Accounting Anxiety in Accounting Education: A Case Study on

Accounting Undergraduate Students in Universitas Negeri Medan

Choms Gary Ganda Tua Sibarani

1

, Andri Zainal

1

and Ulfa Nurhayani

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: Accounting Anxiety, Accounting Students, Factors Analysis

Abstract: Extant studies highlight that accounting anxiety is as an individual fear or fear of accounting in terms of

understanding accounting concepts, applying economic events by completing the accounting cycle,

preparing final accounts, interpreting, analyzing, and communicating financial information useful for

decision-making purposes. this study to ascertain whether there is a difference between accounting and non

accounting educational students Unimed accounting and what factors influence it. Seen from the

independent sample t test found that T test table is 2,0024 and the sig value is 0, 30 <0, 05 which means that

there are differences in accounting anxiety. then there are 4 factors that affect accounting anxiety that is

cognitive anxiety, anxiety, confidence, and doubt seen from result of factor analysis test. The population in

this study are students of Accounting Education and Non-Education Accounting Student, Faculty of

Economics Unimed of batch 2015 that were engaged in academic year of 2017/2018. The sampling

procedure used a Purposive Random Sampling. The sample in this study consisted of 60 samples taken

summed up from 30 samples representing each department as respondent.

1 INTRODUCTION

Accounting in general has been widely known as a

discipline that studies measurement, reporting or

assurance providers regarding financial information

that will help managers, investors, tax authorities

and other decision makers in policy making. who

can provide financial and non-financial effects in

companies, organizations and government

institutions. Mastery of the competencies in question

makes accountants as one of the professions that

have bright career prospects in the professional

world. So that helped make the accounting

department as one of the most popular study

programs by the majority of high school (SMA)

graduates. This can also be seen from the graph of

specialization of study programs at Universitas

Negeri Medan (UNIMED) which places the

Accounting and Accounting Education study

programs in the top 10 (ten) study programs of

favorite choice of high school graduates in the last

five years.

However, mastering the competencies related to

accounting at the tertiary level has its own

challenges and obstacles that must be a serious

concern for policy makers in increasing the added

value of graduates. Zakiah (2013) specifically

criticizes that accounting education that has been

taught at high ranking tends to be impressed as a

mechanism-oriented knowledge in general, which is

inversely proportional to the practices actually faced

in the world of work later. Identical conditions are

also found in the teaching and learning process in

classrooms where relative students perceive

accounting knowledge as a difficult science with

mastery and memorizing demands for accounting

accounting techniques that make student accounting

competencies less optimal (Franco and Roach ,

2017; Duman et al., 2015; Buckhaults and Fisher,

2011; Malgwi, 2004).

The need to find the best and practical

formulation to make accounting as a fun discipline

both in theory and practice is a central implication in

this study. The complexity of accounting science

coupled with the dynamics of racing against time in

learning process materials related to accounting

without realizing it makes PBM static and

procedural for students and lecturers. Analysis of

accounting anxiety to these two objects (students

Sibarani, C., Zainal, A. and Nurhayani, U.

Accounting Anxiety in Accounting Education: A Case Study on Accounting Undergraduate Students in Universitas Negeri Medan.

DOI: 10.5220/0009496201050112

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 105-112

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

105

and lecturers) becomes important and

comprehensive to be studied in depth so that it can

make a significant contribution to improving the

output of alumni who have added value, especially

in facing the demands of the workforce. In addition,

in a more general and sustainable context, by

identifying and analyzing anxiety accounting

educators can also provide input for relevant policy

making to improve pedagogical and professional

competence of accounting lecturers and accounting

education, especially in the UNIMED environment.

Reviewed from an epistemological point of view;

The structure and method of this research refers to

the Processing Efficiency Theory which is the basis

for thinking in associative and comparative testing

between accounting anxiety and academic

performance in accounting students and educators in

the UNIMED environment.

Implementation of standard lectures / PBM at

UNIMED based on the Indonesian National

Qualifications Framework (KKNI) which is directed

to improve student competence through six ways

called 6 (six) tasks, namely: routine assignments,

textbook reviews, academic journal reviews (critical

journal report), idea engineering, mini research and

project since the 2016/2017 academic year also

brought important issues in this study, This is due to

relatively different preparations in the pre and post

implementation of learning process under KKNI

standards what is meant is particularly good among

UNIMED's lecturers and accounting students so that

it also influences the accounting anxiety profile in

the two study objects in question. However, as far as

the proposer team's knowledge is concerned, there

have been no relevant studies in analyzing the

effectiveness of the standard implementation of IQF-

based lectures on accounting anxiety among students

and accounting lecturers.

This study focuses on the analysis of accounting

anxiety (Accounting Anxiety) and the application of

the KKNI-based lecture standard on UNIMED

accounting education students based on an empirical

study of the Perspective of the Processing Efficiency

Theory aimed at:

(1) explore factors relevant to accounting anxiety

among students in accounting education study

programs;

(2) reviewing accounting anxiety profiles among

students in accounting study programs and

accounting education;

(3) analyze differences in accounting anxiety

among students in accounting study programs and

accounting education; and

Accounting Anxiety: Definition and Impact on

Academic Performance of Students and

Accounting Educators

Prior studies have highlighted the role of anxiety as

one of the main obstacles in achieving individual

academic performance (see Franco and Roach, 2017;

Duman et al., 2015; Buckhaults and Fisher, 2011;

Malgwi, 2004 and; Ameen et al., 2002). Although

there is not yet one standard definition of accounting

anxiety - given that the majority of empirical

literature and studies are dominated by research in

the field of computer anxiety - but does not deny the

fact that users (accounting), especially at the level of

higher education also experience anxiety conditions

that are identical with conditions on computer

anxiety and similar anxiety in other fields of science

such as mathematics, chemistry, and language

(Malgwi, 2004). When the intended accounting user

is a student and educator / lecturer experiencing

anxiety in learning process, it will have a negative

impact on their academic performance related to the

field of accounting science.

Epistemologically, this phenomenon is

specifically reflected in processing efficiency theory

by Eysenck and Calvo (2002). Processing efficiency

theory articulates anxiety as a concern that comes

from two interrelated forms of anxiety: emotional

state anxiety and innate anxiety (anxiety trait) which

has implications for decreased motivation in

completing a job and aversive behavior. According

to Eysenck and Calvo (2002), decreasing motivation

in completing tasks that are sometimes followed by

unpleasant behavior activities will ultimately have a

direct impact on the decline in individual

performance which confirms a significant

correlation between anxiety and performance.

In this study, the definition of accounting anxiety

that is relevant to the theory of processing efficiency

refers to the terminology developed by Malgwi

(2004). The terminology in question defines

accounting anxiety as fear and / or concern of

individuals involved in accounting science in terms

of understanding accounting concepts, completing

the accounting cycle, interpreting, analyzing, and

communicating financial information that is useful

for decision-making purposes. In addition, Malgwi

(2004) argues that accounting anxiety also includes

conditions of fear and / or concern in the use of

applicable accounting software, taking part in public

accountant certification (CPA) and other accounting

concentration certifications that describe anxiety.

accounting for professional accountants. Concern

about failure to achieve the ideal level of

professional competence caused by failure and

negligence in achieving these professional

certifications is one form of accounting anxiety

experienced by educating accountants.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

106

Based on the premise that has been described in

the previous paragraph, this research underlines

accounting anxiety and its role in academic

performance / performance which is viewed from

the perspective of students (Franco and Roach,

2017; Duman et al., 2015; Malgwi, 2004) and

accounting educators (Ameen et al., 2002). Through

an integrative study of accounting anxiety from two

perspectives: students and educators can provide

comprehensive and complementary studies in

reducing the negative impact of accounting anxiety

in real terms. Thus, with a decrease in accounting

anxiety, especially in PBM, it will provide a

significant stimulus to academic achievement on

both sides.

Accounting Anxiety and Performance of PBM

Pre and Post Implementation of Standards for

Lectures based on IQF at UNIMED

Quoted from the official UNIMED page

(https://www.unimed.ac.id/2016/09/13/unimed-

susun-standar-perkuliahan-kurikulum-kkni/) the

implementation of the KKNI-based lecture standards

has begun since the odd semester lecture process for

new students in the 2016/2017 academic year. The

special character of this KKNI-based lecture

standard involves aspects of knowledge, skills and

attitudes. As stated by the UNIMED Chancellor,

Prof. Dr. Syawal Gultom, M.Pd., through the

implementation of lecture standards based on the

KKNI. student competence will be fostered through

six ways called 6 (six) tasks, namely; routine

assignment, critical book report, critical journal

report, idea engineering, mini research and project.

The legal basis in the drafting of the lecture plan

designed refers to Permenristekdikti Number 44 of

2015. In article 12 it is stated that the semester

lecture plan is established and developed by

lecturers independently or jointly in the expertise

group of a field of science and / or technology in the

study program. The design of the lecture standard

for this KKNI curriculum will be the reference for

all lecturers in designing, implementing and

evaluating the lecture process carried out in the

class. This is intended to accelerate advanced

campus performance which must have lecture

standards with special autonomy to the lecturers to

arrange according to the characteristics of their

respective studies. If there are already standards for

planning, implementing, and evaluating, the lecturer

can only develop it to be carried out in lectures.

These six tasks become a new pattern in the lecture

process that will be applied by lecturers in the odd

semester of the 2016/2017 academic year. The

UNIMED Chancellor reaffirmed that there is no

single subject that is not appropriate when applied to

these six tasks. Logical and practical justification of

the application of the six tasks basically because all

subjects must have a source / literature, in the form

of books, journals and related research results.

Furthermore, the implementation of the standards

of lectures based on IQF provides a special

challenge for students and educators in the

UNIMED environment. In particular, this demand

has relatively had an impact on the increase in

significant academic anxiety compared to the

previous application of lecture standards that were

conventionally focused on students (student learning

center / SCL). However, there is no scientific study

that can provide empirical evidence of this

hypothesis. Thus, the initiative to investigate the

effect of accounting anxiety on the implementation

of the IQF-based lecture standards for each student

and accounting education at UNIMED will provide

meaningful PBM evaluations to improve the

implementation of the IQF-based lecture standards

on an ongoing basis in the intended scientific field.

2 METHODOLOGY

2.1 Research Method

This study uses research methods using a

quantitative approach and the type of research is

explanative which is comparative, this method is

used to explain differences and factors that influence

the variables contained in the study (Sugiyono,

2007).

Factor analysis is an analysis that aims to find

the main factors that most influence the dependent

variable from a series of tests conducted on a series

of independent variables as a factor. Especially for

Factor Analysis, the following assumptions must be

met:

1. Correlation between Independent variables. The

correlation or correlation between independent

variables must be strong enough, for example

above 0.5.

2. Partial Correlation. The magnitude of the partial

correlation, the correlation between the two

variables by considering the other variables,

must be small. In SPSS detection of partial

correlations is given through the Anti-Image

Correlation option.

3. Testing all correlation matrix (correlation

between variables), measured by the Bartlett

Test of Sphericity or Measure Sampling

Adequacy (MSA). This test requires a

significant correlation between at least a few

variables.

4. In some cases, the assumption of normality of

the variables or factors that occur should be

fulfilled.

Accounting Anxiety in Accounting Education: A Case Study on Accounting Undergraduate Students in Universitas Negeri Medan

107

2.2 Population and Samples

The population and sample in this study were

Accounting Education students and Non-Accounting

Education students, Unimed Faculty of Economics

for the 2015 academic year 2017/2018 in the even

semester. The reason researchers conducted research

in the 2015 class because according to the 2015

scholarship students had taken accounting courses as

a whole so the researchers wanted to know the level

of anxiety about the accounting subject. The

sampling method is done by using Purposive

Random sampling. The sample in this study 60

samples taken from 30 samples representing each

department as respondents to be given a

questionnaire (questionnaire).

3 RESEARCH METHOD

Descriptive Statistics from Questionnaire

Table 1: Questionnaire

No Indicators Accounting

Education

Students of

2015

Accounti

ng

Students

of 2015

1 Learning accounting

provides an interesting

challenge

4,2333 4,1667

2 Learning accounting can

improve my competence

as a student and

prospective worker in

the future

4,1333 3,9000

3 I don't like learning

accounting because the

lessons are not fun and

difficult for me

3,7667 3,7333

4 I feel the difficulty in

understanding the

accounting system is

working / functioning

3,9667 3,7667

5 I think learning to

understand accounting

can make me a

p

roductive individual

3,6333 3,6333

6 I feel uncertain about

my ability to present,

analyze, translate

financial reporting.

3,9000 3,6000

7 I am very excited to

present, analyze and

translate accounting

reports

3,4000 3,2000

8 I'm sure I'm not

sure that I will be able

to study the accounting

syste

m

3,8000 3,6667

9 I am confident with

myself, that I can study

and study accounting I

will get accounting

expertise

4,0000 3,8667

10 I think everyone will be

able to activate the

application of

3,9000 3,8000

accounting information

systems if they have

motivation and practice

what they have learned.

11 Learning accounting

will give new skills, the

more you practice the

b

etter the results.

4,4000 4,1000

12 I began to worry about

using accounting

software, I would

become dependent on

the software and lose

my analytical skills.

3,7667 3,4333

13 I am sure that the more I

practice with accounting

software, the more I will

get used to using it as I

do now using software

3,6000 3,3667

14 In my opinion, I will be

able to complete my

competence with the

demands of the

accounting profession /

accounting education

p

rofession.

3,6333 3,4000

15 I am worried that if I

apply the wrong

accounting principles, I

will be able to cause the

resulting financial

statements to be wrong

3,4667 3,2667

16 I am hesitant to use

accounting software for

fear of making a

mistake and I cannot

correct the erro

r

3,1000 3,2333

17 People who can

understand transactions

- adjusting journal

accounting transactions

in completing an

accounting cycle are

smart people

3,4333 3,4667

18 If I get a chance I will

study and practice the

use of accounting

software.

3,4667 3,7333

Difference in Accounting Anxiety Test

Data Normality Test

The purpose of the data normality test is to

determine the distribution of data in the accounting

anxiety variable that will be used in this study.

If the significance value is <0.05, the data is not

normally distributed

If the significance value is> 0.05, the data is

normally distributed

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

108

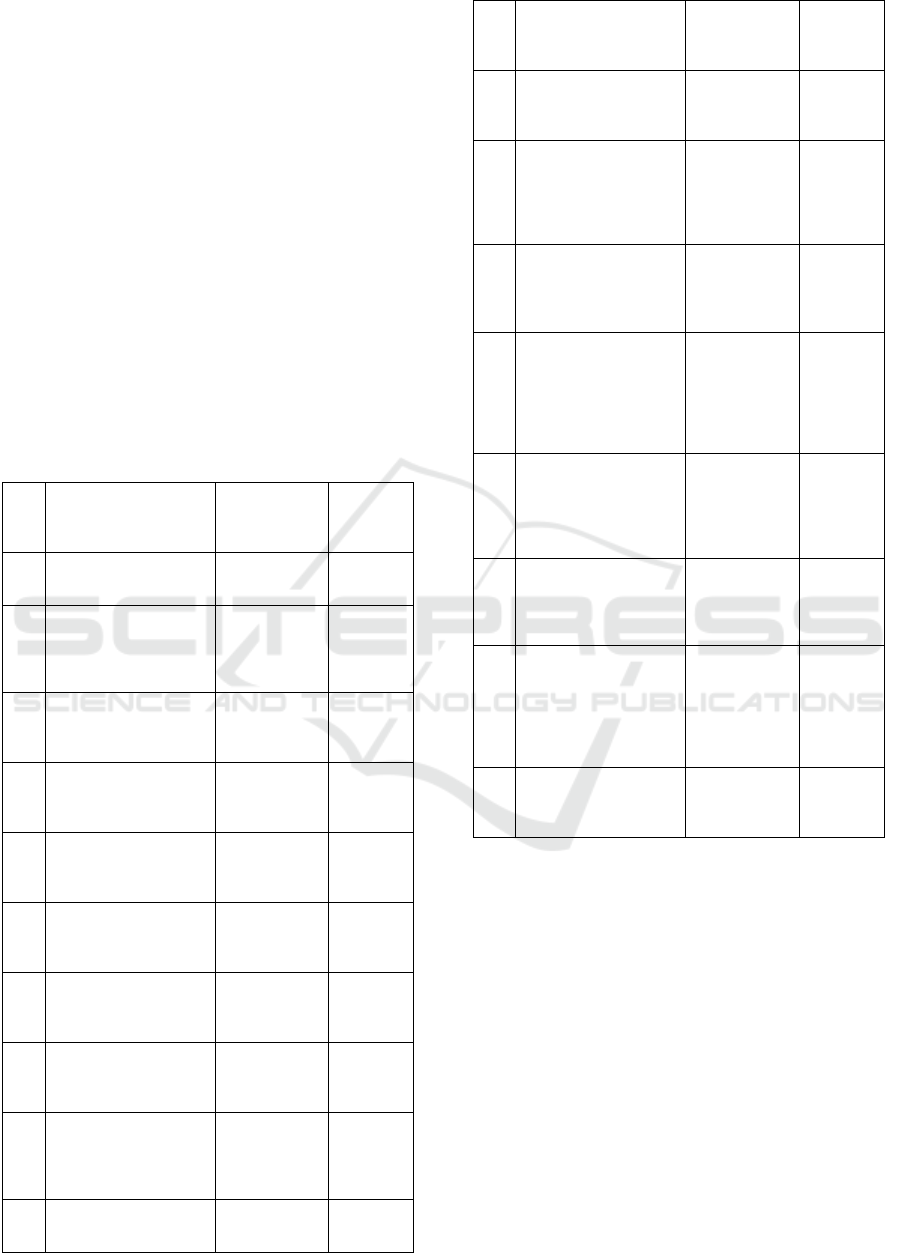

Table 2: Data Normality Test

From the results of the table above seen from

Shapiro-wilk significance value> 0.05, it can be said

that the data is normally distributed.

Homogeneity Test

To test the homogeneity of the data is used to

determine whether variant 2 is the same or different

population.

/

Table 3: Homogeneity Test

If the significance value > 0.05, the data used is

homogeneous. After the data is normally distributed

and homogeneous then conducted an Independent

Sample T Test to see the differences in accounting

anxiety of accounting education students with

accounting non-education.

Independent Sample T-Test

In this study the aim is to compare two sample

groups, each of which is different so that there are

indications to direct researchers to use statistical test

methods, namely Independent Sample T-Test

(Ghozali, 2009).

Table 4: Independent Sample T-Test

Basic Decision Making in T Test

H0 is accepted and H1 is rejected if the value of

t-counts < t-table or if the value of sig > 0.50

H0 is rejected and H1 is accepted if the value of

t-counts > t-table or if the value of sig < 0.50

Based on the results of the analysis found that

there are differences in accounting anxiety between

students of Accounting Education with Non-

Education Accounting, seen from the 2-tailed sig

value in the Independent Sample T Test of 0.030

which means <0.05.

After finding the difference, the researcher

continued the research to examine the factors that

influence the accounting anxiety, namely by using

the factor analysis test below.

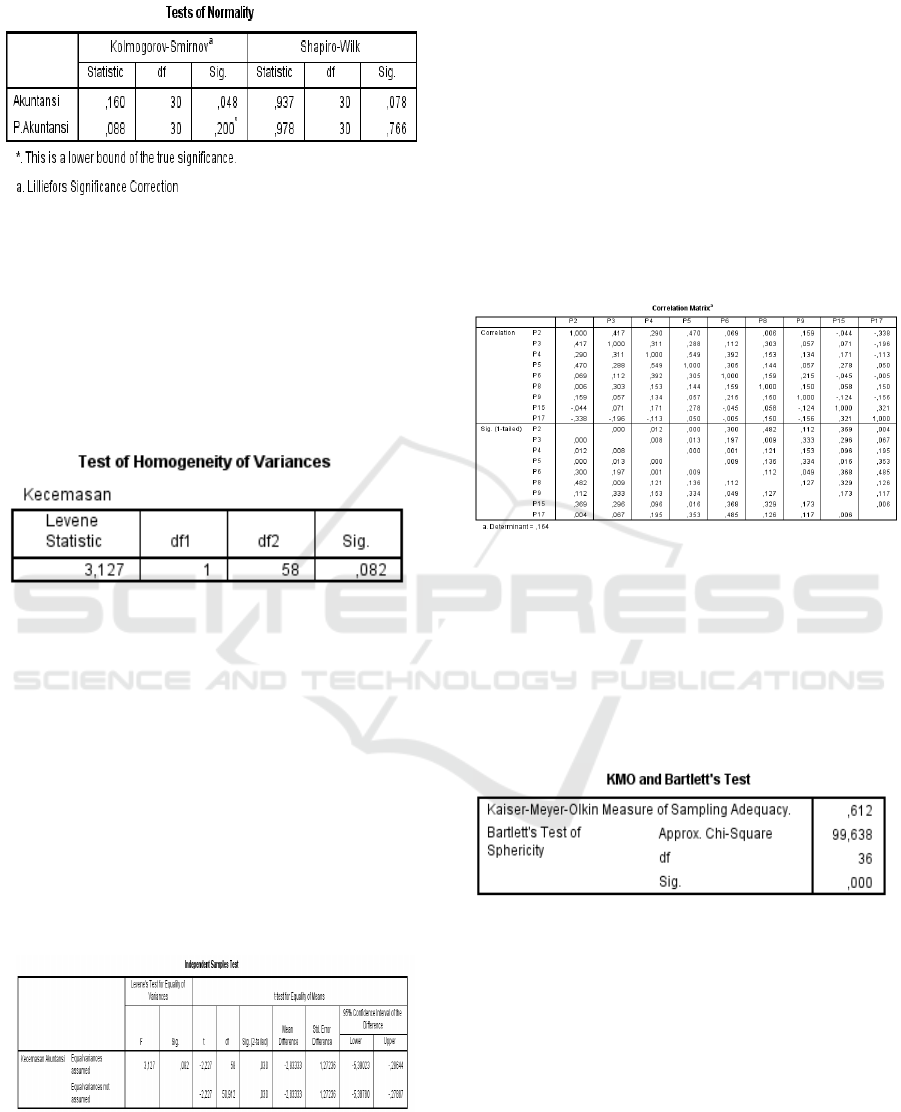

Factor Analysis

Table 5: Factor Analysis

Correlation matrix is considered to be

interrelated when the determinant is close to 0. The

determinant results are close to 0. The calculation

results show a value of 0.164. This value is close to

0, with the correlation matrix between the

interrelated variables.

We tested the assumption of factor analysis one

by one before the factor analysis test is carried out.

Table 6: KMO and Bartlett’s Test

Correlations between independent variables, in

factor analysis, must be> 0.5 with significance

<0.05. The significance of the research is 0,000.

From the results above obtained KMO value of

0.612 which means greater than 0.5. Meanwhile, the

significance generated from Bartlett's Test of

Sphericity is 0,000. With the results above, it can be

said that the variables and samples used allow for

further analysis.

Accounting Anxiety in Accounting Education: A Case Study on Accounting Undergraduate Students in Universitas Negeri Medan

109

Table 7: Correlations between independent variables

Furthermore, to see the partial correlation can be

observed Anti-Image Matrices table. The value

considered is MSA (Measure of Sampling

Adequacy). MSA values range from 0 to 1, with the

following conditions: (Santoso, 2006: 20)

1. MSA = 1, variables can be predicted without

errors by other variables.

2. MSA> 0.5, the variables can still be predicted

and can be analyzed further.

3. MSA <0.5, variables cannot be predicted and

cannot be analyzed further, or excluded from

other variables.

Based on the results of the MSA above, all

independent variables can be further analyzed

because each value is> 0.5.

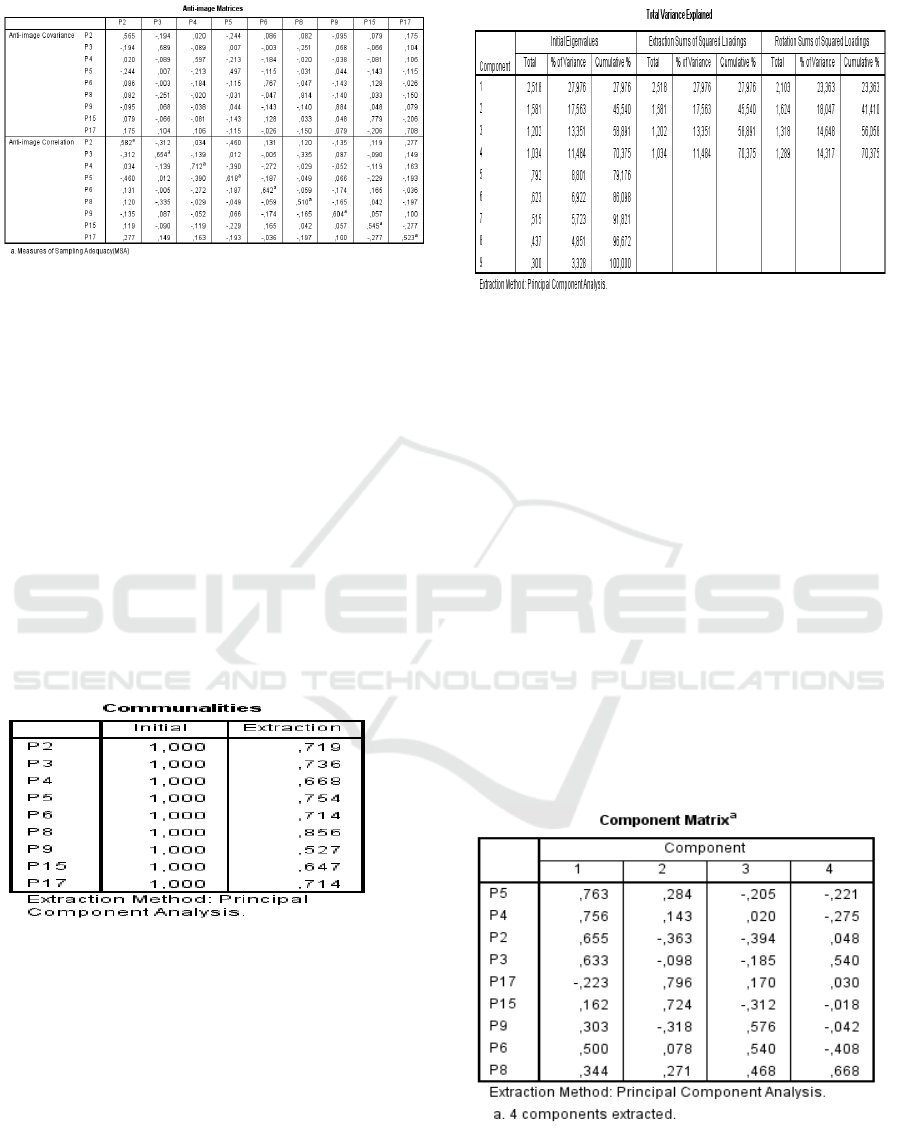

Factors Grouping

Table 8: Factors Grouping

This research effort is to determine whether

independent variables can be grouped into one or

several factors. The purpose of the variable

explanation by the factor is how much that will later

be able to explain the variable. For this reason, you

should see the Communalities table. The result is a

factor capable of explaining the variable because the

average explanation is above 50% then the fixed

factor will be determined.

Possible Factors Formed

In order to determine how many factors that might

be formed can be seen in the Total Variance

Explained table.

Table 9: Total Variance Explained

Components range from 1 to 9 representing the

number of independent variables. Pay attention to

the Initial Eigenvalues column which we determine

the value of SPSS 1. The variance can be explained

by factor 1 is 2,518 / 9 x 100% = 27,976. Factor 2 is

1,581 / 9 x 100% = 17,563. factor 3 is 1,202 / 9 x

100% = 13, 351%. While factor 4 is 1,034 / 9 x

100% = 11,484. And, the total of the four factors

will be able to explain the variables of 27,976% +

17,563% + 13,351% + 11,484% = 70,375%. Thus,

because the value of Eigenvalues is set to 1, the total

values to be taken are those> 1 namely components

1, 2, 3, and 4.

Factors Loading

After we know that the maximum factor that can be

formed is 4, then we determine each independent

variable will be in factors 1, 2, 3 or 4. How to

determine it is to look at the Component Matrix

table as follows:

Table 11: Factors Loading

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

110

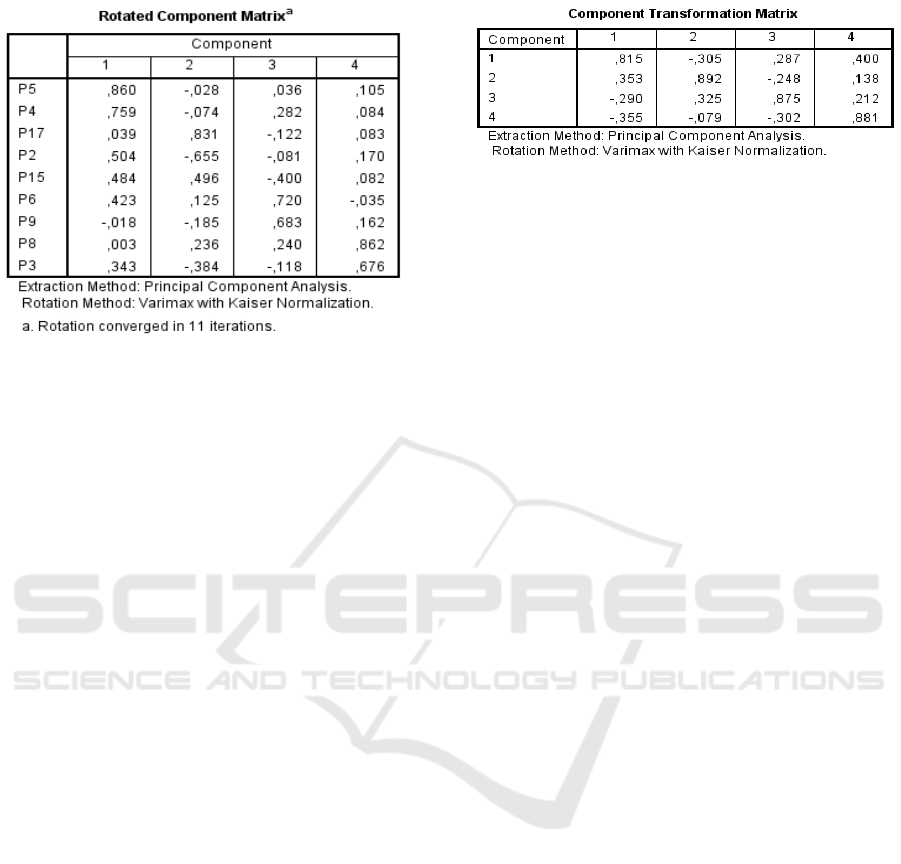

Table 12 :Rotated Component

In determining input variables to certain factors

follows the magnitude of the correlation between

variables with factors, namely to the large

correlation. Seen in the Rotated Component Matrix

table, thus the member factors and variables are:

Factor 1:

a. I feel the difficulty in understanding the

accounting system is working / functioning.

b. I think learning to understand accounting can

make me a productive individual

Factor 2:

a. I am worried that if I apply the wrong

accounting principles, I will be able to cause the

resulting financial statements to be wrong.

b. Learning accounting can improve my

competence as a student and prospective worker

in the future.

c. People who can understand transactions -

adjusting journal accounting transactions in

completing an accounting cycle are smart

people.

Factor 3:

a. I feel uncertain about my ability to present,

analyze, translate financial reporting.

b. I am confident with myself, that I can study and

study accounting I will get accounting expertise.

Factor 4:

a. I don't like learning accounting because the

lessons are not fun and difficult for me.

b. I'm sure I'm not sure that I will be able to study

the accounting system.

Table 13 : Component Transformation Matrix

As the final step of determining factors, you can

see the following Component Transformation Matrix

table: Factors 1, 2, 3 and 4 have a correlation of >

0.5 which means that they are quite strong. Thus it

can be said to be appropriate to summarize the 9

independent variables.

It has been obtained that there are 4 factors

formed, namely Factor 1, Factor 2, Factor 3 and

Factor 4.

Factor 1 contains variables in the form of

cognitive anxiety. Observing from a cognitive

perspective, it is appropriate to recognize that

anxiety can have an adverse or negative effect on

student learning and performance. Students have

varying degrees of anxiety because they are different

when asked to use them, for example computers to

perform tasks (Burket et al. 2001).

Factor 2 contains the anxiety variable. The

creation of anxiety consists of various problems and

mostly depends on the subject matter. Emphasis is

placed on accounting educators to embrace the use

of technology to make accounting and technology

more comparable. For example, previous research

on computer anxiety was associated with various

types of learning styles (Bozionelos 1997).

Therefore, in order to improve student performance,

various types of training or private tutoring are

needed to reduce computer anxiety (Broome and

Havelka 2002).

Factor 3 contains variables that are self-

confidence. Confidence is the ability of individuals

to understand and believe in all their potential so that

they can be used in the face of adaptation to their

environment.

Factor 4 contains a doubtful / doubtful variable

which in the Big Indonesian Dictionary (KBBI)

means that in a state of uncertainty (in making

decisions, making choices) or in doubt.

4 CONCLUSIONS

Based on the results of the analysis it can be

concluded that there are significant differences in

accounting anxiety among students of education and

Non Accounting Education Medan State University.

Accounting Anxiety in Accounting Education: A Case Study on Accounting Undergraduate Students in Universitas Negeri Medan

111

It was seen in the independent sample T test that it

was found that the T test table was 2.0024 and the

sig value was 0, 30 <from 05.05.

Then the result is that there is a significant

difference in accounting anxiety among students in

Accounting Education and Non Accounting

Education at UNIMED. There are 4 factors that

affect accounting anxiety:

1. Cognitive Anxiety

2. Anxiety

3. Self Confidence

4. Doubt

Future studies are suggested to explore more

deeply and add other variables, for example:

previous experience, GPA, gender, and so on. And

also researchers who use qualitative are advised to

dig deeper about the substance of research material

related to accounting anxiety itself.

ACKNOWLEDGEMENT

The researcher would like to thank the Accounting

Education students and Non-Accounting Education

students, Unimed Faculty of Economics who

supports the study.

REFERENCES

Ameen, E. C., Guffey, D. M., & Jackson, C. (2002).

Evidence of teaching anxiety among accounting

educators. Journal of Education for Business, 78(1),

16-22.

Buckhaults, J., & Fisher, D. (2011). Trends in accounting

education: Decreasing accounting anxiety and

promoting new methods. Journal of Education for

Business, 86(1), 31-35.

Duman, H., Apak, İ., Yücenurşen, M., & Peker, A. A.

(2015). Determining the anxieties of accounting

education students: A sample of Aksaray University.

Procedia-Social and Behavioral Sciences, 174, 1834-

1840.

Eysenck, M. W., & Calvo, M. G. (2002). Anxiety and

performance: The processing efficiency theory.

Cognition & Emotion, 6(6), 409-434.

Franco, A., & Roach, S. S. (2017). Factors That Determine

Accounting Anxiety Among Users of English as a

Second Language Within an International MBA

Program. International Journal of Learning,

Teaching and Educational Research, 16(1).

Malgwi, C. A. (2004). Determinants of accounting anxiety

in business students. Journal of College Teaching

and Learning, 1(2), 81-94.

Zakiah, F. (2013). Pengaruh Kecerdasan Intelektual,

Kecerdasan Emosional dan Kecerdasan Spiritual

terhadap Pemahaman Akuntansi. Diunduh dari:

repository.unej.ac.id

Sugiyono (2007). Metode Penelitian Kuantitatif, Kualitatif

dan R&D. Bandung: Afabeta.

Broome, T., D.Havelka. (2002). Determinants of

Computer Anxiety in Business Students. The

Review of Business Information System, Vol. 6,

Number 2.

Ghozali, Imam. (2009). Aplikasi Analisis Multivariate

dengan Program IBM SPSS 21 Update PLS Regresi.

Semarang: Badan Penerbit Universitas Diponegoro.

Bozionelos, N. (1997) Psychology of Computer Use:

XLV. Cognitive Spontaneity as a Correlate of

Computer Anxiety and Attitudes toward computer

Use.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

112