Analysis the Effect of Dual Monetary Policy Instrument on Index

Industrial Productial in Indonesia

Mutiara Shifa

1

, Dede Ruslan

1

and Fitrawaty

1

1

Faculty of Economics, Universitas Negeri Medan, Medan, Indonesia

Keywords: Conventional Monetary Policy, Islamic Monetary Policy, Industrial Production Index (IPI), VAR/VECM.

Abstract: This study aimed to analyse instrument of monetary policy in affecting economic growth in Indonesia that

measure using Industrial Production Index (IPI). Since Indonesia has a dual finance system and this research

is meant to compare the effectiveness both system as a instrument of monetary policy through interest rate

channel, this research will be written in two models as in conventional model and sharia model. Using VAR

research and conducted by Impulse Response Function (IRF) and Forecast Error Variance Decomposition

Test. The IRF Test showed that on the conventional model, the responses of IPI to the shock of SBI and

PUAB is positive and permanent, so do the response of IPI to the shock of SBIS and PUAS is positive and

permanent. Fluctuation on the mechanism of sharia monetary policy subside faster than the conventional

monetary. And for the result of FEVD test, conventional model give a positive contribution in the sense of

raising economic growth, where in this research is measured by IPI, amounted to 37,51%, while the sharia

model give a positive contribution to IPI, amounted 7.14%. Therefore, we can conclude that in Indonesia,

mechanism of monetary transmission through interest rate channel using conventional model can be said

better than sharia model in the term of raising economic growth.

1 INTRODUCTION

The function and role of the Bank-owned Indonesia

as the central bank in support of the development of

the financial markets and the economy of a country.

According to Warjiyo and Solikin (2003), this is due

to the policies implemented by the central bank can

affect the development of interest rates, credit

amount, and the amount of money in circulation,

which will affect not only the development of

financial markets, but also economic growth,

inflation, and welfare of society as a whole. This is

called policy with monetary policy. The development

of the financial markets and the economy is that

macroeconomic stability is among other things

reflected by price stability (low inflation rate),

improving the development of real output (economic

growth), as well as sufficient breadth field/job

opportunities available.

Periodically, every year the Government set an

economic growth target and announced through the

State income and Expenditure Budget (APBN). Then

the target will be evaluated during the one year later

along with the turn of the year in which data on the

realization of economic growth that year was also

presented. The Government can just change the target

figures for economic growth in the middle period to

take place when the economic growth target proved

difficult to achieve on the State of the economy in the

period of walking. This is the same as the decision

changes the target figures for economic growth in the

last four years. The economic growth target set by the

Government for the period of 2010-2015 each year

amounted to 6.3%, 6.8%, 5.5%, and 5.1% by year

calculation base used is the year 2010, as can be seen

on the graph 1 below.

Source: Ministry of Finance.

Figure 1: Comparison of targets and the realization of

economic growth (Base Year 2010).

In the year 2013 the growth economy Indonesia

amounting to 5.78%. This figure is far lower than the

target which was already decided after roughly 6.8%.

398

Shifa, M., Ruslan, D. and Fitrawaty, .

Analysis the Effect of Dual Monetary Policy Instrument on Index Industr ial Productial in Indonesia.

DOI: 10.5220/0009494203980406

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 398-406

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

In later years, Indonesia's economic growth was

increasingly debased i.e. 5.02% figure is treading in

the year 2014 and 4.73% in 2015. Indonesia's

economic growth rate by the year 2015 is the lowest

figure for six years, where this is the first time for

Indonesia stepped on the numbers below 5% since

2009. Later, in the year 2016 economic growth back

step on number 5% i.e. 5.02%. However, this figure

is still below the target of economic growth of 5.2%

in 2016.

The index of industrial production or IPI number

index that describes the development of the

production sector of manufacturing industry in early

as well as of data series that are longer and complete

because its nature is designed to periodically

monthly. Ordinary dipakain this index as a proxy for

the activities of the economy or the national income

primarily due to unavailability of real gross domestic

product or gross national Product as measured by the

monthly basic.

The Government is using monetary policy in

controlling and influencing the development of real

output (economic growth) that where data can be

reflected through IPI. In this case, the tool used by the

Government of one is the transmission mechanism of

monetary policy and its instruments are used. The

transmission of monetary policy basically shows the

interaction between central banks, banking, and other

financial institutions, as well as the perpetrators of

real sector of economy. The interaction between the

central bank and banking can be seen on the

interactions in financial markets. Interaction through

financial markets occurs because on the one hand the

central bank conducts monetary control through

financial transactions conducted with banking. On the

other hand, the financial transaction banking to

portfolio investment. These interactions will be

influential on the development of short term interest

rates as interest rates PUAB and SBI(Warjiyo,

2004:6-20).

This research concentrates the instruments of

monetary policy interest rate channel. This is because

the channel of interest rates further stressed the

importance of this aspect of prices in financial

markets against a wide range of economic activity in

the real sector. The most important features in the

transmission mechanism of monetary policy path of

interest rates is on the emphasis of real interest rates

that affect the decisions of economic actors spending

(consumption and investment), so that although the

nominal interest rate is from any zero monetary

policy will still be used effectively through changes

in the price level. In this regard, monetary policy is

the central bank will have an effect on the

development of a wide range of interest rates in the

financial sector and will further influence on the level

of real output.

As a solution of the conventional monetary

system containing usury, Islam introduced Islamic

monetary system, i.e. the monetary system based on

Islamic sharia principles. Based on Bank Indonesia

Regulation No. 10/36/PBI/2008, to achieve the final

objective, Bank Indonesia can do control based on

sharia principles. Sharia's own monetary policy

prohibits the use of usury or interest in its execution,

because in addition to indeed is haraam, monetary

Islam considers interest usury or very risky against

the economic crisis and prone to instability.

In principle, monetary policy and the purpose of

islam is not much different from the conventional

monetary, that is, to achieve full employment

conditions in which all sectors of the production can

be used optimally, guarantee the stability of exchange

rates and prices (supervision inflation) and an

instrument of redistribution of wealth where wealth

synergize between monetary and real sector. In

achieving the goal, economic instruments have Sharia

moter monetary control is not much different from the

conventional instruments of monetary control.

In addition, to link the Islamic economic and

monetary policy, monetary economic system of

Sharia also has an Islamic monetary policy

transmission one of its channels is channel modifying

interest rates interest rate pass-through use the policy

rate pass-through, where interest rates used are

changed using the yield level. Some short term money

market instruments used were the SBIS and PUAS.

SBIS is a form of modification of Bank Indonesia

Certificates or SBI, SBI interest rates where replaced

by the level of berakadkan yields the SBIS were.

While PUAB is a form of modification of the PUAS

in which the instruments used in Indonesia is the

Mudharabah Interbank investment certificates

(SIMA).

SBI interest rates, interest rate PUAB O/N, yields

SBIS and SIMA are often used as an instrument of

short-term interest rates to monetary control in

achieving the target of the end of which one is

economic growth (real output developments) that can

Industrial production index using diliat. Here is the

data rates of SBI, PUAB O/N, yields SBIS, SIMA,

and the IPI 2013-2016 year.

Analysis the Effect of Dual Monetary Policy Instrument on Index Industrial Productial in Indonesia

399

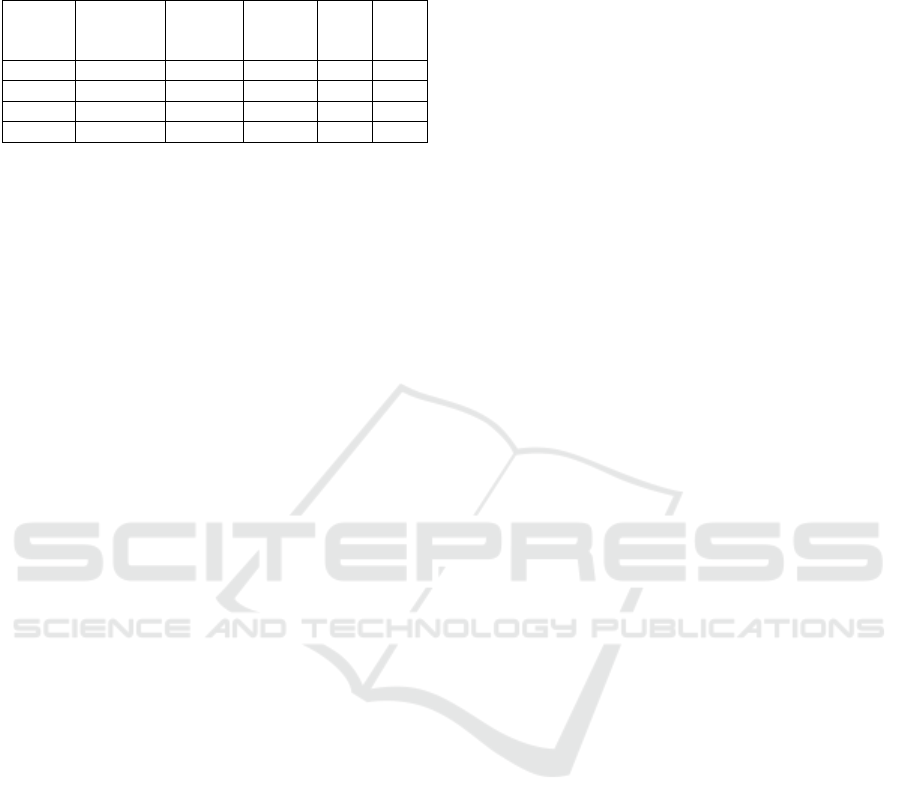

Table 1: SBI Rate, Equivalent data Rate SBIS, PUAB O/N

Rate, Equivalent Rate PUAS, and IPI 2013-2016 Period (in

billion, and Percent).

Years

Position SBI

PUAB

O/N Rate

Position

SBIS

Eq

Rate

PUAS

IPI

2013

1,011,470

4.95

53,581

5.21

11489

2014

1,121,632

5,92

74,484

6.4

12036

2015

732,367

6.11

96,919

6.08

12609

2016

1,004,143

4.81

101,647

5

13114

Source: Bank Indonesia and the Central Bureau of statistics.

Table 1 above shows the trend of the fluctuation

in the position of SBI, SBI's position in 2013 is

Rp1,011,470 billion which then in 2014 rising to,632

billion Rp1,121. Then in the year 2015 positioning

SBI decline i.e. amounting Rp732,367 billion and

then menigkat again in 2015 i.e. Rp1,004 of,143

billion. While interest rates PUAB O/N tend to

increase from a year 2013-2015 but later experienced

a decline in the year 2016, where in the year 2013 the

figure stepped on 4.95% in 2014 rising at a rate of

5.92%. In the year 2015 back rising at 6.11%, then in

the year 2016 decline be 4.81%. While the rate of

yield SATISFIED investment certificates represented

by the Mudharabah Interbank tend to decline, where

in the year 2013 yield results are in Figure 5.21% then

in 2014 rising to 6.40% past year 2015 experience the

decline be 6.08% and then decreased until the year

2016 to reach 5.00%. IPI number syang index data

obtained from medium to large industrial production

with basic year 2010 issued on a monthly basis by the

Central Bureau of statistics, annual rataan

peningkataan experience each year, where in the year

2013 is at number 114.89, then in 2014 has increased

up to 120.36 on the numbers. And then in 2015 get

back on the numbers increased to 126.09, later in the

year 2016 continues to increase in numbers 131.14.

SBI, PUAB O/N, SBIS and SIMA as instruments

of short-term interest rates in the monetary policy

transmission mechanism is already widely used by

previous studies. Such as research conducted by Aam

Selamet with the result that the relationship of SBI,

SBIS, PUAB, and with the banking financing PUAS

is negative and the pattern of relationship banking

financing and inflation also negatively. Then research

other Aam Slamet with Yulizar Sanrego have results

that conventional monetary instruments contribute

more than the monetary instruments. Later, Irfan

Ayuniyyah Qurroh research Syauqi Beik, Laily

Arsyianti Dwi and have the results that total and the

return of Sharia financing has a positive relationship

with the IPI.

Against the background of the research above,

there are any formula problem that will be raised in

this research are as is how significant an influence and

comparison between conventional monetary policy

variables and Sharia line interest rates affect the IPI.

2 THEORICAL FRAMEWORK

The theory Keynes mentioned that, the interest rate is

determined by the supply and demand for money,

according to this theory there are three motifs, why

would someone be willing to hold cash, i.e.

transaction motives, just in case and speculation.

Three motives which are the source of any such

request for money that is termed Liquidity preference

(Mankiw,2003), requests the money according to the

theories of Keynes based on the conception that

generally people want him remains illiquid for meet

three of these motifs. The theory Keynes stressed the

existence of a direct relationship between people's

willingness to pay the price of money (interest rates)

with a request for money for the purpose of

speculation, in this case a huge demand when interest

rate is low and small requests If the high interest.

According to Kasmir (2007:37-40) are the main

factors that influence the determination of the

seriousness of the great interest rates generally can be

explained as follows, namely: Needs funds, profit

Target is desirable, Quality Assurance, the wisdom of

the Government, Period of time, the reputation of the

company, the products are competitive, good

relations, competitors.

2.1 Conventional Monetary Policy

Monetary policy is primarily a policy that aims to

achieve internal balance (high economic growth,

price stability, equitable development) and external

balance (the balance of the balance of payments) as

well as macroeconomic goal, namely maintaining

economic stabilization can be measured by

employment, price stability and a balanced

international balance of payments. If stability in the

troubled economy activity, then monetary policy can

be used to restore the (stabilization actions). The

influence of monetary policy is first felt by the

banking sector, which is then transferred to the real

sector.

2.2 Islamic Monetary Policy

Based on the concept of Islam, money is the property

of the Community (public goods) (Arif,2010).

Hoarding of money or activities that are not

productive money will result in the amount of money

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

400

in circulation is reduced, so that the process of the

economy will be hampered. On the other hand,

stacking the money or property will push human

nature of greed and lazy, and imposes against the

continuity of the economy.

In addition, the money that is not utilized in the

productive sector (idle assets) will be reduced due to

the existence of the obligation of zakat must be

issued. Therefore, the money must be spun (u.s.

money flow concept) in order to give rise to the

economic prosperity of the community. Like the

theory of the economic system of Islam, Islamic

financial instruments does not recognize interest rates

and implement a system of profit and loss (profit and

loss sharing). Big nothingness of customer profit

Islamic banking is determined by his little big profit

earned from bank financing and investment activities

conducted in the real sector, so that the monetary

sector has a dependency on the real sector. If

investment and production in the real sector is doing

well, then returns on the monetary sector will increase

as well (Huda,2008)

Islamic monetary management rationale was

the creation of the stability of money demand and

ordered him to an important objective that is

productive activities. So, every instrument that

leads to instability and allocating funding sources

that are not productive, would be abandoned. aim

to ensure that monetary expansion, but quite able

to generate adequate growth and can produce an

equitable prosperity for the community. The rate of

growth of the intended nature of sustainability,

must be realistic and include the medium term and

the long term.

2.3

Instruments of Monetary Policy

Conventional monetary policy instruments

according to Bank Indonesia consists of: discount

rate (Discount Rate), Compulsory Minimum Giro

(Statutory Reserve Requirment), an appeal to the

Moral (Moral Suasion), open market operations

(Open Market Operation). In its open market

operations, BI can do the buying and selling of

securities that Bank Indonesia's certificate there is

(SBI).

Islamic monetary policy Instrument according

to Karim (2002:203-204) are: certificates of

Wadiah Bank Indonesia (SWBI) or currently

known as Certificate Bank Indonesia Sharia

(SBIS), current Mandatory Minimum (Statutory

Reserve Requirment) and mudharabah interbank

investment certificates (certificate IMA) Sharia.

Based on the problem and research objectives,

then the hypothesis in this study include:

1. Allegedly there is influence and significant

among variables of conventional monetary

policy interest rate path with IPI in Indonesia.

2. Allegedly there is influence significant

between the variable and the monetary policy

interest rate IPI line Sharia in Indonesia.

3 RESEARCH METHOD

To analyze and manipulate data in this study, the test

will use Vector Autoregressive (VAR). VAR

describes the relationship of causality between the

variables in a model including intersep. This method

was developed by Sims in 1980 (Sugianto, Hermain

Harahap, and 2015; Ascarya 2009) that assumes that

all the variables in the model are endogenous,

meaning that it is specified in the model, so this

method is called by the ateoritis model (unfounded

theory).

VAR is a model of a-priori against economic

theory, however it is very useful in determining the

level of eksogenitas a variable economy in an

economic system in which occurs the

interdependence between variables in the economy.

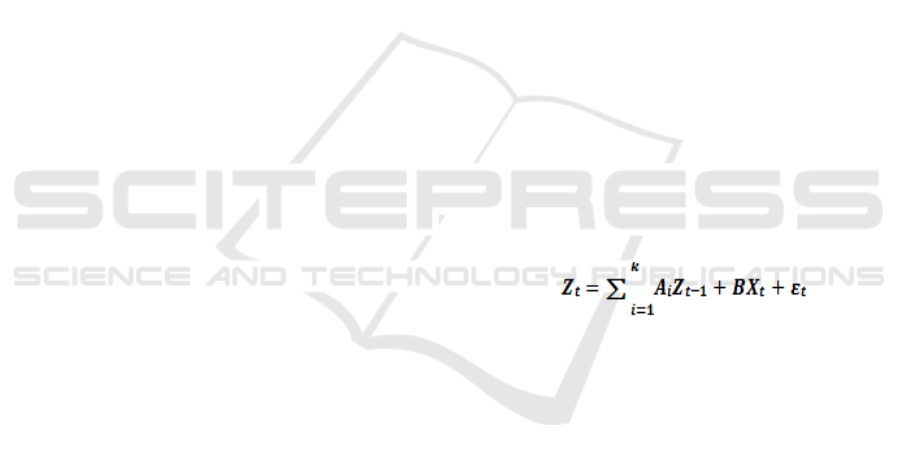

The VAR model is mathematically can be written

(Ramadan and Beik, 2013; P, 2003) as follows:

Z

t

:

vector of endogenous variables as much as t

X

t

:

vector of endogenous variables as much as t

A

i

dan B:

matrix-matrix coefficients of

the will being estimated

t

:

vector of residual-residual that is contemporary berkolerasi but

not berkolerasi with the values of their own lag nor berkolerasi

with the rest of the variables in the right-hand side of the above

equation.

The first phase is done in process data time series

is to test the stasioneritas or the unit root test.

Stationary data will have a tendency to approach the

average value and fluctuated around the average

value or have a constant variety. If the data is

stationary, then the selected methods are methods of

VAR and if not stationary then the VECM using the

method. (Ramadan and Beik, 2013).

VAR estimation is very sensitive to the length of

the lag are used. Determination of lag (order) to be

used in the VAR model can be determined based on

the criteria of Akaike Information Criterion (AIC),

Schwaz Information Criterion (SC), or Hannan

Analysis the Effect of Dual Monetary Policy Instrument on Index Industrial Productial in Indonesia

401

Quinnon (HQ). In addition the optimal lag length

testing is very useful for relieving the problem of

autocorrelation in the VAR system, so that the

optimal lag with use expected to no longer appear

problem of auto correlation (Nugroho, 2009;

Hasanah 2011).

If the phenomenon of stasioneritas is at the level

of the first difference, then the testing needs to be

done to look at the possibility of Granger. The

concept of Granger was basically to see long-term

balance between variables observed. Sometimes an

individual data is not stationary, but when connected

in linear data becomes stationary. This is then called

terkointegrasi that such data. (Rusydiana, 2009).

Forecast Error Variance Decomposition (FEVD)

is another method of dynamical systems by using

VAR. In response to the presence of innovation

demonstrates the effect of a policy (shock)

endogenous variable against other variables.

Variance decomposition is used to compile an

estimate of error variance of a variable, that is, how

big is the difference between a variation before and

after the shock, the shock that comes from either

myself or the shock of the other variables to see the

influence of relative variables research on other

variables.

4 ANALYSIS

This research uses the Augmented Dickey-Fuller test

(ADF) to test the stasioneritas of each variable.

Stasioneritas ADF test results are then compared with

critical values McKinon on degree of significance of

5%.

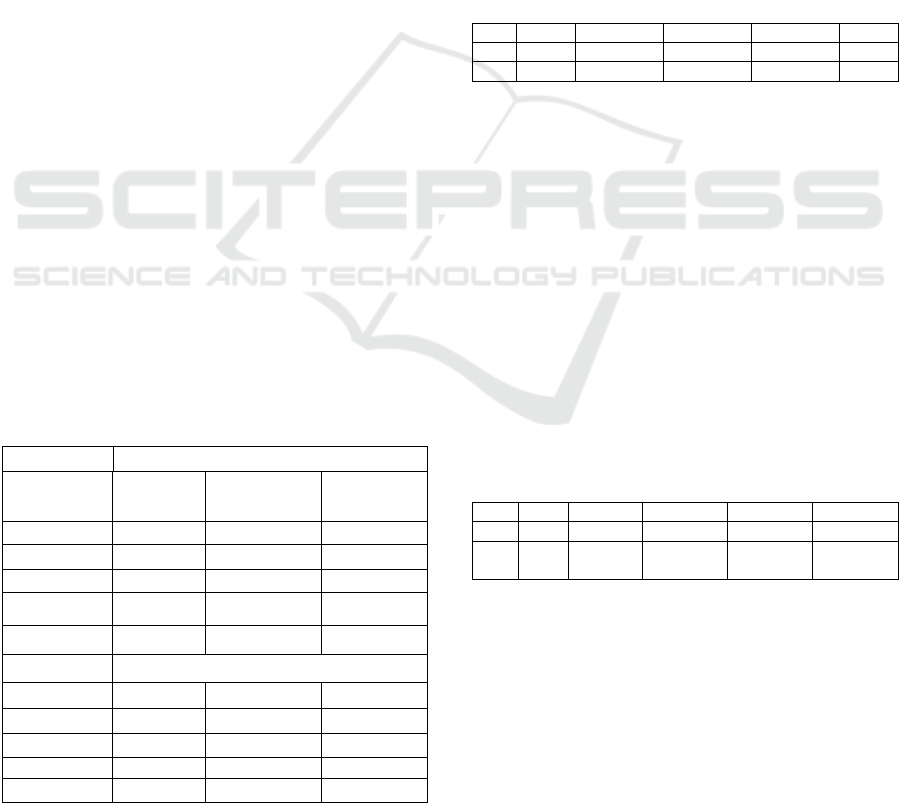

Table 2: Stationerity Test ADF Method.

Variable

Level

Prob.

ADF

t-statistic

ADF

p-value

5%

LNIPI

0.7322

-1.036381

-2.928142

LNSBI

0.2238

-2.158510

-2.926622

LNPUAB

0.5529

-1.442889

-2.928142

LNSBIS

0.7539

-0.977155

-2.925169

LNPUAS

0.1840

-2.275281

-2.926622

1

st

difference

LNIPI

0.0000

-7.902248

-2.928142

LNSBI

0.0012

-4.319495

-2.926622

LNPUAB

0.0000

-6.961848

-2.928142

LNSBIS

0.0000

-6.535199

-2.926622

LNPUAS

0.0000

-9.213325

-2.926622

Source: the Data that have been processed.

The result of the stationary test made the sixth

data variables are shown from the above table that

looks at the level of the level, all variables have the

value of the probability of more than 0. Because of

those reasons, then performed a test of integration at

the level of the first difference. At the level of the first

difference, it can be seen that all variables have values

less than 0.05 probability of ADF so that it is said that

all the variables are stationary and do not occur in the

root level of the unit is the first difference.

4.1 The Optimum Lag Test

Following are the results of the test the optimum lag

(lag length) Conventional Models prepared from data

variables are used i.e. variable IPI, SBIS, and PUAB

(conventional).

Table 3: Result the Optimum Lag of conventional Models.

Lag

LR

FPE

AIC

SC

HQ

0

NA

1.04e-07

1.300969

-7.444375*

-7.521937*

1

20.04045*

9.45e-08*

-7.662502*

-7.171004

-7.481253

Source: The Data that have been processed.

As seen from the above table, the data States that

in this study, the lag criteria suggested by SC and HQ

is the lag to-0. But when viewed from the criteria of

LR, FPE, and AIC, the lag suggested to use is the lag.

According to Sukmanada Kassim (2010), the length

of the lag that is used must be long enough to limit the

dynamics of the system. However, the length of the

lag also should not be too long. The conventional

model for this, since three of the five criteria

suggested to use 1 lag, then lag lag is used to-1.

Following are the results of the test the optimum lag

(lag length) Model of Sharia that are processed from

the data of the variables used i.e. variable IPI, SBIS,

and satisfied.

Table 4: Results Lag Optimum Model of Sharia.

Lag

LR

FPE

AIC

SC

HQ

0

NA*

4.63e-08*

-8.374261*

-8.251387*

-8.328949*

1

11.521

5

5.25e-08

-8.251082

-7.759584

-8.069833

Source: The Data that have been processed.

As seen from the above table, the data States that

in this study, the lag criteria suggested by LR, FPE,

AIC, SC, and HQ is the lag to-0. Because the five

criteria suggested lag lag 0 is used, then the lag lag is

used to-0. Lag 0 results obtained by these Islamic

monetary instruments can happen considering

transactions SBIS and PUAS is the kind of spot

transactions settlement was the slowest in two days,

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

402

allowing a relationship both these variables do not

have lag.

4.2 Test the Granger Johannsen

After knowing the value of optimal lag, Granger test

done next to analyze long-term relationship

antarvariabel. Following are the results of the test of

a conventional Model Johansen Granger.

Table 5: Test Conventional Model Granger.

Hypotesis

Trace

Statisitc

0.05

Critical Value

Prob.

Conclusion

None

115.1736

29.79707

0.0000

Countegrated

At most 1

61.01620

15.49471

0.0000

Countegrated

At most 2

14.52600

3.841466

0.0001

Countegrated

Source: The Data that have been processed.

Test results from the above it can be concluded

that there is a Conventional Model at Granger. It can

be seen from Statistics Trace values greater than the

value of the 0.05 Critical Value, and is seen also from

the probability value smaller than 0.05. In addition,

the results of the above tests can also be inferred that

there is a linear equation is long term contained in the

model, including variables IPI, SBI, and PUAB.

These test results also show that analysis of the

Conventional Model is used for the analysis of the

VECM. After learning the results of Conventional

Models, Granger test next would be presented o

Granger Sharia Model test data.

Table 6: Granger Test Model of Sharia.

Hypotesis

Trace

Statisitc

0.05

Critical

Value

Prob.

Conclusion

None

129.8704

29.79707

0.0000

Cointegrated

At most 1

75.63557

15.49471

0.0000

Cointegrated

At most 2

30.24998

3.841466

0.0000

Cointegrated

Source: The Data that have been processed.

Test results from the above it can be concluded

that there exists a Granger on the Model. It can be

seen from Statistics Trace values greater than the

value of the 0.05 Critical Value, and is seen also from

the probability value smaller than 0.05. In addition,

the results of the above tests can also be inferred that

there are two long-term linear equations contained in

models, between variables IPI, SBIS, and satisfied.

The results of this test also proves that the analysis is

used to Model the sharia is the analysis of the VECM.

After the known existence of Granger's next test

then the process is done using methods of error

correction. If there is a difference in the degree of

integration of the antarvariabel test, the testing was

done simultaneously (jointly) between long term

equations with equation error correction, having in

mind that in a variable occurs Granger. Following are

the results of the estimation of the conventional

Model of the VECM.

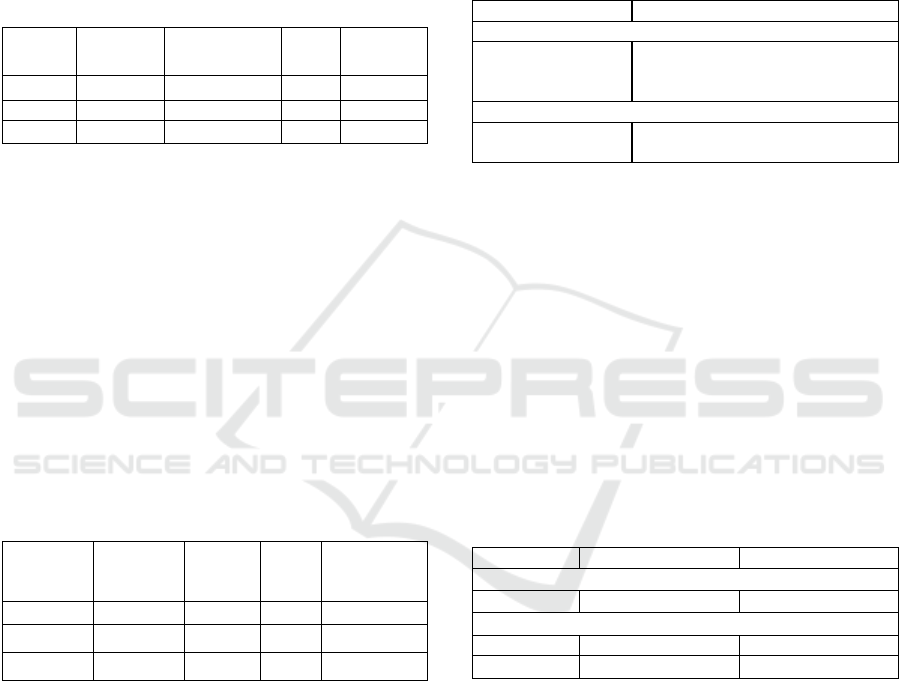

Table 7: VECM estimation of short term and long term

Conventional Model.

Variable

Coef.

t-stat

Short Term

CointEq1

-1.758884

-7.82460

DDLNPUAB(-1)

-0.030082

-1.44460

DDLNSBI(-1)

-0.007983

-0.30626

Long Term

DLNPUAB(-1)

-0.028445

-0.86480

DLNSBI(-1)

0.005043

0.27146

Source: The Data that have been processed.

Based on the test results of the VECM on top, on

a short term analysis, both variables significantly to

IPI, is it seen from the second t-statistic value of

variable on smaller than -1.67943. On its influence on

IPI, the existence of a mechanism of adjustment of

sound long term short term indicated by error Granger

is negative (CointEq1-1.758884). While in the long

run, these two variables are significantly to IPI, these

views of the value of the t-statistic greater than

PUAB-1.67943 and t-statistics of SBI are smaller

than at 1.67943. Then occurred the following is an

analysis of the VECM to Islamic Model.

Table 8: VECM estimation of short term and long term

Islamic Model.

Variable

Coef.

T-stat

Short Term

CointEq1

-0.291197

-2.60881

Long Term

LNPUAS(-1)

-0.438058

-9.24157

LNSBIS(-1)

-0.104447

-1.82001

Source: processed data.

Based on the test results of the VECM on top,

both variables are PUAS or SBI has no effect against

the IPI. In addition, in the long run, these two

variables are not significant effect on IPI, it is seen

from a t-statistic value each smaller than-1.67943. It

is typical of the VECM VAR/test in which not all lag

significantly in each equation.

Analysis the Effect of Dual Monetary Policy Instrument on Index Industrial Productial in Indonesia

403

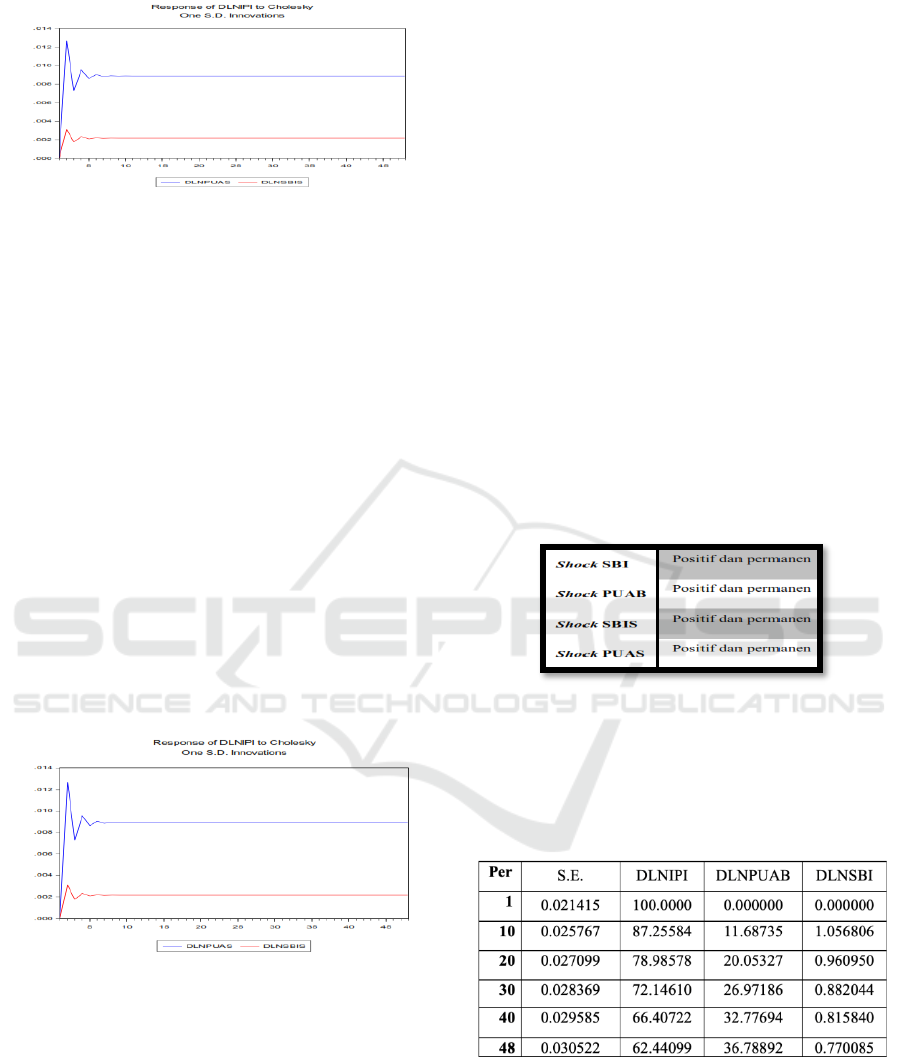

Figure 2: Impulse Response of industrial production index

(IPI) Conventional Models.

From the picture above, can be parsed results IRF

on variables in the Conventional Model is as follows:

1. DLNIPI response against the shock

DLNPUAB fluctuate until the thirteenth

month and began converging on the fourteenth

period. One month lag time required for

DLNIPI to respond to the shock DLNPUAB.

This positive response indicates when interest

rates rise, the PUAB it would be followed by

a rise in the level of the IPI.

2. DLNIPI response against the shock DLNSBI

fluctuate until the twelfth month and began

converging on the thirteenth period. One

month lag time required for DLNIPI to

respond to the shock DLNSBI. This positive

response indicates when the number of

positions the SBI is increasing, it will be

followed by a rise in the level of the IPI. Then,

here are the results of the IRF on variables in

the Model.

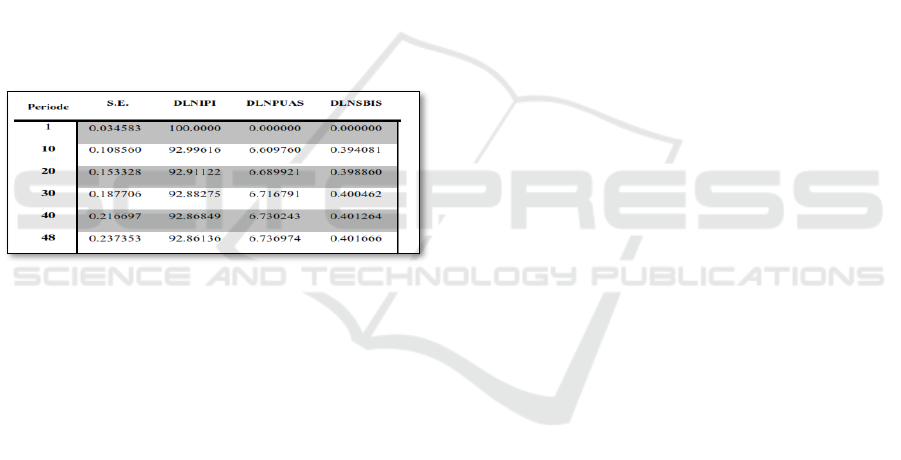

Figure 3: Impulse Response of industrial production index

(IPI) Model of Sharia.

From the above image obtained results IRF on

variables in the Model of Sharia is as follows:

1)

Response DLNIPI DLNSBIS surprise against

fluctuating funds sixth month and began

converging on the seventh period. A one

month grace period required for DLNIPI to

respond to the shock DLNSBIS. This positive

response indicates when the number of

positions the SBIS increases, it will be

followed by a rise in the level of the IPI.

DLNIPI response against the shock DLNPUAS

fluctuate until the fifth month and start converging on

the sixth period. One month lag time required for

DLNIPI to respond to the shock DLNPUAS. This

positive response indicates when the yield rate

increasing, it will be followed by a rise in the level of

the IPI.

The picture IRF that is approaching the point of

balance (equilibrium) indicates that a response is

variable due to the longer shocks will progressively

disappear, so the shocks are not left a permanent

influence against the variable. The response variable

of monetary policy interest rates to conventional line

the longer this increasingly stable indicating response

was the longer responya are increasingly

disappearing. The following is the conclusion from

the test results IRF for Conventional Models and

models of Sharia.

Table 9: The response Variable Against the increase of one

standard deviation of the IPI.

Following are the results from the test of Variance

Decomposition on a Conventional Model.

Table 10: The Test Results of The Forecast Error Variance

Decomposition of Industrial Production Index (IPI)

Conventional Models.

The table above presents the test results of

Variance Decomposition, in which any variables and

how big the variables affect variables industrial

production Index (IPI) in the Groove of conventional

monetary policy. In the first period to see that IPI

could be explained by the PUAB of 0% to during the

IPI could be explained PUAB of 36.79%. Next on the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

404

first period look that IPI could be explained by the

SBI of 0% to during the IPI could be explained SBI

of 0.77%.

For IPI, can explain the period 100% of IPI and

declining influence on late period amounted to

62.44%. So on a Conventional Model, variable IPI as

an indicator of economic growth was largely

influenced by the PUAB variable of 36.79%. These

results indicate that the influence of a variable

throughout the period PUAB and SBI against IPI will

be even greater. This happens because the IPI get

direct influence from all the variables such as the

proposed instrument and the conventional monetary

effect on the monetary transmission. In addition, test

results from the FEVD known PUAB (36.74%) and

SBI (0.77%) positive contributions of 37.51%. Then

here is the variance decomposition test results on the

Islamic Model.

Table 11: The test results of the Forecast Error Variance

Decomposition Indexes of industrial production in

Indonesia.

The table above presents the test results of

Variance Decomposition, in which any variables and

how big the variables affect variables industrial

production Index (IPI) in the Groove of monetary

policy. In the first period to see that IPI could be

explained by PUAS amounting to 0% until the end of

the period of IPI could be explained PUAS of 6.74%.

Next on the first period look that IPI could be

explained by the SBIS registration 0% until the end

of the period of IPI could be explained SBIS of

0.40%.

The test results of both FEVD well on

conventional monetary policy as well as monetary

policy of Sharia can be said that conventional

monetary policy path of interest rates contributed the

increase in the production of industrial output bigger

than monetary policy Sharia, i.e. the interest rate path

of 37.51%, and Islamic monetary policy interest rates

line accounts for the production of industrial output

amounted to 7.14%. So it can be said that

conventional monetary policy interest rate path have

instruments that leih instrument than monetary policy

interest in the path of Sharia influenced the

production of the output of the industry.

5 RESULTS

Economic growth is one of the final target of monetary

policy in Indonesia, which is one of the charge

indicators will be seen using the industrial production

Index (IPI). The end goal can be reached through

several lines using monetary policy, one of which is

the monetary policy interest rate path.

This study discusses the transmission mechanism

of monetary policy conventional and syariah track

interest rates in affecting economic growth reflected

industrial production index (IPI). Based on the testing

that has been done on conventional models by using

the variable position of the SBI interest rates and

PUAB, the results obtained are saying that these

variables have a positive affect toward the IPI and

permanent, where the increase in the number of both

the variables affect the increase of IPI 37.51%.

6 CONCLUSIONS

VECM estimation of the results it can be concluded

that:

a.

Both in the short and long term, PUAB and SBI

significant effect on IPI.

1) In the short term, as the independent

variable of the transmission mechanism of

monetary policy,SBI and PUAS no effect

on IPI.

2) As for the long term, PUAS and SBIS no

significant effect on IPI.

b.

On the results of the test Impulse Response

Function (IRF) on the transmission mechanism

of monetary policy path of interest rates,

showed that:

1) The Conventional Model.

- Shock (shock), SBI respond positively

and permanently, which means that

variable of SBI influenced the increase

of economic growth (IPI)

- Shock (shock) PUAB respond

positively and permanently, which

means the PUAB affect the increase of

economic growth (IPI)

2) The Model Syariah.

- Shock SBIS respond positively and

permanently, which means that variable

of SBI decrease increase in economic

Analysis the Effect of Dual Monetary Policy Instrument on Index Industrial Productial in Indonesia

405

growth (IPI)

- Shock PUAS respond positively and

permanently, which means that the

variable PUAB influenced the increase

of economic growth (IPI)

In a test of Variance Decomposition variables a

transition mechanism of conventional models of

monetary policy against the IPI, it can be concluded

that the conventional variables include SBI (0.77%)

and PUAB (36.74%) that provides a positive

contribution against the IPI of 37.51%. Whereas in a

test of Variance Decomposition variables

transmission mechanisms of monetary policy against

the Islamic model of IPI, it can be inferred that Sharia

variables include SBIS (0.40%) and content (6.74%)

that provides a positive contribution against the IPI of

7.14%. So it can be said, based on results of test of

VECM in this study, the flow of transmission

mechanism of monetary policy through interest rates

to conventional models of the line better than any line

of transmission mechanism of monetary policy

through the tribal line model Sharia in affect IPI as

one indicator of economic growth.

REFERENCES

Ascarya. (2002). Instrumen-instrumen Pengendalian

Moneter. Jakarta: Pusat Pendidikan dan Studi

Kebanksentralan (PPSK) BI.

Ascarya. (2012). Alur Transmisi dan Efektifitas Kebijakan

Moneter Ganda di Indonesia. Jakarta: Pusat Pendidikan

dan Studi Kebanksentralan (PPSK) BI.

Ascarya. (2014). Monetary Policy Transmission

Mechanism under Dual Financial System in Indonesia:

Interest-Profit Channel. Malaysia: The International

Islamic University Malaysia.

Ayuniyyah Qurroh, Irfan Syauqi Beik, dan Laily Dwi

Arsyianti. (2013) Dynamic Analysis of Islamic Bank

and Monetary Instrument towards Real Output and

Inflation in Indonesia. Hannover: Proceding of Sharia

Economics Conference.

Chapra, M. Umer. (2000) Sistem Moneter Islam. Jakarta:

Gema Insani Pres.

Ginting, Ramlan et al. (2013) Likuiditas Rupiah Operasi

Moneter, Operasi Moneter Syariah dan Sertifikat Bank

Indonesia Syariah. Jakarta: Pusat Pendidikan dan Studi

Kebanksentralan (PPSK) B,.

Hasanah, Dini. (2011). Analisis Efektivitas Jalur

Pembiayaan Dalam Mekanisme Transmisi Kebijakan

Moneter Di Indonesia Dengan Metode VAR/VECM.

Bahan-Bahan Terpilih dan Hasil Riset Terbaik. Medan:

FRPS.

Natsir, M. (2008) Peranan Jalur Suku Bunga Dalam

Mekanisme Transmisi Kebijakan Moneter di Indonesia.

Jurnal Ekonomi.

Pratama, Yogi Citra. (2013). Effectiveness of Conventional

and Syariah Monetary Policy Transmission. Bogor:

Tazkia University College of Islamic Economics Vol.

8.1:79-96.

Rusydiana, Aam Slamet. (2009). Mekanisme Transmisi

Syariah Pada Sistem Moneter Ganda di Indonesia.

Bogor: Tazkia University College of Islamic

Economics.

Sanrego, Yulizar D dan Aam Slamet Rusydiana. (2013).

Transmission Mechanism in Dual Monetary System:

Comparison Between Shariah and Conventional

Monetary System. Bogor: Tazkia University College of

Islamic Economics.

Setiawan, Rifky Yudi dan Karsinah. (2016). Mekanisme

Transmisi Kebijakan Moneter Konvensional dan

Syariah dalam Memengaruhi Inflasi dan Pertumbuhan

Ekonomi di Indonesia. Semarang: Economics

Development Analysis Journal.

Simorangkir, Iskandar. (2014). Pengantar

Kebanksentralan: Teori dan Praktik di Indonesia.

Jakarta: Rajawali Pers.

Sri Herianingrum dan Imrojan Syapriatma. (2016) “Dual

Monetary System and Macroeconomic Performance in

Indonesia”. Jakarta: Al-Iqtishad Vol. 8, No. 1:65-80.

Sugianto, Hendra Hermain, dan Nurlela Harahap. (2015)

“Mekanisme Transmisi Kebijakan Moneter Melalui

Sistem Moneter Syariah”. Sumatera Utara: Human

Falah Vol. 2, No. 1:50-75.

Sugiyono, F.X. (2004). “Instrumen Pengendalian Moneter:

Operasi Pasar Terbuka”.Jakarta: Pusat Pendidikan dan

Studi Kebanksentralan (PPSK) BI.

Susamto, Akhmad Akbar dan Malik Cahyadin. (2008)

“Praktik Ekonomi Islami di Indonesia dan Implikasinya

terhadap Perekonomian”. Jurnal Ekonomi Syariah

MUAMALAH Vol. 5.

Warjiyo, Perry dan Solikin. (2003) “Kebijakan Moneter di

Indonesia”. Jakarta: Pusat Pendidikan dan Studi

Kebanksentralan (PPSK) BI.

Warjiyo, Perry. (2004) “Mekanisme Transmisi Kebijakan

Moneter di Indonesia”. Jakarta: Pusat Pendidikan dan

Studi Kebanksentralan (PPSK) BI.

Zein, Aliman Syahuri. (2015) “Apa dan Bagaimana:

Mekanisme Transmisi Kebijakan Moneter Syariah di

Indonesia”. Padangsimpuan: At-Tijaroh Vol. 1, No.

1:91-122.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

406