The Influence of Foreign Exchange Risk towards Shareholder Value

Ekayana Sangkasari Paranita

1

and Sugeng Wahyudi

2

1

Faculty of Economics and Business, Sahid University, Jakarta-Indonesia

2

Faculty of Economics and Business, Diponegoro University, Semarang-Indonesia

Keywords: Foreign Exchange Risk, Shareholder Value

Abstract: Multinational companies that have foreign exchange debt will be burdened with foreign exchange risk

because the cash flows in local currencies will be affected by contractual obligations. Cash flow fluctuations

may have an impact on shareholder value. There was a research gap on the influence of foreign exchange

risk towards shareholder value. In Indonesia, the depreciation of Rupiah rate on foreign exchange rate

triggers fluctuation on income and liabilities. The purpose of this study is analyze the influence of foreign

exchange risk towards shareholder value with foreign-debt based hedging as a mediation variable. Model

developed based on the balancing theory and the contracting theory. Panel regression model applied to

analyze the empirical research on public companies listed in the Indonesia Stock Exchange. The findings

proved that the foreign exchange risk had positive effect on shareholder value with the foreign-debt based

hedging as mediation. So companies that have had foreign exchange risk should apply foreign-debt based

hedging to maximize the shareholder value. The findings of this study have theoretical implication that

supported contracting and balancing theory.

1 INTRODUCTION

Globalization has encouraged many companies to

extend their business, but it has also exposed them to

foreign exchange fluctuations. Thus, company

management should manage variability of their cash

flows from foreign operations due to foreign

exchange fluctuations (Bartram 2007). Fluctuations

in foreign exchange rates have increased firms’

exchange rate exposure and affected the firms’

sustainability (Yusgiantoro 2004).

International financial management is based on

the perspective that the fundamental purpose of

financial management is to maximize shareholder

value (Eun et al. 2012). The company's goals can be

achieved through the implementation of financial

management functions with accurate, considering

any financial decisions taken will affect other

financial decisions that impact on shareholder value

(Fama 1980; Jensen 1986).

International financial risk management is

mainly based on the irrelevant Modigliani-Miller

proposition. Further, most of the companies live in

market imperfections so that the maximization of

shareholder value should take into account agency

problems. Financial risk management should applied

to manage cash flow fluctuations, which may have

an impact on shareholder value fluctuations. The

deminishing in cash flow fluctuations will reduce the

market imperfections costs, so it will provide more

cash flow for shareholders, and will increase the

expected shareholder value (Eiteman 2010).

When a multinational company has liabilities in

foreign currency from international transactions, the

company is facing foreign currency exposure

because the cash flows in local currencies will be

affected by contractual obligations. With the

increase in global business, contracts with foreign

currencies become a norm so the urgency of the

management of foreign exchange exposure is greatly

increased. Companies that have foreign exchange

exposure is facing foreign exchange risk.

Some empirical research had studied the

influence of foreign exchange risk towards

shareholder value (Berry 2006; Clark and Judge

2008; Khediri 2010; Afra and Alam 2011).

However, based on previous empirical findings,

there is no valid conclusions regarding the influence

of foreign exchange risk towards shareholder value.

This study will explore the influence of foreign

1236

Paranita, E. and Wahyudi, S.

The Influence of Foreign Exchange Risk towards Shareholder Value.

DOI: 10.5220/0009500112361243

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1236-1243

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

exchange risk towards shareholder value, and

expected to obtain findings that contribute both

theoretically and empirically.

In the last decade, the Indonesian economy grow

stable and reach an average of over 6% per year. But

in 2013, the exchange rate depreciated 6.3% derived

from the uncertainty of global economic recovery

and external imbalance following the widening

current account deficit, so it caused imbalance in the

domestic foreign exchange market (Bank Indonesia

2014).

To anticipate the negative impact of foreign

exchange rate fluctuation and to protect the

shareholders value, then the multinational

companies conduct corporate hedging policy.

Hedging will ensure that the value of the foreign

currency used to pay or the amount of foreign

currency that will be received in the future will not

be affected by changes in foreign exchange rate

fluctuations. Corporate hedging policy could

contribute to maximize shareholder value. Public

companies in Indonesia were also exposed to foreign

currency exposure, but the implementation of the

corporate hedging policy was limited already. Some

companies conduct foreign exchange derivatives,

while the others conduct foreign debt to hedge their

cash flows variability. A synthesis of both of them is

expected to perform better than partial hedging

policy (Paranita 2014).

This study was based on two research problems.

First, there was a research gap on the influence of

foreign exchange risk towards shareholder value.

Second, there was still limited studies on corporate

hedging on public companies in Indonesia, while the

depreciation of Rupiah rate on foreign exchange rate

triggers fluctuation on income and liabilities. So the

purpose of this study is develop theoretical and

empirical model to analyze the influence of foreign

exchange risk and the corporate hedging policy on

shareholder value.

Originality of this study is the synthesis of the

perspective of balancing theory and contracting

theory as a basic theoretical framework of the

influence of foreign exchange risk towards

shareholder value.

2 THEORICAL FRAMEWORK

2.1 Agency Theory

There were separation of ownership and control of

the company so that the distribution of stock

ownership in the company becomes an important

matter. However, these conditions could potentially

lead to a conflicts between the owner and the

manager. Jensen (1976) suggested that the agency

relationship occurs when the principal delegates

authority to the agent to perform some decision

making on behalf of the principal and

conceptualized as a series of contracts.

In corporate risk management, agency issues

have been shown to influence managerial behavior

on risk and hedging. Agency theory also explains the

purpose of integration between shareholders,

management, and creditors caused by the asymmetry

distribution of income, which makes the company is

in a very risky condition (Myers and Smith 1987).

So the agency theory implies that hedging policy has

significant influence on shareholder value (Fite and

Pfeiderer 1995).

2.2 Balancing Theory

The major point in the corporate financial decision is

to establish an optimal capital structure.

Determination of the optimal capital structure

composition of funding will be used to finance its

assets. Determination of capital structure policy

involves a trade off between risk and return. The

higher total debt increase cash flow volatility or

company's business risk but at the same time it is

also increases the expected return. However,

increasing the expected return for issued the optimal

debt would raise the stock price. Optimal capital

structure is the capital structure that balances risk

and return so that it can maximize the stock price

(Modigliani and Miller 1963; Myers 1984).

Business owners tend to use debt at a certain

level in order to maximize shareholder value.

Manager behavior can be controlled through

participation in corporate ownership. Ownership of

these shares can align the interests of managers and

owners of the company. The implication show that

the managers act more cautiously in determining the

capital structure of the company (Jensen and

Meckling 1976; Mao 2003).

2.3 Contracting Theory

The organization was viewed as a legal entity which

has a series of contracts either explicitly or

implicitly between individuals within the

organization. The series of contracts will provide

useful insight for the organization. Organizational

behavior is the behavior of the balance of complex

contract system, built to maximize agents and have

different purposes (Jensen 2000).

Jensen and Meckling (1976) stated that an

agency relationship is a series of contracts, in which

the principals delegated to several group of agents to

decide policy behalf of the pricipals. Conflicts of

interest between managers, shareholders, and

creditors increase understanding the importance of

the implementation of the contract. The contract

structure of an organization will limit the risks faced

The Influence of Foreign Exchange Risk towards Shareholder Value

1237

by the agency through the specification of fixed or

varied payment based on specific performance. In

general, the agent’s compensation contract plan

reflects the separation of management decision and

control decision.

2.4 Hedging Theory

Hedging is the strategy to protect the value of the

company from exposure to foreign exchange rates

fluctuations. Multinational company which decides

to hedge against their transaction exposure could use

the money market instruments. The basic principle

of hedging is to perform a balancing commitments

in the same foreign currency, which is the second

commitment for the same number of initial

commitment, but opposite in sign (Eiteman 2010).

Corporate hedging policy with foreign exchange

derivatives and foreign debt was applied by

multinational companies which had the agency

problems related to foreign exchange exposure.

Foreign exchange derivatives is used to hedged

foreign exchange risk due to the fluctuations in

assets and liabilities denominated in foreign

currency (Hu and Wang, 2006; Al Shboul and

Alison, 2009; Schiozer and Saito, 2009). The foreign

debt is used as a natural hedge for companies which

has revenues in foreign currency to issued foreign

debt to reduce the foreign exchange risk (Davies et

al., 2006; Klimczak, 2008; Otero et al., 2008;

Gonzalez et al., 2010). Foreign-Debt Based Hedging

as a hedging policy synchronization derived from

foreign exchange derivatives and foreign debt is

expected to affect perform better than partial

hedging policy (Paranita 2014).

Having manage the risk of foreign exchange

fluctuations, the foreign-debt based hedging

contribute in securing the company's cash flow. The

stability of the cash flow have a significant impact

on the increase in shareholder value of the company

(Suriawinata 2004); (Magee 2009), (Aretz and

Bartram 2010). Agency problems affect the foreign-

debt based hedging, and the foreign-debt based

hedging affect shareholder value. Therefore, foreign-

debt based hedging which is the synchronization of

foreign exchange derivatives and foreign debt may

become a mediation between foreign exchange risk

towards shareholder value.

2.5 Hypotheses Development

Hypotheses about the implications of foreign

exchange risk towards shareholder value have

developed based on the positive theory of risk

management, the Capital Asset Pricing Model

(CAPM), which analyzes the relationship between

risk and return in asset management. For companies

with great financial performance, high risk capital

structure could have stock price appreciation. This

could happens because most of the investors avoid

the high risk company, so they offering higher

returns. The shareholder value can be described by

the signaling theory. Shareholder value as one of the

company's financial performance reflect the market

interpretation of signalling information published.

The company financed the project with debt or

equity in a certain amount, then the market interprets

the composition and financial performance in the

company's stock price appreciation (Ross 1977).

Nowadays there are an abundant contracts in

foreign currencies denominated, so the management

should focus on the increasing of foreign exchange

exposure. Multinational companies would be

affected by foreign exchange exposure since they

have to manage the cash flows of contractual

obligations or receivables (Magee 2009). A

derivative transaction is a payments contract

between the parties, whose value is derived from the

value of the asset, reference rate or index. Some

research suggests that companies with tight financial

constraints and foreign exchange exposures tend to

use foreign currency derivative (Geczy et al. 1997;

Al-Shboul and Alison 2009).

Companies use the optimal capital structure that

balances the benefits and cost in the use of debt. If

the benefits of the use of debt is still large, then the

debt can be issued. But if the cost of using debt

outweigh the benefits, then the debt is not keeping

up (Myers 1984). This concept encourages

multinationals companies to issue foreign debt to

hedged foreign currency exposure. The foreign debt

is used as a natural hedge for companies which has

revenues in foreign currency to issued foreign debt

to reduce the foreign exchange risk (Kedia and

Mozumdar 2003).

Foreign-debt based hedging as a corporate

hedging policy synchronization with foreign

exchange derivatives and foreign debt is expected to

affect more synergistic than partial hedging policy

(Paranita 2014). Refers to the balancing theory and

the signaling theory, we developed the hypothesis 1

that the higher foreign exchange risk, the more

foreign-debt based hedging applied.

Signalling theory stated shareholder value as one

measure of the company's financial performance

which reflects the market interpretation of signal

information published on the company. The higher

foreign exchange risk and the higher the risk of its

business, the market expects a high return. This way

impact in the increase of stock price and furthermore

shareholder value. Refers to signaling theory, we

developed the hypothesis 2a that market apreciate

the foreign exchange risk so it could increase

shareholder value.

Contracting theory argues that when companies

manage projects with international capital, they will

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1238

experience the uncertainty of future cash flows in

domestic currency. Foreign-debt based hedging

policies reduce the uncertainty by reducing the

volatility of cash flows. Although these risks were

nonsystematic, but not only affect the company's

risk. It also directly affects shareholder value. The

higher foreign exchange risk, the more intensive the

company apply foreign-debt based hedging. Refers

to hedging theory and signaling theory, we

developed the hypothesis 2b that the foreign-debt

based hedging could increase shareholder value.

Foreign-debt based hedging will be respond

positively by the market because it reflects

fluctuations in cash flow stability and sustainability

of the company's operations. Market appreciate it as

a positive policy and the company's stock price

appreciation happened. It will eventually increase

the shareholder value. Refers to hedging theory and

signaling theory, we developed the hypothesis 3 that

the foreign-debt based hedging could be a mediation

between the influence of foreign exchange risk

towards shareholder value.

3 RESEARCH METHOD

Population in this study are all companies listed on

the Indonesia Stock Exchange (IDX) in 2013-2016.

The sampling method was purposive sampling.

Financial companies had been excluded from the

sample since their business activity require

derivatives to be used for trading purpose or

speculative motive. Disclosure of hedging policy

explored by content analysis from the notes to the

annual report of each company. Based on the

purposive sampling, we had got 66 companies in

2013-2016 each. Thus, the total number of panels

data that meet the criteria are 264 data.

Foreign exchange risk proxied by foreign sales to

total sales ratio, which is reflects the composition of

the foreign revenue to total revenue that contains

risk of fluctuations in foreign exchange rates. It

draws on research by Al-Shboul and Alison (2009),

Clark and Mefteh (2011), as well as Junior Rossi

(2011). Foreign-debt based hedging proxied by

foreign debt to total assets ratio, which is the

synchronization both foreign exchange derivatives

and hedging policy with foreign currency debt. It

reflects the effectiveness of corporate hedging

compared to the amount of assets of the company. It

draws on research by Aabo (2006), Clark and Judge

(2008), Klimczak (2008), Otero et al. (2008),

Schiozer & Saito (2009), Gonzales (2010), and

Paranita (2014). Shareholder value proxied by

market-to-book-value of equity ratio, which is

reflects the estimated value of a company from the

ratio of market capitalization devided by

shareholder’s equity. It draws on research by

Suriawinata (2004), Eldomiaty (2006), and Paranita

(2014).

In order to observe the interaction between

foreign exchange risk, foreign-debt based hedging

and shareholder value, panel data regression model

is used. According to Gujarati (2009), there are four

options in the panel data regression models, i.e. the

Pooled Ordinary Least Squares (OLS) model, Cross

Section Fixed Effects Model (FEM), Period Fixed

Effects Model (FEM), and Random Effects Model

(REM). To determine the best models between

Pooled OLS Model and Fixed Effects Model,

Redundant Test is used. While for determining the

best model between the Fixed Effects Model and

Random Effects Model, the Hausman test is used.

To examine the empirical research model with

mediating variables, it sets two structural equation

models as follows:

HED = βY1X1FR + ε2 ……………….…..... (1)

SV = βY2X1FR + βY2Y1HED + ε1 …....…. (2)

where :

SV = market-to-book value of equity,

representin

g

shareholder value.

FR = foreign sales to total sales ratio,

representin

g

forei

g

n exchan

g

e ris

k

.

HED = foreign debt to total assets ratio,

representing foreign-debt based

hedging.

4 ANALYSIS AND RESULT

4.1 Model 1

Empirical results for hypotheses were analyzed

using four models of data panel. The results of data

analysis of Model 1 can be summarized in the

following table :

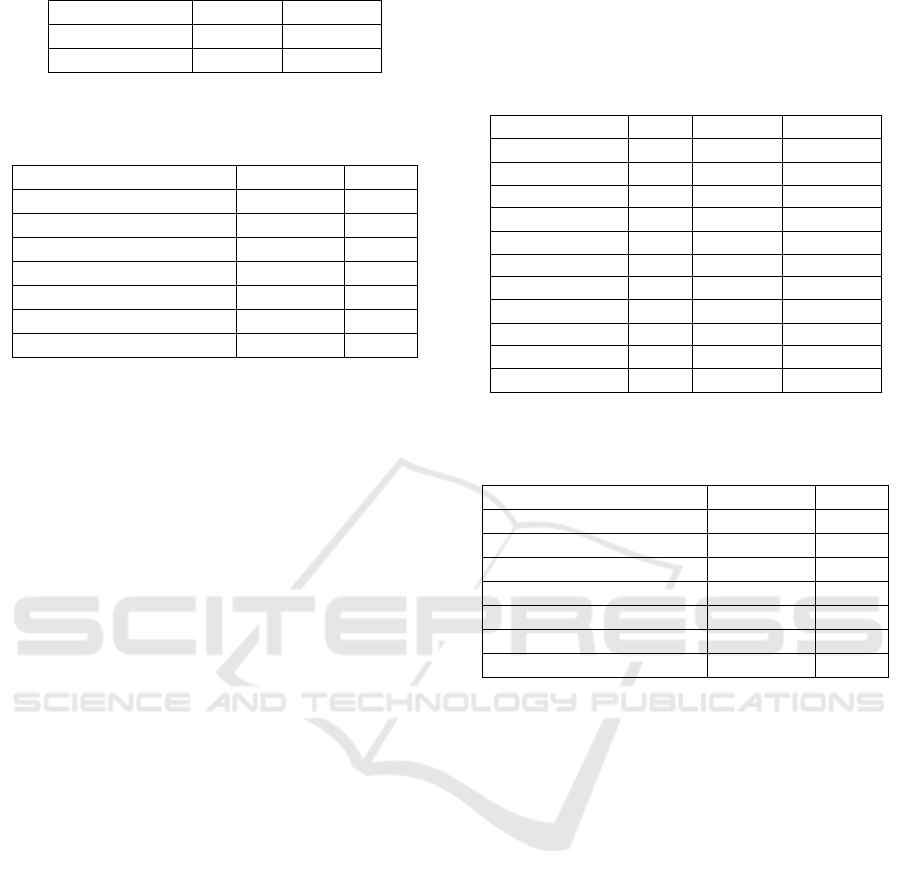

Table 1: Empirical Results

Metho

d

FR

Pooled OLS Coeff. 0,0080

Prob. (0,6292)

Fixed in Cross Coeff. 0,0274

Prob. (0,4894)

Fixed in Perio

d

Coeff. 0,0087

Prob. (0,6023)

The Influence of Foreign Exchange Risk towards Shareholder Value

1239

Rando

m

Coeff. 0,0111

Prob. (0,6153)

Then we conduct the Redundant Test and Hausman

Test as follows :

Table 2: Redundant and Hausman Test

Redundant Test F-statistic

4,6926

Cross Section Fixed Effect

(0,0000)

Redundant Test F-statistic

0,6989

Period Fixed Effect

(0,5534)

Hausman Test Chi-square

d

9,8056

Cross Section Random Effect

(0,0203)

Redundant Test on Cross Section Fixed Effect

Model is used to test the null hypothesis that the

estimator Cross Section Fixed Effect Model has no

difference with the Pooled OLS model. F-statistic

value of 4.6926 with a probability of 0.0000 is

significant at α 0.05 indicates that the null

hypothesis is rejected, or in other words the Cross

Section Fixed Effect Model is better than Pooled

OLS Model.

Redundant Test on Period Fixed Effect Model is

used to test the null hypothesis that the estimator

Period Fixed Effect Model has no difference with

the Pooled OLS model. F-statistic value of 0.6989

on 0.5534 probability is not significant at α 0.05

indicates that the null hypothesis can not be rejected,

or in other words Period Fixed Effect Model no

difference and not better than Pooled OLS Model.

The statistical test was developed Hausman χ2

distribution asimtosis. If the null hypothesis is

rejected, then the meaning of Cross Section Random

Effect Model is not appropriate because the random-

effect correlated with the possibility of one or more

independent variables. χ2 value of 9.8056 with a

probability of 0.0203 is significant at α 0.05

indicates that the null hypothesis can be rejected, or

in other words the Cross Section Fixed Effect Model

is more appropriate than the Cross Section Random

Effect Model.

Based on Redundant Test and the Hausman test,

it can be stated that in this regression model, the

most appropriate model is Cross Section Fixed

Effect Model (FEM). Thus, the results of the data

analysis regression model can be expressed as

follows :

HEDit = 0,0274 FRit

t-stat. (3,1733)

prob. (0,0018)

4.2 Model 2

While the results of data analysis of Model 2 can be

summarized in the following table :

Table 3: Empirical Results

M

ethod

HED

FR

P

ooled OL

S

Coe

ff

.

-0,1423 -0,1072

P

rob.

(0,7951)

(0,4654)

F

ixed in Cross Coeff. 1,4714 0,1398

P

rob.

(

0,0010

)

(

0,5676

)

F

ixed in Period Coe

ff

.

-0,1249

-0,1143

P

rob.

(0,8213)

(0,4399)

R

andom Coeff.

0,0818

0,00336

P

rob.

(0,0095)

(

0,8530

)

Then we conduct the Redundant Test and

Hausman Test as follows :

Table 4: Redundant and Hausman Test

Redundant Test F-statistic

12,7298

Cross Section Fixed Effect

(0,0000)

Redundant Test F-statistic

0,2039

Period Fixed Effect

(0,8936)

Hausman Test Chi-s

q

uare

d

14,0155

Cross Section Random Effect

(0,0072)

Redundant Test on Cross Section Fixed Effect

Model is used to test the null hypothesis that the

estimator Cross Section Fixed Effect Model has no

difference with the Pooled OLS Model. F-statistic

value of 12.7298 with a probability of 0.0000 is

significant at α 0.05 indicates that the null

hypothesis is rejected, or in other words the Cross

Section Fixed Effect Model is better than Pooled

OLS Model.

Redundant test on Period Fixed Effect Model is

used to test the null hypothesis that the estimator

Period Fixed Effect Model has no difference with

the Pooled OLS Model. F-statistic value of 0.2039

on 0.8936 probability is not significant at α 0.05

indicates that the null hypothesis can not be rejected,

or in other words Period Fixed Effect Model no

difference and no better than Pooled OLS Model.

The statistical test was developed Hausman χ2

distribution asimtosis. If the null hypothesis is

rejected, then the meaning of Cross Section Random

Effect Model is not appropriate because the random-

effect correlated with the possibility of one or more

independent variables. χ2 value of 14.0155 with a

probability of 0.0072 is significant at α 0.05

indicates that the null hypothesis can be rejected, or

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1240

in other words the Cross Section Fixed Effect Model

is more appropriate than the Cross Section Random

Effect Model.

Based on Redundant Test and the Hausman test,

it can be stated that in this regression model, the

most appropriate model is Cross Section Fixed

Effect Model (FEM). Thus, the results of the data

analysis regression model can be expressed as

follows :

SVit = 0,1398 FRit + 1,4714 HEDit

t-stat. (3,0572) (3,3329)

prob. (0,0676) (0,0010)

Cross Section Fixed Effect Model incorporates

all observations but still accommodating each unit

cross section to have intercept dummy variables.

This model accommodates the heterogeneity of

inter-unit cross section with its own intercept value.

If the cross section of this study unit is a company

registered in the Indonesia Stock Exchange this

model assumes that each company will have a

different intercept. These differences reflect the

characteristic of each company, such as economies

of scale, managerial styles, types of markets served,

and so on.

4.3 Hypothesis 1

Hypothesis 1 testing results states that the effect of

foreign exchange risk on foreign-debt based hedging

indicated by the coefficient of 0.0274 in the

direction of a positive relationship. The test results

of the causality is not enough evidence to be able to

accept the hypothesis 1 as the result of the analysis

shows the significance value of t at 3.1733 and

probability value of 0.0018 which means that the

effect is not significant at α = 5%. Based on the

results of empirical testing, the hypothesis 1 can be

rejected or unacceptable.

Foreign exchange risk is measured with the

foreign sales to total sales ratio, which reflects the

composition of foreign sales from international

transactions compared to total sales. In this study, it

had been proven that there is no influence of foreign

sales to total sales ratio on foreign-debt based

hedging. In our samples, mostly companies have had

less foreign sales than the total sales, so this variable

had not significantly affect companies to apply

foreign-debt based hedging. This empirical test

results do not support the research findings by

Pramborg (2005); Berry (2006); Eldomiaty et al.

(2006); and Clark and Judge (2008) in significance.

4.4 Hypothesis 2

The hypothesis 2a testing result states that the effect

of foreign exchange risk on shareholder value

indicated by the coefficient of 0.1398 in the

direction of a positive relationship. The test results

of this causal relationship is evidence to be able to

accept the hypothesis 2a for the results of the

analysis showed the significance value of t at 3.0572

and probability value of 0.0676, which means a

significant influence on α = 5%. Based on the results

of empirical testing, then the hypothesis 2a is

declared acceptable. Thus, the results of this study

empirically find sufficient evidence that the foreign

exchange risk significantly have positive effect on

shareholder value. Foreign exchange risk proxied by

foreign debt to total asset, which is indicates the

effectiveness of the use of foreign currency-

denominated debt to total assets of the company.

While the effect of foreign-debt based hedging

on shareholder value indicated by the coefficient of

1.4714 in the direction of a positive relationship.

The test results of this causal relationship is

evidence to be able to accept the hypothesis 2b for

the results of the analysis showed the significance

value of t at 3.3329 and probability value of 0.0000,

which means a significant influence on α = 1%.

Based on the results of empirical testing, then the

hypothesis 2b is declared acceptable. Thus, the

results of this study empirically find sufficient

evidence that the foreign-debt based hedging

significantly have positive effect on shareholder

value. Foreign-debt based hedging proxied by

foreign debt to total assets ratio, which is indicates

the effectiveness of the use of foreign currency-

denominated debt to total assets of the company.

The increase in foreign debt to total assets ratio can

increase shareholder value. The results support the

findings of empirical test by Clark and Judge (2008);

Eldomiaty et al. (2006); Aabo (2006); Magee

(2009); Aretz and Bartram (2010).

4.5 Hypothesis 3

Foreign exchange risk with proxy foreign sales to

total sales ratio significantly have positive influence

on shareholder value with a coefficient of 0.1298.

Foreign-debt based hedging proxied by the

interactions between hedge ratio and the foreign debt

ratio, which reflects the foreign debt to total assets

ratio. The value of the coefficient indirect effect of

foreign exchange risk towards shareholder value

through mediation foreign-debt based hedging is

equal to 0.2403. Indirect effect coefficient is greater

than the direct effect coefficient, so that the

hypothesis 3 which states foreign-debt based

hedging could be mediation between the influence of

foreign exchange risk towards shareholder value is

acceptable.

The Influence of Foreign Exchange Risk towards Shareholder Value

1241

It means while the foreign exchange risk grow up,

companies will apply foreign-debt based hedging, so

that the shareholder value will increase. The results

of this study empirically find sufficient evidence that

foreign exchange risk can increase shareholder value

through foreign-debt based hedging as mediation.

The findings of this study are expected to contribute

to fill in the research gap on the influence of foreign

exchange risk on shareholder value. The results

support the findings of empirical studies by Clark

and Judge (2008); Eldomiaty et al. (2006); Aabo

(2006); Magee (2009); Aretz and Bartram (2010).

Based on a literature review and analysis of data, our

study had developed models to analyze the influence

of foreign exchange risk towards shareholder value

with hedging policy as a mediation variable. The

model of foreign-debt based hedging was derived

from synthesis of the contracting theory and the

balancing theory.

The concept of foreign-debt based hedging support

contracting theory and balancing theory. The

concept of hedging policy with foreign currency

derivative supports contracting theory which states

that the conflict of interest between managers,

shareholders, and creditors increase understanding

of the importance of the contract (Jensen and

Meckling 1976). Hedging contracts with foreign

currency derivative is a means to limit the risk of

fluctuations in cash flows encountered agents, as

well as potentially detrimental to shareholders. The

concept of hedging policy using foreign debt

supports balancing theory, which states that the

funding company uses an optimal capital structure

that balances the benefits and costs on the use of

debt (Modigliani and Miller 1963; Myers 1984).

The findings of this study also support the hedging

theory which states that multinational companies to

hedge against exposure to the transaction, can use

the money market instruments. The basic principle

of hedging is to perform a balancing commitments

in the same foreign currency, which is the second

commitment for the same number of initial

commitment, but opposite in sign (Eitman 2010).

Empirically, the findings of this study concluded

that the foreign exchange risk significantly have an

influence on the maximization of shareholder value

through foreign-debt based hedging as mediation. It

means while the foreign exchange risk grow up,

companies will apply foreign-debt based hedging, so

that the shareholder value will increase.

This study uses all companies listed in Indonesia

Stock Exchange in all sectors, except for the

financial sector. As such, the findings of this study

can be used as a reference for investors. Factors that

proven empirically contribute to shareholder value is

foreign exchange risk and foreign-debt based

hedging. Thus, the investor can make such factors as

the benchmarks prospective because of the potential

to maximize shareholder value.

5 CONCLUSION

Based on a literature review and analysis of data, our

study had developed models to analyze the influence

of foreign exchange risk towards shareholder value

with hedging policy as a mediation variable. The

model of foreign-debt based hedging was derived

from synthesis of the contracting theory and the

balancing theory.

The concept of foreign-debt based hedging

support contracting theory and balancing theory. The

concept of hedging policy with foreign currency

derivative supports contracting theory which states

that the conflict of interest between managers,

shareholders, and creditors increase understanding

of the importance of the contract (Jensen and

Meckling 1976). Hedging contracts with foreign

currency derivative is a means to limit the risk of

fluctuations in cash flows encountered agents, as

well as potentially detrimental to shareholders. The

concept of hedging policy using foreign debt

supports balancing theory, which states that the

funding company uses an optimal capital structure

that balances the benefits and costs on the use of

debt (Modigliani and Miller 1963; Myers 1984).

The findings of this study also support the

hedging theory which states that multinational

companies to hedge against exposure to the

transaction, can use the money market instruments.

The basic principle of hedging is to perform a

balancing commitments in the same foreign

currency, which is the second commitment for the

same number of initial commitment, but opposite in

sign (Eitman 2010). Empirically, the findings of this

study concluded that the foreign exchange risk

significantly have an influence on the maximization

of shareholder value through foreign-debt based

hedging as mediation. It means while the foreign

exchange risk grow up, companies will apply

foreign-debt based hedging, so that the shareholder

value will increase.

This study uses all companies listed in Indonesia

Stock Exchange in all sectors, except for the

financial sector. As such, the findings of this study

can be used as a reference for investors. Factors that

proven empirically contribute to shareholder value is

foreign exchange risk and foreign-debt based

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1242

hedging. Thus, the investor can make such factors as

the benchmarks prospective because of the potential

to maximize shareholder value.

REFERENCES

Aabo, T. (2006). The Importance of Corporate Foreign

Debt in Managing Exchange Rate Exposure in Non-

Financial Companies. European Financial

Management 12 (4):633-649.

Aretz, K., and Bartram, Sohnke M. (2010). Corporate

Hedging and Shareholder Value. The Journal of

Financial Research 33 (4):317-371.

Bartram, S. M. (2007). Corporate Cash Flow and Stock

Price Exposures to Foreign Exchange Rate Risk.

Journal of Corporate Finance 13:981-994.

Bartram, S. M., Brown, Gregory W., and Fehle, Frank R.

(2009). International Evidence on Financial

Derivatives Usage. Financial Management

Spring:185-206.

Clark, E., and Judge, Amrit. (2009). Foreign Currency

Derivatives versus Foreign Currency Debt and the

Hedging Premium. European Financial Management

15 (3):606-642.

Clark, E., and Judge, Amrit. (2008). The Determinants of

Foreign Currency Hedging : Does Foreign Currency

Debt Induce a Bias? European Financial Management

14 (3):445-469.

Davies, D., Eckberg, Christian., and Marshall, Andrew.

(2006). The Determinants of Norwegian Exporters'

Foreign Exchange Risk Management. The European

Journal of Finance 12 (3):217-240.

Eiteman, D. K., Stonehill, Arthur I., and Moffett, Michael

H. (2010). Multinational Business Finance. Twelfth

Edition ed. Massachusetts: Pearson Education.

Eun, C. S., Resnick, Bruce G., and Sabherwal, Sanjiv.

(2012). International Finance. Sixth Edition ed. New

York: McGraw-Hill Irwin.

Fama, F. E. (1980). Agency Problems and the Teory of

The Firm. The Journal of Political Economy 88

(2):288-307.

Gonzales, L. O., Bua, Milagros Vivel., Lopez, Sara

Fernandez., and Santomil, Pablo Duran (2010).

Foreign Debt as a Hedging Instrument of Exchange

Rate Risk : a New Perspective. The European Journal

of Finance 16 (7):677-710.

Hu, C., and Wang, Pengguo (2006). The determinants of

foreign currency hedging - evidence from Hong Kong

non-financial firms. Asia-Pacific Financial Markets

12:91-107.

Jensen, C. M., and Meckling W. (1976). Theory of The

Firm : Managerial Behaviour, Agency Cost and

Capital Structure. Journal of Financial Economics 3

(4):305-360.

Jensen, M. C. (1986). Agency Cost of Free cash Flow,

Corporate Finance, and Takeovers. American

Economic Review 76 (2):323-329.

Khediri, K. B. (2010). Do investors really value

derivatives use? Empirical evidence from France. The

Journal of Risk Finance 11 (1):62-74.

Modigliani, M., and Miller M. (1958). The Cost of

Capital, Corporate Finance and Theory Of Investment.

The American Economic Review 48 (3):261-297.

Myers, C. S. (1984). The Capital Structure Puzzle. Journal

of Finance 39 (3):575-592.

Pramborg, B. (2005). Foreign Exchange Risk

Management by Swedish and Korean Nonfinancial

Firms : A Comparative Survey. Pasific-Basin Finance

Journal 13:343-366.

Schiozer, R. F., and Saito, Richard. (2009). The

Determinants of Currency Risk Management in Latin

American Nonfinancial Firms. Emerging Markets

Finance & Trade 45 (1):49-71.

Yusgiantoro, P. (2004). Manajemen Keuangan

Internasional. Jakarta: Fakultas Ekonomi Universitas

Diponegoro.

The Influence of Foreign Exchange Risk towards Shareholder Value

1243