

B : bid price

To get the average value of quoted half spread is

by dividing spread with the quantity of the spread

trading. Another alternative of measurement friction

is effective half spread.

M

P

E

S

(2)

Where :

P is trading price

M is quoted mid point

The effective half spread is lower than quoted

half spread. Effective half spread is an actual total

friction measured because using a stock price

variable than quoted half spread with bid and ask

(Cai et al., 2008).

Trading friction consist of real and information

Friction. Trading half spread is one of the model

used for measure real friction, half from the

differences average trading price in ask minus

average trading price in bid. Trading half spread

consists of first trading half spread and second

trading half spread.

The first trading half spread defined as

(Stoll, 2000) :

2/)(1

11

BA

PPTS

A

P

1

is price in trading in i in the side of ask,

B

P

1

is price in trading in i in the side of bid.

The second trading half spread defined as (Stoll,

2000) :

2/)(2

22

BA

PPTS

A

P

2

is price in trading in i in the side of ask,

B

P

2

is price in trading in i in the side of bid.

After all measurements of friction were

completed, proceed with the calculation of the

proportional half spread to the four friction measures

(S, ES, TS1 and TS2). Proportional half spread is

obtained by dividing the average half of the spread

by the average price of each stock during the

observation period. Informational friction is a cost

caused by adverse information. Informational

friction can be said as a profit of informed trading

for the loss of uninformed trader [(Glosten and

Milgrom, 1985)(Kyle, 1985) (Copeland and Galai,

1983)]. Stoll did not formulate a specific model for

informational friction. In this case, informational

friction is considered to be difference between total

friction and real friction.

Trading friction that can affect trading liquidity

can be expanded by analyzing several determinants

of the bid-ask spread itself. Quoted spread is

influenced by several factors including trading

volume, stock price, number of market makers and

risk of securities (Glosten and Harris, 1988). In line

with Glosten and Harris, Stoll states that friction is

strongly influenced by the characteristics of trading.

Friction is directly proportional to volatility and

inversely proportional to the number of tradings,

transaction volume, stock price and market

capitalization (Stoll, 2000). Friction will decrease

with increasing the number of tradings, volume,

market capitalization and stock prices will increase

with increasing volatility.

The hypothesis that will be built in the

correlation analysis between proportional half

spreads and some trade characteristics is:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1252

Hypothesis 1a: There is a strong and negative

correlation between friction and

the average price of a stock.

Hypothesis 1b: There is a strong and negative

correlation between friction and

the average number of transaction.

Hypothesis 1c: There is a strong and negative

correlation between friction and

transaction volume.

Hypothesis 1d: There is a strong and negative

correlation between friction and

market capitalization.

3 RESEARCH METHOD

Based on the results of previous studies about

trading friction and decomposition spread, it was

founded that the amount of friction in the Indonesian

Stock Exchange was 1%. The friction of 1% per

year is a friction generated at relatively liquid

company, high market capitalized stocks, which are

scattered at various prices of friction (Nurhayati,

Ekaputra and Husodo, 2018). High market

capitalization stocks will have high liquidity

(Husodo. Zaäfri A and Henker, 2009).

To develop Nurhayati’s research (Nurhayati,

Ekaputra and Husodo, 2018), this research will use

the data, that also used in Nurhayati's research to

carried out an analysis of the correlation of trading

friction with several characteristics of trading.

Besides average trading friction, the data employed

in the study consist of stock price, trading volume,

trading quantity and market capitalization. The

samples were chosen purposively from regular

market was sorted based on the top 10 stocks are

sorted by capitalization which represents each tick

size from the biggest to smallest.

In collecting data at three time points, there were

some data released from the sample due to the

inavailability and incompleteness. The sample

consist of 38 stocks in 2006 or 10,9 % from the

population, which is 348 emitens, 43 stocks in 2007

or 12 % from 357 emiten and 50 stocks in 2008 or

12,3 % from 406 stocks. Observation period was

divided in three points, which are in 2006, 2007 and

2008 which consist of three months in 2006 and

2008 (August, September and October) and two

months in 2007 (July and August). The average

number of trading days in 2006 are 51 days with the

trading transactions of 541.875 transactions. In

2007, the average numbers of trading days are 41

days with the number of trading transactions of

804.785 transactions. In 2008, the average number

of transactions days are 50 days with the number of

trading transactions of 1.719.175 transactions. The

transaction data employed in the study, which was

obtain from data stream at Economic Data Center

and Business Library of Faculty of Economics

University of Indonesia (PDEB UI).

4 ANALYSIS

Nurhayati, Ekaputra and Husodo (2018) have

calculated trading friction using quoted half spread

(S), effective half spread (ES), first trading half

spread (TS1), second trading half spread (TS2) with

proportional half spread and and this research will

develop it. Using the same object of research, this

study will examine and correlate some trading

characteristic to trading friction. Based on the

calculation of frictions during the observation

period, Nurhayati, Ekaputra and Husodo (2018)

have found that the average amount of frictions in

Indonesian Stock Exchange on large capitalized

stocks is 1%.

The average proportional quoted half spread

(%S) at Indonesian Stock Exchange in 2006 is 1.1%,

and the average proportional effective half spread

(%ES) is 1.1%. In 2007 the average of proportional

quoted half spread (%S) is 1.2%, and the average of

proportional effective half spread (%ES) is 1.2%.

While in 2008, the average of proportional quoted

half spread (%S) at Indonesian Stock Exchange is

1.%, and the average of proportional effective half

spread (%ES) is 1.2%. Based on the results of the

measurement of friction, the next analysis of the

correlation between trading friction and trading

characteristics such as stock price, transaction

volume, number of transactions and market

capitalization will be analyzed (Nurhayati, Ekaputra

and Husodo, 2018).

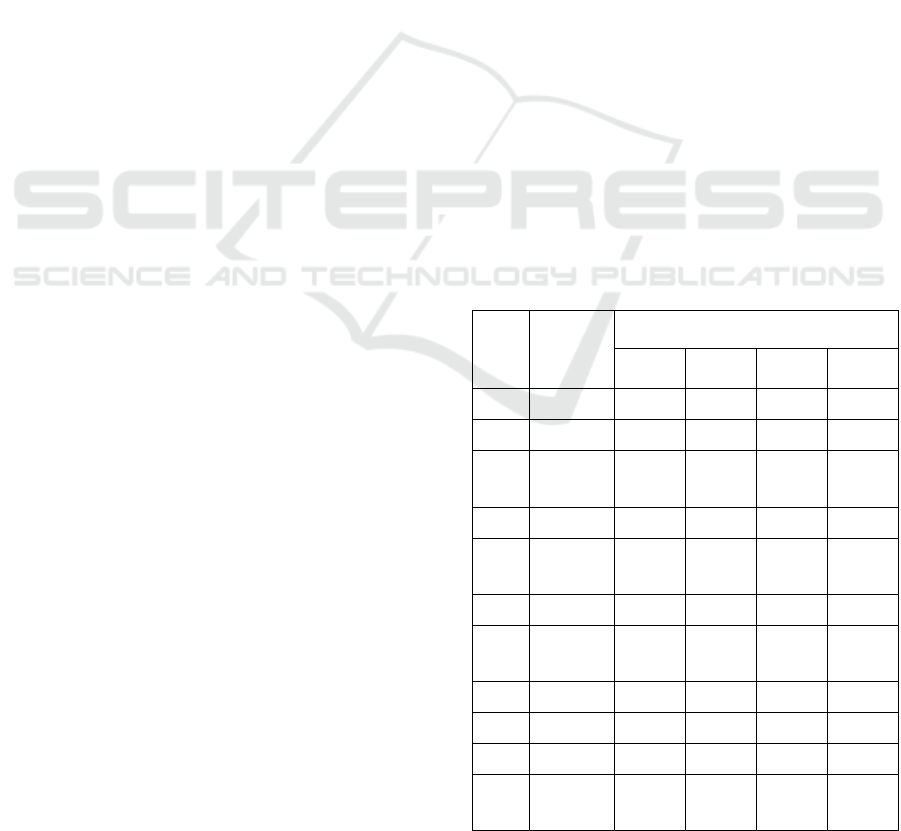

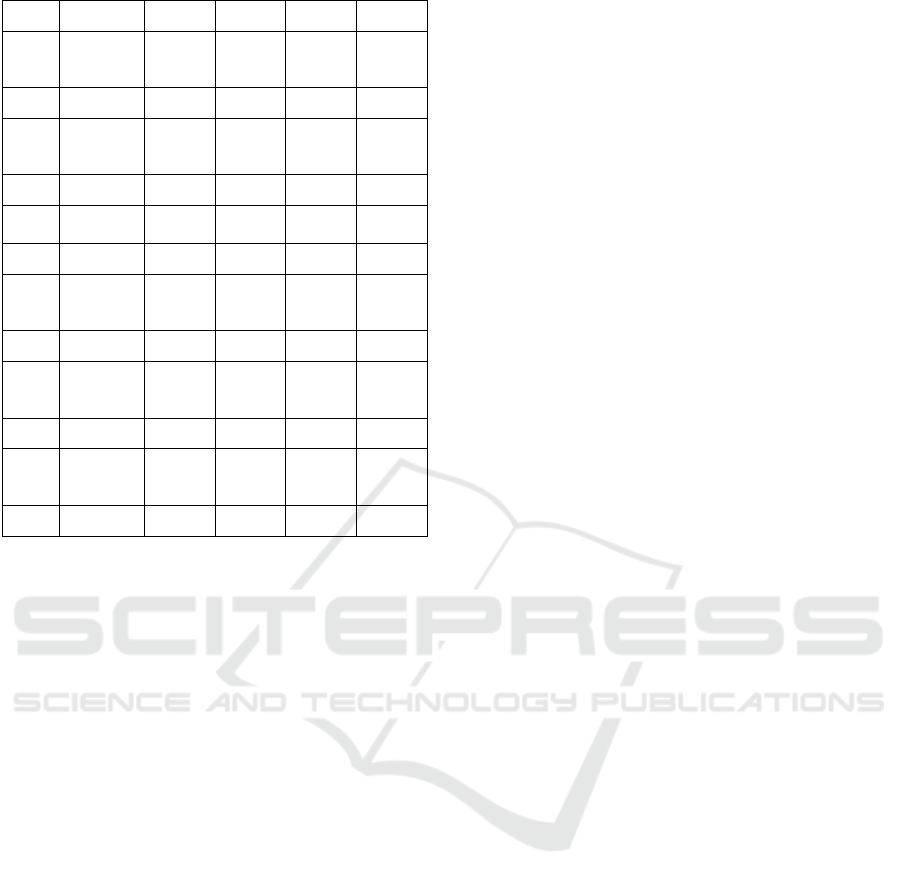

Table 1 presents data on correlation test results

between several friction measures with several

characteristics of trade. Correlation coefficient

between proportional quoted half spread (% S),

proportional effective half spread (% ES),

proportional first traded half spread (% TS1),

proportional second traded half spread (% TS2) with

the average price of 2006 was -26.5%, -27.5%,

-28.6% and -25.7% and significant at α 10% on % S,

% TS2 and significant at 5% on % ES and % TS1.

Correlation coefficient between proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

The Correlation between Trading Friction and Trading Characteristic in Indonesian Stock Exchange

1253

(% TS1) and proportional second traded half spread

(% TS2) with the average price in 2007 was -14%,

14.1%, -17.9% and -20.9%. Although the

correlation between proportional half spread shows a

relationship that is inversely proportional, but the

resulting parameters show a non-significant

relationship between the two, so it cannot prove

hypothesis 1a which states that there is a strong and

negative relationship between spread and stock

price.

Correlation coefficient values are proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

(% TS1), proportional second traded half spread (%

TS2), and to the average price in 2008, respectively

at -21.7%, -24.2%, -25.6% and -26.2%, and

significant at α 10% on % S, 10% on % ES,% TS1,

and % TS2. The correlation shows that there is an

inverse relationship between the proportional half

spread to the average price, meaning that the higher

the average price, the smaller the proportional

spread

Correlation coefficient between proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

(% TS1) and proportional second traded half spread

(% TS2) with the number of transactions in 2006

was -44.8%, -44. 6%, -42.7% and -42.3%.

Correlation coefficient between proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

(% TS1) and proportional second traded half spread

(% TS2) with the number of transactions in 2007

was -38%, -38.7%, -30.9% and -41.1%. Correlation

coefficient between proportional quoted half spread

(% S), proportional effective half spread (% ES),

proportional first traded half spread (% TS1) and

proportional second traded half spread (% TS2) the

number of transactions in 2008 was -31.3%, -31.4%,

-25.8% dan -26.7%, significant at α 5% on % S,%

ES and significant at 10% on % TS1,% TS1. All the

correlation test results were significant at 1% , so the

1b hypothesis is proven.

Correlation coefficient between proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

(% TS1) and proportional second traded half spread

(% TS2) with the volume of transactions in 2006

was -5.8%, -4.6%, -3.9%, -0.5%. Correlation

coefficient between proportional quoted half spread

(% S), proportional effective half spread (% ES),

proportional first traded half spread (% TS1) and

proportional second traded half spread (% TS2) with

the volume of transactions in 2007 was -2.2%, -

2.2%, -1.4%, -2.1%. Correlation coefficient

between proportional quoted half spread (% S),

proportional effective half spread (% ES),

proportional first traded half spread (% TS1),

proportional second traded half spread (% TS2) with

the volume of transactions in 2008 was -13.8%, -

11.4%, -11%, -13.6%. The overall results for 2006,

2007 and 2008 were not significant. so the 1c

hypothesis is not proven.

Correlation coefficient between proportional

quoted half spread (% S), proportional effective half

spread (% ES), proportional first traded half spread

(% TS1) and proportional second traded half spread

(% TS2) with the market capitalization in 2006 was -

28.8%, -29.1%, -29.6%, -28.7%. Correlation

coefficient between proportional quoted half spread

(% S), proportional effective half spread (% ES),

proportional first traded half spread (% TS1) and

proportional second traded half spread (% TS2) with

the market capitalization in 2007 was -25.7%, -

26.1%, -26.1%, -32.5%. Correlation coefficient

between proportional quoted half spread (% S),

proportional effective half spread (% ES),

proportional first traded half spread (% TS1),

proportional second traded half spread (% TS2) with

the market capitalization in 2008 was -28.5%, -

31.3%, -26.8%, -29.1%. The overall results for

2006, 2007 and 2008 were significant at α 5 and

10%, so the 1d hypothesis is proven.

Table 1: The Correlation of trading friction with

trading characteristics

Year

Trading

Character

istic

Proportional Half Spread of Friction

%S %ES %TS1 %TS2

2006

Price -0,265 -0,275 -0,286 -0,257

sig 0,108 0,095 0,081 0,12

Transacti

on

Amount -0,448 -0,446 -0,427 -0,423

sig 0,005 0,005 0,007 0,008

Transacti

on

Volume -0,058 -0,046 0,039 -0,005

sig 0,731 0,782 0,814 0,974

Mark3t

Capitaliz

ation -0,288 -0,291 -0,296 -0,287

sig 0,08 0,076 0,071 0,08

2007

Price -0,14 -0,141 -0,179 -0,209

sig 0,371 0,367 0,251 0,179

Transacti

on

Amount -0,38 -0,387 -0,309 -0,411

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1254

sig 0,012 0,01 0,043 0,006

Transacti

on

Volume -0,22 -0,227 -0,142 -0,217

sig 0,156 0,144 0,364 0,162

Market

Capitaliz

ation -0,257 -0,261 -0,261 -0,325

sig 0,096 0,091 0,091 0,033

2008

Price

-

0,217 -0,242 -0,256 -0,262

sig 0,13 0,091 0,073 0,066

Transacti

on

Amount -0,313 -0,314 -0,258 -0,267

sig 0,027 0,026 0,071 0,061

Transacti

on

Volume -0,138 -0,114 -0,11 -0,136

sig 0,338 0,429 0,448 0,346

Market

Capitaliz

ation -0,285 -0,313 -0,268 -0,291

sig 0,045 0,027 0,06 0,041

5 RESULTS

Based on the result, trading volume and holding

price are not proved to be able to decrease the

spread, although in substance, both of them negative

correlated with trading friction, but trading character

such as holdings price or trading volume are can not

explain trading friction because the parameter is not

significant. Variable of transaction amount and

market capitalization empirically verify is negative

to the spread. More high the transaction quantity, the

spread will more decrease and more high market

capitalization, spread / friction will be lower.

Research conducted by Rhee and Wang (2008)

found a high preference for foreign investors in large

capitalized stocks because it was proven that large

capitalized stocks had a lower level of risk.

Hypothesis testing conducted in this study can prove

the effect of market capitalization dan number og

transaction on spreads. The higher the spread market

capitalization and number of transaction will be

lower.

Trading friction have negative related with

holdings price, trading volume, transaction quantity

and market capitalization. The correlation result can

verify the tight correlation between trading friction

with holdings price, transaction quantity and market

capitalization, however cannot verify correlation

with trading volume because of the parameters has

not effect. As The number of transaction also related

with how many trading. When the transaction, there

is the information from the buy to sell or otherwise.

The oft transaction holding and high transaction

quantity, then decrease the gap information between

buyer and seller, so the spread will smaller and

liquidity will higher. Market capitalization showed

the size of company. Small capitalized companies

have a higher level of risk (Fama and French, 1992).

Correlated analysis between trading friction and

some trading character such as holdings price,

trading volume, transaction quantity and market

capitalization is needed.

6 CONCLUSIONS

By using the intraday data with high frequency in

the Indonesian Stock Exchange, this study can prove

that trading friction has a negative relationship with

stock prices, trading volume, number of transactions

and market capitalization. The correlation test results

can prove the closeness of the relationship between

trade friction and stock prices, the number of

transactions and market capitalization, and cannot

prove its relationship with trading volume because

the parameters prove to be insignificant.

REFERENCES

Black, F. (1971) ‘Toward a fully automated stock

exchange, part I’,

Financial Analysts Journal,

27(4), pp. 28–35.

Cai, C. X.

et al. (2008) ‘Trading Frictions and Market

Structure: An Empirical Analysis’,

Journal of

Business Finance & Accounting

, 35(3–4), pp.

563–579. doi: 10.1111/j.1468-5957.2008.02076.x.

Copeland, T. E. and Galai, D. (1983) ‘Information Effects

on the Bid-Ask Spread’,

The Journal of Finance,

38(5), pp. 1457–1469. doi: 10.1111/j.1540-

6261.1983.tb03834.x.

Demsetz, H. (1968) ‘The Cost of Transacting’,

The

Quarterly Journal of Economics

, 82(1), pp. 33–53.

Fama, E. F. and French, K. R. (1992) ‘the_cross-

section_of_expected_stock_returns.pdf’.

Glosten, L. R. and Harris, L. E. (1988) ‘Estimating The

Components of Bid/Ask Spread’, 21, pp. 123–142.

Glosten, L. R. and Milgrom, P. R. (1985) ‘Bid, ask and

transaction prices in a specialist market with

heterogeneously informed traders’,

Journal of

financial economics

, 14(1), pp. 71–100.

Harris, L. (2002)

Trading and Exchanges: Market

The Correlation between Trading Friction and Trading Characteristic in Indonesian Stock Exchange

1255

Microstructure for Practitioners. 1 edition. Oxford

University Press.

Husodo. Zaäfri A and Henker, T. (2009) ‘Intraday speed

of adjustment and the realized variance in the

Indonesian Stock Exchange.’,

Indonesian Capital

Market Review

, 1 No. 1.

Kyle, A. (1985) ‘Continuous Auctions and Insider

Trading’,

Econometrica, 53(6), pp. 1315–35.

Nurhayati, I., Ekaputra, I. A. and Husodo, Z. A. (2018)

‘Trading Friction and Spread Decomposition in

Indonesian Stock Exchange’, pp. 122–138.

Rhee, S. G. and Wang, J. (2008) ‘Foreign Institutional

Ownership and Stock Market Liquidity: Evidence

from Indonesia.’

Stoll, H. R. (2000) ‘Presidential Address: Friction’,

The

Journal of Finance

, 55(4), pp. 1479–1514. doi:

10.1111/0022-1082.00259.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1256