Implementation Proposal of Activity based Costing on the Loans

Department: A Case Study in PT. BPR Cincin Permata Andalas

Dissa Elvaretta

1

and Christina Juliana

1

1

Faculty of Economics and Business, Universitas Indonesia, Jakarta -Indonesia

Keywords: ABC, Traditional Costing, Loans Department, Bank

Abstract:

This study aims to determine the comparison between the result of the implementation proposal of

Activity Based Costing (ABC) system on the Loans Department at PT. BPR Cincin Permata

Andalas and the proposed implementation of the ABC system with traditional cost allocation

system that has been used so far. The research method used is single case study with a single unit

analysis by collecting data through observation, documentation, and interviews. The result of the

proposed implementation of ABC system can be utilized by PT. BPR Cincin Permata Andalas as

recommendation to arrange the next strategy. Results from this research shows the different

calculation of overhead costs with traditional cost method and ABC. ABC system describes cost

information reliable for calculating the cost of each customer better.

1 INTRODUCTION

The soaring competition leads companies engaged in

manufacturing, trading and service industries to be

extra careful in managing strategies that can enhance

their competitive advantage in order to continue to

sustain the competition. The level of competition is

due to the ease in getting information and rapid

technological developments, so that the opportunity

to conduct business activities becomes more open.

Competitive advantages cannot be maintained with

just the current market share position or resources

(Marvianti, 2013). However, companies must be able

to make innovations that will later impact the

company's profitability and increase competitive

advantage.

The rapid change in the business environment is

not only influenced by economic conditions but also

influenced by customers. The increasing number of

competitors makes it easier for customers to freely

determine which products and services to choose and

thus encouraged companies to set strategies in order

to established good relationships with customers.

The financial services industry plays an important

role in the development and economic growth of a

country, particularly in the banking industry. PT.

BPR Cincin Permata Andalas is one of the banks that

actively contributes to economic growth in Indonesia,

specifically in West Sumatra. PT. BPR Cincin

Permata Andalas contributes by channeling funds in

the form of loans to local and small business. The

provision of credit is based on the prudence principle

because it contains some substantial potential risk

which can affect the bank’s performance. Therefore

PT. BPR Cincin Permata Andalas must be able to

process, analyze, and assess every credit application

to determine that the application is safe, effective and

healthy. Hence, PT BPR Cincin Permata needs a cost

information from each credit analysis process to get a

decent and profitable customer. Raaij (2005)

explained that this cost information will be useful in

managerial decision making and be as reference for

companies in choosing their strategies to increase

their profitability. Using Activity Based Costing

system is considered capable of tracing the costs

arising from each activity influenced by the customer

and assigns costs accurately to each customer. The

results of the ABC system are expected to be able to

provide information to differentiate high-cost

customers and low cost customers so that further

strategic decisions can be measured.

This research was conducted in the credit

department in PT. BPR Cincin Permata Andalas by

considering the fact that the most important income is

credit interest income. Furthermore, this research is

986

Elvaretta, D. and Juliana, C.

Implementation Proposal of Activity based Costing on the Loans Department: A Case Study in PT. BPR Cincin Permata Andalas.

DOI: 10.5220/0009499609860990

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 986-990

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

expected to be able to provide more accurate cost

information on the calculation of credit application

fees with ABC compared with traditional cost system.

2 THEORICAL FRAMEWORK

Hansen and Mowen (2015) define costs as cash or

cash equivalents sacrificed to obtain goods or services

that are expected to provide benefits now and in the

future for the company. Horngren, et al., (2013)

argues that costs are sacrifices or resources used for

specific purposes. Different cost for different

purposes, which means that each cost classification

has different objective in the decision making

(Horngren, et al., 2012). Horngren, et al., (2012)

classified costs into two; direct costs, which is the

cost that directly related to cost objects and its

economic value can be easily calculated and indirect

costs, which is the cost that associated with product

costs but its economic value can not be traced easily.

If the procedure for assigning the costs is wrong,

this will lead to a wrong decision taken by

management. Tracing coss into cost objects is divided

into two methods (Hansen and Mowen, 2015), the

direct tracing and driver tracing method. Direct

tracing can be perform by identifying costs that

specifically related directly to the cost object and thus

charged directly into the cost object. Driver tracing is

a method of allocating or charging costs by paying

attention to the causal relationship between the cost

and the cost object. Indirect costs are costs that cannot

be traced directly so that it requires a method called

cost allocation. Allocation is usually based on

assumptions or policies set by management.

Horngren, et al., (2012) explains that there are four

reasons of why the costs allocation is very important.

It is to predict the impact of business decisions, used

as a tool to shape the motivation desired by functional

managers, to calculate income and assess the cost of

assets, and to calculate costs or justifications in

spending. Generally there are three cost allocation

systems, which are the direct costing, traditional

costing, and Activity Based Costing (ABC) systems

Traditional costing system focus on production.

costs. This system is also known as volume based

costing because the overhead is charged based on

volume of the cost drivers (Cooper and Kaplan,

1999). In its development, traditional costing is

deemed unable to produce reliable information so

Cooper and Kaplan (1999) developed an allocation

method based on activities called Activity Based

Costing (ABC). Blocher and David Stout (2012)

explain that ABC system is a cost allocation system

that allocated costs to its cost objects based on the

activities carried out for these cost objects, Stout and

Propri (2011) mentioned that if ABC implementation

is done correctly, it will be able to provide accurate

information about costs to management regarding

product costs so that the information can be used as a

basis for decision making for strategies such as the

process of repairing, pricing, and managing customer

relationships.

Blocher, Stout, and Cokins, 2012 stated that to

gain full closure on the flow of the ABC system , one

must understand about activity, resource, driver cost,

resource cost driver, and activity cost driver. ABC

described a causal relationship between resource,

activity and cost object. In conclusion, the assignment

of costs according to ABC is done through two stages,

namely assigning overhead costs to activities and

assigning activities to the cost object using two cost

drivers; the resource cost driver and activity cost

driver (Blocher, Stout, and Cokins, 2010; Cooper and

Kaplan, 1999).

In practice, it is difficult to apply the ABC system

to companies and allocate the overhead costs

compared to traditional method. ABC requires

companies to identify significant activities in their

business process. However, the allocation of costs

with ABC is considered sufficient enough to provide

more accurate information on the overhead cost of the

company.

The benefits of the ABC system are 1) ABC is

useful to determine the cost of the product more

accurately. 2) ABC system is very useful for company

management to conduct profitability analysis more

accurately, both in profitability analysis of products,

customers, processes and departments. 3) ABC can be

used as an inventory valuation measure. 4)

Appropriate and effective implementation of the

ABC system can help companies to manage their

activities better, to eliminate activities that do not

provide value and improve the quality of the

company's internal processes consistently.

The weakness of the ABC system is 1) The

application of the ABC system requires the support of

human resources and adequate information

technology and a long time to socialize to all parts of

the company. 2) Identification of causal relationships

between company operating activities and production

costs requires careful and adequate steps. Mistakes

that occur in determining the trigger of activity will

bring distorted cost information to management and

could cause serious damage. Cooper and Kaplan,

(1999) in his research explained how ABC can be

used to improve performance in insurance companies.

The application of ABC can be used in various

service industries such as banks, medical service

industries and government departments.

Implementation Proposal of Activity based Costing on the Loans Department: A Case Study in PT. BPR Cincin Permata Andalas

987

3 RESEARCH METHOD

This research is categorized as qualitative research.

Moleong (2015) explained qualitative research aimed

to understand the phenomenon of a research object so

that efforts can be determined to improve and analyze

the phenomenon. The method of data collection in

this study was conducted in 3 methods. First is the

observation by visiting the object of research directly;

Second is the documentation in the form of annual

reports, along with other data related to research; and

the third is conducting interviews with the director,

head of credit and 2 account officers. This research is

a single case study with a single unit of analysis and

it focused only on one research object. A single case

study brings a role to the research used in current

management and can provide knowledge valid

because this study focuses on one object. The object

of this research is PT. BPR Cincin Permata Andalas

where its specialty lies on providing loans to its

customer.

4 ANALYSIS

4.1 Allocation Policy Cost at PT. BPR Cincin

Permata Andalas

Based on interviews conducted with PT. BPR Cincin

Permata Andalas, the calculation of overhead costs

for processing a loan is done in a simple way, namely

by dividing the overhead costs by the amount of the

ceiling loan that has been given

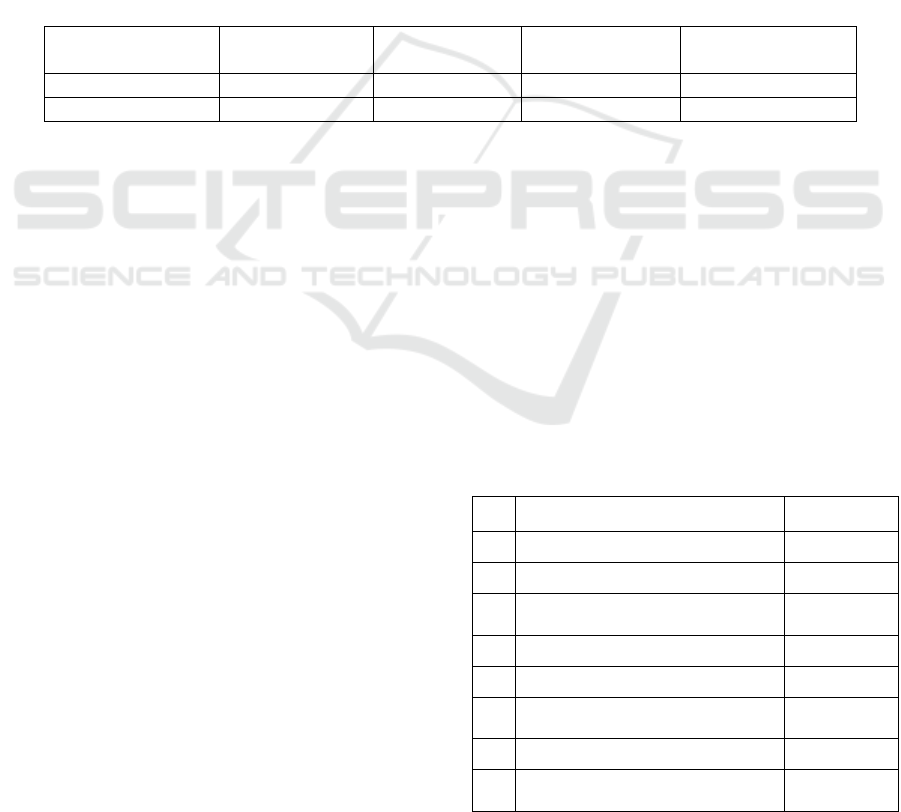

Table 1: Cost Allocation at PT. BPR Cincin Permata Andalas on December 31, 2017 (in Rupiah)

4.2 Development of Activity based Costing at

PT. BPR Cincin Permata Andalas

To develop a loan calculation using the ABC system,

the steps are as follows:

1. Determine all activities of the lending process

There are 14 activities includes: marketing;

customer data collection and file administration,

customer interviews, BI Checking, Making loan

portfolio, surveys, reviews of loan portfolio,

loan approvals, scheduling agreements,

agreements and loan realization,

documentation, supervision and loan

monitoring, making supervision reports, and

handling non-performing loans.

2. Determine resource costs

After determining the activities related to

lending, the next step is identifying the amount

of resource costs to process a loan application.

To determine the amount of resource cost, this

research has been traced the resources through

observation, documents, and interviews. There

are 5 overhead costs that have been traced, i.e.

payroll expense, education and training

expense, rent expense, maintenance expense,

and fuel expenses

3. Assign resource costs to activities

4. Identify activity drivers and assign activity costs

on cost objects

This is the last step in the development of ABC

in order to search the activity costs to object

costs so as it is grouped into one cost pool. The

cost pool results at PT. BPR Cincin Permata

Andalas are batch level, unit level, and facility

level

There are 11 cost pools that are used to trace costs

into the cost object. The calculation of the total

activity costs found in each cost pool, then these costs

are allocated to each customer segment. The

following is summary table of the cost pool at PT.

BPR Cincin Permata Andalas.

Table 2: Cost pool of the loan process PT. BPR

CincinPermataAndalas (in Rupiah)

No Rated aspect Category

1 Number of visits to customers 93.680.163

2 Number of customers served 62.757.395

3 Number of customer NPWP 12.657.004

4 Number of loan portfolio made 25.256.057

5 Number of reviews conducted 87.099.074

6 The amount of analysis carried out 73.036.989

7 Loan agreement 186.509.619

8 Number of documents recorded 74.362.979

Customer

Se

g

mentation

Working capital

Loan

Investment

Loan

Consumption

Loan

Total

N

umber of plafon

d

38.779.000.000 12.146.000.000 5.280.834.000 56.205.834.000

Overhead Cos

t

618.869.272 193.836.514 84.276.178 896.981.964

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

988

9 Number of monitoring conducted 170.551.102

10 Number of reports made 23.188.652

11 Number of actions taken 87.882.930

Total 896.981.965

Source: PT BPR Cincin Permata Andalas which has

been processed

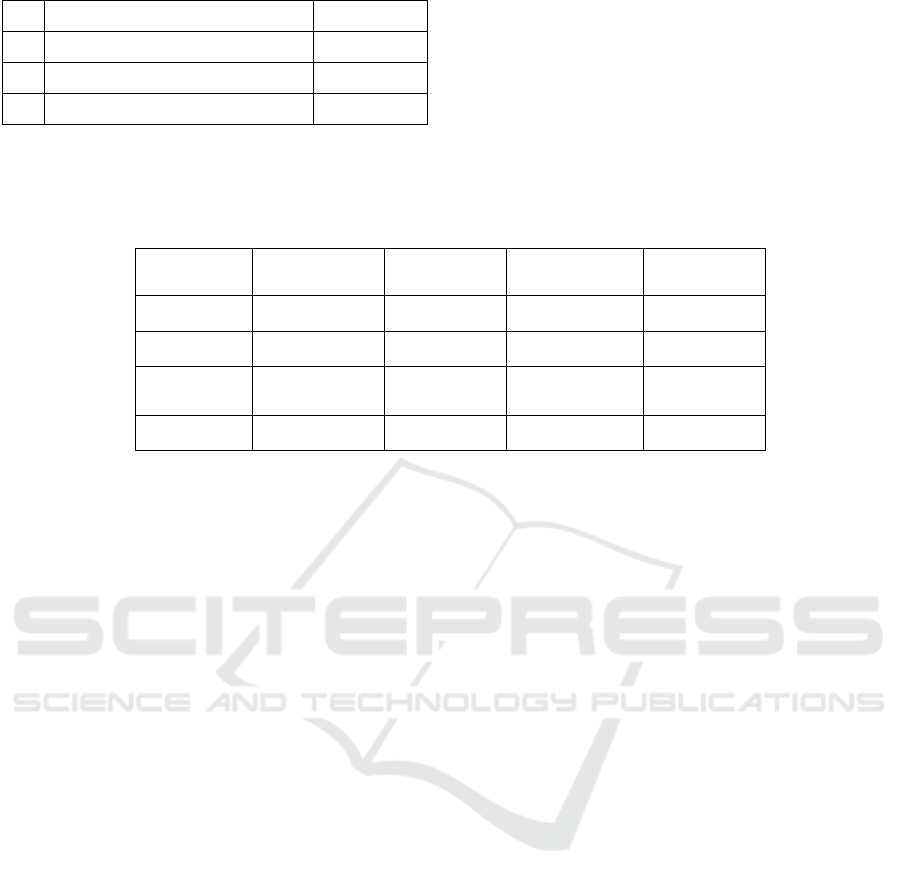

4.3 Comparison ABC with Traditional Costing

From the table, the allocation for each customer

segment is determined, so the results can be compared

to the calculations made by management.

Table 3: Comparison of Overhead Cost Allocation of the Process of Giving Loan in PT. BPR Cincin Permata Andalas (in

Rupiah)

Cost

allocation

Working

capital Loan

Investment

Loan

Consumption

Loan

Total

Traditional 618.869.272 193.836.514 84.276.178 896.981.964

ABC 636.538.463 171.453.668 88.989.833 896.981.964

Difference (17.669.191) 22.382.847 (4.713.655)

Information Undercosted Overcosted Undercosted

By comparing the overhead costs made on

management calculations and calculations according

to the ABC system, can be seen that the allocation of

costs used by PT. BPR Cincin Permata Andalas all

this time is not quite right. This affects the profit of

each segment of loan customers at PT. BPR Cincin

Permata Andalas. They can also find out that the

allocation of costs using the ABC system provides

information on which customers are high cost to serve

and which customers who are in the low cost to serve.

The working capital loan customers experienced

a considerable undercosted amounting to Rp.

17,669,191 from management calculations. Working

capital loan customers are customers who are in high

cost to serve, because it requires a greater activity cost

to process a loan application.

The investment is overcosted quite large, which is

Rp. 22,382,847 from management calculations,

which is why it is necessary to maximize the loan for

investment loan customers.

Consumption loan customers have undercosted

not too large because this customer segment is the

smallest customer segment of PT. BPR Cincin

Permata Andalas. However, consumption loan should

also be maximized because they have the potential to

provide greater profits.

Based on the activity of the lending process of PT.

BPR Cincin Permata Andalas which was developed

through the ABC system, it can be concluded that the

activities carried out mainly in the field are activities

that generate considerable costs, namely marketing,

reviewing or surveying, monitoring loan customers,

and handling non-performing loans or bad loan. BPR

Cincin Permata Andalas can encourage AOs to work

more efficiently in conducting loan assessments in the

field without ignoring the principle of prudence.

PT. BPR Cincin Permata Andalas held an

additional number of AOs, it was expected to

accelerate the loan assessment process. The

application of ABC can identify which non value

added activities and value added. To get around

undercosted and overcosted, this research suggests

reviewing the duties, functions, and authority of each

employee's work.

The ABC system implementation provides an

overview for PT. BPR Cincin Permata Andalas that

there are costs that should be charged more to

customers.

One of the strategy is to charge these costs to

customers with provision fees and administrative

costs and service fees on the loan process, while

collateral valuation by considering high cost of goods

sold to reduce the loan risk that will occur. Therefore,

the ABC system is recommended for its application

to the loan department of PT. BPR Cincin Permata

Andalas to produce more reliable cost information.

5 RESULTS

The calculation of overhead costs carried out by PT.

BPR Cincin Permata Andalas does not reflect actual

cost information. The development of ABC system

shows that working capital loans and consumption

loans are undercosted while investment loan is

overcosted. ABC system provides an overview to PT.

BPR Cincin Permata Andalas for customers who are

Implementation Proposal of Activity based Costing on the Loans Department: A Case Study in PT. BPR Cincin Permata Andalas

989

high cost to serve and low cost to serve in processing

loan

The cost of marketing activities can be reduced by

reducing marketing activities in the field by utilizing

technology such as social media.

The cost for BI Checking can be reduced by

utilizing the latest technology managed by Bank

Indonesia, namely SLIK, which requires a shorter

check time.

The results of ABC development at PT. BPR

Cincin Permata Andalas can find out the costs that

should be charged more to customers by increasing

fees and administration fees.

6 CONCLUSIONS

PT. BPR Cincin Permata Andalas has problems with

the cost allocation system, where the cost allocation

system that has been implementedto date has not been

able to provide accurate financial information in

decision making. Costs should be measured precisely

to avoid wrong decisions that can affect the level of

profit on the bank latter.

PT. BPR Cincin Permata Andalas has not

calculated in detail the use of fees for the process of

granting a loan. This research was conducted to

provide a solution to the obstacles faced by PT. BPR

Cincin Permata Andalas by developing the ABC

system to allocate costs to operational expenses

related to the loan process as of it is expected to be

able to produce accurate cost information.

The results of the ABC system development in

calculating overhead costs for loan processing,

provide information on the rate of fees consumed by

each service activity provided to customers..

Compared to the cost calculation carried out by PT.

BPR Cincin Permata Andalas, that the ABC system is

considered capable to provide information on

charging fees to customers so that customers that are

more profitable and unprofitable can be identified.

The results of the development of ABC can be

used to measure the performance of employees at PT.

BPR Cincin Permata Andalas so the effectiveness and

efficiency in serving loan can be maximized.

REFERENCES

Blocher, Edward, and Paul Juras David Stout. (2012). Cost

Management: A Strategic Emphasis. 6th Edition. New

York: McGraw-Hill Education.

Blocher, Edward J., Stout, David E., & Cokins, Gary.

(2010). Cost management: A strategic emphasis (5

th

ed). Singapore: McGraw-Hill Education

Cooper, R., dan Robert S. Kaplan. (1999). Edisi 2. The

Design of Cost Management Systems. New Jersey:

Prentince-Hall, Inc.

Hansen, Don R., and Mowen, Maryanne M. (2015)

Cornerstones of Cost Management Third Edition.

South-Western: Cengange Learning

Horngren, C. T., Datar., S. M., & Rajan., a. M. (2012). Cost

Accounting: A Managerial Emphasis. Essex: Education

Limited.

Horngren, Charles T, Srikant M Datar, and Madhav V

Rajan. (2015). Cost Accounting : A Managerial

Emphasis. Boston: Pearson Hall.

Marvianti, S. (2013). Analisis Penerapan Activity Based

Costing terhadap Customer Profitability pada PT. X.

Moleong, L. J (2015). Metodologi Penelitian Kualitatif.

Cetakan 24. Jakarta. PT. Remaja Perkasa

Stout, David E., dan Joseph M. Propri. (2011)

“Implementing Time-driven Activity-based Costing at

a Medium-sized Electronics Company”, Management

Accounting Quarterly, Spring, Vol. 12 No. 3.

Raaij, E. M. (2005). “The Strategic Value of Customer

Profitability Analysis”. Marketing Intelligence

Planning, Vol. 23 Iss 4 , 372-381

Undang-Undang No. 10 Tahun 1998 tentang Perbankan

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

990