The Intention to Pay on Cash Waqf based on Religiosity and Gender

Perspectives: An Empirical Studies

Alvien Nur Amalia

1

, Puspita

1

and Anna Sardiana

1

1

Islamic Finance and Banking Department, STIE Indonesia Banking School, Jakarta -Indonesia

Keywords: Intention to Pay, Religiosity, Gender, Cash Waqf

Abstract: Cash waqf is one of a solution to social problems in Indonesia. However, the potential for collecting cash

waqf is not the same as the realization. The low of intention to pay from the community towards cash waqf

was indicated to be one of the causes. This intention was related to the community religiosity. On the other

hand, history told about the role of women in the development of cash waqf was large and important. The

purpose of this research was to analyze how much the community intention to pay on cash waqf based on

religiosity and gender perspectives. Primary data were collected from 146 respondents. The dependent

variable in this research was the intention to pay. While the independent variables were religiosity and gender.

Data were analyzed using logistic regression analysis. The results showed that gender variable did not affect

the intention to pay on cash waqf. Meanwhile, the religiosity variable had a positive effect on the intention to

pay. Based on this independent variable, respondents had opportunities about more than 50 percent in case of

the intention to pay on cash waqf.

1 INTRODUCTION

The Indonesian economy in recent years shows stable

growth, which is in the range of 5-6 percent

(www.bappenas.go.id). Even though the poverty rate

in Indonesia continues to decrease every year, in

March 2018, the number of poverty was 25.95 million

people or 9.82 percent, which had decreased by 633.2

thousand people compared to those recorded in

September 2018 which reached 26.58 million people

or 10.12 percent (www.bps.go.id). However,

Indonesia is one of the poorest countries in the world,

its rank is 88th according to the World Bank (Anita,

2018). Poverty is one of the social problems and

becomes a common enemy for all countries,

including Indonesia. Poverty made a gap between the

rich and the poor people wider. Demands for

prosperity in economic equality urgently needed in

Indonesia. In fact, Indonesia has potential solutions to

overcome these problems by using endowment

money or cash waqf instruments (Medias, 2009).

As one of the largest Muslim country in the world,

Indonesia has the potential to be the largest collector

and developer in developing the endowment money

or cash waqf compared to other Muslim countries (M.

N. R. Al Arif, 2012). Endowment money is so much

easier and flexible since most the people are able to

contribute by using cash as long as they have money

(Osman, Mohammed, & Amin, n.d.). Endowment

money or cash waqf as a financial instrument is

classified as a new product in the history of Islamic

banking pioneered by Muhammad Abdul Mannan in

Bangladesh. Utilization of cash waqf can be divided

into two, namely the procurement of private and

social goods. Therefore, cash waqf is considered to

open up unique opportunities for the creation of

investments in the fields of religion, education, and

social services (Dahlan, 2017).

In some developing countries such as Egypt,

Jordan, Saudi Arabia, Bangladesh, and more

countries have made cash waqf as one of their

economics pillars (Fauza, 2015). The potential of

Indonesian in using cash waqf if managed routinely,

trustworthy, professionally and committed are able to

save Indonesia from foreign debt. Most of the

development in Indonesia financed by the debt. The

management of cash waqf can minimize debt to

multilateral institutions. This is because cash waqf

has been able to complement state revenues besides

taxes, zakat and other incomes (Kusumawardani,

2015).

Amalia, A., Puspita, . and Sardiana, A.

The Intention to Pay on Cash Waqf based on Religiosity and Gender Perspectives: An Empirical Studies.

DOI: 10.5220/0009497313111316

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1311-1316

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1311

There is an anomaly in Indonesia, whereas the

amount of collecting of fund from cash waqf program

is lower than its potential. Although, the

empowerment of cash waqf in Indonesia has been

formally formalized by very progressive legislation in

regulating fiqh law, namely Law No.41 of 2004

concerning waqf and Government Regulation No.42

of 2006 concerning implementation guidelines (O. S.

Arif, 2010). And legally, there are some of official

waqf institutions in Indonesia, namely Islamic

Financial Institutions (LKS) which have been pointed

by the Minister of Religion of the Republic of

Indonesia. Every of cash waqf that given by someone

can be proven by giving a certificate by the legal

institution (M. N. R. Al Arif, 2012).

Meanwhile, the cash waqf collection in Indonesia

is still not optimal yet, even though the distribution of

cash waqf has been implemented. It is caused by the

community intention of waqf so could not empower

yet. The low accumulation of cash waqf funds

illustrates that people's intention or desire to pay cash

waqf is still low. From the data of the Indonesian

Waqf Agency (Badan Wakaf Indonesia/BWI) in

2017, the amount of cash waqf that succeeded to be

collected was around 199 billion rupiahs. In which, it

was very far from what BWI's predicted, which states

that the potential of cash waqf in Indonesia able to

reach 120 trillion rupiahs. This amount of money

shows that public intention in making cash waqf was

and still very low (Nuraini, Takidah, & Fauzi, 2018).

On the other hand, there was a lack of

understanding of cash waqf in Indonesia. This is can

be seen from the trend of most of Indonesia people

know about waqf only as limited to immovable

property (Medias, 2009). In most cases, waqf in

Indonesia is used for worship purposes such as the

construction of mosques, prayer rooms, Islamic

boarding schools, cemeteries, orphanages and so on.

So that this does not have a significant impact on

Indonesia's economic growth (Putri, 2015).

Therefore, people's understanding of cash waqf must

be improved and socialized. To overcome this

problem, BWI has various programs to socialize cash

waqf to the community, such as BWI goes to campus

and BWI goes to community or other society

(Haliding, 2018).

Basically, in the implementation of productive

waqf can be divided into two dimensions, namely the

economic dimension as described previously and the

religious dimension. Where religious dimensions

have the meaning that, waqf carried out by a Muslim

is a God’s command that needs to be done by every

Muslim. This is a form of obedience of a Muslim to

his God. So that from the waqf activity will get a

reward from Allah SWT for carrying out and obeying

His commands. This dimension of religion, shows a

vertical relationship between mankind and its creator

commonly known as hablun-minannas (Kurniawan,

n.d.). Waqf is valued not only as ordinary charity, but

a religious activity that can provide greater rewards

for benefits, especially for beneficiaries. Because the

rewards of endowments continue to flow as long as

the assets represented can still be used continuously.

Waqf management can be managed by male or

female. In addition, the role of Muslim women is

considered to have more high potential in developed

and empowered waqf, especially cash waqf.

Throughout Islamic history, women have a large

contribution in the field of waqf (Ak, 2017). Recorded

in Islamic history in the Mamluk era, 30 percent of

the waqf administrators or Nazir were women. Based

on the population growth projection of the National

Development Planning Agency (BPPN), the Central

Statistics Agency (BPS), and the United Nations

Population Fund noted that in 2018 Indonesia's

population reached 265 million, in which 131.88

million of those numbers were women. So, women

have a huge potential in doing waqf.

Based on the previous explanation, the research

related to the intention to pay on cash waqf in

Indonesia and what factors influence it is very

attractive for research. So, it is expected from this

research can show the main factors that can influence

the interest of the Indonesian people in making cash

waqf. It is intended that the cash waqf in Indonesia

can be maximally realized, realizing the huge

potential of cash waqf in Indonesia.

2 THEORETICAL FRAMEWORK

In general, in terminology shara’ waqf is a type of gift

which is carried out by holding (ownership) of origin

(tahbis al asli), then making the benefits for the

public. What is meant by the tahbis al asli, is holding

things that have been waqf so that they are not

inherited, sold, donated, mortgaged, rented or the like

(M. N. R. Al Arif, 2012). In addition, other meanings

of waqf are as one of the Islamic policies in the form

of property that is given benefits to others. The Qur'an

said waqf as al-habs, interpreted as personal property

given for the public interest. The essence of waqf is a

form of permanent goods in Islamic teachings as

Amal jariyah (continuous) and as one of shadaqah

jariyah (Kencana, 2015).

Whereas according to Law No. 41 of 2004, waqf

is a legal act of wakif to separate and/or give a portion

of his property to be used forever or for a certain

period of time in accordance with his interests for the

purposes of worship and/or general welfare according

to Islamic law. The introduction of cash waqf on May

11, 2002, by the MUI fatwa. In the fatwa explained

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1312

that money is included in property that can be

represented. Not only that, but the definition of

money itself is also expanded not only in cash but also

including securities such as shares.

The level of understanding religion or religiosity

of a Muslim is the extent to which a person

understands and obeys and carries out all religious

orders in social life. While, religion is a teaching that

comes from God and has been contained in the holy

book Al Qur'an which aims as a way of life for

humans in order to achieve happiness in the hereafter

(Sidiq, 2015). Religion is something that is very

universal and has a significant influence on attitudes,

values, and behavior of the people both individually

and in groups in society. Religion has a very

important role in one's life and can shape beliefs,

knowledge, and attitudes. In a previous study by Sidiq

(2015) said that religiosity or level of understanding

can be referred to as a belief in God which is

characterized by religious gain and enthusiasm. So

that it can be concluded that, the stronger one's trust

in God, the higher the level of religious

understanding. One of the manifestations is, by doing

things ordered by religion such as having

representation.

The function of the basic understanding of

religion itself is to provide orientation, motivation,

and help people to know and live something sacred.

Through religious experience, namely the

appreciation of the relationship between humans to

God, humans can have the ability, ability, and

sensitivity to know and understand the divine

existence. Religion itself has constructive, regulative

and formative power in building the order of life of

the people. Basically, the level of understanding

religion or religiosity covers all dimensions of all

dimensions of human life (Ash-shiddiqy, 2017).

In addition, the relationship between intention and

waqf is also important, because intention is a

motivation that encourages someone to encourage

what they want to do if they are free to choose (Sidiq,

2015). Intention in a large dictionary of Indonesian

can be interpreted as a tendency of one's heart to be

high towards a passion or desire. Intention is also said

to be a person's tendency to choose to do activities.

Another understanding of intention is a strong urge to

do something to realize the achievement of goals and

ideas that are desirable, including encouragement for

the community to make cash waqf (Ash-shiddiqy,

2017).

The role of Muslims, both men and women in

realizing the activities of representing money is very

important. Comparison of the number of sexes

between men and women in Indonesia is not too lame,

namely from 265 million of that number, 49.8 percent

or 131.88 million women are of the type. It can be

seen that women's potential in representation is quite

large. In the letter At-Taubah verse 71 which reads as

follows:

This is means:

“The believing men and believing women are allies of one

another. They enjoin what is right and forbid what is wrong

and establish prayer and give zakah and obey Allah and His

Messenger. Those – Allah will have mercy upon them.

Indeed, Allah is Exalted in Might and Wise”

.

From the verse QS At-Taubah it can be seen that

every human being, whether male or female, has the

same rights and obligations in fulfilling the goodness

of zakah, infaq, shadaqah, and waqf (ziswaf). The

role of women as philanthropists or all activities of

generosity in Islam has been carried out since the time

of the Prophet Muhammad. Throughout Islamic

history, women have a large contribution in the

representation. At present, women are considered to

have an important role in taking various household

financial decisions. Based on a survey conducted by

the Financial Services Authority (OJK), said that 51

percent of family financial planning in making

decisions was made by women. This shows that

women have a dominant role in setting philanthropic

budgets in a family both in the form of zakat and waqf

(Ak, 2017).

Previous research conducted by Ash-shiddiqy

(2017), said that the benchmark for understanding

one's religion can be seen from the dimensions of its

religious practices, namely the extent to which a

person performs his religious obligations such as

zakah, infaq, shadaqah and waqf. Where the higher

the level of understanding of someone religion, the

more aware it will be in carrying out religious

teachings as well as arising someone intention in

conducting worship activities such as cash waqf.

From this, it can be seen that there is a relationship

between someone religiosity and the intention to pay

cash waqf

Ho1: Religiosity has no influence on someone's

intention to pay on cash waqf

Ha1: Religiosity has an influence on someone's

intention to pay on cash waqf

In addition, a previous study of the role of a

woman in representing money was also carried out by

Merlyana Fitriana Ak (2017). In his research, it was

The Intention to Pay on Cash Waqf based on Religiosity and Gender Perspectives: An Empirical Studies

1313

stated that the characteristics of female muzzaki in

Medan as philanthropists in Islam were productive

age women 19-50 years old. But having a habit of

saving is not routine, and the factors that influence the

interest of muzzaki women in the city of Medan are

income factors, monthly expenses, and age. As well

as the second factor that affects is the level of

education and saving habits. And the third factor that

can influence is the condition of religious

understanding as well as work factors and marital

status.

Ho1: Gender has no influence on someone's

intention to pay on cash waqf

Ha1: Gender has an influence on someone's

intention to pay on cash waqf

3 RESEARCH METHOD

The method used in this study is a survey by

distributing questionnaires to the research sample.

The selection of samples in this study uses a

purposive sampling method, which is to choose

samples based on groups, regions or groups of

individuals through certain considerations which are

believed to represent all units of analysis that exist in

this study.

The research questionnaire was distributed

randomly to Civil Servants (PNS) and the Republic

of Indonesia Police (POLRI) who are work and

domiciled in Jakarta. In this study also used

regression analysis with the use of logistic models

through the help of the SPSS program.

Based on the description, by following the general

form of logistics modeling, the research model used

in this study is obtained as follows:

L

i

= ln (

=β

0

+β

1_determinants_of cash_waqf

+

In applying the dependent variable; the intention to

pay on cash waqf will be obtained:

A. L

i

= ln (

;if Civil Servants (PNS) and the

Republic of Indonesia Police (POLRI) who are

work and domiciled in Jakarta have the intention

to pay on cash waqf

B. L

i

= ln (

;if Civil Servants (PNS) and the

Republic of Indonesia Police (POLRI) who are

work and domiciled in Jakarta have no intention

to pay on cash waqf

The determinants of cash waqf are proxied by the

level of religiosity and gender, so the model formed

is as follows:

L

i

= ln (

= β

0

+β

1

Religiosity+ β

2

Gender

4 ANALYSIS

In this study, there were 160 respondents filled out the

questionnaire, but there were several questionnaires

that were rejected because they were not in

accordance with the sample criteria determined by the

researcher. In addition, there were also respondents

who sent more than one questionnaire with the same

response. Therefore, as many as 14 questionnaires

were rejected so the total questionnaires used as

samples in this study were only 146 respondents, with

female respondents as many as 76 people and 70 male

respondents.

In research which is using logit regression

analysis, the analysis does not require classical

assumptions testing, like in multiple regression

analysis. The fit model research will be carried out by

looking at the values of several test results as in table

1 as follows:

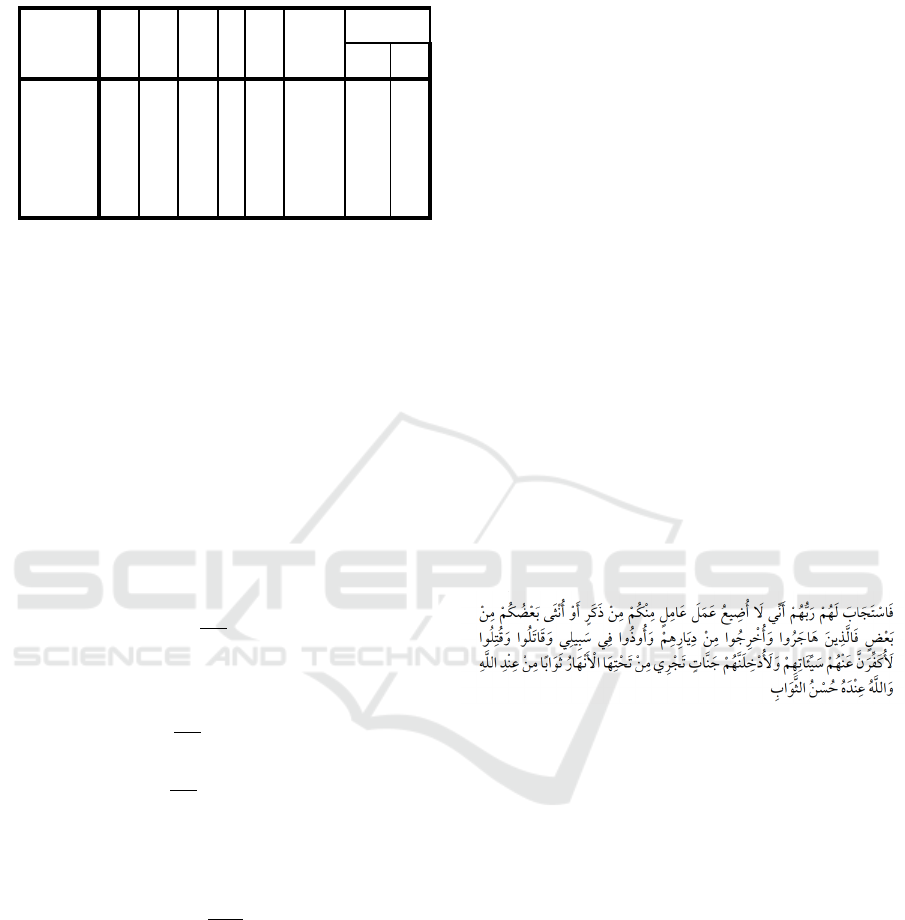

Table 1: Fit Model Tests

Test Types Scores

Nagelkerke R Square 0,256

Hosmer and Lemeshow Test 0,065

Omnibus Tests of Model Coefficients 0,014

Source: Data Primer Diolah (2018)

Based on table 1 it is known that the Nagelkerke

R Square value is 0.256. This indicates that the

intention to pay on cash waqf variable can be

explained by its variables independent; in this study

include gender and religiosity by 25 percent. Then,

the Hosmer and Lemeshow Test value are 0.065

where the value is greater than 0.05 (α = 0.05), means

that the former model can be accepted because it is

appropriate with the observational data. As well as the

value of Omnibus Tests of Model Coefficients of

0.014 where the value is smaller than 0.05 (α = 0.05),

means that the independent variables from this study,

religiosity and gender have an influence on the

dependent variable, the intention to pay on cash waqf

simultaneously

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1314

Table 2: Variable in the Equation

Based on Table 2 above, it can be seen that the

variable gender has no influence on the intention to

pay on cash waqf of the Jakarta people. This is

because the gender variable has a significant value

greater than 0.05, which is 0.990. So that gender

variable is not included in the model that forms

opportunities for intention to pay on cash waqf.

Table 2 also showed, religiosity variable has an

influence on the intention to pay on cash waqf of the

people of Jakarta. This is proven by the religiosity

variable has a significant value smaller than 0.05,

which is 0.002. The models formed from the test

results are as follows:

L

i

= ln (

=0,147

Religiousity+

In which;

(

=e

0,147

(

=1,159

P = 1,159 (1-p)

P = 1,159-1,159p

p+1,159p =1,159

2,159p = 1,159

p=

,

,

p= 0,54

Based on these calculations, it can be seen that the

people of Jakarta who have the intention to pay on

cash waqf because of their religiosity equal to 0.55 or

54 percent in percentage. So, it can be seen that the

opportunity of the people of Jakarta who have no

intention to pay on cash waqf is around 46 percent.

The trend of the Jakarta people to intention to pay on

cash waqf will increase by 1,221 times if there is an

increase in religiosity. So, religiosity is an important

factor that determine Jakarta people to make

decisions for having an intention to pay on cash waqf

or no.

5 RESULTS

Religiosity is the main factor in forming someone's

faith. The more a person understands his/her religion,

the more they will be closer to the teachings of Islam.

So, they will easy to obey their God and do the good

things include cash waqf. This is also mentioned in

previous research by Amalia (2017). In this study, it

was stated that a cash waqf would be easier be done

by people with a high faith condition. For example; in

the month of Ramadhan, when someone would leave

and go home from an Umrah or Hajj, and at

retirement age, people would easily make waqf. A

person in this condition of high faith is called a person

with a theta condition.

In addition, Islam considers the position of men

and women in the same position, both are created by

Allah SWT. Almost all Islamic laws and Shari'a

contained in the Qur'an apply to Adam and Eve in a

balanced manner, as well as in doing charitable

activities. This is as mentioned in Q.S. Al Imran verse

3: 195 as follows:

This is means:

“And their Lord responded to them, "Never will I allow to

be lost the work of [any] worker among you, whether male

or female; you are of one another. So those who emigrated

or were evicted from their homes or were harmed in My

cause or fought or were killed - I will surely remove from

them their misdeeds, and I will surely admit them to gardens

beneath which rivers flow as a reward from Allah, and

Allah has with Him the best reward."

The verse explains that, whether a man or woman

has the same rights and obligations as a servant of

Allah SWT in doing charity, so too is doing cash

waqf.

Therefore, women have equal equality with men

in their intellectual potential. Like men, women also

have the ability to think, learn and practice what they

have learned from meditation and remembrance of

Allah SWT (Wartini, 2013)

q

B S.E. Wald df Sig. Exp(B)

95% C.I.for

EXP(B)

Lower

Uppe

r

Step 1

a

Reli

giosi

t

y

.200 .065 9.337 1 .002 1.221 1.074 1.389

Gen

der(

1)

-.014 1.135 .000 1 .990 .986 .107 9.123

Cons

tant

-

1.901

1.726 1.213 1 .271 .149

a. Variable(s) entered on step 1: Religiosity, Gender.

Sumber : Data Primer Diolah (2018)

The Intention to Pay on Cash Waqf based on Religiosity and Gender Perspectives: An Empirical Studies

1315

6 CONCLUSIONS

Based on the description above the opportunity of the

Jakarta people who have an intention to pay on cash

waqf not influenced by someone's gender, because the

thing that distinguishes from one person to the

another in doing charity is only their faith.

While the opportunity for the Jakarta people who

have an intention to pay on cash waqf influence by

their religiosity held at 0.54 or 54 percent. So that we

can find out the opportunities of people who have no

intention to pay on cash waqf due to a lack of

religiosity is 46 percent.

One of the things that need to be done by

regulators, in Jakarta case, is Wakaf Agency (BWI)

of Jakarta and the Provincial Government (Pemprov)

of Jakarta, should be more active in inviting clerics or

community role models to remind the Jakarta people

about what is allowed and prohibited in Islam. So,

when a person's level of faith increases,

understanding of cash waqf will also be opened so the

intention to pay on cash waqf is increasing too.

In addition, the role of the government, especially

the Jakarta Provincial Government, is also needed to

increase the intention to pay on cash waqf of Jakarta

people, by providing socialization about cash waqf

and how to do it, which can be started from the

smallest community, such as the Neighborhood

Association (rukun tetangga/RT), Citizens

Association (Rukun Warga /RW), Kelurahan,

Kecamatan, Kotamadya and also the province.

Cooperation between institutions can also be

implemented between waqf and educational

institutions by creating waqf curriculum for

Elementary, Junior, and Senior High Schools or

Universities.

REFERENCES

Amalia, A. N. (2017). Analisis Implementasi Bauran

Promosi pada Pengumpulan Dana Wakaf Uang di

Lembaga Wakaf Al Azhar. Laporan Penelitian

Hibah Internal STIE Indonesia Banking School.

Anita. (2018). 100 Negara Termiskin di Dunia Tahun 2018

Versi World Bank dan IMF. Daftar Informasi, p. 1.

Arif, O. S. (2010). Wakaf Tunai Sebagai Alternatif

Mekanisme Redistribusi Keuangan Islam. La_Riba

Jurnal Ekonomi Islam, IV(2003), 85–115.

Ash-shiddiqy, M. (2017). Pengaruh Pendapatan,

Religiusitas, jarak Lokasi, Tingkat Pendidikan dan

Akses Informasi Terhadap Minat Masyarakat Untuk

Berwakaf Uang di Badan Wakaf Uang/Tunai MUI

Daerah Istimewa Yogyakarta.

Dahlan, R. (2017). Faktor-faktor yang mempengaruhi

persepsi nazhir terhadap wakaf uang. Jurnal Zakat

Dan Wakaf, 4(Juni), 1–24.

Fauza, N. (2015). Rekonstruksi pengelolaan wakaf: belajar

pengelolaan wakaf dari bangladesh dan malaysia,

9(Juli), 161–172.

Haliding, S. (2018). Mengoptimalisasi Potensi Wakaf

Produktif. Ekonomi, p. 1.

Kencana, U. (2015). Konsep Hukum Pengelolaan dan

Pengembangnan Wakaf Uang Berbentuk Saham

Dalam Perseroan Terbatas (Pemberdayaan

Coorporate Social Responsibility Perusahaan).

Jurnal Wakaf Dan Ekonomi, 1–16.

Kurniawan, M. (n.d.). Wakaf Produktif dan Pemberdayaan

Ekonomi Umat.

Kusumawardani, L. (2015). Pengelolaan Wakaf Uang

Dalam Bentuk Reksa Dana Syariah (Suatu Tinjauan

Hukum Pengelolaan Wakaf Uang dalam Bentuk

Reksa Dana Syariah di Badan Wakaf Indonesia).

Jurnal Wakaf Dan Ekonomi Islam, 8(Januari), 36–

50.

Medias, F. (2009). Wakaf produktif dalam perspektif

ekonomi islam. La-Riba Jurnal Ekonomi Islam,

IV(Juli), 69–84.

Nuraini, I., Takidah, E., & Fauzi, A. (2018). Faktor-Faktor

Yang Mempengaruhi Intensi Dalam Membayar

Wakaf Uang Pada Pegawai Kantor Wilayah

Kementerian Agama Provinsi Dki Jakarta. Jurnal

Ekonomi Syariah Dan Bisnis, 1(2), 97108.

Osman, A. F., Mohammed, M. O., & Amin, H. (n.d.). An

Analysis Of Cash Waqf Participation Among Young

Intellectuals.

Putri, S. Y. (2015). Analisis Permasalahan Pemanfaatan

Sukuk Waqf-Based Untuk Mendorong Wakaf

Produktif di Indonesia ; Pendekatan Analytic

Network Process (ANP). Jurnal Wakaf Dan

Ekonomi Islam, 8(Januari), 17–35.

Sidiq, H. A. (2015). Pengaruh Pengetahuan Zakat, Tingkat

pendapatan, Religiulitas, dan Kepercayaan Kepada

Organisasi Pengelola Zakat Terhadap Minat

Membayar Zakat Pada Lembaga Amil Zakat : (Studi

Kasus Terhadap Muzakki di Fakultas Agama Islam

dan Fakultas Ekonomi dan Bisnis U.

Wartini, A. (2013). Tafsir Feminis M . Quraish Shihab :

Telaah Ayat-Ayat Gender dalam Tafsir Al-Misbah.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1316