The Online Accountability of Small Cash Waqf (Endowment)

Institutions in Indonesia

Dodik Siswantoro

Faculty of Economics and Business, Universitas Indonesia

Keywords: Waqf, accountability, cash, Indonesia

Abstract: The objective of this paper is to analyze the online accountability of small cash endowments in Indonesia. It

is an interesting issue that small institutions must be accountable like large organizations. The number of

registered cash endowment institutions in Indonesia has increased to 192 until the mid of 2018 but this must

be supported by a good accountability. The research employs a case-study approach based on some small

cash endowment institutions in Indonesia. There are three out of ten institutions from the initial proposal.

Data is collected by an in-depth discussion on the specific topic on accountability. The findings show that low

accountability may result from the low economic scale of an endowment fund to support the accountability

besides limited resources. These institutions must utilize economic tools to boost accountability.

1 INTRODUCTION

Accountability is the most important aspect in a

public sector organization. This institution uses

public fund from society and they must be responsible

for the usage of the fund. The public sector includes

government institutions and not-for-profit

organizations (NPO). In the case of NPO, they should

be more accountable as they rely on public fund or

society for their programs. If they fail or ignore to

uphold the accountability, the society would not trust

and stop giving a donation to this institution.

In Indonesia, most waqf institutions unwittingly may

ignore accountability due to the lack of resources.

However, as the parts of zakat institution or

organization and Islamic financial institution like

Islamic cooperative, they have to promote

accountability aspects to the stakeholders, which is

the society. Social media can be an effective tool to

promote this effort. However, only people who are

keen on social media can utilize it consistently,

aggressively, and persistently.

The use of a website can be an effective and

efficient way for accountability dissemination to the

public (Gandia, 2011; Saxton & Guo, 2011 and

Tremblay-Boire & Prakash, 2014). In this case, the

waqf institution, which is a part of a larger

organization, can also support and supply related

accountability information on waqf activities.

Research on accountability index of the non-profit

organization has been conducted by Dumont (2013)

in Illinois. This index may be of much benefit to the

measurement of accountability level of the institution.

The objective of this paper is to analyze the online

accountability of small cash endowments in

Indonesia. Online accountability is obligatory as they

can reach all aspects of the stakeholder even in a far

distance. The paper starts from the introduction.

Coming after that are the literature review on the

online accountability, the research method, issue

analysis, and the conclusion.

2 LITERATURE REVIEW

Research on the accountability of cash waqf

institutions in Indonesia has been conducted by

Siswantoro et al. (2018). They found that majority of

cash waqf institutions in Indonesia are low in

accountability index. The lowest accountability

theme is Islamic aspect (31.36%), performance

(33.98%) and finance (38.39%). This condition has

resulted from unawareness of institutions to meet

these themes and to disclose it to the public. In the

finance theme, information and management note on

shariah board activity is not achieved, due to the lack

1336

Siswantoro, D.

The Online Accountability of Small Cash Waqf (Endowment) Institutions in Indonesia.

DOI: 10.5220/0009499713361340

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1336-1340

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

of supporting information. Then in the performance

theme, good governance information is not achieved

as no data is available for this. Meanwhile, the Islamic

aspect theme, Shariah compliance is not achieved

either as the institutions assume that it is not

necessary to publish Islamic compliance to the

society.

The utilization of website for accountability can

be an effective way to improve and to spread

information accountability to the public. The purpose

of a website is to spread the information and

interactive communication between the institution

and the public in order that it can give benefits to the

institution as well (Saxton & Guo 2011; Gandia,

2011; Tremblay-Boire & Prakash, 2014). Rodriguez

et al. (2011) found the older the organization, the

more positive the correlation to the transparency

capability. The experience of accountability is also an

important factor to the transparent quality.

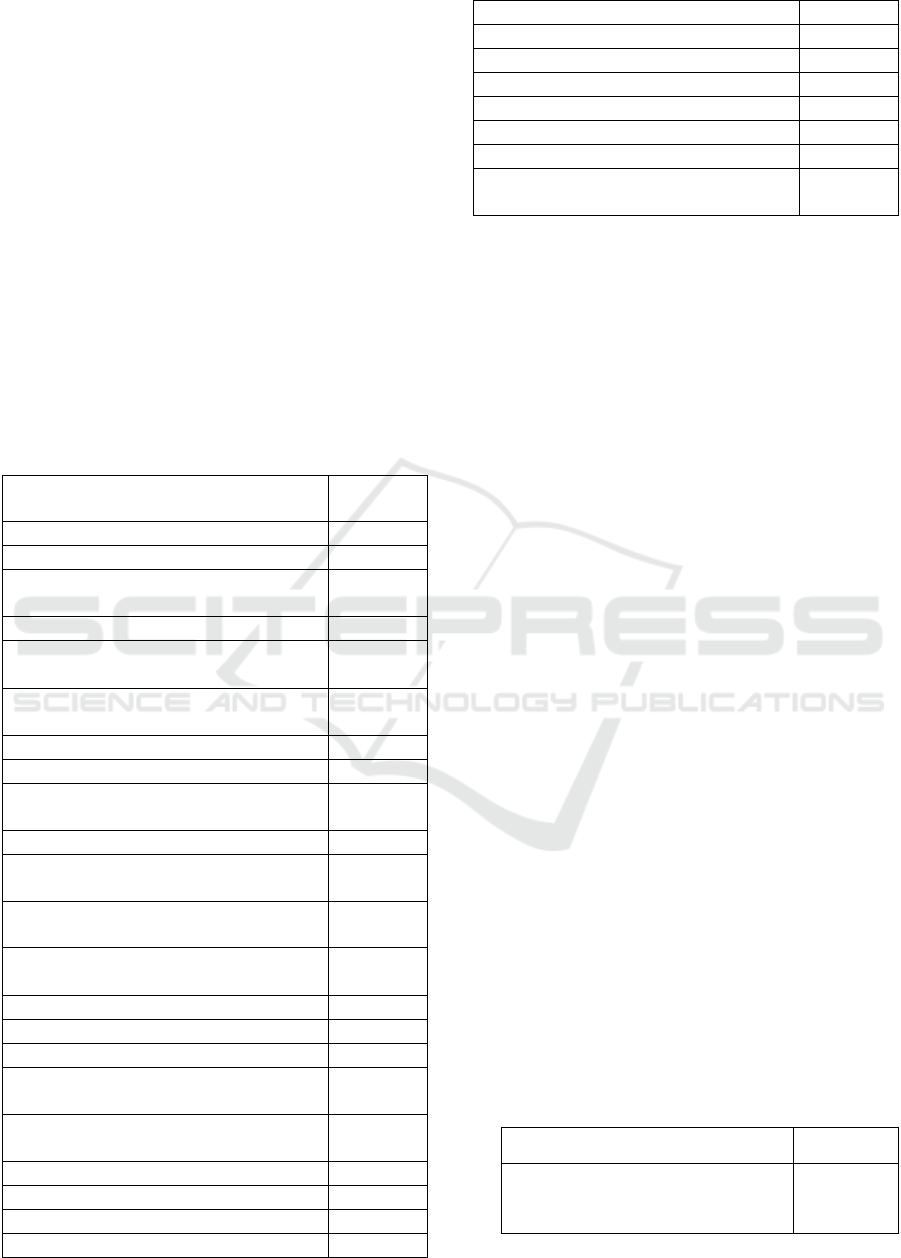

Table 1: Accountability Index Theme

Theme

Weight

(%)

Finance

Audited financial statements

10.56

Expenditure information based on

category

7.00

List of donors

3.90

Composition and management

structure

3.35

Activity and shariah board

information

2.50

Management note

2.69

Performance

Income on investment (net

income/average total asset)

5.99

Suggestions from beneficiaries

3.31

Program effectiveness and effects of

evaluation

5.73

Employee competence upgrading

program

3.25

Employee code of ethics and

regulations

2.26

Good governance information

2.55

Performance indicators

2.42

Public

Benefits of the waqf for beneficiaries

information

5.25

Information on the percentage of

funds used for social empowerment

4.05

Environment report

2.08

Response to suggestions

2.38

Program description and activity

3.75

Engagement

Contact access and availability

4.76

Waqf online participation

3.05

Updates and organizational news

3.35

FAQ

2.09

Islamic aspect

Shariah compliance

8.00

Regulation compliance

5.75

Total

100.0

0

Source: Siswantoro et al. (2018)

Dumont (2013) proposed an accountability index

which measures the level of online accountability.

Some aspects to be measured are accessibility,

interactive website, performance, governance, and

organization profile. However, each aspect may not

be fitted to different organization types.

Siswantoro et al. (2018) have proposed how to

measure accountability index for cash waqf

institution (see table 1). It consists of five themes.

They are (a) finance (b) performance (c) public (d)

engagement and (e) Islamic aspect. They also apply

this measurement to large cash waqf institutions in

Indonesia. It uses the online approach as cash waqf

institutions adopt social media to publish and to

disseminate the accountability themes to the public.

The fact is that the large cash waqf institutions in

Indonesia have low accountability index. This may

result from the unawareness of disclosing the

accountability themes to the public.

3 RESEARCH METHOD

The research employed a qualitative method with an

in-depth interview. The research objects are three

cash waqf institutions around Depok city, West Java

Indonesia. The selected objects are the final target

after some programs proposed to them.

Initially, ten institutions of cash waqf endowment

were invited to attend the socialization program of

accountability index for cash waqf organization.

Later, only five institutions confirmed to participate

in the program. Only two institutions attended the

socialization and others failed to attend. Eventually,

three institutions were in the final objects for an in-

depth interview (see table 2).

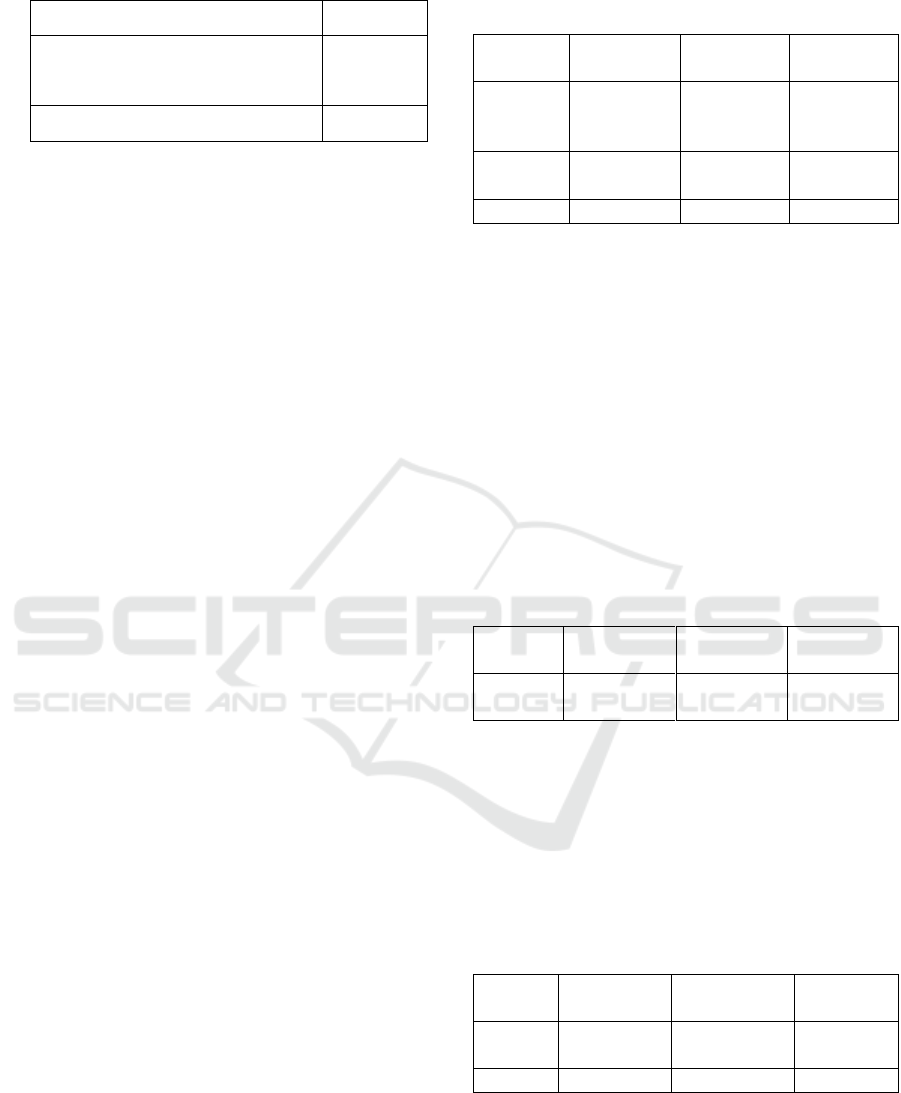

Table 2: Object research filter

Description

Amount

Invitation to join the

accountability socialization

10

The Online Accountability of Small Cash Waqf (Endowment) Institutions in Indonesia

1337

No response

(5)

Come to the socialization

program

2

Final object

3

Source: Data

The themes and aspects of accountability proposed by

Siswantoro et al. (2018) can be guidance for the in-

depth interview. It begins with asking about each

theme and aspect in the accountability index. It also

asked and how the institution supplies the information

of related issues.

4 ANALYSIS

The analysis is based on the comparative responses

for the accountability index. It comprises:

a. Finance

In finance theme, most cash institutions do not fulfill

each indicator aspect. Therefore, the question would

be focused on how they would prepare each aspect.

The financial system of cash waqf institutions is still

a part of zakat (tithe) institution. Zakat institutions

were initially established as not-for-profit

organizations that collect zakat and charity from

Muslims. When they turn into larger institutions, they

practice like waqf institutions that provide financing

to customers. As zakat and waqf have different

characteristics, most zakat institutions separate this

scheme. Only institution A separated the waqf

financial system from other institution. Institution B

was established in 2014, institution A was in 2015

and institution C in 2018. Institution C was not aware

that they have been registered to the government as a

cash waqf institution.

Although institution A was only established in

2015, they have already had a good financial system

and report. Therefore, it is not difficult to have a

similar treatment for cash waqf institutions. Such was

not the case for institution B. Although it was

established in 2014, they have not had any

representative website or social media to inform the

accountability theme of finance aspects. In fact, their

target is the member of the cooperative. Accordingly,

they do not aggressively promote cash waqf to the

society (see table 3). Institution C would like to

develop the financial system and prepare the website

to inform important issues.

Table 3: Finance Theme

Aspect

Institution

A

Institution

B

Institution

C

Financial

system

Separated

Enhanced,

separate

report

Being

developed

Website

Developed

Enhanced

Being

prepared

Target

n.a

Member

n.a

Source: Data

b. Performance

Concerning the performance theme, institution A

already has developed some programs for cash waqf.

They divided them into two programs. They are

productive and social waqf. The productive waqf is

delivered to profitable projects. The earned profit is

given to beneficiaries. Meanwhile, social waqf is

delivered to schools, hospitals, and mosques. They

coordinated further program development with other

institutions. Meanwhile, institution B focuses on

financing programs for their cash waqf. This scheme

earns a profitable profit. Nevertheless, the amount of

cash waqf is small. This can be another issue of

efficiency (see table 4).

Table 4: Performance Theme

Aspect

Institution

A

Institution

B

Institution

C

Program

Developed

Working

capital

n.a

Source: Data

c. Public

Institution A concerns with receiving inputs from

society. This may be a good strategy for the cash waqf

institution to develop their programs. Meanwhile,

institution B only focuses on their members as they

have limited resources to involve the society (see

table 5).

Table 5: Public Theme

Aspect

Institution

A

Institution B

Institution

C

Input

Concern

Focus on

member

n.a

Society

Involve

Member

n.a

Source: Data

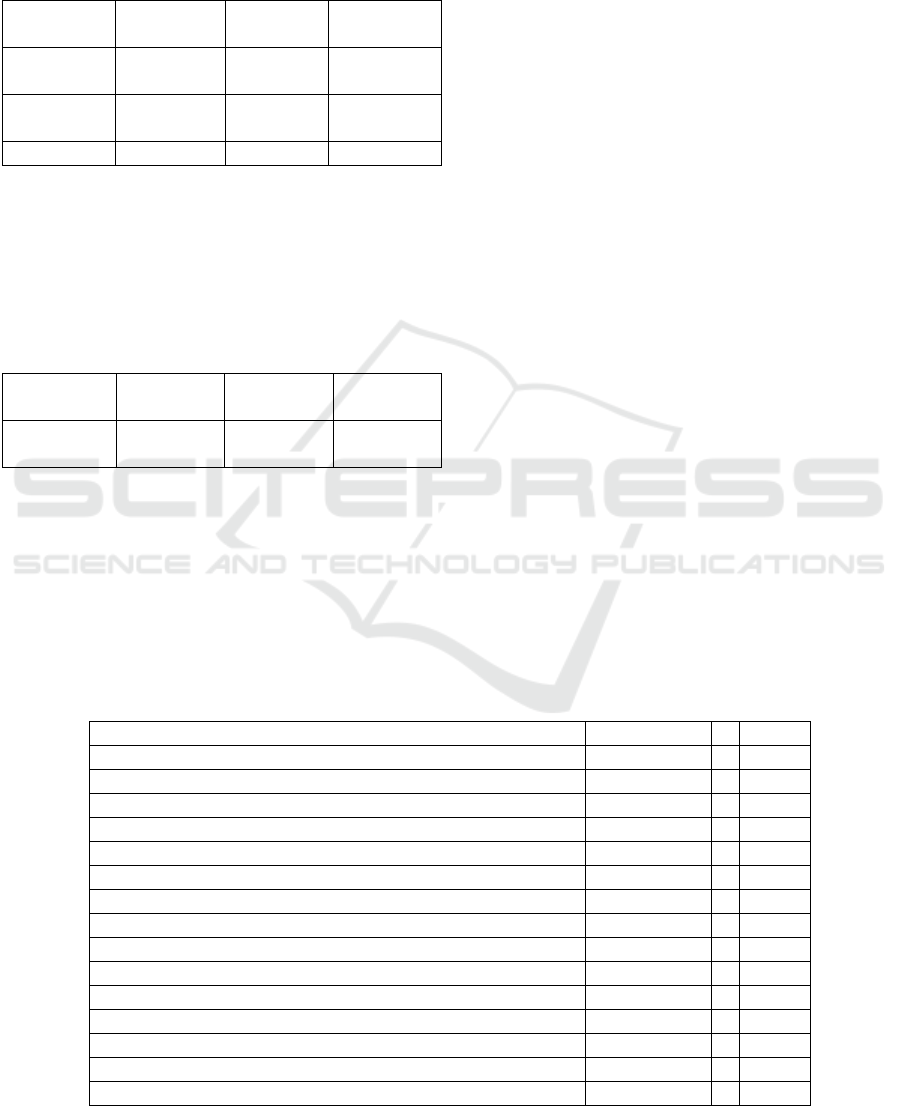

d. Engagement

In the engagement theme, only institution A actively

socialized the cash waqf program to the society. They

utilized Whatsapp to promote the programs. The

weakness of this scheme is that rather than

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1338

transferring the information to the public, it only

reaches the registered members. Such is also the case

for institution B. They utilized Whatsapp to inform

their members (see table 6).

Table 6: Engagement Theme

Aspect

Institution

A

Institutio

n B

Institution

C

Socializati

on

Active

n.a

n.a

Informatio

n

By WA

By WA

n.a

Learning

Phase

n.a

n.a

Source: Data

e. Islamic aspect

For Islamic aspect theme, only institution A has

ensured compliance with Islamic aspect and disclosed

the financial report. Institution B planned to comply

with for Islamic aspect (see table 7).

Table 7: Islamic Aspect Theme

Aspect

Institution

A

Institution

B

Institution

C

Islamic

compliance

Check and

disclose

Plan

n.a

Source: Data

The problems faced by the aforementioned

institutions above are that they do not have sufficient

cash waqf funds to support the operational expenses.

This has resulted in the failure to hire resources for

promoting accountability themes. The best solution is

that they are still allowed to be parts of larger parent

institutions to support activities.

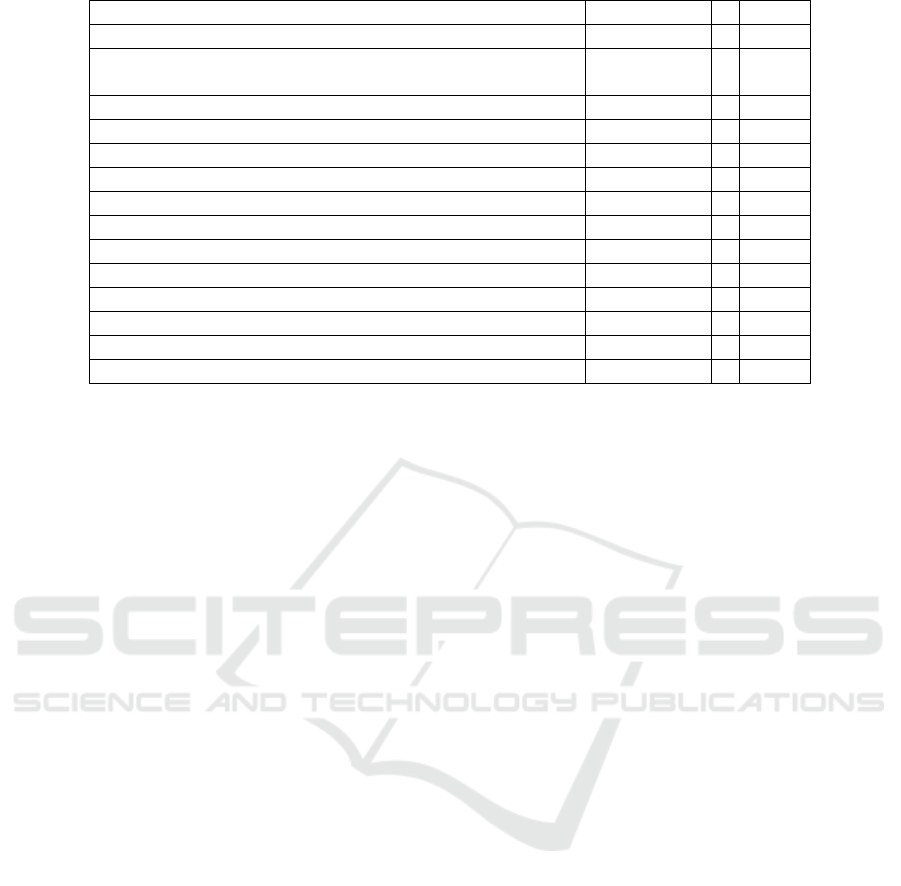

To see the accountability score, the indicator of

accountability was assessed. Only institution A is

feasible to be assessed as they have online

accountability basis. The score is 39.75, which was

lower than the finding of the research conducted by

Dodik et al. (2018) (see table 8). The institution

should focus on disclosing information in the related

themes.

The achievement of each theme ranks as follows.

In descending percentage, engagement ranks first

(84.2%), followed by the public at the second rank

(51.3%). Islamic aspect ranks third (41.8%) and

performance ranks fourth (35.4%). Finance ranks the

lowest with the percentage of 34.5%. Finance theme

is the most important issue of which that the

institution must be aware. An audited financial

statement is obligatory. The institution must find a

way to have their financial statements audited.

Furthermore, they have to disclose the financial

statements to the public. The financial statements can

be disclosed efficiently by social media such as

Twitter, Facebook, YouTube, and line.

Performance theme is also important for a

productive cash waqf. Donors should know how

much profit that the institution will generate. This

theme is also important to see the performance of cash

waqf institution in the disclosure to the society. If the

society knows that the institution really works and

performs well, the amount of cash waqf will increase.

In addition, public themes such as response to

suggestion are important to see how the cash waqf

concern with the society. Finally, Islamic compliance

should also be disclosed to the public transparently in

order that the society sees that the institution is

promoting Islamic teaching.

Table 8: Islamic Accountability Index Scoring

Theme

Weight (%)

A

Score

Finance

Audited financial statements

10.56

0

0

Expenditure information based on category

7.00

1

7

List of donors

3.90

0

0

Composition and management structure

3.35

1

3.35

Activity and shariah board information

2.50

0

0

Management note

2.69

0

0

Performance

Income on investment (net income/average total asset)

5.99

0

0

Suggestions from beneficiaries

3.31

1

3.31

Program effectiveness and effects of evaluation

5.73

1

5.73

Employee competence upgrading program

3.25

0

0

Employee code of ethics and regulations

2.26

0

0

Good governance information

2.55

0

0

Performance indicators

2.42

0

0

The Online Accountability of Small Cash Waqf (Endowment) Institutions in Indonesia

1339

Public

Benefits of the waqf for beneficiaries information

5.25

1

5.25

Information on the percentage of funds used for social

empowerment

4.05

0

0

Environment report

2.08

0

0

Response to suggestions

2.38

0

0

Program description and activity

3.75

1

3.75

Engagement

Contact access and availability

4.76

1

4.76

Waqf online participation

3.05

1

3.05

Updates and organizational news

3.35

1

3.35

FAQ

2.09

0

0

Islamic aspect

Shariah compliance

8.00

0

0

Regulation compliance

5.75

1

5.75

Total

100.00

45.3

Source: Dat

5 CONCLUSION

The accountability issue, especially for a small not-

for-profit organization, seems to be ignored as they

have limited resources and are ignorant of the

benefits. However, social media actually can ease the

cash waqf institution to promote accountability. The

most difficult issue is the audited report as the budget

has to be audited it. In addition, the institution still

needs some supporting staff to inform the activity of

each accountability index theme. To be accountable,

cash waqf institution must find efficient ways to

communicate the accountability to the public.

REFERENCES

Dumont, G. E. (2013). Nonprofit virtual

accountability an index and its application.

Nonprofit and Voluntary Sector Quarterly, 42

(5), 1049-1067

Gandia, J. L. (2011). Internet disclosure by nonprofit

organizations: Empirical evidence of

nongovernmental organizations for development

in Spain. Nonprofit and Voluntary Sector

Quarterly, 40 (1), 57-78.

Rodriquez, M. M. G., Perez, M. C. C., & Godoy, M.

L. (2011). Determining factors in online

transparency of NGOs: A Spanish case study.

Voluntas. 23, 661-683.

Saxton, G. D., & Guo, C. (2011). Accountability

online: Understanding the web-based

accountability practices of nonprofit

organizations. Nonprofit and Voluntary Sector

Quarterly, 40 (2), 270-295.

Siswantoro D., Rosdiana H., dan Fathurahman H.

(2018). Islamic accountability index of cash

waqf institution in Indonesia. Gani, L., Gitaharie,

B.Y., Husodo, Z., dan Kuncoro, A. Competition

and Cooperation in Economics and Business.

New York: Taylor Francis Group.

Tremblay-Boire, J., & Prakash, A. (2014).

Accountability.org: Online disclosure by U.S.

nonprofits. Voluntas, 26, 692-719.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1340