Analysis of Factors Affecting Timeliness Publication of Financial

Statements: Empirical Study on Manufacturing Companies in

Indonesia Stock Exchange

Lusi Elviani Rangkuti, Jalilah Ilmiha

Universitas Islam Sumatera Utara, Medan

Keywords : Timeliness, debt to equity ratio, profitability, company size, auditor quality, and auditor turnover.

Abstract This study aims to find empirical evidence about the factors that influence the timeliness of financial

reporting of manufacturing companies listed on the Indonesia Stock Exchange. The factors tested in this

study are debt to equity ratio, profitability, company size, auditor quality, and auditor turnover. Samples

from this study used 43 manufacturing companies x 3 years of research. = 129 financial report data. which

is consistently listed on the Indonesia Stock Exchange in the 2014-2016 period taken using the purposive

sampling method. These factors are then tested using logistic regression at a 5 percent significance level.

The results identified that Debt to Equity Ratio (DER), profitability (ROA), firm size (SIZE), auditor quality

(KAP), and auditor turnover (AUDCH). has no effect on the timeliness of financial reporting of

manufacturing companies listed

1 INTRODUCTION

Financial reporting means for companies is to

communicate various economic measurement

information about resources owned and performance

to various parties who have an interest in the

information. Timeliness of financial reporting is an

important characteristic for financial statements

where financial reports that are reported in a timely

manner will reduce asymmetric information. The

longer the time delay in the presentation of a

company's financial statements to the public, the

more likely there are insider information about the

company. If this happens, it will direct the market to

no longer work properly. (Fitrah Qulukhil Imaniar,

2016).

One way to measure transparency and quality of

financial reporting is timeliness. The time period

between the date of the company's financial

statements and the date when financial information

is announced to the public relates to the quality of

financial information reported.

The demand for compliance with the timeliness

in submitting financial statements of public

companies in Indonesia has been regulated in UU

No. 8 Tahun 1995 concerning the capital market.

Bapepam also issued a special power of attorney No.

: SKU-194 / MK.01 / 2012. Bapepam also issued an

attachment to the decision of the Chairperson of

Bapepam and financial institutions regarding the

submission of annual issuance reports or public

companies No. : KEP-431 / BL / 2012 concerning

the obligation to submit annual reports in accordance

with the provisions of No.XK6 as contained in the

attachment of this decision. for the financial year

ending on or after December 31are late in submitting

financial reports in accordance with the provisions

stipulated by Bapepam will be subject to

administrative sanctions in accordance with

applicable regulations.As a result, companies that

are late in submitting financial reports in accordance

with the provisions stipulated by Bapepam will be

subject to administrative sanctions in accordance

with applicable regulations.

2 THEORETICALFRAMEWORK

2.1 Factors AffectingtheAccuracyof

Financial ReportingTime

In this study, only six factors will influence the

timeliness of corporate reporting, namely: debt to

Rangkuti, L. and Ilmiha, J.

Analysis of Factors Affecting Timeliness Publication of Financial Statements: Empirical Study on Manufacturing Companies in Indonesia Stock Exchange.

DOI: 10.5220/0008886404330437

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 433-437

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

433

equity ratio, profitability, ownership structure,

auditor turnover. auditor quality, and company size.

2.1.1 Debt to Equity Ratio

DER=

X 100%

(1)

2.1.2 Profitabilitas

ROA=

X 100%

(2)

2.1.3 Company Size

The size of the company in this study according to

(IAI.2015) company size is measured by the total

assets owned by the company.

Company Size = Ln (total assets) (3)

2.1.4 Auditor Quality

Annisa (2004) defines the quality of auditors as a

combination of profitability in detecting and

reporting material financial report errors. De Angelo

concluded that the Public Accountant Office was

bigger, the audit quality produced was better.

Quality auditors are good news for investors, so

management will immediately submit financial

reports audited by a reputable Public Accountant

Office.

2.1.5 Auditor Change

Substitution of public accountants is done because

the expiration of a work contract agreed between the

Public Accountant Office and the assignor and has

decided not to renew with a new assignment.

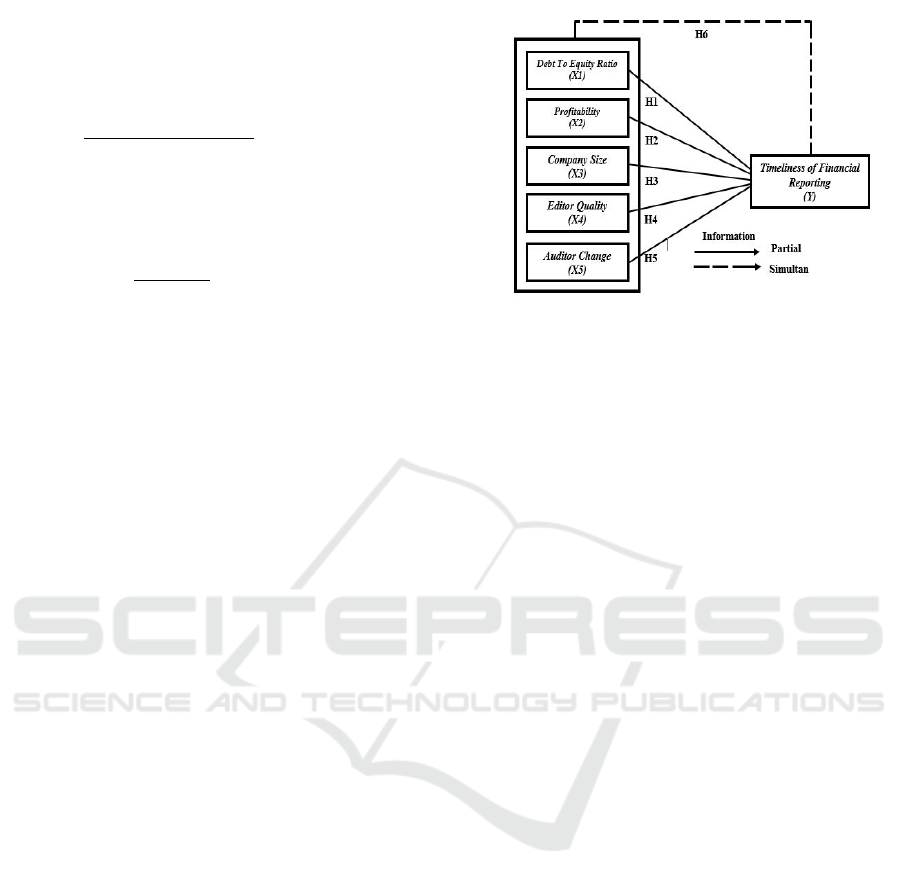

The framework of thinking about the

relationships between the variables described above

can be described as follows:

Figure 1: Theoretical Thinking Framework

H1: debt to equity ratio negatively affects the

timeliness of financial reporting.

The ratio of debt to equity is also known as the

financial leverage ratio. The high debt to equity ratio

reflects the high risk of corporate finance,If the

company has a little debt, it can still be said that it is

reasonable because the debt can increase the cash

inflows and can be used to generate more corporate

profits. But if the company's debt is too large (Debt

to Equity is too large), the company will not be able

to pay the loan and interest on the loan.

H2: Profitability has a positive effect on the

timeliness of financial reporting.

Profitability shows the company's success in

making a profit. With the greater profitability ratio,

the better the performance of the company so the

company will tend to provide that information to

other interested parties.

H3: Firm size has a positive effect on the timeliness

of financial reporting.

The size of the company can show how much

information is contained in it, while reflecting the

awareness of the management regarding the

importance of information, both for external parties

and internal parties of the company.

H4: Auditor Quality (KAP) has a positive effect on

the timeliness of financial reporting.

Sanjaya and Ni Gusti (2016); Calen (2012)

defines audit quality as a combination of the

probability of detecting and reporting material

financial report errors. He concluded that the Public

Accountant Office was bigger, the audit quality

produced was also better. The quality of auditors

auditing companies is very important, qualified

auditors are good information so management will

ICMR 2018 - International Conference on Multidisciplinary Research

434

immediately submit audited financial statements by

reputable public accounting firms.

H5: Auditor turnover negatively affects the

timeliness of the company's financial reporting

.

Statement of Auditing Standards (PSA) 16

requires communication both oral and written

between the preceding auditor and the substitute

auditor before accepting the assignment. In contrast

to the first assignment as a result of auditor changes,

the reassignment of the auditor hasaccess to all

programs used in the past period and work papers

related to the program. The number of procedures

adopted by a substitute auditor in the auditing

process takes longer than if the auditor continues to

accept the assignment. This can lead to the length of

auditing which results in a delay in the submission

of audited financial statements (Ksa, 2003).

3 RESEARCH METHODS

The population in this study are manufacturing

companies listed on the Indonesia Stock Exchange.

researchers took the population from the basic

industrial and chemical sectors, as many as 66

companies and the sample was 43 companies per

year in 2014,2015,2016 observations. So that

obtained the amount of data (n) A total of 43 x 3

years = 129 data. Sampling in this study uses

purposive sampling method, namely the selection of

non-random samples whose information is obtained

with certain considerations.

The variables in this study consisted of:

a. Dependent Variable

Timeliness of financial reporting (Y) is the

period of time to announce audited annual

financial reports to the public from the closing

date of the company book (December 31) to the

date of submission to Bapepam-LK. Timely

financial statements will be more useful than

those that are not on time.

b. Independent Variables

The independent variables in this study are debt

to equity ratio, profitability, firm size, auditor

turnover and auditor quality on the timeliness of

financial reporting.

4 RESULTS AND ANALYSIS

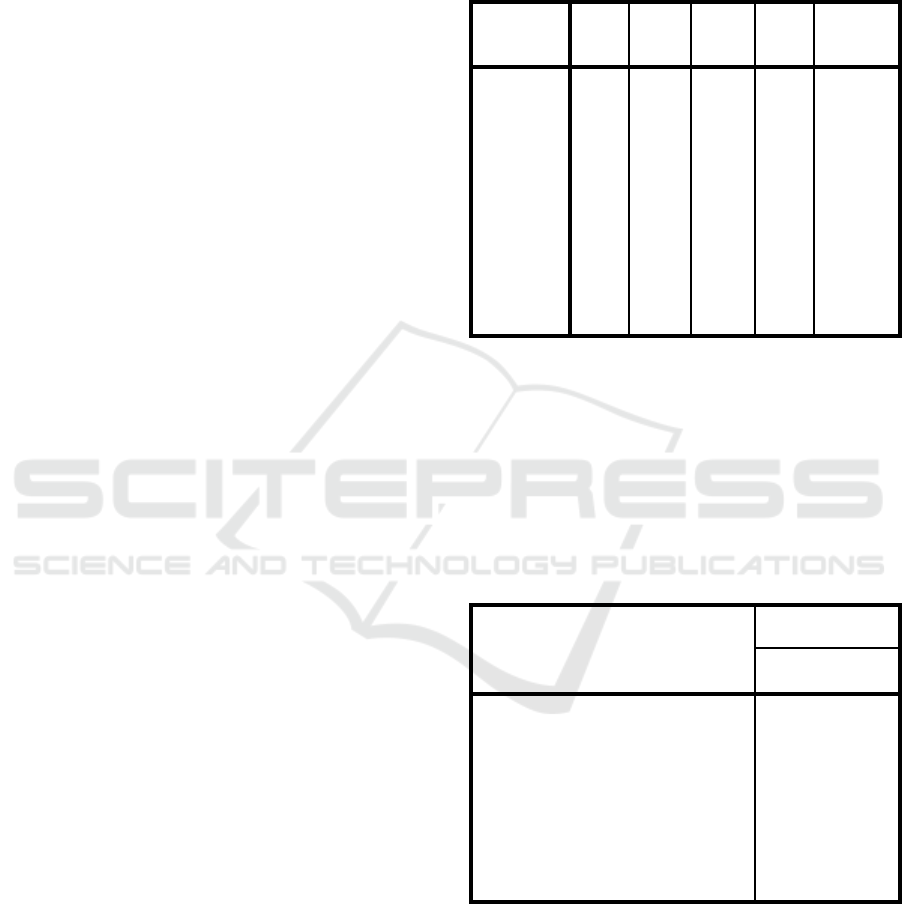

4.1 Descriptive Statistical Analysis

Table 1: Descriptive Statistics.

N Min Max Mean

Std.

Deviation

DER 43 -4,9 20,5 3,8 4,5

ROA 43 -,88 ,62 ,13 ,3

SIZE 43 37,1 88,7 65,4 16,0

KAP 43 ,00 3,0 1,2 1,4

AUDCH 43 ,00 3,0 ,67 1,0

Valid N

(listwise)

43

In accordance with the description above, it can be

interpreted that the average (mean) value for a

company that is on time is feasible.

4.2 Simultaneous Influence Analysis

To see the results of simultaneous effects can be

seen in the results of the following SPSS output :

Table 2: Iteration History

a,b,c

.

-2 Log likelihood Coefficients

Constant

32.1 -1.5

30.9 -1.9

30.9 -2.0

30.9 -2.

30.9 -2.02

a. Constant is included in the model.

b. Initial -2 Log Likelihood: 30,912

c. Estimation terminated at iteration number 5

because parameter estimates changed by less

than ,001.

Analysis of Factors Affecting Timeliness Publication of Financial Statements: Empirical Study on Manufacturing Companies in Indonesia

Stock Exchange

435

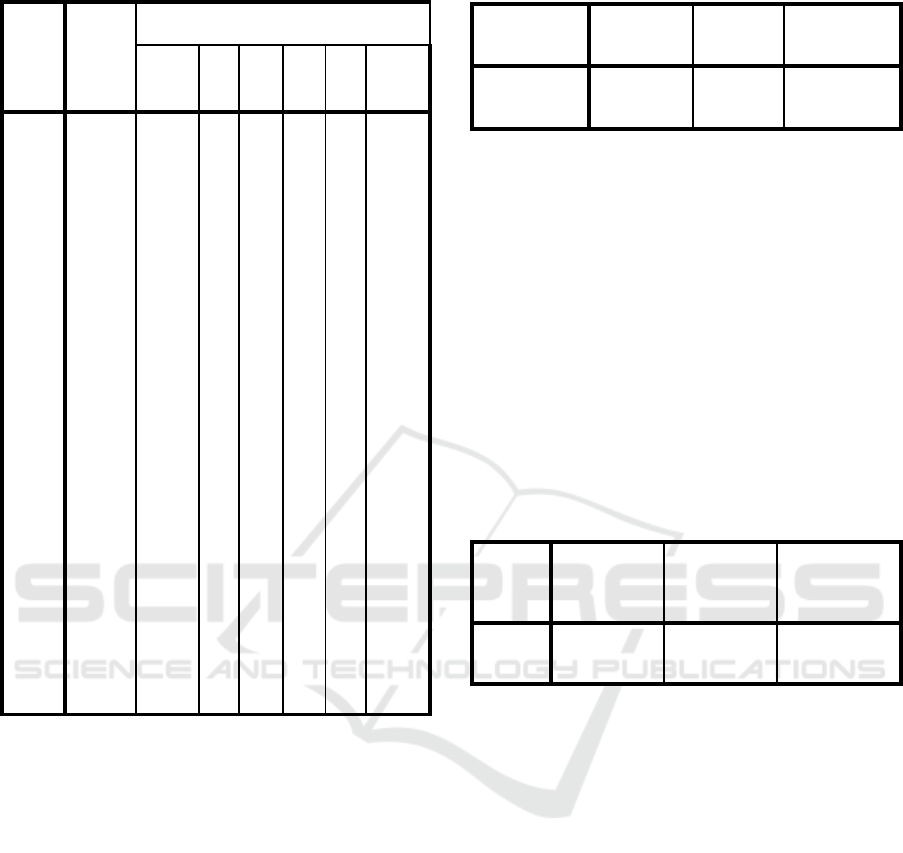

Table 3 : Iteration Historya,b,c,d.

Iterati

on

-2 Log

likeliho

od

Coefficients

Const

ant

DE

R

RO

A

SIZ

E

KA

P

AUD

CH

Ste

p 1

1 28.686 -1.640

-

.04

4

-

1.1

65

.01

1

-

.12

8

-.227

2 25.375 -2.258

-

1.9

47

.02

1

-

.25

0

-.513

3 24.717 -2.499

-

.14

3

-

2.3

92

.02

7

-

.31

4

-.787

4 24.648 -2.491

-

.16

8

-

2.6

16

.02

8

-

.32

3

-.931

5 24.646 -2.475

-

.17

3

-

2.6

62

.02

8

-

.32

2

-.958

6 24.646 -2.475

-

2.6

63

.02

8

-

.32

2

-.958

7 24.646 -2.475

-

.17

3

-

2.6

63

.02

8

-

.32

2

-.958

a. Method: Enter

b. Constant is included in the model.

c. Initial -2 Log Likelihood: 30,912

d. Estimation terminated at iteration number 7

because parameter estimates changed by less than

,001.

With α = 0.05 and degree of freedom (df) = k =

5, where k is the number of predictor variables, the

value χ² (p) of the chi-square distribution table is

11.07048. Because 6.266 <11.07048 or -2 (L0-L1)

<χ² (p), it can be concluded that together

(simultaneously), the five predictor variables (DER,

ROA, SIZE, KAP, AUDCH) have no significant

effect on the accuracy variable Financial Reporting

Time.

4.3 Model Feasibility Test (Goodness of

Fit)

Based on the results of the SPSS calculation, the

results of Hosmer-Lemeshos are as follows:

Table 4: Hosmer and Lemeshow Test.

Step Chi-square df Sig.

1 6.003 8 .647

Based on the results of SPSS Version 22 shows

that the results of the Hosmer and Lemeshow Test

are 6.003 and are significant at 0.647 because this

value is above 0.05, the model is said to be fit and

the model is acceptable.

4.4 Determination Test (Contribution

of Variables Free of Bonded

Variables)

To see the results of the contribution of independent

variables (DER, ROA, SIZE, KAP, and AUDCH) to

TW (Y) can be seen in the following Summary

Model of the SPSS output:

Table 5: Model Summary.

Step -2 Log

likelihood

Cox & Snell

R Square

Nagelkerke R

Square

1 24.646

a

.136 .264

a. Estimation terminated at iteration number 7 because

parameter estimates changed by less than ,001.

H1: Debt to Equity Ratio affects the timeliness of

corporate financial reporting.

Corporate debt variables measured by debt to

equity ratio (DER) show a negative coefficient value

of -. 173 with a significant variable of 0.360> 0.05.

This means that it can be concluded that H1 is

rejected. Thus it is not proven that corporate debt

affects the timeliness of corporate financial

reporting.

H2: Profitability affects the timeliness of company

financial reporting.

The profitability variable as measured by Return

on Assets (ROA) shows a positive coefficient value

of -2.663 with a variable significance of 0.225> 0.05

(5 percent). This means that it can be concluded that

H2 is rejected. Thus it is not proven that the

probability affects the timeliness of corporate

financial reporting. This result is consistent with

research

ICMR 2018 - International Conference on Multidisciplinary Research

436

H3: Company size affects the timeliness of company

financial reporting.

Variable Company Size shows a positive

coefficient value of 0.028 with a significant variable

of 0.498> 0.05. This means that it can be concluded

that H3 is rejected. Thus it is not proven that

company size affects the timeliness of corporate

financial reporting.

H4: The quality of the auditor influences the

timeliness of the company's financial reporting.

The auditor quality variable (KAP) shows a

negative coefficient value of -0.332 with a

significant variable of 0.463> 0.05 which means that

it can be concluded that H4 is rejected. Thus it is

proven that the Quality of Auditors (KAP) does not

affect the timeliness of the company's financial

reporting.

H5: Auditor turnover affects the timeliness of

company financial reporting.

The variable auditor change shows a negative

coefficient value of 0.958 with a significant variable

of 0.253> 0.05. This means that H5 is rejected, thus

it is not proven that the change of auditor affects the

timeliness of the company's financial reporting.

5 CONCLUSION

From the results of data research and discussion, the

following conclusions are obtained:

1. The object of the study consisted of 43

companies in a row in 2014 - 2016. Overall the

company was on time in financial reporting to

Bapepam.

2. The test results with logistic regression show

empirical evidence that DER, ROA, SIZE, KAP

and AUDCH simultaneously do not have an

effect on the timeliness of financial reporting.

REFERENCES

Attachment to the decision of the Chairperson of Bapepam

and financial institutions regarding the submission of

annual reports on issuance or public companies

Number: KEP-431 / BL / 2012 concerning the

obligation to submit annual reports

Based on the decision of the capital market and financial

institution supervisory body Number: KEP-431 / BL /

2012. Regarding the delivery of emitan periodic

financial statements or public companies.

Dwiyanti Rini., 2010. Analysis of factors that affect the

timeliness of financial reporting at manufacturing

companies listed on the Indonesian stock exchange.

Thesis: Diponegoro University Semarang.

Elma muncar aditya, Sarwono budiyanto., 2015. Factors

that affect the timeliness of financial reporting

(empirical study of food and Beverages companies in

the 2010-2012 period) thesis: university STIE Widya

Manggala Semarang.

Hedy kuswanto and Sodikin manaf., 2104. Factors that

influence the timeliness of submitting financial reports

to the public (Empirical studies on manufacturing

companies listed onthe Indonesian stock exchange

2010-2013. Lecturers: STIE Dharma Putra

Nurmiati., 2016. Factors influence the timeliness of

financial reporting. Journal: Mulawarman University

Indonesia.

Siska Prahesty., 2011. Analysis of factors that affect the

timeliness of financial reporting. Thesis: Diponegoro

University Semarang.

UU No. 8 of 1995 concerning the capital market.

Yennisa dewi utami., 2017. Factors influence the

timeliness of financial reporting in sub-sector

companies in the Indonesian stock exchange. Journal:

PGRI Yokyakarta University.

www.idx.co.id

www.sahamok.co.id

Analysis of Factors Affecting Timeliness Publication of Financial Statements: Empirical Study on Manufacturing Companies in Indonesia

Stock Exchange

437