The Role of Good Governance on Maqoshid Index Performance:

The Case of Islamic Bank in Indonesia

Irman Firmansyah

1

, Nisa Noor Wahid

1

, Adil Ridlo Fadillah

1

and Dedi Kusmayadi

1

1

Accounting Department, Economics Faculty, Siliwangi University, Jl. Siliwangi No. 24 Tasikmalaya Indonesia

Keywords: Islamicbank, maqoshid sharia index, good governance.

Abstract: This study aims to analyse the performance of each Islamic bank through the maqoshid sharia index

approach, which measures the performance in accordance with the Islamic banks operational purpose. In

addition, the important factor in improving performance is the implementation of good governance so that it

will be tested the influence of good corporate governance on maqoshid shariaperformance. This research

was conducted at Islamicbanks in Indonesia in period of 2012 until 2016. The result of research shows that

overall, the best performing bank of maqoshidshariais Bank PaninSyariah. In addition, the results of the

regression show that good corporate governance does not affect the performance of maqoshid shariain

Islamic banks in Indonesia. This research proves that good governance in Islamic bank has not been able to

improve the performance of maqoshid sharia. The biggest possibility is that banks still prioritize earnings as

a measure of performance.

1 INTRODUCTION

Currently,Islamic banking continues to progress.

The data show that the development of Islamic

banks in 2015 that had weakened can be proven

again in the next year that Islamic banks are able to

compete and pass some economic crisis conditions.

This shows that sharia banks have a good

performance.

To measure the performance of Islamic banks

can be done through the mechanism of financial

statement analysis. Financial statement analysis is a

way of analyzing the condition of a company based

on data taken from the financial reporting. In

measuring financial performance, the researchers

measure the performance of the bank's profitability

ratio is a ratio that measures the company's ability to

generate profits. The greater the profitability ratio

the better the company's financial performance.

Some research on financial performance (ROA)

such as research conducted by Choong et al, Hidayat

and Firmansyah (Choong et al. 2012); Hidayat and

Firmansyah, 2017).

Measuring the performance of Islamic banks is

certainly different from conventional banks that only

see the performance of the business side or the

ability to generate profits. In Islamic banks profit

should not be the only measure of performance,but

other aspects need to be taken into account,

especially the social and human resources aspects.

To restore the purpose of the existence of

Islamicbanks, the performance of sharia banks

should be measured by maqashid sharia rather than

just the rate of return of profit. As in Omar

Muhammed's research that formulates a useful

measurement for measuring the performance of

Islamic banking developed based on the principles

of maqoshid sharia with the aim that there is a

measurement for Islamic banks in accordance with

its purpose. Performance measurement for Islamic

banking does not focus only on profit and other

financial measures, but incorporated other values of

banking that reflect the size of non-profit benefits

that are in line with the objectives of sharia banks.

His research resulted in a measurement of financial

performance of Islamic banking called maqoshid

sharia index (MSI). Until now this MSI model has

been widely applied in subsequent scientific studies

to measure the performance of sharia banking in

various countries including in Indonesia. Some

studies that use maqoshid sharia index on Islamic

banking is MohamedandRazak (2008), Rusydiana

and Firmansyah (MohamedandRazak, 2008;

Rusydiana and Firmansyah, 2017).

374

Kusmayadi, D.

The Role of Good Governance on Maqoshid Index Performance: The Case of Islamic Bank in Indonesia.

DOI: 10.5220/0008885403740382

In Proceedings of the 7th International Conference on Multidisciplinary Research (ICMR 2018) - , pages 374-382

ISBN: 978-989-758-437-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Maqasid syariah index (MSI) is developed based

on three main factors, namely individual education,

justice creation, and welfare achievement, in which

three factors are in accordance with the general

purpose of maqasid syariah that is "to achieve

prosperity and avoid evil". These three objectives

are universal which should be the objective and

operational basis of every entity with public

accountability, not only Islamic banks but also

conventional banks, as they relate to the welfare of

all stakeholders, not just shareholders or owners of

the company.

Related to the implementation of good

governance for Islamic banks, another important

factor apart from the performance of maqoshid

sharia is the implementation of governance. A good

bank of course must run good governance as well in

order to produce maximum performance.

Implementation of GCG certainly gives hope to

improve the performance of Islamic banks,

especially the performance measured by maqoshid

index. As in Todorovic's, Jinarat and Quang, Gupta

and Sharma, Danoshana and Ravivathani studies that

demonstrate the effect of GCG implementation on

performance improvement. In this study the

performance measured is not by maqoshid index but

only financial performance measured by ROA.

Therefore, to know the effect of GCG

implementation on performance measured by

maqoshid sharia index, it is necessary to do further

research (Todorovic's, 2013; Jinarat and Quang,

2010; Gupta and Sharma, 2014; Danoshana and

Ravivathani, 2014).

2 LITERATURE

2.1 Islamic Bank

Islamic Bank is a banking system in Islamic

Economy that runs its business operations based on

the concept of division of either profit or loss,

meaning that the results obtained by customers will

fluctuate in accordance with the benefits obtained by

the bank where the greater the bank's profits, the

greater the results obtained by customers. Islamic

banks are developed based on principles that do not

allow the separation between the temporal and the

religious

.

2.2 Maqoshid Sharia Index

The language of Maqasid al-Syariah consists of two

words namely maqasid and syari’. Maqasid is the

plural form ofmaqshud which means intent/purpose,

sharia means the path to the source, and simply

maqashd al-syariah means the purpose of the law is

prescribed in Islam. From the many opinions

regarding maqasidsharia, as previous research by

MuhammedandRazak, Firmansyah,Rusydiana and

Firmansyah, the researchers considered that Ibn

Ashur's view of the purpose of sharia is to create

prosperity and avoid the ugliness identical with Abu

Zahrah's opinion on maqasidsharia, more clearly to

be reduced to several measurements

(MuhammedandRazak, 2008; Firmansyah,

2018;Rusydiana and Firmansyah, 2017). As Abu

Zahrah classifies Sharia objectives, which include:

1) Tahdhib al-Fard (educating the individual), 2)

Iqamah al-Adl (creating justice), 3) Jalb al-Maslahah

(prosperity).

Maqasidsyariah index (MSI) is a model of

measuring the performance of Islamic banking in

accordance with the objectives and characteristics of

sharia banking. MSI is developed with three main

factors, namely: education, the creation of justice

and the achievement of welfare, where the three

factors are universal. The three performance

measures based on maqoshid sharia, namely

education, justice, and welfare require national

banks to be able to design educational and training

programs with moral values so that they will be able

to improve the skills and skills of the employees.

Justice means that sharia banks must ensure honesty

and fairness in all transactions and business

activities covered by the product, all activities of

free interest. The last sharia banking should develop

investment projects and social services to improve

the welfare of the community

(MuhammedandRazak, 2008).

The research of MuhammedandRazak, Antonio

et al show that the maqoshid sharia approach can be

a strategic alternative approach that can illustrate

how well the national banking performance can be

implemented in the form of a comprehensive policy

strategy (MuhammedandRazak, 2008; Antonioet al.

2012).

Operationally, the method of Sakaran (Sakaran,

2000) is able to explain the elements to be measured

through the research. This is done by observing the

behavior of the dimensions illustrated by the concept

described. These dimensions will be translated into

observable and more measurable derivative

elements, which can form the measurement indexes.

Based on the Sakaran method, the behavioral

characteristics to be measured are derived into a

concept, denoted as (C). The concept will be

downgraded into several dimensions that will be

The Role of Good Governance on Maqoshid Index Performance: The Case of Islamic Bank in Indonesia

375

more easily observable and measurable, denoted by

(D). Dimensions will be lowered back into some of

the clearer elements of measurement, denoted by

(E). (Muhammedand Razak, 2008).

By using Sakaran method, the banking objectives

according to the shariamaqasid framework described

before in the second part covering: education for

individuals, administering justice and realizing

welfare, can be explained operationally. Each goal is

translated as concept (C). Then with certain

characteristics it is lowered into some measurable

dimension (D). This dimension will obviously be

derived again into specific elements which can be

easily measured (E) described in the table below:

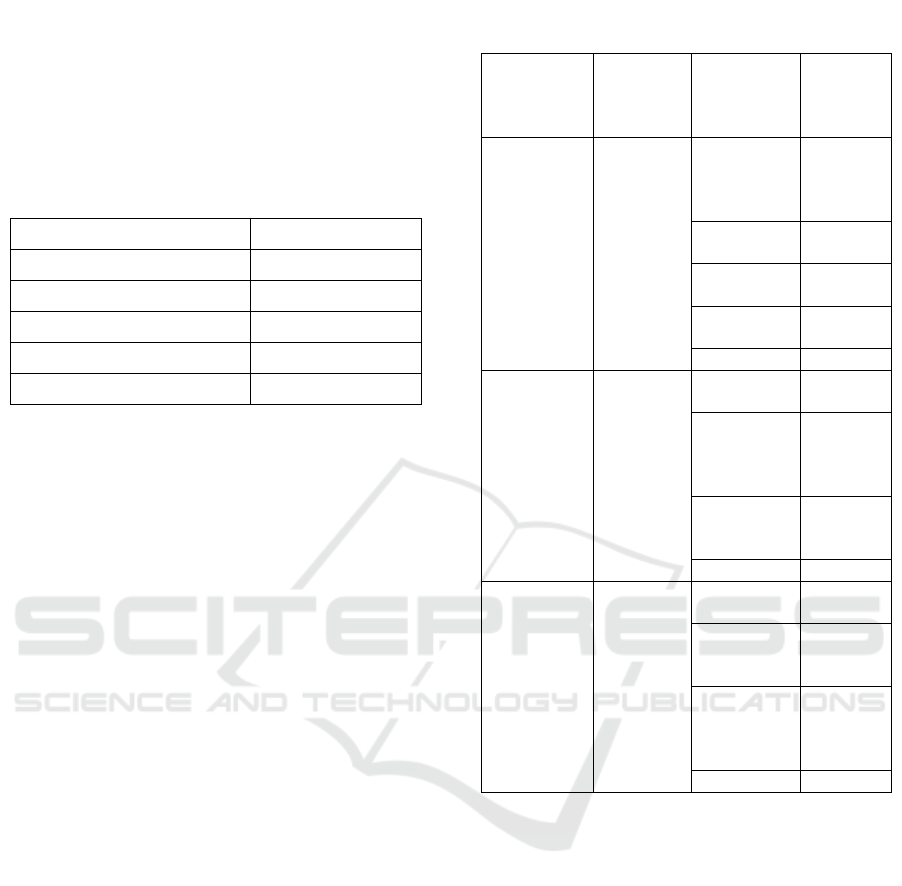

Table 1: Operational Objectivity of Islamic Bank.

Concept

(Objectives)

Dimensions Elements Performance Ratios

Source of

Data

1. Education

Individual

D1. Advancement of

Knowledge

E1. Education grant

R1. Education grant/total

income

Annual

Report

E2. Research

R2. Research expense/total

ex

p

ense

Annual

Re

p

ort

D2. Instlilling new skills

and improvement

E3. Training

R3. Training expense/ total

expense

Annual

Report

D3. Creating awarenens

of Islamic banking

E4. Publicity

R4. Publicity expense/total

expense

Annual

Report

2. Establishing

Justice

D4. Fair dealing E5. Fair return R5. Profit/total income

Annual

Re

p

ort

D5. Affordable product

and service

E6. Affordable price

R6. Bad debt/total

investment

Annual

Re

p

ort

D6. Elemination of

injustices

E7. Interest free product

R7. Interest free

income/total income

Annual

Report

3. Public

interent

D7. Profitability E8. Profit ratios R8. Net profit/total asset

Annual

Re

p

ort

D8. Redistribution of

income & wealth

E9. Personal Income R9. Zakat/net income

Annual

Re

p

ort

D9. Investment in vital

real secto

r

E10. Investment ratio in

real secto

r

R10. Investment

deposit/total deposit

Annual

Report

Source: MuhammedandRazak (Muhammed andRazak,2008)

The ratios were chosen because they met several

criteria in this study, including:

1. Discussion of banking objectives that are closer

to Islamic values can be represented through

these ratios. Dimensions and elements can be

easily identified through these objectives.

2. Previous studies that examine identic problems

also use the same ratios in measurement, both for

sharia banking and conventional banking. So, it

can be implemented in both agencies (Al-Osaimy

and Bamakhramah, 2004; Hameed et al. 2004).

3. Data to be collected by researchers is much

easier, because the data source is the annual

financial statements of banks.

4. The possibility of measuring the implementation

of the concept of maqasid sharia is more

accurate by using these ratios

.

The ratios presented in Table 1 are those that

meet the criteria of maqasidsharia. The description

of these ratios as well as their relation to the

maqasid sharia framework is:

a. The first objective which is the goal of individual

education is described by R1; which is the ratio

of educational grants/total income. R2; is the

ratio of research costs incurred bank/total cost.

R3; is the ratio of training cost/total cost. R4; is

the ratio of publicity costs/total costs incurred by

the bank. The interpretation of these four ratios is

the higher the value of the ratio, in other words

the higher the funds allocated or issued by the

bank for the fulfillment of these four indicators,

both training, education grants, publicity, and

research, the better the achievement of the goals

of the maqasidsharia on the bank.

b. The second objective which is the goal of the

administration of justice is described by R5;

which is the ratio of profit earned bank/total

profits earned bank. R6; is the ratio of bad

debts/total investment bank. R7; is the ratio of

noninterest income/total revenue. The objective

of achieving justice by sharia banks and

conventional banks is better if R5 is lower. This

means that if the profit or profit received by the

ICMR 2018 - International Conference on Multidisciplinary Research

376

bank is smaller than the total bank income, then

the bank is considered increasingly applying the

goal of achieving justice. Likewise, when R6 in

banks in Indonesia is low, the goal of achieving

justice in the national banking is highly valued.

This means that if the debt is not collected in the

national banking is small compared to the total

investment channeled by the national banking,

the achievement of the goal of equity is better

because it reduces the income distribution

disparity. On the contrary, the attainment of

justice in the national banking system is

considered better if the R7 value is higher. This

means that if the non-interest investment is

channeled national banks higher than the total

total investment that the bank is doing, then the

achievement of the goal of justice better by

maqasidsharia.

The goal of welfare achievement (maslahah)

which is the third goal is illustrated through R8, R9,

and R10 based on this concept. The goal of welfare

achievement by the national banking is better if the

value of R8, R9, R10 is higher. This means that the

higher net profit, zakat issued bigger, and investment

banking national at real sector more dominant, hence

assessed national banking increasingly support the

realization of maslahah (welfare).

2.3 Good Corporate Governance and

the Impact on MSI

Good Corporate Governance is a corporate

management system designed to improve corporate

performance, protect the interests of stakeholders

and improve compliance with applicable legislation

and ethical values in general. Corporate governance

is a concept that concerns the structure of the

company, the division of tasks, the division of

authority and the division of responsibility burden of

each of the elements that form the structure of the

company and the mechanisms that must be taken by

each element of the company, elements of the

structure of the company also regulate the

relationships between the elements of the company

structure with elements outside the company.

Banks are required to conduct self-assessment of

Bank Health Level by using Risk Approach, either

individually or consolidative at least every semester

for the end of June and December position as

stipulated in Bank Indonesia regulation concerning

Health Rating Commercial banks.

Good corporate governance plays a key role in

enhancing integrity and efficiency of companies, as

well as financial markets in which company

operates. Poor corporate governance weakens

company's potential and in worst care can open the

way for financial difficulties and frauds. Companies

which follow the best practice of corporate

governance usually raise capital easier and by lower

price and in long term are more profitable and

competitive than companies that have poor corporate

governance (Todorovic, 2013).

The importance of GCG implementation for the

company because it has been proven to improve

performance. Several studies have shown that GCG

affects performance (Todorovic, 2013;Jinaratand

Quang, 2010; Gupta and Sharma, 2014;

DanoshanaandRavivathani, 2014).

3 RESEARCH METHOD

3.1 Population

This study used the population of all Islamic banks

in Indonesia from 2012 until 2016. From the total

population, purposive sampling method was used to

select the sample in this study. Banks used as

sampling was a bank that did not suffer losses.So

this research obtained 7 Islamic banks.

3.2 Variables

In this research there are two variables that are

independent variable (good corporate governance)

and dependent variable (maqoshid sharia index).

3.2.1 Good Corporate Governance

This variable is taken as a result of self assessment

covering 11 (eleven) GCG Implementation

Assessment Factor that is:

1. execution of duties and responsibilities of the

Board of Commissioners;

2. execution of duties and responsibilities of the

Board of Directors

3. the completeness and performance of the

Committee's duties;

4. handling of conflict of interest;

5. implementation of compliance function;

6. implementation of internal audit function;

7. implementation of external audit function;

8. implementation of risk management including

internal control system;

9. provision of funds to related parties and large

exposures;

The Role of Good Governance on Maqoshid Index Performance: The Case of Islamic Bank in Indonesia

377

10. transparency of Bank's financial and non-

financial condition, GCG implementation report

and internal reporting; and

11. Bank's strategic plan.

The GCG scoring scores consist of numbers 1

through 5 with the following criteria:

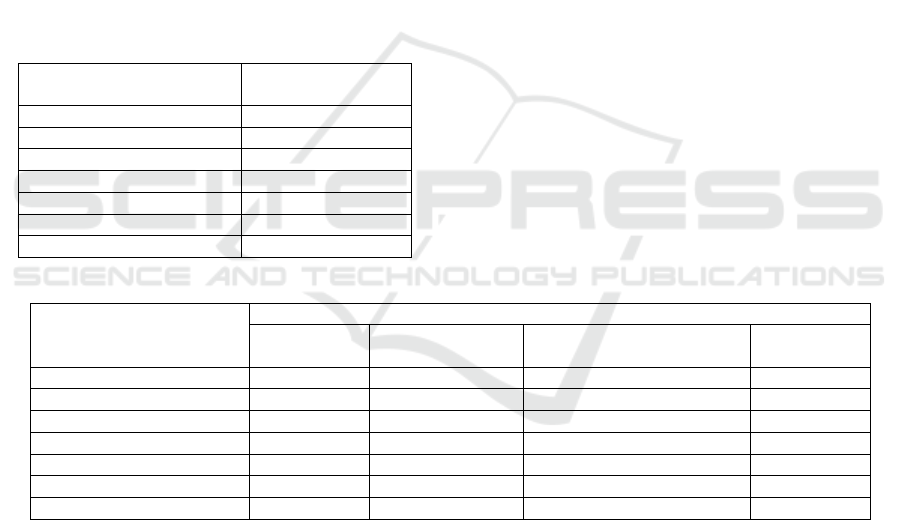

Table 2: GCG Composite Measurement.

Composite Value Composite Predicate

Composite Value< 1,5 Very good

1,5 ≤ Composite Value< 2,5 Good

2,5 ≤ Composite Value< 3,5 Enough good

3,5 ≤ Composite Value< 4,5 Not too good

4,5 ≤ Composite Value< 5 Not good

3.2.2 Maqoshid Sharia Index

In this study, the ratios used as described in Table 1

are derived from previous studies conducted by

MuhammedandRazak(MuhammedandRazak,2008).

In a previous study, researchers verified the

measurements to be used for sharia scattered experts

in the Middle East and Malaysia, who are experts in

both fields, both in Islamic banking and

conventional banking. Confirmation submitted done

in two stages. The first stage is an interview to 12

experts in the field of Islamic banking, fiqh(law)

Islam, and Islamic Economic Sciences related

performance measurement developed by previous

writers in the study. Interviews on the 12 experts

stated that the twelve experts approved the reliability

of performance measurements developed by

researchers at the time.

The second stage, previous researchers verify

performance measurements developed to 16 experts

in the field of banking through a questionnaire. The

sixteen experts were asked to answer the weighted

questions given to each of the ratios in order to be

measurable, as well as to re-identify the performance

measurement component whether acceptable and in

accordance with the banking conditions. The

average weights given by the experts are described

in Table 3:

Table 3: Average Weight for 3 Objectives and 10

Provided Elements Experts.

Objectives

Average

weighting

(scale

100%

)

Unsures

Average

weightin

g (scale

100%

)

O1.

Education

30

E1.

Education

Grants/

donations

24

E2.

Research

27

E3.

Trainin

g

26

E4.

Publicit

y

23

TOTAL 100

O2. Justice 41

E5. Fair

return

30

E6.

Affordable

Product

Price

32

E7. Not

interest

p

roduct

38

TOTAL 100

O3.

Welfare*

29

E8. profit

ratio

33

E9.

Transfer

earning

30

E10.

Investment

Ratio to

Real Secto

r

37

TOTAL 100

*Maslahah includes the bank’s interest plus the public

interest

Source: Muhammed and Razak (Muhammed and Razak,

2008)

Sample Bank Rankings According to Performance

Indicators.

Based on 10 predetermined ratios, there will only

be 7 ratios used in determining the performance of

the national banking system, namely: The first 4

ratios referring to the first sharia objectives and the

educational objectives. And the last 3 ratios referring

to the third sharia goal and the goal of welfare

attainment. While the other 3 ratios which are the

manifestations of the second sharia objective of

applying justice cannot be used in this study due to

the limited data on the sample used. Ratios that can

be used in research, including:

a. Education grants/total income (R1,1)

b. Research cost/total cost (R1,2)

ICMR 2018 - International Conference on Multidisciplinary Research

378

c. Training cost/total cost (R1,3)

d. Cost of publicity/total cost (R1,4)

e. Net income/total assets (R3,1)

f. Zakat/Net income (R3,2)

g. Distributed investment/total disbursement

(R3,3)

3.3 Data Analysis Method

3.3.1 Measurement of Maqoshid Sharia

Index as Performance Measurement

The method used by researchers in the research

maqoshid sharia index is referring to the methods

used by Muhammed and Razak (Muhammed and

Razak,2008). This method is used to weight,

calculate distribution and process the rank (rank) in

certain data. This method is an attribute decision-

making method. The decision maker then gets the

total score from each bank by multiplying the scale

level on each attribute by evaluating the

correspondent obtained for each intra attribute and

adding the total score for the product.

Mathematically, the calculation of Performance

Indicators (PI) for each goal can be seen in the paper

MuhammedandRazak (MuhammedandRazak, 2008).

3.3.2 Testing the Role of Good Corporate

Governance on MSI

To test the effect of GCG implementation on the

MSI performance then used simple regression

analysis with the following equation:

MSI = a + bGCG + e (1)

Where: MSI = Maqoshid sharia Index

GCG = Good Corporate Governance

a = Constanta

e = error

4 RESULT AND DISCUSSION

Based on the results of research, the data collected

are as many as 7 Islamic banks the period 2012 to

2016. Islamic banks are:

1. Bank Syariah Mandiri

2. Bank Muamalat

3. Bank Mega Syariah

4. Bank BNI Syariah

5. Bank BRI Syariah

6. Bank BCA Syariah

7. Bank Panin Syariah

4.1 Maqoshid Sharia Index

Assessment of maqoshid sharia performance

divided into 3 major sections of education, justice

and welfare. The following is explained about all

three.

4.1.1 Education Objective

In banking, the total aspects of educational

objectives that can be researched are aspects of

research, training and publicity. The following table

describes the research results of the three elements:

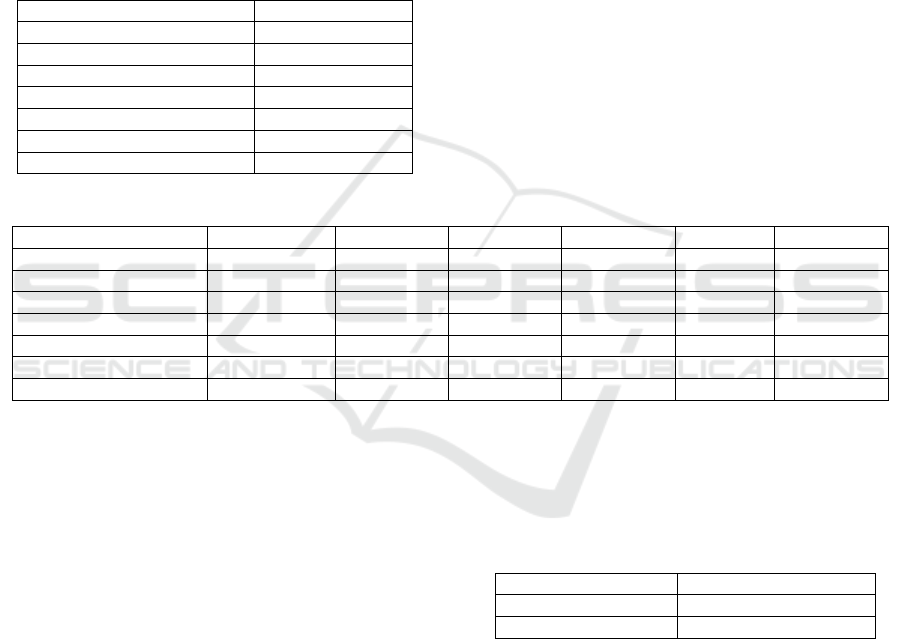

Table 4: Maqoshid sharia Index at Educational Objective.

Bank Names

O1

Re-search Cost /

Total Cost

Training Cost/

Total cost

Publi-city cost/

Total Cost

Aver-age

Bank S

y

ariahMandiri 0,0007 0,0099 0,0189 0,0098

Bank Muamalat 0,0030 0,0150 0,0380 0,0187

BRI Syariah 0,0029 0,0093 0,0254 0,0125

BNI Syariah 0,0005 0,0296 0,0613 0,0305

Me

g

a S

y

ariah - 0,0197 0,0777 0,0325

PaninS

y

ariah - 0,0104 0,0199 0,0101

BCA S

y

ariah - 0,0148 0,0106 0,0085

The table above shows that the aspect of the first

educational goal is the existence of research

conducted in the period 2012 to 2016. The results

showed that the average aspect of research

objectives seen from the implementation of research

that the largest index conducted by the bank

Muamalat that is equal to 0.3%, then followed by

BRI Syariah is to 0.29% and the third is Syariah

Mandiri Bank by 0.07%.

The second aspect of goal is to provide education

and training for employees. The results showed that

the largest index obtained BNI syariah that is equal

to 2.96%, then bank Mega Syariah of 1.97% and the

third is Bank Muamalat that is equal to 1.5%.

The Role of Good Governance on Maqoshid Index Performance: The Case of Islamic Bank in Indonesia

379

Aspects of further educational objectives of

publication / promotion to introduce banks to the

public. The results showed that the largest index was

performed by Mega Syariah bank of 7.77%,

followed by BNI Syariah 6.13% and third was Bank

Mualamatof 3.8%.

As if seen from the average value of this aspect

shows that the best educational objectives obtained

by Bank Mega Syariah with a value of 3.25% this

value slightly above the BNI syariah which has a

value of 3.05%.

4.1.2 Justice Objective

As in previous goals, the justice objectives from the

total aspects of justice objectives that can be

researched are just aspects of fair returns. The

following table describes the research results of both

elements:

Table 5: Maqoshid sharia Index at Justice Objective.

Bank Names Net profit/ total

income

B

ank SyariahMandiri 0,0782

B

ank Muamalat 0,0133

B

RI S

y

ariah 0,0700

B

NI Syariah 0,0844

M

ega Syariah 0,0853

PaninSyariah 0,1072

B

CA S

y

ariah 0,0926

Table 5 above explains that the sharia maqoshid

performance in Islamicbank from the element of

justice objectives can only be seen viewed from one

aspect that is related to the percentage of net income

of total income. The results showed that banks of all

banks studied in the period of research 2012 to 2016

which has the highest index of this aspect is the bank

Panin Syariah is equal to 10.72%, followed by BCA

Syariah that is equal to 9.26% and the third tertnggi

obtained Bank Mega Syariah that is equal to 8,53%.

4.1.3 Walfare Objective

Different from the previous objectives, in this

welfare goal the total aspect of the objectives can be

studied overall consisting of the bank's profit ratio,

the transfer of income and the ratio of investment to

the real sector. The following table describes the

research results of both elements:

Tabel 6: Maqoshid sharia Index at Walfare Objective.

Bank Names

O3

Net profit/

Total Asset

Zakah/net profit Invest.

financin

g

/Tot.financin

g

Aver-age

B

ank S

y

ariahMandiri 0,0069 0,0352 0,2395 0,0939

B

ank Muamalat 0,0010 0,2304 0,4988 0,2434

B

RI Syariah 0,0052 0,2426 0,3642 0,2040

B

NI Syariah 0,0091 0,0374 0,1744 0,0736

M

e

g

a S

y

ariah 0,0124 0,0344 0,0209 0,0225

PaninS

y

ariah 0,0086 0,0214 0,7248 0,2516

BCA S

y

ariah 0,0057 - 0,4774 0,1610

The third element of maqoshid sharia related to

welfare objectives consists of the percentage of

profit earned on total assets, the amount of zakat

incurred from the total net profit earned, and the

amount of investment financing to the real sector of

total financing disbursed.

The first aspect is the percentage of profits

earned. Table 6 shows that the highest profit index

during the period of 2012 to 2016 obtained by Bank

Mega Syariah 1.24% followed by BNI syariah with

an average of 0.91% and the third largest index

obtained by PaninSyariah Bank of 0.86%.

The second aspect of welfare is zakat. The

largest index of zakat is issued by BRI sharia worth

24.26% followed by Muamalat bank which is

23.04% and the third largest is BNI Syariah of

3.74%. Moreover, the data show that there are

syariah banks still have not issued zakat during the

study period.

The third aspect of the welfare objective is the

real investment of the total invested investment. The

results showed that PaninSyariah bank has the

largest percentage of investment in financing sector

that is equal to 72.48%, second place is Bank

ICMR 2018 - International Conference on Multidisciplinary Research

380

Muamalat which is 49.88% and third rank is BCA

syariah equal to 47,74%. All three banks have the

best ratings in terms of financing distribution as the

characteristics of Islamic banks.

On average, banks that have the greatest value of

the welfare aspect are PaninSyariah Bank which is

an average of 25.16% followed by Bank Muamalat

which is 24.34%.

Overall, the following table describes the

performance of sharia banks from the aspect of

maqoshidsharia after performing the weighting in

accordance with the provisions.

Table 7: Analysis Result of Maqoshid sharia Index.

Ban

k

Names MSI

B

ank S

y

ariahMandiri 0,197

B

ank Muamalat 0,235

B

RI Syariah 0,228

B

NI Syariah 0,196

M

EGA S

y

ariah 0,180

PANIN S

y

ariah 0,252

B

CA S

y

ariah 0,221

The result of maqoshid sharia index (MSI)

analysis was conducted to 7 Islamicbanks in

Indonesia research range 2012 until 2016 obtained

that the best MSI performance obtained by Bank

Panin Syariah that is average value of MSI equal to

0,252. This shows that Bank PaninSyariahis the best

bank among other Islamicbanks during 2012 to

2016.

4.2 Good Corporate Governance

Islamic bank governance assessment based on self

assessment was conducted by each Islamic bank that

can be explained in the following table of Good

Corporate Governance assessment result:

Table 8: GCG Composite Assessment Result.

Ban

k

Names 2012 2013 2014 2015 2016 Ave

r

-a

g

e

Bank S

y

ariahMandiri 2,25 1,85 2,12 2,00 1,00 1,84

Bank Muamalat 1,15 1,15 2,74 2,61 2,25 1,98

BRI Syariah 1,38 1,35 1,74 1,61 1,60 1,53

BNI Syariah 1,25 1,30 1,43 1,75 1,80 1,50

Me

g

a S

y

ariah 1,60 1,86 1,80 1,54 1,64 1,68

PaninS

y

ariah 1,35 1,35 1,40 1,95 1,80 1,57

BCA S

y

ariah 1,55 1,80 1,00 1,00 1,00 1,27

Based on the results of this study, it can be seen

that all Islamic banks have a small score. The more

score the better the governance. A total of 6 Islamic

banks have a composite score of between 1.5 to 2.5

so that it is in either category. While 1 Islamic bank

has a score below 1.5 so it is in very good

category.To find out whether there is any impact of

GCG implementation on the improvement of

maqoshid sharia performance, then regression

analysis is done.

4.3 Testing the Impact of GCG on

Maqoshid Sharia Performance

To know the effect of GCG implementation on

Maqoshid sharia performance can be seen on Adjust

R-Square value. The results showed that the value of

0.008 or 0.8%. This value is very small indicating

that GCG gives very little effect to the success of

maqoshid performance of sharia.

In addition, the value is supported by a

significance value of 0.609 (greater than 0.05) so it

is concluded that GCG has no effect on the sharia

maqoshid performance in Islamicbanks in Indonesia.

Table 9: Output SPSS.

Adjust R-Square 0,008

t 0,516

Sig. 0,609

These results provide an explanation that in

Islamic banks, governance is implemented still not

have a significant impact on performance changes.

This can be because the implementation of GCG

will have an impact over a long period of time, or it

could be because running operations through good

governance is intended only to improve financial

performance. While the performance of maqoshid

sharia is the performance in accordance with Islamic

sharia which thinks of all aspects.

The Role of Good Governance on Maqoshid Index Performance: The Case of Islamic Bank in Indonesia

381

Therefore, it should be re-examined on the

impact of GCG on performance to ascertain whether

GCG is intended to improve performance or does

not have an effect on the performance of Islamic

banks.

5 CONCLUSIONS

Based on the results of previous research and

discussion, this research can be summarized as

follows:

1. From the point of maqoshid sharia

performance,the bank that has the best

performance from the aspect of education

objective is Bank Mega Syariah, while from

the aspect of justice objective is Bank Panin

Syariah, as well as from the aspect of welfare

objective is Bank Panin Syariah again. Overall,

banks that have maqoshid sharia performance

during the 2012-2016 research period is Bank

Panin Syariah.

2. Regression results show that good corporate

governance does not affect the performance of

maqoshid sharia in Islamicbank in Indonesia.

Some of the important suggestions for this study

are related to the deficiencies that can be improved,

including:

1. Not all banks can be examined in this study

because there are banks whose data is difficult

to obtain so further research is attempted to

obtain data as optimal as possible.

2. The range of study period can be extended and

can be added period 2017. In this study was not

included because the availability of data on the

website cannot be found

3. Can be added with regression analysis to know

the existence of factors that can affect

performance maqoshid sharia index.

REFERENCES

Al-Osaimy, H. Mahmood&Bamakhramah, S. Ahmed.

2004. An Early Warning System for Islamic Banks

Performance, Jeddah, Islamic Economics. 17(1), pp: 3-

14.

Antonio, SanregodanTaufiq. 2012. An Analysis of Islamic

Banking Performance: Maqasid Index Implementation

in Indonesia and Jordania.Jurnal of Islamic Finance

IIUM, 1(1), pp: 012-029.

Choong, Yap Voon Chan KokThim, and

BernetTalasbekKyzy. 2012. Performance of Islamic

Commercial Banks in Malaysia: An Empirical Study.

Journal OfIslamic Economics, Banking and Finance,

8(2), pp: 67-80.

Danoshana ,S., &Ravivathani ,T. 2014. The impact of the

corporate governance on firm performance: A study

on financial institutions in Sri Lanka. Merit Research

Journal of Accounting, Auditing, Economics and

Finance, 1(6), pp: 118-121.

Gupta, P., & Sharma, A. M. 2014. A Study of the Impact

of Corporate Governance Practices on Firm

Performance in Indian and South Korean Companies.

Procedia - Social and Behavioral Sciences, 133, pp. 4-

11.

Hameed, Shalul., Pramano, Sigit., Alrazi, Bakhtiar,

Bahrom, Nazli. 2004. Alternative Performance

Measures for Islamic Banks. 2nd International

Conference on Administrative Science, King Fahd

University of Petroleum and Minerals, Saudi Arabia.

Hidayat, ImanPirman&Firmansyah, Irman. 2017.

Determinants of Financial Performance in the

Indonesian Islamic Insurance Industry. Etikonomi,

16(1), pp: 1-12.

Firmansyah, Irman. 2018. Efficiency and Performance of

Islamic Bank: Quadrant Analysis Approach.

International Journal of Islamic Business and

Economics. 2(1).

Jinarat, Veerasak and Quang, Truong. 2010. The Impact of

Good Governance on Organization Performance after

the Asian Crisis in Thailand. Asia Pacific Business

Review, 10(1).

Muhammed, Mustafa Omar&Razak, Dzuljastri Abdul.

2008. The Performance Measures of Islamic Banking

Based on the Maqasid Framework, IIUM International

Accounting Conference INTAC IV Putra Jaya Marroit

Malaysia, best paper.

Rusydiana, A. Slamet&Firmansyah, Irman. 2017.

Efficiency versus MaqashidSyariah Index

AnAplication on Indonesia Islamic Bank. Shirkah:

Journal of Economics and Business, 2(2).

Sekaran, Uma. 2000. Research Method for Business: a

Skill building Approach, New York, John Wiley &

Sons.

Todorovic, Igor. 2013. Impact of Corporate Governance

on Performance of Companies. Montenegrin Journal

of Economics, 9(2).

ICMR 2018 - International Conference on Multidisciplinary Research

382