Regional Tax and Levies, General Allocation Funds, and Special

Allocation Funds Effects to the Capital Expenditures Allocation with

Total Population as Moderating Variables in Districts/Cities in North

Sumatera Provinces

Sahala Purba

1

, Reynhard Nababan

1

, Iskandar Muda

1

and Syafruddin Ginting

1

1

Faculty of Economic and Business, North Sumatera University, Medan Indonesia

Keywords: Regional Taxes, Regional Levies, General Allocation Funds (DAU), Special Allocation Funds (DAK),

Total Population, and Capital Expenditures.

Abstract: Objective of this study is to analyse the influence of various local government revenue sources (Regional

Taxes and Levies, General Allocation Funds, and Special Allocation Funds) on fund allocation into Capital

Expenditures and using Population as moderating variables. Taking into an account important role of Capital

Expenditures in running the government system to improve public welfare. The population used in this study

were all Regencies/Cities in North Sumatra, 33 Regencies/Cities from 2014–2016.Sample in this study were

23 Regencies/Cities using purposive sampling method of those districts/cities reported their annual financial

statements. Data analysis technique used multiple linear regression analysis and for moderating variable

analysis used absolute difference value test. The study results indicated that Regional Taxes, General

Allocation Funds (DAU), and Special Allocation Funds (DAK) have positive and significant effects on the

Capital Expenditures allocation, while Regional Levies shows a negative effect. The study also showed that

Total Population was able to moderate all variables to Capital Expenditures.

1 INTRODUCTION

Decentralization is transfer of certain role of central

government, with all of the administrative, political

and economic attributes related to the it, to

democratic local (i.e. municipal) governments which

are independent of the central government within a

legally delimited geographic and functional domain

(Faguet, 2002). Decentralization empower local

government to make policy suit for their environment

for the purpose of public services improvement and

promoting their local economy. To achieve the

purpose and conduct their administration local

government are required to improve their revenue and

collect source of funding through local tax and local

fee (Soewardi & Ananda, 2015). The Australian

Constitution and case law require that different types

of government collection must have certain

characteristics to meet the legal definitions of tax,

levy, charge, excise or penalty such as: (a)

Compulsion. A tax is usually compulsory in that the

taxpayer has no choice about whether to pay it. (b)

Revenue raising. The most significant, though not

sufficient, factor that needs to be considered is

whether the purpose of the local government

collection is to raise revenue. (c) Public purposes.

Taxes are generally imposed for ‘public purposes’,

including the financing of government expenditures.

(d) Payment for services. The collection is not a tax

when it is a ‘payment for services rendered’ or a ‘fee

for services’, even though it may have similar nature

of a tax. Whether a collection is a tax or a fee for

service, it does not depend on the label given to it, but

on its substance and operation. (e) Arbitrariness. To

recognize as a tax, a collection must not be imposed

in an arbitrary manner. Liability for a tax must be

imposed by reference to criteria that are general and

clear in their application, and not as a result of an

administrative decision based on individual

preference, unrelated to any test laid down by the

legislation (Weier, 2006).

The concept of local autonomy and

decentralization was introduced in Indonesia post

reformation in 1998. The central government retains

five functions that affect the nation and transfer11

functions to local governments, districts, and

Purba, S., Nababan, R., Muda, I. and Ginting, S.

Regional Tax and Levies, General Allocation Funds, and Special Allocation Funds Effects to the Capital Expenditures Allocation with Total Population as Moderating Variables in Districts/Cities

in North Sumatera Provinces.

DOI: 10.5220/0009493203910397

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 391-397

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

391

municipalities to perform their obligations. The

power of central government is limited to six broad

areas consists of finance, foreign affairs, defence,

security, religion, and state administration and justice

(Nasution, 2016). Law No. 32 of 2014 revised of Law

No. 32 of 2004 concerning regional government

defines revenue for regional government, consists of:

regional taxes, regional levies, and others, and

transfer from central government in form of revenue

sharing, DAU, and DAK. The law also explains

regional autonomy’s right, authority and obligation of

the autonomous region to regulate and manage their

own government affairs and the interests of the local

community. With regional autonomy each region is

required to be able to manage all the resources, to

finance regional expenditures, to increase services in

various sectors, especially the public sector for

various purposes such as to attract investors to invest

in the region (Kemenhumkam, 2014).

Based on description above the study is being

done to look into correlation of regional

governmental revenue sources consists of regional

taxes, regional levies, general allocation funds, and

special allocation funds, and the capital expenditures

allocation with population as moderating variables,

with study cases for districts or cities in North

Sumatra provinces. Discussion will be divided into:

first regional taxes effects, second regional levies

effects, third general allocation fund effects, special

allocation fund effects, followed by reviewed whether

total population can moderate all 4 variables.

2 THEORICAL FRAMEWORK

A literature review refer to those of those article and

papers that has been published by accredited scholars

and researchers (D. Taylor & Procter, 2008).

2.1 Regional Government Revenue

Sources

The state as a sovereign person of public law is

manifested by its functions in society, functions that

must be maintained from public funds. The state

sovereignty in financial terms is manifested by

taxation and is done with the tax authority, as a public

institution. (Morar, 2015)Tax has always been an

important and crucial tool for the government

administration in almost all countries both developed

and developing (Miskam, Noor, Omar, & Aziz,

2013). It is also the revenue sources for almost all

countries. Tax collection can be divided into: Federal

Tax and State or Local or Regional Taxes. Regional

taxes consists of a vehicle and ownership transfer tax,

a vehicle fuel tax, a surface water tax, a cigarette tax.

Local taxes consist of a hotel tax, a restaurant tax, an

advertisement tax, a public lightning tax, a non-metal

and stone minerals tax, a parking tax, a land and

building tax, a land and building acquisition tax, etc.

Property taxes consists of land and building tax, land

and building acquisition tax (UCLG, 2016).

Regional government can also generate revenue

from levies. A levy is a temporary tax collection by

federal, state or local governments and being used for

a stated public purpose. A taxpayer can be liable for

various levies’ depending on an individual annual

taxable income. In comparison, a tax is usually a

general contribution imposed on individuals,

properties or businesses. Tax is collected and

deposited into the government’s consolidated fund

and further on is allocated to various purposes in

accordance with the government plan (M. Taylor,

2012).

In accordance with Law No. 32 of 2014, regional

government receives transfers of DAU, Revenue-

Sharing Fund and DAK from the central government.

DAU are funds sourced from national budget

revenues allocated with the aim of equal distribution

of financial capacity between regions to fund regional

needs in the implementation of decentralization

(Kemenhumkam, 2014). In addition, DAU has

objective to reduce fiscal imbalances between sub-

national governments. DAU transfers from central

government are defined following certain formula,

consists of a base allocation which is equal to the

amount of spending on personal, and a fiscal gap

allocation which can be positive or negative. This

fund is then allocated 10% to at the provinces level

and 90% at the districts and municipalities level; The

transfer amount normally represents 50% of that of

regional revenues. While DAK is a transfer system to

fund responsibilities that are considered as national

priorities (UCLG, 2016). DAK is a fund allocation

from the national budget to certain regions to fund

specific activities in certain areas such as activities in

local development, improvement in infrastructure or

public services (Kemenhumkan, 2005b).

2.2 Regional Government

Expenditures

Government expenditures in form of public and

capital spending which play significant roles in the

operation of nation’s economies. Public expenditures

can be divided into administrative, internal securities,

health, education, etc. Capital expenditure refers to

the amount spent in the acquisition of fixed and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

392

productive assets whose useful life normally beyond

the accounting or fiscal year, as well as spending

incurred to upgrade or improve of existing

infrastructures and fixed assets such as lands,

building, roads, machines and equipment, etc.,

including intangible assets (Aigheyisi, 2013). In

accordance with Law No. 58 of 2005, regional

government spending is divided into Capital

Expenditures and Non Capital Expenditures. An

example of the later is local government employee

salaries, etc (Kemenhumkan, 2005a).

Capital expenditures has wide-ranging benefits

for a region’s economy. These benefits can be seen in

term of improvement in the public capital facilities

such as transportation, water, etc prevention in

negative effects on public safety, and environmental

protection (Fisher & Sullivan, 2016), in line with

other study result showing that the government

investment on infrastructure increases the marginal

efficiency of private capital (Dadgostar & Mirabelli,

1998).

2.3 Total Population

Current understanding of population does not show a

correlation between the effect of population growth

and economic development of less developed areas.

Some theoretical analyses propose that population

growth creates pressure on natural resources, reduces

private and public capital formation, and also

resulting to capital resources allocation to regular

spending instead of capital expenditures. On the other

side, increase in population crate positive effects such

as economies of scale and specialization, new

generation with higher motivations compared with

older ones (Atanda, A. A., Aminu, S. B., & Alimi,

2012). For the study purpose, we factor population as

an important part of economy on the region.

Accordingly, we hypothesize the following:

H1: There is a positive and significant relationship

between regional taxes and capital expenditures.

H2: There is a positive and significant relationship

between regional levies and capital expenditures.

H3: There is a positive and significant relationship

between DAU and capital expenditures.

H4: There is a positive and significant relationship

between DAK and capital expenditures.

H5: There is a positive and significant relationship

between all variables together regional taxes,

regional levies, DAU, and DAK, and capital

expenditures.

H6: Population can moderate between all variables

together regional taxes, regional levies, DAU, and

DAK, and capital expenditures.

3 RESEARCH METHOD

3.1 Research Sites

The literature study was conducted in the

District/City in Provinsi Sumatera Utara using data

available in website www.djpk.kemenkeu.go.id, and

www.sumut.bps.go.id

3.2 Population and Sample

This study takes a population from District/City

Government of North Sumatra Province which

consists of 25 regencies and 8 cities for reporting

period of 2014 to 2016.The sample of this study, is

set using a purposive sampling method with criteria

of districts/cities that produce their financial

statements for 3 consecutive years from 2014 - 2016.

A seen in table 3.1, for 69 samples consists of 23

regencies/cities for 3 years reporting period.

3.3 Types and Data Sources

The data type for this study is quantitative data,

namely research methods based on the philosophy of

positivism, used to examine a particular population or

sample, data collection using research instruments,

data analysis is quantitative/statistic with the aim of

testing predetermined hypotheses (Pratama, 2017).

4 RESULT

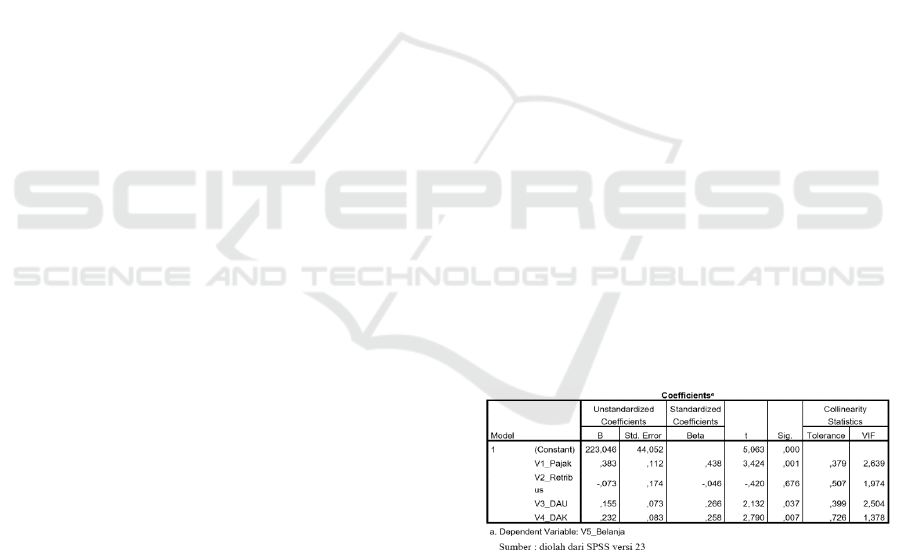

Table 1: Multiple Linear Regression Analysis.

Based on table 1 above, multiple linear regression

equations obtained, as follow:

Y = 223,046 + 0,383X1 - 0,073X2 + 0,155X3 +

0.232X4 + e.

The multiple linear regression equation above

showed that regional tax (B = 0.383), DAU

(B=0.155) and DAK (B=0.232) has a positive relation

with capital expenditures. Meanwhile regional levies

showed a negative correlation (B=-0.073) with

Regional Tax and Levies, General Allocation Funds, and Special Allocation Funds Effects to the Capital Expenditures Allocation with Total

Population as Moderating Variables in Districts/Cities in North Sumatera Provinces

393

capital expenditures. The negative correlation

indicates increase in the levies does not contribute to

increase in capital expenditures.

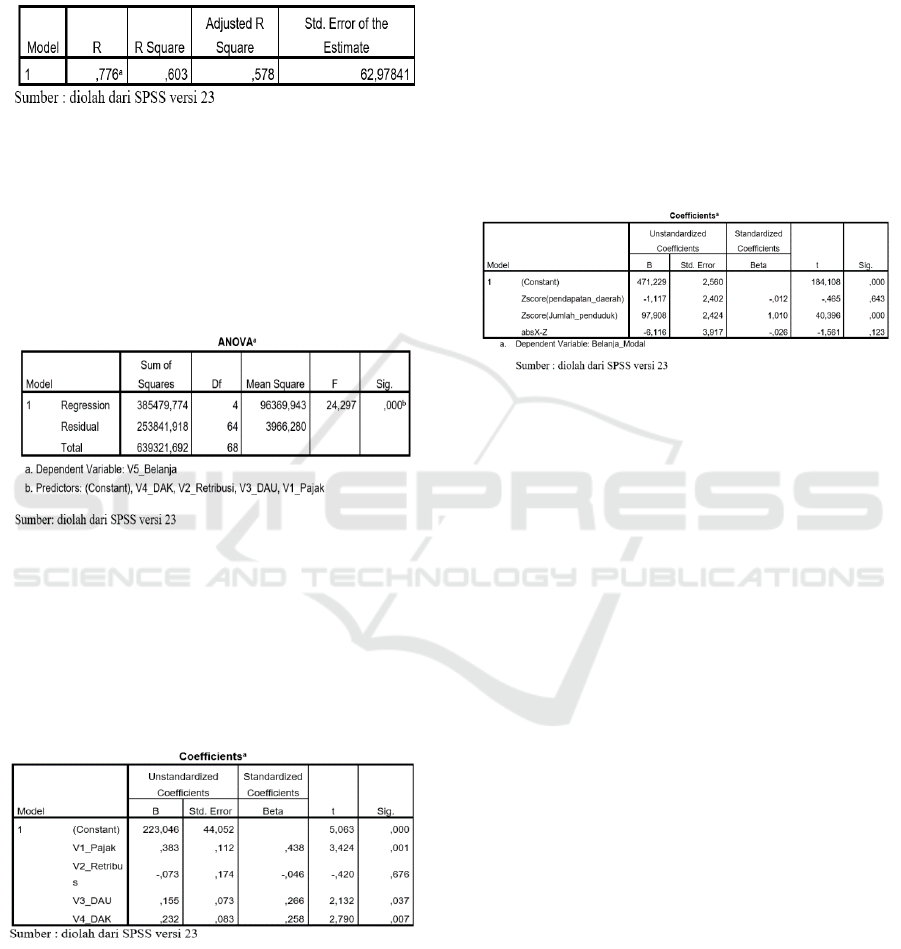

Table 2: Determination Coefficient Analysis.

Based on table 2 above, it is shown coefficient of

determination (R-Square) at 0.603.These values can

be interpreted as variables of Local Taxes, Local

Levies, DAU, and DAK together explains 60.3%

variations in Capital Expenditures, the remaining

39.7% is explained by other variables or factors.

Table 3: Significance of Simultaneous Effect Test.

Based on table 3, it is known that Fcount is

24,297>Ftable value of 2.76 and with probability

value (Sig.) 0,000 <0,05. This means that the regional

taxes, regional levies, DAU, and DAK

simultaneously/jointly significantly has effect on

Capital Expenditures.

Table 4: t-test.

Table 4 above showed that: Regional Tax variable

shows the value below the significant level of 5% (α

= 0.05) and the value of t counts 3.424> t-table 1.667

which means that H1 is accepted so that the Capital

Expenditures is positive and significantly impacted

by regional tax. Regional levies variable shows a

value above the significant level of 5% (α = 0.05) and

t count value of -0.420 <t-table 1.667 which means

that H2 is rejected so that the regional levies does not

significantly influence capital expenditures. DAU

variable shows the value below the significant level

of 5% (α = 0.05) and t count value of 2.132> t-table

1.667 which means that H3 is accepted so that DAU

has positive and a significant effect on capital

expenditures. DAK variable shows the value below

the significant level of 5% (α = 0.05) and the value of

t count 2.790> t-table 1,667 which means that H4 is

accepted so that DAK has a significant effect on

capital expenditures.

Table 5: The Absolute Difference Value Test.

Based on table above, it can be seen the significant

value of the interaction (Abs X-Z) of 0.049 shows the

value below the significant level of 5% (α = 0.05) and

the regression coefficient is positive at 61.684 which

means that H6 is accepted so that the population is

able to moderate the regional tax, regional levies,

DAU, and DAK for Capital Expenditures.

5 DISCUSSION

5.1 Regional Taxes Effects

Based on the research results obtained that regional

tax has a significant and positive effect on Capital

Expenditures, this is seen from the t test in table 4.4,

a significant level of 0.001 which is smaller than

0.005 and a positive regression coefficient of 0.383,

so the hypothesis of the influence of regional tax on

allocation Capital Expenditures are accepted. This

means that regional taxes increase will trigger an

increase in the allocation of Capital Expenditures,

Law No. 28 of 2009 explains that tax is used for the

purposes of the state for the greatest prosperity of the

people. Tax revenue is meant for state financing and

national development, through the allocation of the

tax revenue to capital expenditures for public needs.

Regional tax is a component of local revenue that

describes the independence of an area and has the

largest contribution in providing income for the

region, the Regional Government has the authority to

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

394

allocate its income in the direct expenditure sector or

for capital expenditure, this means in North Sumatra

from 2014-2016 allocates tax for Capital

Expenditures. This study results are in line with prior

research, (Jaya & Dwirandra, 2014) which concluded

that the is a significant positive effect of Regional

Taxes to Capital Expenditures. But it is different from

the study of (Juwari, Setyadi, & Ulfah, 2016) which

stated variable Regional Taxes do not have an impact

on Capital Expenditures because income from tax is

less so that it relies on balancing funds to finance its

Capital Expenditures.

5.2 Regional Levies Effects

The study results showed that there is no significant

effect of regional levies to capital expenditures, this

is seen from the t test in table 4, a significant level of

0.676 which is greater than 0.05 and the regression

coefficient is negative that is -0.073, so the hypothesis

of the influence of regional levies to allocation of

Capital Expenditures is not supported. This is in line

with the prior research (Juwari et al., 2016), stating

that there is no significant effect of regional levies to

Capital Expenditures because the income from

regional levies is less so that it relies on balancing

funds to finance its Capital Expenditures. This

research is different from the other research (Jaya &

Dwirandra, 2014),who stated that regional levies had

a significant effect into Capital Expenditures.

5.3 General Allocation Fund Effects

Based on the research results obtained, there is a

significant effect of DAU to capital expenditures, this

is seen from t test in table 4.4, a significant level of

0.037 which is smaller than 0.05 and regression

coefficient of 0.155 so that the hypothesis on DAU

effect on the allocation of capital expenditures is

accepted. This is in line with the prior research (Yawa

& Runtu, 2015), which stated that there is a positive

and significant effect of DAU to capital expenditures.

This research is different from the other research

(Jaya & Dwirandra, 2014), which stated that there is

no effect of DAU to capital expenditures.

5.4 Special Allocation Fund Effects

The study results showed there is a significant

positive effect of DAK on capital expenditure, this is

seen from the t test in table 4.4, a significant level of

0.007 which is smaller than 0.05 and the regression

coefficient is positive that is 0.232 so the hypothesis

of the influence of DAK on capital expenditures

allocation is accepted, which means if the DAK in a

region increases, capital expenditures will also

increase. The study results is in line with the prior

research (Wandira, 2013)which stated that there was

a significant influence between DAK variables on

capital expenditure, while in (Tolu, Walewangko, &

Tumangkeng, 2016), there is positive effect of DAK

capital expenditure allocation, because the need was

a national commitment or priority.

5.5 Regional Taxes, Regional Levies,

General Allocation Fund, and

Special Allocation Fund Effects

Combined

Based on simultaneous testing (F), the variables of

regional taxes, regional levies, DAU and DAK have

a significant effect on the allocation of capital

expenditures, this is seen from the F test in table 4.3,

the significance level of 0.000 this means the

significance level <5% (0.05) and seen from the

testing of the coefficient of determination (R Square)

in table 4.3 of 0.603, this means that 60.3% of the

Capital Expenditure variable can be explained by the

four independent variables which is regional tax,

regional levies, DAU, and DAK, and the remaining

39.7% explained by other potential variables outside

the model. Regional taxes, regional levies, DAU and

DAK are all revenues sources for region that can be

allocated to finance the needs in the region, one of

which is Capital Expenditure.

5.6 Population Effects

Based on the results of the research obtained, the

population was able to moderate local taxes, regional

levies, DAU, and DAK on Capital Expenditures. This

is seen from the test of the absolute difference value

in table 4.5, the significant level of 0.049 which is

smaller than 0.05 and the regression coefficient is

positive that is 61.684 so that it can be said that the

Population is able to moderate the relationship of

local taxes, regional levies, DAU, and DAK to capital

expenditures.

6 CONCLUSIONS

Study results shows that three is a significant positive

effect of variables Regional Taxes, General

Allocation Fund and Special Allocation Fund, on the

allocation of Capital Expenditures. This mean that

certain increases/decreases in Regional Taxes is

Regional Tax and Levies, General Allocation Funds, and Special Allocation Funds Effects to the Capital Expenditures Allocation with Total

Population as Moderating Variables in Districts/Cities in North Sumatera Provinces

395

responded through positive changes or have

influences in allocation of Capital Expenditures.

Another test shows all four variables together

Regional Taxes, Regional Levies, DAU and DAK

have positive and significant effect on the allocation

of Capital Expenditures. This means certain

increases/decreases in Regional Taxes is responded

through positive changes or have influences in

allocation of Capital Expenditures. While regional

levies alone do not have a significant effect on the

allocation of Capital Expenditures. The study results

showed that Population as a moderating variable has

a significant level, which means that the population is

able to moderate all variables on the allocation of

capital expenditure.

The study is far from conclusive on variables to

capital expenditures allocation nor the reasons to why

regional levies which is also a revenue sources, does

not follow the same trend as the other three variables.

Which might require a more in-depth study. Another

area could also be explored by adding another

moderating variable such as economic growth and

inflation rates or expanding the scope beyond 3

(three) years as used in this study, and inclusion those

district/cities absence from the respondent lists.

REFERENCES

Aigheyisi, O. S. (2013). The Relative Impacts of Federal

Capital and Recurrent Expenditures on Nigeria’s

Economy (1980-2011). American Journal of

Economics, 210–221. https://doi.org/10.5923/j.

economics.20130305.02

Atanda, A. A., Aminu, S. B., & Alimi, O. Y. (2012). The

Role of Population on Economic Growth and

Development: Evidence from Developing Countries.

MPRA Munich Personal RePEc Archive.

Dadgostar, B., & Mirabelli, F. (1998). Does government

public capital expenditure matter?: Evidence for

Canada. Economic Analysis and Policy, 28(2), 199–

211. https://doi.org/10.1016/S0313-5926(98)50019-7

Faguet, Aj.-P. (2002). The Determinants of Central vs

Local Government Investment_Institution and Political

Matters (Vol. 44). Houghton Street London.

https://doi.org/ISSN 1470-2320

Fisher, R. C., & Sullivan, R. (2016). Why Is State and Local

Government Capital Spending Lower in the New

England States Than in Other U . S . States ?, (July), 24.

Jaya, I. P. N. P. K., & Dwirandra, A. A. N. . (2014).

Pengaruh Pendapatan Asli Daerah pada belanja Modal

dengan Pertumbuhan Ekonomi sebagai Variabel

Pemoderasi. E-Journal Akuntansi Universitas

Udayana, 1, 79–92.

Juwari, Setyadi, D., & Ulfah, Y. (2016). Pengaruh Pajak

Dan Retribusi Serta DAU dan DAK terhadap Belanja

Daerah dan Pertumbuhan Ekonomi pada

Kabupaten/Kota di Wilayah Kalimantan. Journal

GeoEkonomi, 07(01), 1–15. Retrieved from

https://www.researchgate.net/publication/311678017_

Pengaruh_Pajak_dan_Retribusi_serta_Dana_Alokasi_

Umum_dan_Dana_Alokasi_Khusus_terhadap_Belanja

_Daerah_dan_Pertumbuhan_Ekonomi_pada_Pemerint

ah_Kabupatenkota_di_Wilayah_Kalimantan

Kemenhumkam. (2014). Undang undang Republik

Indonesia No. 23 Tahun 2014 Tentang Pemerintahan

Daerah. Undang undang Republik Indonesia No. 23

Tahun 2014.

Kemenhumkan. (2005a). Peraturan Pemerintah Nomor 58

tahun 2005 tentang Pengelolaan Keuangan Daerah.

Menteri Hukum dan Hak Azasi Manusia Republik

Indonesia.

Kemenhumkan. (2005b). Peraturan Pemerintah Republik

Indonesia No. 55 tahun 2005 tentang Dana

Perimbangan. Menteri Hukum dan Hak Azasi Manusia

Republik Indonesia.

Miskam, M., Noor, R. M., Omar, N., & Aziz, R. A. (2013).

Determinants of Tax Evasion on Imported Vehicles.

Procedia Economics and Finance, 7(Icebr), 205–212.

https://doi.org/10.1016/S2212-5671(13)00236-0

Morar, I. D. (2015). Taxation: Effects and Influences.

Procedia Economics and Finance, 32(15), 1622–1627.

https://doi.org/10.1016/S2212-5671(15)01488-4

Nasution, A. (2016). Government Decentralization

Program in Indonesia. Asian Development Bank

Institute. Tokyo. https://doi.org/10.2139/ssrn.2877579

Pratama, R. (2017). Pengaruh Pendapatan Asli

Daerah_Dana Alokasi Umum_Dana Alokasi Khusus

terhadap Alokasi Belanja Modal dengan pertumbuhan

ekonomi sebagai variabel moderasi. JOM Fekon, 1(2),

1–15.

Soewardi, T. J., & Ananda, C. F. (2015). The

Transformation of Bea Acquisition Rights to Land and

Buildings (BPHTB): Case Study in Kediri City of East

Java. Procedia - Social and Behavioral Sciences,

211(September), 1179–1185. https://doi.org/10.1016/j.

sbspro.2015.11.157

Taylor, D., & Procter, M. (2008). The Literature Review: A

Few Tips on Conducting it. Writing Support, University

of Toronto, 1–2. https://doi.org/10.1109/EW.2010.

5483464

Taylor, M. (2012). Is it a levy, or is it a tax, or both?

Revenue Law Journal, 22(1), 188. Retrieved from

http://search.informit.com.au/documentSummary;dn=

222692456112614;res=IELAPA

Tolu, A., Walewangko, E. N., & Tumangkeng, S. Y. L.

(2016). Alokasi Umum dan Dana Alokasi Khusus

terhadap Belanja Modal (Studi pada Kota Bitung).

Jurnal Berkala Ilmiah Efisiensi, 16(02), 540–549.

https://doi.org/10.1007/s10995-009-0486-x

UCLG. (2016). Indonesia Basic socio economic indicators.

United Cities and Local Government Publications.

Retrieved from https://www.oecd.org/regional/

regional-policy/profile-Indonesia.pdf

Wandira, A. G. (2013). Pengaruh PAD, DAU, DAK, dan

DBH terhadap Pengalokasian Belanja Modal.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

396

Accounting Analysis Journal, 2(33), 44–51.

https://doi.org/ISSN 2252-6765

Weier, A. (2006). Legal definitions of taxation terms–

implications for the design of environmental taxes and

charges. 50th Annual Conference of the Australian

Agricultural and Resource Economic Society.

Retrieved from http://ageconsearch.umn.edu/bitstream/

139927/2/2006_weier.pdf

Yawa, H., & Runtu, T. (2015). Pengaruh Dana Alokasi

Umum ( Dau ) Dan Pendapatan Kota Manado the

Influences of General Allocation Fund ( Dau ) District

Own. Jurnal Berkala Ilmiah Efisiensi, 15(04), 390–

400.

Regional Tax and Levies, General Allocation Funds, and Special Allocation Funds Effects to the Capital Expenditures Allocation with Total

Population as Moderating Variables in Districts/Cities in North Sumatera Provinces

397