Analysis Application of Proportional Methods for Murabahah

Financing in BMT Al Jabbar Mu'amalah Malang

Imtiyaz Farras Mufidah

1*

, Ulfi Kartika Octa

2

, Puji Handayati

3*

1

Accounting Department of the Faculty of Economics Maulana Malik Ibrahim State Islamic University Malang

2

Graduated Scool of Maulana Malik Ibrahim State Islamic University Malang

3

Universitas Negeri Malang

Keywords : Proportional Advantage Recognition Method, Murabahah

Abstract : The development of one of the most dominant products of Islamic financial institutions in the community

to date is Murabahah financing. Recognition of profit on the financing of Murabahah recognized “by

PSAK 102 and DSN MUI No 84/DSN-MUI/XII 2012 is using the proportional method. This study aims to

determine the application of proportional profit recognition methods on Murabahah financing in BMT Al

Jabbar Mu'amalah Malang. The research method used by researchers is a descriptive qualitative research

method with a case study approach conducted at BMT Al Jabbar Mu'amalah Malang. Where the data

obtained is primary data in the form of interviews with the parties concerned and secondary data in the form

of contract contracts, processed data that can be accounted for from sources that can be trusted by

conducting literature studies, interviews and internet media. The results of this study indicate that BMT Al

Jabbar Mu'amalah Malang, uses a proportional method in recognizing the benefits of Murabahah financing,

in accordance with PSAK 102 and DSN MUI No 84/DSN-MUI/XII/2012. Where using a proportional

method, recognition of profits will be the same for each period. Indicates that earnings are stable, and can be

understood as not changing which will reduce the possibility of usury.

1 INTRODUCTION

Sharia financing distribution in Islamic banking is

very varied, it can be proven by the Sharia Banking

Statistics (SPS) published by the Financial Services

Authority (OJK) shows that the three best-selling

Islamic financing contracts grew brilliantly in 2016.

Total financing channeled by banks and business

units Sharia is based on mudharabah, musyarakah,

and murabahah reaching Rp 203.72 trillion in May

2016. The most dominant contract is murabahah

with a 61% portion followed by musyarakah 31.7%,

and mudaraba 7, 29% (Hariyanti, 2016). The reason

that Murabahah financing is very interested and in

accordance with the needs of most customers is that

it can be used as consumptive financing and working

capital to purchase merchandise inventories.

The forms of Islamic financial institutions are in

other forms, namely Baitul Maal wa Tamwil (BMT).

BMT is generally established in the form of

cooperatives, then regulated in Law No. 17 of 2012

concerning Cooperatives becomes a temporary legal

umbrella for BMT. One of the products offered by

Islamic financial institutions, one of which is the

distribution of funds or financing products, is an

activity at BMT Al Jabbar Mu'amalah Malang, in the

distribution of funds with the principle of buying

and selling that has attractiveness by customers on

Murabahah financing. According to Ms. Rizky,

Accounting Section of BMT Al Jabbar Mu'amalah

Malang (Interview, Monday, November 13, 2017,

09.05 WIB), in reality, financing with the principle

of buying and selling (Murabahah) applied at BMT

Al Jabbar Mu'amalah Malang, has the dominant

portion compared financing with other principles. In

the last 2016 Murabahah financing reached a

portion of 60% compared to other products offered,

the reason was because the rate of capital turnover

was faster, lower risk, and according to customer

needs.

Based on the background above, the researcher

wants to reaffirm the proportional method of

recognizing profits for Murabahah financing at the

Al Jabbar Mu'amalah Malang BMT, where until

now Murabahah financing is still the most dominant

Mufidah, I., Octa, U. and Handayati, P.

Analysis Application of Proportional Methods for Murabahah Financing in BMT Al Jabbar Mu’amalah Malang.

DOI: 10.5220/0008785100350039

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 35-39

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

35

level compared to another financing. Customers

have their own attraction to apply for Murabahah

financing due to low risk and relatively large profit

margins for BMT. This needs special attention to be

studied further in order to get clear information, the

research conducted by researchers this time focuses

more on the application of proportional profit

recognition methods to Murabahah financing. The

difference from the previous study of this study aims

to determine the level of development and the

determination of proportional Murabahah financing

margins. Through these comparisons, researchers

can find out the accuracy of accounting practices

that have been carried out at BMT Al Jabbar

Mu'amalah Malang. For this reason, the author takes

the data on the Al Jabbar Mua'malah Malang BMT.

The purpose of this study was to find out how the

application of the method of proportional profit

recognition of Murabahah financing at the BMB Al

Jabbar Mu'amalah Malang.

2 LITERATURE REVIEW

2.1 Understanding of Baitul Maal wa

Tamwil (BMT)

Ridwan (2004) explains the meaning of BMT as

follows: "BMT stands for Baitul Maal wa Tamwil or

it can also be written as “Baitul Maal wa Baitul

Tamwil. Literally or Lughowi, Baitul Maal” means a

house of funds and Baitul Tamwil means a business

house. Baitul Maal was developed based on the

history of its development, namely from the

prophet's time to the Middle Ages of Islamic

development, where Baitul Maal served to collect as

well as socialize social funds. While Baitul Tamwil

is a profit-oriented business institution. "

Judging from the meaning given by Ridwan, it

appears that BMT has two business activities. The

first attempt was related to social principles, namely

at Baitul Maal, and the second effort was related to

economic principles, namely at Baitul Tamwil.

2.2 Definition of Murabahah

Etymologically Murabahah has the origin of the

word rabaha which means something that grows in

merchandise, so for an Arab person or trader, it is

considered profitable if the assets of the merchandise

grow/increase. According to Antonio (2001)

describes the meaning of Murabahah as a contract

of sale and purchase of goods by stating the

acquisition price and profit agreed upon by the seller

and buyer. In Murabahah, the profit level must be

agreed in advance at the beginning of the contract.

In other words, the seller must notify the buyer of

the purchase price of the item and state the amount

of profit added to the cost. Whereas according to

PSAK No. 102, Murabahah is defined as follows:

“Murabahah is selling goods with a selling price

equal to the acquisition price plus the agreed profit

and the seller must disclose the purchase price of the

item to the buyer. Cost is the amount of cash or cash

equivalent paid to obtain an asset up to the asset

under conditions and places that are ready to be sold

or used."

2.3 The foundation of Sharia

Murabahah in the Al- Qur'an and

Al-Hadist

2.3.1 Allah SWT says in the Al-Qur'an

surat” Al-Baqarah / 2: 275

Meaning: "Those who eat usury cannot stand, but

like the establishment of a person who is possessed

by a demon because of being insane. That is because

they say that buying and selling are the same as

usury. In fact, God has justified buying and selling

and forbidden usury. Whoever receives a warning

from his Lord, then he stops, then what he has

obtained first becomes his and his business (up to) to

Allah. Whosoever repeats, they are the inhabitants

of hell, they abide therein." (Surat al-Baqarah (2):

275)

What is meant by this verse is usury here is usury of

nasi’ah. According to some scholars, usury of

nasi’ah is forever Haram, although it does not

multiply. There are two kinds of usury: nasi'ah and

fadl.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

36

2.3.2 Prophet's hadith narrated by Abu Said

Al-Khudri

From “Abu Sa'id Al-Khudr that Rasulullah SAW”

said, "Indeed, buying and selling must be like".

Hadist explained above that, are required to like

the same, or be pleased with others, or there is also a

mutual agreement between the two parties, namely

between the seller and the buyer. Because this is

included in one of the terms and conditions of the

Murabahah contract.

3 RESEARCH METHODS

3.1 Research Types and Approaches

In this study, researchers used qualitative descriptive

research methods. The reason for using the

descriptive qualitative research method with the case

study approach is here because the case study

technique has a specific and in-depth research focus

on the case as the object under study. This is felt

appropriate to be used in this study which aims to

research, analyze and explain the application of

proportional profit recognition methods on

Murabahah financing in BMT Al Jabbar Mu'amalah

Malang.”

4 DISCUSSION

4.1 General Description of “BMT AL

Jabbar Mu'amalah Malang”

Baitul Maal wa Tamwil (BMT) Al Jabbar

Mu'amalah Malang is an institution that has a legal

entity in the form of a shari'ah business alliance. As

a follow up to the results of a special member

meeting on basic changes, BMT Al Jabbar

Mu'amalah Malang was established as a legal entity

in the form of cooperatives dated February 8, 2011.

The decree was stated in the decision of the Minister

of Cooperatives and UKM with P2T Number /02/

09.01/II/2011.”

BMT Al Jabbar Mu'amalah Malang has a legal

entity in the form of cooperatives, then the vision

and mission as well as aspects that carry it out.

However, the BMT Al Jabbar Mu'amalah Malang

also continued to enter and continue to implement

Islamic law in its operational activities.”

4.2 Application of Murabahah

Financing Agreement on BMT Al

Jabbar Mu'amalah Malang

The sale price of “Murabahah financing at BMT Al

Jabbar Mu'amalah Malang” is done by increasing the

cost of goods ordered by customers with the desired

margin level. While the installment is carried out

using the flat method or fixed profit. The method of

charging installments in a flat manner is chosen by

BMT because this method is considered more

appropriate, using a flat method or modification of

the proportional method. The implementation of the

proportional method has been regulated through

SEBI Number 15/26/DPbs/2013 concerning

Implementation of the Accounting Guidelines for

Indonesian Islamic Banking (PAPSI).

4.3 Transaction of Murabahah

Financing Agreement with

Proportional Method on BMT Al

Jabbar Mu'amalah Malang

Below is an example of a Murabahah financing

contract transaction conducted at BMT Al Jabbar

Mu'amalah Malang: Pak Yassar has a desire to own

a motorcycle to carry out his business as an online

motorcycle taxi and he did not have enough capital

to buy the motorcycle in cash. Therefore, Ms. Yassar

went to the BMT Al Jabbar Mu'amalah Malang to

get help getting the desired or needed motorcycle.

The following is an example of Murabahah

financing simulation conducted at BMT Al Jabbar

Mu'amalah Malang.

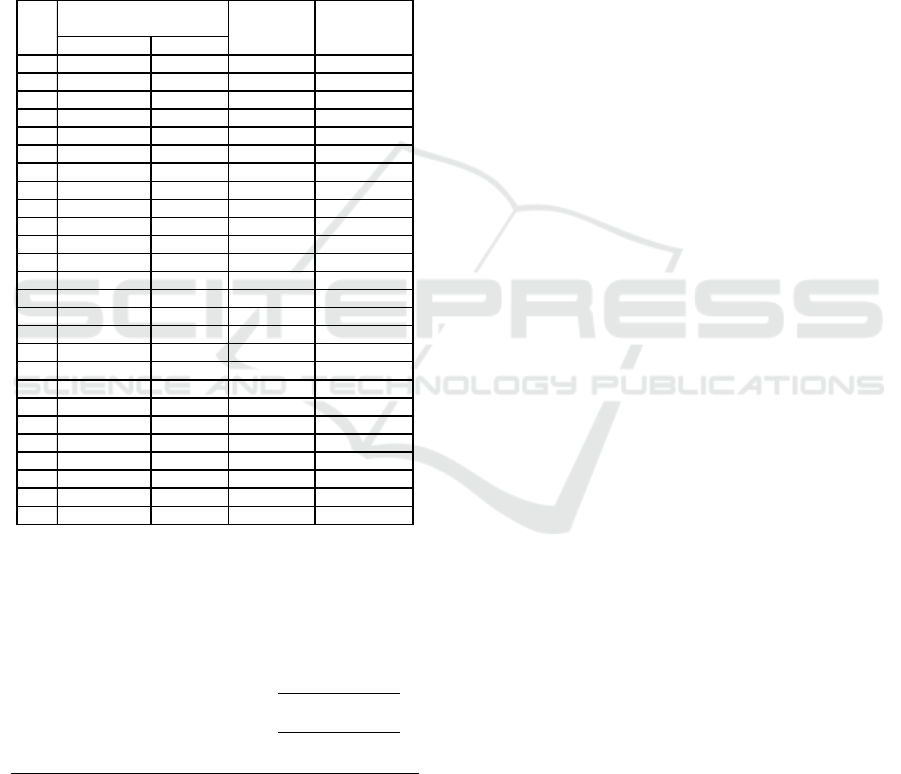

Tabel 1: Murabahah Financing Simulation

Mr. Yassar

Financing Contract

Murabahah

Financing

Objectives

Purchase 1 (one)

motorcycle

Cost of purchase

Rp 18.000.000,00

Margin

19% of the cost of purchase

Payment term

2 years (24 months)

Analysis Application of Proportional Methods for Murabahah Financing in BMT Al Jabbar Mu’amalah Malang

37

Source: Data from the interview section of Accounting

(2017)

The margin level requested by “BMT Al Jabbar

Mu'amalah Malang in rupiah is equal to Rp 18.

000.000,00 x 19 % = Rp 3.420.000,00

The following is the principal installment

schedule and the margin of Murabahah owned by

Ms. Yassar which uses the proportional method in

the form of table 2 namely

Ms. Yassar Murabahah

Financing Installment Proportional Method.

Tabel 2: Ms. Yassar Murabahah Financing Installment

Proportional Method (in rupiah)

Principal Margin

0

- - - 18.420.000

1

625.000 142.500 767.500 17.652.500

2

625.000 142.500 767.500 16.885.000

3

625.000 142.500 767.500 16.117.500

4

625.000 142.500 767.500 15.350.000

5

625.000 142.500 767.500 14.582.500

6

625.000 142.500 767.500 13.815.000

7

625.000 142.500 767.500 13.047.500

8

625.000 142.500 767.500 12.280.000

9

625.000 142.500 767.500 11.512.500

10

625.000 142.500 767.500 10.745.000

11

625.000 142.500 767.500 9.977.500

12

625.000 142.500 767.500 9.210.000

13

625.000 142.500 767.500 8.442.500

14

625.000 142.500 767.500 7.675.000

15

625.000 142.500 767.500 6.907.500

16

625.000 142.500 767.500 6.140.000

17

625.000 142.500 767.500 5.372.500

18

625.000 142.500 767.500 4.605.000

19

625.000 142.500 767.500 3.837.500

20

625.000 142.500 767.500 3.070.000

21

625.000 142.500 767.500 2.302.500

22

625.000 142.500 767.500 1.535.000

23

625.000 142.500 767.500 767.500

24

625.000 142.500 767.500 -

TOTA

L

15.000.000 3.420.000 18.420.000 -

Install

ment

period

Remaining

installments

Total

Installments

Installment

Source: Secondary data processed in 2017

The following is the account recording form for

Murabahah financing agreement on BMT Al Jabbar

Mu'amalah Malang:

The purchase price of a motorbike = Rp 18.000.000,00

Murabahah profit “margin = Rp 3.420.000,00+

Selling prices to customers = Rp 21.420.000,00

Agreed advance = Rp 3.000.000,00-

Remaining installments = Rp 18.420.000,00”

Installments the month (24 months) = Rp 767. 500,00

4.3.1

For recording purchases of goods from

motorbike dealers:

Stock Rp 18.000.000,00

Cash of Rp 18.000.000,00

(Recognition is in accordance with PSAK 102

revised 2013 paragraph 18).

4.3.2

For agreed Murabahah financing

records:

Murabahah Receivables “Rp 21.420.000,00”

Stock “Rp 18.000.000,00”

Margin Rp 3.420.000,00”

(Recognition is in accordance with PSAK 102

revised 2013 paragraph 22).

4.3.3

For recording installment payments

per month:

Cash of “Rp 625.000,00

The margin of Rp 142.500,00

Murabahah Receivables Rp 767.500,00

PSAK 102 concerning Murabahah” Accounting, the

amount of the installments on the payment of the

price of goods is based on an agreement made

between BMT as a seller and the customer

(Ms.Yassar) as a buyer.

As explained by Wahyuni (2014), the advantage

of this method (proportional) is the principal

installment and margin installments that are always

the same will make it easier for customers to

understand the contract to be agreed upon. The

amount of margin agreed upon and understood and

does not change will reduce the possibility of usury

risk. The use of proportional methods aims to

implement Islamic bank financial reporting in a

good, accurate, measurable and in accordance with

sharia principles through sharia accounting (Faisal,

2014).

5 CLOSING

5.1 Conclusion

Based on the data obtained and the results of the

analysis conducted by the researcher by comparing

between theory and practice, it can be concluded that

in “BMT Al Jabbar Mu'amalah Malang uses the

method of recognizing the benefits of Murabahah

financing proportionally as a modification of the flat

rate method. And for accounting records of

Murabahah transactions and proportional methods

used by BMT Al Jabbar Mu'amalah Malang in

accordance with PSAK 102 and Fatwa DSN No

84/DSN-MUI / XII/2012.”

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

38

5.2 Suggestion

Based on the results of the analysis and conclusions

contained in this study, the researchers proposed

suggestions for improvement efforts to “BMT Al

Jabbar Mu'amalah Malang, as follows:”

a. Should the “BMT Al Jabbar Mu'amalah Malang”

improve the clarity of the structure in the

division of duties and responsibilities of each, so

that there is no duplication of the duties of

authority and responsibility so that they can

avoid the possibility of manipulating data.

b. Providing education to the public regarding the

Murabahah agreement made at BMT Al Jabbar

Mu'amalah Malang.

REFERENCES “

Al-Qur’an and the translation.

Antonio, Syafi’i, Muhammad. 2001. Bank Syariah dari

Teori ke Praktek. First print. Jakarta:” Gema Insani.

Dewan Standar Akuntansi Keuangan. 2013. PSAK No.

102. Jakarta: Ikatan Akuntansi Indonesiaa.

Dewan Syariah Nasional. “Fatwa Dewan Syariah Nasional

Metode Pengakuan Keuntungan Tamwil bi Al-

Murabahah Di Lembaga Keuangan Syariah. Fatwa

DSN MUI. Jakarta. 2012.

Faisal. 2014. Metode Anuitas dan Proporsional

Murabahah sebagai Bentuk Transparansi dan

Publikasi Laporan Bank. Skripsi. Universitas

Malikulsaleh. Aceh.”

Gustani. 2017. Perbedaan Metode Anuitas dan Metode

Proporsional. Artaloka.ID. In

http://akuntansikeuangan.com/perbedaan-metode-

anuitas-dan-metode-proporsional/. Accessed on

August 24, 2017 at 07.20 WIB.

Hariyanti, Dini. (19 Agustus 2016). Tiga Akad Terlaris

Pembiayaan Syariah Tumbuh Signifikan Mei 2016.

BISNIS.Com, JAKARTA. In

http://finansial.bisnis.com/read/20160819/90/576256/t

iga-akad-terlaris-pembiayaan-syariah-tumbuh-

signifikan-mei-2016. Accessed on August 24, 2017 at

07.00 WIB.

Karim, Adiwarman, Azwar. 2011. Bank Islam, Analisis

Fiqih dan Keuangan. Jakarta: Rajawali Pers.

Kasmir. 2005. Cet. 11. Pemasaran Bank. Jakarta: prenada

Media.”

Marwal, M. Ilyas. 2007. Rekonstruksi Murabahah Sebuah

Ijtihad Solusi Pembiayaan. Jakarta.

Pedoman Akuntansi Perbankan Syariah Indonesia

(PAPSI) Tahun 2013.”

Ridwan, Muhammad. 2004. Manajemen Baitul Maal wa

Tamwil (BMT). Yogyakarta: UII Press.

Wahyuni, Mirasanti. 2014. Anuitas di Perbankan Syariah.

STIE Bank BPD Jateng.

Interview with Head of Operations Section of BMT Al

Jabbar Mu'amalah Malang Lissanawati, SE.

Interview with Accounting BMT Al Jabbar Mu'amalah

Malang Rizky Churatul Aisyah, S. Ak.

Analysis Application of Proportional Methods for Murabahah Financing in BMT Al Jabbar Mu’amalah Malang

39