Problem based Learning Module’s on Tax Education

Roza Thohiri

1

and Revita Yuni

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: Problem Based Learning, Module, Tax Education, 4-D Model

Abstract: Economic education students as prospective teachers and the academic community are expected to help the

government educate taxation to the community. But so far there are still many students who complain that

taxation is a difficult subject. Because of the many types of taxes and calculation methods. This study will

test problem based learning based learning modules in taxation courses. This research was conducted to

disseminate problem based learning based modules from previous studies that can be used by students

studying independently. Students understand various types of taxes and how to calculate the amount of tax

imposed on individuals and entities, so they can provide education back to the community. This study uses

the 4D (four-D models) model. Four-D model development consists of 4 main stages, namely: 1) define

(determine material), 2) design (design), 3) develop (development), and 4) dessiminate (dissemination), 3

stages have been carried out in previous research so has produced a valid module and can be used for the

final stage of deployment. The dissemination of taxation modules based on problem based learning tests the

practicality and effectiveness of modules. From the results of this research, a problem based learning

module is generated in the course of taxation which is quite valid, practical and effective. The practicality

value of the module by students is 81.11% and the module can be categorized as practical in the learning

process. The activity value of students from five categories observed in the learning process is 80.97% and

the module can be categorized as effective. Students as prospective teachers and the academic community

are expected to assist the Director General of Taxes in educating taxation to the public in order to increase

public awareness and help the public to do tax calculations and reporting which will increase the tax payer

ratio and increase tax revenue for the state in order to support development.

1 INTRODUCTION

Tax based on legal views is an agreement that arises

because of the law which causes the obligation of

citizens to deposit a certain amount of income to the

state. Tax is an obligation for every citizen who has

been regulated by the Law, because almost 80% of

the state income sources come from taxes, thus

making the government through the Directorate

General of Taxes persistent to collect taxes from the

public.

Education about the importance of taxes needs to

be done, in order to increase public awareness and

compliance in paying taxes and can reduce tax

avoidance practices (tax avoidance) and tax evasion.

Higher education has a strategic role in improving

human resources. Many students think that taxation

is a difficult subject, this can be seen from the low

understanding of the material obtained by students

based on formative values. Factors that influence

material understanding are learning intensity and

learning facilities. Good understanding and learning

facilities are needed in mastering the material.

Learning facilities are complete learning tools both

at home and on campus. One facility that supports

learning intensity is teaching materials in the form of

interactive lecture modules / books.

Based on observations of researchers in the field,

the presentation of modules used by students in the

form of material that is monotonous. So that students

feel bored and less motivated to learn. Departing

from this problem the use of problem based learning

based learning modules is one alternative in

overcoming these problems. The use of Problem

based learning based learning modules aims to

increase student involvement actively in the learning

process. The use of this learning module is expected

to increase student competence in understanding

Yuni, R.

Problem based Learning Module’s on Tax Education.

DOI: 10.5220/0009496301130119

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 113-119

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

113

material and learning independently without the help

of a facilitator.

Preparation of problem based learning based

learning modules has begun with previous research.

From the results of previous studies it has been

produced problem based learning modules with

content material, language and design that are valid

for use by students in taxation subjects. By

presenting the problem based learning module,

students are expected to be able to solve whatever

problems they face.

2 THEORICAL FRAMEWORK

a. Learning Module

Modules are a set of teaching materials that are

presented systematically so that users can learn

independently or without a facilitator / teacher.

Thus, a module can be used as teaching material

instead of the teacher's function. The teacher has the

function of explaining material with sound. A

module must be able to explain material with

communicative language for students according to

their level of knowledge and age. Modules are a way

of organizing subject matter that takes into account

the function of education. The strategy of organizing

learning material contains squencing which refers to

the making of the sequence of presentation of

subject matter, and synthesizing which refers to

efforts to show students the relationship between

facts, concepts, procedures and principles contained

in the learning material. To design learning material

capability categories that can be learned by students,

namely verbal information, intellectual skills,

cognitive strategies, attitudes, and motor skills. The

strategy of organizing learning material consists of

three stages of the thinking process, namely the

formation of concepts, interpretation of concepts,

and application of principles (Santyasa: 2009).

According to Sanjaya (2010: 332-333), the

purpose of using modules in the learning process is

as follows; (a) Increasing the effectiveness and

efficiency of achieving educational and teaching

goals, (b) Encouraging students to be more active in

independent learning, (c) So that the learning

process does not rely too much on the teacher,

meaning that there are or not teachers ) Learners can

find out the results of self-learning in an advanced

manner, (e) Learners can know the results of their

own learning on an ongoing basis, and will know

where their own weaknesses are.

According to the Ministry of National Education

(2008b: 3-4) a module can be said to be good and

interesting if there are characteristics as follows; (a)

Self Instructional, that is through the module,

someone or participant learns to be able to teach

themselves, not dependent on other parties, (b) Self

Contained, that is, all learning material from one

competency unit or sub-competency studied is

contained in one module as a whole The aim is to

provide the opportunity for learners to learn the

learning material that is complete, because the

material is packaged into one whole unit, (c) Stand

Alone (stand alone) ie the module developed is not

dependent on other media or does not have to be

used together with other learning media, (d)

Adaptive modules should have high adaptive power

to the development of science and technology, (e)

User Friendly; the module should be friendly with

the wearer. Information that appears is helpful and

friendly to the wearer, including the ease of the user

in responding, accessing as desired. The use of

language that is simple, easy to understand and uses

general terms.

b. Problem Based Learning

The problem based learning (PBL) learning model

known as the problem-based learning model is a

learning model that uses real problems encountered

in the environment as a basis for gaining knowledge

and concepts through critical thinking skills and

solving problems. The application of the PBL model

can help create learning conditions that originally

only transfer information from lecturers to students

to the learning process which emphasizes

constructing knowledge based on understanding and

experience gained both individually and in groups.

The problems raised in PBL are real problems in the

field.

PBL is a learning method that uses problems as a

first step in collecting and integrating new

knowledge. According to Hmelo-Silver & Barrows

in Fakhriyah (2014) states that the problems raised

in PBL learning do not have a single answer,

meaning that students must be involved in

exploration with several solution paths.

Problem Based Learning learning model shapes

students' thinking abilities that are truly optimized

and developed to be able to solve real problems.

Based on Trianto's opinion (2010: 90) said that

"Problem based learning model is a learning model

that is based on the many problems that require

authentic investigation, namely investigation that

requires real solutions to real problems".

Problem Based Learning learning has a purpose

in its application in the learning process. As for

Suyanto and Jihad (2013:154) argues that: Problem-

based learning is designed to (a) help students

develop thinking skills and problem solving skills,

(b) learn the role of adults authentic, and (c)

becoming independent learners. The aim of using

this model is to provide students with the basic

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

114

abilities to be able to solve the problems they face.

With Problem Based Learning learning can direct

students to be able to solve problems scientifically

by using critical thinking patterns, reflective,

rational and innovative. So that it can be applied in

the process of solving problems related to everyday

life.

c. Tax

Soemitro dalam Resmi (2013), said that: "Tax is a

people's contribution to the state treasury based on

the law (which can be forced) by not receiving

reciprocal services (contra) that can be directly

shown, and which are used to pay for public

expenses". Meanwhile, based on Law Number 16 of

2009 concerning General Provisions and Procedures

for Taxation in Article 1 point 1, it states that: "Tax

is a compulsory contribution to the State owed by an

individual or an entity that is compulsory under the

law by not receiving compensation directly and used

for the purposes of the State for the greatest

prosperity of the people ". Based on the tax

definition above, it can be concluded that the tax

must have 4 (four) elements, namely contributions

from the people to the state, based on the law, do not

get lead or counter-direct services and are used to

finance state households.

From the elements inherent in the definition of

tax, there are two functions of tax collection,

namely: 1. Budgetair function, where taxes are a

source of state income. 2. Regular function, where

tax as a source of income can also be used as a

regulator in various aspects, such as social,

economic, cultural and income distribution.

d. Learning achievement

Learning is a process of changing behavior as a

result of interaction with the environment.

According to Slameto (2013:2) "Learning is a

business process carried out by someone to obtain a

change in new behavior as a whole, as a result of his

own experience in interaction with his environment"

Sardirman (2011:19) says that "Learning is always a

change in behavior or appearance, with a series of

activities such as reading, observing, listening,

imitating and so forth".

Sagala (2012:50) says that "The essence of

learning seen from psychology is a change in

maturity for students as a result of learning while

viewed from the process is the interaction between

students and educators as a learning process". It can

be said that learning is a process of change in

behavior experienced by students and the results of

changes in behavior that can be said to be the result

of learning. In accordance with the opinion of

Purwanto (2011:24) who said "Learning is a change

in behavior so that learning outcomes are the result

of behavioral changes. Learning outcomes are

behavioral changes due to the educational process in

accordance with educational goals ". Sudjana

(2009:22) states "Learning outcomes are abilities

possessed by students after he receives his learning

experience". In addition, Suprijono (2010:5) says

"Learning outcomes are patterns of actions, values,

understandings, attitudes, appreciation and skills".

3 RESEARCH METHOD

a. Research Approach

Based on the purpose of the research is to produce a

problem based learning based learning module that

is valid, practical, and effective, this research

approach is development research. According to

Putra (2012: 70) research and development is a

systematic study of scientific knowledge that is

complete or understanding of the subject under

study. The development model and development

procedures are as follows: Development Model, this

study uses a 4D model (four-D models). According

to Thiangarajan in Trianto (2011: 184) the

development of a four-D model consists of 4 main

stages, namely: 1) define (determine the material), 2)

design (design), 3) develop (development), and 4)

dessiminate (spread).

In this study only carried out until the develop

stage, the desseminate stage was not carried out.

Development Procedure, this module was developed

using the four D (4-D) model, namely defining,

designing, developing and disseminating stages.

The module design steps can be specified as

follows: develop. This stage aims to produce a

practical and effective problem based learning based

learning module. The development phase includes:

1. Practicality. After the test phase the validity is

revised and then tested to find out the

practicality. Practicality is the practicality of the

module when used in the learning process. This

activity aims to determine the extent of ease of

use, benefits and efficiency of learning time

using problem based learning based modules.

The practicality of the module is assessed by

lecturers (colleagues). The lecturer gives an

assessment of the problem-based learning

module that is easy to use in the learning

process and can help lecturers in the learning

process. Practicality by students to see

convenience for students in the learning process

by using problem based learning based

modules.

Problem based Learning Module’s on Tax Education

115

2. Effectiveness. The assessment of the

effectiveness aspects of the taxation module

based on problem based learning is the result of

cognitive evaluation, namely the results of

student learning tests and student activities

during the learning process.

b. Location and Research Subjects

This research was conducted at the Faculty of

Economics, Medan State University. The research

subject of developing a problem based learning

based learning module that is valid in taxation

courses is the students studying Economics

Education, Faculty of Economics, Medan State

University. The criteria used as location selection

and research class are the conditions of students who

are in accordance with the needs of researchers

where the class has never used problem based

learning based learning modules.

c. Technique and Data Collection Tool

Tools or instruments are one of the tools for data

collection. The means of collecting data in this

development research is a questionnaire.

Questionnaires are used to obtain practicality data

and learning evaluation results to see effectiveness

data. The research instruments developed for data

collection in research are instruments of practicality

and effectiveness.

The type of instrument that will be developed to

assess the modules that have been compiled is to use

practical sheets. Practical sheets contain aspects of

assessment which include ease of use

(learnability),effectiveness,effectiveness of time.

This effectiveness instrument is used to collect data

to see the effectiveness of the module in the learning

process. Effectiveness instrument consisting of:

Student Activity Observation Sheet

The observation sheet of student activities is

used to obtain data about student learning activities

during the learning process. Observations were made

by 1 observer. Recording of observations is carried

out in accordance with predetermined indicators.

The categories of student activities by observers

are as follows:

a) Read the module and do problem orientation

b) Students ask questions while taking lessons

c) Answering questions from lecturers and from

other students

d) Summarizing learning outcomes

e) Answering exercises and understanding tests

f) (modified from Trianto, 2012: 368-369)

d. Learning outcomes

Evaluation of student learning outcomes is done

by means of a final test, to see students'

understanding of problem based learning based

modules.

e. Data Analysis Technique

Practical Data Analysis

To analyze the practicality of the module is based on

questionnaires given to lecturers (colleagues) and

students. Questionnaires are arranged on a Likert

scale with a positive category. Positive statements

get high weight with details as follows:

a. a.very good (SB) with weight 5

b. b.good (B) with weight 4

c. c.enough (C) with weight 3

d. d.less (K) with weight 2

e. bad (J) with weight 1

By using a modified formula from (Lubis,

2009:87).

Degreeofachievement

∑

∑

highestscale

100

Modified

Degreeofachievement

∑

eachitem

∑

highestscore

100

The level of achievement of the module practicality

category uses the classification in the table below.

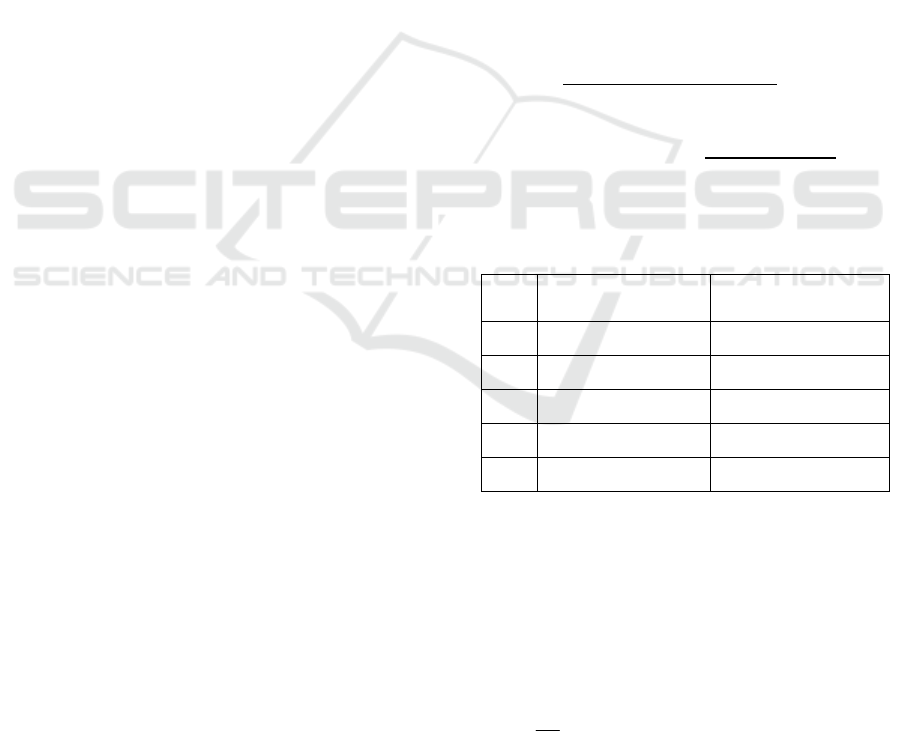

Table 1: Module Practical Level Table

N

o Performance

Achievement (%)

Categor

y

1 90-100 very practical

280-89

p

ractical

3 65-79 quite practical

4 55-64 less practical

5 0-54 very less practical

The module is said to be practical if it has reached a

level of practicality above 80%. (Lubis, 2009: 87)

Effectiveness Test Data Analysis

Effectiveness observed from the analysis of student

learning outcomes is the cognitive learning

outcomes. Determining student completeness

(individuals) can be calculated using the following

equation:

%100x

Tt

T

KB

KB = Mastery Learning

T = Number Of Score

Tt = Total Score

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

116

%100x

N

F

P

Information:

P = Percentage of student activities

F = Frequency of active student

N = Total of student

Data on the percentage of student activities obtained

grouped according to the following criteria:

81% - 100% = very active

61% - 80% = active

41% - 60% = quite active

21% - 40% = less active

0% - 20% = very less active

Modules are said to be effective if students meet the

criteria of 41% -100%.

4 RESULS AND DISCUSSIONS

Use Module

The problem based learning module limited trial is

conducted on Regular B class students in Economic

Education Study Program, Faculty of Economics,

Medan State University. The test serves to assess the

practicality of the module by students as module

users. The effectiveness of the module can be seen

as activity or student activities during the learning

process using modules. In addition, it is also an

evaluation to see student learning outcomes.

Module Practicality

Module practicality assessment is assessed by

students as module users. The problem based

learning module practicality is assessed by the

Regular B class students of the Economic Education

study program who are also the subject of module

trials. After the assessment of the module based on

problem-based learning practices by students, data

analysis was then carried out. The results of data

analysis can be seen in the table below.

Table 2: Practicality Results

N

o

Variable Achievemen

t rate (%)

Category

1 Learnabilit 80,53 practical

2 Efficiency 80,18 practical

3 effectivene

ss of time

82,63 practical

Average 81,11 practical

The results of practical assessment data analysis by

Regular Class B students of Economic Education

Study Program and also as the subject of problem-

based module based testing consisting of three

variables, namely 1) Learnability with derjad

achieving 80.53% categorized as problem based

learning based modules practical for users, 2)

80,18% efficacy with alphabet is practically used in

the learning process, 3) effectiveness of time with

alphabetical achievement of 82,63% categorized as

practical problem-based learning modules can

streamline the time in the learning process. The

practical value of modules by students achieving

81.11% and modules can be categorized as practical.

Module Effectiveness

Assessment of effectiveness serves to observe the

effectiveness of the modules used in the learning

process. To get the results of the effective module

based on problem based learning, observations of

student activities were carried out during the

learning process and learning outcomes.

Student Activities

The problem based learning taxation module based

trial is conducted in four meetings where 2 observers

observe each meeting. The names of observers in

this study can be seen in the table below.

Table 3: Name Observer Student Activities

No Name Information

1

Revita Yuni,

S.Pd, M.Pd

Dosen Pendidikan

Ekonomi, Unimed

2 M. Aulia

Mahasiswa

Pendidikan Ekonomi

The categories of student activities by observers are

as follows:

1. Read the module and do the exercises

2. Students ask questions when following learning

3. Answering questions from lecturers and from

other students

4. Summarizing learning outcomes

5. Complete the task

The first activity is to read the module and do the

exercises. The percentage of student activities

reading modules and doing exercises from the first

meeting to the fourth meeting were 100%, 97.36%,

100%, 94.73%, and with an average of 98.09% in

the very active category. Students who are absent or

permits are categorized as not carrying out activities.

From the results of observations, students are very

active in reading modules and doing exercises.

Problem based Learning Module’s on Tax Education

117

The second activity is that students ask questions

while following the learning process. The percentage

of student activities from the first to the fourth

meeting were 78.94%, 65.78%, 67.10%, 73.68% and

with the average student activity 71.37% categorized

as active students. From the data above students are

asking questions at the second meeting and when

stable and increasing in the next meeting. In

addition, a variety of students also asked questions at

each meeting. It can be stated that learning using

modules can motivate students in the learning

process.

The third activity is to answer questions from

lecturers and from other students. The percentage of

four meetings is 68%, 68.42%, 71.05%, 78.94% and

with an average student activity of 71.60% it can be

categorized as an active student. From the above

data it can be stated that students respond to

questions from lecturers and other students always

increasing at each meeting.

The fourth activity is to conclude the learning

outcomes. The percentage of four meetings is

63.15%, 59.21%, 69.73%, 78.94%, and with an

average student activity of 67.75% can be

categorized as active students.

The fifth activity is to complete the task. The

percentage of four meetings is 100%, 94.73%,

94.73%, 94.73%, and with the average student

activity 96.04% can be categorized as very active

students. Because the completion of assignments for

students at the end of each lesson is the

responsibility of each individual.

The average student activity of each category

from four meetings in general can be seen in the

table below.

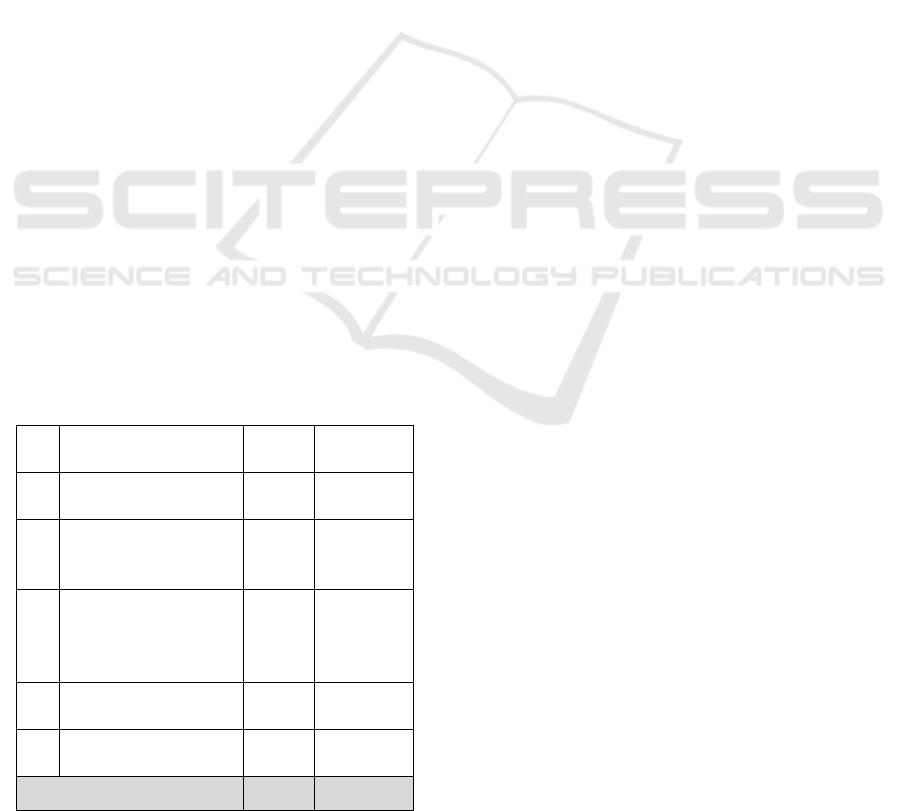

Table 4. of Results of Achievement of Student

Activities

N

o

Category Of

Activities

% Criteria

1

Read the module

and do the exercises

98,09

Very

active

2

Students ask

questions when

following learning

71,37 Active

3

Answering

questions from

lecturers and from

other students

71,60 Active

4

Summarizing

learning outcomes

67,75 Active

5 Complete the task 96,04

Very

active

Average 80,97 Active

The results of the observation analysis, 5 categories

of student activities during the learning process with

the achievement of 80.97% were categorized as

active students. Students who are declared graduated

are as much as 70% of existing learning outcomes.

Learning Outcomes

Learning outcomes are based on the results of data

analysis, graduating students totaling 33 people and

students who were declared not to pass 5 people.

The percentage of students who graduated was

86.84% and 13.16% of students were declared not

graduated. From the results of the evaluation above,

based on the established theory the learning process

is effective because it is more than 85%.

5 CONCLUSIONS

The description of the data and the discussion above

can be summarized as follows:

1. A problem based learning module has been

produced in taxation courses that are quite valid,

practical and effective.

2. The practicality of modules by students is

81.11% and modules can be categorized as

practical in the learning process. The value of

student activities from the five categories

observed in the learning process, 80.97% can

categorize active students and modules are

categorized as effective.

REFERENCES

Putra, Nusa. (2012). Research & Development Penelitian

dan Pengembangan: Suatu Pengantar. Jakarta:

Rajawali Press.

Purwanto. (2011). Evaluasi Hasil Belajar. Jakarta :

Pustaka Belajar

Sagala, Syaiful. (2012). Konsep dan Makna Pembelajaran.

Bandung : Alfabeta

Sanjaya, Wina. (2010). Kurikulum dan Pembelajaran,

Teori dan Praktek Pengembangan KTSP. Jakarta:

Kencana

Slameto. (2013). Belajar dan Faktor-faktor yang

Mempengaruhi. Jakarta : Rineka Cipta

Soemitro.(2015).http ://www. seputarpengetahuan.com

/2015/03/12-pengertian– pajak – menurut – para –

ahli -terlengkap.html di unduh tanggal 29 April 2016

Suprijono, Agus. (2010). Cooperatve Learnng Teori dan

Aplikasi PAIKEM. Yogyakarta : Pustaka Belajar

Suyanto dan Jihad. (2013). Menjadi Guru Profesional.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

118

Jakarta : Erlangga

Sudjana. (2009). Penilaian Hasil Proses Belajar Mengajar.

Bandung : Remaja Rosdakarya

Trianto. (2010). Mendesain Model Pembelajaran Inovatif

Progresif. Jakarta : Kencana

Trianto. (2012). Mmendesain Model Pembelajaran

Inovatis-Progresisf. Jakarta: Kencana.

Sanjaya, Wina. (2010). Strategi Pembelajaran Berorientasi

Standar Proses Pendidikan. Jakarta: Kencana.

Problem based Learning Module’s on Tax Education

119