Customer Relationship Management, Customer Satisfaction and

Its Impact on Customer Loyalty

Sulaiman, Said Musnadi

Faculty of Economic and Business, University of Syiah Kuala, Banda Aceh, Indonesia

Keywords: Customer Relationship Management, Satisfaction, Customer Loyalty.

Abstract: This study aims to determine the effect of Customer Relationship Management (CRM) on Customer

Satisfaction and its impact on Customer Loyalty of Islamic Bank in Aceh’s Province. The study population

is all customers in in the Islamic Bank. This study uses convinience random sampling with a sample size of

250 respondents. The analytical method used is structural equation modeling (SEM). The results showed that

the Customer Relationship Management significantly influences both on satisfaction and its customer loyalty.

Furthermore, satisfaction also affects its customer loyalty. Customer satisfaction plays a role as partially

mediator between the influences of Customer Relationship Management on its Customer Loyalty. The

implications of this research, the management of Islamic Bank needs to improve its Customer Relationship

Management program that can increase its customer loyalty.

1 INTRODUCTION

1.1 Background

The phenomenon underlying this study is the low

customer satisfaction toward Islamic Bank, possibly

also caused by other factors such as they are less

concerned for the bank to build a mutual relationship

with its customers in terms of customer relationsip

management (CRM), which is one of the businesses

based approach to manage relationships with its

customers.

Customer Relationship Management (CRM)

focuses on what value will customer get rather than

to the products or services to be sold by the company.

Through the application of Customer Relationship

Management (CRM), companies are expected to be

able to establish communication and a good

relationship with its customers. This condition is also

expected that the company will not only sell and

market a product and service with good quality or

competitive prices but also it is able to answer

customers' desires and needs as described by Indah

and Dewi (Indah and Dewi, 2013), which can lead to

satisfaction and customer loyalty.

Does the formation of loyalty as a result of

achievement of customer satisfaction of Islamic Bank

is still not currently identified, this is caused by a

small number of studies on customer loyalty in the

bank, as a result of understanding about the loyalty

and satisfaction of Islamic bank’s customers is still

confusing, and there is a very limited clarification

about Customer Relationship Management (CRM) as

a good influence on customer satisfaction and its

loyalty as a result of a few empirical study about it.

Based on the above point of view, the authors are

interested to conduct an empirical study entitled:

"Customer Relationship Management, Customer

Satisfaction and Its Impact on Customer Loyalty of

Islamic Bank".

1.2 Objective of This Study

The purpose of this study is as follows:

1. To determine the effect of Customer Relationship

Management (CRM) on satisfaction and its impact

on customer loyalty of the Islamic bank.

2. To determine the indirect effect of Customer

Relationship Management (CRM) on customer

loyalty of the Islamic bank through its customer

satisfaction.

692

Sulaiman, . and Musnadi, S.

Customer Relationship Management, Customer Satisfaction and Its Impact on Customer Loyalty.

DOI: 10.5220/0008892606920698

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 692-698

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

2.1 Customer Loyalty

According to Kotler and Armstrong (Kotler and

Armstrong, 2011, p. 271), consumer loyalty in

general can be interpreted fidelity someone on a

product, goods and services. Consumer loyalty is a

manifestation and continuation of consumer

satisfaction to use the facilities and services provided

by company, as well as to be a repeated buyer of the

company.

2.2 Customer Satisfaction

According to Kotler (Kotler, 2011, p. 42) satisfaction

is feeling happy or disappointed someone who

emerged after comparing anatara perception /

impression of the performance (yield) of a product

and expectations.

Additionally, Tjiptono (Tjiptono, 2011, p. 349)

defines customer satisfaction as an emotional

response to the evaluation of the consumption

experience of a product or service. Then, Oliver

(Oliver, 2011) mentions that the product features play

an important role in the creation of customer

satisfaction.

Based on some of the above definition, consumer

satisfaction can be formulated as postpurchase

evaluation relulted from the selection of specific

purchasing where the perception of the performance

of products selected meet or exceed expectations

before buying decision.

2.3 Customer Relationship

Management

Customer Relationship Management is defined as an

integrated function that consists of the sale strategy,

marketing and service aiming to increase revenue

from customer satisfaction (Kalakota and Robinson,

2010, p. 172).

Customer Relationship Management is the

concept of building a strong relationship between the

companies, in this case the management with

customers (Sutedjo, 2011, p. 65). So, Customer

Relationship Management is a customer service

approach that focuses on building and maintaining

long-term relationships (Ardiyhanto, 2011).

Based on the above point of view, the organization

can focus on the development of an important asset in

the long term, a more progressive in relationships

with valued customers. CRM program is making a

vision for how to transform their companies to

develop important attributes, so that they can be

bonded by the organization, products and intend to

make a purchase (Gordon, 2002: 2).

According to the above viewpoint, it can be

concluded that the Customer Relationship

Management can affect the level of customer

satisfaction. Furthermore, customer satisfaction can

have an impact on customer loyalty.

For more details, how the Customer Relationship

Management variable affect customer satisfaction

and its impact on customer loyalty will be explained

in the following section.

2.4 Effect of Customer Relationship

Management on Customer

Satisfaction

Customer Relationship Management (CRM) is a

method to attract, to maintain and to improve

customer satisfaction and strengthen relationships

with customer (Tung, 1997).

Furthermore, Customer Relationsip Management

(CRM) provides data and information relating to

customers, such as in shopping behavior, habits in

consuming products, and others (Agrawal, 2004).

These data and information are used to improve

understanding how to communicate with customers

in order to create value and customer satisfaction

(Agrawal, 2004).

From the above description, it can be concluded

that customer relationship management influence

customer satisfaction. In other words, the better

customer relationship management, the higher the

level of customer satisfaction is.

2.5 Effect of Customer Relationship

Management on Customer Loyalty

Customer relationsip Management (CRM) is a

strategy focusing on creating customer satisfaction

and long-term relationships by integrating several

functional areas of the company to achieve

competitive advantage (Payne and Frow, 2005; Indah

and Dewi, 2013; Chang, 2007; Nguyen, Sherif, and

Newby, 2007).

Findings of researches conducted by Ardiyhanto

(Ardiyhanto, 2011) and Ariyanti (Ariyanti, 2006)

show that there are significantly customer

relationship management on customer loyalty. This

means that the better implementation of CRM in a

business unit, it had a positive impact on customer

loyalty. Therefore, CRM’s applications allow

companies to leverage information from all points of

the box with the customer, whether it is via web, call

Customer Relationship Management, Customer Satisfaction and Its Impact on Customer Loyalty

693

center, or through marketing and servicing staff in the

field.

Based on the above description, it can be

concluded that the better customer relationship

management program implemented by the company,

the more customers to be loyal to the products/

services produced by the company.

2.6 Effect of Satisfaction on Customer

Loyalty

Parasuraman in Lupiyoadi (Lupiyoadi, 2011, p. 182)

states that it is the feeling of satisfaction after

evaluating the product experience. Lupiyoadi also

added that in the banking industry, customers satisfy

has great potential to become loyal, so it will be a

loyal customer who will use all bank products.

The higher Customer confidence will increase the

love of the bank's customers, and of course,

customers will be more like the product of the bank.

Complacency customers to guarantee the service will

also make customers believe that these brands are the

best, and it maybe even customers would recommend

bank products to the general public. The higher the

level of customer satisfaction, the more it will

increase customer loyalty.

2.7 Indirect effect of Customer

Relationship Management on

Customer Loyalty through

Customer Satisfaction

Basically, sense of satisfaction and dissatisfaction of

customers is the difference between expectations and

perceived performance. Thus, understanding the

customer satisfaction means that the performance of

the goods or services received by consumers is at least

equal to their expected.

To create customer satisfaction, the companies

that engaged in the service should be able to offer a

value to gain more customers and also have the ability

to maintain customer loyalty. Then through a

customer relationship management program that is

good and right, it is expected customers will be loyal;

of cource, when customers quite satisfied. In other

words, customer relationship management will have

an effect on customer loyalty is only when such

customers can be satisfied. Therefore, customer

relationship management program indirect effect on

layalitas through customer satisfaction.

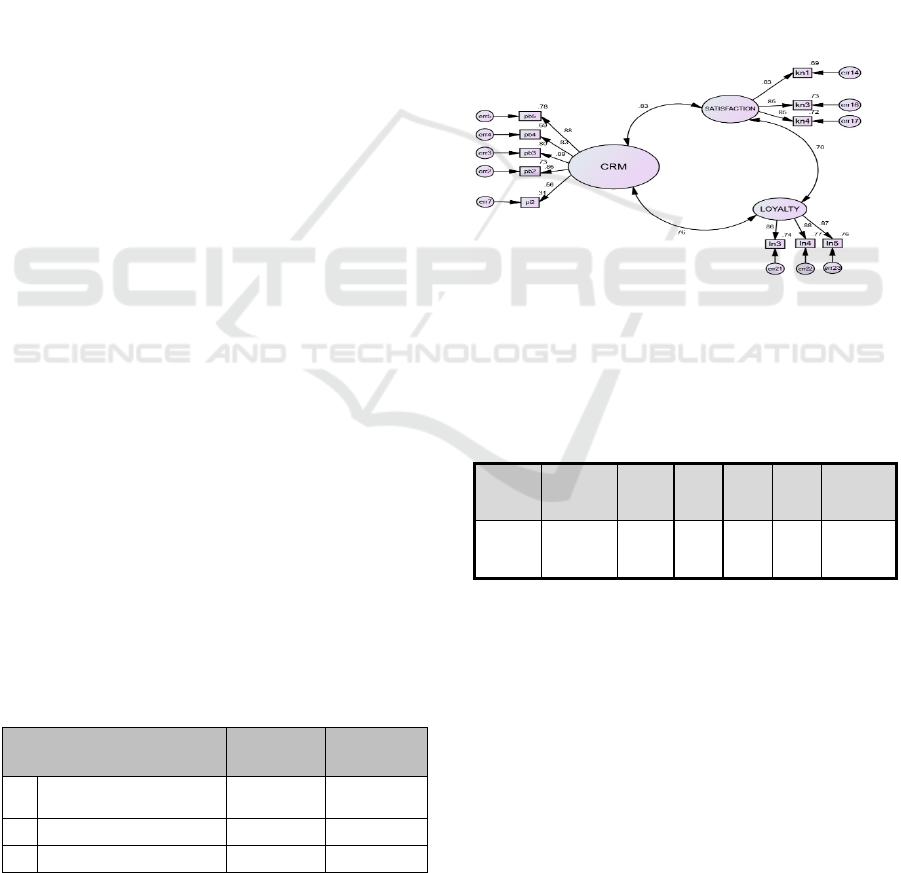

2.8 Theoretical Framework of Studi

Based on the background of the problem, literature

review and hypothesis described above, a conceptual

model or theoretical framework can be developed in

this research, ie as shown in the following diagram:

Figure 1: Model of Study theoretical Framework.

2.9 Hypothesis

2.9.1 Direct Effect

H

1

: Customer Relationship Management programs

effect positively and significantly on customer

satisfaction of Islamic Bank.

H2: Customer Relationship Management Program

effect positively and significantly on customer

loyalty of Islamic Bank.

H3: Customer satisfaction effect positively and

significantly on customer loyalty of Islamic

Bank.

2.9.2 Indirect Effect

H4: There is an indirect effect of customer

relationship management program positively

and significantly on customer loyalty mediated

by customer satisfaction of Islamic Bank.

3 RESEARCH METHOD

3.1 Location, Object and Limitation of

Study

This research was conducted at Islamic Bank in

Aceh’s Province. The variables of this research

consisted of customer loyalty (Z), customer

satisfaction (Y) and customer relationship

management.. The limitation of this study is lack of

repondents of Islamic Bank.

ICMR 2018 - International Conference on Multidisciplinary Research

694

3.2 Population and Sample

The study population is all customers of Islamic Bank

operated in Aceh’s Province. This study uses

convinience random sampling. Sample of this study

that have been gathered are 250 respondents.

3.3 Questionaire Design

The research questionnaire is divided into three parts.

The first part is the question of customer relationship

management. The second part contains questions

about customer satisfaction. The third part is a

question of customer loyalty.The number of

indicators of each variable can be found in the

appendix

.

4 FINDING AND DISCUSSION

4.1 Validity and Reliability Test

Before cunducting the main study, it is necessary to

test the validity and reliability of the questionnaire to

carry out the "Pilot Project" involving 50 respondents

were selected randomly.

4.1.1 Validity

Based on the results of testing the validity of the

research instrument in terms of item-total statistics of

the 50 respondents indicated that all of the items

statement for independent variables consist of

customer relationship mnagement, where dependent

variable consists of satsfaction and customer loyalty

at the Islamic Bank have a correlation value of r

greater than 0.2012. Thus the statement means that all

item are valid for all variables.

4.1.2 Reliability

The test results of the research instrument in terms of

reliability of the item-total statistics of the 50

respondents as indicated in the following table:

Table 1: Output of Reliability Testing.

Variable/Sub Variable

Cronbach

Alpha

Reliability

X

Customer relationship

mana

g

ement

0.933 Reliable

Y Customer satisfaction 0.956 Reliable

Z Customer loyalty 0.880 Reliable

Source: Output of SPSS, 2018

Based on the results as the above table, all

expressed a reliable research instrument.

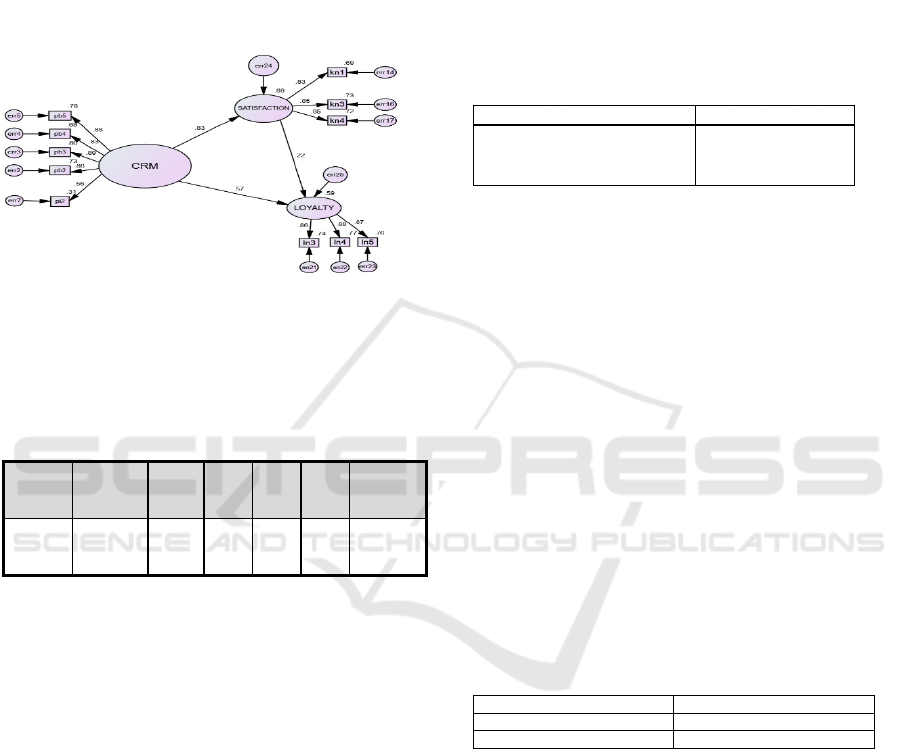

4.2 Step-one Approach by

Measurement Model

All constructs (customer relationship management,

satisfaction and customer loyalty) will be

incorporated in the phase of measurement model.

This phase in line with Anderson and Gerbing

(Anderson and Gerbing, 1988), which conducted the

first steps.

The latest results of the measurement model

(measurement model) can be seen in the following

figure.

Figure 2: Analysis of Measurement Model.

Table 2: Fit Indices of Measurement Model Analysis.

Fit

Indice

s

X

2

X

2

/df GFI TLI CFI RMSE

A

94.833

(p<.000

)

2.31

3

.93

6

.96

6

.97

5

.073

The results of the above analysis indicates that the

value of Chi-square = 94.833 (p <.000) with X2/df =

2.313. GFI value of 0.936, TLI of 0.966 and CFI of

0.975 > 0.90 showed good fit results. RMSEA value

of 0.073 indicates a satisfactory value, which is in

between 0.05 to 0.08 (requirements).

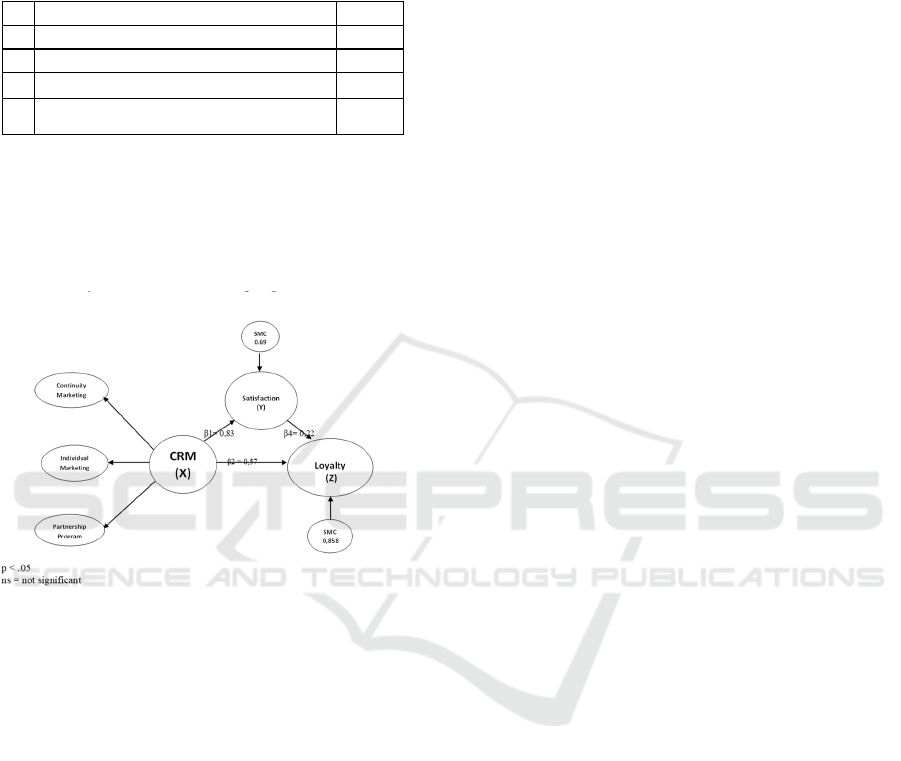

4.3 Structural Equation Modeling

(SEM) (Step-Two Approach)

According to Garver and Mentzer (Garver and

Mentzer, 1999), the way to achieve predictive validity

can be met by connecting an construct to the others to

Customer Relationship Management, Customer Satisfaction and Its Impact on Customer Loyalty

695

predict the relationship or influence, in which the

correlation should be enough value (ie, known as the

coefficient of structural or weight of standardized

regression in AMOS), and should statistically

significant.

A clearer picture of the structural equation model

can be shown as follows:

Figure 3: Analysis of Structural Equation Modeling.

Table 3: Fit Indices of Structural Equation Modeling.

Fit

Indice

s

X

2

X

2

/d

f

GF

I

TL

I

CF

I

RMSE

A

94.833

(p<.000

)

2.31

3

.93

6

.96

6

.97

5

.073

Based on the above picture of a structural equation

model, it shows that the regression coefficient of

structural or all of the lines are significant at p <.05.

In detail, coefficient of customer relationship

management is 0.83* and are able to explain 69.3%

of the variance (Squared Multiple Correlation) to the

satisfaction of the customer. In detail, it is estimated

that the predictor (customer relationship

management) could explain 69.3% of variance on

customer satisfaction, which means the error variance

to predict customer satisfaction is about 30.7%

customer satisfaction explained by other factors.

Furthermore, output also shows that the

correlation coefficient of customer relationship

management (0.57*) and customer satisfaction

(0.22*) and they are able to explain 58.5% of the

variance (Squared Multiple Correlations) on

customer loyalty of Islamic Bank in Aceh Province.

The results showed that the customer relationship

management (correlation coefficient equal to 0.57 on

structural) has a significant impact as compared to

customer satisfaction factors. From these results can

be explained also that there is a variance of 41.5%

error for predicting customer loyalty. In other words,

it can be explained by other factors.

4.4 Testing Hypothesis of Direct Effect

The following table will describe result explaining

relationships among constructs.

Tabel 4: Relationships among Constracts.

Source: Data Analysis, 2016

The above table with the result of a structural

equation model is able to explain the purpose of this

study. Output of the structural equation model also

simultaneously explains the direct effect of the factors

of customer relationship management, customer

satisfaction and customer loyalty, where both

directions have a significant effect as having been

hypothesized. Thus, these results are also able to

prove the hypothesis 1, 2, and 3 of this study.

4.5 Hypothesis Testing of Indirect

Effect

Testing the hypothesis by incorporating the role of

mediating variables as suggested by Kelloway (1995)

(satisfaction) that will explain the indirect effect

where it can be seen in the following table.

Table 5: Indirect Effect by Structural Equation Modeling.

Source: Output of Standardized Indirect Effect

Regarding the previous results indicate that the

direct effect of the significant predictors (customer

relationship management) on customer satisfaction

(p> 0.05), and it appears that there is a direct

relationship between the significant and positive

customer relationship management and customer

loyalty (p <0.01). Thus, there is an indirect effect of

customer relationship management on customer

loyalty is positively and significantly with customer

satisfaction by correlation coeficient at 0.181. Thus,

hypothesis 4 is not rejected.

Estimate S.E. C.R. P Label

Customer Satisfaction <--- Customer_Relationship_Management .811 .061 13.398 *** par_9

Customer Loyalty <--- Customer_Relationship_Management .648 .124 5.240 *** par_10

Customer Loyalty <--- Customer Satisfaction .252 .126 1.999 .046 par_11

Constructs Customer relationship management

Customer Satisfaction

0.000

Customer Loyalty

0.181

ICMR 2018 - International Conference on Multidisciplinary Research

696

The summary of the accepted or rejected the

hypothesis in this study can be seen as in the

following table.

Table 6: Summary of the Hypothesis Testing.

Note: √ = hypothesis not rejected

X= hypothesis not accepted

Picture of the relationship of direct and indirect

effect among constructs in this research model can be

seen clearly as in the following figure.

Figure 4: Significantcy Relationship among Contructs in

the Model.

5 CONCLUSION AND FUTURE

RESEARCH PLANNING

The results of this research have contributed

empirically that the factor of customer relationship

management are built in this research model affects

both customer satisfaction and customer loyalty of

Islamic Bank. The finding is consistent with

Ardiyhanto (2011) and Ariyanti (2006) who

discovered there is a positif and significant

relationship between CRM and Loyalty.

Additionally, this factor proved significantly affect

customer satisfaction, and it also have a significant

influence on customer loyalty. Customer satisfaction

factor plays a role as a partial mediating variable

between customer relationship management and

customer loyalty.

RECOMMENDATION

Recommendations that can be explained is in order to

create more customer loyalty of Islamic Bank in

Aceh’s Province, Managers should be able to increase

customer relationship management.

FUTURE RESEARCH PLANNING

Additionally, recommendations that can be

explained, especially for planning future research is

there are various limitations of the study. Thus,

research needs to be replicated by developing other

factors, so it will produce a better model

.

REFERENCES

Agrawal, M. L., 2004. Customer Relationship Management

(CRM) & Corporate Renaissance. Journal of Service

Research, 3(2), 149-167.

Anderson, J.C., & Gerbing, D.W., 1988. Structural

Equation Modelling in practice: a review and

recommended two-step approach. Psychological

Bulletin, Vol. 103 (3), pp. 411-423.

Ardiyhanto, D., 2011. Analisis Pengaruh Customer

Relationship terhadap Loyalitas Pelanggan dalam

Pembelian Sepeda Motor Yamaha pada PT. Megatama

Motor di Makasar. Unpublished Undergraduate Thesis,

Makasar.

Cheng, E.W.L., 2007. SEM being more effective than

multiple regression in parsimonious development

research, Journal of Management Development, Vol.

20 (7/8), pp.650-667.

Garver, M.S., & Mentzer, J.T., 1999. Logistic research

method: employing structural modeling to test for

construct validity, Journal of Business Logistics, Vol.

20 (1), pp. 33-57.

Gordon, I., 2002. Best practices: Customer relationship

management, Ivey Business Journal, No.67, Vol.1, p.1–

5.

Hair, J. F., Anderson, R., E., Tatham, R.L., & Black, W.C.,

2013. Multivariate data analysis, 7/E, Prentice Hall,

Pearson Educational International.

Indah & Devi., 2013. Analisa Pengaruh Customer

Relationship Management terhadap Keunggulan

Bersaing dan Kinerja Perusahaan, Business Accounting

Review, Vol. 1, No. 2, pp. 50-60.

Kalakota, R. dan Robinson, M., 2010. E-Business 2.0

Roadmap for Success, Massachusetts: Addsion Wesley

Longman Inc,

Kelloway, E.K., 1995. Structural Equation Modelling in

perspective. Journal of Organizational Behavior,

Vol.16, p. 215-224.

Kotler, P., & Armstrong, G., 2011. Principles of Marketing

(14th ed.). New Jersey: Prentice Hall.

Hypothesis

Summary

H

1

Customer Relationship Management programs effects positively and

significantly on customer satisfaction of Islamic Bank.

√

H

2

Customer Relationship Management Program effects positively and

significantly on customer loyalty of Islamic Bank.

√

H

3

Customer satisfaction effects positively and significantly on customer

loyalty of Islamic Bank.

√

H

4

There is an indirect effect of customer relationship management

program positively and significantly on customer loyalty mediated by

customer satisfaction of Islamic Bank.

√

Customer Relationship Management, Customer Satisfaction and Its Impact on Customer Loyalty

697

Lupiyoadi, Rambat., 2011. Manajemen Pemasaran Jasa,

Edisi Ketujuh, Salemba Empat, Jakarta.

Nguyen, T. U. H., Sherif, J. S. & Newby, M., 2007.

Strategies for Successful CRM Implementation.

Information Management & Computer Security, 15(2),

102-115.

Oliver., 2011. Satisfaction: A Behavioral Perspective on the

Consumer, 2d ed. London: M.E. Sharpe.

Parasuraman, A., et al., 2005. A Conceptual Model of

Service Quality and Its Implication for Future

Research, Journal of Marketing, Col. 49 (Fall).

Payne, A. & Frow, P., 2005. A Strategic Framework for

Customer Relationship Management, Journal of

Marketing, 69, 167-176.

Sutedjo, Budi dan Philip, John., 2011. I-CRM: Membina

Relasi Dengan Pelanggan, Do Com.Andi, Jogyakarta.

Tjiptono, F., 2011. Pemasaran Jasa. Bayumedia, Malang.

Tung, Khoe Yao., 1997. Teknologi Jaringan Intranet,

Yogyakarta: Andi Yogyakarta.

APPENDICES

Table 7: Operational Variable of Study.

Source: Result of the Previous Study

Table 8: Characteristic of Respondent.

Source: Output of Data Analysis, 2016

Tabel 9: Validitas Indikator.

Source: Output of Data Analysis, 2016

No Variable Definition Dimension Indicator Measure Scala Item

Independent

1 Customer

Relationship

Management

𝑋

1

Customer

Relationship

Management is a

customer service

approach that

focuses on

development and

maintenance of

long term

relationships with

customers that

can provide

added value for

both of them,

both for

customers and

companies.

Ardiyhanto

(2011)

Continuity

Marketing

Individual

Marketing

Partnership

Program

Member Card;

Discount;

Voucher;

Special Fasilitas;

Point Reward

System;

Be friendly and

polite;

The service is fast

and precise;

Ability to handle

complaints;

special greeting

cards;

Greetings by

employees;

The relationship

with the customer;

Cultivate and

maintain

relationships;

relationships create

loyalty;

Ardiyhanto (2011)

1-5 Interval PB1-PB5

PI1-PI5

PK1-PK5

2 Customer

Satisfaction (Y)

Satisfaction is a

feeling that arises

after evaluating

the product user

experience.Sumbe

r : Woodruff dan

Jenkins dalam

Tjiptono,

(2011:169)

Confidence

customers

Rasa customer

intimacy

Satisfied customers

for service

assurance

No complaints

from customers

performance of the

bank as expected

Woodruff and

Jenkins in

Tjiptono,

(2011:169

1-5 interval KN1-KN5

Dependent

3 Customer Loyalty

(Z)

Customer loyalty

can also be called

a positive

purchase behavior

of customer. .

Tjiptono,

(2011:173)

Repurchasing

Habitual to

cumsume the

brand

Always like the

brand

Keep choosing the

brand

Tetap memilih

merek tersebut.

Being sure brand

is the best

Recommend the

brand for others

Tjiptono,

(2011:173)

1-5 interval LN1-LN6

No

Characteristic of Demography

( n = 49 )

Total

Respondent %

1.

Gender

1. Male

2. Female

185

65

74.0

26.0

2.

Age

1. < 20 years

2. 21 - 30 years

3. 31 - 40 years

4. 41 - 50 years

5. > 50 years

10

66

98

66

10

4.0

26.4

39.2

26.4

4.0

3.

Status Perkawinan

1. Not merriage

2. Merriage

3. Widow

24

219

7

9.6

87.6

2.8

4.

Educational Background

1. Junior High School

2. Senior High School

3. Academi/Diploma (D-3)

4. Undergraduate (S-1)

5. Post Graduate (S-2)

75

144

19

11

1

30.0

57.6

7.6

4.4

0.4

5.

Kind of Job

1. Farmer

2. Farmer of Plantation

3. Breeder

4. Trader

5. Company’s Staff

6. Civil Servant

5

169

46

10

14

6

2.0

67.6

18.4

4.0

5.6

2.4

6.

Income per Month

1. < Rp 2.000.000

2. Rp 2.000.000 – 3.999.999

3. Rp 4.000.000 – 5.999.999

4. Rp 6.000.000 – 7.999.999

5. Rp 8.000.000 – 9.999.999

6. > Rp 10.000.000

28

70

116

26

8

2

11.2

28.0

46.6

10.4

3.2

0.8

Total 250 100.0

Variable

Nomor of

Item

r

hitung

r

tabel,

95 %

( N = 50 )

Validity

Independent

Customer relationship management (X)

Continuety Marketing

(pb))

Pb1 0.841 0.2012

Valid

Pb2 0.815

0.2012

Valid

Pb3 0.895

0.2012

Valid

Pb4 0.745

0.2012

Valid

Pb5 0.920

0.2012

Valid

Individual Marketing

(pi)

Pi1 0.615

0.2012

Valid

Pi2 0.564

0.2012

Valid

Pi3 0.579

0.2012

Valid

Pi4 0.759

0.2012

Valid

Pi5 0.550

0.2012

Valid

Partnership Program

(pk)

Pk1 0.774

0.2012

Valid

Pk2 0.886

0.2012

Valid

Pk3 0.879

0.2012

Valid

Mediation

Customer Satisfaction

(Y)

Kn1 0.787

0.2012

Valid

Kn2 0.932

0.2012

Valid

Kn3 0.876

0.2012

Valid

Kn4 0.888

0.2012

Valid

Kn5 0.914

0.2012

Valid

Dependent

Customer Loyalty

(Z)

Ln1 0.534

0.2012

Valid

Ln2 0.663

0.2012

Valid

Ln3 0.785

0.2012

Valid

Ln4 0.810

0.2012

Valid

Ln5 0.833

0.2012

Valid

Ln6 0.699

0.2012

Valid

ICMR 2018 - International Conference on Multidisciplinary Research

698