Financial Performance, Intellectual Capital

and Corporate Social Responsibility Disclosure in the Manufacturing

Sector

Ayu Ambang Lestari*, Lilik Handajani, Eni Indriani

Graduated school of Universitas Negeri Malang

Keywords: “ Corporate social responsibility, company size, financial performance, industry type, intellectual capital

Abstract: The objective of this study is to examine “the influence “of corporate social responsibility disclosure in “the

manufacturing sector on financial performance with intellectual capital as an intervening variable. “The data

used in this study “is secondary data taken “from the annual report year 2013-2015 of “manufacturing

companies listed on the Indonesia Stock Exchange. This study also explored sensitivity analysis by testing

lag t and t + 1. The sample in this research is 102 companies which are determined based on purposive

sampling method. The results based on simple regression analysis and path analysis “showed that the

disclosure “of corporate social responsibility has a significant and “positive influence on financial

performance. However, “disclosure of corporate social responsibility has no influence “on “intellectual

capital and intellectual capital has no influence “on the financial “performance. The result also found “that

corporate social responsibility disclosure has no indirect “influence on “the financial performance through

intellectual capital. Other findings also reveal that the variable control of company characteristics as

reflected by company size and industry type has no influence “on financial performance. The result of this

study implies “that management “is expected to focus more on corporate social responsibility activities in

order to improve company performance and consider the quality and quantity of corporate social

responsibility disclosure in the company prospectus so as to reduce information asymmetry. In addition,

investors could use this result as a material consideration in analyzing the disclosure of non-financial

companies such as disclosure of corporate social responsibility is in making investment decisions.

1 INTRODUCTION

Corporate social responsibility (CSR) activities are

“part of good “corporate governance. CSR “is

expected to be able to increase the company's

performance because CSR activities are the

company's alignment with the community so that the

community is able to choose good products that are

valued not only from the goods but also through its

corporate governance. Companies that do CSR will

attract sympathy from the community. The

community will become loyal to the company, so

they will enjoy the products “of the company. This

can increase “the level of profitability “of the

company, where the company “will be able to

survive longer

“Research on the effect of CSR disclosure on the

company's “financial performance was carried out

by Safitri (2012), Mustafa and Handayani (2014)

who found that “CSR had no significant effect on

the company's “financial performance. Contradictory

to “the results of Daud and Amri (2008),

Candrayanthi and Saputra (2013), Sari and Suaryana

(2013), Agustina et al., (2015), Sari et al., (2016)

who found “that CSR has a significant effect on

financial performance.

“Other types “of disclosure made “by the

company to achieve competitive advantage and

company performance are intellectual capital (IC).

The important problem facing now is the difficulty

in measuring intellectual capital. The difficulty in

measuring intellectual capital directly encourages

Pulic (1998) to introduce indirect measures of

intellectual capital by using “Value Added

Intellectual Coefficient (VAIC

TM

). VAIC

TM

“is a

measure to assess “the efficiency of added value as a

result of the company's “intellectual ability.

Research on the relationship between intellectual

capital and financial performance has been widely

Lestari, A., Handajani, L. and Indriani, E.

Financial Performance, Intellectual Capital and Corporate Social Responsibility Disclosure in the Manufacturing Sector.

DOI: 10.5220/0008783802370245

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 237-245

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

237

carried out in Indonesia and has diverse results. Like

the research conducted by Zuliyati and Arya (2011),

Agustina et al., (2015), Faradina and Gayatri (2016)

which prove “that intellectual capital (IC) “has a

positive effect on financial performance.

Contradictory to the results of Daud and Amri's

(2008) study which proves that intellectual capital

disclosure “has a negative “effect on Company

Performance. As well as Santoso (2012), Safitri

(2012) who proved “that intellectual capital has no

significant “effect on company “performance.

“Increasing the relevance of the annual report

“will reduce information “asymmetry, especially

through intellectual capital which is “influenced by

various characteristics of the company indicated to

cause the company's financial performance to

increase. “In this study, the characteristics “of the

company as indicated “by the size “of the company

and “the type of industry affect the company's

financial performance.

There are several reasons that support motivated

researchers to conduct research. First, the absence of

a standard that specifies what items “are included in

intangible assets that can be managed, measured,

and reported, both reported by “mandatory

disclosure and voluntary disclosure. Secondly,

because of the inconsistency of the results of

previous studies related to disclosure of corporate

social responsibility, intellectual capital and

financial performance. This has led to the

occurrence of "information gap" because of the

reality that occurred in Indonesia, the type of

information needed by stakeholders, especially

investors, was not disclosed (Oktari, 2016). Of these

reasons, researchers were motivated to do research

again by adding increasingly diverse variables and

indicators, research sites, and different research

times.

The purpose of this study is to examine the effect

of CSR disclosure on financial performance and

intellectual capital, examine the effect of intellectual

capital on financial performance, And examine the

effect of CSR disclosure on financial performance

through intellectual capital.

2 LITERATURE REVIEW

2.1 Signaling Theory

Signaling theory discusses the company's drive “to

provide information to external parties. The

encouragement “is caused by “the occurrence “of

information asymmetry “between management and

external parties. To reduce information asymmetry,

companies must disclose information that is owned,

both financial and non-financial information. One of

the “information that must be disclosed by the

company is information about “corporate social

responsibility or “CSR. This information can “be

contained in separate “annual reports “or corporate

social reports. “The company conducts “CSR

disclosures in the “hope that it can improve financial

reputation and performance (Retno and Priantinah,

2012).

2.2 Stakeholder Theory

In the context of intellectual capital (IC), stakeholder

theory “argues that all stakeholders have the right to

be treated fairly and managers must manage the

organization to benefit all stakeholders. By utilizing

all the company's potential, “both employees (human

capital), physical assets (capital employed), “and

structural capital, the company “will be able to

create value added for “the company. By increasing

“the value added, “the company's financial

performance will increase “so that financial

performance in “the eyes “of stakeholders “will also

increase (Faradina and Gayatri, 2016).

2.3 Corporate Social Responsibility

Environmental issues that have developed lately

have made companies have to report all activities

about their company, not just operational reports but

reports “about the company's concern for the

surrounding environment. “The report is non-

financial, “and voluntary in informing stakeholders.

So that the company at this time is not only to

pursue “profits that can harm other parties, but is

responsible for the activities carried out. CSR is a

form of corporate regulation that is “integrated into

“a business model, and as corporate responsibility as

an impact of activities carried out on the

environment, customers, workers, stakeholders, and

other users (Hadi, 2011 in Safitri, 2012).

2.4 Financial Performance

Company performance is one important indicator,

not only for companies, but also for investors.

Performance shows the ability of company

management to manage their capital. Financial

performance is the achievement achieved by the

company in a certain period as a result of the work

process during that period. (Dewa and Sitohang,

2015).

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

238

2.5 Intellectual Capital

The idea or idea of intellectual models began in the

mid-1980s which were indicated by the emergence

of a shift from production based to service to the

knowledge-based economy. Some researchers argue

that there is no definitive definition of IC. The

definition of IC found in some literature is quite

complex and diverse. There is a difference in the

concept of intellectual capital measurement among

experts, and this is a dilemma.

2.6 Company Size

Company size (Size) can be interpreted as a scale to

compare the size of a company by using a certain

calculation. Brigham and Houston (2011) state that

the size of a company “is the size of a “company that

can be classified based on various ways,

including“the size “of income, total assets, and total

equity. “In this study the size of the company is

based on “total assets, because “the total assets show

more company size than other calculations.

2.7 Industrial Type

Industrial type is defined as a potential factor that

influences corporate social disclosure practices.

Aggraini (2006) defines a high profile as an industry

that has consumer visibility, high political risk, or

high competition. In Robert's research it was also

stated that there was a systematic relationship

between this type of industry and social

responsibility activities. This researcher includes the

automobile, aviation and oil industries as a high

profile (Silaen, 2016).

3 RESEARCH METHODS

The “type of research used “is explanatory research.

This research is located in Indonesia. The population

in this study were all manufacturing sector

companies listed on the Indonesia Stock Exchange

(IDX) in “2013-2015. In the sampling “in this study

using purposive sampling method, so as “to produce

34 “sample companies.

3.1 Regression Analysis

Linear regression analysis can be used to determine

changes in the influence that will occur based on the

influence that existed in the previous period. To find

out the extent to which the estimated “effect of

corporate social responsibility disclosure and

financial performance is carried out using a simple

linear regression formula, as follows:

ROA = α + β1 CSRij + Ɛ1 (1)

3.2 Path Analysis

In the path analysis there is a variable that plays a

dual role, namely as an independent variable in a

relationship, but becomes a dependent variable in

other relationships given the tiered causality

relationship. The following is the model of each

dependent variable.

IC = α + p1 CSRij + p4 Size + p4 JI + Ɛ

1

(1)

ROA = α + p1 CSRij + p3 VAIC

TM

+ p4 Size + p4

JI + Ɛ

2

(2)

4 RESULTS AND DISCUSSION

4.1 Classic Assumption Test

4.1.1 Normality Test

Based on the results of the normality “test can be

seen Kolmogorov-Smirnov “value of 0.87 with a

significance of 0.056. The value of Sig = 0.056> α =

“0.05, the data is normally distributed

.

4.1.2 Heteroscedasticity Test

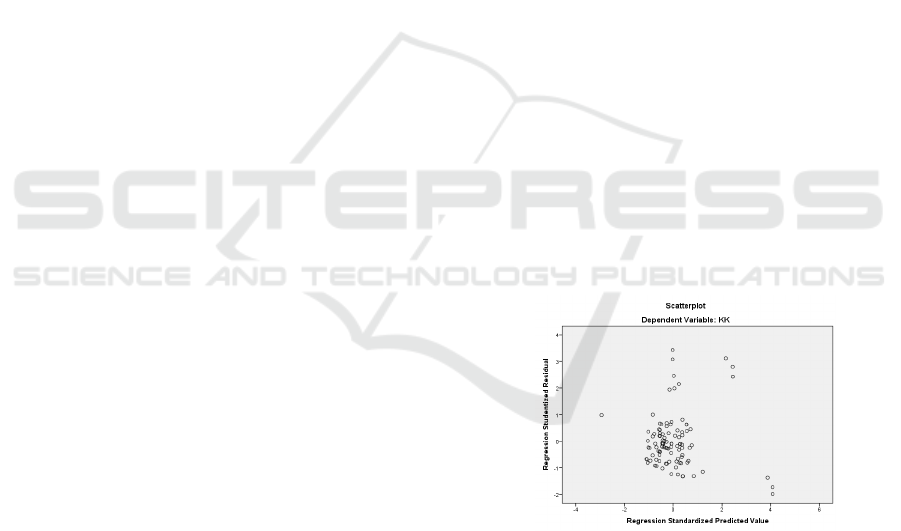

Figure 1: Graph of the heteroscedasticity test plot

Based on the plot “graph, it can be “seen that the

points spread randomly and spread both above and

below the number 0 on the Y-axis. It can be

concluded that there is no heteroscedasticity “in the

regression model. In addition to graphical methods

there are also other tests “that can be used “to detect

the presence or absence of heteroscedasticity such as

the Glejser test.

Financial Performance, Intellectual Capital and Corporate Social Responsibility Disclosure in the Manufacturing Sector

239

Table 1: Heteroscedasticity Test Results with Glejser Test

Model Sig.

1 Regression

Residual

Total

,019

b

Based on table 1 above, it can be seen “that the

significance value is “greater than 0.05 that is 0.19,

it can be concluded that in this regression model

heteroscedasticity does not occur.

4.1.3 Autocorrelation Test

Table 2: Autocorrelation Test Results

Model

Dubin-

Watson

1 1,917

Based on table 2 shows that the Durbin-Watson

value is 1.917 while from the Durbin-Watson table

with a significance of 0.05 and the amount of data

(n) = 102, and k = 1 (the number of independent

variables) obtained dL values of 1.6576 and dU

amounting to 1.6971. The value of dU is 1.6971

smaller than Durbin-Watson (d) of 1.917 and

smaller than 4-dU (1.6971 <1.917 <2.3029) so that it

can be concluded that this “regression model does

not have autocorrelation.

4.2 Hypothesis Testing

4.2.1 Regression Analysis

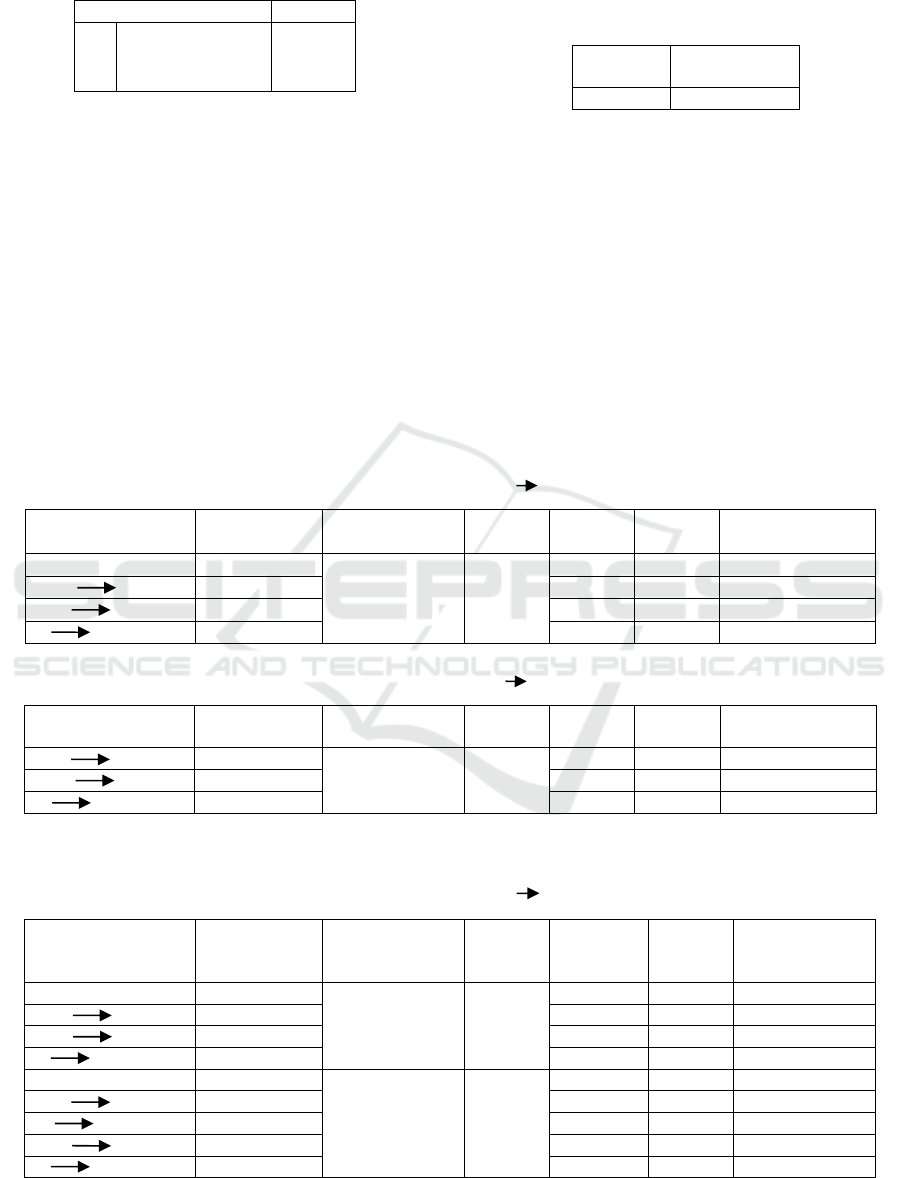

Table 3: Test Result (t t)

Influence between

variables

Coefficient

(Beta)

Determinant

Coefficient

F t Sig. Conclusion

Constant ,028

0,105

3,812

,278 ,781

CSR KK ,211 2,926

,004

Significant

SIZE KK ,001 ,243

,809

Not significant

JI KK ,013 ,758 ,450 Not significant

Table 4: Test Result (t t+1)

Influence between

variables

Coefficient

(Beta)

Determinant

Coefficient

F t Sig. Conclusion

CSR KK ,215

0,108

3,966

3,083 ,003 Significant

SIZE KK ,000 -,051 ,959 Not significant

JI KK ,016 ,907 ,367 Not significant

4.2.2 Path Analysis

Table 5: Test Result (t t)

Influence between

variables

Path

Coefficient

(Beta)

Determinant

Coefficient

F t Sig. Conclusion

Constant -148,761

0,021

0,714

CSR IC -263,988 -1,359 ,177 Not significant

SIZE IC 9,387 ,958 ,340 Not significant

JI IC 2,380 ,050 ,960 Not significant

Constant ,022

0,113

3,101

CSR KK ,202 2,764 ,007 Significant

IC KK -3,7025 -,985 ,327 Not significant

SIZE KK ,001 ,336 ,737 Not significant

JI KK ,014 ,763 ,447 Not significant

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

240

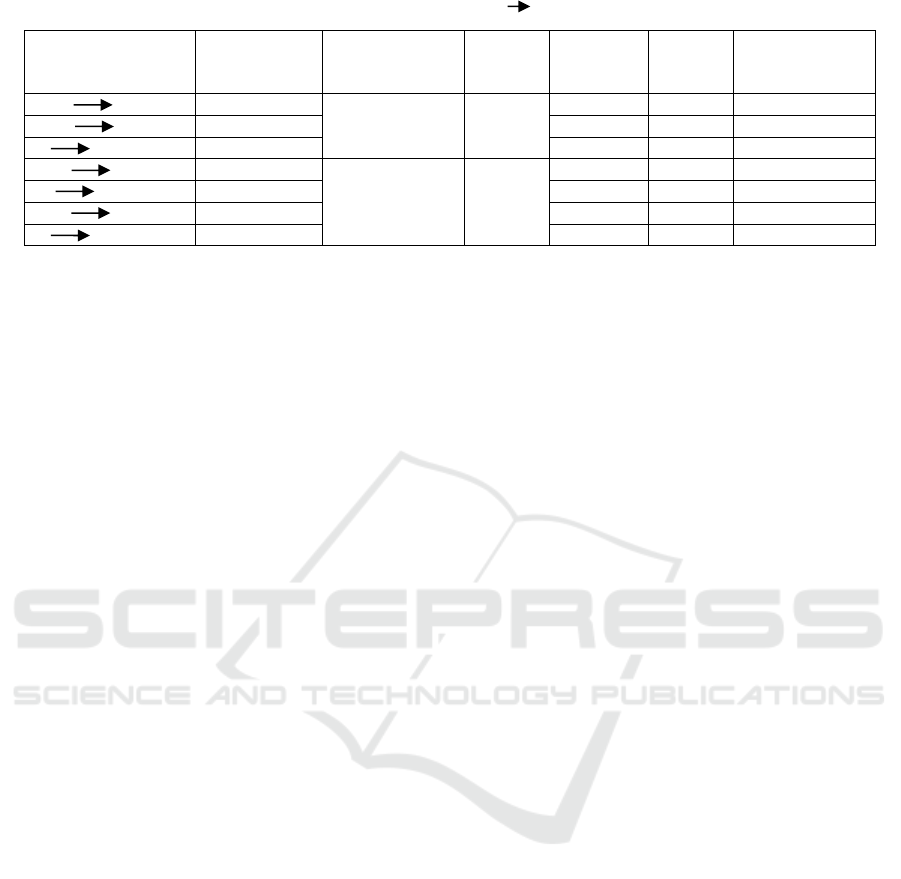

Table 6: Test Result (t t+1)

Influence between

variables

Path

Coefficient

(Beta)

Determinant

Coefficient

F t Sig. Conclusion

CSR IC -263,988

0,021

0,714

-1,359 ,177 Not significant

SIZE IC 9,387 ,958 ,340 Not significant

JI IC 2,380 ,050 ,960 Not significant

CSR KK ,210

0,111

3,032

2,967 ,004 Significant

IC KK -2,0435 -,560 ,576 Not significant

SIZE KK 1,2355 ,003 ,997 Not significant

JI KK ,016 ,907 ,367 Not significant

4.2.3 Hypothesis Testing Results

The results of testing “the first hypothesis (H1) “in

this study indicate “that corporate social

responsibility disclosure “has a significant “positive

effect on the “company's financial “performance.

The results “of a simple regression test obtained a

probability of 0.004, so that the probability of

significance < 0.05 which causes H1 to be accepted.

In the test lag t + 1 also shows the same results with

a probability of 0.003. The results of this study are

supported by the data in the annex which shows that

the highest “level of corporate social responsibility

disclosure “in 2013 was 0.7033 or 70%, able to

generate ROA of 0.0938. The highest level of

corporate social responsibility disclosure in 2014

was 0.725 or 72%, able to generate ROA of 0.067.

Finally, the highest level of corporate social

responsibility disclosure in 2015 was 0.725 or 72%,

capable of generating ROA of 0.069.

The second hypothesis (H2) shows that

“disclosure of corporate social responsibility has no

effect “on intellectual capital. “The results of path

analysis testing obtained a probability of 0.177, so

the probability of significance > 0.05 which causes

H2 to be rejected. In the test lag t + 1 also shows the

same results with a probability of 0.177. The results

of this study are supported by the data in the annex

which shows that the highest corporate social

responsibility disclosure in 2013 of 0.7033 was able

to produce VAIC

TM

of 5.669. The highest level “of

corporate social responsibility disclosure in 2014 “of

0.725 was able “to produce VAIC

TM

of 6.047.

Finally, the highest level “of corporate social

responsibility disclosure in 2015 “of 0.725 was able

“to generate VAIC

TM

of 5.585.

The third hypothesis (H3) shows that intellectual

capital “does not affect the company's financial

performance. The results “of the path analysis test

obtained a probability of 0.327, so the probability of

significance > 0.05 which caused H3 to be rejected.

In testing lag t + 1 also shows the same results with

a probability of 0.576. The results of this study are

supported by the data in the annex which shows that

the highest intellectual capital value in 2013

amounted to 367.47 capable of generating ROA of

0.051. The highest intellectual capital level in 2014

was 623.65 which was able to generate ROA of

0.041. Finally, the highest intellectual capital rate in

2015 amounted to 2231.99 capable of generating

ROA of 0.077.

The results showed that the characteristics “of

the company did “not have a significant relationship

to company “performance. “Variable type “of

industry “does not affect the company's

performance. Based on “the results “of the path

analysis test the probability is 0.447 so the

probability of significance is > 0.05. In the test lag t

+ 1 also shows the same results with a probability of

0.367. “The size of the company that is proxied by

size does not have a significant effect on the

company's financial performance. “The results of the

path analysis test obtained a probability of 0.737, the

lag t + 1 test also shows the same results with a

probability of 0.997 so that the probability of

significance is > 0.05.

5 DISCUSSION

5.1 Effect of “Corporate Social

Responsibility Disclosure on

Financial Performance

The results of testing the first hypothesis (H1) in this

study indicate that disclosure of corporate social

responsibility has a significant positive effect on the

company's financial performance. “The results of

this study indicate that the corporate social

responsibility programs carried out by the “company

were only seen in the following year. “Companies

that carry out corporate “social responsibility

activities will get many benefits such as customer

Financial Performance, Intellectual Capital and Corporate Social Responsibility Disclosure in the Manufacturing Sector

241

loyalty and trust from creditors and investors. “This

will trigger the company's finances to be better so

that the company's profits.

The “results of this study are consistent with the

results of Daud and Amri (2008), Candrayanthi and

Saputra (2013), Sari and Suaryana (2013), Agustina

et al. (2015), Sari et al. (2016) which found that

there was “a positive influence “between corporate

social responsibility disclosure “and financial

performance. By making CSR disclosures,

consumers will also give a positive reaction to the

products produced by the company itself. This will

increase consumer loyalty to a product. This

consumer loyalty will increase product sales, which

has an impact on increasing corporate profits

(Candrayanthi and Saputra, 2013). Contradictory to

the results of Safitri's (2012) research, Mustafa and

Handayani (“2014) found that CSR “had no

significant “effect on the company's financial

performance.

5.2 Effect “of “Corporate Social

Responsibility Disclosure on

Intellectual Capital

The second hypothesis (H2) shows that “disclosure

of corporate social responsibility has no effect “on

intellectual capital. “The initial assumption formed

in this study is that if disclosure of “corporate social

responsibility increases, “the company will also try

to make good use of the “intellectual capital

potential of the company. “This assumption is

refuted by the results of research that show that

disclosure of corporate social responsibility does not

affect intellectual capital. “This is because the items

that have been disclosed by CSR (labor practice

items) are the “same as item intellectual capital

(VAHU). “So companies that have disclosed

corporate social responsibility do not need

“intellectual capital anymore to improve the

company's financial performance.

The “results of this study are not consistent with

the results of Luthan “et al. (2016) research which

found that CSR activities significantly affect IC

disclosure, especially activities related to employee

development. Another study was conducted by

Ratnaningrum and Nasron (2014), “based on the

results of testing with PLS, “it can be concluded that

there is a negative effect of IC (VAIC

TM

) “on the

disclosure of corporate social responsibility. Based

on the three forming indicators VAIC

TM

, VACA,

and VAHU it was proven that it was able to explain

VAIC

TM

, while STVA proved to be insignificant.

5.3 The Influence of Intellectual

Capital on Financial Performance

The third hypothesis (H3) shows that intellectual

capital “does not affect the company's financial

performance. “Stakeholder theory considers

organizational accountability not only limited to

economic or financial performance. “Companies

should need to make disclosures about intellectual

capital more than what is required by the authorized

body. “Intellectual capital is crucial for a company's

success, “other assets and capabilities also contribute

to the company's profitability and market value.

Companies from different industries have

different ranges of assets and capabilities to operate

their businesses effectively. “So the company needs

more than just “physical assets (fixed) and financial

assets. This shows that the higher the intellectual

capital value of a company, “the future performance

of the company will not be higher.

The “results of this study are consistent with the

results of Santoso's “research (2012), Safitri (2012)

which prove that intellectual capital has no

significant effect on company performance. This is

because Indonesian investors still do not give more

value to companies that have higher intellectual

capital, besides that there are indications that in

Indonesia they still use indications of physical and

financial asset use in the contribution of company

performance (Safitri, 2012). Contradictory to the

results of research by Daud and Amri (2008),

Zuliyati and Arya (2011), Agustina et al. (2015),

Faradina and Gayatri (2016) which prove “that

intellectual capital (IC) has a positive effect “on the

company's “financial performance.

5.4 The Influence “of “Corporate

Social Responsibility Disclosure on

Financial Performance through

Intellectual Capital

The fourth hypothesis (H4) shows that disclosure of

corporate social responsibility does not affect

financial

performance through intellectual

capital. “Based on the results of testing the “t and t +

1 lags “show the same “results. “Shows “that the

variables of corporate social responsibility

disclosure “have a significant effect on the

company's financial performance, disclosure “of

corporate social responsibility “does not

significantly influence intellectual capital and

intellectual capital does “not have a significant

“effect on financial “performance. Another finding

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

242

in “this study is “that the characteristics of the

company also do not affect financial performance.

So it “can be concluded that indirectly “disclosure of

corporate social responsibility does not affect

financial performance through intellectual capital.

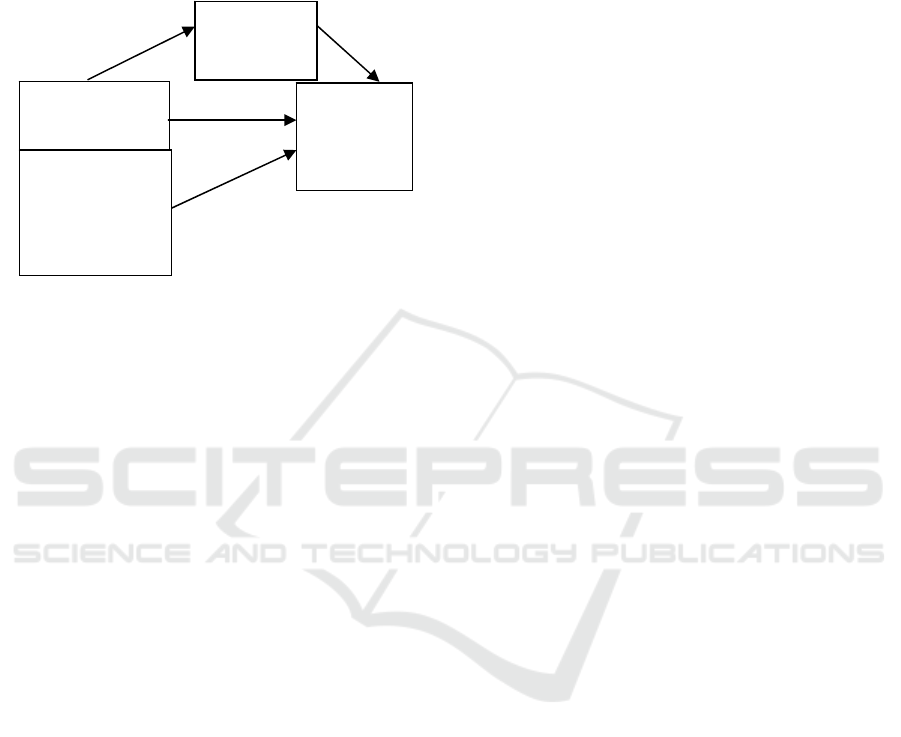

Not Significant

Significant

Figure 2: Path analysis test results.

5.5 Effect of Control Variables

This study uses two control variables, namely

company size and type of industry. The results

showed that the characteristics “of the company did

not have a significant relationship to company

performance. “Variable type “of industry “does not

affect the company's performance. “High profile and

low profile industries basically do not guarantee

companies can produce high company performance,

because not all high profile companies are

considered and can attract investors to invest.

The size of the company that is proxied by size

does not have a significant effect on the company's

financial performance. “The results of the path

analysis test obtained a probability of 0.737, the lag t

+ 1 test also shows the same results with a

probability of 0.997 so that the probability of

significance is> 0.05. “Basically, large assets do not

guarantee the company can produce high corporate

value. “Large assets that can be managed

productively will result in the increased financial

performance of the company. Conversely, large

assets that cannot be managed productively will

result in decreased financial performance.

“The results of this study are consistent with the

results of research conducted by Fachrudin (2011),

Mahaputeri “and Yadnyana (“2014) which prove

that firm size does not have “a significant effect on

company performance. This shows “that the size “of

a large company does not necessarily guarantee and

make the company's performance will be better

(Mahaputeri and Yadnyana, 2014). Contradictory

with the results of Waskito's (2014), and Isbana

(2015) study which proves that firm size “has a

positive influence “on financial performance proxied

by ROA.

6 CONCLUSION

The results of this study found that disclosure of

corporate social responsibility had a significant

positive effect on the company's financial

performance even though the impact was only seen

in the next year. “This is because companies that

carry out “corporate social responsibility activities

will get many benefits such as customer loyalty and

trust from creditors and investors.

The results of this study found that disclosure of

corporate social responsibility does not affect

intellectual capital, “even though t and t + 1 tests

have been conducted but the results obtained remain

the same.

The results of this study found that intellectual

capital does not affect the company's financial

performance, “even though t and t + 1 tests have

been conducted but the results obtained remain the

same. This is because Indonesian investors still do

not give more value to companies that have higher

intellectual capital, “besides that there are

indications that in Indonesia they still use indications

of the use of physical and financial assets in

contributing to the company's performance.

The results of this study found that indirect

disclosure of corporate social responsibility does not

affect financial performance through intellectual

capital, “even though t and t + 1 tests have been

conducted but the results obtained remain the same.

“Based on the results of the path analysis test, “it is

pointed out that corporate social responsibility

disclosure has a significant effect on financial

performance, “meaning that corporate social

responsibility disclosure directly affects financial

performance without involving intellectual capital as

a mediator.

Another finding of this study is that company

characteristics reflected by company size and type of

industry do not affect the company's financial

performance, “even though t and t + 1 tests have

been carried out but the results obtained remain the

same.

Intellectual

Capital

(VAIC

TM

)

Disclosure of

Corporate

Social

Performanc

e

Finance

(ROA)

Control

Variables:

a. Company size

b. Industrial

Type

Not

Significant

Not

Significant

Financial Performance, Intellectual Capital and Corporate Social Responsibility Disclosure in the Manufacturing Sector

243

REFERENCES

Agustina, Wahyuni, Gede Adi dan “Ni Kadek. 2015.

“Pengaruh Intelectual “Capital, Corporate Social

Responsibility Dan Good Corporate Governance

Terhadap Kinerja Keuangan (Studi Kasus Pada

Perusahaan Bumn Yang Terdaftar Di Bursa Efek

Indonesia “Pada Tahun 2011-2013). e-Journal S1 Ak

Universitas Pendidikan Ganesha. Volume 3. Hal 1-11.

Anggraini, Fr. Reni Retno. 2006. Pengungkapan Informasi

Sosial yang Mempengaruhi Pengungkapan Informasi

Sosial dalam Laporan Keuangan Tahunan (Studi

Empiris pada Perusahaan-Perusahaan yang terdaftar di

Bursa Efek Jakarta). Simposium Nasional Akuntansi

IX. Hal “1123-1135.

Bapepam-LK Nomor: KEP 11/PM/1997

Brigham, Eugene F dan Joel F. Houston. 2011. Dasar-

Dasar Manajemen Keuangan. Edisi 11: Buku 2.

Jakarta: Salemba Empat.

Candrayanthi, Saputra. “2013. Pengaruh Pengungkapan

Corporate Social Responsibility Terhadap Kinerja

Perusahaan (Studi Empiris Pada Perusahaan

Pertambangan Di Bursa Efek Indonesia). E-Jurnal

Akuntansi Universitas Udayana. Hal 141-158.

Daud, M, Rulfah “dan Abrar Amri. 2008. Pengaruh

Intellectual Capital Dan Corporate Social

Responsibility Terhadap Kinerja Perusahaan (Studi

Empiris Pada Perusahaan Manufaktur Di Bursa Efek

Indonesia). Jurnal Telaah and Riset Akuntansi. Vol. 1,

No. 2. Hal. 213-231.

Dewa, Putra Aditya “dan “Sonang Sitohang. 2015.

Analisis Kinerja Keuangan PT Indofood Sukses

Makmur Tbk Di Bursa Efek Indonesia. Jurnal Ilmu

dan Riset Manajemen. Volume 4, Nomor 3. Hal 2-25.

Faradina, Ike dan Gayatri. 2016. “Pengaruh Intellectual

Capital Dan Intellectual Capital Disclosure Terhadap

Kinerja Keuangan Perusahaan. E-Jurnal Akuntansi.

Vol.15.2. Hal 1623-1653.

Kuiksuko. 2013. Pengaruh Jenis Industri Dan Ukuran

Perusahaan Terhadap Luas Pengungkapan Tanggung

Jawab Sosial Pada Laporan Tahunan Perusahaan.

Skripsi. Fakultas Ekonomi Dan Bisnis. Universitas

Hasanudin, Makassar.

Luthan, Elvira, Asniati, Yohana. 2016. A Correlation Of

CSR And Intellectual Capital, Its Implication Toward

Company’s Value Creation. “International Journal Of

Business And Management Invention. Volume 5 Issue

11. Page 88-96.

Mahaputeri, Asmi, Ajeng Dan Yadnyana. 2014.

“Pengaruh Struktur Kepemilikan, Kebijakan

Pendanaan Dan Ukuran Perusahaan Pada Kinerja

Perusahaan. E-Jurnal Akuntansi Universitas Udayana.

Vol. 9. Hal “58-68.

Maulida, Aris. 2013. “Analisis Pengaruh Ukuran

Perusahaan, Umur Perusahaan, Kepemilikan Publik,

Profitabilitas Dan Leverage Terhadap Tingkat

Pengungkapan Intellectual Capital Pada Perusahaan

Yang Terdaftar Di JII Tahun 2012-2013. Skripi.

Fakultas Syariah “Dan Hukum. Universitas Islam

Negeri Sunan Kalijaga, Yogyakarta.

Mustafa, Cintya, Cut “dan Nur Handayani. 2014.

Pengaruh Pengungkapan Corporate Social

Responsibility Terhadap Kinerja Keuangan

Perusahaan Manufaktur. Jurnal Ilmu and Riset

Akuntansi. Vol. 3 No. 6. Hal 2-16.

Oktari, “Putri, Ayu, I Gusti. 2016. “Determinan Modal

Intelektual (intellectual capital) Pada Perusahaan

Publik Di Indonesia Dan Implikasinya Terhadap Nilai

Perusahaan. Skripsi. Fakultas Ekonomi “Dan Bisnis,

Universitas Mataram, Mataram.

Pulic, Ante. 1998. Measuring the Performance of

Intellectual Potential in Knowledge Economy. Paper

presented at the 2nd McMaster Word Congress on

Measuring and Managing Intellectual Capital by the

Austrian Team for Intellectual Potential.

Purwanto, Agus. 2011. Pengaruh Tipe Industri, Ukuran

Perusahaan, Profitabilitas, Terhadap Corporate Social

Responsibility. Jurnal Akuntansi and Auditing.

Volume 8/No. 1. Hal 1-94.

Ratnaningrum, dan Muhammad Nasron. 2014. Peran

Intellectual Capital Dalam Memprediksi

Pengungkapan Tanggungjawab Sosial Perusahaan.

Jurnal Akuntansi dan Manajemen. “Vol. 25, No. 2.

Hal 113-121.

Retno, Dyah, Reni “dan Priantinah. 2012. Pengaruh Good

Corporate Governance Dan Pengungkapan Corporate

Social Responsibility Terhadap Nilai Perusahaan

(Studi Empiris Pada Perusahaan Yang Terdaftar Di

Bursa Efek Indonesia Periode 2007-2010). Jurnal

Nominal. Volume I “Nomor I. “Hal 84-100.

Safitri, Nur, Amelia. “2012. Pengaruh Pengungkapan

Intelectual Capital dan Corporate Social

Responsibility Terhadap Kinerja Perusahaan (Studi

Pada Perusahaan High Profit yang Terdaftar di BEI).

Skirpsi. Fakultas Ekonomi dan Bisnis, Universitas

Diponogoro, Semarang.

Sari, Merta, Kade, Ni luh “dan I Gusti Ngurah Agung

Suaryana. 2013. Pengaruh Pengungkapan CSR

Terhadap Kinerja Keuangan Dengan Kepemilikan

Asing Sebagai Variabel Moderator. E-Jurnal

Akuntansi. Vol 3.2. Hal 248-257.

Sari, Handayani, dan “Nuzula. 2016. Pengaruh

Pengungkapan Corporate Social Responsibility

Terhadap Kinerja Keuangan Dan Nilai Perusahaan

(Studi Komparatif Pada Perusahaan Multinasional

Yang Terdaftar Di Bursa Efek Indonesia Dan Bursa

Malaysia Tahun 2012-2015). Jurnal Administrasi

Bisnis (JAB). Vol. 39 No. 2. Hal 75-82.

Santoso, Setyarini. 2012. Pengaruh Modal Intelektual dan

Pengungkapannya Terhadap Kinerja Perusahaan.

Jurnal Akuntansi Dan Keuangan. Vol. 14. NO. 1. Hal:

16-31

Silaen. 2016. “Analisis Pengaruh Size Perusahaan, Tipe

Industri, Basis Perusahaan, Profitabilitas, Leverage

Dan Likuiditas Terhadap Tingkat Pengungkapan

Sosial Pada Perusahaan Yang Go Public Di BEI 2010.

Waskito, Titis. 2014. Pengaruh Struktur Kepemilikan

Manajerial, Kepemilikan Institusional, Dan Ukuran

Perusahaan Terhadap Kinerja Keuangan. Skripsi.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

244

Fakultas Ekonomi Dan Bisnis. Universitas

Muhammadiah Surakarta.

Zuliyati dan Ngurah Arya. 2011. Intellectual Capital Dan

Kinerja Keuangan Perusahaan. Dinamika Keuangan

dan Perbankan. Vol. 3, No. 1. Hal 113 – 125.

www.bapepam.co.id

www.finance.yahoo.com

www.idx.co.id

www.sahamok.com

Financial Performance, Intellectual Capital and Corporate Social Responsibility Disclosure in the Manufacturing Sector

245