Analysis of Influencing Factors of IPO Under-pricing: Case Studies

on Companies Listing in IDX during 2008-2017

Meigia Nidya Sari, Erlina and Rina Bukit

Department of Master of Accounting, Faculty of Economics and Business, University of Sumatera Utara, Indonesia

Keywords: Under-Pricing, Financial Ratio, Non-Financial Information.

Abstract: Under-pricing is a price below the market price or stock price in the secondary market higher than the stock

price in the primary market in which investors are interested in purchasing. Under-pricing is influenced by

several factors, such as company size, return on asset, financial leverage, and percentage of public offering,

trading volume, auditor reputation, company age, and industrial type to under-pricing during the IPO in the

Indonesia Stock Exchange. 130 samples of companies were used. The technical of collecting samples using

senses. The data analyzed using multiple linear regressions. Based on the results of data analysis, trading

volume and auditor reputation had significantly negative effect on under-pricing, while financial leverage

had significantly positive affect on u//under-pricing, while company size, company age, industrial type had

insignificantly negative affect on under-pricing, and percentage of public offering had insignificantly

positive affect on under-pricing.

1 INTRODUCTION

Initial Public Offering (IPO) becomes good

alternative way for company to get funding.

However, there are times when it is difficult to

determine the initial stock price at the IPO. Because

many considerations must be made in determining

the price between the issuer and underwriter, while

the stock price sold in secondary market will be

determined by market mechanism depend on supply

and demand. The difficulty of determining initial

stock price is due to the absence of relevant

information. The limited information about what and

who the company will do an initial public offering

make underwriters and potential investors should

perform a good analysis before deciding to buy or to

order the stock (Hatta, 2010).

The determination of the stock price to be

offered at the IPO is an important factor as it relates

to the amount of funds that the issuer will receive

and the risk that the underwriter will bear. The

amount of funds received by the issuer is the

multiplication between the numbers of shares

offered at the price per share, so the greater the price

per share, the higher the funds will be obtained.

PT. Krakatau Steel (Persero) Tbk conducted an

IPO in 2010 by releasing 3,155,000,000 shares of

public shares and listing them on the Indonesia

Stock Exchange. Initial shares offered through the

book building process (initial offer) recorded a

demand surplus of 9 times. Share ownership of PT.

Krakatau Steel after the IPO is divided into 80%

owned by the Government of the Republic of

Indonesia, and the remaining 20% will be owned by

the public. In this offer, the Company appointed PT.

Bahana Securities, PT. DanareksaSekuritas, and PT.

MandiriSekuritas as the underwriters. The IPO

implementation price is set at Rp. 850 per share or

acquisition of IPO fund is set at Rp. 2.681 trillion.

Such a price is the cause of controversy in the public

regarding the initial stock price offered whether it is

relatively appropriate or reasonable with the current

condition of the company. PT. Krakatau Steel

became one of the companies that experienced

under-pricing post IPO that is from the price

determination of Rp. 850 per share immediately

skyrocketed to the level of Rp. 1,200 per share that

is up about 40% more, whereas the funds absorbed

should be more than Rp. 2.681 trillion (Purwoko,

2010).

452

Sari, M., Erlina, . and Bukit, R.

Analysis of Influencing Factors of IPO Under-pricing: Case Studies on Companies Listing in IDX during 2008-2017.

DOI: 10.5220/0008888904520458

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 452-458

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 PREVIOUS RESEARCH

REVIEW

The first research conducted by Islam et al (2010).

The results of this study indicated that Variable

percentage capacity for public offering, company

size, and industrial type has a significant negative

effect on under-pricing at the level, while company

age variable has a positive effect on under-pricing.

The second research conducted by (Saurabh

Ghosh, 2005) showed that the variable size of the

size does not affect the under-pricing, while the

company age, company size, and industrial type

variables have a significant negative effect on under-

pricing.

The third study conducted by (How et al., 1995)

showed All independent variables ie Company Age,

offer size, listing time, and reputation of underwriter

Negatively significant effect on under-pricing.

The fourth research conducted by (Kim et al.,

1993) showed the variable of Financial Leverage

and Ownership Retention have positive effect on

under-pricing while Investment, underwriter quality,

ROA, and Gross Proceeds have positive effect on

Under-pricing.

The fifth research conducted by Mega Gunawan

and Viriany Jordin (2015) showed that ROA

variable and company size have a significant effect

on under-pricing level, while DER, EPS, company

age and percentage of shares offered to public have

no significant effect on under-pricing level.

The sixth study of the research conducted by

Shoviyah Nur Aini (2013) showed that ROE

variable, company size, company age, underwriter

reputation, and IPO fund use for investment have no

effect on under-pricing, while auditor reputation

variable has significant negative effect on under-

pricing

The seventh research conducted by (Reza

Widhar Pahlevi, 2014) showed Variable Reputation

underwriter, auditor's reputation has no significant

effect on under-pricing, while the variable leverage

has positive influence on under-pricing, while ROA,

NPM, Current ratio, company size, and company's

age have a significant negative effect on under-

pricing.

The eighth research conducted by (Hapsari and

Kholiq Mahfud, 2012) showed Variable Reputation

underwriter, auditor reputation, ROE, company size

has a significant negative effect on under-pricing,

while current ratio variable and EPS has no effect on

under-pricing.

The ninth research conducted by (Lismawati

Munawaroh, 2015) showed that underwriter

Reputation variable and company's age have no

effect on under-pricing level, while company

profitability variable (ROA), and company size have

significant negative effect to under-pricing level,

while Financial leverage (DER) against under-

pricing.

The tenth research conducted by (I Dewa Ayu

Kristiantari, 2012) showed that underwriter

reputation variable, company size, purpose of

investment fund use negatively affect under-pricing,

while auditor reputation variable, company age,

company profitability, financial leverage, and

industry type have no effect on under-pricing.

Based on the description previously described,

the hypothesis of this penetration are: company size,

financial leverage, Percentage of public offering,

trading volume partially or simultaneously effect on

under-pricing of shares at initial public offering in

Indonesia Stock Exchange.

3 RESEARCH METHOD

This is a causal associative research with the

characteristics of the problem of causality between

two variables or more. From the type of data used in

this study is quantitative research, quantitative

research methods aimed at researching on a

particular population or sample, data collection

using research instruments, quantitative / statistical

data analysis, with the aim to test the predefined

hypothesis (Ghozali, 2013)

3.1 Population and Sample

This research took the population of companies

conducted IPO on BEI from 2008-2017 who under-

priced with saturated or census sampled technique so

that obtained as many as 130 companies that

experienced under-pricing during that period as

population and the amount also used as sample.

3.2 Data Analysis Technique

Data analysis technique used is multiple linear

regression analysis. Tests conducted are: Descriptive

Statistics, Classic Assumption Test, namely the

Normality Test, Multicolinearity Test,

Heteroskedastisitas Test and Autocorrelation Test.

Hypothesis Testing with Test t (Partial Test) and

Test F (Simultaneous Test), Determination

Coefficient Analysis and Multiple Linear regression

Analysis.

Analysis of Influencing Factors of IPO Under-pricing: Case Studies on Companies Listing in IDX during 2008-2017

453

4 RESULTS AND DISCUSSIONS

4.1 Descriptive Statistics Analysis

Descriptive statistical analysis is used to find out the

description of a data viewed from the value of the

distribution of frequency and percentage, as well as

the maximum, minimum, and mean value, of the

Company Size, ROA, Financial Leverage,

Percentage of Public Shares Offer, Trade Volume,

Auditor Reputation, Age of Company, Industry

Type, and Under-pricing.

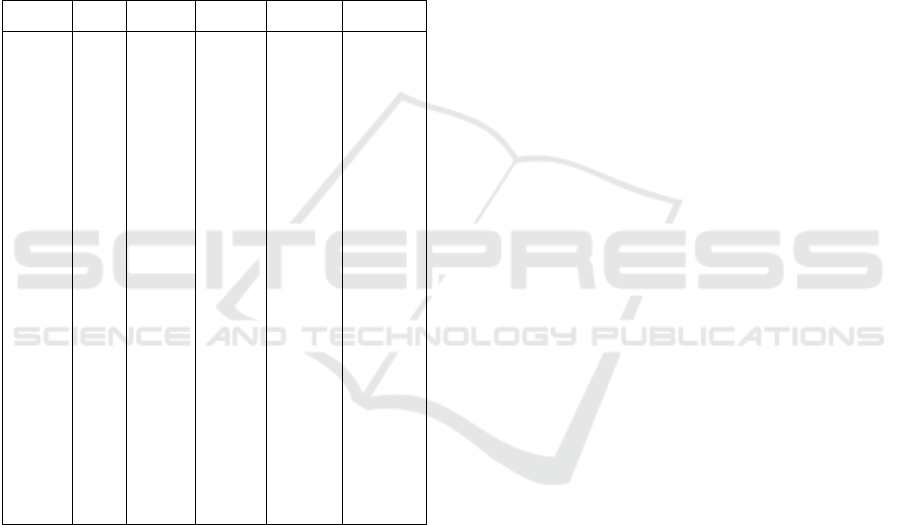

Table 1: Descriptive Statistics of Independent and

Dependent Variable.

N

Min

Max

Mean

Std. Dev

Size

(X1)

130

8.99

17.62

13.8749

1.52097

ROA

(X2)

130

0.72

3.11

1.3753

.33573

FL

(X3)

130

1.00

1.43

1.0612

.06760

PPO

(X4)

130

1.02

91.00

24.5727

14.24606

Vol

(X5)

130

7.31

26.24

19.2514

3.65568

AR

(X6)

130

.00

1.00

.2692

.44528

Age

(X7)

130

1.00

60.00

18.8154

13.3717

Type

(X8)

130

.00

1.00

.3462

.47758

Up (Y)

130

.00

.70

.3368

.25371

Valid

N

130

According to Table 1, it is known that the

average value of company size is 13.8749 and the

standard deviation of the company size is 1.52097.

While the minimum value of the size of the

company is 8.99 derived from the issuer of BSIM

(Bank Sinarmas, Tbk) and the maximum value of

the size of the company is 17.62 derived from

BBTN issuer (Bank Tabungan Negara, Tbk).

The average value of ROA is 1.3753 and the

value the standard deviation of ROA is 0.33573.

While the minimum value of ROA is 0.72 from the

issuer of BAEK (Bank Ekonomi, Tbk) and the

maximum value of ROA is 3.11 from NIRO

(Nirvana Development, Tbk) issuer. The average

value of financial leverage is 1.0612 and the

standard deviation value of financial leverage is

0.06760. While the minimum value of financial

leverage is 1.00 derived from the issuer of BRMS

(Bumi Resources Minerals, Tbk) and the maximum

value of financial leverage is 1.43 obtained from

issuer MINA (Sanurhasta Mitra, Tbk).

The average value of percentage of public

offering is 24,5727 and the standard deviation value

of percentage of public offering is 14.24606. While

the minimum value of percentage of public offering

percentage is 1.02 obtained from MAPB issuer

(MAP Boga Adiperkasa, Tbk) and the maximum

value of percentage public offering is 91 obtained

from IBFN issuer (Intan Baruprana Finance, Tbk).

The average value of trading volume is 19.2514

and the standard deviation of trading volume is

3.65568. While the minimum value of trading

volume is 7.31 obtained from NASA (Ayana Land

International, Tbk) and the maximum value of

trading volume is 26.24 obtained from IBST issuer

(Inti Bangun Sejahtera, Tbk).

The average value of the auditor's reputation is

0.2692 and the standard deviation value of the

auditor's reputation is 0.44528. While the minimum

value of the auditor's reputation is 0 obtained from

firms audited by other than the Big Four KAP and

the maximum value of the auditor's reputation is 1

obtained from firms audited by the Big Four KAP.

The average value of the company's age is

18.8154 and the standard deviation of the company's

age is 13.37172. While the minimum value of

company's age is 1 obtained from ICBP issuer

(Indofood CBP Sukses Makmur, Tbk) and the

maximum value of company's age is 60 obtained

from BJBR issuer (Bank Jawa Barat, Tbk).

The average value of the industry type is 0.3462

and the standard deviation value of the industry type

is 0.47758. While the minimum value of the type of

industry is 0 obtained from non-manufacturing

companies and the maximum value of the type of

industry is 1 obtained from the manufacturing

companies.

The average value of under-pricing is 0.3368 and

the standard deviation of under-pricing is 1.01042.

The minimum value of under-pricing is 0.00

obtained from POWR issuer (Cikarang Listrindo,

Tbk) and the maximum value of under-pricing is

0.70 obtained from MPOW (Mega Power Makmur,

Tbk) issuer.

ICMR 2018 - International Conference on Multidisciplinary Research

454

4.2 Classic Assumption Test

4.2.1 Normality Test

The normality test aims to test whether in the

regression model, the intruder or residual variable

has a normal distribution. Test t and F assume that

the residual values follow the normal distribution.

In this study, the normality test for residuals using

the Kolmogorov-Smirnov test. Level of

significance used α = 0.05. The basis for the

decision is to look at the probability p, with the

following conditions:

If the probability value p ˃ 0.05, then the

assumption of normality is met

Then Hois accepted, Ha is rejected.

If the probability is <0.05, then the assumption

of normality is not met

Then Ho is rejected, Ha accepted.

Table 2: Normality Test.

One-Sample Kolmogorov-Smirnov Test.

Unstandardized

Residual

N

130

Normal

Parameters

a,,b

Mean

.0000000

Std. Deviation

.97144095

Most Extreme

Differences

Absolute

.051

Positive

.040

Negative

-.051

Kolmogorov-Smirnov Z

.582

Asymp. Sig. (2-tailed)

.887

a. Test distribution is Normal.

b. Calculated from data.

Note that according to Table 2, the probability

value or Asymp is known. Sig. (2-tailed) of 0.887.

If the probability value, ie 0.887, is greater than the

level of significance, ie 0.05, the assumption of

normality is met.

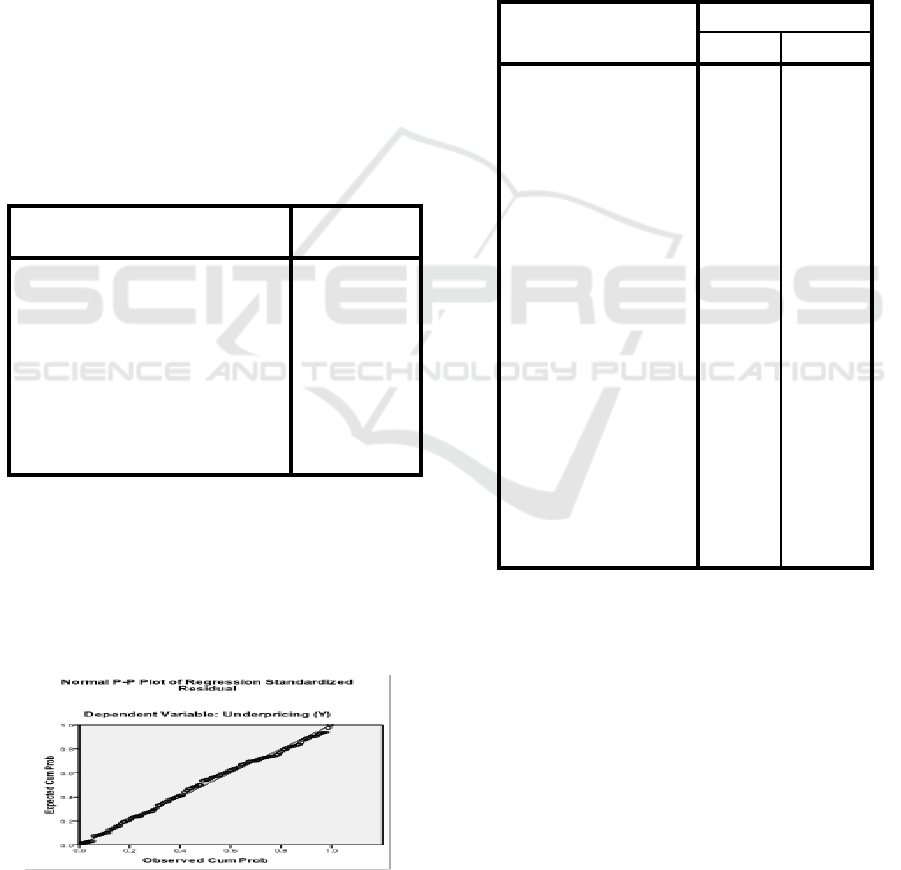

Figure 1: Normality Test with Normal Probability Plot

Approach.

Based on the normality test with the normal

probability plot approach (Figure 1), the points

spread quite closely to the diagonal lines. This

indicates the assumption of normality is met.

4.2.2 Multicollinearity

To check whether there is multi co linearity or not

cannot be seen from the value of variance inflation

factor (VIF). VIF values of more than 10 indicated

an independent variable of multicolinearity

(Ghozali, 2013).

Table 3: Multicollinearity Test.

Model

Collinearity Statistics

Tolerance

VIF

1

(Constant)

Ukuran

Perusahaan

(X1)

.733

1.365

ROA (X2)

.874

1.144

Financial

Leverage (X3)

.787

1.271

PersentasePen

awaranSaham

Publik (X4)

.937

1.067

Volume

Perdagangan

(X5)

.886

1.128

Reputasi

Auditor (X6)

.847

1.180

Umur

Perusahaan

(X7)

.857

1.167

JenisIndustri

(X8)

.891

1.122

Based on Table 2, it is known that all VIF

values are not more than 10 or all VIF values <10,

and the tolerance value is not less than 0.1 then the

indication does not occur multicollinearity or in

other words accept Ho and reject Ha.

4.2.3 Heteroscedasticity Test

The heteroscedasticity test according to Ghozali

(2011: 139) aims to test whether in a regression

model the residual variance inequality varies from

one observation to another fixed, heteroscedasticity.

The way used to detect the presence or absence of

heteroscedasticity in this study by looking at the plot

Analysis of Influencing Factors of IPO Under-pricing: Case Studies on Companies Listing in IDX during 2008-2017

455

graph between the predicted value of dependent

variable (ZPRED) with residually is SRESID. The

detection of whether or not heteroscedasticity can be

done by looking at the presence of a particular

pattern on the scatterplot chart between SRESID and

ZPRED where the Y axis is predicted and the X axis

is the residual (Y-predicted Y). The basic analysis

used to detect heteroscedasticity:

If there is a certain pattern, such as the existing

dots form a certain pattern that is regular (wavy,

widened then narrowed), then indicates there has

been heteroscedasticity.

If there is no clear pattern, and the points spread

above and below the number 0 on the Y axis, there

is no heteroscedasticity.

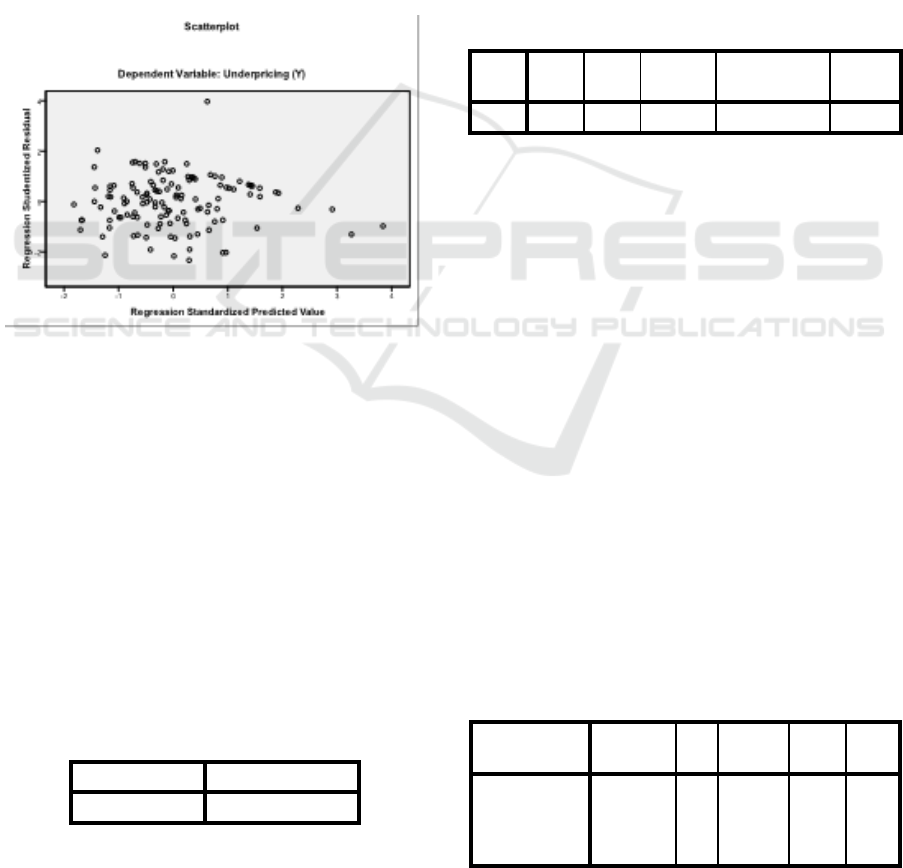

The results of the heteroscedasticity test shown

in Figure 2:

Figure 2: Heteroscedasticity Test.

Note that according to Figure 2, there is no clear

pattern, and the points spread above and below the

number 0 on the Y axis, hence no heteroscedasticity.

4.2.5 Autocorrelation Test

Assumptions about residual independence (non-

autocorrelation) can be tested using the Durbin-

Watson test (Field, 2009). The statistical value of the

Durbin-Watson test ranges between 0 and 4. The

statistical value of the Durbin-Watson test that is

smaller than 1 or greater than 3 indicates an

autocorrelation.

Table 4: Autocorrelation Test.

Model

Durbin-Watson

1

1.798

According to Table 4, the value of the Durbin-

Watson statistic is 1.798. Note that since the Durbin-

Watson statistic value lies between 1 and 3, the non-

autocorrelation assumption is met. In other words,

there is no high autocorrelation symptoms in the

residual, then accept Ho and reject Ha.

4.2.4 Coefficient of Determination Analysis

The coefficient of determination (R²) is a value

(value of proportion) which measures how much the

ability of the independent variables used in the

regression equation, in explaining the variation of

the dependent variable.

Table 5: Coefficient of Determination.

Model Summary

b

.

Model

R

R

Square

Adjusted

R Square

Std. Error of

the Estimate

Durbin-

Watson

1

.521

a

.272

.224

1.00304

1.798

a. Predictors: (Constant), Industrial type (X8), Persentage

of public offering (X4), Financial Leverage (X3), ROA

(X2), Auditor reputation (X6), Trading volume (X5),

Company age (X7), Company size (X1)

b. Dependent Variable: Under-pricing (Y)

Based on Table 5, the coefficient of

determination value R² lies in the R-Square column.

It is known that the coefficient of determination is

R2 = 0.272. The value means all independent

variables, ie company size, ROA, financial leverage,

percentage of public offering, trading volume,

auditor reputation, company age, and industry type

can explain the effect of under-pricing variable by

27.2%, the rest of 72.8% influenced by other factors.

4.2.6 Significance of Simultaneous Effect

Test (F test)

F test aims to examine the effect of free variables

simultaneously or simultaneously to the dependent

variable.

Table 6: Significance of Simultaneous Effect Test (F test).

ANOVA

b

.

Model

Sum of

Squares

Df

Mean

Square

F

Sig.

1

Regression

45.445

8

5.681

5.646

.000

a

Residual

121.737

121

1.006

Total

167.182

129

ICMR 2018 - International Conference on Multidisciplinary Research

456

a. Predictors: (Constant), Industrial type (X8), Persentage

of public offering (X4), Financial Leverage (X3), ROA

(X2), Auditor reputation (X6), Trading volume (X5),

Company age (X7), Company size (X1)

b. Dependent Variable: Under-pricing (Y)

Based on Table 6, it is known that F count is

5,646 and Sig ,000 because the value of F arithmetic

is 5,646> F table 2.015 and the value of Sig 0,000

<0,05.

Hence company size, ROA, financial leverage,

percentage of public offering, trading volume,

auditor reputation, company age, and industry type

have a significant effect on under-pricing.

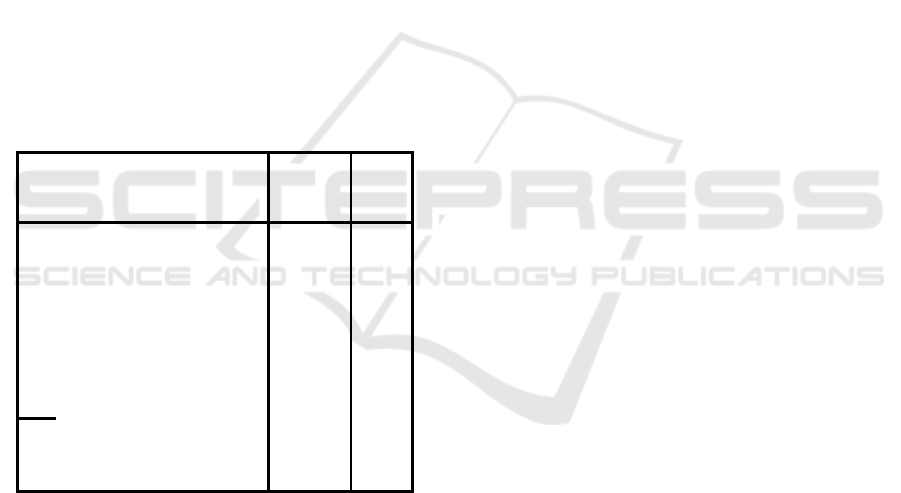

4.2.7 Multiple Linear Regression Analysis

and Partial Effect Significance t Test

Table 7 below presents the regression coefficient

value, as well as the statistical value t for partial

effect test.

Table 7: Multiple Linear Regression Analysis and Partial

Effect Significance t Test.

Coefficients.

Model

T

Sig.

1

(Constant)

1.349

.180

Company Size(X1)

-.680

.498

ROA (X2)

.050

.960

Financial Leverage (X3)

2.492

.014

Percentage of Public

Offering(X4)

.744

.459

Trading Volume (X5)

-3.615

.000

Auditor Reputation (X6)

-2.339

.021

Company Age (X7)

-.640

.523

Kinds of industry (X8)

-.102

.919

a. Dependent Variable: Under-pricing (Y)

Based on Table 7, multiple linear regression

equations are obtained as follows:

Y = 3,632 – 0,619X1 + 0,025X2 + 4,216X3 +

0,101X4 – 1,562X5 – 0,109X6 – 0,072X7 –

0,004X8 + e

Based on the multiple linear regression equation

above, it is known:

1. The regression coefficient value of company size

is -0.619 that is negative value. The value can be

interpreted company size negatively affect under-

pricing. Sig value of 0.498> 0,05 and t value | -0,680

| <t table | 1,979 |, then company size has no

significant effect on under-pricing.

2. The value of the regression coefficient of ROA is

0.025, which is positive. The value can be

interpreted ROA has a positive effect on under-

pricing. Sig value of 0.960> 0.05 and value of t

count | 0.050 | <t table | 1,979 |, then ROA has no

significant effect on under-pricing.

3. The regression coefficient value of financial

leverage is 4,216, which is positive. The value can

be interpreted financial leverage positive effect on

under-pricing. The Sig value is 0.014 <0.05 and the

value of t arithmetic | 2,492 | > t table | 1,979 |, then

financial leverage has a significant effect on under-

pricing.

4. The regression coefficient value of the percentage

of public share bid is 0.101, which is positive. The

value can be interpreted as percentage of public

offering positive effect on under-pricing. Given

value of Sig 0,459> 0,05 and t value count 0,744 | <t

table | 1,979 |, then the percentage of public offering

has no significant effect on under-pricing.

5. The value of the regression coefficient of trading

volume is -1.562, which is negative. The value can

be interpreted trading volume negatively affect

under-pricing. The value of Sig 0,000 <0,05 and t

value | -3,615 | > t table | 1,979 |, then trading

volume has a significant effect on under-pricing.

6. The regression coefficient value of the auditor's

reputation is -0.109, which is negative. The value

can be interpreted by the auditor's reputation

negatively affect under-pricing. Sig value of 0,021

<0.05 and value of t count | -2,339 | > t table | 1,979

|, then the auditor's reputation has a significant effect

on under-pricing.

7. The regression coefficient value of the company's

age is -0.072, which is negative. The value can be

interpreted the age of the company negatively affect

under-pricing. Given value of Sig 0,523> 0,05 and t

value count | -0,640 | <t table | 1,979 |, then the

company's age has no significant effect on under-

pricing.

8. The regression coefficient value of industry type

is -0.004 that is negative value. This value can be

interpreted by industry type negatively affecting

under-pricing. Given value of Sig 0,919> 0,05 and t

value count | -0,102 | <t table | 1,979 |, then the type

of industry has no significant effect on under-

pricing.

Analysis of Influencing Factors of IPO Under-pricing: Case Studies on Companies Listing in IDX during 2008-2017

457

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusions

From the results of research analysis and hypothesis

testing conducted earlier, it can be drawn conclusion

as follows:

1. Company size, return on asset, financial leverage,

percentage of public offering, trading volume,

auditor reputation, company age and industry

type simultaneously can influence the under-

pricing variable in the company IPO Indonesia

stock exchange for 2008 -2017 of 27.2%, the rest

of 72.8% influenced by other factors.

2. Company size return on asset, percentage of

public offering, company age and industrial type

partially have no significant effect on under-

pricing in companies with IPO in Indonesian

securities for the period of 2008-2017.

3. Company size has no significant negative effect

on under-pricing.

4. Return On Asset has no significant positive

effect on under-pricing.

5. Financial leverage has a significant positive

effect on under-pricing

6. Percentage of public offering has no significant

positive effect on under-pricing.

7. Trading volume has a significant negative effect

on under-pricing

8. Auditor reputation has a significant negative

effect on under-pricing

9. Company age has no significant negative effect

on underpricing.

10. Industrial type has no significant negative effect

on under-pricing.

5.2 Suggestions

The suggestions for the next research are:

1. For further research, it is better to use

independent variables other than independent

variables that have been used by researchers to

be more varied and developing.

2. Further research should increase the number of

samples for more accurate results.

3. Further research is to expand the source of

information and theory of international journals

for more quality research.

4. Further research must further modify variables

that have been widely used with non-financial

variables or other alternative information.

REFERENCES

Ghosh, Saurabh., 2005. Underpricing of Initial Public

Offering: The Indian Experience. International

Journal of Emerging Markets Finance and Trade. Vol.

41. No. 6.

Gunawan, Mega &Viriany., 2015.Faktor-Faktor yang

Mempengaruhi Tingkat Underpricing Saham Pada

Perusahaan Yang Melakukan IPO yang Terdaftar di

Bursa Efek Indonesia. Jurnal Ekonomi. Vol. XX. No.

02, Hal.174-192.

Hapsari, Venantia Anita & M. KholiqMahfud., 2012,

“Analisis Faktor-Faktor Yang Mempengaruhi

Underpricing Saham Pada Penawaran Umum”

Diponegoro Journal of Management, Vol. 1, No.1,

Hal. 1-9

How J. C H. Y Izan & G. S Monroe., 1995. Differential

Information and The Underpricing of IPO Australian

Evidence. International Journal of Accounting and

Finance. Vol. 8. No. 1.

Ghozali, Imam., 2013. Aplikasi Analisis Multivariate

dengan Program SPSS. Semarang, Badan Penerbit

UNDIP.

Hatta, A. J and Isfaatun., 2010. Analisis Informasi Penentu

Harga Saham Saat Intial Public Offering. Journal

Akuntansi Bisnis. Vol. 1.No. 15. Hal 66-74.

Islam, Aminul MD, Ruhani Ali & Zamri Ahmad., 2010.

An Empirical Investigation of The Underpricing of

Initial Public Offering in The Cittagong Stock

Exchange. International Journal of Economics and

Finance. Vol. 2.No. 4.

Katti, Supriya B.V. Phani., 2016, Underpricing of Initial

Public Offerings: A Literature Review. Universal

Journal of Accounting and Finance, Department of

Industrial and Management Engineering, Indian

Institute of Technology, India.

Kim, Joeng-Bon, Itzhak Krinsky & Jason Lee., 1995.

Motives for Going Public and Underpricing New

Findings from Korea. Journal of Business Finance

and Accounting. Vol. 20.No. 2.

Kristiantari, I dewa Ayu., 2012. Analisis Faktor-Faktor

yang Mempengaruhi Underpricing Saham Perdana di

BEI.T esis, Universitas Udayana, Denpasar.

Munawaroh, Lismawati., 2015. Faktor-Faktor yang

Mempengaruhi Underpricing Sahampada Penawaran

Umum Perdana di Bursa Efek Indonesia. Jurnal

Akuntansi & Bisnis. Vol 2. No 2.

Shoviyah, Nur Aini., 2013. Faktor-Faktor yang

Mempengaruhi Underpricing Pada Perusahaan IPO di

Bursa Efek Indonesia. Jurnal Ilmiah Manajemen. Vol.

1. No. 1.Hal.88-102.

Pahlevi, Reza Widhar., 2014. Analisis Faktor-Faktor yang

Mempengaruhi Underpricing Saham Pada Penawaran

Umum Perdana di BEI. Jurnal Siasat Bisnis. Vol. 18.

No. 2.

Purwoko, Krisman., 2010. Terlalu Murah Batalkan IPO

KrakatauSteel.https://republika.co.id/berita/breaking-

news/ekonomi/10/11/04/144256-bambang-soesatyo-

terlalu-murah-batalkan-ipo-krakatau-steel (Accessed

on 8, Juli 2017)

ICMR 2018 - International Conference on Multidisciplinary Research

458