Indonesian Islamic Banking Performance Analysis

Erna Handayani

1

and Naelati Tubastuvi

1

1

Magister Management, Universitas Muhammadiyah Purwokerto, Banyumas-Indonesia

Keywords: Return on Assets, Capital Adequacy Ratio, Financing to Deposit Ratio, Non Performing Financing,

Operating Expense to Operating Income Ratio, Net Operating Margin

Abstract: The performance of Islamic banking in Indonesia must be improved continuously so that it can be

equivalent to conventional banking. Performance can be assessed from several bank health ratios. This

study analyzes the effect of Capital Adequacy Ratio (CAR), Financing to Deposit Ratio (FDR), Non

Performing Financing (NPF), Operating Expense to Operating Income Ratio (BOPO) and Net Operating

Margin (NOM) towards Return on Assets (ROA). The study was conducted on 13 Islamic public banks

registered at Indonesia Financial Service Authority (OJK) during 2012-2017 with multiple linear regression

methods. Partially, the results of the study showed that CAR and BOPO have significant effect towards

ROA, while CAR, FDR, NPF, BOPO and NOM have simultaneous effect on ROA.

1 INTRODUCTION

Public awareness of Islamic banking in Indonesia

has increased after issuance of the Indonesian Ulema

Council Fatwa (Fatwa MUI) Number 1 of 2004

concerning interest and usury. The development of

Islamic banking continues to increase which can be

seen from the growth in the number of Sharia

Commercial Banks, Sharia Business Units and

Islamic People's Financing Banks. Based on

Indonesia Financial Services Authority statistics on

Islamic banking at the end of 2017, there were 13

Sharia Commercial Banks, 21 Sharia Business Units

and 167 Islamic People's Financing Banks.

Based on Indonesia Financial Services Authority

data until August 2017, the total Indonesian Islamic

financial assets (excluding Sharia Shares) reached

Rp 1,048.8 trillion, which consisted of Sharia

Banking assets of Rp 389.74 trillion, Sharia Non-

Bank Financial Industry of Rp 99.15 trillion, and

Markets Sharia capital of Rp. 559.59 trillion.

The total Indonesian Islamic financial assets is

small compared to the total assets of the financial

industry which reached Rp. 13,092 trillion. It

showed that the market share of the Islamic finance

industry only reached 8.01% of the total national

market share. (Press Release: Sharia Financial

Market Share, Indonesia Financial Services

Authority, 2017).

Although the market share of the national

banking and sharia finance industry still has not

reached the expected level (seen from the market

share data), in terms of the magnitude of Indonesian

Islamic financial assets has reached the ninth largest

position in the world with assets around USD 35.6

billion (in 2013). In addition, Indonesia has received

recognition and appreciation from the international

community together with the UAE, Saudi Arabia,

Malaysia and Bahrain are considered to be in a

position to offer lessons to other countries in the

world for sharia finance development. The Indonesia

Financial Services Authority also received the award

as the best regulator in promoting Islamic finance

(Indonesia Financial Services Authority, 2017).

Based on the data above, Islamic banking in

Indonesia is required to continue improving the

performance of its business in facing the challenges

from both in international competition and an

increase in the market share of domestic banking. In

addition, a significant increase in profitability is

needed for the development of the position of

Islamic banking in Indonesia. Data from Indonesia

Financial Services Authority (2017) which showed

Islamic banking performance from its Return on

Assets (ROA) is still in the range of 0.63-1.12%.

This number still lags behind general conventional

banking, which ranges from 2.35-2.50%.

1244

Handayani, E. and Tubastuvi, N.

Indonesian Islamic Banking Performance Analysis.

DOI: 10.5220/0009500612441250

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1244-1250

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The Government through Indonesia Financial

Services Authority has made the direction of the

Indonesian Islamic banking development which

called the Sharia Banking Roadmap 2015-2019. This

is proof that the government is starting to give more

attention to the continuous growth of Islamic

banking (Indonesia Financial Services Authority,

2017)

Another regulator, Bank Indonesia, has

established a risk-based bank rating system

contained in Bank Indonesia Regulation no.

1/13/2011 concerning the assessment of risk-based

bank rating of commercial banks. In this regulation,

banks are required to conduct a self-assessment of

the health of banks with a risk-based approach (Risk

based Bank Rating-RBBR) both individually and on

a consolidated basis. The purpose of evaluating the

risk-based bank rating is to obtain an overview of

the health of the bank so that it can be used as an

input for the bank in developing future business

strategies and plans and improving weaknesses that

could potentially disrupt the bank's performance.

(Indonesian Bankers Association, 2015)

Assessment of the bank health level, both

individual and consolidation with the assessment

factors including:

1. Risk Profile

2. Good Corporate Governance (GCG)

3. Earning

4. Capital

The risk profile consists of credit risk, market

risk, operational risk, liquidity risk, strategic risk,

compliance risk, legal risk, reputation risk, and risk

profile ranking. Good Corporate Governance (GCG)

consists of structure, process, results and GCG

ranking. Earning (Rentability) consists of

performance, source, sustainability, and rentability

ratings. Capital consists of adequacy, management

and capital rating (Indonesian Bankers Association,

2015).

Banking performance will increase with a good

level of health. Banking performance concerns the

study of profitability. There are two ratios which are

usually used to measure banking performance,

namely Return on Assets (ROA) and Return on

Equity (ROE).

Return on Asset as a benchmark for bank

profitability is influenced by several factors

including internal factors and external banking

factors. Internal factors include capital risk, liquidity

risk, credit risk and operational risk.

Based on the background above, this study tried

to measure the effect of Capital Adequacy Ratio

(CAR), Financing to Deposit Ratio (FDR), Non

Performing Financing (NPF), Operating Expense to

Operating Income Ratio (BOPO) and Net Operating

Margin (NOM) towards Return on Asset (ROA).

This study was conducted on Islamic banking in

Indonesia, especially Sharia Commercial Banks

registered at Indonesia Financial Services Authority

during 2012-2017.

2 THEORICAL FRAMEWORK

Based on Circular Letter of Bank Indonesia No.6 /

23 / DPNP dated May 31, 2004 concerning the Risk-

based Bank Rating System for Commercial Banks,

there are eight indicators used to measure the level

of profitability, namely return on assets, return on

equity, net interest margin, operating expense to

operating income, development of operating profit,

composition of the portfolio of earning assets and

diversification of income, application of accounting

principles in revenue recognition, prospects for

operating profit.

The ratio commonly used in measuring the level

of rentability / profitability is ROA (Hery, 2016).

ROA is a measurement of the bank's financial

performance in obtaining profit before tax, which is

generated from the total assets of the bank (Circular

Letter of BI No.3 / 30 / DPNP December 14, 2001).

ROA can be calculated by dividing profit after tax

by total assets (Sartono, 2001).

Based on Circular Letter No.9 / 24 / DPBS /

2007 concerning the Sharia risk-based bank rating

system, Bank Indonesia stipulates a minimum ROA

of 1.26% or greater than 1.25% to determine the

ROA for a health bank. So that the greater the ROA

shows the bank's performance the better, because the

rate of return is greater (Husnan, 1992). ROA as a

reflection of the bank's financial performance is

influenced by factors as follows:

2.1 Bank Capital

Assessment of capital factors includes an assessment

of the level of capital adequacy and capital

management. (Indonesian Bankers Association,

2016). There are several ratios used to monitor bank

capital positions, one of which is Capital Adequacy

Ratio (Indonesian Bankers Association, 2016).

According to Bank Indonesia regulations, Capital

Adequacy Ratio is a ratio that shows how much the

bank assets containing risk (credit, participation,

securities, bills on other banks) that are also financed

from their own capital in addition to obtaining funds

from outside sources. Capital Adequacy Ratio is

obtained by dividing Capital with Risk Weighted

Assets or RWA (Circular Letter of BI, 2011).

Based on the Indonesia Financial Services

Authority Regulation Number 21 / POJK.03 / 2014

concerning about Minimum Capital Requirement for

Indonesian Islamic Banking Performance Analysis

1245

Sharia Commercial Banks, the provision of

minimum capital is determined as follows:

a. 8% (eight percent) of Risk Weighted Assets for

banks with a risk profile rating of 1 (one);

b. 9% (nine percent) up to less than 10% (ten

percent) of RWA for banks with a risk profile

rating of 2 (two);

c. 10% (ten percent) up to less than 11 (eleven

percent) of RWA for banks with a risk profile

rating of 3 (three); or

d. 11% (eleven percent) to 14% (fourteen percent)

of RWA for banks with a risk profile rating of 4

(four) or 5 (five).

The greater the CAR ratio, the bank has the

potential to increase profits. In other words, CAR

affects ROA. This has been proven by Kishori

(2017), Anggreni, (2014), Shamki, Alulis and

Sayari, (2016), Margaretha (2017), Chou and

Buchdadi, (2016), Sukirmo (2016), Sudiyanto

(2010), Nahar and Prawoto, (2017), Kinanti, (2017),

Amelia, (2015), Andhina Dyah Sulityowati, Noer

Azam Achsani, (2017), Hantono, (2017), M, Ali and

Habbe, (2012) and Bachri (2013). Meanwhile, some

research showed different results and indicates that

CAR does not have a significant effect on ROA

(Sudiyatno, 2013, and Wibowo and Syaichu, 2013).

2.2 Liquidity

Banks are very concerned about fulfilling their

liquidity because the most important measure of

public trust is about whether the bank can fulfill the

withdrawal of funds made by the customers for their

interests anytime. It is in addition to fulfill the

conditions set by the monetary authorities and

correspondent banks where banks maintain non-

bank accounts (Ericson Leon Boy Sonny, 2007).

In the banking industry, the liquidity ratio is

known as the Loan to Deposit Ratio. In Islamic

banking, the term of loan is known as financing

(Antonio, 2001). This ratio is known as Financing to

Deposit Ratio (FDR). FDR is a ratio to measure the

composition of the amount of financing provided

compared to the amount of public funds and the

capital used (Kasmir, 2012). The higher this ratio

shows the lower the ability of bank liquidity because

the amount of funds needed for financing is getting

bigger (Dendawijaya, 2009).

Based on Financial Services Authority

Regulation Number 3 / POJK.03 / 2016 concerning

Islamic People's Financing Bank is setting the

Financing to Deposit Ratio ranges from 78% -100%.

If the FDR is under the standard set by Indonesia

Financial Services Authority, it shows the lack of

effectiveness of the bank in channeling its financing,

so that there is a loss of opportunity for profit. If the

FDR is more than 100%, the financing channeled

exceeds the funds collected so that the bank will

experience a shortage of funds to fulfill its

obligations. This high and low ratio indicates the

level of liquidity of the bank, the higher the FDR

number of a bank, described as a bank that is less

liquid compared to banks that have a smaller ratio.

FDR is calculated from the amount of financing

divided by third party funds (Muhammad, 2005).

Several studies have examined the effect of liquidity

(FDR) on profitability (ROA) with a significant

effect that was carried out by Zakaria (2015),

Farooq, Qasim and Asad, (2015), Malik et al.,

(2014), Chou and Buchdadi, (2016), Hantono,

(2017) dan Sukirmo (2006), Kishori (2017),

Andhina Dyah Sulityowati, Noer Azam Achsani,

(2017) dan M, Ali and Habbe, (2012). Meanwhile,

research from Pramuka, (2010) showed that FDR

has no significant effect on ROA.

2.3 Credit Risk

Credit risk is also called financing risk. Financing

risk is the risk due to the failure of the debtor and /

or other parties in fulfilling the obligation to pay off

financing at the bank. In financing activities, both

commercial financing and consumption financing,

there is a possibility that the debtor cannot fulfill the

obligation to the bank for various reasons such as

business failure, because the character of the debtor

who does not have good faith to fulfill obligations to

the bank, or indeed there is an error from the bank

itself in the financing approval process (Indonesian

Bankers Association, 2015).

Sharia Commercial Banks need to improve

management of their financing risks so that the level

of Non Performing Financing does not exceed the

provisions of Indonesia Financial Services

Authority. Financial Services Authority Regulation

Number 3 / POJK.03 / 2016 concerning Islamic

People's Financing Bank have set that the ratio of

Non-Performing Financing is a maximum of 7% of

total financing.

According to Bank Indonesia regulations in

2012, Non Performing Financing is calculated by

adding all of KL, D, M Financing divided by total

financing. The higher the NPF level of a bank, the

lower the income that must be obtained. Vice versa,

if the NPF level is low, the level of bank income will

increase. Thus, increasing NPF is considered to have

a significant effect on bank performance. Previous

research that proved the significant effect of NPF

towards ROA was found by Yoppy and

Purbaningsih, (2014), Zakaria (2015), Anggreni,

(2014), Amelia, (2015), Pramuka, (2010), Hantono,

(2017), Wibowo (2013) and Bachri (2013), Nahar

and Prawoto, (2017), Kinanti, (2017) and Sudiyanto

(2010). Whereas, previous research from M. Ali and

Habbe, (2012) found that NPF has no significant

effect on ROA.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1246

2.4 Operational Risk

Operational risk is a risk that happens due to

inadequate and / or non-functioning internal

processes, human errors, system failures, or the

presence of external problems that affecting bank

operations (Ali, 2006). Operational risk is the risk of

loss because the bank works inefficiently,

uneconomically, ineffectively, not smooth,

insecurely, and disorderly. Generally, bank failures

are caused by operational risks. In the CAMEL

approach, the measurement of operational risk is

reflected in the BOPO ratio. The higher BOPO ratio

indicates high operational risk (Hayati, 2017).

Financial Services Authority Regulation Number

3 / POJK.03 / 2016 concerning Islamic People's

Financing Bank have set that the BOPO ratio

(Operating Expense to Operating Income) is a

maximum of 94% (Indonesian Bankers Association,

2015).

If a bank has BOPO more than the predetermined

provisions, the bank is included in the inefficient

category, because the higher the BOPO means that

the increase in operational costs is greater than the

increase in operating income so that the profit

earned will eventually decreases. According to

Suyanto, (2016), BOPO (Operating Expense to

Operating Income) can be measured by dividing the

operating expenses with operating income.

Previous research have showed that BOPO has

effect towards the profitability (ROA) (Sudiyatno,

2013; Nahar and Prawoto, 2017; Amelia, 2015;

Chou and Buchdadi, 2016; Sukirmo, 2006;

Sudiyanto, 2016; Wibowo, 2013; M, Ali and Habbe,

2012; and Margaretha 2015). Meanwhile, research

from Malik et al., (2014) showed that BOPO has no

significant effect on ROA.

2.5 Net Operating Margin (NOM)

Net Operating Margin (NOM) is a ratio to assess the

bank's profitability. NOM is calculated by dividing

operating profit by the average of earning assets

(Indonesian Bankers Association, 2016). Operating

profit is annual net interest income deduced by

annual operating expenses. Earning assets are assets

that generate interest both on the balance sheet and

on TRA. Average earning assets are calculated by

adding the total productive assets positions from

January to June divided by 6 (Indonesian Bankers

Association, 2016). Banks are required to maintain a

positive NOM value. The higher the NOM, the

higher the bank's income generated by the bank's

productive assets. The previous research supported

the statement was the research from M. Ali and

Habbe, (2012), Subandi (2013), Sudiyatno, 2013),

Andhina Dyah Sulityowati, Noer Azam Achsani,

(2017). However, the opposite results found by

(Rindhatmono, 2005).

3 RESEARCH METHOD

This study uses secondary data in the form of

financial statements of Islamic Commercial Banks

presented by Indonesia Financial Services Authority

website, ojk.go.id, during 2012-2017. Data is

collected with time series, namely quarterly financial

statements.

The analytical model used is multiple regression

analysis model. The analysis technique that will be

used in this study is multiple linear regression

analysis. Multiple linear regression analysis measure

the strength of the relationship between two or more

variables, also shows the direction of the

relationship between assumed to be random /

stochastic which means it has a probabilistic

distribution (Ghozali, 2016). In this study, a

regression test was performed with an independent

variable (x) towards the dependent variable (y). The

multiple linear regression equation used are:

Y

it

= α + β

1

X

1it

+ β

2

X

2it

+ β

3

X

3it

+ β

4

X

4it

+ β

5

X

5it

+ e

it

Where :

Y : Financial Performance (ROA)

i : Islamic Commercial Banks

t : Year

α : Constant/Intercept

β : Regression Coefficient

X_1 : Capital Adequacy Ratio

X_2 : Financing to Deposit Ratio

X_3 : Non Performing Financing

X_4 : BOPO ratio (Operating Expense to Operating

Income)

X_5 : Net Operating Margin

e : error

The hypothesis in this study are:

1. Capital with CAR indicators affects

performance (ROA) in Sharia Commercial

Banks in Indonesia during 2012-2017.

2. Liquidity Risk with the FDR indicator affects

the performance (ROA) of Islamic Commercial

Banks in Indonesia during 2012-2017.

3. Credit Risk with the NPF indicator affects the

performance (ROA) of Islamic Commercial

Banks in Indonesia during 2012-2017.

4. Operational risks with BOPO indicators affect

performance (ROA) in Islamic Commercial

Banks in Indonesia during 2012-2017.

5. Rentability with NOM indicators influences

performance (ROA) in Islamic Commercial

Banks in Indonesia during 2012-2017.

Before testing multiple linear analysis of the

research hypothesis, it is necessary to test a classic

Indonesian Islamic Banking Performance Analysis

1247

assumption first. The classic assumption test aims to

find out and test the feasibility of the regression

model used in this study. The classic assumption test

consists of normality test, multicollinearity test,

autocorrelation test, and heteroscedasticity test

(Ghozali, 2016).

4 ANALYSIS

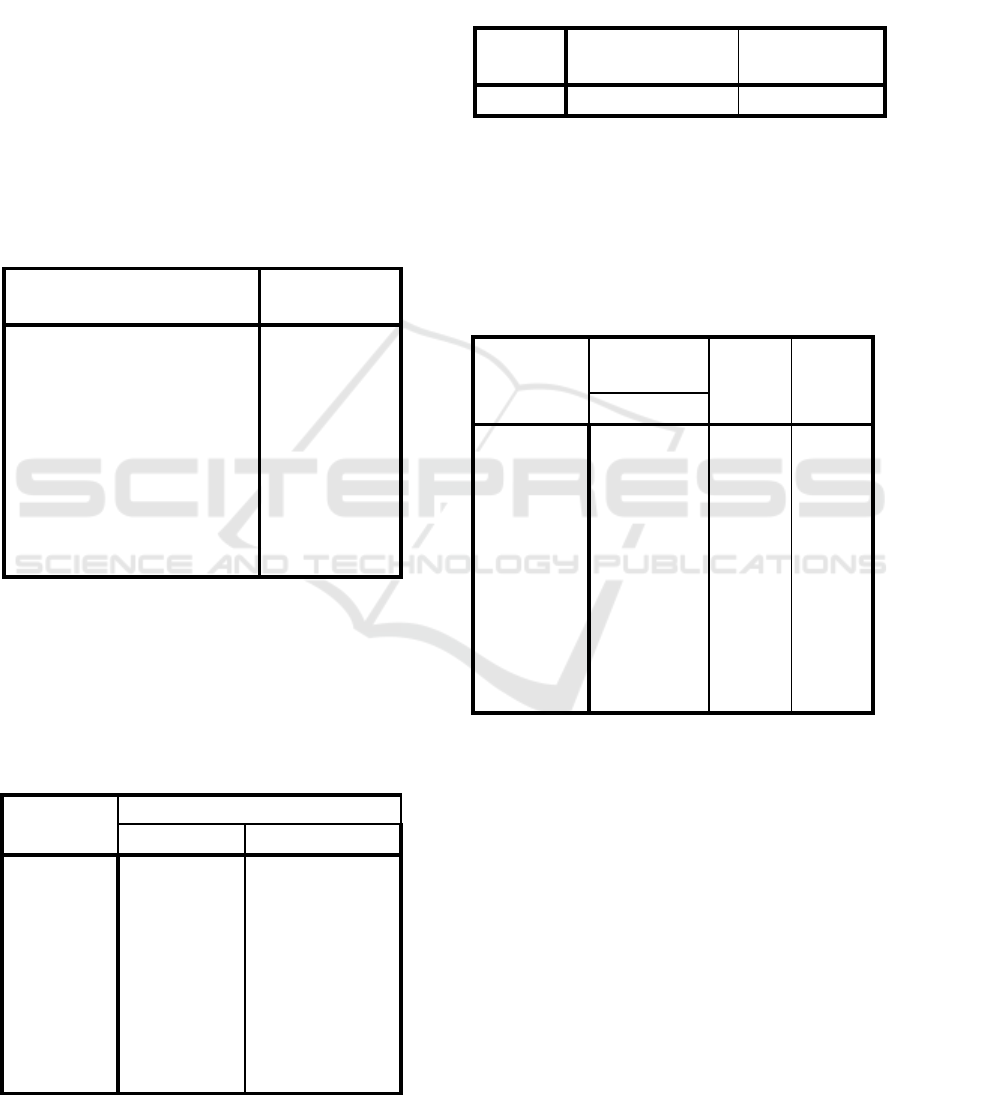

Table 1 showed that the sig. value of normality test

is 0.603. It was concluded that the normality

assumption of research data was fulfilled because it

was greater than 0.05. (Ghozali, 2016)

Table 1: Normality Test

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N

215

Normal

Parameters

a,

b

Mean

-.0389634

Std.

Deviation

.35537830

Most

Extreme

Differences

Absolute

.052

Positive

.052

Negative

-.027

Kolmogorov-Smirnov Z

.764

Asymp. Sig. (2-tailed)

.603

a. Test distribution is Normal.

b. Calculated from data.

Multicollinearity test results as shown in Table 2

obtained a Tolerance value of > 0.1, while the VIF

value is < 10, meaning that there were no symptoms

of multicollinearity (Suliyanto, 2011).

Table 2: Multicollinearity Test

Model

Collinearity Statistics

Tolerance

VIF

1

(Constant)

CAR

.726

1.377

FDR

.829

1.206

NPF

.672

1.487

BOP

O

.511

1.955

NOM

.684

1.463

Autocorrelation test results showed in table 3.

indicates that the Durbin Watson value of 0.772 are

found between -2 and 2, so it is concluded that there

is no data autocorrelation (Santosa, 2012).

Tabel 3: Autocorrelation Test

Model Summary

b

Mod

el

Std. Error of

the Estimate

Durbin-

Watson

1

.31112

.779

a. Predictors: (Constant), NOM, CAR, FDR,

NPF, BOPO

b. Dependent Variable: ROA

Table 4. showed the results of Heteroscedasticity

Test. The sig value for the independent variable is

greater than 0.05, which means there is no

heteroscedasticity (Suliyanto, 2011).

Table 4: Heteroscedasticity Test

Model

Standardized

Coefficients

T

Sig.

Beta

1

(Constant)

-

.631

.529

CAR

.052

.618

.537

FDR

-.063

-

.786

.433

NPF

.092

1.05

9

.291

BOPO

.151

1.54

3

.125

NOM

.042

.483

.630

a. Dependent Variable: abs_res2

After all the classical assumption tests are carried

out and resulted that all the data can be used, then

multiple linear regression analysis is carried out. The

following are the equations obtained from the test

results:

ROA =7,508+0.09CAR+0,01FDR+0,13 NPF –

0,076BOPO+0,011NOM

The results showed that the value of ROA constant

is 7.508. CAR regression coefficient is 0.09

indicating that a 1% increase from the CAR value

will increase ROA by 0.09% assuming other

variables remain. The result is similar with FDR,

NPF and NOM. BOPO regression coefficient is -

0.076 which means that if there is a reduction in

BOPO of 1%, it will increase the ROA by 0.076.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1248

Table 5. showed the coefficient of determination test

with the results of the Adjusted R Square value is

0.861. It means that 86.1% percent ROA can be

affected by the simultaneous effect from

independent variables namely CAR, FDR, NPF,

BOPO and NOM, while the rest are influenced by

other variables.

Table 5: Coefficient of Determination Test

Model Summary

Mode

l

R

R

Square

Adjusted

R Square

Std. Error of

the Estimate

1

.930

a

.864

.861

.31112

a. Predictors: (Constant), NOM, CAR, FDR,

NPF, BOPO

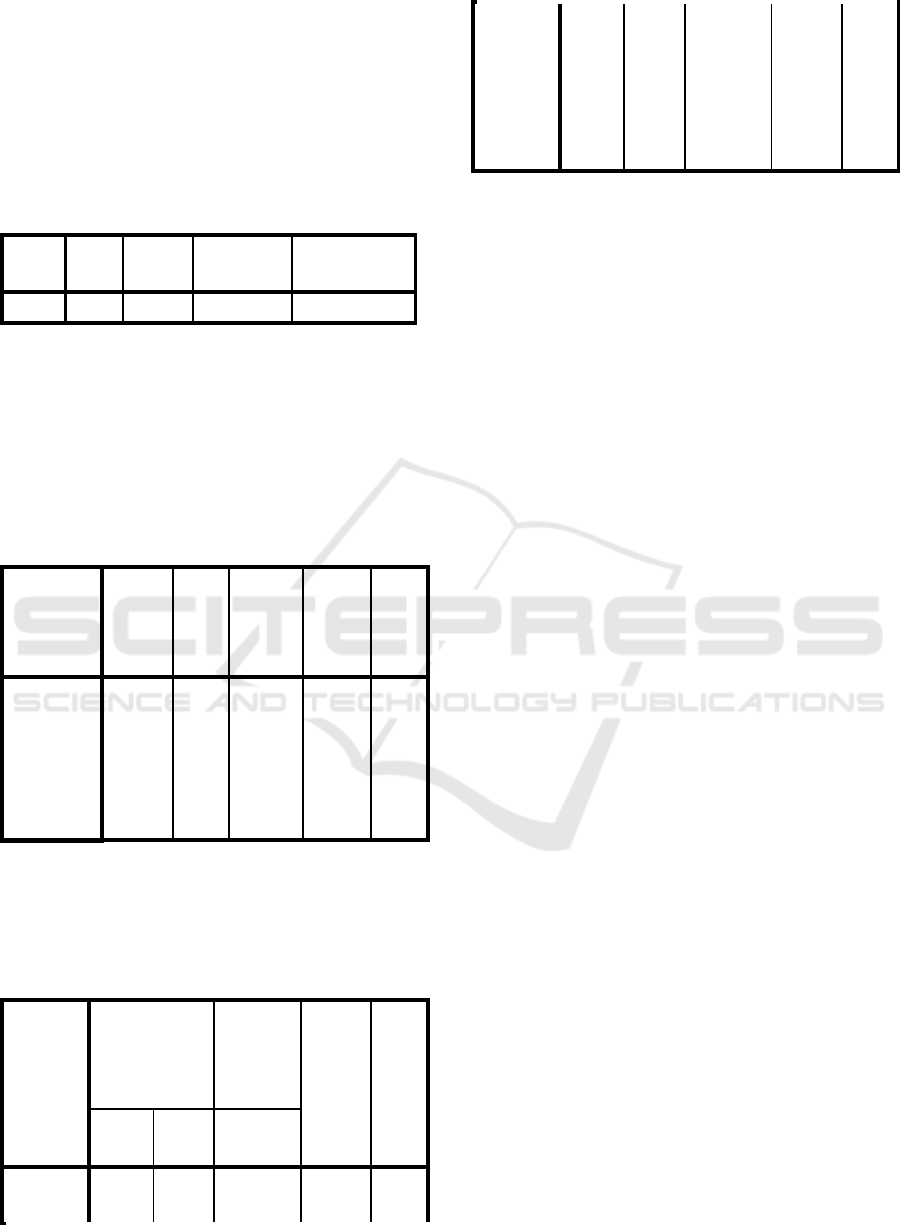

Table 6 showed the results of the F test where the

results is 0,000 which means that all the independent

variables simultaneously affect the dependent

variable.

Table 6 Results of the F Test

ANOVA

a

Model

Sum

of

Square

s

Df

Mean

Square

F

Sig.

Regressio

n

128.5

48

5

25.710

265.6

14

.000

b

Residual

20.230

209

.09

7

Total

148.77

8

214

a. Dependent Variable: ROA

b. Predictors: (Constant), NOM, CAR, FDR, NPF, BOPO

Coefficients

a

Table 7: Showed the Results of T test

Model

Unstandardiz

ed

Coefficients

Standard

ized

Coeffici

ents

t

Sig.

B

Std.

Error

Beta

1

(Consta

nt)

7.508

.298

25.173

.000

CAR

.009

.002

.120

3.995

.000

FDR

.001

.001

.031

1.118

.265

NPF

.013

.017

.023

.733

.464

BOPO

-.076

.003

-.864

-24.221

.000

NOM

.011

.008

.047

1.525

.129

a. Dependent Variable: ROA

Table 7 showed the results of T test. It found that

CAR results significantly affects ROA with a sig

value of 0,000 > 0.05. The result is similar with the

BOPO value. The sig. value of FDR, NPF and NOM

are greater than 0.05, so they are not significant.

Hypothesis Test 1

The results of data analysis show that Hypothesis 1:

CAR has a significant effect on ROA, supported.

This result supports the opinion that with the

addition of capital, banks have greater opportunities

to increase profits. The results of hypothesis 1 are in

line with previous researches from Kishori (2017),

Anggreni, (2014), Shamki, Alulis and Sayari,

(2016), Margaretha (2017), Chou and Buchdadi,

(2016), Sukirmo (2016), Sudiyanto (2010).

Hypothesis Test 2

The results of hypothesis 2 showed different results.

The result showed that T test value of more than

0.05, which is 0.265, the conclusion of the FDR has

no effect towards ROA. This result is the same as

previous result by Pramuka, (2010). So, hypothesis 2

is not supported.

Hypothesis Test 3

The test of the effect of NPF towards ROA obtained

a significant value of 0.464, it is concluded that

hypothesis 3 is not supported. The result is

supported by previous research from M, Ali and

Habbe, (2012).

Hypothesis Test 4

Significant affect towards ROA is then obtained

from BOPO. In general, effective costs will increase

profits. So, hypothesis 2 is supported. The result is

supported by previous researches from Sudiyatno,

(2013), Sudiyatno, (2013), Amelia, (2015), Chou

and Buchdadi, (2016), Sukirmo (2006), Sudiyanto

(2016), Wibowo (2013) and M. Ali and Habbe,

(2012), Margaretha (2015).

Hypothesis test 5

Indonesian Islamic Banking Performance Analysis

1249

The result of t test showed that the value is 0.129,

then hypothesis 4 is not supported. This result is

supported by previous research from Ferdi

Rindhatmono (2005).

5 CONCLUSION

The results showed that CAR and BOPO have a

significant effect towards ROA, while FDR, NPF

and NOM have no significant effect towards ROA.

In the other hand, FDR, NPF and NOM have a

simultaneous effect on ROA with a coefficient level

of 86.1%. Based on 5 years’ observation, other

factors that affect ROA in Indonesian Islamic

Banking still need to be explored. The significant

effect of CAR and BOPO have been theoretically

proven. However, it needs to be reexamined why

FDR, NPF and NOM has no effect towards ROA.

Based on existing theories, credit risk and liquidity

risk are important for banks because during the

period of 2012-2017 there were several Islamic

banks that were in the early stages of developing and

some were newly founded. It is because banks are

still focused on aspects of capital and performance

efficiency.

REFERENCES

Amelia, E. (2015) ‘Financial Ratio And Its Influence To

Profitability In Islamic Banks’, (95), pp. 229–240.

Andhina Dyah Sulityowati, NoerAzamAchsani and Tanti

Novianti (2017) ‘Analysis of Factors Affecting

Profitability in XYZ Bank ( One of Commercial

Bank in Indonesia )’, 7(4), pp. 276–282.

Anggreni, M. R. (2014) ‘Pengaruh Dana Pihak Ketiga,

Kecukupan Modal, Risiko Kredit Dan Suku Bunga

Kredit Pada Profitabilitas’, ISSN: 2302-8556 E-

Jurnal Akuntansi Universitas Udayana, 1, pp. 27–37.

Chou, T. and Buchdadi, A. D. (2016) ‘Bank Performance

and Its Underlying Factors : A Study of Rural Banks

in Indonesia’, 5(3), pp. 55–63. doi:

10.5430/afr.v5n3p55.

Farooq, U., Qasim, M. and Asad, M. (2015) ‘An Empricial

Study on Impact Liquidity Risk Management on

Firm Performance in the Conventional Banking of

Pakistan’, 17(2), pp. 110–118. doi: 10.9790/487X-

1723110118.

Hantono (2017) ‘Effect of capital adequacy ratio (car),

loan to deposit ratio (ldr) and non performing loan

(npl) to return on assets (roa) listed in banking in

indonesia stock exchange’, International Journal of

Education and Research, 5(1), pp. 69–80.

Kinanti (2017) ‘Influence Of Third-Party Funds, Car, Npf

And Fdr Towards The Return On Assets Of Islamic

Banks In Indonesia Risma Ayu Kinanti *)

Purwohandoko **)’, 14(2), pp. 135–143.

M, M. S., Ali, M. and Habbe, A. H. (2012) ‘Pengaruh

rasio kesehatan bank terhadap kinerja keuangan

bank umum syariah dan bank konvensional di

indonesia’, 1(1), pp. 79–86.

Malik, M. F. et al. (2014) ‘Interest Rate and Its Effect on

Bank ’ s Profitability’, 4, pp. 225–229.

Nahar, F. H. and Prawoto, N. (2017) ‘Bank ’ S

Profitability In Indonesia : Case Study Of Islamic

Banks Period 2008-2012’, 18. doi:

10.18196/jesp.18.2.4043.

Pramuka, B. A. (2010) ‘Faktor-Faktor Yang Berpengaruh

Terhadap Tingkat Profitabilitas Bank Umum

Syariah’, pp. 63–79.

Rindhatmono, F. (2005) Profitabilitas Bank Pasca Merger

Di Indonesia.

Shamki, D., Alulis, I. K. and Sayari, K. (2016) ‘Financial

Information Influencing Commercial Banks

Profitability’, 8(6), pp. 166–174. doi:

10.5539/ijef.v8n6p166.

Sudiyatno, D. P. dan B. (2013) ‘Faktor-faktor yang

mempengaruhi kinerja bank (studi empirik pada

industri perbankan di bursa efek indonesia)’, Jurnal

Bisnis dan Ekonomi (JBE), 20(1), pp. 25–39.

Suyanto, H. A. (2016) Pengelolaan BPR dan Lembaga

Keuangan Pembiayaan Mikro. Yogyakarta: CV

Andi Offset.

Wibowo, E. S. (2013) ‘Analisis pengaruh suku bunga,

inflasi, car, bopo, npf terhadap profitabilitas bank

syariah’, Diponegoro Journal of Management, 2, pp.

1–10. Available at: http://ejournal-

s1.undip.ac.id/index.php/djom.

Yoppy, R. and Purbaningsih, P. (2014) ‘The Effect of

Liquidity Risk and Non Performing Financing ( NPF

) Ratio to Commercial Sharia Bank Profitability in

Indonesia’. doi: 10.7763/IPEDR.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1250