Factor-Factor Affecting Labor Demand Food Beverages and Tobacco

Industry of North Sumatra Province

Elida Madona Siburian

1

, Muhammad Fitri Rahmadana

1

and Indra Maipita

1

1

Department of Economics, Faculty of Economics, State University of Medan, North Sumatra, 20219, Indonesia

Keywords: Labor Demand Food Beverages and Tobacco Industry, Investment Industry Sector, Number of Large and

Medium Manufacturing, Minimum Wage of Regency/City, Gross Regional and Domestic Product

Abstract: Labor demand in North Sumatra during the period 2012 to 2016 showed a fluctuating condition. The aim of

this research is to analyze the factors that affecting labor demand food beverages and tobacco industry at the

regency/city in North Sumatra Province using panel data. With independent variables Investment Industry

Sector, Industry Number, Minimum Wage for regency/city and Gross Regional Domestic Product while the

dependent variable is Labor Demand. Data obtained the Central Statistics Agency (BPS) of North Sumatra

Province during 2012-2016. The method used Panel Least Square (PLS) with Random Effect Model

(REM). The result show that Investment Industry Sector has positively effect the labor demand as 21,88%

and significant, Industry Number has positively effect the Labor Demand as 48,48% and significant,

Minimum Wage of regency/city has negatively effect the Labor Demand as 13,14% and significant and

Gross Regional Domestic Product has positively effect the Labor Demand as 34,51% and significant at the

Labor Demand in North Sumatra Province.

1 INTRODUCTION

Improving community welfare is one of the main

goals of economic development in developing

countries. One of the important problems faced by

developing countries is high population growth. The

high population growth affects the increase in the

workforce. This condition will be a problem if it is

not balanced with employment. One indicator used

to assess the success of a country's economic

development is seen from the employment

opportunities created by economic development

activities (Freter, 2014). One sector that plays an

important role in economic development is the

industrial sector. This sector has several advantages,

such as absorbing a large workforce and creating

high added value. The industrial sector is believed to

be a sector that can lead other sectors in an economy

towards progress

In Indonesia, the industrial sector is prepared to

be able to become a leading sector that is able to

become a motor that drives the progress of other

sectors. Thus the industrial sector is expected to be

able to provide employment so that it can absorb the

large number of workers in Indonesia. In the

Province of North Sumatra from 2014-2016 the

contribution of the manufacturing industry to the

GRDP of North Sumatra Province each year has

increased. Where each year the contribution of the

Processing Industry to North Sumatra GRDP always

increases in 2015 by 0.13 percent from 2014 and in

2016 by 0.28 percent. While the lowest contribution

is from the water supply sector, recycling waste

management where in 2015 only increased by 0.01

percent from 2014 and in 2016 did not experience an

increase from the previous year.

In the Province of North Sumatra the Processing

Industry is divided into 9 groups namely (1) Food,

beverages and tobacco industries; (2) Manufacture

of textiles, apparel and leather; (3) Timber industry,

household; (4) Paper industry, printing and

publishing; (5) Chemical, coal, rubber and plastic

Siburian, E., Rahmadana, M. and Maipita, I.

Factor-Factor Affecting Labor Demand Food Beverages and Tobacco Industry of North Sumatra Province.

DOI: 10.5220/0009500304350441

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 435-441

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

435

industries; (6) Industries of non-metallic minerals

except oil and coal; (7) Base metal industry; (8)

Manufacture of metal goods, machinery and

equipment; (9) Other processing industries. (BPS

North Sumatra, 2017). Of the 9 industrial groups, the

growth of the number of industries each year from

2013-2016 fluctuated, the highest growth was

achieved by the food, beverage and tobacco

industries. The role of growth in the 9 industrial

groups will have an impact on the number of

workers used.

Absorption of labor in 9 industrial groups each

year fluctuates. The highest absorption of labor is in

the food, beverage and tobacco industry sectors

where the number of workers employed in 2016 is

89,782 people. While the lowest was in other

processing industries, which amounted to 2,655

people. So that it can be concluded that the role of

the food, beverage and tobacco industry sector is

able to spur regional economic growth and the

development of the industrial sector in North

Sumatra Province. The growth and development of

the industrial sector promises to broaden

employment opportunities. On the other hand, the

government wants to optimize the role of the food,

beverage and tobacco industries in North Sumatra

province in contributing to the demand for labor so

that there needs to be an in-depth study of the factors

that affect labor demand in the food, beverage and

tobacco industries.

According to Simanjuntak (1985) and Hani

Handoko (1985), Demand for labor in the small

industrial sector is influenced by internal and

external factors of each of its business units.

Internally influenced by output values, wage rates,

labor productivity, capital (technology), and other

non-wage expenditures. While externally is

influenced by the level of economic growth,

inflation, unemployment and interest rates. Based on

the research of Afrida (2003) that the high and low

absorption of labor by the economic sector depends

on several factors such as output value, wage level,

education level (labor quality), working capital and

the number of industries. In line with the results of

the study of Esti R (2003) that the factors that

influence labor demand are industrial output,

working capital (investment), wage level and the

number of industries used by the sector. Based on

the results of previous research the author tried to

examine the factors that influence labor demand,

namely: industrial investment, number of industries,

wage level and GRDP.

2 THEORICAL FRAMEWORK

2.1 Effects of Investment Industrial Sector on

Labor Demand

In Keynes's macro theory, to decide whether an

investment will be carried out or not depends on the

comparison between the amount of expected profit

(expressed in percentage per unit time) on the one

hand and the cost of using funds / interest rates on

the other. This expected level of profit is called the

Marginal Efficiency of Capital / MEC (Boediono,

1986). In summary this concept can be described, if

the expected profit (MEC) is greater than the interest

rate, then the investment is carried out. If the MEC

is smaller than the interest rate, then the investment

should not be carried out and if the MEC = the

interest rate, then the investment may be carried out

and may not be in accordance with the decision of

the owner of the capital.

From the description above it is known that the

level of investment desired by investors is

determined by two things, namely the interest rate

that applies the MEC or investment function. This

MEC function / investment function shows the

relationship between the prevailing interest rate and

the level of investment expenditure desired by

investors.

Through the investment function curve there are

three things that need to be underlined about this

investment function, that is, first, the function has a

negative slope which means that the lower the

interest rate, the greater the investment expenditure

desired or planned by investors.

Second, in reality this investment function is

difficult to obtain because its position is very labile

and easily changed in a short period of time. The

volatility of the investment function can be

understood, because its position is very dependent

on the MEC values of the existing projects and that

the MEC is the profit expected by investors. Because

it is based on future expectations / expectations (if

on the basis of subjective calculations) where the

MEC of a project may change from day to day and

sensitive to changes in the socio-economic

conditions of a country. The existence of political

turmoil in an area, rumors of a devaluation, the issue

of foreign exchange control, and restrictions on

imports for example will directly be able to change

the subjective judgment of investors in a project. So

many factors influence the MEC, so the position of

investment functions will be very easy to change.

The volatility of the investment function is a

theoretical and Keynesian explanation of the fact

that in reality investment expenditure (I) shows

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

436

unpredictable up and down fluctuations over time.

This instability is a characteristic that distinguishes

investment from other aggregate demand elements

(C, G).

Third, what needs to be emphasized is the

relationship between Keynes's investment theory and

reality, especially regarding the issue of the

availability of investment funds. Keynesian theory is

based on the assumption that at the prevailing

interest rate, every investor can get any funds to

finance projects that are considered profitable to

implement. What limits the amount you want to

invest is only an assessment of MEC projects that

are open to him. In reality the opposite is often the

case with so many profitable projects, MEC rises but

it is difficult to obtain credit from banks for

example, resulting in realized investments being

smaller than the desired level of investment

(Boediono, 1986).

2.2 Effect of the Number of Large and Medium

Regency/City on Labor Demand

A company or industrial business is a unit (unit) of a

business that carries out economic activities, aimed

at producing goods or services. Squire in Kemala

(2006) argues that in general, the growth of business

units in a production sector in an area will increase

the number of workers.

Matz (1990) said, to determine the size of adding

or reducing the amount of labor carried out by

employers, then:

1) Employers will need a certain amount of money

to be obtained with the additional company, as

well as labor. If the number of outputs produced

by a larger number of companies will produce a

large output as well, so the more number of

companies that stand, the more likely there will

be an increase in production output.

2) The output value of a region estimates that

production will increase with the increase in the

number of companies producing the same goods.

By increasing the number of companies, it is

expected to increase the number of production,

so that the increase in the number of workers will

also increase because labor is needed in the

production process. Lestari (2011) argues that

the more the number of companies or business

units that stand, the more there will be an

increase in labor force, meaning that if a business

unit of an industry is added, then the demand for

labor will also increase.

2.3 Effect of Minimum Wages of Regency/City

on Labor Demand

Wages are an income as a reward from employers to

workers or workers for a job or service that has been

or has been done. Simanjuntak, (2001) says that

wages for employers can be seen as a burden

because the greater the wages paid to employees, the

smaller the proportion of profits for employers.

According to Kuncoro, 2002 (in Fitria, 2014), the

quantity of labor demanded will decrease as a result

of wage increases. If the wage level rises while the

prices of other inputs remain, then the price of labor

is relatively more expensive than other inputs. This

situation encourages employers to reduce the use of

labor that is relatively expensive with other inputs

whose relative prices are cheaper in order to

maintain maximum profits. Siringo-ringo (2012),

Providing wages is a reward / remuneration from the

company to its workers for the achievements and

services contributed in production activities. The

Effect of Minimum Wages on Labor Demand

Wages are an income as a reward from

employers to workers or workers for a job or service

that has been or has been done. Simanjuntak, (2001)

says that wages for employers can be seen as a

burden because the greater the wages paid to

employees, the smaller the proportion of profits for

employers.

2.4 Effect of GRDP on Labor Demand

The increase in GRDP is one of the most important

indicators in assessing the performance of an

economy, especially to carry out an analysis of the

results of economic development that has been

carried out by a country or region. The increase in

GRDP will drive other sectors so that from the

production side it will require a production

workforce. A general view states that increasing

GRDP is positively correlated with labor. Todaro

(2000) says that population growth and labor force

growth (which occurs after population growth) are

traditionally considered as one of the positive factors

that spur economic growth (GRDP). A larger

number of labor means that it will increase the

number of productive labor, while greater population

growth means increasing the size of its domestic

market.

Factor-Factor Affecting Labor Demand Food Beverages and Tobacco Industry of North Sumatra Province

437

3 RESEARCH METHOD

This study uses secondary data with time series data

types during the period 2014-2016. With the data

used sourced from the Central Statistics Agency.

The data required include the number of industrial

sector investments in rupiah units, the number of

food, beverage and tobacco industries in company

units, district / city minimum wages in rupiah units,

and the GRDP of constant prices in rupiah units in

North Sumatra Province.

The data analysis method used in this study is

quantitative with a panel data analysis model or

pooled data. Panel data is a combination of time

series data and time data (cross section). To

overcome the intercorrelations between the

independent variables which ultimately can lead to

the inappropriate regression estimation, the panel

data method is more appropriate to use. The data

used in this study are in the form of time series data

from 2014 to 2016 and a cross section consisting of

25 districts and 8 cities in North Sumatra Province.

The function model of the equation in this study are:

JTKMMT = 𝛽

+ 𝛽

INVSI

+ 𝛽

NLMM

+𝛽

MWRC

+ 𝛽

GRDP + ε

..(3.1)

4 ANALYSIS

4.1 Selection of models in data processing

In panel data processing, it is necessary to select the

most appropriate model between Common Effect

estimation models, Fixed Effect estimation models

and Random Effect estimation models. To choose

between the three estimation models there are

several tests that can be done, including:

4.1.1 Chow Test (F-statistical test)

This test is used to determine the most

appropriate model to be used between the Common

Effect estimation model or the Fixed Effect

estimation model, with the hypothesis:

H0: choose to use the CommonEffect

estimation model.

H1: choose to use the fixed effect

estimation model.

This hypothesis test can be done by comparing

F-statistics with F-tables. If F-statistics > F-table

then H0 is rejected which means the most

appropriate model to use is the Fixed Effect Model

and can also be done by considering the probability

value (Prob.) For F-statistics. If the value of the

Prob. F-statistic < 0.05 (determined at the beginning

as the level of significance or alpha) then the chosen

model is Fixed Effect Model, but if > 0.05 then the

chosen model is the Common Effect Model.

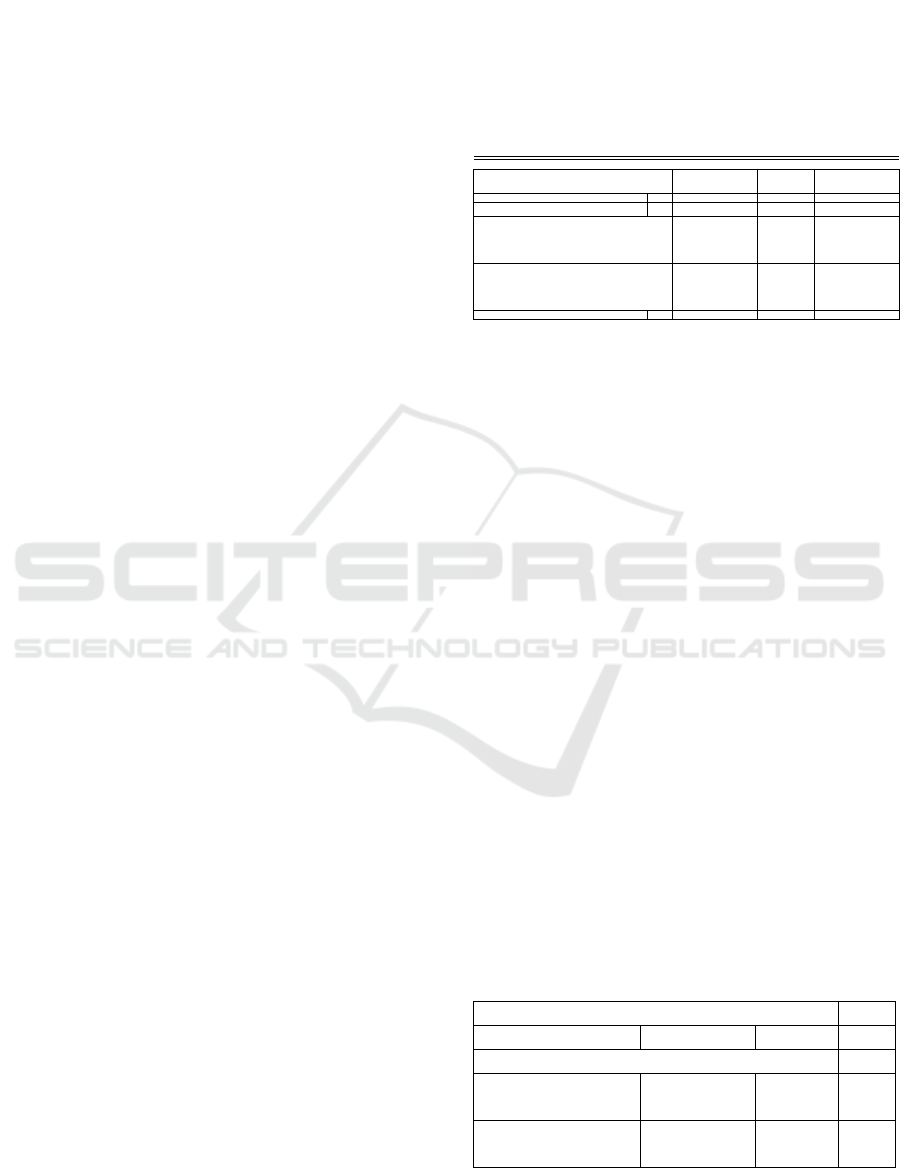

Table 1

Chow Test Results

Redundant Fixed Effects Tests

Equation: FEM

Test cross-section fixed effects

Effects Tes

t

Statistic d.f. Prob.

Cross-section F 9.508492

(32,62

) 0.0000

Cross-sectionChi-square

175.8478

72 32 0.0000

From Table 1, the F-statistic value is 9.508492

with the F-table value in df (32.62) α = 5% is

1.51520 so that the F-statistic value > F-table with a

probability of 0.0000 (< 0.05), so H1 statistics are

accepted and reject H0, according to the results of

this estimation the right model used is the estimation

model Fixed Effect Model.

4.1.2 Hausman Test

This Hausman test is used to select the model that

will be used between the Fixed Effect estimation

model or the Random Effect estimation model, with

the following hypothesis test:

H0: choose to use the Random Effect

estimation model.

H1: choose to use the FixedEffect

estimation model.

The Hausman test can be done by comparing

Chi-Square statistics with Chi-Square tables. If Chi-

Square statistics > Chi-Square table then H0 is

rejected which means the most appropriate model to

use is the Fixed Effect Model and can also be done

by considering the probability value (Prob.) For Chi-

Square statistics. If the value of the Prob. Chi-

Square statistic < 0.05 (determined at the beginning

as a significance level or alpha), the chosen model is

Fixed Effect Model, but if > 0.05 then the selected

model is Random Effect Model.

Table 2: Hausman Test Results

Correlated Random Effects - Hausman Tes

t

Equation: REM

Test cross-section random effects

Test Summar

y

Chi-Sq.

Statistic

Chi-Sq.

d.f. Prob.

Cross-section

rando

m

9.157344 4

0.

0673

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

438

From Table 2 the statistical Chi-Square value is

9.157344 with the Chi-Square table at df (4) α = 5%

is 7.815 so the Chi-Square value is statistical > Chi-

Square table with a probability of 0.0673 ( > 0.05)

then H0 is accepted and H1 is rejected so the panel

data model used is the Random Effect Model.

From the results of the Chow Test and Hausman

Test different results were obtained then continued

with the Lagrange Multiplier Test.

4.1.3 Lagrange Multiplier Test

The Lagrange Multiplier Test is used to select the

model that will be used between the Random Effect

estimation model or the Common Effect estimation

model, with the following hypothesis test:

H0: choose to use the Common Effect

estimation model.

H1: choose to use the Random Effect

estimation model.

If the LM value is greater than the critical value

of Chi-Squares then H0 is rejected which means that

the right model for panel data regression is Random

Effect Model and vice versa, if the LM value is

smaller than the critical Chi-Squares value then the

null hypothesis is accepted which means the model

the right for panel data regression is the Common

Effect Model.

Table 3: Lagrange Multiplier Test Results

La

g

ran

g

e Multiplier Tests for Random Effects

N

ull h

y

potheses: No effects

Alternative hypotheses: Two-sided (Breusch-

Pa

g

an) and one-side

d

(all others) alternatives

Test H

y

pothesis

Cross-

section Time Both

Breusch-Pa

g

an 47.26726

0.41381

4 47.68107

(0.0004) (0.5200) (0.0000)

In Table 3 it can be seen that the value of the

Prob. Breusch-Pagan cross-section is 0.0004 ( <

0.05) so that H1 is statistically accepted and H0 is

rejected. Then the model used is the estimation

model of Random Effect.

4.2 Hypotesis Result

4.2.1 T-Test (Partial Test)

T-Test aims to determine the effect of the

independent variables of industrial sector

investment, number of industries, regency / city

minimum wages and GRDP in North Sumatra

Province.

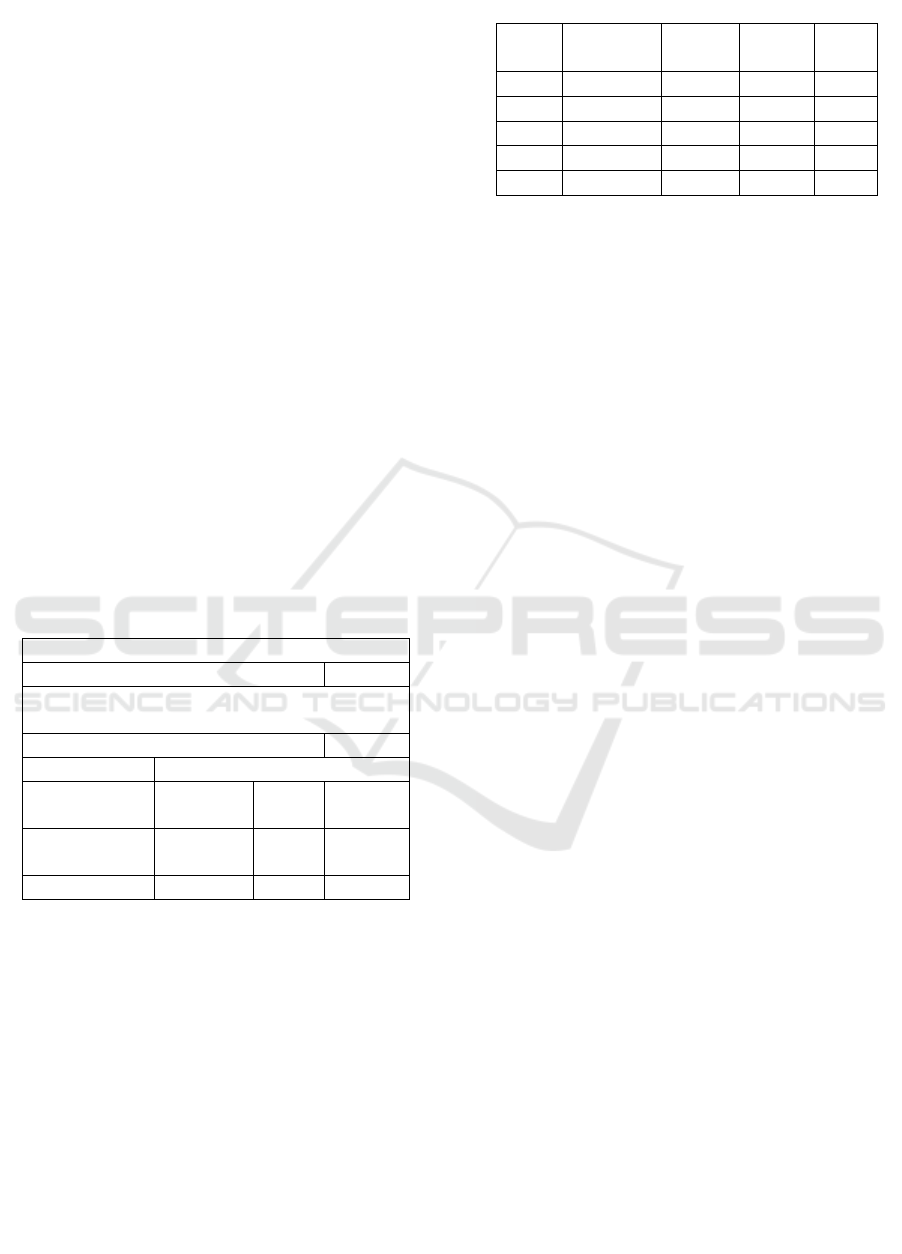

Table 4: T-Statistical Result

Varia Coefficien

t

Std.

Erro

r

t-

Statistic Prob.

C 0.8850 1.2648 0.6997 0.4858

INVSI 0.1811 0.0831 2.1882 0.0311

N

LMM 0.7235 0.1493 4.8485 0.0000

MWRC -0.2470 0.1879 -1.3148 0.0191

GRDP 0.6282 0.1820 3.4513 0.0008

Table 4. is the result of testing the independent

variables, Investment Industry Sector, Number of

Large and Medium Manufacturing, Minimum Wage

of Regency/City, Gross Regional and Domestic

Product partially towards the demand labor in North

Sumatra Province in 2014 - 2016. This study uses α

= 5% or α = 0.05 .

If written in an equation, the result is:

JTKMMT

it

= 0,885050 + 0.181931INVS

it

+

0.724135JIMMT

it

-0,247051UMK

it

+

0.628250PDRB

it

+ ɛ

it

From these equations can be concluded as follows:

1. Constants of 0.885050 which means that if the

Investment variable, the number of industries,

MSEs and GRDP is zero, meaning that there is

no increase or decrease then the amount of labor

demand in North Sumatra Province is 0.885050.

2. Investment Variables have a t-statistic of

2.188233 and probability shows a value of

0.0311 which is smaller than the confidence level

α = 5% (0.0311 < 0.05) then this can prove that

the investment variable in the industrial sector

has a significant effect on the demand of North

Sumatra Province workers means H1 is accepted

and H0 is rejected. The investment variable

coefficient is 0.181931, which means that every

increase in investment by 1 percent will increase

labor demand by 0.181931 percent with the

assumption that number of large and medium

manufacturing, minimum wage of regency/city

and GRDP is considered to be zero, meaning

there is no increase or decrease. This is in line

with the opinion of Sukirno (2000) which states

that investment or investment can develop

businesses or add business units, with business

development will require a lot of labor. Thus the

addition of capital can reduce the problem of

unemployment. Also in line with the results of

Erviyanti's (2013) study that increasing

investment will also increase the amount of

employment.

3. Variable number of large and medium

manufacturing has a t-statistic of 4.848522 and

probability shows a value of 0.000 which is

smaller than the level of confidence α = 5%

Factor-Factor Affecting Labor Demand Food Beverages and Tobacco Industry of North Sumatra Province

439

(0.000 < 0.05) so this can prove that the variable

number of large and medium manufacturing has

a significant effect on the demand for Sumatra

Province labor North which means H1 is

accepted and H0 is rejected. The number of large

and medium manufacturing coefficients is

0.724130, which means that each increase in the

number of industries by 1 percent will increase

labor demand by 0.724130 percent with the

assumption that the investment variable,

minimum wage of regency/city and GRDP are

considered to be zero, meaning there is no

increase or decrease.

Minimum wage of regency/city variable has a t-

statistic of -1.314806 and probability shows a

value of 0.0191 which is smaller than the

confidence level α = 5% (0.0191 < 0.05) so this

can prove that Minimum wage of regency/city

variables have a significant effect on the demand

for labor in North Sumatra Province which

means H1 is accepted and H0 is rejected. The

Minimum wage of regency/city variable

coefficient is -0.247051, which means that every

increase in Minimum wage of regency/city of 1

percent will reduce labor demand by -0.247051

percent assuming the investment industry sector

variable, number of large and medium

manufacturing and GRDP are considered to be

zero, meaning there is no increase or decrease.

This is in line with the opinion of Kuncoro

(2001) that the quantity of labor demanded will

decrease as a result of rising wages. It is also in

line with Ehrenberg's (1998) research stating that

if there is an increase in the average wage level,

it will be followed by a decrease in the number

of workers requested.

4. GRDP variable has a t-statistic of 3.451348 and

probability shows a value of 0.0008 which is

smaller than the level of confidence α = 5%

(0.0008 < 0.05) then this can prove that the

GRDP variable has a significant effect on the

demand of North Sumatra Province workers

means H1 is accepted and H0 is rejected. The

GRDP variable coefficient is 0.628250, which

means that every increase in GRDP of 1 percent

will increase labor demand by 0.628250 percent

with the assumption that the investment industry

sector variable, number of large and medium

manufacturing and minimum wage of

regency/city is considered to be zero, meaning

that there is no increase or decrease. This is in

line with the opinion of Todaro (2000) which

states that population growth and labor force

growth are traditionally considered as one of the

positive factors that spur economic growth

(GRDP).

4.2.2 F-Statistics Test

To test whether the independent variable has a

simultaneous effect on the dependent variable, the F-

test is used by looking at probability and F-statistics.

The hypothesis is as follows:

H1: Investment industry sector, number of large and

medium manufacturing, Minimum wage of

regency/city, and GRDP together have a

significant effect on the demand labor in the

North Sumatra Province for the period 2014-

2016.

H0 : Investment industry sector, number of large and

medium manufacturing, Minimum wage of

regency/city, and GRDP does not affect the

demand for labor in the Province of North

Sumatra for the period 2014-2016.

The F-statistic Result value is 64,887 with a

probability of 0.0000 which means it is smaller than

α = 5%. The probability value of F-Statistics is

smaller than α = 5%, then H1 is accepted and H0 is

rejected so it can be concluded that together the :

Investment industry sector, number of large and

medium manufacturing, Minimum wage of

regency/city, and GRDP have a significant effect of

64,887 on the demand for provincial labor North

Sumatra 2014-2016 period.

4.2.3 Determination Coefficient Test Results (R2)

According to Gujarati and Porter (2012), the

coefficient of determination (R2) is used to measure

the goodness of fit of a regression line. This value

shows how much influence the independent

variables together can provide an explanation of the

dependent variable, where the coefficient of

determination (R2) is between 0 to 1 (0 ≤R2 ≤1).

The smaller R2 approaches 0, meaning that the

smaller the influence of the independent variable on

the dependent variable. Conversely, if R2

approaches 1, it indicates the stronger influence of

independent variables on the dependent variable.

Based on the results of the panel data analysis of

R Square the determination coefficient is 0.734. This

means that 73 percent of the demand labor in 33

(thirty three) regencies / cities in the Province of

North Sumatra in the 2014-2016 period can be

explained by Investment industry sector, number of

large and medium manufacturing, Minimum wage of

regency/city, and GRDP. While the remaining 27

percent is explained by other variables not examined

in this study.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

440

5 RESULTS

Based on the results of the analysis that has been

carried out regarding the factors that affect the

demand for labor in the food, beverage and tobacco

industries in the Sumatran province, the following

conclusions are obtained:

a. Investment Industry Sector has a positive and

significant effect on the demand labor in North

Sumatra Province. This means that the increase

in investment in the industrial sector causes

demand for labor in the food, beverage and

tobacco industries to also increase.

b. The number of large and medium manufacturing

has a positive and significant effect on the

demand labor in North Sumatra Province. This

means that the increasing number of industries

causes the demand labor food, beverage and

tobacco industries to also increase.

c. Minimum Wages of regencycity have an effect

on negatively influencing the demand for labor

in North Sumatra Province. This means that the

increase in minimum wages causes the labor

demand food, beverage and tobacco industries to

decline and vice versa.

d. GRDP has a positive and significant effect on the

demand labor in North Sumatra Province. This

means that increasing GRDP causes the demand

labor food, beverage and tobacco industries will

also increase.

6 CONCLUSIONS

Based on the results of the testing and the following

discussion some suggestions were made regarding

the results of the study:

a. Private investment as a source of development

funding needs to be increased by increasing the

provision of facilities to encourage private

investment. The facilities in question are: clear

regional regulations on investment, ease of

investment, providing clear and accurate

information about investment opportunities,

making maps of regional potential, establishing

integrated service units in the regions to facilitate

the service of making business licenses and no

less important conducive climate for private

investment such as security.

b. District / city governments in North Sumatra

Province are expected to continue to increase

minimum wage of regency/city so that the

community can meet their needs.

c. In addition to investment, the number of large

and medium manufacturing, minimum wage of

regency/city and GRDP there are other factors

related to labor demand such as credit interest

rates, real GRDP, industrial output values and

others that might be used as additional variables

for further research.

REFERENCES

Afrida BR., (2003), Ekonomi Sumber Daya

Manusia. Jakarta: Ghalia Indonesia.

Boediono. (1986). Teori Pertumbuhan Ekonomi.

Balai penerbit Fakultas Ekonomi, UGM.

Yogyakarta.

Central Bureau of Statistics (BPS). North Sumatra in

Numbers. Year 2001 - 2017.

Fitria Riyan, Parapita. (2014). Effect of production

value and wage level on employment in the

food and beverage manufacturing industry in

Semarang district. Vol 1 no 1.

Freter, Pieter N. De. (2007). Analysis of the Effect

of Investment on Economic Development in

the Papua Province. Management Application

Journal. Vol. 5 No. 1.

Hani Handoko, (1985), Personnel and Human

Resource Management, Liberty, Yogyakarta.

Kemala, Eva Sari. (2006). Pengaruh Investasi dan

Upah Terhadap Kesempatan Kerja Pada

Industri Besar dan Menengah di Provinsi

Sumatera Selatan. Kajian Ekonomi, Vol. 5 No.

2, 2006.

Kuncoro Haryono, (2001), "Profit Sharing System

and Absorption Stability of Labor", Media

Economy, Volume 7, Number 2 pp. 165-168.

Lestari Sucitrawati. (2011). Effect of Inflation,

Investment, and Wage Levels on

Unemployment Rate in Bali Province. Bali:

Faculty of Economics, Udayana University.

Matz, Hanmen Usry. (1990). Akuntansi Biaya

Perencanaan dan Pengendalian l. Jakarta:

Erlangga.

Simanjuntak, Payaman J. (2001) Pengantar Ekonomi

Sumber Daya Manusia, Jakarta: Lembaga

Penerbit Fakultas Universitas Indonesia.

Simanjuntak, Payaman J. 1985. Pengantar Ekonomi

Sumber Daya Manusia. Jakarta: Penerbit FE

UI.

Sukirno, Sadono. (2000). Pengantar Teori Mikro

Ekonomi. Jakarta: PT. Raja Grafindo Persada.

Todaro, Michael P. 2000. Pembangunan Ekonomi di

Dunia Keriga. Erlangga Jakarta.

Factor-Factor Affecting Labor Demand Food Beverages and Tobacco Industry of North Sumatra Province

441