The Determinants of Inflation in North Sumatra Error Correction

Model

Duma Lasmaria Siagian

1

, Muhammad Yusuf

1

and Fitrawaty

1

1

Post Graduate School, State University Of Medan

Medan, North Sumatera, Indonesia

Keyword: Inflation, Government Spending, Money Supply, Exchange Rate, Economic Growth, Error Correction Model

(ECM)

Abstract: The stability of inflation is a requirement for economic growth and benefit the improvement of community

welfare. This research aims to analyze the effect of government spending, the money supply, exchange rates

and economic growth against inflation in North Sumatra. The analysis uses equations by the method of Error

Correction Model (ECM). This study analyzed the relationship between the dependent and independent

variables in both the short term and long term. Estimation results show that in the long term and the short

term, the variable amount of the money supply and economic growth was a negative and significant effect

against inflation in North Sumatra. While the variables do not affect government spending significantly to

inflation in North Sumatra. ECM model is considered valid because the value of the Error Correction Term

(ECT) is significant and in the long term and the short term only the variable exchange rate that has a

significant influence against inflation in North Sumatra. These results show that the exchange rate played an

important role in controlling the level of inflation in North Sumatra.

1 INTRODUCTION

A variety of macroeconomic indicators, inflation is

one of the important indicators for the economy of a

country. Inflation gives considerable influence

towards the achievement of some goals of

macroeconomic policy, such as economic growth,

employment, income distribution and the balance of

payments (Aulia Pohan, 2008).

North Sumatra also have experienced high

inflation that is at the moment the Government of

the old order and the last in 1998. Inflation occurs

when the old order caused by uncontrolled money

printing. In 1997-1998 have made the economy of

the North Sumatra is at an unstable state. Its impact

is the increase in the inflation amounted to 83.56

percent higher than the national figure of 77.63

percent. The condition of the rising inflation due to

rising prices of imported commodities and rising

foreign debt due to the weakening of the exchange

rate of the rupiah against the U.S. dollar and other

foreign currencies.

For it required an effort in keeping inflation at a

low and stable level. Based on Act No. 23 of the

year 1999, Bank Indonesia focuses its policy on

achieving the stability of rupiah value by placing

inflation as a cornerstone in monetary policy. Since

July 2005 the Bank Indonesia has implemented

monetary policy framework and consistent with the

Inflation Targeting Framework (ITF), which

includes four fundamental elements, namely the use

of the interest rate target as operational Bank

Indonesia (BI), the process of the formulation of

monetary policy, the communication strategy of the

anticipatory more transparent and strengthening

coordination with government policy. These steps

are intended to enhance the effectiveness of

monetary policy and governance in achieving the

target of the end of price stability to support

sustained economic growth and social welfare

(Endri, 2008).

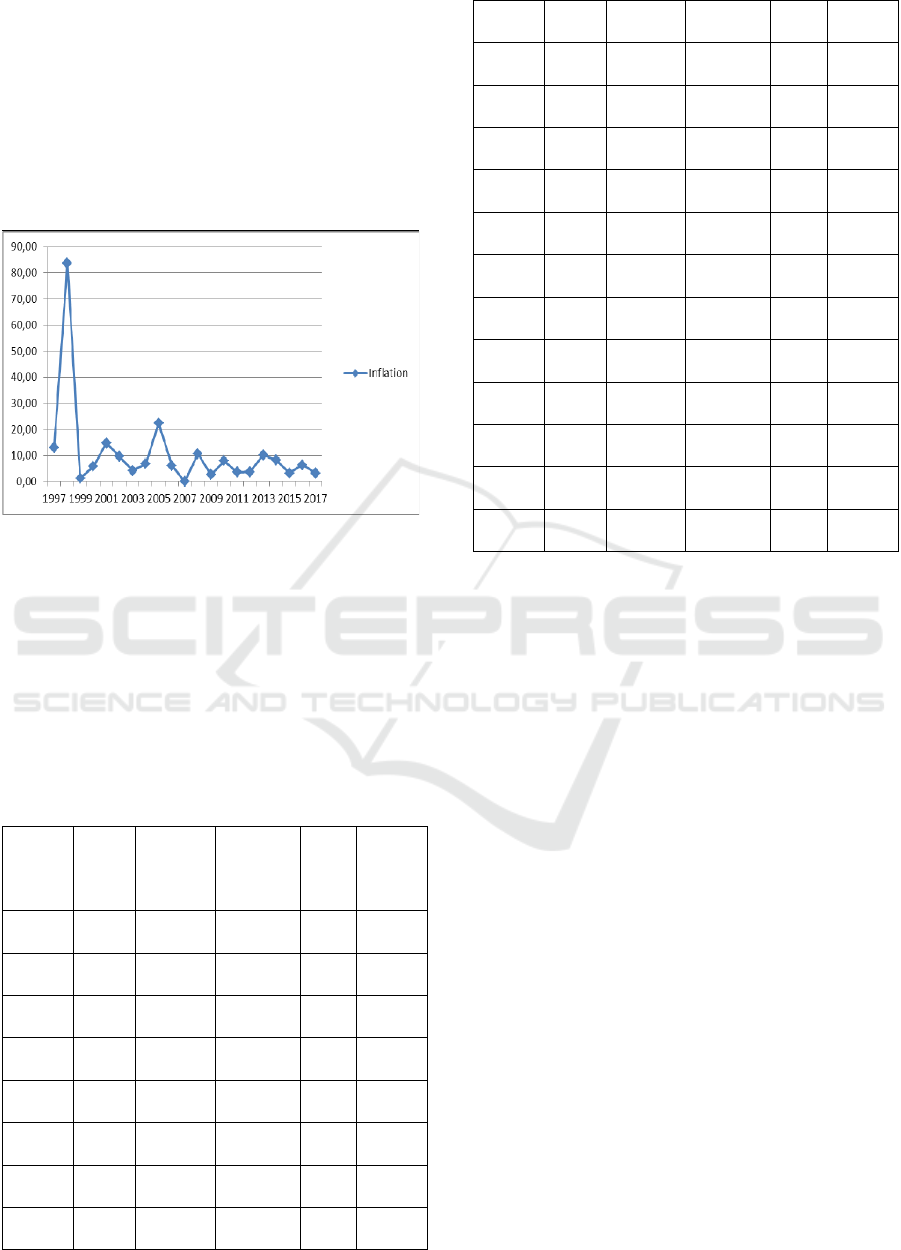

Based on the data of inflation in North Sumatra

during the 1997-2017 inflation rate trend shows up

and down from year to year. The highest inflation in

1998 reached 83.56 percent and the lowest the year

1999 reached 1.37 percent. Inflation in 2000

increased by 5.73 percent compared to the previous

period. This increase is due to rising freight rates on

1 September 2000, the increase in fuel oil as of

October 2000. With the increase in fuel oil in 2002,

2005, 2008, and the year 2013 be a contributor to

inflation are quite high in that year (Bank Indonesia,

2014).

Inflation in 2015 also belongs to a low of 3.14

percent. As one of the factors suppressing inflation

rate years 2015, this is the weakening of purchasing

422

Siagian, D., Yusuf, M. and Fitrawaty, .

The Determinants of Inflation in North Sumatra Error Correction Model.

DOI: 10.5220/0009499804220429

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 422-429

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

power due to the decline in jobs, as the

unemployment rate in February 2015 rise 428,794

people when compared with February 2014,

bringing the total reached 7.45 million people.

Inflation in 2016 exceeded the targets set by Bank

Indonesia at the beginning of the year that is 6.34

percent and also speeding the Government's inflation

target of 5.3 percent. While the year 2017 the

inflation rate decreased by 3.20 percent.

Figure 1: The Trend of inflation in North Sumatra

Years 1997-2017

Based on the classical view that the main factors

affecting inflation is the money supply and credit.

View of keynes then add some variables such as

interest rates, government spending and investment

(Ackley,1983:543).

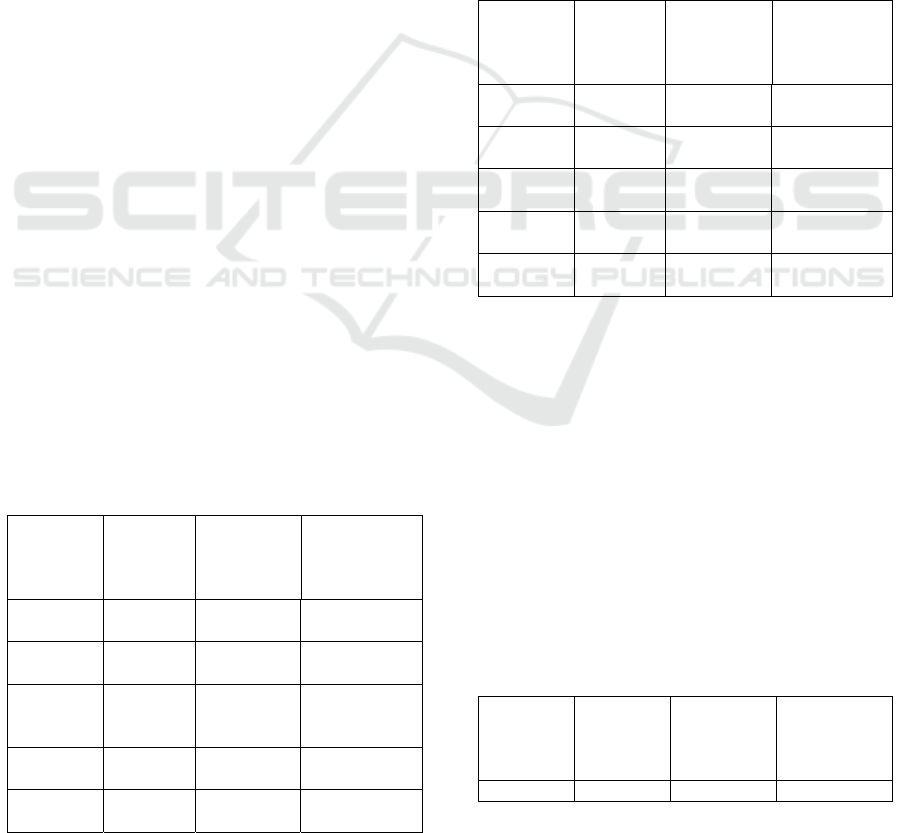

Table 1: The Development of the inflation (INF),

government spending (GS), the money supply (MS),

exchange rate (EXC) and economic growth (GDP)

in North Sumatra.

Years

INF

(%)

GS

(billion

rupiah)

MS

(billion

rupiah)

EX

C

(Rp/

U$)

GDP

(%)

1997 13.10 771

355.643

4.65

0 5.70

1998 83.56 342

577.381

8.02

5

-10.90

1999 1.37 449

646.205

7.10

0

2.59

2000 5.73 416

747.027

9.59

5

4.83

2001 14.79 916

844.054

10.4

00

3.72

2002 9.59 1.021

883.903

8.94

0

4.07

2003 4.23 1.352

955.692

8.46

5

4.48

2004 6.80 1.501 1.033.87

7

9.29

0

5.74

2005 22.41 1.830 1.202.76

2

9.83

0

5.48

2006 6.11 2.184 1.382.49

3

9.02

0

6.20

2007 6.60 2.560 1.649.66

2

9.41

9

6.90

2008 10.72 2.967 1.895.83

9

10.9

50

6.39

2009 2.61 3.444 2.141.38

4

9.40

0

5.07

2010 8.00 3.666 2.471.20

6

8.99

1

6.42

2011 3.67 4.611 2.877.22

0

9.06

8

6.66

2012 3.68 7.633 3.307.50

8

9.67

0

6.45

2013 10.18 7.260 3.730.40

9

12.1

89

6.07

2014 8.17 7.808 4.173.32

7

12.4

40

5.23

2015 3.24 7.959 4.548.80

0

13.7

95

5.20

2016 6.34 9.476 5.003.30

0

13.3

07

5.18

2017 3.20 13.034 5.126.20

0

13.5

48

5.12

Source: Central Bureau of Statistics (BPS), Bank

Indonesia

Based on the data in table 1 that in 2005 the

inflation rate up from 6.80 percent to 22.41 percent,

the inflation rate is rising. Bank Indonesia attempted

to embody a high economic growth target but still

maintaining a relatively low inflation rate and stable,

but in the same year, the economic growth

experienced a decline from 5.74 percent to 5.48

percent. It is known that in the year 2009 the money

supply increased from 1,895,839 billion rupiahs into

2,141,384 billion rupiahs. Table 1 known also in the

same year the rupiah depreciates from Rp 10.950/US

dollar to Rp 9400/US dollar, which with increasing

money supply in the community and the occurrence

of the depreciation of the rupiah should have an

impact on high inflation. But inflation in 2009

experienced a drastic decline from 10.72 percent to

2.61 percent. While government spending has

increased from 2,967 billion rupiahs be 3,444 billion

rupiahs. This data does not match the theory. The

phenomenon certainly became one of appeal to

conduct research related to inflation. In addition, the

discovery of the difference results from earlier

studies where results are in accordance with the

theory and results that contradict the theory. This

fact certainly is questions about how big the

influence of government spending, the money

supply, exchange rates and economic growth in

The Determinants of Inflation in North Sumatra Error Correction Model

423

increasing the inflation rate and push in North

Sumatra.

Because inflation is a long-term phenomenon. So

it's interesting to do further research about inflation

in North Sumatra. In General, this research examines

the relationship between the independent variable

and the dependent variable in the short and long

term. The purpose of this research is to analyze the

effect of government spending (GS), the money

supply (MS), the exchange rate (EXC) and

economic growth (GDP) against inflation (INF) in

North Sumatra.

2 THEORETICAL FRAMEWORK

Inflation is a process of rising prices of General

goods continuously (Nopirin, 2009:25). In the short

term, fiscal policy affects aggregate demand side,

while in the long run fiscal policy will affect the

supply side. Fiscal policy-oriented to improve the

supply side can overcome the problem of limited

production capacity and therefore its impact is a

more long term in nature. The impact of fiscal policy

on the economy through the approach of aggregate

demand is explained through the Keynesian

approach. The keynesian approach assumes the

existence of price rigidity and excess capacity so

that the output is determined by aggregate demand.

Keynes stated that the recession, the economy-based

market mechanisms will not be able to recover

without intervention from the Government. (Nanga,

2005). According to research conducted by Berto

Muharman (2013), the influence of fiscal

instruments against inflation found that State

spending and taxes the positive effect in the short

term while the negative effect in the long term.

The growth of the money supply happened

reasonably will provide a positive influence on the

economy in the short term, Indonesia is another case

with significant growth will trigger inflation which

would of course give negative influences. The

quantity theory of money is the oldest theories

concerning inflation, the theory highlights the role of

the addition of the money supply and expectations

about the price increase. It means that inflation can

only happen if there are additions to the money

supply. With the increase of the money supply

continuously, the community would feel rich so it

will raise consumption and this will raise prices. In

addition, the inflation rate is determined by society's

expectations about rising prices in the future.

Theoretically, there is a positive relationship

between the money supply and the inflation rate.

Increasing the money supply will increase inflation

rate. Research conducted by Ferdiansyah (2011)

shows the results that the money supply a positive

effect against inflation and Maggi and Saraswati

(2013) shows that the amount of money in

circulation a significant and positive effect in the

long term. However, research conducted by the

Issuance, et.al. (2014), Sipayung and Budhi (2013),

Symbolic (2010) shows the results that the money

supply is negative and not significant effect against

the inflation rate in Indonesia.

The occurrence of inflation triggered by the

weakening of the exchange rate of the rupiah against

the U.S. dollar since August 14, 1997, the rupiah's

exchange rate system is practiced in Indonesia is a

free-floating exchange rate system which means that

the exchange rate of the rupiah will be formed and

submitted fully to market mechanisms or based on

the laws of supply and demand of the market. The

weakening of the exchange rate of rupiah against

foreign currencies results in increasing the value of

exports. The price of domestic goods cheaper

overseas parties draws to increase the amount of

demand for the goods so that the price will go up

slowly and causes inflation (Sipayung, 2013).

According to the Keynesian Theory explaining

the relationship between inflation and economic

growth which in the short term (short-run) aggregate

offer curve is positive. The next long-term

relationships (long-run relationships) between

inflation and economic growth in which inflation

rises but economic growth down. These

circumstances justify empirically prove of some

related research between inflation and economic

growth that high inflation causes economic growth

down (Mankiw, 2003).

3 RESEARCH METHOD

This study uses secondary data in the form of time

series during the years 1997-2017. The calculation

of the inflation rate in this study uses the concept of

inflation CPI gained from the Central Bureau of

Statistics (BPS). Government spending (GS) in units

of billions of rupiah, the money supply used is

money in the broad sense in units of billions of

rupiah were sourced from publications of Bank

Indonesia. As for the data exchange rate of rupiah

against the U.S. dollar using the Middle rate set by

Bank Indonesia in units of thousands of rupiah.

Economic growth data and in units of a percent is

obtained from the Central Bureau of Statistics

(BPS).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

424

The estimation model used in this study is the

analysis of the dynamic model with the regression

that is by using the model of error correction (Error

Correction Model/ECM) Domowitz and Elbadawi.

In the context of Economics, the dynamic model

specification is very important because it deals with

the establishment of the model of an economic

system that is associated with the change of time of

both short term and long term. This study uses

statistics programs help E-Views version 7.

4 ANALYSIS

4.1 Stationeritas Test

The first thing to do is to examine whether the data

is stationary or not. This Stasioneritas test needs to

be done because a regression analysis should not be

did when the data used is not stationary and

normally if it still done the resulting equations then

are a spurious regression.

4.1.1 Unit Root Test

The unit root test is normal testing was introduced

by David Dickey and Wayne Fuller. The root test is

done to find out whether the data used stationary or

not. Data testing performed using test Augmented

Dickey-Fuller (ADF) was the count of an ADF when

the variable is greater than the critical value of

MacKinnon, means the variable is stationary, and

vice versa. Based on table II that Government

spending variables (GS) and exchange rate (EXC) is

not significant at the α = 5%. Because not stationary

at the zero degrees, then it needs to be done again

using stationeritas test the degree of integration of

the single.

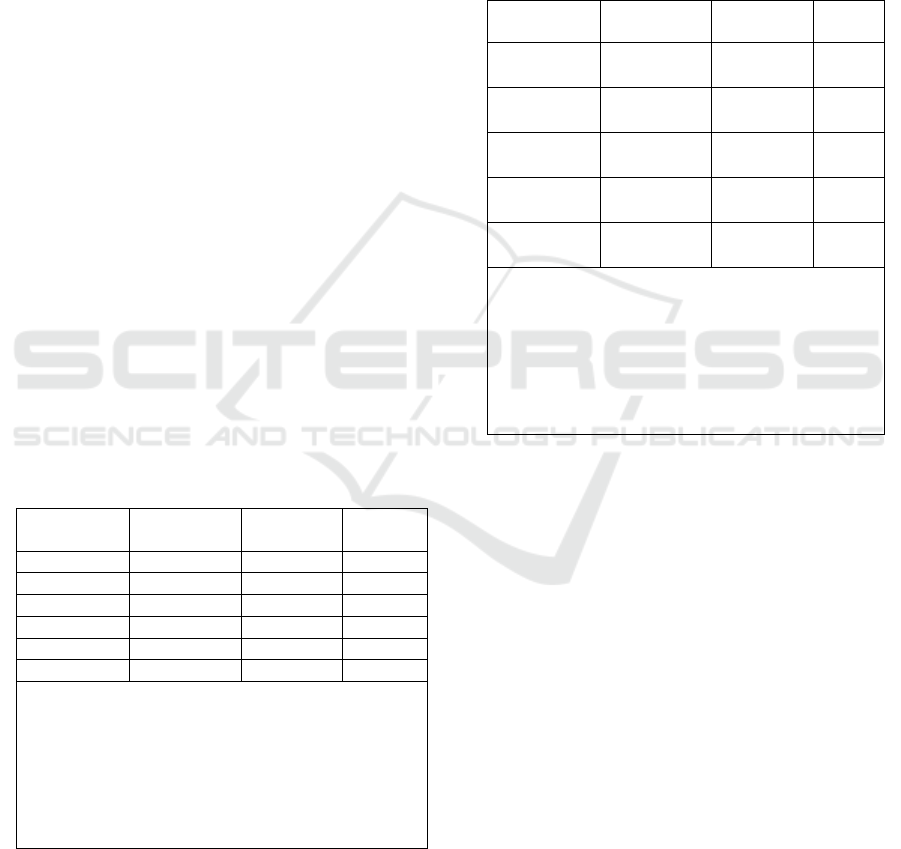

Table 2: Unit Root Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Descrip

tion

INF -

4.961814

-3.020686 Stationary

GS

0.034233

-3.020686

Non

Stationary

MS

-

1.429649

-3.065585

Non

Stationary

EXC -

3.570159

-3.020686 Stationary

GDP -

3.917664

-3.020686 Stationary

4.1.2 Integration Test

A test of the degree of integration is a test done to

measure at the level of difference to how data all the

variables are stationary. The taking of decision is

when the count of an ADF variable is greater than

the critical value of MacKinnon, means the variable

is stationary, and vice versa. Based on table III that

variable inflation (INF), government spending (GS),

the money supply (MS), the exchange rate (EXC)

and economic growth (GDP) has been stationary at

the same degree, that is one degree, shown from the

ADF value calculate more than the value of the

critical (Mackinnon critical values) at α = 5%. Thus,

the Granger test requires a stationary data at the

same degree can be used.

Table 3: Integration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Descrip

tion

INF -

8.791213

0.0008 Stationary

GS -

7.992085

0.9514 Stationary

MS -

8.984249

0.5417 Stationary

EXC -

7.395489

0.0165 Stationary

GDP -

12.84830

0.0079 Stationary

4.1.3 Cointegration Test

In this research to test the residual method based

cointegration test. Residual-based test method using

statistical tests Augmented Dickey-Fuller (ADF) by

observing the regression residual cointegration

stationary or not. Then this residual value will be

tested using the test Augmented Dickey-Fuller

(ADF) to find out if the residual value of the

stationary or not. The results of this research show

that the estimated value of the ADF test > Critical

Value α = 5% (-5.310626 >-3.020686). So it could

be inferred that the empirical model used in this

study to qualify for the cointegration test.

Table 4: Cointegration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Description

ECT -5.310626 0.0004 Stasionary

The Determinants of Inflation in North Sumatra Error Correction Model

425

4.2 Estimation Error Correction Model

(ECM)

Estimation model of inflation using the model of

Error Correction Model (ECM) Domowitz and

Elbadawi aims to seek short-term balance or correct

an imbalance towards short-term long-term balance.

To know that a used Error Correction Model (ECM)

is valid or not can be seen from the value of the

Error Correction Term (ECT) are significant or not.

Equation Error Correction Model (ECM) for short-

term period are as follows:

The results of estimation Error Correction Model

(ECM) that short-term variable changes the money

supply (MS) and economic growth (GDP) had a

negative influence against inflation in North

Sumatra. While the Government spending variables

(GS) and exchange rate (EXC) have a positive

influence against inflation in North Sumatra. The

magnitude of the balance and changes the previous

inflation against the period now is 128 percent.

These adjustments are obtained from coefficients the

Error Correction Term (ECT) of 1.287258 while the

t-statistics is 6.002274 with probability 0.0000 so

significant at 5% and means that the model can be

used.

Table 5: The Results of The Estimation of the Error

Correction Model (ECM) Short-Term

Independen

t Variables

Coefficient t-Statistic Prob

D(LnGS) 0.683037 1.417959 0.1781

D(LnMS) -5.089649 -2.752699 0.0156

D(LnEXC) 3.658554 4.032125 0.0012

D(LnGDP) -0.493542 -4.528430 0.0005

ECT 1.287258 6.002274 0.0000

C 0.335769 1.166629 0.2628

R-squared

Adjusted R-

squared

F-statistic

Prob(F-statistic)

Durbin-Watson

stat

0.904034

0.869760

26.37686

0.000001

2.179223

Equation Error Correction Model (ECM) for

long-term periods are as follows:

The results of estimation Error Correction Model

(ECM) that long-term variable changes the money

supply (MS) and economic growth (GDP) prior

periods have a negative influence against inflation in

North Sumatra. While the Government spending

variables (GS) and exchange rate (EXC) previous

period have a positive influence against inflation in

North Sumatra.

Table 6: The Results of The Estimation of Error

Correction Model (ECM) Long-Term.

Independen

t Variables

Coefficient t-Statistic Prob

LnGS(-1)

1.445744 2.986111

0.009

2

LnMS(-1)

-2.505213 -3.236568

0.005

5

LnEXC(-1)

2.429970 2.498143

0.024

6

LnGDP(-1)

-0.663565 -4.533170

0.000

4

C

5.575499 1.033033

0.318

0

R-squared

Adjusted R-

squared

F-statistic

Prob(F-statistic)

Durbin-Watson

stat

0.671479

0.583874

7.664799

0.001429

2.572411

4.3 Test Determination (R

2

)

4.3.1 F-Test (Simultaneous Test)

F test or simultaneous test is performed to see the

effect of free variables simultaneously or together to

the dependent variable. From the results of the

estimation model for inflation in the short term is

obtained a value of F count of 26.37686 with the

level of probability of 0.000001. Then the variable

is Government spending (GS), the money supply

(MS), exchange rates (EXC) and economic growth

(GDP) in the short term significant effect

simultaneously against inflation (INF) in North

Sumatra.

From the results of the estimation model for

inflation in the long-term is obtained a value of F

count of 7.664799 with the level of probability of

0.001429. Then the variable is Government

spending (GS), the money supply (MS), exchange

rates (EXC) and economic growth (GDP) in the long

ECTGDP

MSGSD

287258.1493542.0EXC658554.3

089649.5683037,0335769.0LINF

GDP

MSGSn

663565.00EXC429970.2

505213.2445744.1575499.5INFL

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

426

term significant effect simultaneously against

inflation (INF) in North Sumatra.

4.3.2 T-Test (Partial Test)

a. The Government Spending

Based on the results of the study showed that the

change in government spending in the short term

does not influence the change of inflation in North

Sumatra with a coefficient of 0.683037. This means

if a change of government spending rose by 1 billion

rupiahs, then inflation will change up by 0.683037

percent.

While in the long-term government spending has

a positive influence and significantly to inflation in

North Sumatra. If change is Government spending

rose by 1 billion rupiahs, then change the inflation

went up by 1.445744 percent.

b. The Money Supply

Based on the results of the study showed that the

percentage of change in the money supply in the

short term to change the percentage of inflation in

North Sumatra with a coefficient of-5.089649. If

changes in the money supply rose by 1 billion

rupiahs, then change the percentage of inflation will

come down of 5.089649 percent.

While in the long-term the money supply has a

negative and significant effect against inflation in

Indonesia with a coefficient of -2.505213. This

means if the money supply rose by 1 billion rupiahs,

then inflation will be down by 2.505213 percent.

c. The Exchange Rate

Based on the results of the study showed that

changes in exchange rates in the short term to

change the percentage of inflation in North Sumatra

with the coefficient of 3.658554. If changes in the

money supply rose by Rp 1/US dollar, then change

the percentage of inflation going up by 3.658554

percent.

While in the long run Exchange rates had a

positive and significant influence against inflation in

North Sumatra. If the exchange rate rose by Rp 1/US

dollar, then change the percentage of inflation going

up by 2.429970 percent.

d. The Economic Growth

Based on the results of the study showed that the

change of the economic growth in the short term to

change the percentage of inflation in North Sumatra

with a coefficient of-0.493542. If the change of

economic growth rose by 1 percent, then change the

percentage of inflation will be down by 0.493542

percent.

While in the long run economic growth has a

negative influence and significantly to inflation in

North Sumatra. If the change of economic growth

rose by 1 percent, then the change in inflation down

by-0.663565 percent

4.3.3 Goodness of Fit Test

Test coefficient determination (R

2

) is used to see

how big the variation of free variables may explain

the variables bound. Adjusted R-squared value of

0.904034 can be explained that Government

spending variable precision (GS), the money supply

(MS), the exchange rate (EXC) and economic

growth (GDP) explains the variations change

inflation rate amounted to 90.40 percent. While the

rest of 9.60 percent described other factors outside

the model.

5 RESULTS

5.1 Influence Government Spending against

Inflation in North Sumatra

Based on the results of the study showed that the

change in government spending in the short term

does not influence the change of inflation in North

Sumatra with a coefficient of 0.683037. This means

if a change of government spending rose by 1 billion

rupiahs, then inflation will change up by 0.683037

percent. Due to North Sumatra Government

spending comes from shopping the employees,

operational expenditure and capital expenditure

because of increased demand for goods and services

could not be anticipated by the side deals. Inflation

occurred in North Sumatra due to the increasing

demand for a hand. These results can be explained

by the theory of Keynes that in the short term fiscal

policy affects aggregate demand side. Rising prices

of goods due to the increase in aggregate demand

due to rising production costs (Nanga, 2005). And

not in line with the research conducted by Berto

Muharman (2013) that influence the fiscal

instrument against inflation in Indonesia found the

country's tax and spending the positive effect in the

short term.

The Determinants of Inflation in North Sumatra Error Correction Model

427

While in the long-term government spending has

a positive influence and significantly to inflation in

North Sumatra. If change is Government spending

rose by 1 billion rupiahs, then change the inflation

went up by 1.445744 percent. This is in accordance

with the theories of keynes. In the long run fiscal

policy will affect the supply side. Fiscal policy-

oriented to improve the supply side can overcome

the problem of limited production capacity. Keynes

stated that the recession, the economy-based market

mechanisms will not be able to recover without

intervention from the Government (Nanga, 2005).

This is in line with research conducted by Marius

Masri (2010) using OLS that employee shopping

model, positive and influential operating

expenditures significantly to inflation in East Nusa

Tenggara Province.

5.2 Influence the Money Supply against

Inflation in North Sumatra

Based on the results of the study showed that the

percentage of change in the money supply in the

short term to change the percentage of inflation in

North Sumatra with a coefficient of -5.089649. If

changes in the money supply rose by 1 billion

rupiahs, then change the percentage of inflation will

come down of 5.089649 percent. Because

government policy to change the money supply has

not been effective in controlling the rate of inflation

and the money supply has not been sufficiently

lowered inflation rates in North Sumatra. These

results can be explained by the theory of Keynes that

the increase in the money supply can raise prices,

but the increase in the money supply is not always

proportional to the increase in the price of goods. In

the short ride down the amount of money circulating

in the economy does not quickly addressed by the

community, for example by changing consumption

patterns. And in line with the research conducted by

Annisa Tri Utami and Soebiyo Daryono (2013)

using OLS model is that the money supply a

negative and significant effect against inflation in

Indonesia.

While in the long-term the money supply has a

negative and significant effect against inflation in

Indonesia with a coefficient of -2.505213. This

means if the money supply rose by 1 billion rupiah,

then inflation will be down by 2.505213 percent.

Due to the money supply consists of cash in

circulation, money giral and quasi money. Although

the value is high but not enough to affect the

inflation increase in North Sumatra. This result does

not match the quantity theory that fluctuations that

occur at the price caused by the ups and downs of

the volume of money supply in the economy

(Mankiw, 2003). So it was concluded that the money

supply has a positive influence against inflation.

And in line with the research conducted by Nugroho

and Basuki (2012) stated that the money supply a

negative and significant effect against inflation in

Indonesia.

5.3 Influence Exchange Rate against Inflation

in North Sumatra

Based on the results of the study showed that

changes in exchange rates in the short term to

change the percentage of inflation in North Sumatra

with the coefficient of 3.658554. If changes in the

money supply rose by Rp 1/US dollar, then change

the percentage of inflation going up by 3.658554

percent. This is in accordance with the Purchasing

Power Parity approach in case of inflation then to

maintain the balance of the Law of One Price, the

exchange rate must depreciate. The theory of

Purchasing Power Parity also said that the country

that its currency is experiencing high inflation rates

should reduce the value of its currency against other

currencies with lower inflation rates (Mishkin,2009).

This is in accordance with the research done

Oktavia, Lakshmi, et al that the exchange rate of a

positive and significant effect against inflation in

Indonesia.

While in the long-term Exchange rates had a

positive and significant influence against inflation in

North Sumatra. If the exchange rate rose by Rp 1/US

dollar, then change the percentage of inflation going

up by 2.429970 percent. Due to the depreciating

rupiah exchange rate against the United States dollar

then inflation increased. But despite the more price

increases or inflation will not reduce the purchasing

power of money. Because of the exchange rate of

the dollar has intrinsic value that is steeper than in

foreign currency exchange rates. This is in

accordance with the research conducted by Priyono

and Setiasih (2009), the relationship of inflation with

Exchange rate is positive.

5.4 Influence Economic Growth against

Inflation in North Sumatra

Based on the results of the study showed that the

change of the economic growth in the short term to

change the percentage of inflation in North Sumatra

with a coefficient of-0.493542. If the change of

economic growth rose by 1 percent, then change the

percentage of inflation will be down by 0.493542

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

428

percent. This is not in accordance with the theories

of keynes explained the relationship between

inflation as economic growth in the short-run

aggregate supply curve is positive. Inflation in North

Sumatra on research is due to the increase in the

price of Fuel. The rising prices of fuel oil which was

followed by rising prices of goods and services will

make the price is not affordable by the people who

earn it anyway. The high price levels that cause

declining purchasing power it will make producers

suffered losses so will lower economic growth in

Northern Sumatra. This is in accordance with the

research done Izzah (2015) stated that the negative

effect of inflation towards economic growth of Riau.

While in the long run economic growth has a

negative influence and significantly to inflation in

North Sumatra. If the change of economic growth

rose by 1 percent, then the change in inflation down

by-0.663565 percent. This is in accordance with the

theories of keynes in the long-term relationship

between inflation and economic growth in which

inflation rises but economic growth down

(Mankiw,2003).

6 CONCLUSIONS

Only the variable exchange rate (EXC) that have

significant influence towards inflation in North

Sumatra in both short term and long term. The

variable amount of the money supply (MS) and

economic growth (GDP) has a negative influence

and significantly to inflation in North Sumatra.

While the Government spending variables (GS) in

the short term is not significant effect against

inflation in North Sumatra.

Because of the exchange rate (EXC) is the main

determining factor affecting inflation in North

Sumatra in both short term and long term so that

Bank Indonesia is expected to maintain the stability

of the exchange rate of the rupiah. The system of

exchange rates used for Bank Indonesia's current

exchange rate system is the right of free use for

keeping the stability of the instrument's value by

open market operations in the money markets either

rupiah or foreign currency.

REFERENCES

Ackley, Gardner. (1983). “Teori Ekonomi Makro”.

Diterjemahkan Oleh Paul Sitohang-Fakultas Ekonomi

Universitas Lampung Teluk Betung. Diperiksa dan

disempurnakan oleh Joedono-Fakultas Ekonomi

Universitas Indonesia. Penerbit Universitas Indonesia.

Jakarta.

Annisa Tri Utami, Daryono Soebagiyo. (2013). “Penentu

Inflasi Di Indonesia, Jumlah Uang Beredar, Nilai

Tukar, Ataukah Cadangan Devisa”. Jurnal Ekonomi

& Studi Pembangunan Vol. 14, No.2, Hal 144-152.

Jakarta. Oktober 2013.

Berto Muharman. (2013). “Analisis Dinamis Pengaruh

Instrumen Fiskal Terhadap PDB dan Inflasi Di

Indonesia”. Jurnal Ilmiah. Fakultas Ekoomi dan

Bisnis Universitas Brawijaya. Malang.

Endri. (2008). “Analisis Faktor-faktor yang

Mempengaruhi Inflasi di Indonesia”. Jurnal Ekonomi

Pembangunan, vol.13(1), pp.1-13, April 2008.

Ferdiansyah, Fadli. (2014). “Analisis Pengaruh Jumlah

Uang Beredar (M1), Suku Bunga SBI, Nilai Tukar,

Suku Bunga Deposito terhadap Tingkat Inflasi”.

Media Ekonomi, vol.19(3), pp. 43-68, Desember

2011.

Izzah, Nurul. (2015). “Analisis Pengaruh Indeks

Pembangunan Manusia (IPM) dan Inflasi Terhadap

Pertumbuhan Ekonomi di Propinsi Riau Tahun 1994-

2013”. Jurnal Penelitian Ekonomi dan Bisnis. Vol. 1

(2), Hal 156-172.

Maggi, Rio, Birgitta Dian Saraswati. (2013). “Faktor-

faktor yang Mempengaruhi Inflasi di Indonesia:

Model Demand Pull Inflation”. Jurnal Ekonomi

Kuantitatif Terapan, vol.6(2), pp. 71-77, Agustus

2013.

Marius Masri. (2010). “Analsis Pengaruh Kebijakan

Fiskal Regional Terhadap Inflasi di Propinsi Nusa

Tenggara Timur (Periode 2001-2008)”. Tesis.

Universitas Diponegoro. Semarang.

Mankiw, N. Gregory. (2003).“Teori Makro Ekonomi”.

Edisi Kelima. Jakarta: Erlangga.

Mishkin, F. S. (2009).“Ekonomi Uang, Perbankan, dan

Pasar Keuangan Edisi 8 Buku 2”. Jakarta: Salemba

Empat.

Nanga, Muara. (2005). “Makro Ekonomi Teori, Masalah

dan Kebijakan Edisi Ke 2”. Jakarta: Raja Grafindo

Persada.

Nugroho, P.W dan Basuki M.U. (2012). “Analisis Faktor-

Faktor Yang Mempengaruhi Inflasi di Indonesia

Periode 2000.1-2011.4”. Disertasi Fakultas

Ekonomika dan Bisnis.

Priyono, Setiasih. (2009). “Analisis Faktor - Faktor Yang

Mempengaruhi Inflasi Di Purwokerto”. Skripsi.

Universitas Muhammadiyah Surakarta. Surakarta.

Pohan, Aulia. (2008). “Potret Kebijakan Moneter

Indonesia”. Jakarta: Raja Grafindo Persada.

Sipayung, Putri Tirta Enistin, Made Kembar Sri Budhi.

(2013). “Pengaruh PDB, NIlai Tukar dan Jumlah

Uang Beredar terhadap Inflasi di Indonesia Periode

1993-2012”. Jurnal Ekonomi Pembangunan

Universitas Udayana, vol. 2 (7), pp. 335-343, Juli

2013.

The Determinants of Inflation in North Sumatra Error Correction Model

429