Development of Taxation Teaching Materials with Problem Solving

Approach to Improve Student Learning Outcomes in Unimed

Economic Faculty

OK Sofyan Hidayat

1

and Muhammad Ridha Habibi Z.

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: IQF, Teaching Materials, Problem Solving Approach, Learning Outcome.

Abstract: In this case the government through KEMENRISTEKDIKTI establishes a college curriculum based on IQF.

The IQF is a statement of the quality of Indonesian human resources whose classification of qualifications is

based on the level of ability stated in the formulation of learning outcomes. To support the above, this is

where the role of the lecturer is to facilitate the improvement of student competencies through the

development of teaching materials, learning models, assignments whose completion process is specifically

designed by students so that students have hardskill and soft skills. Specifically, the objectives of this

research are 1) To find out whether the taxation teaching materials in the tax subject in KDBK are

developed in accordance with the latest tax regulations. 2) To implement and foster lecturers in improving

the quality of taxation learning through the use of taxation teaching materials with a tax problem solving

approach in KDBK at the Faculty of Economics, Medan State University. 3) Become a training facility for

lecturers to publish their research results in scientific journals, both locally and nationally accredited and

textbooks (ISBN). This study was designed with a research and development approach with the following

stages of activities: 1) Pre Development 2) Development of instructional materials and learning strategies 3)

Review and product testing 4) Test the effectiveness and application of learning strategies and teaching

materials. The subjects of this study were students of business education programs who took taxation

courses. Data analysis in this research and development uses quantitative descriptive analysis. All collected

data were analyzed by descriptive statistical techniques which were quantitatively separated by categories to

sharpen the assessment in drawing conclusions. Data analysis in this research and development is explained

in three, namely a) data analysis from practitioners and experts / experts, b) data analysis when product

trials, and c) analysis of experimental test data using Gain scores. N-gain testing is done to determine the

improvement of learning outcomes between before and after learning. The results of the study show that

taxation teaching materials as development products are "feasible and quite feasible / attractive / motivated"

improving student learning outcomes shown by the results of scores of 91.67%, 85.71%, and 87.5%. The

use of teaching material products shows an increase in student learning outcomes, which is indicated by the

difference in the mean pre-test score and post-test small group is 2.5 and the large group is 2.76. This means

that the use of instructional materials as a result of development can increase student scores by 25% and

27.6%.

1 INTRODUCTION

At present there have been important changes in the

dynamics of the relationship between higher

education and the world of work, especially related

to the gap between higher education outcomes and

competency demands in the world of work

(Mutmainah, 2006). One of the causes of the rapid

development of science and technology has resulted

in fundamental changes in qualifications,

competencies and requirements to enter the

workforce which has resulted in increasingly intense

competition among graduates so that the increasing

number of educated unemployed due to not

qualifying. In this case the government through

KEMENRISTEKDIKTI establishes a college

250

Hidayat, O. and Habibi Z., M.

Development of Taxation Teaching Materials with Problem Solving Approach to Improve Student Learning Outcomes in Unimed Economic Faculty.

DOI: 10.5220/0009495502500257

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 250-257

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

curriculum based on IQF. The IQF is a statement of

the quality of Indonesian human resources whose

classification of qualifications is based on the level

of ability stated in the formulation of learning

outcomes.

Universities as producers of educated human

resources need to measure their graduates, whether

the graduates produced have 'ability' equivalent to

'ability' (learning outcomes) which has been

formulated in the IQF qualification level. As a

national agreement, the graduates of an

undergraduate program, for example, must at least

have the "ability" which is equivalent to "learning

achievement" which is formulated at the level of 6

KKNI, equivalent Masters level 8, and so on.

Description of learning outcomes in the IQF,

contains four elements, namely elements of attitude

and values, elements of work ability, elements of

scientific mastery, and elements of authority and

responsibility. In this case, UNIMED, especially the

faculty of economics, has applied the IQF-based

curriculum to produce graduates who are highly

qualified and have high competitiveness at the

national and even international levels to answer the

needs of users, who need professionals.

To support the above, this is where the role of

the lecturer is to facilitate the improvement of

student competencies through the development of

teaching materials, learning models, assignments

whose completion process is specifically designed

by students so that students have hardskill and soft

skills. This identifies that the lecturer must be able to

improve the competence of students so that they are

able to compete in the world of work. Development

of taxation teaching materials with a problem-

solving approach is expected to improve student

competencies so that graduates meet the required

qualifications given the increasing need for labor in

the field of taxation.

The taxation course is one of the compulsory

subjects presented at the UNIMED Faculty of

Economics. This course combines theory in the form

of tax regulations that always change along with the

growth and social and economic changes and the

practice of calculating the tax itself. In the previous

learning process, this taxation was traditional where

the lecturer explained the material and gave an

example after the student presented his resume and

the results were very poorly understood by students

because the learning process was done in one

direction and students tended to be passive (just

listen). Therefore, the tax learning strategy will be

changed using Student Center Learning (SCL) with

a problem-solving approach and using taxation

teaching materials that will be changed with a

problem solving approach as well.

This is done considering the student learning

outcomes in the even semester of 2016/2017 shows

the average midterm test score of 68.5 (less) and the

average semester final examination score of 77.5

(enough). Learning evaluation results show that one-

way learning models are less favored by students

because only a few active students participate in the

learning process. In Unimed's environment, in

particular the Faculty of Economics has

implemented the Student Center Learning (SCL)

which demands student creativity but the learning

process is not yet interesting. This is a challenge for

taxation lecturers to create more interesting and not

boring learning so that the ability of students to

master taxation will increase. For this reason

researchers want to develop taxation teaching

materials must use a problem-solving approach by

adjusting the latest tax regulations and raising the

latest issues regarding taxation and adjusting it to

teaching materials.

Problem Formulation

Based on the research background, the problem of

this research can be formulated as follows: 1. Are

the teaching materials for taxation subjects

developed in accordance with the latest tax

regulations 2. How can Student Center Learning

(SCL) learning strategies with problem solving

approaches improve tax learning outcomes at the

Unimed Faculty of Economics 3. How the

implementation of Student Center Learning (SCL)

learning strategies with problem solving approaches

can improve tax learning outcomes at the Unimed

Faculty of Economics 4. Needs analysis is carried

out at the Accounting Department of the Faculty of

Economics, Medan State University in the taxation

courses contained in semester 2.

Research and Development Objectives

This Research and Development aims: 1. To find out

whether taxation teaching materials on the subjects

in the taxation KDBK are developed in accordance

with the latest tax regulations 2. To implement and

foster lecturers in improving the quality of taxation

learning through the use of taxation teaching

materials with a tax problem solving approach in

KDBK at the Faculty of Economics, Medan State

University 3. Become a training facility for lecturers

to publish their research results in scientific journals,

both locally and nationally accredited and textbooks

(ISBN).

Development of Taxation Teaching Materials with Problem Solving Approach to Improve Student Learning Outcomes in Unimed Economic

Faculty

251

2 LITERATURE REVIEW

Student Center Learning Learning Strategies

with a Solving Approach Problem

The learning process is the process of interacting

students with educators and learning resources in a

learning environment (Siti Mutmainah, 2011).

Handoko (2005) states that as educators are required

to be able to choose the most accommodating and

conducive learning method so that students can

understand something delivered. Many learning

goals can be developed ranging from gaining

knowledge, developing concepts, understanding

technical analysis, acquiring skills to use / practice

concepts, developing communication skills to

develop certain attitudes, developing thinking

patterns to developing judgment and wisdom.

Technological developments and the

advancement of the business world demand

universities to produce graduates who have high

competencies, so now there must be a change in

learning strategies centered on Student Center

Learning (SCL) students with a problem-solving

approach. Raising a question / case designed by the

lecturer that is able to bring out the students'

curiosity is then presented by randomly selecting

groups of students who will advance so that all

students have first understood and solved the

problem / case and then held a question and answer

so that the main role of the lecturer is as consultants

and facilitators, not as authorities and the only

source of knowledge. Siti Mutmainah (2011) states

that a case is called a good case if it has the

following characteristics: 1) decision-oriented

(raises a managerial situation in which a decision

must be made), 2) there is active student

participation (the case must be able to arouse

students' curiosity), 3 ) development of discussions

(the emergence of diverse views and analyzes), 4)

substantive cases (consisting of main sections that

discuss issues and other information), 5) questions

(understanding of what should be asked).

Problem solving learning strategy is a technique

in helping students learn to be able to understand

and master learning material by using problem

solving strategies. Problem solving is more likely

towards concepts or strategies. Problem solving

learning strategies can be implemented through a

learning approach, which is a way that is done by the

teacher / lecturer so that the material displayed can

adapt to the students. In addition, it can also be done

using learning methods, namely by presenting

material that is still broad (general). Problem solving

learning through the learning approach in the

subject, the lecturer conveys the subject matter by

directing students to the understanding of the

following subject matter in solving the problems.

Lecture material is seen as a problem that must be

understood, understood and resolved. Strategy

Problem solving learning as a teaching and learning

process, students are taught about problem solving

strategies by providing various examples of

problems related to lecture material concepts that

can and must be solved through problem solving

strategies.

Problem solving learning through the learning

approach in the subject, the lecturer conveys the

subject matter by directing students to the

understanding of the following subject matter in

solving the problems. Lecture material is seen as a

problem that must be understood, understood and

resolved. Strategy Problem solving learning as a

teaching and learning process, students are taught

about problem solving strategies by providing

various examples of problems related to lecture

material concepts that can and must be solved

through problem solving strategies.

According to Krulik and Rudnick (Carson, 2007:

21-22), there are five stages that can be done in

solving problems, namely as follows: 1. Read (read).

Activities carried out by students / students at this

stage are recording key words, asking other students

/ students what is being asked about the problem, or

re-expressing the problem into a language that is

easier to understand. 2. Explore (explore). This

process involves finding patterns to determine the

concept or principle of the problem. At this stage the

student / student identifies the problem given,

presents the problem in an easy-to-understand way.

The question used at this stage is, "what is the

problem like?" At this stage it is usually done

drawing or making tables. 3. Choose a strategy

(select a strategy). At this stage, students / students

draw conclusions or make hypotheses about how to

solve problems encountered based on what has been

obtained in the first two stages. 4. Solve the problem

(solve the problem). At this stage all mathematical

skills such as counting are done to find an answer. 5.

Review and discuss (review and extend). At this

stage, students check the answer again and see the

variation from how to solve the problem.

Definition of Teaching Materials

One of the initial activities in improving learning is

designing teaching materials that refer to a

development model to facilitate learning. Learning

design can be used as a starting point for efforts to

improve the quality of learning. This means that the

improvement of the quality of learning must begin

from improving the quality of learning design, and

designing learning with a system approach (Degeng,

1989 in M. Harijanto 2007).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

252

Teaching materials are media and learning

resources that have a strategic position because

teaching materials prepare guidelines for students

both for the sake of independent learning and in

scheduled face-to-face activities, also equipped with

methods and evaluation, and guidelines for students.

Teaching materials are different from textbooks

(Anik Tri Suwarni et al, 2007).

Table 1: Teaching Materials

Text Book Teaching Materials

In general :

1. Assuming

interest from

readers

2. Written mainly

for use general

lecturer / reader

3. Designed to be

marketed widely

4. Don't always

explain the

purpose

instructional

5. Arranged

linearly

6. Structure based

on the logic of

science (content)

7. Not necessarily

giving practice

8. Don't anticipate

learning

difficulties

college student

9. Not necessarily

giving a

summary

10. Narrative writing

style

11. The material is

very solid

12. Do not have a

mechanism for

collect user

feedback

13. Do not give

suggestions on

ways study the

material in it

In general :

1. Generating interest from

readers

2. Written and designed for

student use

3. Explain instructional goals

4. Compiled based on

"flexible learning" patterns

5. The structure is based on

the final competency will

be achieved

6. Focusing on providing

opportunities for college

student

7. Accommodate student

learning difficulties

8. Always give a summary

9. Writing style (language)

communicative and semi-

formal

10. Packed for use in the

process instructional

11. Has a mechanism to collect

feedback from students

12. Includes learning

instructions

The instructional material developed must be

able to increase the motivation and effectiveness of

its users. Widodo in Lestari (2013: 2) revealed that

there are five characteristics of teaching materials,

namely 1) self instructional means that they can be

useful and used by students individually. Having

independent teaching materials can increase one's

awareness to want to try to complete their tasks

independently without seeing the work of others, 2)

self contained are various questions raised in each

chapter with the aim of sharpening the knowledge

and mastery of the knowledge that has been learned

from the teaching material 3) stand alone that does

not need help from other teaching materials. Good

teaching materials cover all subject matter so that

they do not need other teaching materials to

complete them, 4) adaptive if the teaching materials

can adapt the development of science and

technology, flexible use in various places, as well as

the contents of learning materials and software can

be used up to a certain time 5) user friendly that

makes it easier for users when they want to wear it.

The use of language is simple, easy to understand

and uses general terms.

The development of teaching materials must also

adjust to the curriculum because teaching materials

are part of curriculum development. Therefore the

procedure for developing instructional materials

must be related to the curriculum that applies as the

main reference, meaning that the instructional

material developed must be in accordance with the

IQF curriculum which refers to the learning

achievement standards and graduate competence

standards.

Development of Teaching Materials for Taxation

Subjects

Until 1960-1970 researchers had developed a

general model of problem solving to explain the

process of solving. Polya developed a problem

solving procedure on the basis of the nature of

problem solving ability as a process. There are four

stages of problem solving, namely; (1)

understanding the problem, (2) planning a solution,

(3) implementing the plan, (4) checking back

(www.kajianpustaka.com). Gick's model, 1986

(Foshay & Kirkley, 2003: 4) the following is the

latest model often used for problem solving.

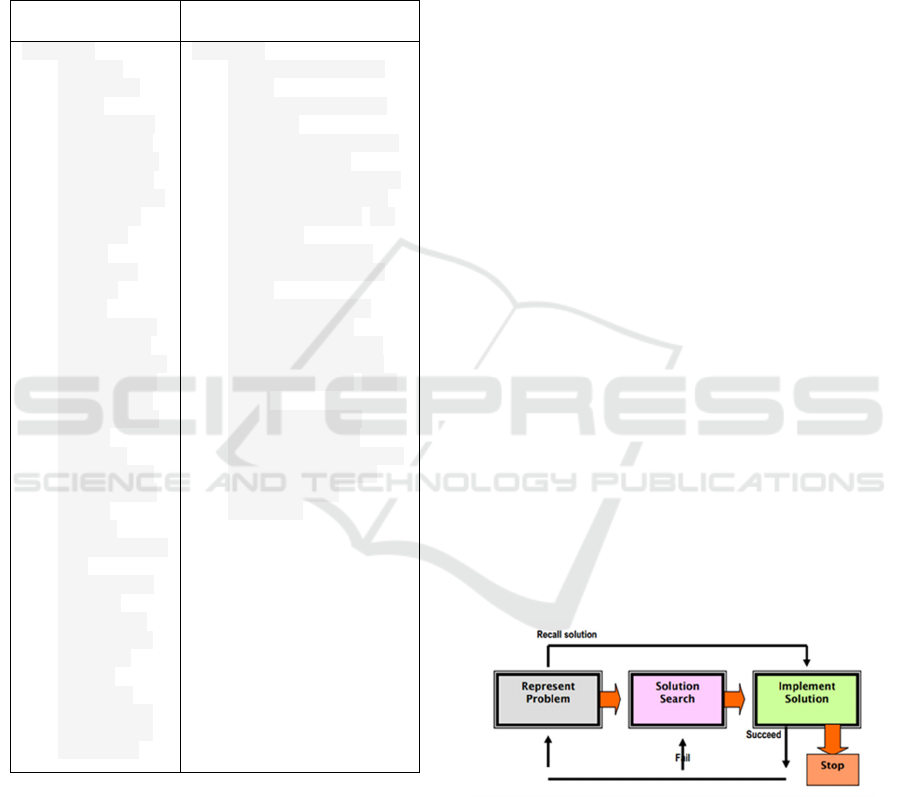

Figure 1: Gick's Model

In Gick's (1986) model there are three basic

sequences of cognitive process activities in problem

solving: (1) showing a problem (represent problem),

namely recalling the appropriate context of

knowledge, identifying goals and starting conditions

that are suitable for the problem; then (2) find a

solution (solution search), which is to clarify the

purpose and develop an action plan to achieve the

goal; and (3) the implementation of a solution

Development of Taxation Teaching Materials with Problem Solving Approach to Improve Student Learning Outcomes in Unimed Economic

Faculty

253

(implement solution), namely implementing the

planned actions and evaluating the results. For

students who are aware that the problem at hand is a

problem similar to a problem that has already been

solved, the procedure can be cut short from the first

step to the third step called recalling the previous

solution and repeating the same solution (recall

solution)

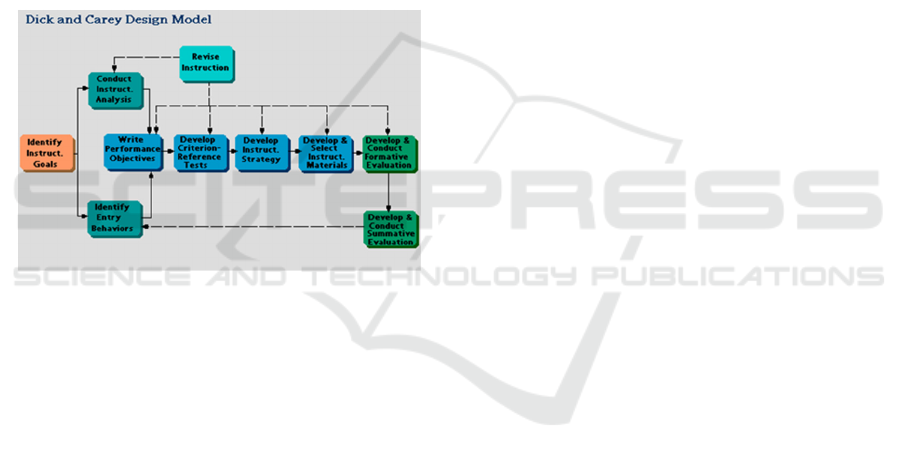

This research is Research and Development (R &

D). Development carried out in the form of Taxation

Teaching Materials. Development of Taxation

Learning Materials follows the Dick and Carey

Model. Sukmadinata (2012) explained "If the ten

steps of the Dick & Carey development model and

follow the stages of learning media development

well, it will be able to produce an educational

product that can be accounted for." The ten steps of

developing the Dick & Carey teaching materials

model are described as follows.

Figure 2: Dick and Carey Design Model

These steps are not standard things that must be

followed, the steps taken can be adjusted to the

needs of researchers. To produce interactive

teaching material products, planning is needed, good

learning design.

3 RESEARCH METHOD

This research was conducted at the Faculty of

Economics, Medan State University, odd semester

2018/2019 school year. Implementation time from

May to October 2018. Research subjects were

divided into 6 study programs namely Economic

Education Study Program, Accounting Education,

Commerce Education, Office Administration

Education, Management Department, and

Accounting Department totaling ± 540 students. The

subject of this product trial was the semester v

business education student 2018/2019 school year

who were taking taxation courses. The total number

of subjects was 21 students with details of 6 students

for small group trials and 21 students for large group

trials.

In the development stage of learning media,

targeting in this case are lecturers, instructional

media experts, learning design experts, subject

matter experts. and students who assess learning

media that have been developed based on criteria, as

follows: (i) evaluators are based on the expertise

they have, (2) evaluators who carry out the

evaluation are determined based on the ability of the

practitioner / lecturer with the classification of

experts in the field of study.

This study uses a development research approach

(Research development Research). Educational

development research according to Borg & Gall

(2003), which is a process used to develop and

validate educational products, including procedures

and processes, such as learning strategies or ways of

managing learning. The development of learning

strategies and teaching materials in this study uses a

development model adopted from Dick, Carey and

Suparman, (2012). The stages of development

implementation consist of: 1) Pre Development 2)

Development of teaching materials and learning

strategies 3) Review and product testing 4) Test the

effectiveness and application of learning strategies

and teaching materials.

Data analysis activities in this study were chosen

into three, namely a) data analysis from practitioners

and experts / experts, b) data analysis when product

trials, and c) analysis of experimental test data. Data

analysis for a, b and c in this study uses quantitative

descriptive analysis. All collected data were

analyzed by descriptive statistical techniques which

were quantitatively separated by categories to

sharpen the assessment in drawing conclusions. This

analysis is intended to describe the characteristics of

the data in each variable. This method is expected to

make it easier to understand the data for the next

analysis process. The results of data analysis are

used as a basis for revising the developed media

products. Qualitative data in the form of statements

that are not feasible, less feasible, quite feasible and

feasible to be converted into quantitative data with a

value scale of 1 to 4.

The collected data is processed by summing,

compared to the expected number and percentage

obtained (Arikunto, 1996: 244), or can be written in

a formula as follows:

Percentage of eligibility (%) = (Observed

score)/(Expected score) x 100 %

The collected data were analyzed with

quantitative descriptive analysis techniques which

were revealed in the distribution of scores and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

254

percentages on the categories of the predetermined

rating scale. After presenting it in percentage form,

the next step is to describe and draw conclusions

about each indicator. The suitability of aspects in the

development of teaching materials and learning

media can use the following table:

Table 2: Percentage scale tables

Percentage of

achievement

Interpretation

90 - 100 % Decent / attractive /

motivate

d

75 - 89 % Quite decent / attractive /

motivate

d

60 - 74 %

Less feasible / attractive /

motivate

d

0 - 59 % Not feasible / attractive /

motivate

d

In table 2 above, the percentage of achievement,

value scale and interpretation are mentioned. To find

out the feasibility of using table 2 above as a

reference for assessing data resulting from the

validation of media experts and material experts.

While the small group test of 6 students and a large

group trial of 21 students used objective tests to

obtain pre-test and post-test data. The results of the

percentage of feasibility according to material

experts, design and media and limited field trials are

then used as revision materials for the entire

teaching material before being applied to the target

population of all economic faculty students.

4 RESULT AND DISCUSSIONS

The development of learning strategies and teaching

materials in this study uses a development model

adopted from Dick, Carey and Suparman, (2012).

The stages of development implementation consist

of: a) Pre-development b) Development of teaching

materials and learning strategies c) Review and

product trials d) Test the effectiveness and

application of learning strategies and teaching

materials.

a. Pre-development phase

The pre-development stage is carried out by holding

FGDs with taxation lecturers to identify learning

needs including: a) analyzing learning strategies

carried out in the learning process and analyzing

students' initial behaviors and characteristics in

following taxation courses that tend to be boring so

that they have difficulty in understanding learning

material, indicated by relatively low student learning

outcomes (pre-test) b) reviewing the course syllabus

by mapping the competency standards and basic

competencies of taxation courses based on the IQF

curriculum. c) do an explanation of the subject

matter or concepts and procedures that students will

learn.

b. Development phase of teaching materials and

learning strategies

At this stage, the collection, preparation and making

of teaching materials are carried out by holding an

FGD with tax lecturers and design experts. At this

stage, an overall review of taxation teaching

materials is carried out. All materials are adjusted to

the latest tax regulations that are generally

applicable in Indonesia. Making teaching materials

must pay attention to colors, images, language and

design (appearance) to stimulate students' thoughts,

attention and reading interest.

c. Stage of product review and trial

At this stage FGDs were carried out in each

evaluation stage, namely stage 1 evaluation

consisting of expert material, design and media

review, stage 1 analysis and revision, stage 2

evaluation consisting of small group trials, analysis,

revision 2, revision 3, Phase 3 evaluation consisted

of large group trials, student assessments and

revision 3

d. Test phase of effectiveness and application

The testing phase of product effectiveness (problem

solving based teaching materials) developed was

carried out to assess feasibility based on the

assessment of material experts, design experts and

media experts. The effectiveness test based on

expert material, design, and media aims to get

advice and material input, design, and media of

taxation teaching materials to be developed. These

suggestions and inputs are then analyzed and used to

develop teaching materials with problem solving in

accordance with the material of taxation teaching

materials so as to improve student learning

outcomes.

1. Data Description Test the Effectiveness of

Material Experts (field of study)

Expert material validation data is presented in the

following table:

Table 3: Assessment of Material Experts

N

o

Aspect

Assessm

en

t

Observat

ion Score

Score

Expect

e

d

Feasi

bility

Development of Taxation Teaching Materials with Problem Solving Approach to Improve Student Learning Outcomes in Unimed Economic

Faculty

255

1 Contents

Material

36 40 90%

2 Learning

Strategie

s

8 8 100%

Total 44 48 91,67

%

Based on table 3 above, the average total

assessment of learning material experts about

learning material with this problem solving obtained

91.67% results. In accordance with the percentage

scale in table 2, these results fall into the category of

feasible/attractive/ motivated touse.

The things suggested by the material expert are

1) the need for other sources for learning (in the

form of the latest tax regulations); 2) examples of

more efforts are made to facilitate student

understanding; 3) need to add tax cases / cases to

sharpen students' understanding (evaluation).

2. Description of Data Test the Effectiveness of

Design Expert

Design expert validation data is presented in the

following table:

Table 4: Assessment of Design Experts

N

o

Aspect

Assessm

en

t

Observat

ion Score

Score

Expecte

d

Feasi

bility

1 Textbook

Desi

g

n

48 56 85,71

%

Based on table 4 above, the average total

assessment of learning design experts about the

design of textbooks by solving this problem resulted

in 85.71%. In accordance with the percentage scale

in table 2, the results fall into the category of quite

feasible/attractive/ motivated to use.

The things suggested by the design expert are 1)

need to pay attention to the accuracy of the use of

colors, especially on the cover of textbooks; 2)

Consistent in the use of terms; 3) need to adjust the

type and form of exercises / questions to encourage

students to think critically (evaluation).

3. Description of Data Test the Effectiveness of

Media Expert

Media expert validation data is presented in the

following table:

Table 5: Assessment of Media Experts

N

o

Aspect

Assessmen

t

Observ

ation

Score

Score

Expected

Feasi

bility

1 Textbook

Media

35 40 87,5

%

Based on Table 5. above, the average total

assessment of the learning design experts on the

design of textbooks with the solution of this problem

was obtained at 87.5%. In accordance with the

percentage scale in table 2, these results fall into the

category of quite feasible / attractive / motivated to

use.

The things suggested by media experts are 1)

need to pay attention to the cover design, especially

the use of colors to increase student interest; 2) the

need for additional images to facilitate student

understanding; 3) need to pay attention to the

addition of color usage in the contents of teaching

materials.

3. Small group test results

Before conducting a small group test, the first

textbook is revised according to the advice or input

from the experts, then a small group is tested after

the revision is carried out based on the score

obtained. Aspects of small group trial evaluation for

students are carried out by pre-test and post-test.

This small group test is conducted to get input or

suggestions from potential users (students) based on

the results of the pre-test and post-test scores. The

small group test respondents were taken randomly

from 6 of the business education students of the

UNIMED economics faculty who took semester v

taxation courses in the 2018/2019 school year with

the categories of 2 high, medium and low ability

students respectively. The percentage of assessment

data for small group tests by students is presented in

the table below:

Table 6: Pre-test scores and post-test results for

small group testing

Respondent

No

Score

Pre-

tes

t

Score

Post-

Tes

t

Difference

1 6 8 2

2 7 9 2

3 4 7 3

4 6 8 2

5 5 8 3

6 7 10 3

Average 5,83 8,33 2,5

Source: Data processed, 2018

Table 6. above, shows that the mean / mean pre-

test score is 5.83, and the mean / mean post-test

score is 8.33, or an increase of 2.5. This means that

the use of instructional material products resulting

from development can increase student scores by

25%.

The assessment aspect of large group trials for

students is carried out by pre-test and post-test. This

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

256

large group test was conducted to get input or

suggestions from prospective users (students) based

on the results of the pre-test and post-test scores.

The respondents of this large group test were taken

randomly as many as 21 of the business education

students of UNIMED economics faculty who took

semester v taxation courses 2018/2019 school year

with the categories of each of the 7 high, medium

and low ability students.

5 CONCLUSIONS

Based on the results of research and development of

teaching material products as stated earlier, it was

concluded:

1. Product specifications for teaching materials

that can be used by tutors and tutee (students)

The Faculty of Economics UNIMED as a

guidebook or guide in learning and completing

learning materials, tutorial tasks, and evaluation

of learning outcomes, is teaching material that:

(a) is deemed feasible / clear / interesting /

motivated, both in terms of design and content;

(b) serves as a learning medium in the

independent learning process of students of the

Faculty of Economics, UNIMED; and (c) able

to motivate independent learning and encourage

students to think critically.

2. From the assessment results according to the

material expert, it is "feasible / interesting /

motivated" with a score of 91.67%. The

assessment results according to the design

expert are "quite feasible / interesting /

motivated" with a score of 85.71%; while the

assessment results from media experts are "quite

decent / attractive / motivated" with a score of

87.5%

3. The use of teaching material products shows an

increase in student learning outcomes, which is

indicated by the difference in mean pre-test

scores and post-test small groups is 2.5 and the

large group is 2.76. This means that the use of

instructional materials as a result of

development can increase student scores by

25% and 27.6%.

Recommendations

Based on the results of this research and

development, it is recommended

1. Students can be used as an alternative source of

independent learning

2. The development of this product is proposed to

use more matching colors to make it more

attractive, both in terms of cover and contents.

3. The development of this product is suggested to

add examples of questions and exercises to

facilitate and sharpen students' understanding.

4. The research and development products in the

form of these teaching materials need to be

carried out in an operational field trial on the

larger subjects of UNIMED Faculty of

Economics students, before being used by all

UNIMED Faculty of Economics students to

improve the quality of the products produced.

REFERENCES

Borg, Walter R., & Gall, M.D. (1983). Educational

research: An introduction (4ed). New York &

London: Longman.

Foshay & Kirkley. (2003). Problem Solving.www.indiana-

edu/m

Dick, W., Carey, L., & Carey, J. O. (2005). The

Systematic Design of Instruction (6th ed.), New

York: Addison-Wesley Educational Publishers, Inc.

Handoko. (2005). Metode Kasus dalam Pengajaran

Manaemen). Makalah disampaikan pada Lokakarya

Peningkatan Kemampuan Penyusunan dan

Penerapan Kasus Untuk Pengajaran. Semarang 23

Nopember 2005

Siti Mutmainah. (2011) Pengaruh Penerapan Metode

Pembelajaran Kooperatif BerbasisKasus Yang

Berpusat Pada Mahasiswa Terhadap Efektivitas

Pembelajaran Akuntansi Keperilakuan. Undip-

journal online

Sukmadinata, Nana. S. (2012). Metode Penelitian

Pendidikan. Bandung: PT Remaja Rosdakarya

Suparman, Atwi,M (2012) Desain Instruksional Moderen,

Jakarta: Erlangga

Development of Taxation Teaching Materials with Problem Solving Approach to Improve Student Learning Outcomes in Unimed Economic

Faculty

257