The Influence of Liquidity and Deposit Insurance on Market

Discipline at Regional Development Bank in Indonesia

Syarief Fauzie and M. Deni Rahman Sitepu

Economic Development Department, Faculty of Economic, University of Sumatera Utara, Medan

Keywords: Market Discipline, Deposit Growth, Interest Rates, Liquidity, Deposit Insurance.

Abstract: The purpose of this study is to determine the effect of liquidity on the influence of overhead, short term

debt, inflation and regional growth of gross domestic product on deposit growth and interest rates as market

discipline variables. In the research also use dummy variable in the form of policy of deposit insurance

either implicitly or explicitly by Government of Indonesia as variable which moderate influence of liquidity

to growth of deposit and interest rate. This study used 19 regional development banks in the region during

the period of 2002-2014. In testing the influence of independent variable to dependent variable, this

researchuse multiple linear regression fixed effect model. While the data in this research is secondary data

sourced from annual report published by Bank Indonesia. The results show that liquidity is a variable that

can mediate the influence of short term debt and regional growth of gross domestic product on the growth of

deposits and also can mediate the influence of overhead, short term debt, inflation and regional growth of

gross domestic product against interest rate. The results also show that the implementation of the deposit

insurance policy explicitly is a variable that strengthens the effect of liquidity on deposit growth and interest

rate.

1 INTRODUCTION

Based on the last two decades in the banking world,

there has been a series of crises that systematically

caused bankruptcy of banks that culminated in 1997

in Asian countries such as Thailand, Indonesia,

Malaysia and Korea. The crisis not only resulted in

bankruptcy of banks but also resulted in economic

downturn and devaluation of currencies in countries

that experienced the crisis. In addition, the banking

crisis also affected the decline in public confidence

in the banking industry. This is due to moral hazard

perpetrated by banking actors who have harmed the

public in general and ultimately impacted the public

panic to withdraw their funds from the banks due to

lack of confidence in the community to the bank at

that time.

The incidence of banking crisis in Asian

countries especially in Indonesia resulted in Bank

Indonesia adopting Basel II on the Banking

Architecture which explicitly emphasized the

strengthening of market discipline as stated in Pillar

3 within the Indonesian Banking Architecture (API)

which was enacted in 2004. This is done to improve

banking stability in Indonesia, as well as to avoid

bank failures in the future and to restore public

confidence to banks.

Market discipline is an act by customers,

creditors, and investors in disciplining banks that

take the risk are too big. Market discipline currently

used in banking literature includes two components:

the ability of market actors to precisely judge the

condition of a company and the supervision and

ability of market participants to influence the actions

of corporate management as a way of reflecting

judgments (Flannery. 2000). To achieve these

objectives, in the banking context, adequate

information is needed for the community regarding

the condition of the bank and the ability of the

community itself to assess the condition of the bank

through analysis of available information. In this

case the role of banks as financial institutions to be

trusted by the public is required to provide correct

information about their conditions to customers or

investors.

Based on this, it can be concluded that banks that

have a high risk tend to make customers feel worried

about their deposits. The action taken by the

customers is to discipline the bank, that is by

demanding higher interest rates. This phenomenon

706

Fauzie, S. and Sitepu, M.

The Influence of Liquidity and Deposit Insurance on Market Discipline at Regional Development Bank in Indonesia.

DOI: 10.5220/0008892807060714

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 706-714

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

may still be overcome by the banking sector by

maintaining bank liquidity. But if the customer

withdraws the deposit and is not something that is

impossible, based on fear and to avoid losses due to

risk taken by the bank, the customer may withdraw

all deposits to the bank.

According to Murata and Hori in Taswan that

banks havenegative correlation relationship between

the growth rate of deposits with bank risk and have a

positive correlation relationship between the interest

rate demanded and bank risk(Murata and Hori,

2013). This leads to a decrease in deposit growth in

the bank resulting from market discipline by

customers through interest rates, even worse that

bankruptcy or bank failure, if the customer

withdraws all deposits to the bank. The consequence

of this problem is the decreasing of public

confidence, especially the customers to the bank and

it is not impossible that will have an impact on the

banking crisis.

As already mentioned in the previous

phenomenon that bank liquidity can overcome

market discipline conducted by the customer

through the interest rate demanded by the customer.

Good liquidity management can give confidence to

depositors or savers that they can take funds at any

time or at maturity. The bank's liquidity also has a

negative effect on the market discipline; the better

the management of bank liquidity, the market

discipline undertaken by the customers can be

overcome by the banks.

However, market discipline does not always

carry out its duties to monitor risk. Market discipline

will weaken when customer deposits are fully

guaranteed by the government (Yaling and Yingzi,

2012). AsDermiguc-Kunt and Huizinga, who say the

deposit insurance program is one indication that the

banking system in the country is in a systemic crisis

(Dermiguc-Kunt and Huizinga, 1998). This

guarantee has a positive influence on the banking

sector, the flow of public funds has gradually re-

entered the banking sector, the panic has been eased

and the recovery of public trust in banking has taken

place. But market discipline becomes relatively

lower or weaker when full guarantee is carried out

(Prean and Stix, 2011). The same was stated by

Dermiguc-Kunt and Huizinga, who said that deposit

insurance did indeed weaken market discipline

through deposit rates (Dermiguc-Kunt and Huizinga,

2004).

Yan, etal.said that the condition of market

discipline cannot happen, because all the risks

caused by the bank's decision have been borne by

the deposit guarantee. However, if the guarantee is

done in a limited way and enforced in general, then

the customer can still perform market discipline or

act on bank risk (Yan etal.2011). The same thing

was also expressed by Berger and Turk-Ariss, who

say that market discipline will decrease when the

government takes full or implicit deposit insurance

(Berger and Turk-Ariss, 2012). In contrast to

Distinguin said that market discipline is more

effective if there is an explicit deposit insurance

(Distinguin etal.2011).

Moreover, Distinguin finds that market discipline

is stronger when an explicit deposit insurance is

applied, whereas when the insurance is implicit,

market discipline cannot function

(Distinguinetal.2012). Market discipline performed

by the customer when the implicit period of implied

deposit insurance applies by controlling through the

withdrawal of the deposit because of the bank taking

a high risk. This shows the higher the risk taken by

the bank, the lower the bank's savings.

Conversely, in an explicit deposit insurance

period, market discipline is more sensitive than

when the insurance period is implicit. Market

discipline that customers make when an explicit

deposit insurance period applies is to demand a

higher interest rate or withdraw their savings. This

shows the higher risk taken by the bank, the higher

the interest rate demanded by the customers.

Based on the above problem, firstly, this paper

examines whether banking liquidity affects market

discipline by using the indicator deposit growth and

interest rates. This test includes control variables

consisting of overhead, short term debt,inflationand

regional gross domestic product (RGDP). The use of

these four control variables is due to having an effect

on the growth of deposits. In this test, the liquidity

variable is used as an intermediate variable to see

whether the liquidity variable is an intermediate

variable of indirect relationship between the control

variable to the deposit growth and interest rates

variable as an indicator of market discipline.

Secondly, our test is done to see the influence of

the effect of deposit insurance on the relationship

between banking liquidity to deposit growth and

interest rates by making deposit insurance variable

as a moderating variable to test whether insurance

deposit is a variable that strengthens or weakens the

effect of liquidity on deposit growth and interest

rates.

The research sample used is the Regional

Development Bank located within the Province of

Indonesia. The use of Regional Development Bank

as a sample of this study is due to have a less

competitive level of competition against national

The Influence of Liquidity and Deposit Insurance on Market Discipline at Regional Development Bank in Indonesia

707

banks located in the territory of Indonesia in terms

of technology, marketing,etc. Therefore, the

Regional Development Bank which is a bank owned

by the Regional Government in Each Province in

Indonesia has average interest rate higher than

national bank.Therefore, the research questions in

this research are:

1. How does bank liquidity mediate the effect of

overhead cost, short term debt, inflation and

regional gross domestic product growth on

deposit growth and interest rates?

2. What is the effect of deposit insurance on the

relationship between liquidity and deposit

growth and interest rates?

2 LITERATURE REVIEW

The results of research conducted by Taswan

through the results of estimation and testing

conducted between the banking risk to interest rate,

indicating that the risk of banking has a positive and

significant impact on interest rates (Taswan, 2013).

These results indicate that the higher the risk of

banking, the higher the interest rate demanded by

customers as market discipline against banks that

take high risks. This result is consistent with

research conducted by Dermiguc-Kunt and Huizinga

who found that depositors can discipline banks

involved in excessive risk taking by demanding

higher interest rates (Dermiguc-Kunt and Huizinga,

2004).

Taswan found that bank risk negatively affects

changes in deposit growth in banks. Customers

conduct market discipline in banks by punishing

banks through withdrawal of funds because of taking

high risk banks. Depositors prefer to withdraw their

funds rather than keep their deposits in the bank

(Taswan, 2013).

Furthermore, Dermiguc-Kunt and Huizingafound

out that bank liquidity is the most appropriate

attempt by banks to overcome market discipline by

customers by asking for higher interest rates. While

higher government interest rates lead to lower

liquidity.

Dermiguc-Kunt and Huizinga also found that the

existence of an explicit deposit guarantee reduces

the market discipline of the bank by the customers

(Dermiguc-Kunt and Huizinga, 2004). In contrast to

research conducted by Taswan suggests that market

discipline in the period of implicit deposit

guarantees and explicit deposit guarantee periods is

not statistically different (Taswan, 2013). The effect

of risk taking on changes in deposits in the explicit

underwriting period and the effect of risks on

changes in deposits in the implicit guarantee period

apply equally. Each has a negative effect on the

deposit changes. The similarity of these influences

indicates that market discipline applies regardless of

the difference in the deposit guarantee scheme.

Market discipline applies because solely banks take

high risks.

Based on the research questions and literature

review above, the researchers draw their hypothesis

as follows:

1. H

0

1:There is no significant effect overhead

cost, short term debt, inflation and regional

gross domestic product growth ondeposit

growth through liquidity.

2. H

0

2: There is no signficant effect deposit

insurance on the relationship between liquidity

and deposit growth.

3. H

0

3: There is no significant effect overhead

cost, short term debt, inflation and regional

gross domestic product growth on interest rate

through liquidity.

4. H

0

2: There is no signficant effect deposit

insurance on the relationship between liquidity

and interest rate.

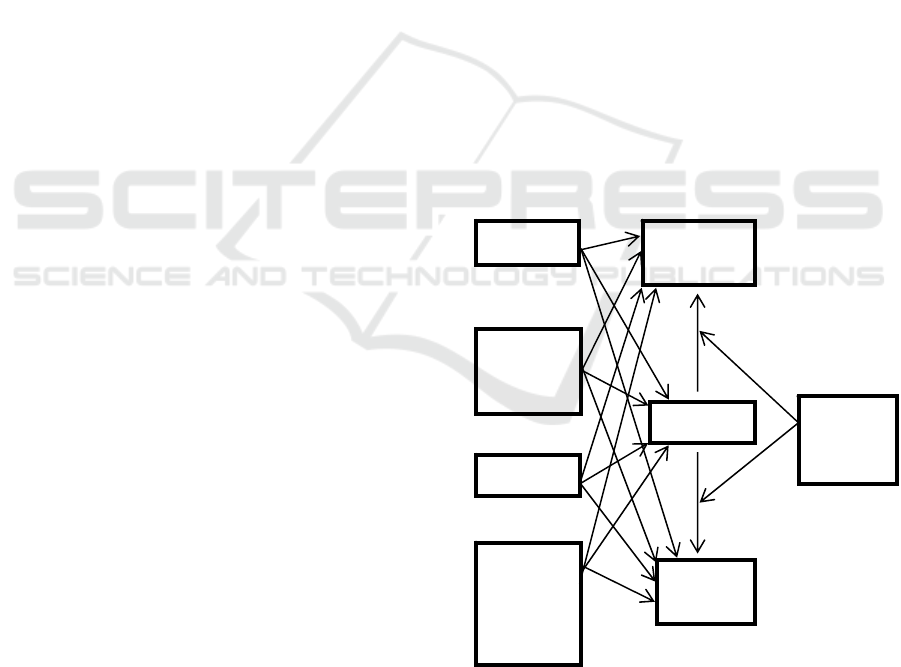

Hypothesis description of the above research is

presented as follows:

Figure 1: Hypothesis description.

Overhea

Shor

Term

Debt

Inflation

Regional

Gross

Domestic

Product

Growth

Liquidity

Deposit

Growth

Interest

Rate

Deposit

Insuranc

e

ICMR 2018 - International Conference on Multidisciplinary Research

708

3 METHODOLOGY

3.1 Research Data

The data used in this study is the data of Regional

Development Bank located in each Province in

Indonesia. The population used in this research is 26

Regional Development Banks registered with Bank

Indonesia for the period of 2002-2014.In this study

used a way to determine the sample data with non-

probability sampling that the data used as a sample

must meet the specific criteria. The selection of

banks through criteria based on purposive sampling

which is a group of subjects based on certain

characteristics believed to haveclose connection with

the characteristics or properties of the population. In

the selection of this criterion is the Regional

Development Bank registered with Bank Indonesia

by including the following sample bank criteria

1. Regional Development Bank which has been

operational within the period of 2002 - 2014.

2. The Bank publishes its annually financial

statements from period 2002 to 2014 completely.

The total sample used in this research is 19

Regional Development Banks in Indonesia that have

been operating in the period 2002-2014. Data

collection is sourced from the financial statements of

Regional Development Banks published by Bank

Indonesia.

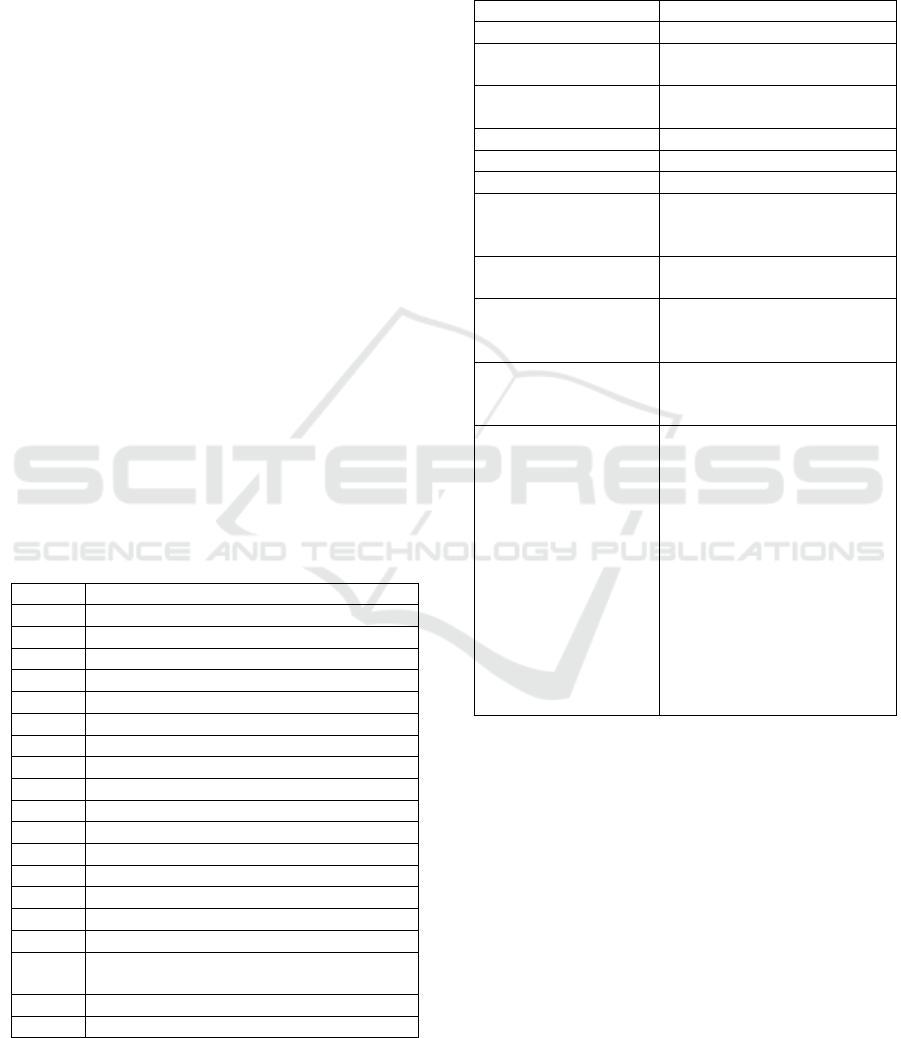

Table 1: Sample Research.

No. Bank

1. PT. Bank Aceh

2. PT. BPD Bengkulu

3. PT. Bank DKI

4. PT. BPD Jambi

5. PT. BPD Jawa Barat danBanten, Tbk

6. PT. BPD JawaTimur

7. PT. BPD Kalimantan Barat

8. PT. Bank Kalimantan Tengah

9 PT. BPD Kalimantan Timur

10. PT. BPD Lampung

11. PT. BPD Maluku

12. PT. BPD Papua

13. PT. BPD Riau, Kepri

14. PT. BPD Sulawesi Tenggara

15. PT. BPD Sulawesi Utara

16. PT. BPD Sumatera Barat

17. PT. BPD Sumatera Selatan dan Bangka

Belitung

18 BDP Sumatera Utara

19 BPD Yogyakarta

3.2 Variable and Definition

Operational definitions of each variable in this study

are as follows:

Table 2: Research Variable and Definition.

Variable Definition

Dependent Variable:

Deposit Growth Percentage growth in real

deposits

Interest Rate The ratio of interest expense

to interest paying debt

Intervening Variable:

Liquidity Liquid assets to total assets

Independent Variable:

Overhead Cost Personnel expenses and other

non-interest expenses over

total assets

Short Term Debt Short term funding to total

interest paying debt

Inflation The annual inflation rate

from the Regional Gross

Domestic Product deflator

Regional Gross

Domestic Product

Regional gross domestic

product per capitaeach

province in Indonesia

Deposit insurance The period of the

government's deposit

insurance policy which

comprises three periods

consisting of an implicit

period of deposit insurance,

an explicit deposit insurance

period with up to 100 million

guarantees and an explicit

deposit guarantee period of

up to 2 billion. Variables

used in differentiating this

period using dummy

variables.

4 RESULT

4.1 Hypothesis Test

4.1.1 Hypothesis 1

Depositors in applying market discipline will

withdraw their savings from high risk banks. In

reducing the risk of high withdrawal of customer

deposits, most banks will increase their investment

in assets with high liquidity. Therefore, bank

liquidity can be endogenous variable as banks can

try to avoid market discipline to some extent by

increasing their liquidity (Dermiguc-Kunt and

The Influence of Liquidity and Deposit Insurance on Market Discipline at Regional Development Bank in Indonesia

709

Huizinga, 2004). In this study, the use of liquidity as

a variable that mediate the influence of controlling

variables such as overhead cost, short term debt,

inflation and regional gross domestic product. As an

intervening variable, liquidity will be treated as an

exogenous and endogenous variable. In the first

stage, we examine the effect of all exogenous

variables on the endogenous variables with the

following equations:

Y

it α β1X1it β2X2it β3X3it β4X4it

β5Zit eit

(1)

WhereY

it

is deposit growth, X

1it

is overhead cost,

X

2it

is short term debt, X

3it

is inflation, X

4it

is regional

gross domestic product andZ

5it

is liquidity. The

result of the panel data regression equation is as

follows:

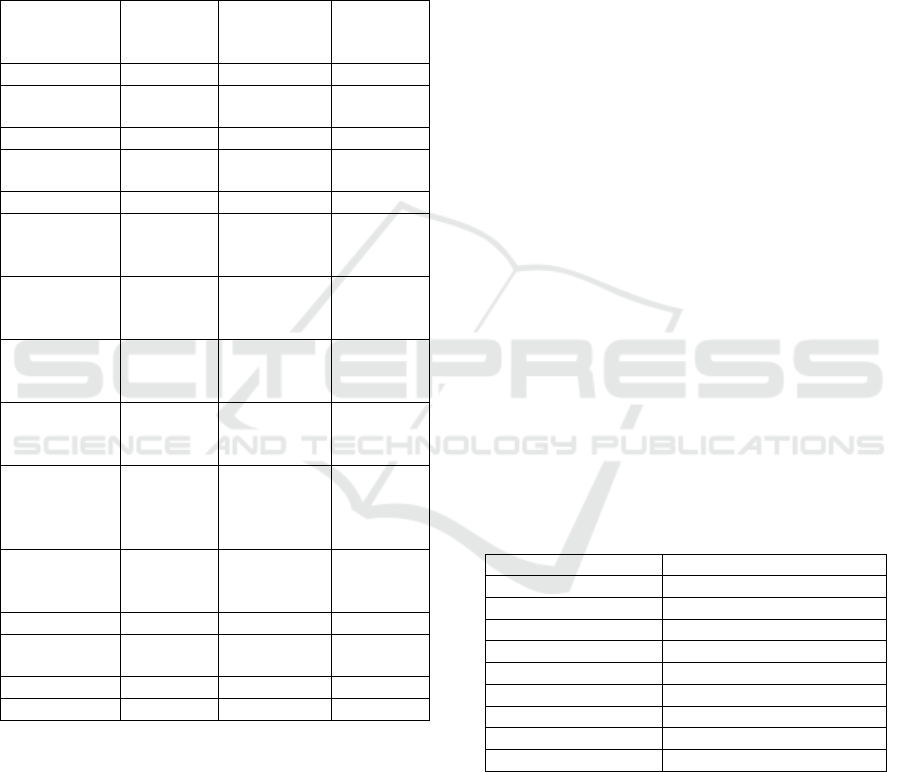

Table 3: Test for Hypothesis 1.

Variables Coefficient

Overhead -5.360008

Short Term Debt -6.001317***

Inflation -3.715142

RGDP Growth -4.027879*

Liquidity -3.018555**

No. Of Obs 247

No. Of Banks 19

Adj. R

2

0.279069

F value 5.140236***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

In the second stage, in testing liquidity as an

intervening variable then we do the regression as

follows:

Y

t α β1Xit β2Zit

(2)

Zt α β3Xit

(3)

Whrere: Y

it

is deposit growth,X

it

is each control

variable consist overhead cost,short-term

debt,inflation,regional gross domestic productand

Z

5it

is liquidity

To determine whether the magnitude of the

direct effect or through the mediation (intervening)

is significant or not, it is necessary to test with Sobel

test between each control variable with liquidity to

deposit growth with the following equation

(Ghozali, 2011):

2β3

β2

2

β33

2

3

(4)

Whereβ

2

is coefficient control liquidity on

interest,β

3

is coefficient each control variable on

liquidity, Sp2is Standard error β

2

, Sp3 is standard

error β

3

. The result of the Sobeltest of each control

variable to the growth of deposit as follows:

Table 4: Sobel Test for Hypothesis 1.

Variables Coefficient T-test

Overhead 14.489664 0.391089

Short Term

Debt

-1.349224*** -3.94707***

Inflation -0.435502 -1.09030

RGDP Growth -1.023942*** -2.93556***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

From the result of regression of fixed effect

model shows that short term debt is significant to the

growth of deposits with statistically significant 1

percent, while the liquidity and regional gross

domestic product (RGDP) have a statistically

significant effect of 5 percent and 10 percent,

respectively. While liquidity has an indirect effect

between short term debt and regional gross domestic

product (RGDP) on the growth of deposits. These

results indicate that increased investment in liquid

assets in banks with high risk does not make

depositors to increase the deposit of funds at the

Regional Development Bank. The increase in RGDP

in each province provides bank motivation to

increase liquid asset investment but does not attract

customers to increase their savings.

4.1.2 Hypothesis 2

The Indonesian Government implements the deposit

insurance policy implicitly before 2005, the adoption

of an explicit deposit insurance policy began in 2005

through the establishment of Deposit Insurance

Agency/LembagaPenjaminSimpanan(LPS) by

pledging savings not exceeding Rp 100 million in

the period 2005 to 2007. Period 2008 and so on, the

Government increased its deposit guarantee to Rp 2

billion. Therefore, to test the impact of deposit

insurance on the effect of liquidity on deposit

growth using the dummy variable. Where the

dummy variable is used to provide the difference

consisting of the period prior to 2004 which is the

period of the deposit insurance policy implicitly, the

2005-2007 period is an explicit period with deposit

insurance up to Rp 100 million and the period 2008-

2014 which is an explicit period with the deposit

insurance until with Rp 2 billion. The dummy

variables for each period of deposit insurance are

(1,0,0), (0,1,0) and (0,0,1). Regression model used to

test the variable of influence of deposit insurance in

moderating liquidity relation to growth of deposit is

as follows:

ICMR 2018 - International Conference on Multidisciplinary Research

710

Y

it

= α + β

1

X

1it

+ β

2

X

2it

+ β

3

X

3it

+ β

4

X

4it

+ β

5

X

5it

+ β

6

Z

it

+β

7

( X

5it

* Z

it

) + e

it

(5)

Where Y

it

is deposit growth, X

1it

is overhead cost,

X

2it

is short term debt, X

3it

is inflation, X

4it

is

regional gross domestic product, X

5it

is liquidity and

Zit is Dummy Variable Period. The results of

multiple linear regression equations are as follows:

Table 5: Test for Hypothesis 2.

Variables

Implicit

Period

Explicit

Period

<100Million

Explicit

Period

<2Billion

Overhead 11.999 -4.7756 -12.159

Short Term

Debt

2.097** -5.157*** 4.038**

Inflation -4.765* -4.749 0.106

RGDP

Growth

-9.614*** -2.660 -2.570

Liquidity -3.406*** -6.861*** 4.398***

Dummy

Implicit

Periode

-5.019***

Dummy

Explicit

<200 Mil

-2.091**

Dummy

Explicit

<2Bil

6.660***

Liquidity x

Dummy

Implicit

4.276**

Liquidity x

Dummy

Explicit

<100Mil

7.478**

Liquidity x

Dummy

Explicit<2Bil

-

10.942***

No. Of Obs 247 247 247

No. Of

Banks

19 19 19

Adj. R

2

0.464 0.315 0.638

F value 31.468*** 5.526*** 18.417***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

From the above results indicate that the implicit

period, the customer retains at high risk Bank with

the overall guarantee by the Government for the

saving in the Bank but when the explicit deposit

guarantee is applied the customer starts to choose

the bank which has low risk as the storage of funds.

In the 2008 and subsequent periods, customers

withdrew their savings to Banks with high liquidity

risk.

4.1.3 Hypothesis 3

Depositors can discipline Banks that take excessive

risk action by requesting high interest rates,

therefore, to avoid high demand for interest rates,

the Bank will lower its liquidity by reducing its

investment in liquid assets. Because generally liquid

assets have a low rate of return. In general, the

Regional Development Bank pays higher interest

expense compared to the national commercial banks

in Indonesia. This is because the national

commercial banks provide more income from other

services than the Regional Development Bank. In

addition, the Regional Development Bank in its

industrial competition tends to offer higher interest

rates to attract customers to keep their funds in the

Bank. The use of liquidity as an intervening variable

in mediating the effects of overhead cost, short term

debt, inflation and regional gross domestic product

on interest rates is based on a strategy by banks to

invest in providing higher returns to cover higher

interest expenses. As with hypothesis 1, then in

testing hypothesis 3 using the liquidity variable as

exogenous and endogenous variable with the

following equation:

Y

it α β1X1it β2X2it β3X3it β4X4it

β5Zit eit

(6)

Where Y

it

isinterest rate, X

1it

is overhead cost,

X

2it

is short term debt, X

3it

is inflation, X

4it

is

regional gross domestic product and Z

5it

is liquidity.

The result of the panel data regression equation is as

follows:

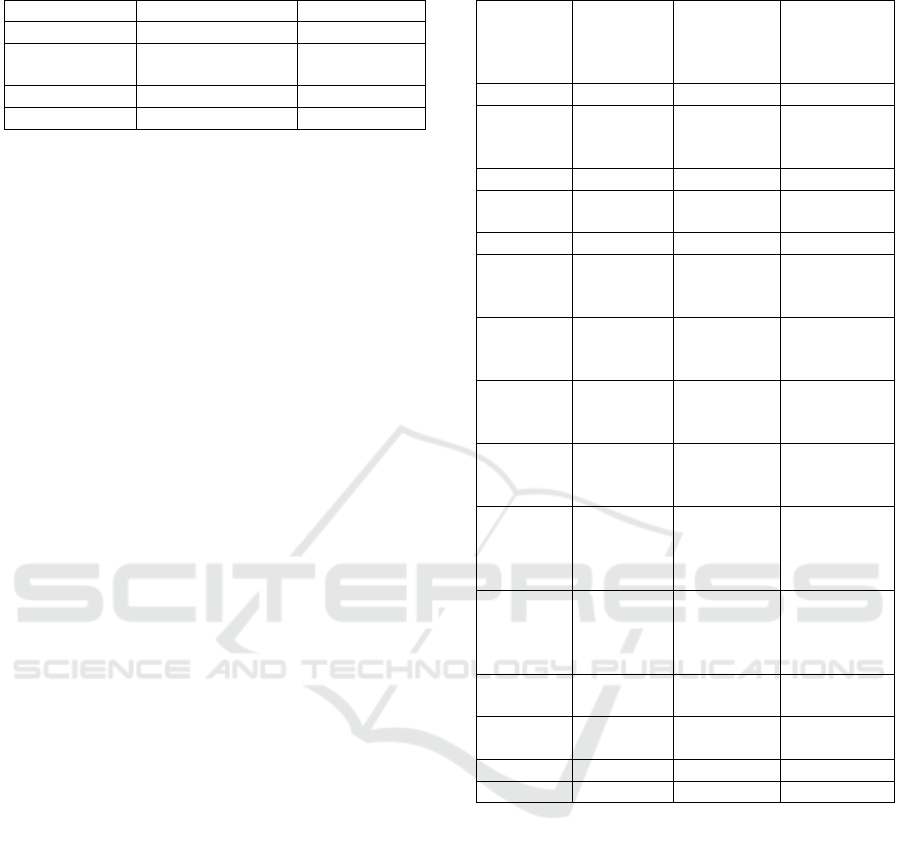

Table 6: Test For Hypothesis 3.

Variables Coefficient

Overhead -0.079211

Short Term Debt -0.015333

Inflation 0.000178

RGDP Growth -0.025820*

Liquidity -0.003430

No. Of Obs 247

No. Of Banks 19

Adj. R

2

0.394068

F value 7.955922***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

Same as testing on hypothesis 1, then in testing

the indirect effect of overhead cost, short term debt,

inflation, regional gross domestic product against

interest rate through liquidity variable by doing the

Sobel test. The result of the test is as follows:

The Influence of Liquidity and Deposit Insurance on Market Discipline at Regional Development Bank in Indonesia

711

Table 7: Sobel Test For Hypothesis 3.

Variables Coefficient T-test

Overhead 0.016464*** 12.444***

Short Term

Debt

-0.001533*** -134.367***

Inflation -0.000494*** -140.985***

RGDP Growth -0.001163*** -152.291***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

From the regression results shown in Table 6,

only regional gross domestic product affects the

interest rate with statistically significant 10 percent.

The result of the Sobel test shows that short term

debt, inflation and regional gross domestic product

have indirect relationship to the interest rate through

liquidity. Regional Development Banks will raise

investment in liquid assets when there is an increase

in short term debt, inflation and regional gross

domestic product. This is done because an increase

in interest expense on short-term debt will make

additional funds by customers. Therefore, additional

short-term investments are needed to avoid liquidity

risk. An increase in inflation will have an impact on

increase of interest rate, therefore the Bank will

increase liquidity to reduce interest rates. The same

strategy is also carried out when regional gross

domestic product increases, which will lead to an

increase in deposits and the Bank will invest in

liquid assets to justify interest rates. Short term debt

that increases (decrease) will be followed by

andecrease (increase) in interest rates, therefore the

bank will undertake a strategy to increase (decrease)

investment in liquid assets to offset the decrease

(increase) in interest rates

4.1.4 Hypothesis 4

As with the tests on hypothesis 2, we will examine

the effect of three different periods of different

deposit insurance policies on the relationship

between liquidity and interest rates.Regression

model used to test the variable of influence of

deposit insurance in moderating liquidity relation to

interest rates is as follows:

Y

it

= α + β

1

X

1it

+ β

2

X

2it

+ β

3

X

3it

+ β

4

X

4it

+

β

5

X

5it

+β

6

Z

it

+ β

7

( X

5it

* Z

it

) + e

it

(7)

Where Y

it

isinterest, X

1it

is overhead cost, X

2it

is

short term debt, X

3it

is inflation, X

4it

is regional gross

domestic product, X

5it

is liquidity and Zit is Dummy

VariabelPeriod.The results of multiple linear

regression equations are as follows:

Table 8: Test For Hypothesis 4.

Variables

Implicit

Period

Explicit

Period

<100Millio

n

Explicit

Period

<2Billion

Overhead -0.026 -0.014 -0.056

Short

Term

Debt

-0.073*** -0.062*** -0.073***

Inflation 0.012 0.008 -0.019

RGDP

Growth

-0.001 -0.017 -0.021

Liquidity 0.008 0.023** -0.025***

Dummy

Implicit

Period

0.019***

Dummy

Explicit

<200 Mil

0.013**

Dummy

Explicit

<2Bil

-0.025***

Liquidity

x Dummy

Implicit

-0.009207

Liquidity

x Dummy

Explicit

<100Mil

-0.044***

Liquidity

x Dummy

Explicit<

2Bil

0.042***

No. Of

Obs

247 247 247

No. Of

Banks

19 19 19

Adj. R

2

0.366 0.244 0.352

F value 21.336*** 12.355*** 20.094***

***,** and * indicate statistical significant at 1,5 and 10

percent, respectively.

The regression results show that when the

deposit insurance policy is explicitly applied it gives

significant effect on the interest rate through

liquidity. This explains that the existence of an

explicit deposit insurance policy makes the customer

to act reduction deposit at banks at risk. Therefore,

the risky bank will raise the interest rate to withdraw

the customer's deposit and the bank will act to

improve the liquidity. The deposit insurance policy

in full or implicitly does not impact the market

discipline behaviour because the customer does not

request higher interest rate payment to the Bank

having the risk high. On the other hand, the

customer is only interested in the bank offering high

interest rate, thereby lowering the investment in

ICMR 2018 - International Conference on Multidisciplinary Research

712

liquid assets to transfer funds to portfolios that

provide higher returns in order to pay for the

increase in interest to increase the deposits of funds

customers. The explanation can be illustrated by the

regression result indicating that liquidity has

negative and statistically significant effect on the

interest rate in the explicit period.

5 CONCLUSIONS

In the face of banking competition in Indonesia,

Regional Development Banks with limited ability to

provide other services, generally use high interest

rates to attract customer deposits. This condition is

particularly vulnerable for the Regional

Development Bank to disburse loan funds to

customers because the loans granted will require

high interest to cover the interest expense to deposit

customers. This will cause some loans to be

channelled to customers who are at risk of failing to

repay the loan. This problem can be seen from this

research where the indirect effect of short-term debt

and regional gross domestic product on the growth

of deposits and interest rates through liquidity has a

negative and significant effect.

This result is also supported by the result of the

research which shows the liquidity has a negative

and statistically significant effect on the growth of

savings in the period of deposit insurance with the

guarantee of up toRp 2 billion. Likewise, the

liquidity of the interest rate which gives a positive

and statistically significant relationship to the

interest rate in the deposit insurance period explicitly

with the guarantee of maximum fund of Rp 2

Billion.

ACKNOWLEGEMENTS

The findings, interpretations, and conclusions

expressed in this paper are entirely from the authors.

We are grateful to the University of North Sumatra

for his assistance in this research and the Islamic

University ofSumatera Utara for his opportunity in

publishing this paper.

REFERENCES

Berger, A. N., & Turk-Ariss, R., 2012. Do Depositors

Discipline Banks and Did Government Actions During

the Recent Crisis Reduce this Discipline? An

International Perspective. Journal of Financial Service

Research, 48(2), 103-126.

Cubillas, E., Fonseca, A. R., & Gonzalez, F., 2012.

Banking Crises and Market Discipline: International

Evidence. Journal of Banking & Finance, 36(8), 2285-

2298.

Dermiguc-Kunt, A., and Huizinga, H., 1998. Market

Discipline and Financial Safety Net Design. Policy

Research Working Paper, 2183. World

Bank.Retrieved from:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=6

29175.

Dermiguc-Kunt, A., and Huizinga, H., 2004. Market

Discipline And Deposit Insurance.Journal of

Monetary Economics, 51(2). 375-399.

Distinguin, T., Kouassi, I., &Tarazi, A., 2011.Bank

Deposit Insurance, Moral Hazard and Market

Discipline: Evidence from Central and Eastern

Europe.SSRN Electronic Journal.Retrieved from

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1

83026.

Distinguin, I., Kouassi, T., &Tarazi, A., 2013. Interbank

Deposits and Market Discipline: Evidence from

Central and Eastern Europe. Journal of Comparative

Economics, 41(2), 544–560.

Flannery, M. J., 2001. The Faces Of Market Discipline.

Journal of Financial Services Research, 20(2/3),107-

119.

Ghozali, I., 2011. AplikasiAnalisis Multivariate Dengan

Program IBM SPSS 19. Semarang:

BadanPenerbitUniversitasDiponegoro.

Hermanto. S. Analisis Bi Rate, Inflasi, Overhead Cost, Net

Interest Margin, Dan Resiko Kredit Terhadap Suku

Bunga Kredit Modal Kerja Pada Bank Umum Milik

Negara Periode 2005 – 2013. Retrieved from

http://jurnalmahasiswa.unesa.ac.id/index.php/jim/articl

e/viewFile/17462/15891.

Karas, A., Pyle, W.,&Schoors, K., 2010. The Effect Of

Deposit Insurance On Market Discipline: Evidence

From A Natural Experiment On Deposit Flows.

BOFIT Discussion Paper, 8. Retrieved from:

https://helda.helsinki.fi/bof/bitstream/handle/1234567

89/8008/166887.pdf?sequence=1.

Martinez Peria, M. S., and Schmukler, S., 2001. Do

Depositors Punish Bank For Bad Behavior?

MarketDiscipline, Deposit Insurance And Banking

Crises. The Journal of Finance, 56(3), 1029-1051.

Miskhin, Frederic S., 2011. Ekonomi Uang, Perbankan,

dan Pasar Keuangan.Edisi 8. Buku 1. Salemba Empat.

Jakarta

Murata, K., and Hori, M., 2006. Do Small Depositors Exit

from Bad Banks? Evidence from Small Financial

Institutions In Japan. The Japanese Economic Review,

57(2). 260-278

Nopiyanti, Duwi. 2010. Utang Jangka Pendek.Retrieved

from http://dnopiyanti.blogspot.com/2010/06/utang-

jangka-pendek.html

The Influence of Liquidity and Deposit Insurance on Market Discipline at Regional Development Bank in Indonesia

713

Prean, N., and Stix, H., 2011. The Effect of Raising

Deposit Insurance Coverage in Times of Financial

Crisis: Evidence from Croatia Microdata. Economic

Systems, 35(4), 496-511.

Riandika, A. F., and Taswan., 2014. Pengujian Disiplin

Pasar Perbankan Berdasarkan Posisi CAR, LDR,

ROA, Dan NPL.Prosiding Seminar Nasional Multi

DisiplinIlmu& Call for Papers Unisbank

Taswan., 2013. Pengujian Empiris Disiplin Pasar Periode

Penjaminan Simpanan Implisit Dan Eksplisit Di

Indonesia. Jurnal KeuangandanPerbankan,

17(2),278–287

Yaling, W., & Yingzhi, L., 2012. Market Discipline and

City Commercial Banks’ Risk Taking. Management

Science and Engineering. 6(3), 26-29. Retrieved from

http://www.cscanada.net/index.php/mse/article/view/j.

mse.1913035X2012603.Z0124/2995.

Yan, X., Skully, M., Avram, K., & Vu, T., 2011. Market

Discipline and Deposit Guarantee: Evidence from

Australian Banks. International Review of Finance,

14(3), 431-457.

ICMR 2018 - International Conference on Multidisciplinary Research

714