Financial Management among Pre-aqil Baligh Student: An

Integrated Strategy in Entrepreneurial Education with Fitrah-based

Approach

Andryas Dewi Pratiwi

1

, Baedhowi

1

, and Dewi Kusuma Wardani

1

1

Magister of Economic Education Department, Sebelas Maret University, Surakarta, Indonesia

Keywords: Financial Literacy, Financial Management, Fitrah-Based Education, Nature-Based School

Abstract: Literacy must be owned by the 21st century generations, especially in digital era. Financial literacy, as one

of six basic literacies, is important to be introduced to children from an early age. One aspect of financial

literacy that must be instilled is independence in managing finances that can be invested through education.

True education is interacting with the nature of children. The best places to interact, care for and grow the

nature of children are family and community. Nature-Based Schools become alternative educational

institutions that synergize the family-based and community-based education. This study aims to describe the

model of developing financial independence by taking the nature of learning. The research conducted at

Sekolah Lanjutan Bengawan Solo (Bengawan Solo Junior High School) used qualitative approach. The

study shows that the development model of financial management independence is part of business

program. This model is carried out by preparing individual weekly proposal. Planning, preparation,

monitoring and evaluation are carried out by parents and facilitators in school. This model aimed to prepare

students for the age of pre-aqil baligh to be able to bear the burden of sharia when baligh arrives, including

independence in the living and the ability of zakat, jihad and other social responsibilities.

1 INTRODUCTION

Changes continue to occur in the community,

including in the people’s way of thinking and acting.

New trends and concepts continue to be developed.

The World Economy Forum in 2015 revealed the

21st century that must be controlled by all

generations. These 21st century skills include basic

literacy, competence, and character. Regarding this,

the Indonesian National Literacy Movement Team

(2017) stated that in order to survive in this era, the

community must work six basic literacy, one of

which is financial literacy. Financial literacy consists

of three complete dimensions, namely financial,

financial and financial behavior (OECD, 2005;

OECD-INFE, 2011; Atkinson and Messy, 2012;

OECD, 2013; OECD, 2014). However, surviving is

not enough. Competitive abilities are needed in

order to win economic matches. In order for these

things to reach, it is hoped that the community can

have a strong character. Financial literacy that can

be used to ensure security, both for individuals,

families, companies and the national economy.

Special emphasis is given to financial literacy by

individuals (Krechovská, 2015).

One effective way to develop financial literacy is

through education. Education is an important part of

every individual's daily life. This greatly affects

people with a variety of social and social over time.

High attention to education needs to be given given

the masivarah that is repeated in life, especially in

today's digital age. Mihalcová, Csikósová, and

Antošová (2014) reveal that the consequences of the

dynamic and dynamic development of society in that

era are better, and develop internally and externally,

it is important to know how these responsibilities

must be addressed for various aspects of life,

including education.

Education is using the nature of children. The

best place to adjust, care for and foster nature is

family and community. Sina (2014) says that

education in the family means individuals learn from

family members. Family is a significant learning

place to develop children's character. In the process

of learning in the family, children introduce various

things that are useful for life in the future in order to

realize prosperity throughout their lives. One of the

Pratiwi, A., Baedhowi, . and Wardani, D.

Financial Management among Pre-aqil Baligh Student: An Integrated Strategy in Entrepreneurial Education with Fitrah-based Approach.

DOI: 10.5220/0009497201450151

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 145-151

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

145

intended assets is the success in seeking

independence and financial freedom. In order for

this to be realized, financial education is needed so

that children can manage their own finances.

Dadaro (2011) revealed that it is important to pay

special attention to financial education for children

as a way to develop their financial literacy. In

addition, financial education is also a tool that can

be ended by low levels of financial literacy or also

called illiteration. Financial education is an

individual process to increase their knowledge and

reflection on financial concepts, services and

products.

Financial education is one type of education that

is very important to give to children. This is because

in this digital era there are many things that are

directly related to good deals and transactions that

are carried out in real or bold ways. According to

Mihalcová, Csikósová, and Antošová (2014),

financial education can be done with several

methods, include (a) making financial education an

official curriculum in schools in various levels of

education, (b) education training and seminars for

adults, and (c ) Financial education carried out by

government agencies both on a national and regional

scale that specifically covers financial services.

In accordance with the accuracy of education

which means interaction with the nature of children,

then in his experience with financial education, it

also takes a form of interaction with their nature.

Fitrah is a natural talent possessed by every

individual. Santoso (2015) revealed that they must

develop themselves. With regard to financial

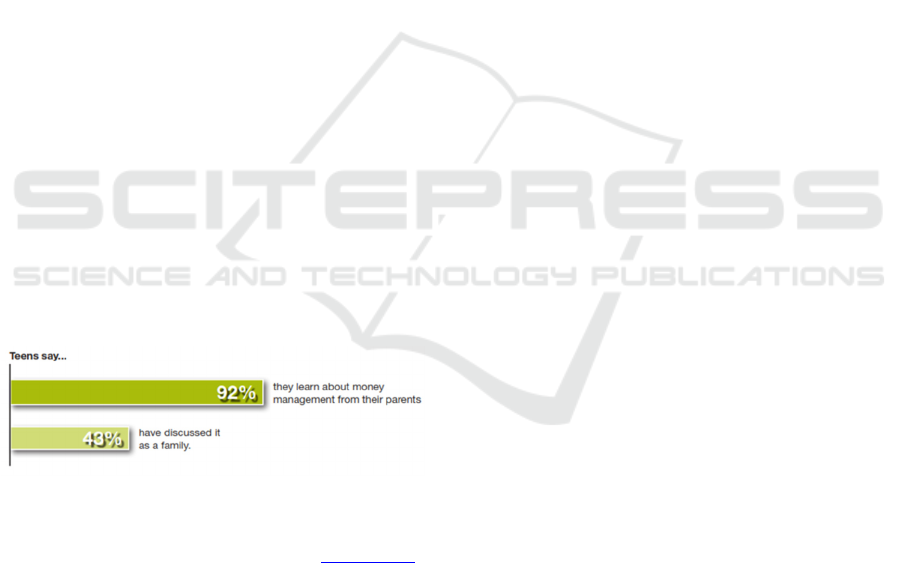

education, the conditions in Figure 1. are as follows:

Figure 1: Results of a survey of youth concerns

about financial management.

Source: Teens and Personal Finance survey: 2011

Junior Achievement, downloaded from www.ja.org

Based on Figure 1. above, adolescents in the survey

want to learn about realities and opportunities in the

global economy, but adults need to provide

guidelines for learning them. The Twelfth Annual

Junior Achievement / The Allstate Foundation

"Teens and Personal Finance" Survey (2011) found

that the current economic conditions make teenagers

care more about the importance of financial

management, especially with regard to the real

money they have. 8 out of 10 teenagers say that they

are motivated to learn about how to manage their

money. The survey results also mentioned that less

than half of those who discussed

about managing money with their families.

Financial education in the family is needed

significantly to prepare children to be smart in

managing their pocket money. This was stated by

Beverly and Clancy (2001) in his research. Not only

that, it is hoped that through financial education

involving the family, children are spared the

wasteful attitude of spending their pocket money and

instill the habit of saving in themselves. Beverly and

Clancy added that in families, children's knowledge

and ability to manage money is often not well

prepared, increasing their chances of growing up

with low financial literacy. There are other

indications related to the lack of discussion about

financial education in families involving children.

Williams (2010) confirmed the findings of

Beverly and Clancy with his research which states

that parents' perception of money is an important

and significant source of children's financial

knowledge. This means that parents are very

important to have knowledge about finance so they

can teach their children to manage personal finances.

Based on the various problems above, various

community-based alternative education and home or

family emerged, one of which was a natural school.

Recognizing various educational problems,

including financial education, natural schools come

with the concept of education that involves families

and communities to be able to empower and develop

the nature of individuals or children involved in the

school. As the name implies, natural schools are

based on nature in facilitating children's learning

activities.

In Indonesia, natural schools have a separate

curriculum that can be integrated in the national

curriculum that is being implemented in national

education. The essence of the natural school

curriculum in the Nusantara Nature School Network

(JSAN) covers 3 major domains, namely leadership,

academics and morals. All three are collaborated

with attention to the talents (fitrah) and skills of

students. In natural schools, educators do not act as

forming students' character, but are facilitators of the

development of children's nature. Based on the

description above, the problems that can be

formulated in this paper are:

How is the model for developing the independence

of natural-based financial management studying at

the Bengawan Solo Junior High School?

In accordance with the above formulation of the

problem, the purpose of this paper is to describe the

development model of financial management

independence by taking into account the nature of

learning for students in natural schools.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

146

2 RESEARCH METHODS

This research is a field research with a qualitative

approach using a case study design. The subjects of

this study were students of Bengawan Solo Junior

High School at level 1 and 2, and school residents.

Data collection in this study was carried out through

observation, interviews and documentation which

was then combined with literature study. Data in this

research were analyzed by triangulation.

3 RESULT AND DISCUSSION

3.1 Curriculum of Bengawan Solo Junior High

School

Bengawan Solo Junior High School is located in

Panjang, Gondangsari, Juwiring, Klaten, Central

Java. Bengawan Solo Junior High School is member

of Bengawan Solo Natural School The curriculum

carried out in Bengawan Solo Junior High School is

a development of the natural school curriculum in

general.

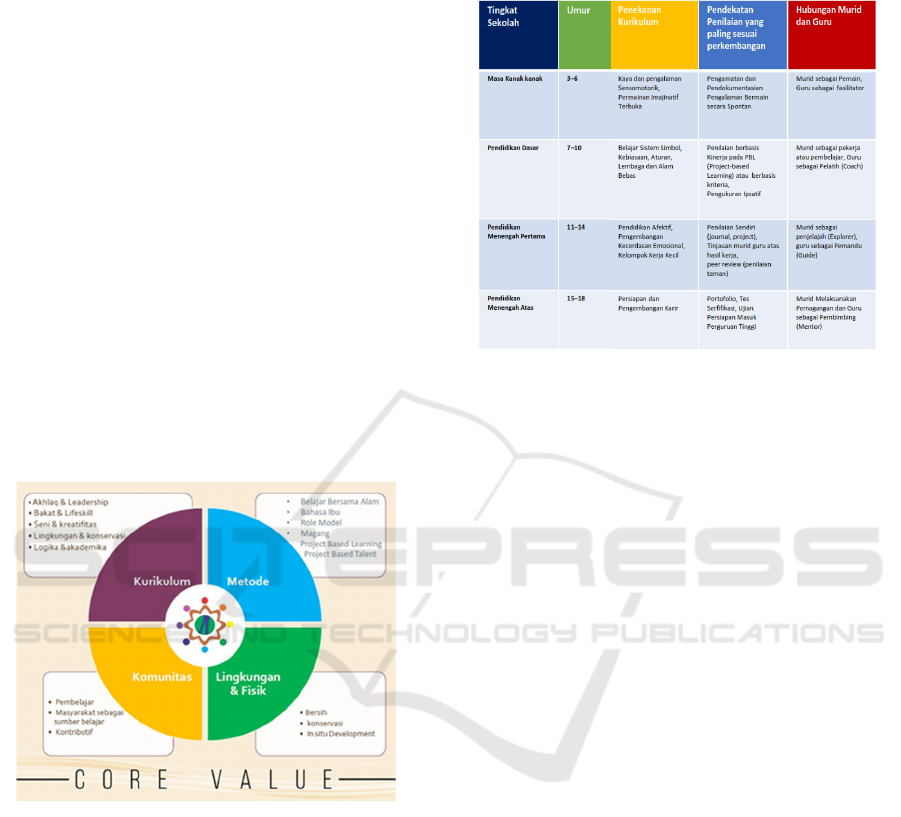

Figure 2: Core Value in the Bengawan Solo Natural

School

More specifically, Bengawan Solo Junior High

School applied a personal curriculum which was

carried out in a thematic based manner such as the

2013 curriculum for the elementary school level in

Indonesia. The application of this personal

curriculum is based on the following human

development research by Thomas Armstrong in

Figure 3.

This is also in line with what was expressed by

the headmaster of Bengawan Solo Junior High

School: "In this personal curriculum, children

designs what things they wants to learn. Facilitators

plays a role in consultation and giving input. So,

what they learned was written in the Timeline given

by Facilitators. This target timeline is given

monthly.”

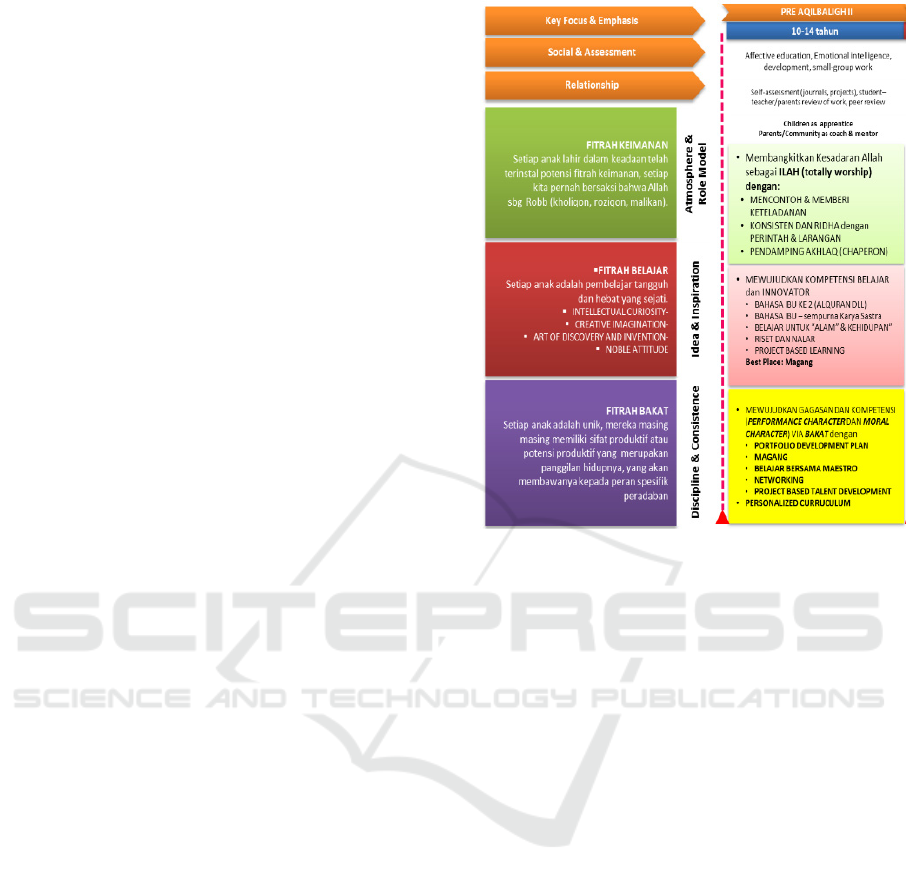

Figure 3: Human development research adapted

from The Best Schools (Thomas Armstrong)

Source: Bengawan Solo Junior High School’

Personal Documents

This is also in line with what was expressed by

the headmaster of Bengawan Solo Junior High

School:

"In this personal curriculum, the child designs

what things he wants to learn. Facilitators (the term

for facilitators in natural schools) plays a role in

consultation and giving input. So, what they learned

was written in the Timeline given by Facilitators.

This target timeline is given monthly.

The applied personal curriculum involves parents

in their planning. The assessment approach used is

self-assessment (based on formal and project),

assessment by facilities and peer assessment.

Assessment by the facility is carried out at the end of

each month by using quantitative methods (self-

report which is completed by students) and

collaborated with qualitative methods in the form of

direct screening and sharing with facilities. This is in

accordance with the narrative of the head of the

Bengawan Solo Junior High School, especially

Bengawan Solo Junior High School’ facilitators:

"If we only use the self report, we cannot judge

whether the child really has achieved the target he

planned in his timeline. So there must be follow-up

in the form of sharing and personal interviews with

children. Ideally, each individual is confirmed

through sharing and interviewing for at least one

hour. So it can't be done in one day at the same time.

And indeed there must be separate treatments, not to

be done in school. Just be flexible in place and time.

"

This is in accordance with the narrative of some

students who are evaluated in different places, for

Financial Management among Pre-aqil Baligh Student: An Integrated Strategy in Entrepreneurial Education with Fitrah-based Approach

147

example in food stalls, in classrooms, at home and

others.

Furthermore, Bengawan Solo Junior High

School’s students are children in the pre-aqil baligh

category (before the final aqil baligh). This has

become a special concern in developing the nature

of children which includes the nature of faith, the

nature of learning, and the nature of talent. Based on

his age, the following is a learning strategy carried

out by Bengawan Solo Junior High School that

shown in Figure 4.

Children aged 10-14 enter the pre-aqil baligh

training stage, which is the preparation stage to build

their ability to carry the burden of sharia when

baligh arrives, including independence in the living

and the ability of zakat, jihad and other social

responsibilities. From the age of 10 this talent began

to be recognized and explored and developed as an

effort to achieve the role of civilization (the mission

of civilization). Age 10-12 is a golden age for the

nature of talent. In this age children are trained to be

independent or mature mentally, spiritually,

emotionally and even financially when they reach

the age of 14-15 years. This is done in order to

minimize the gap between baligh (biological adults)

and aqil (mental adults), that after entering high

school age, children should no longer be considered

as children. Over 15 years old children have become

adults who are equal to their parents in sharia and

social. At this age parents and facilitators can act as

partners for them in carrying out their life missions.

Realizing this, according to Figure 4. above,

Bengawan Solo Junior High School develops a

curriculum that includes various activities and

activities that can support and develop student

independence, namely (1) Rich in Worship, (2) Rich

Work, (3) Rich in Benefits, (4) Rich Insights, (5)

Sports, (6) Academics, (7) Internships, and (8)

Business and Finance. Based on the age of

Bengawan Solo SL students entering the pre-aqil

baligh training phase, namely the preparation stage

to build their ability to carry the burden of sharia

when baligh arrives, business and financial programs

are carried out to be able to prepare students'

independence in terms of livelihood and knowledge

about zakat and other social responsibilities.

Figure 4: Development strategy for children aged

pre-aqil baligh II

Source: Bengawan Solo Junior High School’s

document

Children aged 10-14 enter the pre-aqil baligh

training stage, which is the preparation stage to build

their ability to carry the burden of sharia when

baligh arrives, including independence in the living

and the ability of zakat, jihad and other social

responsibilities. From the age of 10 this talent began

to be recognized and explored and developed as an

effort to achieve the role of civilization (the mission

of civilization). Age 10-12 is a golden age for the

nature of talent. In this age children are trained to be

independent or mature mentally, spiritually,

emotionally and even financially when they reach

the age of 14-15 years. This is done in order to

minimize the gap between baligh (biological adults)

and aqil (mental adults), that after entering high

school age, children should no longer be considered

as children. Over 15 years old children have become

adults who are equal to their parents in sharia and

social. At this age parents and facilitators can act as

partners for them in carrying out their life missions.

Realizing this, according to Figure 4. above,

Bengawan Solo Junior High School develops a

curriculum that includes various activities and

activities that can support and develop student

independence, namely (1) Rich in Worship, (2) Rich

Work, (3) Rich in Benefits, (4) Rich Insights, (5)

Sports, (6) Academics, (7) Internships, and (8)

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

148

Business and Finance. Based on the age of

Bengawan Solo SL students entering the pre-aqil

baligh training phase, namely the preparation stage

to build their ability to carry the burden of sharia

when baligh arrives, business and financial programs

are carried out to be able to prepare students'

independence in terms of livelihood and knowledge

about zakat and other social responsibilities.

3.2 Business Program

General business programs are carried out in natural

schools in Indonesia. However, each natural school

has its own characteristics. Ar-Ridho Nature-Based

Junior High School, for example, has a business

program in the form of small enterprises in

agriculture and fisheries such as mushroom

cultivation, fish and others. Bengawan Solo Junior

High School conducts business programs as a way to

develop student entrepreneurial competencies

through 2 types of businesses, namely personal and

communal business.

Personal business is carried out by students

according to the nature of their talents. According to

the head of the Bengawan Solo Junior High School,

students develop their businesses according to their

talents, both in the form of talent and field talents.

Talent traits are related to the nature of the child

which encourages him to see a phenomenon such as

personalizing and profiling against other people who

are encountered or invited to interact, while talent in

the field is related to the type of work which the

child tends to like cooking, farming and so on.

Personal business is done not limited to the activities

of processing something and then marketing it, but

also related to how students place themselves as

resources that can make money.

Capital to run personal business was obtained

from private parents, cash from Bengawan Solo

Junior High School and from community. Personal

business capital that comes from external students is

a consequence in the form of sharing the results of

the business that he does. If the capital comes from

parents, the profit sharing is adjusted according to

the agreement of each child with his parents.

However, if the capital comes from cash or

community, students are required to return the

amount of money he borrowed, but it is

recommended to take advantage of the results of the

effort he made with the capital.

Meanwhile, communal business is a business

program managed jointly by Bengawan Solo Junior

High School’s students. The program that has been

running is "Cafe 1720". This is a business in the

form of a cafe that is operated in certain weeks

according to the project planned in the timeline. The

cafe is held a full day which includes preparation

(setting places, menus and so on) before 5.00 p.m.

(17.00 Time of West Indonesia) and the execution at

5.00 p.m. (17.00 Time of West Indonesia) until 8.00

p.m. (20.00 Time of West Indonesia). The capital to

run this communal business is obtained from

community money so that the management of the

results is carried out jointly.

3.3 Financial Reports

To support the running of business programs, both

personal and communal, Bengawan Solo Junior

High School includes business and financial

activities on the student timeline at points (8) (as

described in the previous section). The financial

statements made are students' personal financial

statements for a week. Reporting is done every

Friday.

The process of financial education through

financial statements begins with the preparation of

financial proposals by students submitted to their

parents. Previously, it was easy with parents to agree

on what needs could be financed and subsidized by

parents. If in the proposed poposal there is an

inappropriate budget, then the student will evaluate

and correct it. If the proposal is approved, the

student obtains an allowance according to the

proposed plan and must compile a simple financial

report recorded in each of his books. This is in

accordance with the narrative of the Headmaster of

Bengawan Solo Junior High School:

"The principle is like this with his parents. Most

of them are still subsidized with parents. If we talk

about business it is not possible (it can work well) if

the child has not been able to manage their money.

So, starting the first year yesterday, we request it

with parents (related to this financial report) weekly

proposal. From there, put it in the financial report. "

Money managed by students is standard money

for students' daily needs. This financial management

does not include other consumptive needs such as

credit, quota and so on, or financing of Rich Insight

activities, such as monthly roaming or project back-

packing. This is in accordance with the Headmaster

of Bengawan Solo Junior High School statement:

"For quota and credit, we don't allow parents to

give, so children are trained to make their own

money to pay for this need."

In planned and reported financial management,

students not only include income receipts from

parents and expenditures for consumption only, but

also include revenue posts from other sources, such

as personal business results and debt, as well as

other expenditure items such as giving accounts to

peers .

3.4 Discussion

Understanding the concept of managing finances is

the essence of financial education. Financial

Financial Management among Pre-aqil Baligh Student: An Integrated Strategy in Entrepreneurial Education with Fitrah-based Approach

149

education is a solution to problems caused by low

individual financial literacy. Financial education is

provided so that individuals can manage money

properly on target and prevent the possibility of

future financial difficulties resulting from decision

making errors related to personal finance. Financial

education is very important in order to create

positive habits for children to be smart and wise in

managing money. Not only in terms of managing,

but also how children can generate their own income

beyond what has been given by parents. So it is

important for schools and families to work together

in creating these habits.

The model for developing the independence of

the nature of learning-based financial management

applied by the Bengawan Solo Junior High School

can be an example for similar programs to be

implemented by other schools. The freedom that is

well controlled in Bengawan Solo Junior High

School related to the planning of learning targets,

especially those related to business and financial

programs, can be applied to guarantee and develop

the existence of the nature of student learning. This

is in accordance with Santoso's statement (2015) that

the nature of a child can be damaged or even

destroyed if in the learning process there are some of

the following: 1) educators are too driving the child's

learning process, so that paralyzes children's creative

power; 2) educators overload material; 3) the

textbook used does not contain evocative ideas; 4)

the promotion of competition and fear as learning

motivations that damage students' learning intentions

in accordance with the natural disposition.

The model for developing financial management

independence in Bengawan Solo Junior High School

not only prepares students to manage their finances,

but also prepares students for independence in terms

of earning a living. This is evident from the

integration of personal business programs in weekly

financial records. In addition, habituation through

project-based learning makes students more

persistent to earn their own income to finance

planned roaming and back-packing activities.

This model does not only stop at financial

reporting, but is also used as an assessment material

that the student concerned can truly be considered

independent in obtaining his income. In this model,

if students are considered capable and independent,

facilitator will recommend to parents to stop giving

their children an allowance.

4 CONCLUSION AND

SUGGESTION

The model for developing the independence of

natural-based financial management at the

Bengawan Solo Junior High School through the

creation of weekly financial reports collaborated

with business programs instills positive beliefs,

attitudes and habits in students to be smart and wise

in managing money. This behavior is likely to be

carried away to become an adult (aqil baligh) in

managing the right money such as saving money,

saving, investing and paying zakat and infaq. This

indirectly contributes to the basic dimensions of

financial literacy, namely financial knowledge,

financial attitudes and financial behavior. Financial

literacy is a 21st century life skill that improves the

quality of human resources, enhances living

standards so that it can be used as a determinant of

the progress of a nation. The strategy for improving

financial skills in Bengawan Solo Junior High

School needs to be carried out on an ongoing basis.

The implementation of a good model is still not

supported by other sources of financial literacy.

Need to be provided with material to support

financial literacy that is contextual. Facilitators is

expected to add references and use e-books and

other materials that can be easily accessed online

from various sources such as infographics,

videographies, leaflets, and other technical

guidelines. In addition, the creation of a validated

pocket book or simple digital application also needs

to be done so that students can more freely record

their finances at every place and time.

REFERENCES

Atkinson, A. and Messy, F. A. (2012). Measuring

financial literacy: results of the OECD / international

network on financial education (INFE) pilot study.

OECD Working Papers on Finance, Insurance and

Private Pensions, 15, 1-73.

Beverly, S. & Clancy, M. (2001). Financial Education in

Children and Youth Savings Account Policy

Demonstration: Issues and Options. Research

Background Paper, 1-5.

Dodaro, G. L. (2011). Financial Literacy: The Federal

Government's Role in Empowering Americans to

Make Sound Financial Choices. Washington D. C.:

U. S. Government Accountability Office (GAO).

Krechovská, M. (2015). Financial Literacy as A Path to

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

150

Sustainability. Trendy v podnikání - Business

Trends, 2, 3-12.

OECD. (2005). Improving Financial Literacy: Analysis of

Issues and Policies. Paris: OECD Publishing.

OECD. (2013). Financial literacy framework, in OECD

(Ed.), PISA 2012 Assessment and Analytical

Framework: Mathematics, Reading, Science,

Problem Solving and Financial Literacy. Paris:

OECD Publishing.

OECD. (2014). PISA 2012 technical background, in

OECD (Ed.), PISA 2012 Results: Students and

Money: Financial Literacy Skills for the 21st

Century, Vol. VI. Paris: OECD Publishing.

OECD-INFE. (2011). Measuring Financial Literacy: Core

Questionnaire in Measuring Financial Literacy:

Questionnaire and Guidance Notes for Conducting

International Comparable Survey of Financial

Literacy. Paris: OECD Publishing.

Santoso, H. (2015). Fitrah Based Education. Bekasi:

Cahaya Mutiara Timur.

Sina, P. G. (2014). The Role of Parents in Educating

Finance in Children. Variety: Journal of Humanities

Development, 14 (1), 74-86.

The Allstate Foundation. (2011). Teens and Personal

Finance survey: 2011 Junior Achievement. Allstate

Foundation. Downloaded from www.ja.org.

National Literacy Movement Team. (2017). Financial

Literacy Supporting Materials. Jakarta: Ministry of

Education and Culture. Downloaded from

www.gln.kemdikbud.go.id.

Williams, S. (2010). Parental Influence on the Financial

Literacy of Their School-Aged Children: An

Exploratory Study. Parental Influence on the

Financial Literacy of Their Children, 23-33.

Financial Management among Pre-aqil Baligh Student: An Integrated Strategy in Entrepreneurial Education with Fitrah-based Approach

151