Effectiveness of Saving and Loan Activities of Islamic Cooperation in

Deli Serdang

Muhammad Buhari Sibuea

1

and Faiz Ahmad Sibuea

2

1

Agribusiness Department, Faculty of Agriculture, UMSU, Medan

2

Magister Agribusiness Department, IPB, Bogor

Keywords: Effectiveness, Sharia Cooperative Woman

Abstract: This research was conducted in Tanjung Gusta Village, Sunggal Sub-district, Deli Serdang Regency. which

is determined purposively. And this research is done to see the effectiveness of the implementation of

saving and loan activities at Al-Ikhlas Sharia Women Cooperative, and the influence of Sharia Cooperative

to increase members’ income. From the results of the research, it can be concluded: Implementation of

saving and loan activities atAl-Ikhlas Sharia Women Cooperative, is about understanding program, target

accuracy, timeliness, achievement of goals, and effective real changes. The existence of cooperative has an

effect on increasing members’income. Before the existence of the cooperative, some people still find

difficulties in their economics, especially women in research areas; many also borrow from moneylenders

and need capital to establish business. After the average difference of test then the results are sig 0.00 value

that is <0.05 H0 rejected, H1 accepted. Then according to the test criteria if the sig value <0.05 then H0 is

rejected and H1 accepted that the average members’ earnings before joining the cooperative is not the same

or significantly different from the average members’income after joining the cooperative.

1 INTRODUCTION

Poverty is a social problem that is always present in

the community, especially in developing countries.In

Indonesia, the problem of poverty is a social

problem that is always relevant to be studied

constantly.Not because the problem of poverty has

existed for a long time and still present up to now,

but also because now the symptoms are increasing in

line with that still faced by the Indonesian nation

(LumbanTobing, 2013).

Society conducts various kinds of business

activities such as, trade, livestock, and so on.Even

for the unlawful thing they do to cover the shortfall,

one of which by using the moneylender services in

terms of obtaining an injection of funds.By reason of

increasing working capital, traders are willing to

borrow money at multiples of interest.Although the

practice is very detrimental to the borrower, but the

borrower still chooses it because of the rapid

disbursement process and does not have to specify

what type of business is being done (NajibulMillah,

2008).

Various efforts have been made by the

government to overcome poverty by launching

empowerment programs such as, Bimas (Mass

Guidance), Transmigration, KIK (Small Investment

Credit), KUK (Small Business Credit).But there are

still some weaknesses such as the role of the

government is still very dominant and the urban

areas have not been completely reached (Manalu,

2014).

One of the efforts to increase the role of

government that is better able to mobilize the

participation of the community in development and

change their mindset and mental attitude is to

establish cooperatives.Through this concerted effort,

it is expected to involve communities in their life

groups and to assist and empower them in

productive activities that match their potential

(Ahmad Subagyo, 2014).

The difficulty of gaining access is one of the

reasons why the level of welfare or income of the

poor remains low.Therefore, the program in its

implementation should prioritize self-

managedsystem, in the sense of local people get the

widest opportunity to manage activities related to the

fulfillment of the needs.They can easily access the

facilities made for them.In addition, the planning

used is a"bottom-up planning"or development plan

464

Sibuea, M. and Sibuea, F.

Effectiveness of Saving and Loan Activities of Islamic Cooperation in Deli Serdang.

DOI: 10.5220/0008889104640471

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 464-471

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

drawn from the bottom up, the development plan

includes programs and projects that are really

needed and involving the communityin the

development plan (YennyVerawati, 2014).

In the past, the range of exchange of cooperative

movement experiences was limited by political /

economic sector, consequently there was oftena

different understanding of cooperatives among

people's talks.Although until the 1960s the concept

of the cooperative movement had not yet received an

international agreement, but with the 1966

revolution of the International Labor Organization

(ILO) the basis of cooperative development began to

be used with the pressure at that time is to utilize the

cooperative model as a vehicle for the promotion of

community welfare, workers who were thenenlisted

with the name of the workers (Couture, 2002).

The Islamic economic system is a precious grace

for humanity.If the system is implemented

thoroughly and in accordance with its teachings, will

be a means that can provide satisfaction for every

need of society.This system becomes useful, rational

and just for the economic progress of the

people.However, the application of this system has a

close relationship with religion, ideology and culture

of Islam so it cannot be separated from the basis of

religion that must be based on the absolute al-Qur'an

and al-Sunnah (NajibulMillah, 2008).

Sharia cooperatives have similar understanding

in their business activities in the field of financing,

investment and savings in accordance with the

pattern of profit sharing (sharia), or better known as

Sharia Financial Services Cooperative.For example,

the product of buying and selling in a cooperative is

generally renamed by the term murabahah, the

product of saving and loan in a general cooperative

is renamed by mudaraba.The name of the

operational system being used also changes, from

conventional (ordinary) systems to the appropriate

sharia systemwith Islamic rules ( Anonim, 2014).

Cooperative is a container that can help people,

especially small and medium society.Cooperatives

play an important role in the economic growth of the

community such as the price of basic commodities

are relatively cheap and there is also a cooperative

that offers borrowing and money storage for the

community.Cooperatives that offer borrowing and

saving money are called saving and loan

cooperatives.The goal is people can save at the

cooperative so that people can feel calm in saving

the money, in addition to lending; the community

can lend to the cooperative with a very small interest

to build desired business (Widyanti and Sunindhia,

2003).

For Al-Ikhlas Sharia Women Cooperativeto provide

saving and loan to members is one of the

cooperative activities.Before the existence of

Al-

Ikhlas Sharia Women Cooperative some people borrow

money by using the loan shark. With the

Al-Ikhlas

Sharia Women Cooperativethe chain of moneylenders

is cut off.Prerequisites to become relatively easy

members of cooperatives such as collecting ID

cards, filling out member registration forms, paying

principal savings that have been determined by

cooperatives and paying mandatory monthly

savings, often make people do not take into account

in the long term debt repayment .As a result in the

realization of lending by cooperatives not

necessarily run smoothly because not all members

are able to return the loan to the cooperative due to

various problems encountered.So that the

cooperative must conduct continuous monitoring to

follow the business development of the

members.Therefore it is deemed very important to

be more aware of the effectiveness of savings and

loan activities at

Al-Ikhlas Sharia Women Cooperative

in TanjungGusta Village, SunggalSubdistrict,

DeliSerdang Regency

.

This researchisdonetoanalyze the effectiveness of

the implementation of saving and loan activities at

Al-Ikhlas Sharia Women Cooperative, and to determine

the influence of Sharia Cooperative to increase

member’s income.

2 METHODOLGY

2.1 Research Design

This research uses the method of descriptive

research with qualitative approach and quantitative

research methods using SPSS to answer

theeffectiveness of the implementation of saving and

loan at sharia cooperatives.

2.2 Sample

The sample of this research comes from

Al-Ikhlas

Sharia Women Cooperative

is one-on-one cooperative

in the field of Sharia in the Village

of Tanjung

Gusta districts Sunggal Deli Serdang Regency.The

total population in the study area is 107 members

and among the members there are women who work

as farmers.As the object of research is 30 people

then the sampling in this study is by using saturated

samples.

Effectiveness of Saving and Loan Activities of Islamic Cooperation in Deli Serdang

465

2.3 Research Instrument

To answer the problem (1) the method used in this

studyisdescriptive research with qualitative

approach. In addition the researcher intends to

understand the social situation in depth, finding

thepattern, hypothesis, and theory.

(2) the effect of increasing income by using the

paired mean

t-testif normal andWilcoxon testif not

normal.To find out normal or not normal the data are

done with the normality test with the help of SPSS

application version 16.

2.4 Data Collection and Analysis

To know the influence of the existence of

cooperative to increase members’ income will be

analyzed by using the normality test.

2.4.1 Normality Test

Normality test is done to know the data areof normal

distribution or not.The test is used as a first step to

determine hypothesis test.Normality test in this

research is done as a requirement that must be

fulfilled.The stages performed in the normality test

are as follows using Kolmogorov-Smirnov.

Testing criteria:

1. If sig> 0.05 then the data are expressed in normal

distribution.

2. If sig <0.05 then the data distributedare not

normal.

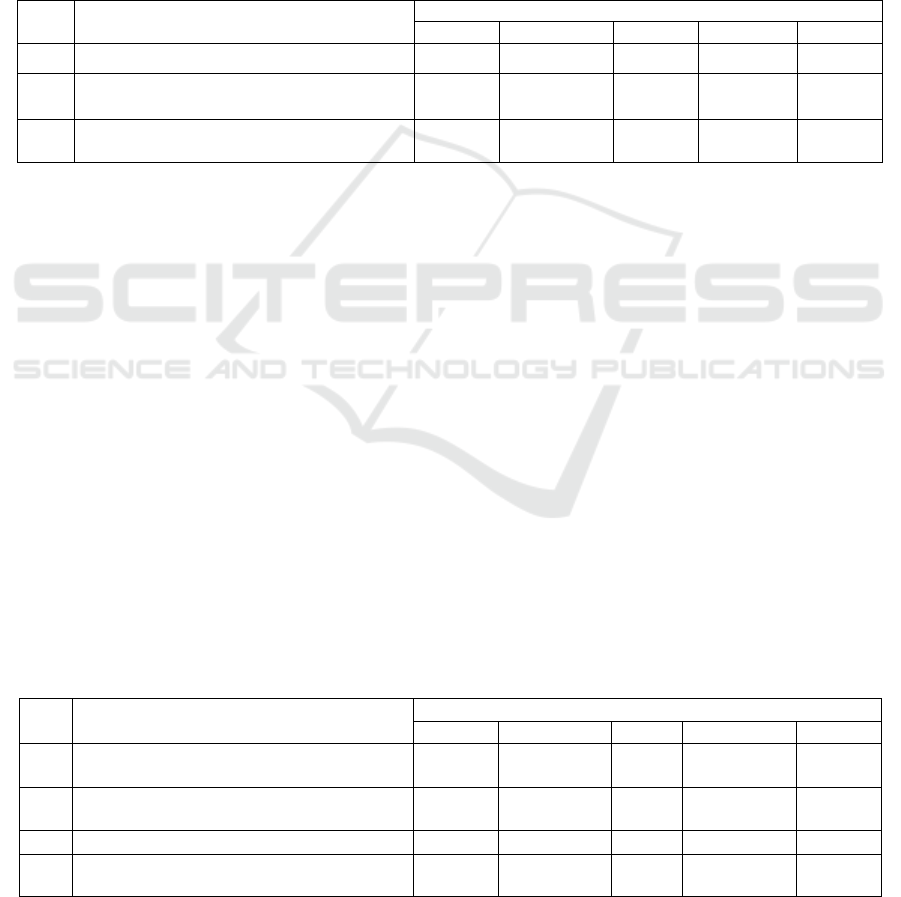

Table 1: Normality Test results using the One-Sample

Kolmogorov-Smirnov Test.

Before Afte

r

As

y

m

p

. Si

g

.

(

2-tailed

)

.529 .143

Source: Primar

y

Data Processin

g

, 201

7

Results of testing the effect on revenue:

a. Prior to joining the cooperative

After the normality test results are obtained

that sig 0.529> 0.05. thenthe normal

distribution of data are obtained.

b. After joining the cooperative

After the normality test results are obtained

that sig 0.143> 0.05. thenthe normal

distribution of data are obtained.

The results of the normality test both before and

after the data are expressed in normal distribution.

Because the data is normally distributed, the test is

continued using averagedifferent test (paired sample

t-test).

3 RESULT

3.1 Effectiveness of Implementation of

the Saving

The effectiveness of the cooperative savings can be

seen through the 5 indicators of effectiveness,

namely: (1) Comprehension program, (2) Targetting,

(3) Punctuality, (4) achievement of objectives and

(5) real change.

3.1.1 Comprehension Program

Indicators of the effectiveness of comprehension

program is a way to know the extent to which

respondents understand the program that is given to

cooperatives such as, information on activities,

respondents, motivation of the respondent to join,

the requirement to follow the activities, the parties to

give an explanation, the subject of each meeting, the

frequency of group meetings and facilitator service

attitude. Effectiveness of activities based on

understanding of the program can be seen in the

following tables:

ICMR 2018 - International Conference on Multidisciplinary Research

466

Table 2: Activities by Understanding Program Effectiveness.

No

.

Question

Answer

E%CE% TE

1.

Information about the activities of Savings

and Loans

22 (73.23%) 8 (26.77%) -

2.

The response after obtaining information

about the savings and loan progra

m

27 (90%) 3 (10%) -

3. Motivation to join 28 (93.33%) 2 (6.67%) -

4.

Requirements to follow the activities of

savin

g

s and loan

26 (86.67%) 4 (13.33%) -

5.

Source explanation of micro-credit

activities

21 (70%) 9 (30%) -

6.

Introduction to fellow members of the

group

23 (76.67%) 7 (23.33%) -

7. Topics talks group meetings 25 (83.33%) 5 (16.67%) -

8.

Frequency of meeting his fellow group

members

26 (86.67%) 4 (13.33%) -

9. Service attitude facilitato

r

28

(

93.33%

)

2

(

6.67%

)

-

Source: Primary Data Processing, 2017

From Table 2 the above it can be seen that based

on the level of understanding of the members it can

be concluded that the majority of the members know

the activities carried out effectively.

1. I/nformation on Saving and Loan Activity

From the first question in the form of

information about the activities of savings and

loans, the research results show that the

majority of respondents state that information

obtained about responsible Activityis effective.

2. Responding After Obtaining Information of

Saving and Loan Program

The second question about the response after

receiving information about the saving and

loan program, the research results show that the

majority of respondents state that the responses

after obtaining information about the saving

and loan programis effective meaning most

members think better after receiving

information as the information can certainly

benefit and aid the capital.

3. Motivation to Join

The third question about the motivation for

joining, research shows that the majority of

respondents state that the motivation of

members to joinis declared effective.

4. Terms for the Following Event of Saving-Loan

The fourth of the requirement to follow the

activities of savings and loans, the research

shows that the majority of respondents declare

the activities of saving and loan run effectively.

5. The Source of Explanations Concerning Saving

and Loan Activity

The fifth question regarding the source of an

explanation of the saving and loan activities,

the research shows that the majority of

respondents express a description of the

resources is effective. Respondents' answers

regarding the terms for borrowingare

repayment period of the loan and the penalties

imposed when paying the loanlate.

6. Fellow Introduction to Group Members

Of the six questions to the recognition of

fellow group members, the research shows that

the majority of respondents state sources

explanation of micro-credit activities are

effective meaning that most members

recognize all members of the cooperative.

7. Talking about Group Meeting

The seventh question on the topic of the talk

group meetings, the research shows that most

respondents state that the topic of the talk

group meetings is effective meaning that most

members understand the topic of conversation

at every meeting. Based on respondents'

answers regarding the topic of conversation at

a meeting of the group the respondents say they

are in meetings to discuss topics about the

performance of the cooperative as a

cooperative plan for the future, as well as ways

for the welfare of its members.

8. Frequency of Meetings Fellow Group

Members

The eighth question regarding the frequency of

meeting of group members, the research shows

that the majority of respondents state the

frequency of meeting of group members is

based on the effective running of respondents

meaning that almost all members often follow

the meetings conducted once a week.

Effectiveness of Saving and Loan Activities of Islamic Cooperation in Deli Serdang

467

9. Attitude Facilitator Services

The nineth questions about the attitude of

service facilitator, the research shows that the

majority of respondents express an attitude of

service facilitator is friendly so thatthere are

effective service activities based on

respondents' answers meaning that almost all

the members are satisfied with the welcoming

and friendly attitude of service management, as

they offers savings and loans, selling materials

that are cheaper and offering the crediting of

goods or purchasing of goods.

3.1.2 Target Accuracy

Indicators of the effectiveness of targeting accuracy

is a way to determine the appropriate targeting such

as joint activities conducted, the progress of the

fellow members and smooth running of compulsory

savings and voluntary savings. Effectiveness of

activities by targeting accuracy can be seen in the

following tables:

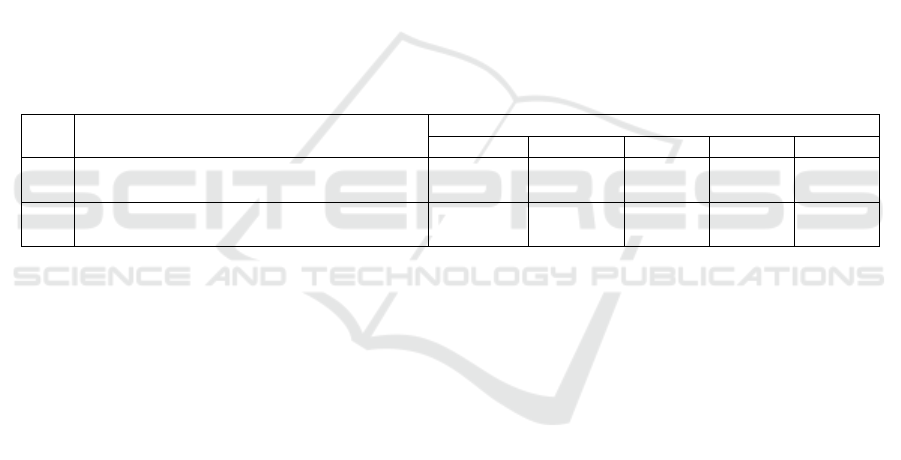

Table 3: Effectiveness of Activity Based Target Accuracy.

No. Question

Answer

E%EE% NE

1. Joint activities member 21 (70%) 9 (30%) -

2.

The development activities of fellow

members

29 (96.67%) 1 (3.33) -

3.

Smoothness compulsory savings and

voluntar

y

savin

g

s membe

r

30 (100%) - - -

Source: Primary Data Processing, 2017

From Table 3 it can be seen that most of the

activities carried out by cooperative runs right on the

intended target.

1. Member Joint Activity

The first question about the appropriateness of

targeted joint activities of members, based on

the research result shows thatactivities with

members are effective. Based on respondents'

answers regarding the joint activities of their

members, the activities are micro-credit

activities, farming activities, women’s religious

activities and extension activities undertaken

by the cooperative.

2. Developments Fellow Member Activity

The second question about the appropriateness

of targeted development activities of the

members, based on the research result it is seen

that the progress is running smoothly.

3. Smoothness Deposit Mandatory And Voluntary

Saving Members

The third question about the accuracy of the

target of smoothness of compulsory savings

and voluntary savings of members, all

members are good at mandatory and voluntary

savings and those who are not fluent in the

payment will be penalized by the cooperative.

3.1.3 Timeliness

Effectiveness indicators of punctuality is a way to

find timely implementation of programs, such as the

opinions of respondents about the time of

disbursement of funds, following the frequency of

the cooperative program, the length of time the

respondent in a complaint to repay the loan and

fellow members of the cooperative. Effectiveness of

activities based on the timeliness can be seen in the

following tables:

Table 4: Effectiveness of Activity Based Timeliness.

No. Question

Answer

E % EE % NE

1.

Opinions on the savings and loan

disbursement activities

26 (86.67%) 4 (13.33%) -

2.

Frequency follow a cooperative program of

the yea

r

30 (100%) - - -

3. The length of time to repay the loan 27 (90%) 3 (10%) -

4.

Complaints fellow members of the

cooperative

21 (70%) 9 (30%) -

Source: Primary Data Processing, 2017

ICMR 2018 - International Conference on Multidisciplinary Research

468

From Table 4 it can be seen that most of the

activities carried out by the cooperative run in a

timely manner in accordance with the existing

policy.

1. Opinions Regarding the Saving and Loan

Disbursement Activity

The first question about the timeliness of the

respondents' savings and loan disbursement

activitiescan be concluded to be effective.

2. Following frequency Cooperative Program

Within One Year

The second question about the frequency of

following cooperative program of the year, the

results show effectiveness; all the members of

the frequency program are more than once a

year, even up to seven times a year to follow

the activities of the cooperative.

3. Old Time Refinance Loan

From the third question regarding the length of

time to repay the loan, the research results

show that the majority of respondents say long

time to repay the loan is effective. The period

of time to repay the loan before lending

determines the funds to be borrowed and the

existing funds at the cooperative.

4. Complaints at the Cooperative

From questions regarding complaints to the

four other members of the cooperative,

research shows that the majority of respondents

do not express complaint as most of the

members behave well.

3.1.4 Achieving Objectives

Indicators of the effectiveness of the achievement of

goals is a way to determine the attainment of the

objectives of the program such as an increase in

income before and after following the cooperative

activities and the provision of capital. Effectiveness

of activities based on the achievement of objectives

can be seen in the following tables:

Table 5: Effectiveness of Activity Based on Achievement of Objectives.

No. Question

Answer

E%CE% TE

1.

The increase in revenue after following

activities

30 (100%) - - -

2.

The provision of capital to help the

development of enterprises

30 (100%) - - -

Source: Primary Data Processing, 2017

Table 5 shows that all activities undertaken by

the cooperative run smoothly or achieve those goals,

supported by the questionnaires.

1. Increased Revenue After Following Event

From the first question regarding the increase

in revenue after joining the activities, the

research shows that all respondents say there is

an increase in revenue after following

activities which are effective as many as 30

people (100%). Members' income increases

after joining the cooperative, both in terms of

venture capital, farming, and in an effort

developed by members.

2. Award Capital Helps Business Development

The second question regarding the provision of

capital support business development efforts,

the research shows that all respondents state

that the provision of capital effectively

supports business development efforts as many

as 30 people (100%). All the members are

helped by the provision of capital. Most of

them simply work as farmers and this provision

help them to make another business.

3.1.5 Real Change

Indicators of the effectiveness of the real change is a

way to know the real changes experienced by

respondents such, the livelihood of the principal

before and after joining the cooperative, saving

frequency before and after joining the cooperative

and alternative places to borrow before and after

joining the cooperative. Effectiveness of activities

based on real changes can be seen in the following

tables:

Effectiveness of Saving and Loan Activities of Islamic Cooperation in Deli Serdang

469

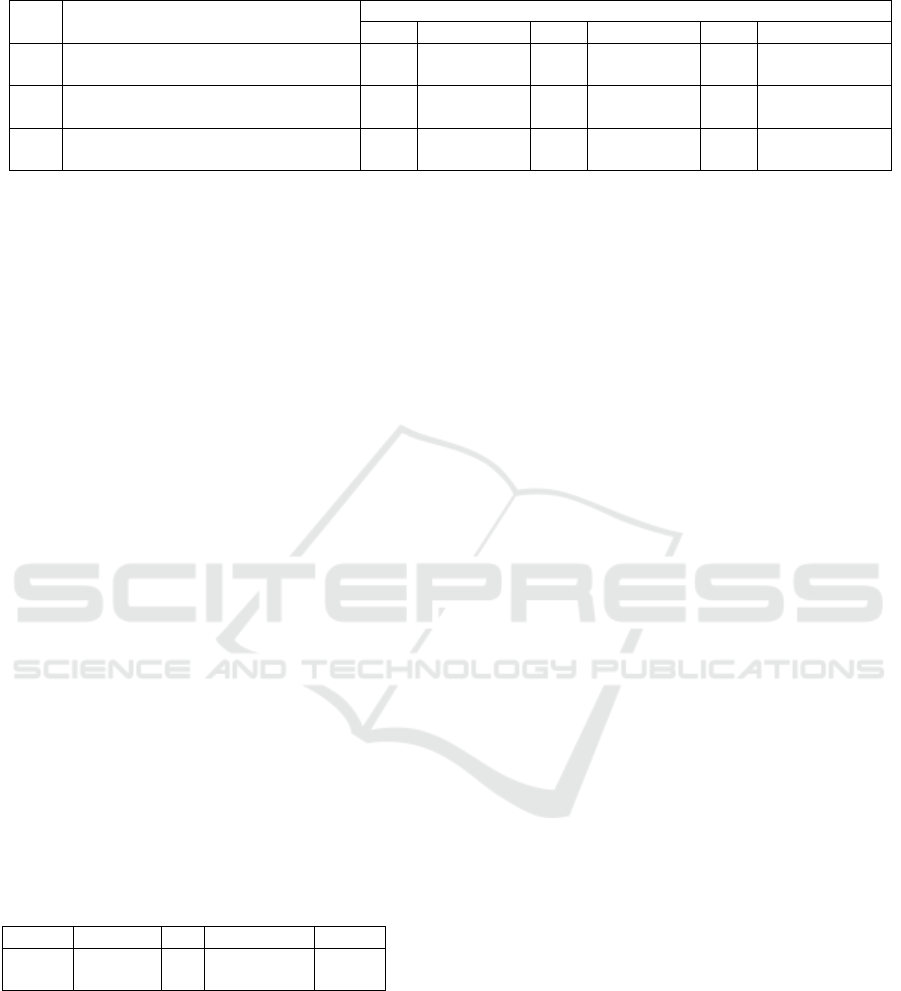

Table 6: Effectiveness of Activity Based Real Change.

No. Question

answer

E % CE % TE %

1.

Principal livelihoods before and after

joining

17 (56.67%) 13 (43.33%) - -

2.

Frequency of member saving before

and after joining

16 (53.33%) 12 (40%) 2 (6.67%)

3.

Alternative of member getting a loan

b

efore and after

j

oinin

g

23 (76.67%) 7 (23.33%) - -

Source: Primary Data Processing, 2017

Table 5 shows that most of the activities carried

out by the cooperative work effectively or noticeable

changes occur in these activities.

1. Basic Livelihood Before And After Registration

From the first question about the livelihood of

goods before and after joining, the research

shows that the majority of respondents statethere

is a change in the principal livelihoods before

and after joining effective.

2. Members frequency Saving Before And After

Registration

The second question regarding the frequency of

saving members before and after joining, the

research shows that the majority of respondents

state there is frequency of saving of members

before and after joining the cooperative.

3. Alternative of Member to Get Loan Before And

After Registration

From the third question on alternatives of

member to get a loan before and after joining the

research results show that the majority of

respondents say there is alternative for members

to get a loan before and after joiningthe

cooperative.

3.2 Impact of Al-Ikhlas Sharia Women

CooperativeMembers against

Increased Revenue

Table 7: Average Result of Paired Sample t-Test.

N correlation Si

g

.

pair 1 Before

afte

r

30 .957 .000

Source: Primary Data Processing, 2017

After testing using average different test the results

are sig 0.00 <0.05 H0 denied, H1 accepted. Then by

testing criteria sig <0.05, H0 is rejected. And the

consequences if H0 is rejected, the alternative

hypothesis or H1 also accepted.

Hypothesis H

1

state that the average income of a

member before joining the cooperative is not the

same or different significantly from the average

income after joining the cooperative members. So

the test is based on paired sample t-test with a level

of 95% and it can be concluded that cooperative

members who have joined the cooperative show

increased earnings significantly higher at an average

of 2.72 or US $ 2.72 million compared to before

joining the cooperative,the average earnings are 1.98

or Rp 1,983,333.

4 CONCLUSION

Conclusions from the study regarding the issues

examined in the fieldcan be summarized as follows:

1. Implementation of micro-credit activities at the

ShariaCooperative is about the understanding of

the program, targeting accuracy, timeliness,

achievement of goals and real change and all

declared effective.

2. The existence of Islamic Cooperation affect the

increase in revenue after testing. There is a

significant difference on the side of the members

before and after joining the cooperative.

5 SUGGESTION

1. The cooperative as a program manageris tobe

continued and the cooperative is to provide good

information through print or electronic media so

that the public could understand about the

purpose of micro-credit activities.

2. Members to join the cooperative should be

strictly selected as not every single person in the

community deserve the membership as most of

the people are self-supported with good earning.

3. The poor people are to be prioritized as they are

the real supporter of the cooperative and in

addition to this they need some financial help to

uplift the welfare of their living. Most of them

are farmers , and even some of them are farmers

without lands.

ICMR 2018 - International Conference on Multidisciplinary Research

470

REFERENCES

Ahmad Subagyo. 2014. Manajemen Koperasi Simpan

Pinjam. Mitra Wacana Media, Jakarta.

Anonim. 2014. Pengertian Koperasi Syariah. Manfaat

Koperasi Simpan Pinjam bagi anggota.

http://logokoperasi.blogspot.co.idhttp://kementriankop

erasi.com Diakses Agustus 2016.

Couture, M-F, D. Faber, M. Levin, A-B. Nippierd.

2002.Transition to Cooperative Entrepreneurship.ILO

and University of Nyenrode. Geneva.

Lumban Tobing, Decy Christien. 2013. Efektivitas Simpan

Pinjam Kelompok Perempuan (SPP) PNPM Mandiri

Pedesaan. Univ. Sumatera Utara.

Manalu, Iin Mai Saroh. 2014. Efektivitas Pelaksanaan

Kegiatan Simpan Pinjam Perempuan Program

Nasional Pemberdayaan Masyarakat Mandiri.Univ.

Sumatera Utara.

Najibul Millah. 2008. Strategi Pusat Koperasi Syariah

Dalam Upaya Pengembangan Koperasi Primer

Syariah.Univ. Islam Negeri Syarif Hidayatullah.

WidiyantiandSunindhia. 2003. KoperasidanPerekonomian

Indonesia. PT. RinekaCipta.

Yenny Verawati. 2014. Analisis Efektivitas

Keberlangsungan Modal Usaha Simpan Pinjam

Perempuan PNPM Mandiri. Tesis. Univ. Udayana.

Denpasar.

Effectiveness of Saving and Loan Activities of Islamic Cooperation in Deli Serdang

471