Financial Literacy and Lifestyle among Housewives

Putri Caturija Sekararum, Dwi Wulandari

*

, Bagus Shandy Narmaditya

Faculty of Economics, Universitas Negeri Malang

Keywords: Socioeconomic status, financial literacy, lifestyle, housewives.

Abstract: The study aims to understand how socioeconomic status affects financial literacy and its impact on

housewives’ lifestyle. This paper applied quantitative research using path analysis. The data were collected

from 97 housewives by using simple random sampling technique in Malang. The findings showed that

socioeconomic status affects financial literacy, socioeconomic status also directly influences lifestyle, while

financial literacy has no effect on lifestyle. In order to achieve a high level of financial literacy, housewives

should improve their education and they have to always motivate the community to be able to increase their

understanding of financial literacy. Moreover, there should be more programs in empowering housewives

together with the improvement of financial literacy so the welfare can be achieved at a greater level and

broader aspects.

1 INTRODUCTION

Financial literacy is closely related to financial

management where the higher level of financial

literacy leads to better financial management.

Personal financial management is one of the

applications of financial management concept on an

individual level. Financial management which

covering plan activity, management, and financial

control are very important to achieve financial

welfare. Good financial management is needed

because by applying good financial management

people will have a better life in the present and

future. Individual needs to conduct good financial

management to fulfill prioritized needs and wants.

Financial literacy is needed to understand better

financial management. In this case, financial literacy

consists of good financial management and a well

understanding of financial service product and

banking including feature, benefit, and risk and also

have the skill to use banking products.

Financial literacy is defined as a personal skill

that is needed by each individual, family, and

society (Remund, 2010). Its function is to achieve

financial welfare (Lusardi, 2007). Financial

knowledge cannot be separated from financial

literacy, but it is not able to describe financial

literacy (Huston, 2010). Everyone needs basic

financial knowledge for the sake of their life

welfares (Nababan, 2013). The financial knowledge

is divided into several types such as income, money

management, saving, investment, and loan or credit.

Basic knowledge about personal finance is by

understanding the most basic things about the

financial system like calculating a simple interest

rate (Lusardi and Mitchell, 2008). Saving is a part of

income that is not spent nor used for consumption

(Nopirin, 1997).

The low level of financial literacy will have an

impact on financial management level for everybody

including housewives. The ineffective money

management could make each individual and

housewives more vulnerable to the financial crisis

(Braunstein and Welch, 2002). Therefore, an

individual ability to make the right financial decision

is needed to support a good personal financial

condition. A good economic decision is related to

financial literacy. It is indicated by the ability to

manage the resources and turn it into something

useful. Specifically, it is about how to manage the

income to meet the needs of life, savings,

investment, and protection. Housewives play roles in

managing the household finance. Baqhir (2003);

Wahyuni (2017), the most important role of a

housewife in the family is to be a manager, a

teacher, and an accountant. Therefore, it is truly

important for them to have good financial literacy.

There are several factors affecting financial

literacy such as socioeconomic status and

demographic factors (Lusardi and Mitchell, 2007;

262

Sekararum, P., Wulandari, D. and Narmaditya, B.

Financial Literacy and Lifestyle among Housewives.

DOI: 10.5220/0008786302620266

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 262-266

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Wulandari and Narmaditya, 2015). Socioeconomic

status is a position where a housewife is seen by her

education background, her profession (the type of

work), and income. Education is conscious guidance

by the educators towards its physical and spiritual

development of forming its main personality

(Hasbullah, 2008). Education is a process of the

ability to develop to a direction that is wanted by the

related organization (Hariandja, 2002). Someone

who has a higher social status could be assumed

having higher education, a great job, and higher

income and it affects the personal understanding of

financial management. Someone who has higher

education background tends to have broader

perspectives than someone who has lower education

background despite income or non-income context

and someone who has a better job will have a higher

income and the income will be well managed.

Socioeconomic factors were predicted to have a

great impact on lifestyle but the main question is

does it affecting lifestyle through financial literacy

or it is directly affecting lifestyle especially among

housewives. The higher level of socioeconomic

status was predicted to increase financial literacy

and higher financial literacy will lead to a better and

manageable lifestyle. Prior studies related

socioeconomics status and its effect on lifestyle were

already conducted (Sarigul, 2014; Van Rooij, 2012)

but it has not been done mainly to housewives which

have different characteristics from men or from

single women. Therefore, housewives as the subject

are definitely important because women are

managers and educators in their household.

Furthermore, housewives must have good financial

literacy to achieve the goal of a prosperous family.

Therefore the main purpose of the research is to

examine the impact of socioeconomic condition to

lifestyles of housewives and to find out whether this

impact is caused by financial literacy among

housewives.

2 METHOD

This research applied quantitative research using

path analysis. In more specifically, this study

employed a path analysis model in order to

understand the relationship between variables and

the role of the intervening variable. The data were

collected using a questionnaire to 97 housewives

who were sample in this research undergo Slovin’

equation. The sample of the research was conducted

by using simple random sampling technique. This

research was particularly conducted in Malang, East

Java, Indonesia for several reasons such as the

number of housewives, a difference of housewives

jobs and socioeconomic status. Validity, reliability

and classical assumption test were conducted to

determine the data is adequate for further analysis.

Figure 1: The research framework model

Socioeconomic status consists of the education

rate, occupation, and income rate is one of the

financial literacy forming factor. Financial literacy

consists of general knowledge of financial

management, saving, loan, insurance, and

investment. We tried to build a model that showed

the relationship between socioeconomic status and

lifestyle and also examine whether the influence of

socioeconomic status to lifestyle is moderated by

financial literacy. Determination of scores for each

variable by assigning values to each item of the

answer by using a Likert scale and eliminating

neutral answers (N) to avoid the middle answer.

Variable socioeconomic status and lifestyle have a

different answer compared to financial literacy

because it is adjusted to the item problem provided.

This analysis bases itself on the model of the

relationship between variables previously

determined by the researcher. Determination of the

model is based on hypotheses regarding various

variables observed.

3 RESULTS AND DISCUSSION

3.1 The Level of Financial Literacy and

Lifestyle Among Housewives

Financial literacy refers to individual knowledge,

behavior, and attitude toward the financial product.

It is measured using an instrument from OECD

(2018) which consist of three main components

related. Individual knowledge is shown by their

understanding on the impact of inflation on spending

power, identifying of interest and risk

diversification, while financial attitude and behavior

are seen by their behavior related to budgeting,

active saving, avoiding borrowing to meet their

Socioecon

omics

status

(

X

)

Financial

Literacy

(Y)

Lifestyle

(Z)

Financial Literacy and Lifestyle among Housewives

263

wants, choosing a product, striving to achieve goals

and paying bills on time. The findings of the

research are explained in figure 1.

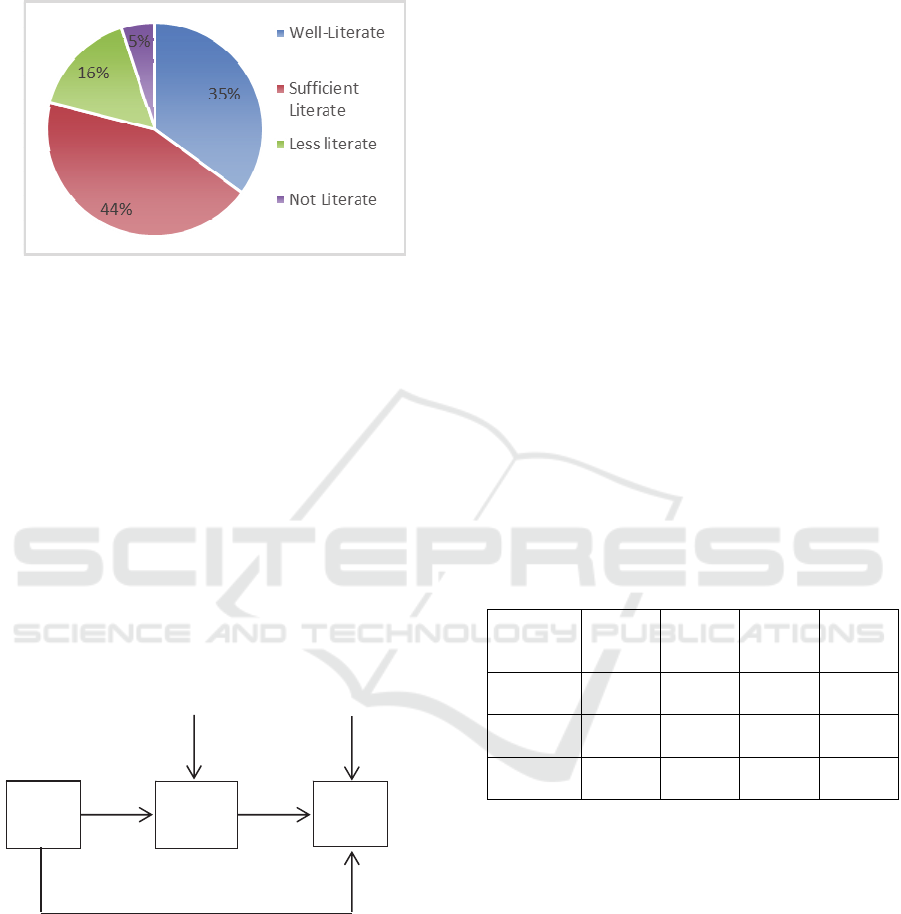

Figure 1: The Housewives level of Financial Literacy

Figure 1 illustrates the level of housewives’

financial literacy in Malang. Overall, housewives are

categorized well-literate even though more than

quarter percentages of housewives are categorized as

sufficient literate and more than 20 percent in a

category less literate and not literate. In other word,

housewives have knowledge related to knowledge,

attitude, and behavior toward financial products.

Lifestyle is defined as a way of life of people on

how they allocate their activities and what they think

important for their life. The lifestyle variable was

how one spends his/her time for their activities, what

has considered as interesting and one’s opinion

about him/herself and the surrounding. The findings

showed that the lifestyle level of housewives are

categorized as moderate and low level while a small

amount of them categorized as very high.

Figure 2. Path Analysis Model

a) The analysis of socioeconomic status effects on

financial literacy: From the analysis, the

significance value of socioeconomic status is

0.000 <0.05. So it can be concluded that there is

a direct significant influence of socioeconomic

status on financial literacy.

b) The analysis of socioeconomic status effects on

lifestyle: from the analysis, the significance

value of socioeconomic status is 0,000 <0.05. So

it can be concluded that there is a direct

significant influence of socioeconomic status on

lifestyle.

c) The analysis of financial literacy effects on

lifestyle: from the analysis, it can be concluded

that the significance value of financial literacy is

0.633 > 0.05. So there is no direct significant

influence of financial literacy on lifestyle.

d) The analysis of socioeconomic status effects on

financial literacy and its impact on lifestyle: It is

known that the direct influence given by

socioeconomic status on financial literacy is

0.557. While the indirect influence of

socioeconomic status on financial literacy and its

impact on lifestyle is -0.577 x -0.32 = 0.185.

Then the total effect that is given by the

socioeconomic status on financial literacy is -

0.577 + 0.185 = -0.393. In accordance with the

results of these calculations, it is known that the

value of direct influence is -0.577 and its

indirect effect is 0.185 which is mean that the

value of indirect influence is greater than the

value of direct influence, These results indicate

that indirect influence of socioeconomic status to

lifestyle (through financial literacy) is higher

than direct influence

Table 1. Summary of Relationship Between Variables

Variables

relationsh

ip

Direct

influen

ce

Indirect

influen

ce

Total

Influen

ce

T

Signific

ant

X – Y 0.557 - 0.557 0.000 <

0.05

Y – Z -0.037 - -0.037 0.633 <

0.05

X – Z 0.032 0.185 0.217 0.000 >

0.05

Socioeconomic status positively affects financial

literacy. Higher education, type of work and higher

income will increase the financial literacy of

housewives because someone with higher education

will have a broader knowledge and broader

perspective whether in the financial competence or

non-financial competence. Numerous studies

provided that financial education definitely has a

positive influence on financial literacy. With a better

job, someone will have a higher income and this will

affect how someone manages his finance. This is

consistent with the previous research stated that age,

education, and income have significant effects on

financial literacy (Isomidinova and Singh, 2017).

Socioeconomic status significantly influences

Socia

l

Financ

ial

i

Lifest

yle

-0,557

0,83

0,52

-

-0,866

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

264

lifestyle. A person’s socioeconomic status is

determined by the education level, type of work,

income rate and it will affect lifestyle in terms of

consumption patterns, fashion styles, and

recreational patterns. This is consistent with the

previous research by (Purwati, 2015) stated that the

socioeconomic status of parents, students'

perceptions of their environment, and economic

learning achievement have a positive and significant

effect on student consumption behavior.

Financial literacy has no effect on lifestyle.

Regardless of the rate of financial literacy on

sufficient, it has no significant impact on lifestyle.

This finding in opposite with Theodora and Marti’ah

(2016) which mentioned that financial literacy

affected to lifestyle even though only small

percentage. In the research, lifestyle is mostly

influenced directly from socioeconomic status. The

financial literacy rate of each housewife is different,

but in this study, the majority of housewives were at

a moderate level. Meanwhile, the housewives

lifestyle is mostly at a low level. This is because

housewives prefer a frugal lifestyle even though

their financial knowledge is quite good.

4 CONCLUSION

The conclusion that can be taken from this research

are (1) Socioeconomic status affects financial

literacy (2) Socioeconomic status influences lifestyle

directly (3) Financial literacy has no effect on

lifestyle. Furthermore, housewives should improve

their education and they should motivate the

community to be able to improve their

understanding of financial literacy so that they can

achieve their financial management purpose. There

should be more programs in empowering

housewives and financial literacy so the welfare can

be achieved at a greater level and broader aspects.

REFERENCES

Baqhir, S. (2003). Seni Mendidik Islami. Jakarta: Pustaka

Zahra.

Braunstein, S., and Welch, C. (2002). Financial Literacy:

An overview of Practice, Research, and Policy.

Federal Reserve Bulletin, 7, 445-457.

Chen, H., and Volpe, R. P. (1998). An Analysis of

Personal Financial Literacy Among College Students.

Financial services review 11(2002) 289.

Hariandja, ETM. (2002). Manajemen Sumber Daya

Manusia. Jakarta, Grasindo.

Hasbullah. (2008). Dasar-dasar Ilmu Pendidikan. Jakarta:

Raja Grafindo Persada.

Huston, S. J. (2010). Measuring Financial Literacy.

Journal of Consumer Affairs,44(2), 22-78.

Isomidinova, G., and Singh, J. S. K. (2017). Determinants

of Financial Literacy: A Quantitative Study Among

Young Students in Tashkent, Uzbekistan. Electronic

Journal of Business and Management, 2(1), 61-75.

Lusardi, A. Mitchel, O. S., and Curto, V. (2008). Financial

Literacy Among the Young. The Journal of Consumer

Affairs- Vol.44: University of Pensylvania.

Lusardi, A., and Mitchell, O. S. (2007). Baby boomer

retirement security: The roles of planning, financial

literacy, and housing wealth. Journal of Monetary

Economics, 54(1), 205-224.

Nababan, D., and Sadalia, I. (2013). Analisis Personal

Financial Literacy dan Financial Behavior Mahasiswa

Strata Fakultas Ekonomi Universitas Sumatra Utara.

Retrieved from

http://repository.usu.ac.id/handle/123456789/345557

Nopirin. (1997). Ekonomi Moneter Buku II. Yogyakarta:

BPFE UGM.

OECD. (2018). OECD/INFE Toolkit for Measuring

Financial Literacy and Financial Inclusion.

Organisation for Economic Co-operation and

Development, France. Retrieved from

http://www.oecd.org/daf/fin/financial-education/2018-

INFE-FinLit-Measurement-Toolkit.pdf

Purwati, Ana. (2011). Pengaruh Status Sosial Ekonomi

Orang Tua, Persepsi atas Lingkungan, dan Prestasi

Belajar Ekonomi terhadap Perilaku Konsumsi. Jurnal

Ekonomi Bisnis 16(1), 11-16.

Remund, D L. (2010). Financial literacy explicated: the

case for a clearer definition in an increasingly complex

economy. Journal of Consumer Affairs- Vol.44 Issue 2

(276-295).

Sarigul, H. (2014). A Survey of Financial Literacy Among

University Students. The Journal of Accounting and

Finance, 64, 208-224

Theodora, B. D., and Marti’ah, S. (2016). The Effect of

Family Economic Education towards Lifestyle

Mediated by Financial Literacy. Dinamika

Pendidikan, 11(1), 18-25.

Van Rooij, M. C., Lusardi, A., and Alessie, R. J. (2012).

Financial literacy, retirement planning and household

wealth. The Economic Journal, 122(560), 449-478.

Wahyuni, S., Machfudz, M., and Badrih, M. (2017).

Pemberdayaan Masyarakat Perempuan Melalui

Pemberantasan ‘Buta Aksara’ Guna

Menumbuhkembangkan Usaha Kreatif Berbasis

Literasi dan Potensi Lokal. Jurnal Inovasi Pendidikan.

1(2), 48-71.

Widayati, I. (2012). Faktor-Faktor Yang Mempengaruhi

Literasi Finansial Mahasiswa Fakultas Ekonomi dan

Bisnis Universitas Brawijaya. Jurnal Akuntansi dan

Pendidikan- 1(1), 89-99.

Wiharno, H. (2015). Karakteristik Sosial Ekonomi Yang

Mempengaruhi Literasi Keuangan Serta Dampaknya

Terhadap Manajemen Keuangan Personal. JRKA-Vol.1

Issue.2(1-15)

Financial Literacy and Lifestyle among Housewives

265

Wulandari, D., and Narmaditya, B. S. (2015). Dampak

Literasi Keuangan Pada Akses Layanan Keuangan:

Studi Pada Kepemilikan Polis Asuransi di Malang.

Jurnal Ekonomi dan Studi Pembangunan, 7(1), 63-67.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

266