Factors Affecting Financial Literacy among Undergraduate Students

of Accounting Education in the Faculty of Economics of

Universitas Negeri Medan

Rini Herliani

1

, Andri Zainal

1

and Roza Thohiri

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords:

Investment knowledge of financial education, financial experience, income and family-heritage,

demographics, logistic regression test

Abstract:

The aim of the research is to explore financial literacy related-aspects among students in the

Accounting Education department of Faculty of Economics at Universitas Negeri Medan

(UNIMED). The bottom line of this study is that a good financial management requires a good

financial knowledge in place. This research aims to help students in developing a complete

understanding and knowledge of financial literacy toward implementing the knowledge into their

daily personal finance management. The data was analyzed using the logistic regression test

indicating that there is a significant effect of financial education, financial, income, experience and

family-heritage and demographics on the knowledge investment. Cox and Snell R-Square is 0.706

(70,6%) and Nagelkerke R-Square is 0.a indicating that financial education, financial, income,

experience and family-heritage and demographics are good predictors for knowledge investment

among students in the Accounting Education department of Faculty of Economics at UNIMED.

1 INTRODUCTION

Financial intelligence is one of the important aspects

in today's life. Financial intelligence is the

intelligence in managing personal assets (Widyawati,

2012). Individuals must have the knowledge and

skills to manage their personal financial resources

effectively for their welfare. A person's knowledge

and understanding in managing his personal finances

is called financial literacy. Remund (2010) describes

five domains of financial literacy, namely 1)

knowledge of financial concepts 2) ability to

communicate about finance 3) ability to manage

personal finance 4) ability in making financial

decisions 5) confidence in making future financial

planning.

Financial literacy is closely related to individual

welfare. Financial knowledge and skills in managing

personal finance are very important in everyday life.

Yushita (2010) explained that financial literacy is a

basic need for everyone to avoid financial problems.

Financial difficulties occur not just a function of mere

income (low income). Financial difficulties can also

arise if there are errors in financial management

(missmanagement) such as credit card use errors and

lack of financial planning. Financial limitations can

cause stress, and low self-confidence.

Having financial literacy is a vital thing to get a

prosperous life. With the right financial management

which is certainly supported by good financial

literacy, the expected standard of living can increase,

this applies to every level of income, because no

matter how high a person's income level, without

proper financial management, financial security will

be difficult to achieve. Not only that, in understanding

the risk and profit figures associated with financial

products, the minimum level of financial literation

has become a necessity. Individuals who have

financial literacy can make effective use of financial

products and services so that individuals will not be

easily deceived by people who sell financial products

that are not suitable for that individual. Financial

knowledge is very important for an individual, so that

they are not wrong in making their financial

120

Herliani, R., Zainal, A. and Thohiri, R.

Factors Affecting Financial Literacy among Undergraduate Students of Accounting Education in the Faculty of Economics of Universitas Negeri Medan.

DOI: 10.5220/0009496401200126

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 120-126

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

decisions. The level of a person's financial literacy

can be seen from how well the individual is able to

utilize financial resources, determine the source of

spending, manage soul risk, manage assets owned,

and prepare for future financial security if it is not

working (Ergun, 2018; Sari et al. , 2017).

For most students, college is the first time they

manage their own finances without supervision from

parents (Sabri et al. 2008). As students, they undergo

a financial transition period, from being tied to

parents to individuals who have the freedom to make

personal decisions regarding their finances. Students

must be able to independently manage their finances

well and must also be able to be responsible for the

decisions they have made. However, some studies

indicate students who have low knowledge of

financial literacy will make wrong decisions in their

finances (see: Ergun, 2018; Hospido et al., 2015;

Luhrmann et al., 2014; Chen and Volpe, 1988).

Students have complex financial problems because

most students have no income and are still dependent

on parents. Problems can occur due to delays in

money from parents or it could also be because a

monthly allowance that runs out prematurely is

caused by unexpected needs or because of poor

financial management (Homan, 2015).

The conditions described in the previous

paragraph cause students to be required to have high

financial literacy. Especially, for students who live in

large cities, where the most consumptive behavior

occurs. This is due to the large number of shopping

centers that influence students to spend money

without thinking about the benefits of goods

purchased. They mostly buy goods only for pleasure,

not based on needs caused by poor financial

understanding.

In the local context in several regions in

Indonesia, Nababan and Sadila's (2012) research

found that the level of financial literacy of Faculty of

Economics undergraduate students from 2008 to

2011 was 56.61% which indicated that the level of

financial literacy was in the category low. The study

conducted by Krisna et al. (2010) revealed the

majority of students at the University of Education in

Indonesia had moderate financial literacy levels

(63%), and only 7% had a high level of financial

literacy, while the rest (30%) entered into groups that

had a low level of financial literacy.

The high and low level of students' financial

literacy is influenced by several factors, both external

and internal factors, including family financial

education, financial learning in universities and peer

interaction (Widyawati, 2012). In addition, financial

literacy is also influenced by demographic factors.

Demography is a description of a person's

background so that it can affect their financial literacy

(Mandell, 2008). Demographic factors according to

Kewon (2011) include age, gender, family status,

migration status, level of education, type of work,

place of residence and regional. Nidar and Bestari

(2012) mention demographic factors that influence

financial literacy include the level of education of

parents, pocket money, education level, faculty,

parental income and insurance. Whereas Ariani and

Susanti (2015) stated that demographic factors

suitable for student characteristics were GPA (Grade

Point Average), gender, place of residence, ATM

usage and work experience. Of the several

demographic factors above, the most appropriate for

the characteristics of students at Medan State

University (UNIMED) are gender, ethnicity, parent

income, residence, ownership of savings accounts

and level of education (having attended financial

seminars).

UNIMED is one of the state universities that is

quite attractive to high school / vocational high school

students or the equivalent who want to go to college,

especially for those who want to become a teacher

and professional in the field of work that is relevant

to accounting science. This high interest caused

UNIMED students not only to come from Medan but

also from outside Medan. Thus, UNIMED students

have diversity such as gender, ethnicity, parental

income, as well as differences in residence between

students as long as they are studying in college.

Savings ownership is also one of the factors that is

included because the average student must have a

savings account, especially for students who live far

from parents, they must have a savings account.

Currently the UNIMED Student Identity Card (KTM)

has been integrated with a savings account of one

bank that cooperates with UNIMED which can be

used by students as a debit card - although based on

the initial Questions and Answers to some

respondents, it indicates that the KTM has not been

used optimally by students concerned. In addition to

the above factors, the experience of financial

education is also a factor that influences financial

literacy, because the experience of students who have

attended financial seminars both in high school (high

school / vocational high school) or when in college

must have differences about their financial literacy

knowledge.

Factors Affecting Financial Literacy among Undergraduate Students of Accounting Education in the Faculty of Economics of Universitas

Negeri Medan

121

2 THEORICAL FRAMEWORK

A person's financial literacy is influenced by several

factors. Ansong and Gyensare (2012) found that

financial literacy was influenced by several factors,

namely: 1) Age 2) Work experience 3) Mother

education 4) Departments.Margaretha and Pambudhi

(2015) found an influence on factor 1) Gender 2)

GPA 3) Parent's income on the level of financial

literacy. Shaari et al. (2013), stating that 1) Age, 2)

Spending habit, 4) Gender, 5) Faculty, 6) Year of

entering college has an effect on financial literacy.

Nababan and Sadalia (2012) found an influence

between factor 1) Gender 2) Stambuk 3) Place of

residence 4) GPA affects financial literacy.

Gender (gender) is a biological difference

experienced by each individual from birth. Gender is

defined as the difference between men and women in

terms of value and behavior. This difference in values

and behavior is the beginning of an indication that

men and women have non-identical literacy.

Research conducted by Chen and Volpe (1998)

explains that men have a higher financial literacy than

women. The research was conducted by conducting a

survey at the University with a sample of 924

students. Krishna et al. (2010) in his study found that

women better understand financial literacy than men.

Bhushan and Medury (2013) conducted research in

India with 516 respondents, in his study found that

there were significant differences between male and

female respondents. who already have a salary in

terms of financial literacy.

Furthermore, Keown (2011) found that people

who live alone have higher levels of personal

financial literacy than those who live with their

spouses or parents. This is because people who live

alone have responsibility for their daily financial

transactions and financial decisions. others.

The study conducted by Shults (2012) found that

there was a significant difference between the value

of students who had savings accounts and no.

Students who have savings accounts even for various

reasons and needs mark their trust in banking

institutions. The need for combined financial

understanding will make them have a savings

account. While students who do not have a savings

account can be caused by the lack of need to make

savings and lack of understanding about finance.

Ownership of a savings account is the first step to

achieving financial security, so that someone who

understands finance will have a savings account even

if they do not have an urgent need for ownership of a

savings account, because the person is not only

thinking about this moment but also thinking about

his long-term plan.

Associated with parents, Nidar and Bestari

(2012) found that income from parents is a significant

factor in the level of financial literacy in West Java

students. Keown (2011) explains that there is a

relationship between the income of parents and

financial knowledge. This shows that parents with

higher household income tend to have higher levels

of financial literacy because they use financial

instruments and services more often.

On the other hand, learning is essentially the

conscious effort of teachers to teach their students

(directing students' interactions with other learning

resources) in order to achieve the expected goals

(Trianto, 2009: 17). Learning in higher education

plays an important role in the process of student

financial literacy. The related research is the result of

Jhonson (2007) research which states that financial

education has a very important role for students to

have the ability to understand, assess, and act in their

financial interests. Furthermore Gutter (2008) in his

research stated that financial education had a positive

and significant effect on knowledge and financial

attitudes

3 RESEARCH METHOD

The research method used in this study is a

descriptive case study using a combination of

quantitative and qualitative data from the

questionnaire adopted from previous research

conducted by T-Zu Chin Peng Martina, Suzanne

Bartholomae, Jonathan J.Fox, and Garrett Cravener

(2007) . Questionnaires were distributed to find out

whether educational experience has an effect on

investment knowledge for UNIMED Accounting

Education students and how the differences and

influence of investment knowledge on financial

education, financial experience, income and

inheritance and demography.

There are 19 statement items that must be filled by

respondents in the Yes and No columns. The

questionnaire also includes the identity of the

respondent, such as Name, Nim, Class, Stambuk,

Gender and Tribe.

The population in the study were all students of

Accounting Education Department in Faculty of

Economics of UNIMED from batches 2014-2017

who were actively attending lectures in the 2017/2018

school year in the even semester. Sampling was

carried out by purposive sampling technique that is

by selecting a sample purposively. The total sample

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

122

in this study is 120 respondents consisting of 30

respondents from each generation.

4 ANALYSIS

4.1 Validity and Reliability Tests of Financial

Literacy

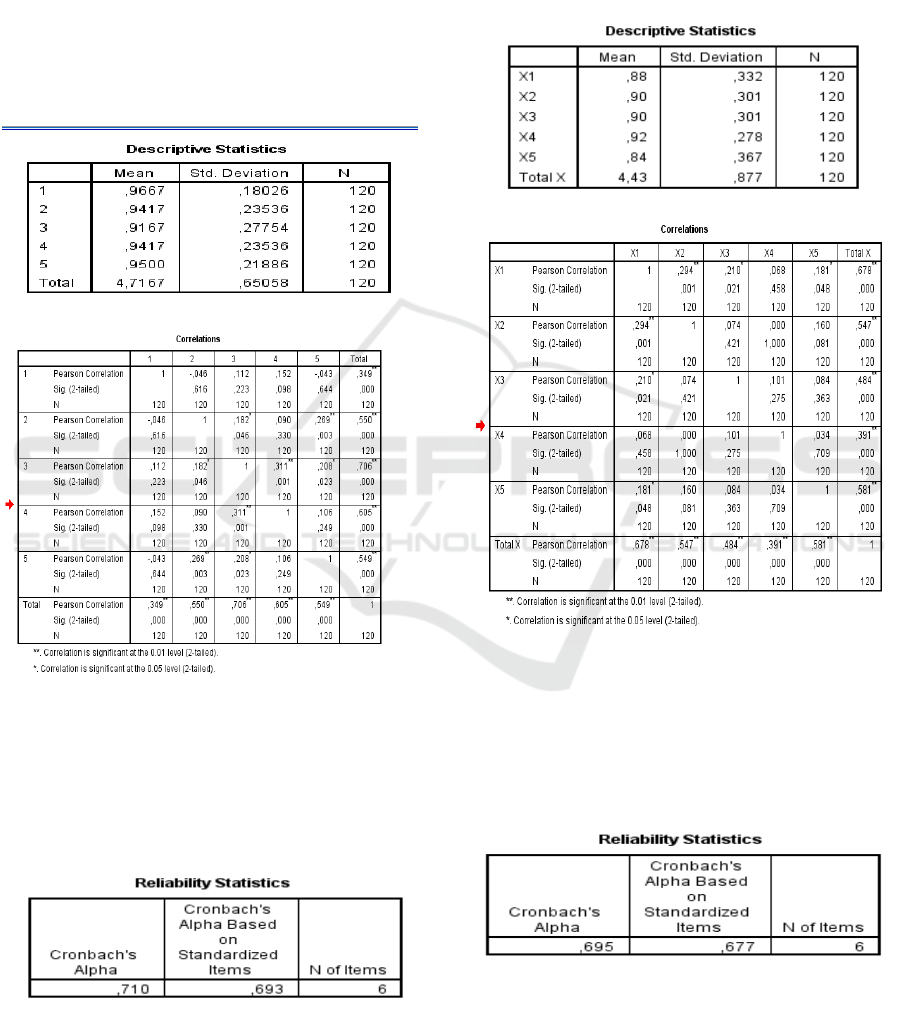

Table 1: Validity and Reliability Tests of Financial

Literacy

From the Descriptive Statistics table above, states that

all the data we provide to respondents is not lost / all

the questionnaires we gave back to us regarding

financial education. From the Correlation table above

states that all of our statements regarding financial

education are declared valid because in the far right

column the name "Total" is above 0.33.

Based on the table above, shows the value of

Cronbach's Alpha financial education variables worth

above 0.60. This shows that the research

questionnaire is reliable so it can be continued to

conduct research.

4.1.2 Validity and Reliability Tests of Financial

Experience

Table 2: Validity and Reliability Tests of Financial

Experience

From the Descriptive Statistics table above, states

that all the data we provide to the respondent is not

lost / all the questionnaires that we provide back to us

regarding financial experience. From the Correlation

table above states that all of our statements regarding

financial experience are declared valid because in the

rightmost column the name "Total" is above 0.33.

Based on the table above, shows the Cronbach

value "S Alpha financial education variables are

valued above 0.60. This shows that the research

questionnaire is reliable so it can be continued to

conduct research.

Factors Affecting Financial Literacy among Undergraduate Students of Accounting Education in the Faculty of Economics of Universitas

Negeri Medan

123

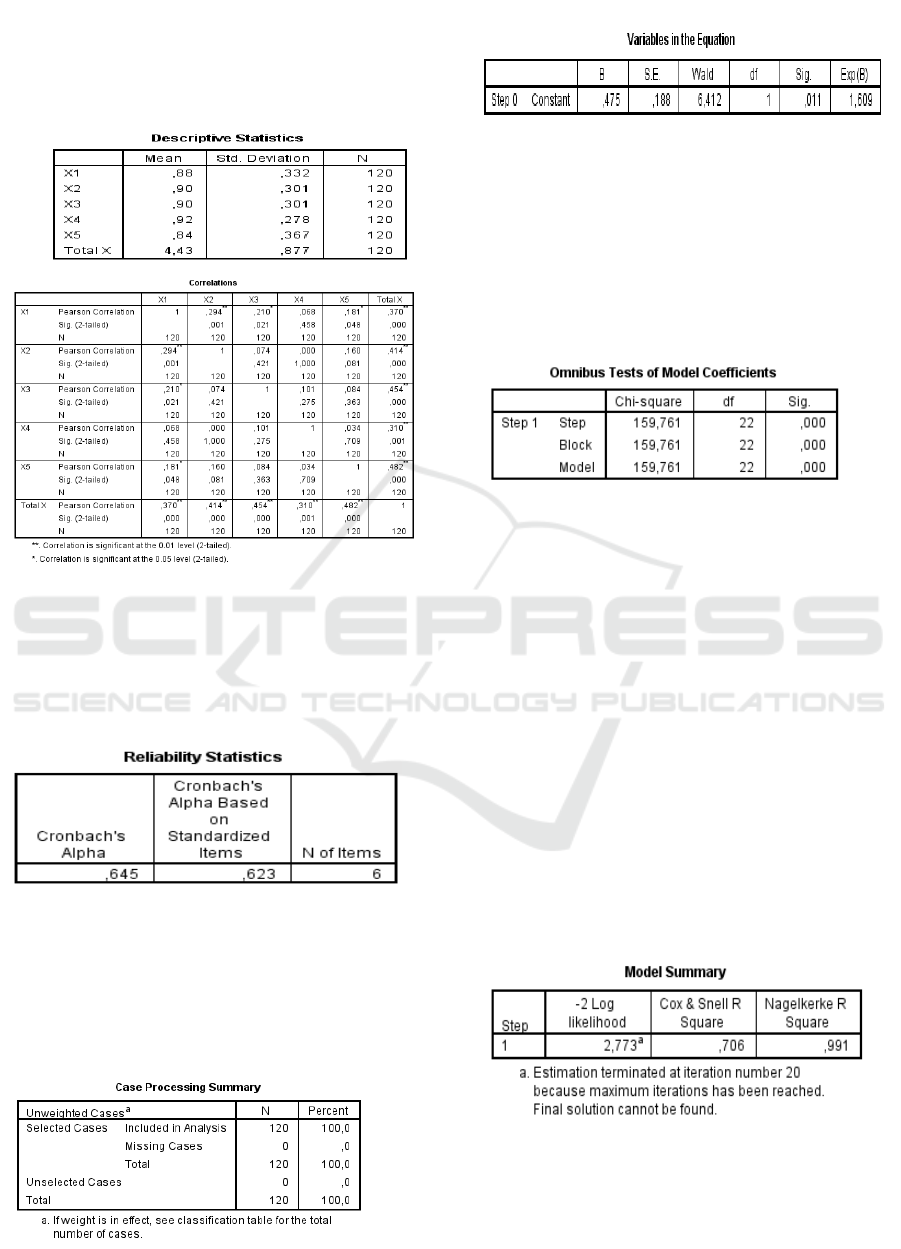

4.1.3. Validity and Reliability Tests of Income and

Family-Heritage

Table 3: Validity and Reliability Tests of Income and

Family-Heritage

From the Descriptive Statistics table above, states

that all data we provide to respondents is not lost / all

questionnaires that we provide back to us regarding

income and inheritance. From the Correlation table

above states that all of our statements regarding

income and inheritance are declared valid because in

the rightmost column the name "Total" is above 0.33.

Based on the table above, shows the Cronbach value

"S Alpha variable income and inheritance value

above 0.60. This shows that the research

questionnaire is reliable so it can be continued to

conduct research.

4.2. Logistic Regression Analysis

The criteria for the data above are: if the value of

S.E> 0.05 means the model is able to explain the data.

If the value of S.E <0.05 means that the model is

unable to explain the data. Based on the table above,

the value of S.E is 0.188 (> 0.05), this means that it is

unable to provide an explanation of the data, so the

Omnibus Test Of Model Coefficents table is needed

as follows:

The criteria: If the results of the Chi Square test

value> Chi Square table test value then Ho is rejected

and if the results of the Chi Square test value <Chi

Square table value test then accept Ho. Chi-Square

Value 159,761> Chi-Square Table on degree of

freedom 22 is 33,924 or with a significance of 0,05 so

reject Ho. Which states that the addition of

independent variables can have a real influence on the

model or in other words the model is declared FIT.

(the model simply explains the data).

So the answer to the hypothesis of the

simultaneous effect of the independent variable on the

dependent variable is to accept H1 and reject H0 or

that means there is a significant influence between

simultaneous financial education, educational

experience, income and inheritance, demography on

investment knowledge because the value of P-value

Chi-Square is 0,000 <Alpha 0.05 or Chi-Square value

count 159.761> Chi Square table 33.924.

From the table above, it can be seen that the

model by entering independent variables (financial

education, financial experience, income and

inheritance, and demographics) on the dependent

variable (knowledge of investment) turns out to have

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

124

changed in the interpretation of parameters (-2 log

likelihood) of 2,773. The R-Sqaure value of 0.706 or

70.6% (Cox & Snell) and 0.991 or 99.1%

(Nagelkerke). Nagelkerke R-Square values of 0.991

and Cox & Snell R Square are 0.706, which indicates

that the ability of the independent variable to explain

the dependent variable is 0.991 or 99.1%. This means

that there is another factor of 0.9% outside the model

that explains the independent variables.

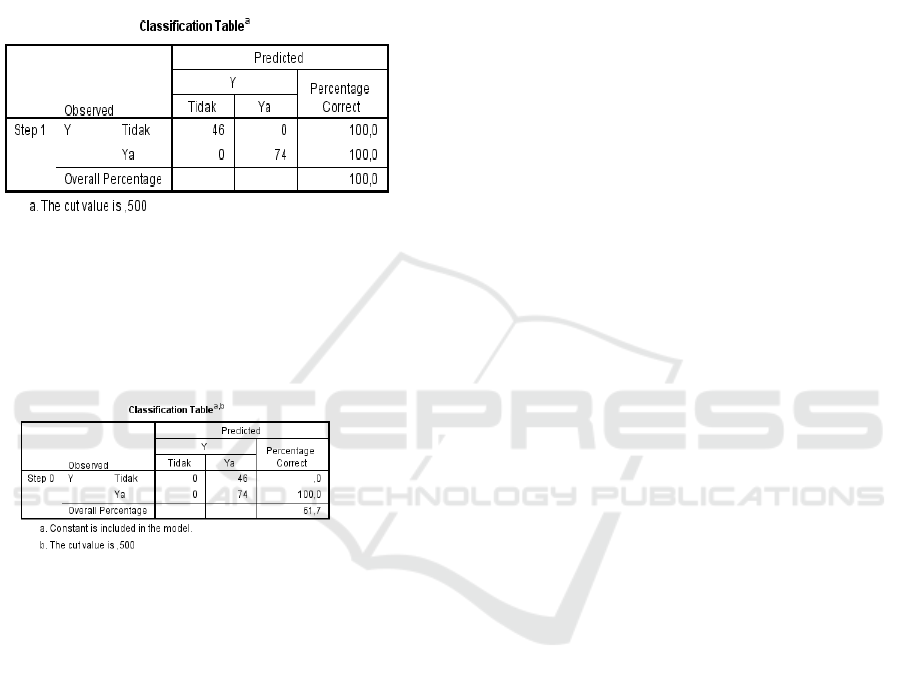

Based on the Classification Table table above,

there are 46 samples whose answers are "No". And

the number of samples whose answer is "Yes" is 74

people. In logistic regression interpretation with

SPSS: The table above gives an overall percentage

value of (46 + 74) / 120 x 100% = 100%. Which

means the accuracy of this research model is 100%.

Classification Table The table is a contingency

table that should occur or also called the expectation

frequency based on empirical data on the dependent

variable, where the number of samples that have the

dependent variable category that answers No (code 0)

is 46 people and those who answer Yes (code 1) are

74 people. The number of samples is 120 people. So

that the overall percentage value before the

independent variable is included in the model is:

74/120 = 61.66%. (rounded up to 61.7%).

5 RESULTS

The purpose of this study was to analyze the influence

of financial education, financial / investment

experience, income, family inheritance and

demographics on investment knowledge in students

in accounting education study programs at the Faculty

of Economics UNIMED. The results reveal that

financial education has a significant influence with

overall financial knowledge. These results are in line

with Chon and Volpe (1998) concluding that financial

education is strongly influenced by financial

knowledge.

Furthermore, when tested based on financial

experience, we found that there was a significant

relationship after learning about financial education.

Students who have experience in managing finances

will have more knowledge in investing. These results

are in line with Chon and Volpe (1998) concluding

that financial education is strongly influenced by

financial knowledge. For variable financial

experience, we found that there were no demographic

differences after learning about financial education.

This is in line with the study of Mandell (2004)

concluding that financial experience has a significant

influence on financial knowledge.

Regarding income and inheritance factors, we

find that there is a significant influence on investment

knowledge. This is in line with the research of

Huddleston (1999) also concluded that income and

inheritance also have a positive impact on one's

knowledge in investing. We found that there was no

significant demographic effect after learning about

financial education. This is in line with the research

of Hayhoe, Leach, Turner, Bruin and Lawrence

(2000). In particular, to answer the purpose of

research on whether students of Unimed Accounting

education study program have implemented financial

education they have learned in real life, we conclude

that students of accounting education study program

Unimed have applied it in their daily lives.

6 CONCLUSIONS

Based on the results of the research, analysis and

discussion, conclusions taken, it can be given advice,

which is suggested to the campus to develop financial

education for students. One of them is by making

seminars on finance for students and making several

courses that discuss finance. Thus, students'

knowledge of UNIMED Accounting Education on

finance will also increase. The higher financial

knowledge a person has, the more likely he or she will

be more understanding and smarter in financial

management.

REFERENCES

ANZ Bank (2011). Adult financial literacy in

Australia. Executive summary of the results

from 2011 ANZ Survey.

Factors Affecting Financial Literacy among Undergraduate Students of Accounting Education in the Faculty of Economics of Universitas

Negeri Medan

125

Ariani, N. A. dan Susanti. (2015). Pengaruh Faktor

Demografi Terhadap Financial Literacy

Mahasiswa Fakultas Ekonomi Universitas

Negeri Surabaya Angkatan 2012. Jurnal

Mahasiswa Teknologi Pendidikan, 3(2).

Ayu Krishna, dkk. (2010). Analisis Literasi keuangan

di Kalangan Mahasiswa dan Faktor-Faktor yang

Mempengaruhinya. Proceeding of The 4th

International Confeeence on Teacher

Education; Join Conference UPI & UPSI: 552-

560

Bhushan, P., & Medury, Y. (2013). Financial literacy

and its determinants. International Journal of

Engineering, Business and Enterprise Applica-

tions (IJEBEA), 4(2), 155–160.

Chen, H., & Volpe, R. P. (1998). An analysis of fi-

nancial literacy among college students. Finan-

cial Services Review, 7(1), 107–128.

Herliani, R. (2012). Pengaruh Anggaran Biaya

Terhadap Efisiensi Biaya Operasional Pada

Asuransi Jiwa Bersama Bumiputera 1912

Medan. Jurnal Mediasi, 4(01).

Homan, Hery Syaerul. (2015). Comparative Study of

Student Financial Literacy and Its Demographic

Factors. First International Conference on

Economics and Banking, 106-111.

Hospido, L., Villanueva, E., & Zamarro, G. (2015).

Finance for all: The impact of financial literacy

training in compulsory secondary education in

Spain. Banco de Espana. Documentos de

Trabajo N.8 1502. Retrieved from

https://pdfs.semanticscholar.org/f393/345ed297

828c34b9e283e28319514dac43d1.pdf

Keown, Leslie Anne. (2011). The Financial

Knowledge of Canadians. Canadian Social

Trends, 91.

Lusardi, A., & Mitchell, O. S. (2014). The Economic

importance of financial literacy: Theory and

Evidence. Journal of Economic Literature,

American Economic Association, 52(1), 5–44.

Nababan, D., & Sadila, I. (2012). Analisis personal

financial literacy dan financial behavior

mahasiswa strata I fakultas ekonomi

Universitas Sumatera Utara.

Nidar, S.R., & Bestari, S. (2012). Personal literacy

among university students (case study at

Padjajaran University students, Bandung,

Indonesia. World Journal of Social Sciesnce,

2(4), 162-171.

Otoritas Jasa Keuangan. (2014). Strategi Nasional

Literasi Keuangan. Jakarta: direktorat literasi

dan Edukasi.

Remud, D.L. (2010). Financial literacy explicated:

The case for a clear definition in an increasingly

compex economy. The Journal Of Consumer

Affairs, 4(2), 276-295.

Sabri, M. F., Othman, M.A., Masud, J., Paim, L.,

MacDonald, M., & Hira, T. K. (2008) Financial

behavior and problems among college students

in Malaysia: Research and education

implication. Consumer Interest Annual, 54, 166-

170.

Sagala, G. H., Zainal, A., & Effiyanti, T. (2017).

Attitude Toward Computer-Based Statistics

Among Pre-Service Teacher Candidates.

Proceedings of MAC 2017. MAC Prague

consulting

Sari, R. C., & Fatimah, P. R. (2017). Bringing

Voluntary Financial Education in Emerging

Economy: Role of Financial Socialization

During Elementary Years. The Asia-Pacific

Education Researcher, 26(3-4), 183-192.

Thohiri, R. (2016). Pengaruh Modernisasi Pajak

Terhadap Tingkat Kepatuhan Wajib Pajak di

KPP Pratama Medan Kota. Jurnal Manajemen

Perpajakan. Volume 5: No.2 Desember.

Thohiri, R. (2016). Pengaruh Kecerdasan Emosional

Terhadap Tingkat Pemahaman Perpajakan

Dengan Kepercayaan Diri Sebagai Variabel

Moderating. Bina Akuntansi IBBI. Volume 20:

No.1, Januari.

Widyawati, I. (2012). Faktor-faktor yang

mempengaruhi literasi finansial mahasiswa

fakultas ekonomi dan bisnis Universitas

Brawijaya. Jurnal Akuntansi dan Pendidikan

1(1), 89-99.

Yushita, A.N., (2017). Pentingnya Literasi Keuangan

Bagi Pengelolaan Keuangan Pribadi. Jurnal

Nominal IV(1).Yeni, Putri Anggraeni. (2017).

Pengaruh Pengetahuan Keuangan dan

Pendidikan Keuangan di Keluarga Terhadap

Pengelolaan Keuangan Mahasiswa di

Surabaya. Jurnal Program Studi Manajemen.

Sekolah Tinggi Ilmu Ekonomi Perbanas

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

126