Analysis of the Factors Affecting the Capital Structure of a

Manufacturing Company Listed on the Indonesian Stock Exchange in

Moderation by Business Risk

*Puteri Anggi Lubis

1

, Iskandar Muda

2

, and Erlina

2

1

Department of Accounting, Faculty of Economics and Business,University of Sumatera Utara, Indonesia

2

Department of Magister of Accounting, Faculty of Economics and Business,University of Sumatera Utara, Indonesia

Keywords: Capital structure, sales growth, profitability, company growth, company size, business risk.

Abstract: This study aims to examine and analyze the factors that affect the capital structure of manufacturing

companies listed on the Indonesia Stock Exchange in moderation by business risk. The population of this

study are all manufacturing companies listed on the BEI in the period of 2012-2016. 42 companies and

simultaneously are used as a sample. The analysis of the data uses multiple linear regression with eviews

7software. The results showed that simultaneous factors of sales growth, profitability, corporate growth and

firm size significantly influence the capital structurevariable. Company growth and firm size have positive

but not significant effect on capital structure variable. Sales growth and profitability in moderation of

business risks are significant to the capital structure. Company growth and firm size in moderation of

business risk are insignificant to the capital structure.

1 INTRODUCTION

The capital structure has become one of the

important consideration factors in corporate finance.

The capital structure is strongly influenced by the

development of the stock market. The existence of

the stock market has given the company an

opportunity to increase its funding sources.

The company's capital needs can basically be

met from two sources, namely internal sources of the

company and external sources. Internal sources of

funds come from the company, namely Retained

Earnings. Retained Earnings are part of net income

after taxes that are not distributed to the owner of the

company, or any other profits reinvested in the

company. While the source of external funds is the

source of funds coming from outside the company.

External sources of funds can be debt and capital

from the owner of the company. The owners' capital

is obtained by issuing securities. With the issuance

of securities, the public can invest in the company.

The characteristics of a company can influence

the decision on the fulfillment of corporate resources

(Ozkan, 2001). Krisnan and Moyer (Krisnan and

Moyer,1996) in Omran (Omran,2009) studied

capital structure in industrialized countries,

whichdespite having similar economic

characteristics, differed in determining the capital

structure and the variables that influenced it. In the

United States, Japan, Italy, and Germany,

profitability, firm size and growth have proven to

significantly affect the capital structure of those

countries. In the United States, taxes are a

significant determinant.

The above results are not much different from

those of developing countries, such as India and

Indonesia. Bhaduri (Bhaduri,2002) in his research in

India found that the characteristics of companies

such as growth, free cash flow, firm size, product

type, and type of industry affect the company's

capital structure. In Indonesia, Yulianti

(Yulianti,2010) examines the significant variables

on capital structure is the company's characteristics

of profitability, liquidity, and size of the company.

The following will describe some of the reviews

of previous research related to this research:

Herlina (Herlina,2014) who examined the Effect

of Company Size, Profitability, Free Cash Flow

Against Capital Structure at Manufacturing

Companies in BEI. Dependent variable in this

research is Capital Structure whereas independent

variable is Company Size, Profitability and Free

570

Lubis, P., Muda, I. and Erlina, .

Analysis of the Factors Affecting the Capital Structure of a Manufacturing Company Listed on the Indonesian Stock Exchange in Moderation by Business Risk.

DOI: 10.5220/0008890605700577

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 570-577

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Cash Flow with technique of Multiple Regression

Model. The results concluded that all independent

variables affect the capital structure.

Nugroho (Nugroho,2006) who examined the

Analysis of Factors Affecting Capital Structure of

Property Companies Go Public In JSE 1994-2004.

Dependent variable in this research is Capital

Structure while the independent variable is

Operating leverage, Liquidity, Asset Structure,

Growth, Price Earning Ratio, Profitability with

Multiple Regression Model technique. The result of

research concludes that Growth, and profitability

have positive effect to capital structure while

Operating Leverage, liquidity and STA have

negative influence.

Saidi (Saidi,2004) who examined the Factors

Affecting the Capital Structure of Manufacturing

Companies Go Public in JSE 1997-2002. Dependent

variable in this research is Capital Structure whereas

independent variable is company size, business risk,

asset growth, profitability and ownership structure

with Multiple Regression technique. The result of

this research concludes that firm size, asset growth,

profiability and ownership structure have an effect

on capital structure while business risk has no

significant effect on capital structure.

Rachmawadani (Rachmawadani,2007) who

studied about Analyzing the Influence of Liquidity

Aspects, Business Risk, Profitability, and Sales

Growth on Capital Structure. Dependent variable in

this research is Capital Structure while the

independent variable is liquidity aspect, business

risk, profitability, and sales growth with Multiple

Regression and Chow Test technique. The result of

the research concludes that Liquidity, business risk,

profitability, and sales growth have positive and

significant effect to company's capital structure.

Taufan (Taufan,2009) who examined the Factors

affecting capital structure in manufacturing

companies listed on the Indonesia Stock Exchange

period 2005-2007. Dependent variable in this study

is the Capital Structure while the independent

variables are business risk, firm size, asset structure

and profitability with multiple regression techniques.

The result of the research conclude that business risk

and firm size have significant negative effect to

capital structure while asset structure and

profitability have positive and significant effect to

capital structure.

Werner R. Murhadi, (Werner R. Murhadi,2009)

who examined the Determinants of Capital

Structure: A Study In Southeast Asia. Dependent

variables in this study are Debt while the

independent variables are Profitability, Company

Size, Asset Tangibility, Corporate Growth and Non

Debt Tax Shield with multiple regression

techniques. The results conclude that the factors that

determine debt policy are profitability, firm size,

asset tangibility and growth rate.

Ng Chin Huat (Ng Chin Huat,2008) who

examined The Determinants Of Capital Structure:

Evidence From Selected ASEAN Countries.

Dependent variable in this research is Leverage

while the independent variables are Profitability,

Non Debt Tax Shield, Growth Opportunities, Firm

Size, GDP, Inflation with multiple regression

techniques. The results concluded that profitability

and growth of inverse relationship with leverage

while non-debt tax shield have a significant negative

impact on leverage. The size of the company

provides a significant positive relationship.

Gurcharan S, (Gurcharan S,2010) researched A

Review of Optimal Capital Structure. Dependent

variable in this research is Leverage while the

independent variables are Size, Bank - Size Of

Banking Industry, SKTMKT - Size Of Stock

Market, GDPRATE - GDP Growth Rate, and INF -

Annual Inflation Rate with multiple regression

techniques. The results conclude that Profitability

and growth opportunity show statistically significant

with inverse relationship with leverage. While non-

debt tax shield has a negative impact on leverage.

Company size shows a positive relationship.

Sashi Kumar, Kanesan (Sashi Kumar, Kanesan,

2009) studied Decision Selected ASEAN Countries.

Dependent variable in this research is Capital

Structure while the independent variable is Asset

Tangibility, Financial Flexibility, Liquidity,

Profitability, Size, Growth Growth, Inflation Rate

and Interest Rate with multiple regression technique.

The results concluded that Asset Tangibility did not

significantly affect the short-term debt ratio;

Masidonda (Masidonda,2013) examined the

Determinants Of Capital Structure and Impact

Capital Structure on Firm Value. Dependent variable

in this study is the Capital Structure while the

independent variable is CEO Ability, CEO of

Ownership Corporate Value with multiple regression

techniques. The results conclude that CEO's ability

and CEO ownership determine the capital structure

(LTDE), profitability and NDTS cash flow has no

effect. Furthermore, CEO ability, profitability,

NDTS and CEO ownership determine the capital

structure (LTDA), but cash flow has no effect. The

capital structure (LTDE and LTDA) determines the

value of the firm.

The hypothesis in this study are as follows: Sales

Growth, Profitability, Company Growth, Company

Analysis of the Factors Affecting the Capital Structure of a Manufacturing Company Listed on the Indonesian Stock Exchange in

Moderation by Business Risk

571

Size affect the Capital Structure moderated by

Business Risks in Companies Registered on the

Indonesia Stock Exchange.

2 METHODOLOGY

2.1 Research Design

The data used in this research are secondary data

involving the financial statements of manufacturing

companies listed in Indonesia Stock Exchange in

period 2012 - 2016 for data analysis. Data were

obtained from the website of Indonesia Stock

Exchange (www.idx.co.id) and Indonesian Capital

Market Directory (ICMD). Eviews 7Software was

used.

2.2 Population and Sample

The population used in this study is a manufacturing

company listed on the Indonesia Stock Exchange in

2012 - 2016. The criteria that must be met by the

sample in this study are as follows:

1. The company is listed on BEI in 2011 until

2015 and is not in the delisting process

during the study period.

2. The Company publishes complete financial

statements with no negative retained

earnings during the 2011-2015 observation

period.

2.3 Instrument

The instrument that is used to collect the data in this

researchis documentation method. The type of data

used in this study is secondary data, namely the

company's annual financial statements that have

been audited by independent auditors in all

companies, fundamental data, closing price of shares

during the period of 2012 to 2016. The data sources

were obtained from the Indonesia Stock Exchange

(www. idx.co.id) and Indonesia Capital Market

Institute (www.ticmi.co.id) an educational institution

that organizes education and training as well as the

capital market profession certification exams.

2.4 Data Collection and Analysis

Data analysis Method performed in this study is

multiple linear regression models. Data are

processed using Eviews 7 software.

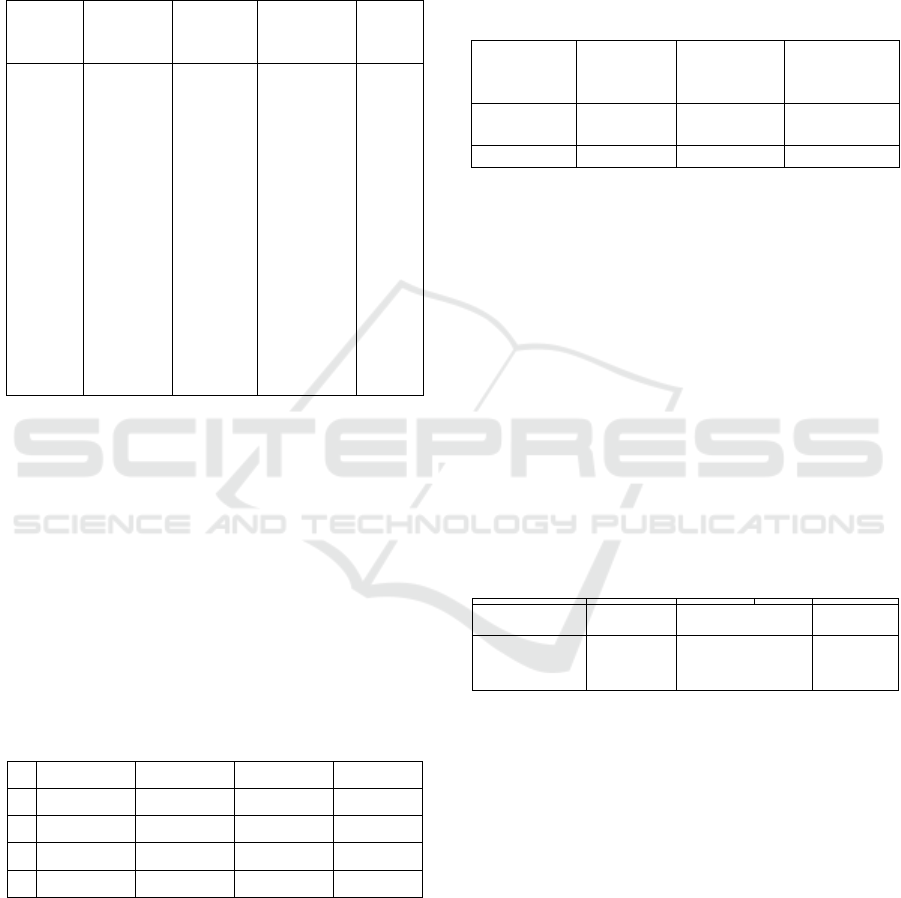

Table 1: Methods Data analysis.

No Criteria Amount Accumulation

1

Manufacturing

company listed on

the Stock

Exchange in 2012-

2016

141

2

Manufacturing

companies that

carry out 2012-

2016 delisting

from the IDX

(20) 121

3

Has a negative

earnings balance

during the

observation period

(

2012-2016

)

(69) 52

4

Does not publish

financial

statements in full

(10) 42

Total sample

companies during the

stud

y

p

eriod

42

2.5 Data Normality Test

In this study, the normality test for residuals uses the

Jarque-Bera (J-B) test. In this study, the level of

significance used is α = 0.05. The basis for decision-

making is to look at the probability numbers of J-B

statistics, with the following conditions.

If the probability value p is 0.05, then the

assumption of normality is met.

If the probability is <0.05, then the assumption of

normality is not met.

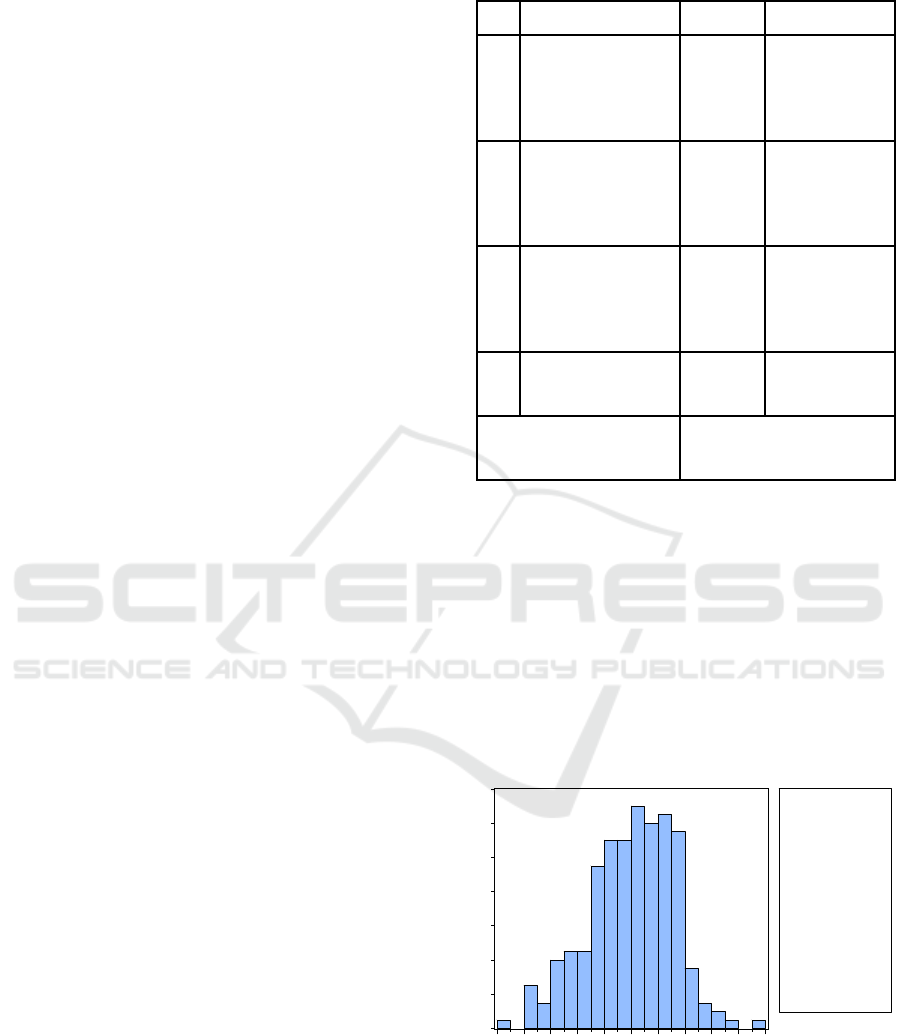

Figure 1: Test of Normality with Jarque-Bera Test.

Note that according to Figure 1, the probability

value of J-B statistic is 0.138355. Because the

probability value p, ie 0.138355, is greater than the

level of significance, ie 0.05, the assumption of

normality is met.

0

4

8

12

16

20

24

28

-2.5 -2.0 -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 2.0 2.5

Series: Residuals

Sample 1 210

Observations 210

Mean 5.96e-16

Median 0.096871

Maximum 2.375562

Minimum -2.354440

Std. Dev. 0.809685

Skewness -0.335987

Kurtosis 3.023437

Jarque-Bera 3.955860

Probability 0.138355

ICMR 2018 - International Conference on Multidisciplinary Research

572

3 RESULT

3.1 Descriptive Statistics

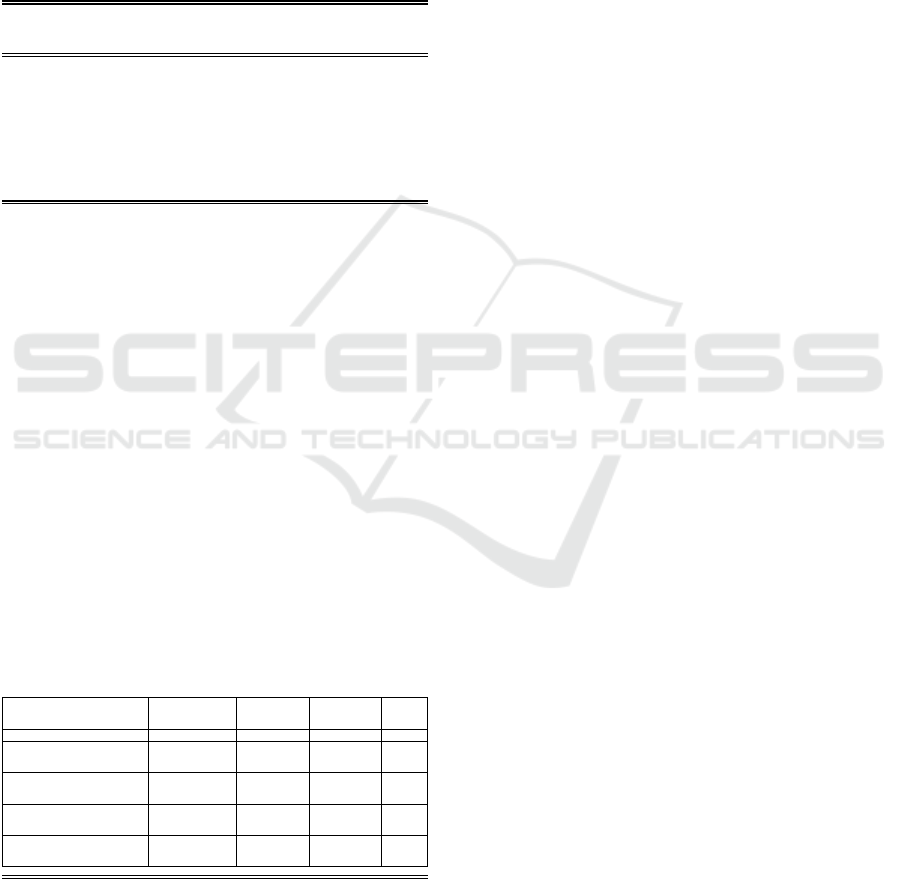

Table 2: Descriptive Statistics Of Profitability, Corporate

Growth, Company Size, Capital Structure, Sales Growth,

and Business Risk.

Variabl

e

Min Max Mean Std.D

eviati

on

Capital

Structu

re

0.01581 5.29829 0.88068 0.817

18

Sales

Develo

p

ment

-0.94 0.90176

6

0.0453 0.225

3

Profita

b

ilit

y

-9.47785 0.90177 -0.08452 1.064

87

Compa

ny

Develo

p

ment

-6.91892 0.94804 0.07250 0.514

90

Compa

n

y

Size

5.402 17.604 14.609 1.840

31

Busine

ss Ris

k

-0.24754 1.03144 0.13724 0.166

37

Source: Results of software Eviews 7

3.2 Classic Assumption Test

3.2.1 Multicollinearity Test

In this study, symptoms of multicolinearity can be

seen from the correlation values between variables

contained in the correlation matrix. (Ghozali, 2013,

p.105) states if the inter-independent variables is a

fairly high correlation, i.e. above 0.9, then the

multico-linearityexists. Multicollinearity test results

are presented in Table 3.

Table3: Multi co linearity Testwith Matrix Correlation.

X1 X2 X3 X4

X1 1.000000 -0.139871 0.153375 0.500706

X2 -0.139871 1.000000 -0.004117 0.019434

X3 0.153375 -0.004117 1.000000 -0.046477

X4 0.500706 0.019434 -0.046477 1.000000

Source: Eviews 7 Software Results

3.2.2 Autocorrelation Test

Assumptions about residual independence (non-

autocorrelation) can be tested using the Durbin-

Watson test Field (Field, 2009, p. 220). The

statistical value of the Durbin-Watson test ranges

between 0 and 4. Field (Field, 2009, p. 220)states as

follows.

The statistical value of the Durbin-Watson test

that is smaller than 1 or greater than 3 indicates an

autocorrelation.Field (Field, 2009, p.220-221) states

as follows.

Table 4: Autocorrelation Test with Durbin-Watson Test.

Log

likelihood

-253.1428 Hannan-

Quinn

criter.

2.490719

Durbin-

Watson stat

2.049199

Source: Software Eviews 7 Results

According to Table 3, the value of the Durbin-

Watson statistic is 2.049199. Note that since the

Durbin-Watson statistic value lies between 1 and 3,

ie 1<2.049199<3, then non-autocorrelation

assumptions are met. In other words, there are no

symptoms of high autocorrelation in residuals.

3.2.3 Heteroscedasticity Test

Detection of the presence or absence of

heteroskedastisitas can be done with Breusch-Pagan

test Gujarati, Gio and Elly(Gujarati, 2003; Gio and

Elly, 2015). The following test results Breusch-

Pagan.

Tabel 5: Heteroskedasticity Test: Breusch-Pagan-Godfrey.

F-statistic 1.705653 Prob. F(4,205) 0.1500

Obs*R-squared 6.763906 Prob. Chi-

Square(4)

0.1489

Source: Results of software Eviews 7

The value of Prob Obs * R-Squared is 0.1489>

0.05, which means there is no heteroscedasticity.

3.2.4 Test (F Test)

F test aims to examine the effect of independent

variables simultaneously or simultaneously to the

dependent variable. Based on Table 6, the value of

Prob is known. (F-statistics),ie 0.0004585 <0,05, it

can be concluded that all independent variableslike

sales growth, profitability, corporate growth, and

company size simultaneously, have a significant

effect on capital structure variable.

Analysis of the Factors Affecting the Capital Structure of a Manufacturing Company Listed on the Indonesian Stock Exchange in

Moderation by Business Risk

573

3.2.5 The Panel Data Regression

Equationand Partial Effect

Significance Test (t Test)

Based on Table 6, we obtain the panel data

regression equation as follows.

Y = 0,081 + 0,075X

1

+ 0,111X

2

+ 0,009X

3

+ 0,033X

4

+ e (1)

Based on Table 6, it is known:

1. The coefficient value of independent variable

of sales growth is 0,081, that is positive value.

The value can be interpreted as variable of

sales growth have positive effect to capital

structure variable. It is known that the Prob

value of the sales growth variable is 0.0161, ie

<0.05, then the sales growth variables have a

significant (statistically) effect on the capital

structure variable, at the 5% significance level.

2. The coefficient value of the profitability free

variable is 0.111, which is positive. The value

can be interpreted profitability variables which

have a positive effect on capital structure

variable. It is known that Prob value of

profitability variable is 0,0013, that is <0,05,

profitability variable has significant effect

(statistically) to capital structure variable, at

5% significance level.

3. The coefficient value of the growth-free

variable is 0.009, which is positive. The value

can be interpreted by company growth variable

have positive effect to capital structure

variable. The value of Prob of the variable

growth of the firm is 0.8384, that is> 0.05, then

the variable of company growth has no

significant effect (statistically) on the variable

of capital structure, at the 5% significance

level.

4. The coefficient value of the independent

variable of firm size is 0.033 is positive. The

value can be interpreted firm size variables

have a positive effect on capital structure

variables. It is known that Prob value of firm

size variable is 0,2646, that is> 0,05, hence

firm size variable has no significant effect

(statistically) to capital structure variable, at

5% significance level.

3.2.6 Moderation Significance Test

The following test results of business risk

significance in moderating the influence of sales

growth, profitability, corporate growth, and firm size

on capital structure using interaction test.

Table 7: Test of Business Risk Significance in Moderating

The influence of sales growth on capital structure.

De

p

endent Variable: Y

Method: Least S

q

uares

Date: 01/24/18 Time: 22:19

Sample: 1 210

Included observations: 210

Variable Coefficient Std. Erro

r

t

-Statistic Prob.

X1 -0.003484 0.049758 -0.070017 0.9442

Z -0.084347 0.054707 -1.541801 0.1247

INTERACTION

_

ZX1-0.037828 0.017999 -2.101654 0.0368

C -0.452432 0.139876 -3.234515 0.0014

Source: Results of Eviews 7software

Based on Table 7, we obtain the moderation

equation of interaction test as follows.

Y = -0.45-0,0034X_1-0,0843Z-0,037X_1 Z (2)

The value of Prob of the interaction_ZX1 is

0.0368 <0.05, then the business risk is significant in

moderating the effect of sales growth on the capital

structure.

Table 8: Test of Business Risk Significance in Moderating

Effect of profitability on capital structure.

Dependent Variable: Y

Method: Least S

q

uares

Date: 01/24/18 Time: 22:22

Sample: 1 210

Included observations: 210

Variable Coefficient Std. Erro

r

t

-Statistic Prob.

X2 0.308515 0.089385 3.451538 0.0007

Z 0.170551 0.064766 2.633333 0.0091

INTERACTION

_

ZX20.070242 0.028105 2.499299 0.0132

C 0.308264 0.219250 1.405992 0.1612

Source: Results of software Eviews 7

Based on Table 8, we obtain the moderation

equation of interaction test as follows.

Y = 0,3082 + 0,3085X_2 + 0,1705Z + 0,0702X_2 Z

(3)

The value of Prob of interaction_ZX2 is 0.0132

<0.05, then the business risk is significant in

ICMR 2018 - International Conference on Multidisciplinary Research

574

moderating the effect of profitability on the capital

structure.

Table 9: Test of Business Risk Significance in Moderating

Influence of company growth on growth of capital

structure.

De

p

endent Variable: Y

Method: Least Squares

Date: 01/24/18 Time: 22:23

Sam

p

le: 1 210

Included observations: 210

Variable Coefficient Std. Erro

r

t

-Statistic Prob.

X3 0.103922 0.100717 1.031817 0.3034

Z 0.082189 0.074373 1.105091 0.2704

INTERACTION

_

ZX3 0.026273 0.028402 0.925066 0.3560

C -0.141654 0.246257 -0.575227 0.5658

Source: Results of software Eviews 7

Based on Table 9, we obtain the moderation

equation of interaction test as follows.

Y = -0.141 + 0.1039X_3 + 0,0821Z + 0,0262X_3 Z

(4)

The probability of Prob value of interaction_ZX3

is 0.3560> 0.05, then business risk is not significant

in moderating the influence of firm growth on

capital structure.

Table 10: Test of Business Risk Significance in

Moderating The influence of firm size on capital structure.

De

p

endent Variable: Y

Method: Least S

q

uares

Date: 01/24/18 Time: 22:23

Sam

p

le: 1 210

Included observations: 210

Variable Coefficient Std. Erro

r

t

-Statistic Prob.

X4 0.083723 0.041797 2.003085 0.0465

Z 0.024084 0.048024 0.501498 0.6166

INTERACTION

_

ZX4 0.004211 0.015460 0.272354 0.7856

C -0.227974 0.132378 -1.722146 0.0865

Source: Results of software Eviews 7

Based on Table 10, we obtain the moderation

equation of interaction test as follows.

Y = -0,227 + 0,083X_4 + 0,024Z + 0,004X_4 Z (5)

The probability of Prob value of interaction_ZX4

is 0.7586> 0.05, then business risk is not significant

in moderating the effect of firm size on capital

structure.

4 ANALYSIS

4.1 Effect of Sales Growth on Capital

Structure

The coefficient value of the free variable of sales

growth is 0.076 is positive to the variable of capital

structure. Known value Prob of variable sales

growth is 0,0150, that is <0,05, hence variable of

sales growth have significant effect to capital

structure variable.

This research is supported by Ni Made Novione

and Made Rusmala (Ni Made Novione and Made

Rusmala,2016) who state that sales growth has a

positive and significant effect on capital structure.

Sales growth will affect changes in capital structure.

This positive value of the coefficient regression

indicates that the increased sales growth will be

followed by increased capital structure and vice

versa. And the research of Rahmawardani

(Rahmawardani,2007) states that Sales growth has a

positive and significant effect.

4.2 Effect of Profitability on Capital

Structure

The coefficient value of the profitability free

variable is 0.121 is positive to the capital structure

variable. Known Prob value of the profitability

variable is 0.0034, ie <0.05, then the profitability

variable significantly influence the variable of

capital structure.

The research supported by Seftianne

(Seftianne,2011) and Rahmawardani

(Rahmawardani,2007) get profitability result which

have a significant positive effect to capital structure.

The results showed that the higher the profitability

of the company, the higher the capital structure is.

Profitability positively affects the capital structure

because the company does an expansion that it

requires a lot of funds to encourage increased profits

in the future.

Analysis of the Factors Affecting the Capital Structure of a Manufacturing Company Listed on the Indonesian Stock Exchange in

Moderation by Business Risk

575

4.3 Effect of Corporate Growth on

Capital Structure

The coefficient value of the growth-free variable of

firm is 0,009.This is positive value of capital

structure variable. Known Prob value of variable

growth of company is 0,8384, that is> 0,05, hence

variable growth of company have no significant

effect to variable of capital structure.

The research supported by Liem et al (Liem et

al.2013) obtained the result of growth which has no

significant positive effect on capital structure. The

results of this study do not support the results of

research conducted by Wahidahwati

(Wahidahwati,2002) which shows that the growth of

the company proved to negatively affect the capital

structure.

4.4 Effect of Company Size on Capital

Structure

The coefficient value of the independent variable of

firm size is 0,036 is positive value to capital

structure variable. Known Prob value of variable

size of company is 0,2365, that is> 0,05, hence firm

size variables have no significant effect to capital

structure variable.

This shows that the size of a large company does

not guarantee the survival of the company or the

smooth operation of the company. Thus the size of

the company does not guarantee the interest of

investors or creditors in investing funds to the

company. The results support the research conducted

by Firnanti (Firnanti,2010) and Hapsari

(Hapsari,2010), but they are different from research

conducted by Sari (Sari,2013) and Finky

(Finky,2013) which states that firm size variables

have positive and significant influence on capital

structure.

4.5 The Influence of Business Risk as

Moderating Variableof Variable

Structure of Capital

From the results of the tests conducted can be seen

that the business risk variables used as moderating

variables show significant when it is used with the

growth of sales and profitability. The results are not

significantly indicated on the use of company

growth and firm size. Firms with high risk levels

tend to avoid additional funding through foreign

capital compared to firms with low risk levels. It

will also increase the likelihood of bankruptcy.

5 CONCLUSIONS

5.1 Conclusion

This study was conducted to examine whether sales

growth, profitability, corporate growth and firm size,

affect the capital structure listed on the Indonesia

Stock Exchange moderated by business risk. The

sample of research is 42 companies listed on BEI

during period 2012-2016.

Based on the result of research, it can be

concluded that:

1. All independent variables: sales growth,

profitability, company growth, and company

size, able to influence/ explain the structure of

capital simultaneously or together equal to

7.7%, the rest of 92.3% influenced by other

factors.

2. All independent variables: sales growth,

profitability, corporate growth, and company

size, simultaneously, have a significant effect

on capital structure variables.

3. Sales growth has a positive and significant

effect on capital structure variable.

4. Profitability has positive and significant effect

on capital structure variable.

5. The growth of the company has a positive, but

not significant effect on the variable of capital

structure.

6. The size of the company has a positive, but not

significant effect on the sales growth variable.

7. Business risk is able to moderate the effect of

sales growth on capital structure.

8. Business risk is able to moderate the effect of

profitability on capital structure.

9. Business risk is not able to moderate the

influence of corporate growth on capital

structure.

10. Business risk is not able to moderate the effect

of firm size on capital structure

5.2 Limitations of Research

Limitations of this study are the sample of this study

which are only taken from manufacturing companies

listed on the Indonesia Stock Exchange (BEI) 5-year

period of 2012 - 2016. This causes the results of the

study which cannot be generalized to other types of

companies listed on the Indonesia Stock Exchange.

ICMR 2018 - International Conference on Multidisciplinary Research

576

REFERENCES

Bhaduri. 2002.The Characteristics of CompaniesSuch as

Growth, FreeCash Flow, FirmSize, ProductType, and

Type of IndustryAffect the Company'sCapitalStructure.

India

Brigham, E.F dan Gapenski, Louis C. 1996. Intermediate

Finance Management. Harbor Drive : The Dryden

Press.

Brigham Eugine F. dan Joel F. Huston 2006. Dasar-Dasar

Manajemen Keuangan. Jakarta: Penerbit Salemba

Empat.

Field. 2009. Autocorrelationstatistical value of the

Durbin-Watson. 220.

Field. 2009. Autocorrelation statistical value of the

Durbin-Watson. 220-221.

Ghozali. 2013. Correlation Matrix. 105.

Gujarati, Damodar N. 2003. Gio and Elly, 2015.

Ekonometrika Dasar. Jakarta : Penerbit Erlangga.

Gurcharan S. 2010. A Review of Optimal Capital

Structure Determinant Of. Journal Economic

Hapsari, Laksmi Indri. 2010. AnalisisFaktor-Faktor Yang

Mempengaruhi Struktur Modal Perusahaan

Manufaktur Di Bursa Efek Indonesia Periode 2006-

2008 Studi Kasus Pada Sektor Automotive And Allied

Product. Skripsi: Universitas Diponegoro Semarang.

Indahningrum, Rizka Putri dan Ratih Handayani. 2009.

Pengaruh Ukuran Perusahaan, Kepemilikan

Institusional, Dividen, Pertumbuhan Perusahaan, Free

Cash Flow dan Profitabilitas Terhadap Kebijakan

Utang Perusahaan. Jurnal Bisnis dan Akuntansi. Vol

11, No. 3. Hlm 189-207.

Jensen, M. Dan W.H. Meckling. 1976, Theory of the firm:

Managerial Bihavior, Agency Cost and Ownership

Structure. Jurnal of Financial Economic.No. 3. Hlm.

305-360.

Liem, dkk. 2013 Faktor-Faktor yang Mempengaruhi

Struktur Modal Kerja pada Industri Cunsomer Goods

yang Terdaftar di BEI periode 2007-2011. Jurnal

Ekonomi dan Bisnis.

Masidonda. 2013. Determinants Of Capital Structure and

Impact Capital Structure on Firm Value. Journal

Business and Economics

Myers, Steward, C. Dan Nicholas S. Majluf. 1984.

Corporate Financing Decision When Firm Have

Investment Information That Investor Do Not. Journal

of Financial Economics. Vol. 13, hlm. 187-220.

Ng Chin Huat. 2008. The Determinants Of Capital

Structure: Evidence From Selected ASEAN Countries.

Journal Business and Economic.

Nugroho. 2006. Analisis Faktor-Faktor yang

Mempengaruhi Struktur Modal Perusahaan Property

yang Go Public Di BEJ Tahun 1994-2004. Jurnal

Ekonomi dan Bisnis.

Ozkan, 2001. Krisnan and Moyer. 1996. in Omran. 2009.

CapitalStructure in IndustrializedCountrieswhich,

DespiteHavingSimilarEconomicCharacteristics,

Differed in Determining the CapitalStructure and the

Variables that Influenced it. In the United States,

Japan, Italy, and Germany.United States.

Rahmawardani. 2007. Menganalisis Pengaruh Aspek

Likuiditas, Risiko Bisnis, Profitabilitas, dan

Pertumbuhan Penjualan Terhadap Struktur Modal.

Jurnal Ekonomi dan Bisnis.

Saidi. 2004. Faktor-Faktor yang

MempengaruhiStrukturModalpada Perusahaan

Manufaktur yang Go Publicdi BEJ Tahun 1997-2002.

Jurnal Ekonomi dan Bisnis.

Salehi, Mahdi., Nazanin Bashiri Manesh. 2012. A Study Of

The Roles Of Firm And Country On Specific

Determinates In Capital Structure: Iranian Evidence.

Interntional Management Review. 8 (2): 51-85.

Sugiyono. 2012. Metodologi Penelitian Bisnis. Bandung:

Alfabeta.

Taufan. 2009. Faktor-faktor yang

MempengaruhiStrukturModal pada

PerusahaanManufaktur yang Terdaftar di Bursa Efek

Indonesia Periode 2005-2007. Skripsi.

Wahidahwati.2002.Pengaruh Kepemilikan Manajerial dan

Kepemilikian Institusional pada Kebijakan Hutang

Perusahaan: Sebuah Perspektif Theory Agency. The

Indonesian Journal of Accounting Research 5 (1).

Werner R, Murhadi. 2009. Determinants of Capital

Structure: A Study In Southeast Asia.

Yulianti.2010. Capital Structure is the Company's

Characteristics of Profitability, Liquidity, and Size of

the Company. Jurnal Bisnis Dan Akuntansi.

www.idx.co.id

www.ticmi.co.id

Analysis of the Factors Affecting the Capital Structure of a Manufacturing Company Listed on the Indonesian Stock Exchange in

Moderation by Business Risk

577