Effect of EPS, ROE, PER, DPR, and Interest Rate on Stock Prices in the

Jakarta Islamic Index Group from 2014 to 2017

Budiyono

1

and Suryo Budi Santoso

1

1

Magister Management, Universitas Muhammadiyah Purwokerto, Central Java, Indonesia

Keywords: Earning per Share, Return on Equity, Price Earning Ratio, Dividend Payout Ratio, Interest Rate, Stock

Prices

Abstract: The research objective was to analyze the effect of earning per share (EPS), return on equity (ROE), and

price earning ratio (PER), dividend payout ratio (DPR), interest rate on stock prices.

Sampling using purposive sampling method, with the criteria of 10 issuers that have the highest stock

capitalization value in the Jakarta Islamic Index (JII) during the period 2014-2017. Analysis used multiple

linear regressions. This research data passed the classic assumption test.

The results showed that earning per share and return on equity had a significant effect on stock prices,

whereas, price earning ratio, dividend payout ratio, and interest rate have no effect.

1 INTRODUCTION

Investors choose stocks that require historical data

on stock price movements on stock exchanges on an

individual, group, or combination basis. Given that

stock investment transactions occur in every share

with a variety of very complex and different

problems, stock price movements require specific

information. Information that is simple and can

represent a certain condition will realize the problem

map. This is symbolized by numbers or certain

terms. Based on this problem map, investors can

predict the situation that will occur in the future. The

historical mapping system contains a number of

facts and certain quantities that describe changes in

stock prices in the past. The form of historical

information that is considered very appropriate to

describe the movement of stock prices in the past is

a stock price index. The stock price index provides a

description of stock prices at a certain time or a

certain period. The stock price index is a record of

changes and movements in stock prices since the

first time they circulated until a certain time

(Sunariyah, 2011).

A company can obtain its own capital through 2

ways to hold part of its profits and issue new

common shares. If profit is not retained, the profit

will be distributed in the form of dividends.

Investors who receive dividends can use it to buy

shares in other companies. If the profit is retained, it

means that the shareholders reinvest the profits that

are entitled to the company. Therefore shareholders

require that the company must be able to provide a

minimum of the profits that can be obtained by

shareholders on other investment alternatives that

have the same risk as the company's risk (Atmaja,

2003).

2 THEORICAL FRAMEWORK

According to (Husnan, 2005), shares are proof of

company ownership in the form of Limited Liability

Company (LLC). The owner of a company's stock is

referred to as a shareholder and can be said to be the

owner of the company. The responsibility of the

owner of the company in the form of LLC is limited

to the capital deposited. In conducting business

activities including investments in shares, investors

will certainly be faced with potential benefits and

risks. According to (Darmadji and Fakhrudin, 2006),

the benefits of buying shares are as follows:

1. Get Dividends

Budiyono, . and Santoso, S.

Effect of EPS, ROE, PER, DPR, and Interest Rate on Stock Prices in the Jakarta Islamic Index Group from 2014 to 2017.

DOI: 10.5220/0009498812291235

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1229-1235

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1229

Dividends are the distribution of profits given

by the issuing company for the profits generated

by the company. Dividends are given after

obtaining approval from shareholders in the

General Meeting of Shareholders (GMS).

Investors who are entitled to receive dividends

are investors who hold shares up to the time limit

determined by the company at the time of

dividend announcement. Generally dividends are

one of the attractions for shareholders with a

long-term orientation, for example institutional

investors, pension funds, and others. The

dividends distributed by the company can be in

the form of cash dividends and stock dividends.

Cash dividends are given to each shareholder in

the form of cash in certain rupiah amounts for

each share, while share dividends are given to

each shareholder in the form of shares so that the

number of shares held by an investor will

increase with the share dividend distribution.

2. Capital Gain

Capital Gain is the difference between the

purchase price and the selling price. Capital gain

is formed by the trading activity of shares in the

secondary market. Generally, investors with

short-term orientation pursue profits through

capital gains. The investor can buy shares in the

morning, then sell them again in the afternoon if

the stock increases.

Besides these two advantages, it is also

possible for shareholders to get bonus shares (if

any). Bonus shares are shares that are distributed

to shareholders taken from premium shares. The

stock premium is the difference between the

selling price and the nominal price at the time the

company makes a public offering on the primary

market.

In addition to getting profits, buying shares can also

risk as follows:

1. Not Receiving Dividend

The company will distribute dividends if its

operations make a profit. Therefore, companies

cannot distribute dividends if they suffer losses.

In other words, the potential profit of investors to

get dividends is determined by the performance

of the company.

2. Capital Loss

In stock trading activities, investors do not

always get capital gains or profits on the shares

they sell. There are times when investors must

sell shares at a price lower than the purchase

price. Thus, an investor experiences capital loss.

In buying and selling shares, sometimes to avoid

the potential for greater losses as the stock price

continues to decline, an investor is willing to sell

his shares at a low price. This term is known as

cut loss.

3. The company went bankrupt or liquidated

If a company goes bankrupt, of course it has

a direct impact on the company's shares. In

accordance with the rules for listing shares on the

Stock Exchange, if a company goes bankrupt or

liquidated, the shares of the company will

automatically be issued from foam or delisted. In

the condition that the company is liquidated, the

shareholders will be in a lower position than the

creditors or bondholders. This means that after

all the company's assets are sold, the proceeds of

the sale are first distributed to the creditors or

bondholders, and if there are still leftovers, then

distributed to the shareholders.

4. Shares are issued from the Exchange (delisting).

Another risk faced by investors is if the

company's shares are excluded from the listing of

the Stock Exchange or delisted. The company's

shares are delisted from the stock exchange

generally due to poor performance, for example

in a certain period of time they have never been

traded, suffered several years of losses, did not

distribute consecutive dividends for several

years, and various other conditions in accordance

with the Securities Listing Regulations at the

Exchange. Delisted shares are of course not

traded again on the exchange. Even though these

stocks can still be traded outside the stock

exchange, there is no clear price benchmark and

if sold usually at a price much lower than the

previous price.

5. The stock is suspended.

A stock suspended or terminated by the

Securities Exchange Authority causes investors

to be unable to sell their shares until the

suspension is revoked. The suspension usually

takes place in a short time, for example a trading

session, two trading sessions, but can also take

place within a period of several trading days.

This is done by the exchange authority if a share

experiences a tremendous surge in prices, a

company is bankrupt by its creditors, or various

other conditions that require the Exchange

Authority to temporarily stop trading the shares.

The trading of these shares will be resumed until

the relevant company provides confirmation or

other information clarity. Abnormal stock price

movements (caused by unclear information) are

not speculations for investors.

The stock price is very important to know in

advance by investors before deciding on a stock

investment. According to (Darmadji and Fakhrudin,

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1230

2006), stock prices are formed because of the

demand and supply of shares. Then, the demand and

supply occur because of many factors, both specific

to the stock and macro nature such as the state of

the economy, social and political conditions, and

information that develops. In other words, the stock

price is the buying and selling price that is being

applied in the securities market which is determined

by market forces, in the sense that it depends on the

strength of demand and supply.

Investors also need to know some ratio analysis

related to company performance. Ratio analysis can

have an impact on the fluctuation of stock prices,

such as Earning Per Share (EPS), Return on Equity

(ROE), Price Earning Ratio (PER), and Dividend

Payout Ratio (DPR). The four ratios are internal

factors that can affect the fluctuation of stock prices.

Earning PerShare (EPS) or income per share is a

form of profit given to shareholders of each share

owned. EPS is obtained from a comparison between

net income after tax and the number of ordinary

shares outstanding. Furthermore, Return on Equity

(ROE) is a ratio that examines the extent to which a

company uses its resources to be able to provide a

return on equity. ROE is obtained from the

comparison between net income after tax and equity.

Whereas, Price Earning Ratio (PER) is a comparison

between market price pershare and earnings per cent

(Fahmi, 2014). According to (Darmadji and

Fakhrudin, 2006) Dividend Payout Ratio (DPR) is a

ratio that measures the ratio of dividends to company

profits. This ratio is used to measure dividend policy

with the Dividend per Share formula : Earning per

Share x 100%. Dividend policy is a decision taken

by a company regarding the distribution of the

company's net profit or the distribution of company

property to shareholders in the form of dividends or

holding in the form of retained earnings

.

According to (Sunariyah, 2011), the interest rate

is the price of a loan. Companies that borrow funds

are charged interest as a price for the source of funds

used. The interest rate is expressed as a percentage

of principal per unit of time. Interest is a measure of

the price of resources used by the debtor that is paid

to creditors. Time units are usually expressed in

units of year (one investment year) or can be shorter

than one year.

The Indonesian capital market was developed

into two major groups of shares. First, conventional

stock groups, while others are sharia stock groups.

Islamic stocks are grouped into one index called the

Indonesian Syariah Stock Index (ISSI). According to

(Sunariyah, 2011), in order to develop the Islamic

Stock Market of the Jakarta Stock Exchange (JSX)

together with PT Danareksa Investment

Management (DMI) has launched a stock index

made based on Islamic sharia namely the Jakarta

Islamic Index (JII). According to (Hartono, 2009),

JII uses a basis dated January 1995 with an initial

value of 100. JII is updated every 6 months, namely

at the beginning of January and July. JII is an index

containing 30 company shares that meet investment

criteria based on Islamic law, with the following

procedure:

1. The selected shares must have been recorded for

at least the last 3 months, except for shares

included in 10 large capitalization.

2. Having a debt to asset ratio should not exceed

90% in annual or mid-year financial statements,

3. From the number 1 and 2 criteria, 60 stocks were

chosen with the largest order of market

capitalization in the last 1 year.

4. Then 30 stocks are selected in the order of the

level of average liquidity in the value of regular

trading over the past year.

3 RESEARCH METHOD

1. Population and sample

According to (Suliyanto, 2009), the population is

the whole object whose characteristics we want

to test. The sample is part of the population

whose characteristics we want to test. The

population used in this study is as many as 30

companies whose shares have been included in

the Jakarta Islamic Index for the 2014-2017

period. In a study two methods can be used in

determining the sample data, namely probability

sampling or non-probability sampling. On

probability sampling, randomly selected data

means that each prospective sample data has the

same opportunity or probability to be selected as

data or samples of a study. Whereas in non-

probability sampling the data used as samples

must meet specific criteria in their selection.

The sampling technique in the Non-

probability sample is purposive sampling which

is based on certain criteria for specific purposes.

The criteria that form the basis of sample

selection are:

a. Companies listed in the Jakarta Islamic

Index on the Indonesia Stock Exchange,

b. Shares traded during the 2014-2017

observation period for the most active

companies.

c. Data needed is available on the website

www.idx.co.id.

Effect of EPS, ROE, PER, DPR, and Interest Rate on Stock Prices in the Jakarta Islamic Index Group from 2014 to 2017

1231

Based on the criteria specified above, a

sample of 17 companies was obtained for the

2014-2017 observation period, then 10 (ten)

large capitalized companies were taken.

2. The Data Analysis Method

a. Regression Analysis

This study uses a multiple regression analysis

method. The regression equation used in this

study is:

Y = α +

β

1

x

1

+

β

2

x

2

+

β

3

x

3

+ β

4

x

4

+

β

5

x

5

+ ε

Remaks:

Y = Stock Price

α

= intercept/constanta

β

1,

β

2,

β

3,

β

4,

β

5

= partial regression

coefficients of the dependent variable

x

1

= Earning per Share (EPS)

x

2

= Return On Equity (ROE)

x

3

= Price Earning Ratio (PER)

x

4

= Dividend Payout Ratio

x

5

= Interst Rate

ε = error for the i-observation

b. Classic assumption test

According to (Ghozali, 2013), before

estimating the regression coefficient value, it

is necessary to test the classic assumptions as

follows:

1) Normality test, aims to test whether in the

regression model of the confounding or

residual variables have a normal

distribution.

2) Multicollinearity test, aims to test

whether in the regression model used

there is a correlation between independent

variables.

3) Heteroscedasticity test, aims to test

whether in the regression model variance

from residual inequality occurs one

observation to another observation.

4) Autocorrelation test, aims to test whether

in the linear regression model there is a

correlation between the confounding

errors in period t with the interfering error

in period t-1 (before).

c. Goodness of Fit

1) Coefficient of Determination

This test aims to measure how far the

model's ability to explain the variation of

the dependent variable. The small value

of R

2

means that the ability of

independent variables to explain the

dependent variable is very limited.

Conversely, if the value of R

2

is close to

one, it means that the independent

variables provide almost all the

information needed to predict the

dependent variable.

2) Simultaneous Significance Test (F Test)

The F statistical test basically shows

whether all the independent or free

variables included in the model have a

joint effect on the dependent variable.

H0: b1 = b2 = ... = bk = 0, meaning

whether all independent variables are not

significant explanations of the dependent

variable.

HA: b1 ≠ b2 ≠ ... ≠ bk ≠ 0, meaning that

all independent variables simultaneously

are significant explanations of the

dependent variable.

d. Significant Individual Parameter Test (t Test)

The t statistical test basically shows how far

the influence of one independent variable /

explanatory individually in explaining the

variation of the dependent variable.

H0: bi = 0, meaning whether an independent

variable is not a significant explanation of the

dependent variable.

HA: bi ≠ 0, meaning that the variable is a

significant explanation of the dependent

variable.

4 ANALYSIS AND RESULTS

In linear regression analysis there are several

assumptions that must be fulfilled so that the

resulting regression equation will be valid if used to

predict (Santoso and Ashari, 2005). Based on the

results of the classic assumption test, the following

results are obtained:

1. One-Sample Kolmogorov-Smirnov Test

Normality Test obtained the Sig. (2-tailed) of

0.704 > 0.05. This means that standardized

residual values are declared to spread normally.

2. The results of the calculation of Tolerance value

indicate that there is no independent variable

that has a Tolerance value of less than 0.10 and

the value of Variance Inflation Factor (VIF) has

a VIF value of more than 10. So it can be

concluded that there is no multicollinearity

between independent variables in the regression

model.

3. Based on the Heteroscedasticity test with the

Glejser method it is known that the regression

model does not occur symptoms of

heteroscedasticity. This is because of the Sig.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1232

independent variables on residual absolute

> 0.05.

4. Outocorrelation test results using the Durbin

Watson method, obtained a DW value of 1.985.

Because the DW value is 1985 located between

dU and 4-dU, it can be concluded that the

regression equation model does not contain

autocorrelation problems.

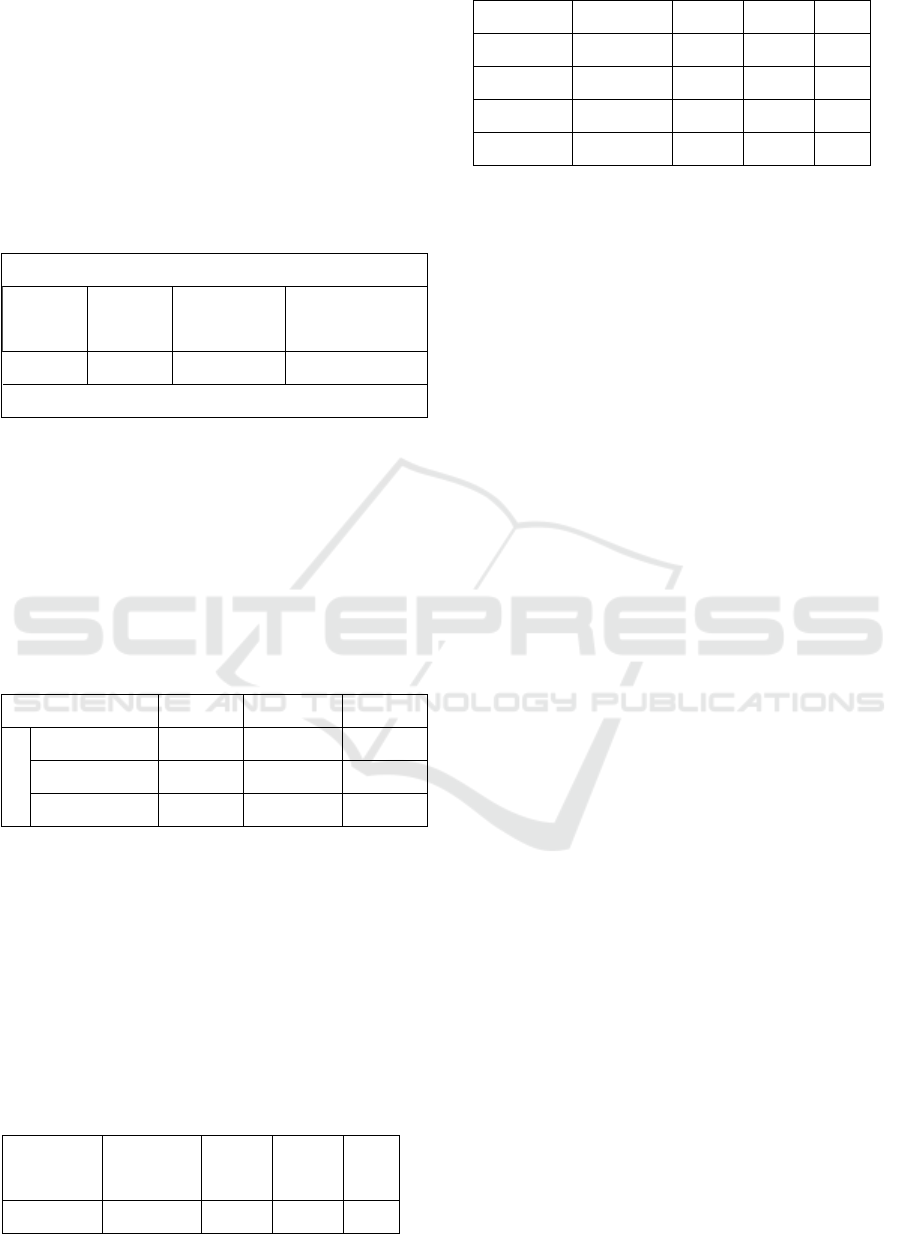

Table 1: Determination Coefficient Hypothesis Test

Results

Model Summary

R

R

Square

Adjusted

R Square

Std. Error

of the Estimate

.914

a

.836

.811

43.38695

Predictors: (Constant), interest rates, price earnings

ratio, earn per share, dividend payout ratio, and

return on equity

Based on Table 1 we see the Adjusted R-Squere

value is 0.81. This means that 81% of the stock price

variable can be explained by variations in the five

independent variables, namely EPS, ROE, PER,

DPR, and interest rates. While the remaining 17% is

explained by other reasons outside the model.

Table 2: F Test Results

a. Dependent Variable: stock price

b Predictors: (Constant), interest rates, price

earnings ratio, earnings per share, dividend payout

ratio, and return on equity

Based on the ANOVA test results in Table 2, the

calculated F value is 34,574 with a significance

value of < 0.05, then the regression model can be

used to predict that EPS, ROE, PER, DPR and

interest rates together influence stock prices.

Table 3: The Results of t Test

Coefficients

a

Model

Unstand

Coef

Stand

Coef

t

Sig.

(Constant)

759.302

16.388

.000

EPS

.002

.683

8.218

.000

ROE

.011

.383

2.987

.005

PER

-.012

-.154

-1.518

.138

DPR

.006

.133

1.433

.161

Tk.Bunga

.502

.009

.127

.899

a. Dependent Variable: harga saham

In Table 3, it can be seen that of the five

independent variables, the EPS and ROE variables

show a sig value of < 0.05, it can be concluded that

EPS and ROE variables have a significant effect on

stock prices. While the PER, DPR, and Interest Rate

variables are > 0.05, it can be concluded that the

effect of the PER, DPR, and Interest Rate variables

on the Stock Price is not significant. Based on the

table above the multiple linear regression equation is

made as follows Y= 759,302 + 0,002X

1

+ 0,011X

2

-0,012X

3

+ 0,006X

4

+ 0,502X

5

+ ε

5 DISCUSSION

1. Effect of Earning per Share (EPS) on Stock

Prices

Referring to table 3, the sig value 0,000

< 0,05 is obtained, then HA is accepted and H0

is rejected. EPS variables have t test 8.218 and

t table 2.032. Because t test > t table can be

concluded that the EPS variable has a positive

and significant effect on stock prices. EPS has a

regression coefficient of 0.683 which means that

every increase in EPS in one unit, then the stock

price rises by 0.683 assuming that the other

independent variables are constant. This result is

in accordance with the research of

(Bratamanggala, 2018), (Wijayanti and

Sulasmiyati, 2018), (Aletheari and Jati, 2016)

that EPS has a significant positive effect on

stock prices.

2. Effect of Return on Equity (ROE) on Stock

Prices

Based on table 3, obtained a value of 0.005

< 0.05, then HA is accepted and H0 is rejected.

ROE variables have t test 2.987 and t table

2.032. So t test > t table can be concluded that

the ROE variable has an influence on stock

prices. So it can be concluded that ROE has a

positive and significant effect on stock prices.

ROE has a regression coefficient of 0.383,

which means that every increase in ROE in one

unit, the stock price rises by 0.383 assuming that

the other independent variables are constant.

Model

Df

F

Sig.

1

Regression

5

34.574

.000

b

Residual

34

Total

39

Effect of EPS, ROE, PER, DPR, and Interest Rate on Stock Prices in the Jakarta Islamic Index Group from 2014 to 2017

1233

These results are consistent with the research of

(Kamar, 2017), (Halim and Basridan Faisal,

2016), and (Susilowati, 2015), that ROE has a

significant positive effect on stock prices.

3. Effect of Price Earning Ratio (PER) on Stock

Prices

If seen in table 3, the sig value is 0.138 >

0.05, then HA is rejected and H0 is accepted.

PER variable has t test -1.518 and t table 2.032.

So t test < t table can be concluded that the

variable PER has no effect on stock prices. So it

can be concluded that PER does not have a

significant effect on stock prices. PER has a

regression coefficient value of -0.154. This

means that every increase in PER per unit, the

stock price decreases by 0.154 assuming that the

other independent variables are constant. This

result is different from the research of (Astuty,

2017), (Suselo et al., 2014), (Ervinta, 2013)

which states that PER has a positive and

significant effect on stock prices.

4. Effect of Dividend Payout Ratio (DPR) on Stock

Prices

Based on table 3, the sig value is 0.161 >

0.05, then HA is rejected and H0 is accepted.

The DPR variable has a t test of 1.433 and t table

of 2.032. So t test < t table can be concluded that

the DPR variable has no effect on stock prices.

PER has a regression coefficient of 0.133, which

means that every increase in DPR is one unit,

then the stock price rises by 0.133 assuming that

the other independent variables are constant.

This result is different from the research of

(Jahfer and Mulafara, 2016), (Wijaya R.Z.,

2017.) which states that the DPR has a positive

but not significant effect on stock prices.

5. Effect of the Effect of Interest Rates on Stock

Prices

In the coeficients column in table 3, there is a

sig value of 0.899 > 0.05, then HA is rejected

and H0 is accepted. The Interest Rate variable

has a t test of 0.127 and t table of 2.032. So t test

< t table can be concluded that the interest rate

variable has no effect on stock prices. So it can

be concluded that the interest rate does not have

a significant effect on stock prices. The interest

rate has a regression coefficient of 0.009, which

means that every increase in one unit of interest

rates, the stock price rises by 0.009 assuming

that the other independent variables are

constants. This result is different from (Satoto

and Budiwati, 2013) research which states that

the BI rate has a positive effect on stock prices.

While the results of his research by (Kristanti

and Lathifah, 2013), state that the BI rate has a

negative effect on stock prices.

6 CONCLUSIONS

Based on the results of testing using multiple linear

regression analysis with a sample of 10 companies

listed in the Jakarta Islamic Index in the period

2014-2017, it can be concluded:

1. Variables Earning Per Share has a positive and

significant effect on stock prices in 10

companies listed in the Jakarta Islamic Index

with the largest capitalization value in the 2014-

2017 period.

2. Variable Return on Equity has a positive and

significant effect on stock prices in 10

companies listed in the Jakarta Islamic Index

with the largest capitalization value in the 2014-

2017 period.

3. Price Earning Ratio variable has a negative but

not significant effect on stock prices in 10

companies listed in the Jakarta Islamic Index

with the largest capitalization value in the 2014-

2017 period.

4. Variables Dividend Payout Ratio has a positive

and insignificant effect on stock prices in 10

companies listed in the Jakarta Islamic Index

with the largest capitalization value in the 2014-

2017 period.

5. Variable Interest Rates have a not significant

positive effect on stock prices in 10 companies

listed in the Jakarta Islamic Index with the

largest capitalization value in the 2014-2017

period.

REFERENCES

Aletheari, I.A.M., Jati, I.K., (2016). Pengaruh

Earning Per Share, Price Earning Ratio, Dan

Book Value Per Share Pada Harga Saham. E-

Jurnal Akuntansi Universitas Udayana, 17(2),

pp. 1254-1282.

Astuty, P., (2017). The Influence of Fundamental

Factors and Systematic Risk to Stock Prices on

Companies Listed in the Indonesian Stock

Exchange, Europan Research Studies Journal,

XX(4A), pp. 230-240

Atmaja, L.S., (2003). Manajemen Keuangan Edisi

Revisi Dilengkapi Soal-Jawab, Yogyakarta,

Andi.

Bratamanggala, R., (2018). The Factors Affecting

Board Stock Price of Lq45 Stock Exchange

2012-2016: Case of Indonesia, European

Research Studies Journal, XXI(1), pp. 115-124

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1234

Darmadji, Hendy, M.F., (2006). Pasar Modal

Indonesia Pendekatan Tanya Jawab, Jakarta,

Salemba Empat.

Ervinta, T.V., (2013). Analisis Pengaruh Faktor

Fundamental Dan Eva Terhadap Harga Saham

Indeks Lq45 Yang Terdaftar Di Bursa Efek

Indonesia Periode 2007-2011, Bina Ekonomi

Majalah Ilmiah FE Unpar, 17(1), pp. 67-87

Fahmi, Irham, (2014). Manajemen Keuangan

Perusahaan dan Pasar Modal, Jakarta, Mitra

Wacana Media.

Ghozali, I., (2013). Aplikasi Analisis Multivariate

Dengan Program IBM SPSS 21 Update PLS

Regresi Edisi 7, Semarang, Badan Penerbit

UNDIP.

Halim, A., BasridanFaisal, H., (2016). Pengaruh

Intellectual Capital Terhadap Profitabilitas Dan

Dampaknya Terhadap Harga Saham

Perusahaan Sektor Keuangan Yang Terdaftar

Di Bursa Efek Indonesia (BEI), Jurnal Bisnis

dan Ekonomi, 23(2), pp. 124-141

Hartono, J., (2009). Teori Portofolio dan Analisis

Investasi. Edisi Keenam, Yogyakarta, BPFE.

Husnan, S., (2005). Dasar-Dasar Teori Porfofolio,

Yogyakarta, AMP YKPN.

Jahfer, A., Mulafara, A.H., (2016). Dividend policy

and share price volatility: evidence from

Colombo stock market. Int. J. Manag. Financ.

Account. 8(2), pp. 97-108.

https://doi.org/10.1504/IJMFA.2016.077947

Kamar, K., (2017). Analysis of the Effect of Return

on Equity (Roe) and Debt to Equity Ratio (Der)

On Stock Price on Cement Industry Listed In

Indonesia Stock Exchange (Idx) In the Year of

2011-2015. IOSR J. Bus. Manag. 19(5), pp.

66–76. https://doi.org/10.9790/487X-

1905036676

Kristanti, F.T., Lathifah, N.T., (2013). Pengujian

Variabel Makro Ekonomi Terhadap Jakarta

Islamic Index, Jurnal Keuangan dan

Perbankan, 17(1), pp. 220-229

Harga Saham LQ45, Jurnal Keuangan dan

Perbankan, 17(2), pp. 211-219

Santoso, P.B., Ashari, (2005). Analisis Statistik

dengan Microsoft Excel dan SPSS, Yogyakarta,

Andi.

Satoto, S.H., Budiwati, S., (2013). Pergerakan Harga

Saham Akibat Perubahan Nilai Tukar, Inflasi,

Tingkat Bunga, Dan Gross Domestic Product,

Jurnal Keuangan dan Perbankan, 17(3),

pp. 407-416

Suliyanto, (2011). Ekonometrika Terapan: Teori dan

Aplikasi dengan SPSS, Yogyakarta, Andi.

Sunariyah, (2011). Pengantar Pengetahuan Pasar

Modal, Yogyakarta, STIM YKPN.

Suselo, D., Djazuli, A., Indrawati, N.K., (2015).

Pengaruh Variabel Fundamental dan Makro

Ekonomi terhadap Harga Saham (Studi pada

Perusahaan yang Masuk dalam Indeks LQ45),

Jurnal Aplikasi Manajemen, 13(1), pp. 104-116

Susilowati, E.M., (2015). The Effect Of Return On

Asset, Return On Equity, Net Profit Margin,

And Earning Per Share On Stock Price,

Eksplorasi XVIII(1), pp. 181-195.

Wijaya, R.Z., (2017). Kinerja Keuangan dan Ukuran

Perusahaan terhadap Harga Saham dengan

Kebijakan Dividen sebagai Variabel

Intervening, Journal Keuangan dan

Perbankan, 21(3), pp. 459-472

Wijayanti, K.D.D., Sulasmiyati, S., (2018).

Pengaruh Faktor Internal dan Eksternal

Perusahaan Terhadap Harga Saham (Studi pada

Perusahaan Sektor Pertambangan yang

Terdaftar di Daftar Efek Syariah Periode 2013-

2016), Jurnal Administrasi Bisnis (JAB), 55(2)

pp. 8-14

Effect of EPS, ROE, PER, DPR, and Interest Rate on Stock Prices in the Jakarta Islamic Index Group from 2014 to 2017

1235