Analysis of the Method of Altman Z-Score to Predict the Potential of

Bankruptcy in Advertising, Printing and Media Companies Listed on

the IDX

Arini

1

,

Puji Handayati

2

,

Akhmad Naruli

3

1

Universitas Negeri Malang

2

Graduated school of Universitas Negeri Malang

3

Graduated school of Universitas Islam Kadiri

Keywords: Altman Z”-Score, Bankruptcy, Financial Reports

Abstract: Purpose - The purpose of this study is to find out the Altman Z method "-Score can predict bankruptcy in

advertising, printing and media companies listed on the Indonesia Stock Exchange.

Design / methodology / approach - First, the researcher determines the sample of the company that is as

many as 9 samples of Advertising, Printing and Media companies listed on the IDX. Second, researchers

calculate working capital to total assets, retained earnings to total assets, earnings before interest and taxes

to total assets, and book value of equity to book value of debt. Third, researchers analyzed the Altman Z

method "-Score.

Findings - The results obtained show that of 9 companies that in 2012 there was 1 company that was

predicted to go bankrupt, 2 companies in gray areas and 6 companies were not bankrupt. In 2013 3

companies were predicted to go bankrupt and 6 companies did not go bankrupt. In 2014 there was 1

company predicted to go bankrupt, 1 company in a gray area and 7 companies not going bankrupt. In 2015

there were 3 companies that were predicted to go bankrupt, 1 company in the gray area and 5 companies did

not go bankrupt.Originality / value - The main contribution helps the management of the company in

assessing the company's financial condition and management decision making in preventing the risks that

will occur associated with the company's bankruptcy.

1 INTRODUCTION

Financial report analysis aims to determine the

current condition and position of the company, by

analyzing the weaknesses and strengths of the

company (Kasmir: 2010). The results of the analysis

of the company's financial statements are to know

the condition and financial development of the

company, as done by a professor at New York

University, Edward Altman. He conducts research

on the financial performance of companies that

experience bankruptcy with healthy financial

performance. Altman uses Multiple Discriminant

Analysis (MDA) which is one of the statistical

techniques that produces an index where later it

allows the classification of observation into one of

several a priori groupings. The research results are

formulated in a mathematical formula called the

Altman Z-Score formula. (Tristantyo: 2012)

Altman (1968) uses five financial ratios which

are considered to be the most contributing to the

bankruptcy prediction model by using an equation

model. The Z-Score model is a model that can be

used to predict financial difficulties. The Z-Score

value is used to classify whether a company is

bankrupt or not. Prihadi (2010) Altman does not

only use one method in his analysis, but he also

develops the Z-Score method that can be used for

several companies, there are three methods, namely

Z-Score for manufacturing companies, companies

going public. Z’-Score method (modification /

model A) for private companies only and Altman

Z”-Score method (Modification / model B) for

service companies, private and going public.

Bankruptcy according to Altman (1973) is a

company that is legally bankrupt. Whereas

according to law no. 4 of 1998 is where an

institution is declared by a court decision if the

debtor has two or more creditors and does not pay at

least one debt that is due to be billed. (Damayanti:

2014).

230

Arini, ., Handayati, P. and Naruli, A.

Analysis of the Method of Altman Z-Score to Predict the Potential of Bankruptcy in Advertising, Printing and Media Companies Listed on the IDX.

DOI: 10.5220/0008783702300236

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 230-236

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The bankruptcy prediction serves to provide

guidance for interested parties about the company's

financial performance whether to experience

difficulties or not in the future. (Butet Agrina

Kurniawati, 2012) examined the analysis of the use

of Altman Z-Score to predict the potential

bankruptcy of food and beverage companies listed

on the Stock Exchange in the period 2007 - 2011.

The results of this study concluded that the average

Working Capital To Total Assets ratio was 0.253,

Retained Earnings to Total Assets are 0.170, Earning

Before Interest and Taxes To Total Assets are 0.100,

Market Value of Equity To Book Value of Debt is

1.759 and the average ratio of Sales to Total Assets

is 1.206. In Z-Score analysis there are three

companies in the healthy category, one company in

the gray area, and one company in the bankrupt

category. Syari'ah Insurance Company Based on the

Altman Z’-Score Method for the period 2009-2013.

The method used to predict bankruptcy is using the

Altman Z-Score modification method that can be

applied to all companies such as manufacturing,

non-manufacturing and bond issuing companies.

The results of this study indicate that from the

results of the analysis of bankruptcy prediction in

2009 - 2013 there was one company predicted to

experience bankruptcy, namely PT. Allianz Life

insurance with a Z score = 1.1205, Z <1.23 in 2011.

Media advertising printing companies are

information services companies. The company

continues to grow along with the development of

technology, information and communication. The

competitive conditions of Advertising, Printing and

Media companies are increasingly tight. Online

technology - this phenomenon came to be known as

online buying and selling - each individual can act as

an advertising agent, can be the owner of an online

buying and selling media, or can be a seller as the

corporation does. An individual can sell and get the

items he wants by using fast access services, such as

tokobagus.com, berniaga.com, jualbeli.com, or

kaskus.com. (Supriadi: 2013)

Therefore the importance of a financial statement

analysis and analysis of financial performance to

predict bankruptcy. This study aims to determine the

financial condition of the company and can provide

input and consideration for external companies,

especially for investors about the possibility of

bankruptcy in order to take steps in making

decisions on their investment in the company.

Advertising, printing and media companies are a

growing service company, with high levels of

competition and developments in information

technology. It is necessary to assess the company's

financial condition. The researchers examined "

Analysis" Altman Z”-Score To Predict Bankruptcy

in Media Advertising Printing Companies

Registered at IDX Period 2012-2015”

2 LITERATURE REVIEW

2.1 Definition of Financial Statement

Analysis

According to Wild, Subramanyam and Halsey

(2008: 3) states that:

Financial statement analysis (financial statement

analysis) is the application of analytical tools and

techniques for general purpose financial statements

and related data to produce estimates and

conclusions that are useful in business analysis.

According to Harahap (2011: 190) as follows:

Decipher financial statement posts into smaller

information units and see their relationships that are

significant or that have meaning with each other

both between quantitative and nonquantitative data

with the aim of knowing deeper financial conditions

that are very important in the process of producing

decisions that right.

2.2 Technical Analysis of Financial

Statements

According to Munawir (2010: 36), the types of

financial statement analysis techniques that can be

done are as follows:

1) Comparative Analysis between Financial

Reports, is an analysis technique by comparing

financial statements for two or more periods.

2) Trend Analysis or the tendency of the company's

financial position and progress expressed in

percentages.

3) Reports with percentages per component are an

analysis method to determine the percentage of

investment in each asset against total assets, also

to determine the capital structure and

composition of the accumulation that occurs

associated with the number of sales.

4) Analysis of Sources and Use of Working Capital,

is an analysis to find out the sources and use of

working capital or to find out the causes of

changes in working capital in a certain period.

5) Analysis of Sources and Use of Cash, is an

analysis to find out the causes of changes in the

Analysis of the Method of Altman Z-Score to Predict the Potential of Bankruptcy in Advertising, Printing and Media Companies Listed on

the IDX

231

amount of cash or to find out the sources and use

of cash for a certain period.

6) Analysis of the ratio, is a method of analysis to

determine the relationship of certain items in the

balance sheet or income statement individually

or a combination of the two reports.

7) Analysis of Gross Profit Change is an analysis to

find out the causes of changes in the gross profit

of a company from another period to period or

changes in gross profit for a period with profit

that is budgeted for that period.

8) Break-Even Analysis, is an analysis to determine

the level of sales that must be achieved by a

company so that the company does not suffer

losses, but also has not made a profit.

Definition of Networking Capital to Total Assets

According to Wardhani (2007) in Tristantyo (2012:

15) working capital to total assets is used to measure

the liquidity of a company's assets relative to its total

capitalization or to measure the company's ability to

meet short-term liabilities

Definition of Retained Earnings to Total Assets

According to Wardhani (2007) in Tristantyo (2012:

15) retained earnings against total assets are used to

measure cumulative profitability. This ratio

measures the accumulation of profits as long as the

company operates.

Definition EBIT (Earnings Before Interest and Tax)

to Total Assets

According to Wardhani (2007) in Tristantyo (2012:

16) income before tax and interest on total assets is

used to measure the actual productivity of the

company's assets. The ratio measures a company's

ability to generate profits from assets used.

Definition of Market Value of Equity to Book Value

of Total Liabilities

According to Wardhani (2007) in Tristantyo (2012:

16) Equity market value of book value of debt is

used to measure how much a company's assets can

decrease in value before the amount of debt is

greater than its assets and the company becomes

bankrupt.

Definition of Sales to Total Assets

According to Wardhani (2007) in Tristantyo (2012:

17) sales of total assets are used to measure

management's ability to deal with competitive

conditions. This ratio measures the management's

ability to use assets to generate sales.

Altman Z-Score Analysis

In Prihadi (2010) Altman does not only use one

method in his analysis, but he also develops the Z-

Score method that can be used for several

companies, namely:

Original Z-Score

Z = 1,2 X

+ 1,4 X

+ 3,3 X

+ 0,6 X

+ 1,0 X

Working capital / Total asset

Retained earnings / Total asset

EBIT / Total asset

Market value of equity / Book

value of debt

Sales / Total asset

Score Condition

>2,99

1,81 – 2,99

<1,81

Not Bankrupt

Grey Area

Bankrupt

Z'-Score (Model A Z-Score) for private company

Z’ = 0,717 X

+ 0,847 X

+ 3,107 X

+ 0,420 X

+ 0,998 X

Working capital / Total asset

Retained earnings / Total asset

EBIT / Total asset

Book value of equity / Book

value of debt

Sales / Total asset

Score Condition

>2,90

1,23 – 2,90

<1,23

Not Bankrupt

Grey Area

Bankrupt

Z”-Score (Model B Z-score)

Z” = 6,56 X

+ 3,26 X

+ 6,72 X

+ 1,05 X

Working capital / Total asset

Retained earnings / Total asset

EBIT / total asset

Book value of equity / Book

value of debt

Score Condition

>2,60

1,1 – 2,60

<1,1

Not Bankrupt

Grey Area

Bankrupt

Bankruptcy

According to Prihadi (2010: 332) states that:

Bankruptcy is a condition where the company is no

longer able to pay off its obligations.

The Bankruptcy Law explained that Bankruptcy

refers to:

Article 1 paragraph (1):

Bankruptcy is a general seizure of all the

wealth of a Bankrupt Debtor whose

management and settlement is carried out by

the curator under the supervision of the

Supervisory Judge as stipulated in this Law.

Bankruptcy according to Altman (1973) is a

company that is legally bankrupt. Whereas

according to law no. 4 of 1998 is where an

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

232

institution is declared by a court decision if

the debtor has two or more creditors and does

not pay at least one debt that is due and can

be billed (Damayanti: 2014).

3 RESEARCH METHODS

The population of this study was all Advertising,

Printing and Media companies listed on the

Indonesia Stock Exchange in 2012-2015, which

numbered 15 companies. And the samples used in

this study are Advertising, Printing and Media

companies that are part of the population.

The data source of this study will use secondary

data in the form of: Annual financial reports of

Advertising, Printing and Media companies listed on

the IDX for the period 2012-2015. The data

collection technique used is documentation. From

the documentation obtained data in the form of

Annual Financial Statements 10 Advertising,

Printing and Media subsector companies which are

located in the Indonesia Stock Exchange in the

period 2012-2015.

The analysis techniques used in this study are as

follows:

1. Collection of data taken from the balance sheet,

income statement and changes in the equity of

the sample of this study,

2. Data or results of financial ratio calculations are

then analyzed using the formula found by

Altman Z-Score, namely:

Z = 6.56 X1 + 3.26 X2 + 6.72 X3 + 1.05 X4

Notes:

Z : Bankruptcy index

X1 : Working capital to total assets

X2 : Retained earnings to total assets

X3 : Earnings before interest and taxes to

total assets

X4 : Book value of equity to book value of

debt

3. Classifying healthy and bankrupt companies

based on the original Altman Z-Score Model

value (Prihadi, 2010), namely:

a. If Z> 2.60 is classified as a healthy company

b. If Z <1.1 is classified as a potential company

going bankrupt

c. If Z between 1.1 and 2.60 is classified as a

company in the gray area.

4. From the results of the analysis, the numbers or

Z values will be obtained which are then

compared with the cut off value, so that it can be

predicted which company can be predicted to go

bankrupt, gray area or healthy

4 RESEARCH RESULTS AND

DISCUSSION

Calculating Working Capital to Total Assets (X1)

This ratio formula is as follows:

WTCA = working capital/ Total assets

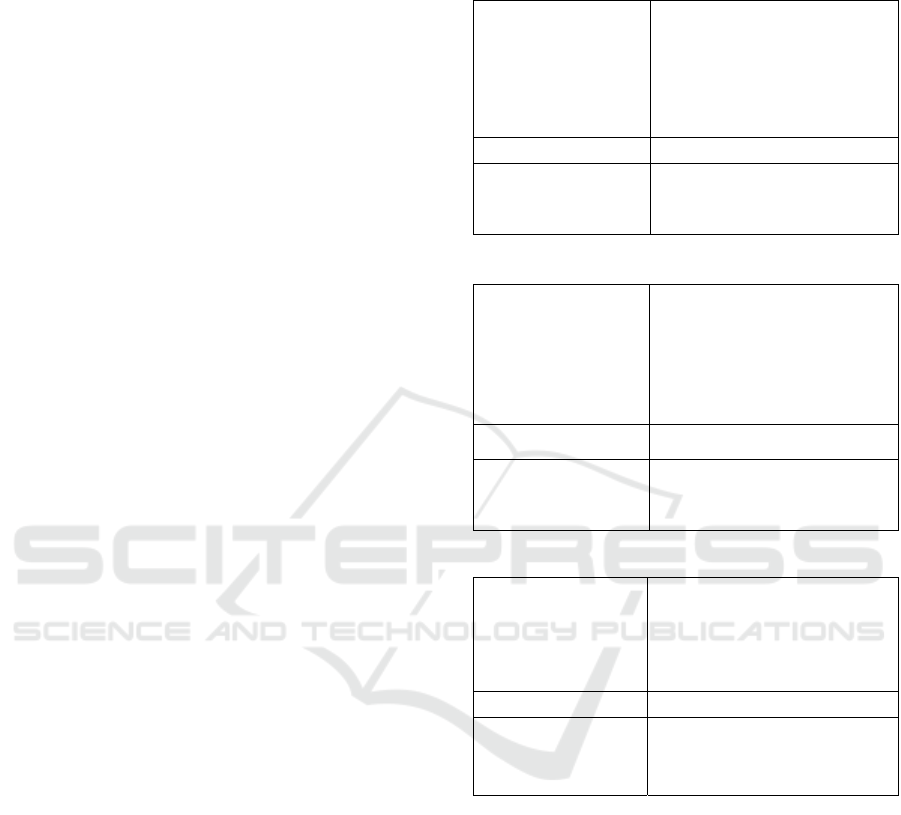

Table 2.1: WCTA Advertising, Printing and Media

Company for the 2012-2015 Period

Code

Company

Year

2012 2013 2014 2015

ABBA -0,0913 -0,0325 0,1196 0,1037

EMTK 0,4582 0,4280 0,5894 0,5197

FORU 0,4015 0,4095 0,4287 0,3997

JTPE 0,1551 0,1423 0,1444 0,0836

KBLV 0,0719 -0,0730 0,0008 -0,1397

MNCN 0,6156 0,5414 0,5715 0,4620

MSKY 0,0395 0,0273 -0,0414 -0,6313

TMPO 0,3742 0,3444 0.2617 0,1856

VIVA 0,3252 0,4032 0,3250 0,0983

Source: secondary data processed

Calculates Retained Earnings to Total Assets (X2)

This ratio formula is as follows:

RETTA = retained earnings / total assets

Table 2.2: RETTA Advertising, Printing and Media

Company for the period 2012-2015

Code

Company

Year

2012 2013 2014 2015

ABBA -0,0523 -0,0190 -0,0008 -0,0809

EMTK 0,1030 0,1229 0,1107 0,0762

FORU 0,2786 0,2996 0,2918 0,2820

JTPE 0,3622 0,3316 0,3544 0,3140

KBLV -0,0564 -0,0644 0,5712 0,4942

MNCN 0,3922 0,4253 0,3941 0,3924

MSKY 0,0819 -0,0187 -0,0445 -0,1580

TMPO 0,1044 0,1165 0,1556 0,1639

VIVA -0,1110 -0,0432 -0,0111 -0,0934

Source: secondary data processed

Calculating Earning Before Interest and Tax to Total

Assets (X3)

This ratio formula is as follows:

EBITTA = EBIT / Total assets

Analysis of the Method of Altman Z-Score to Predict the Potential of Bankruptcy in Advertising, Printing and Media Companies Listed on

the IDX

233

Table 2.3: EBITTA Advertising, Printing and Media

Company for the 2012-2015 Period

Code

Company

Year

2012 2013 2014 2015

ABBA 0,0129 0,0 0,0254 -0,1230

EMTK 0,1379 0,1473 0,0995 0,1368

FORU 0,0662 0,0524 0,0240 0,0160

JTPE 0,1263 0,0950 0,1029 0,1006

KBLV 0.0042 0,0148 0,6294 -0,1417

MNCN 0,2523 0,2489 0,1868 0,1161

MSKY 0,0246 -0,0994 -0,0324 -0,1254

TMPO 0,1649 0,0412 0,0560 0,0128

VIVA 0,0615 0,0458 0,0609 -0,0557

Source: secondary data processed

Calculating Book Value of Equity to Book Value of

Debt (X4)

This ratio formula is as follows:

BVOE to BVD = book value of equity / book value

of debt

Table 2.4: BVOE to BVOD Advertising, Printing and

Media Company for the 2012-2015 Period

Code

Company

Year

2012 2013 2014 2015

ABBA

0,4389 0,5877 0,6397 0,4905

EMTK

3,4028 2,7049 4,5731 7,2895

FORU

0,9548 1,0186 0,9930 0,8963

JTPE

0,8584 0,7265 0,7722 0,6544

KBLV

1,2786 0,8685 2,6112 1,6130

MNCN

4,3859 4,1372 2,2330 1,9491

MSKY

0,8440 0,4166 0,3724 0,2681

TMPO

1,2206 0,9960 0,8136 0,7759

VIVA

1,2766 0,6488 0,7511 0,5327

Source: secondary data processed

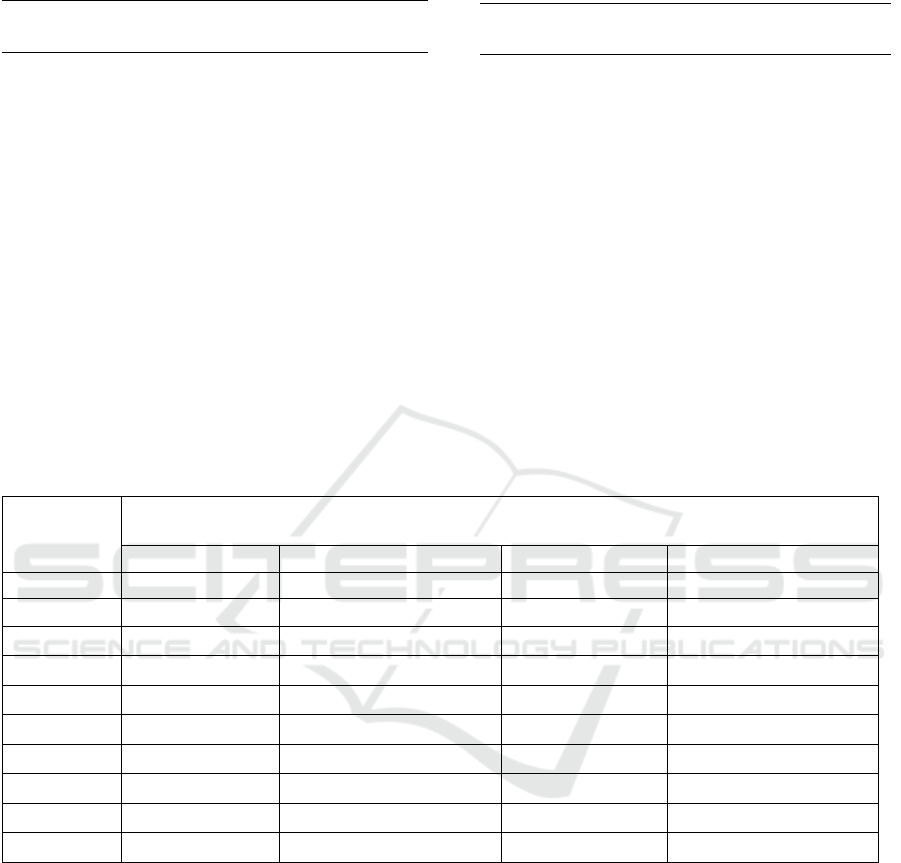

Altman Z-Score Model Assessment

The results of the Altman Z-Score calculation on

advertising, printing and media companies that go

public on the IDX can be seen in the following table

2.5:

Table 2.5: Altman Z-Score in Advertising, Printing and Media Companies for the 2012 - 2015 Period.

Code

Company

Year

2012 2013 2014 2015

ABBA * -0,22210 * 0,80435 ** 1,62421 *0,10429

EMTK *** 4,72894 *** 7,03814 *** 9,69729 *** 12,23111

FORU *** 4,98951 *** 5,08505 *** 4,96715 *** 4,59051

JTPE *** 3,94871 *** 3,41579 *** 3,60537 *** 2,93538

KBLV ** 1,65907 * 0,32285 *** 8,83877 ** 1,43615

MNCN *** 11,61745 *** 10,95469 *** 8,63344 *** 7,13661

MSKY ** 1,57743 * -0,11229 * -0,24341 * -5,21769

TMPO *** 5,18488 *** 3,96177 *** 3,45410 *** 2,65253

VIVA *** 3,52518 *** 3,49528 *** 3,29366 *0,52506

Description: * bankrupt, ** grey area, healthy *** (not bankrupt or healthy)

Altman Z-Score Model Assessment Analysis

From table 2.5 above, it can be seen that the

value of Z-Score in Advertising, Printing and Media

companies listed on the Stock Exchange during 2012

- 2015 shows the criteria of the Altman Z-Score

model that falls into the healthy, gray area and

bankrupt category, which means the company has

the potential for bankruptcy, but some companies

that in certain years have gone bankrupt and some

companies are even very able to anticipate and make

improvements, both in their management and in

their financial structure.

The Working Capital to Total Assets value from

2012-2015 experienced an increase, namely the

Mahaka Media Tbk company, although in 2015 it

decreased slightly. Whereas the MNC Sky Vision

Tbk continued to decline in 2012-2015, so it was in

the category of bankruptcy. This condition is

because the Working Capital to Total Assets value is

negative. A negative sign on the value means that

the company has negative net working capital

(current debt value greater than current assets). So it

can be interpreted that the company lacks current

assets to pay the current debt due to the total assets

of the company.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

234

Another thing that causes a negative Z-Score is

because that year is due to the value of current

liabilities that are greater than the value of the

current asset. The value of current liabilities is

greater than the current asset value, which makes the

company illiquid and tends to experience a crisis

because it cannot fulfill its short-term obligations

resulting in bankruptcy.

From the table above it can also be seen that

several companies from 2012-2015 Z-Score values

experienced an increase and were able to anticipate

and make improvements, both in their management

and in their financial structure, including PT. Elang

Mahkota Teknologi Tbk, PT. Fortune Indonesia

Tbk, PT. Jasuindo Tiga Perkasa Tbk, PT. Media

Nusantara Citra Tbk, and PT. Tempo Inti Media

Tbk.

This causes an increase in the value of Z-Score

every year is a Book Value of Equity to Book Value

of Liabilities that has increased even though some

companies have decreased but not in large numbers

and are still in the healthy category, so that it can be

interpreted that the company's ability to meet

obligations - the obligation derived from the value of

the capital market itself every year trying to

anticipate a decline.

There are 1 (one) companies in 2012 - 2014 in

the healthy category and in 2015 were in the

bankrupt category namely Visi Media Asia Tbk.

This happened because current liabilities continued

to increase from 2012 - 2015, the book value of debt

continued to increase and there was a decline in

working capital in 2015. In addition, 1 (one)

company fluctuating from 2012 - 2015, namely PT.

First Media Tbk, which is 2012 was in the gray area

category, in 2013 was in the category of bankruptcy,

in 2014 it was in the healthy category and in 2015 it

was in the gray area category. This is due to an

increase in the value of current liabilities and a large

book value of debt (book value fo debt) in 2015, as

well as a significant decline in the value of capital

(working capital) so that it is negative.

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusion

The results of the analysis of the Altman Z-Score

model can show the potential for bankruptcy in the

Advertising, Printing and Media companies listed on

the Stock Exchange in 2012 - 2015. The Z-Score ¬

has increased and decreased. Besides being caused

by the fluctuating value of Working Capital to Total

Assets each year, the value of the Book of Value of

Equity to Book Value of Debt also fluctuates every

year.

Companies that are in the healthy category from

2012 - 2015, namely PT. Elang Mahkota Teknologi

Tbk, PT. Fortune Indonesia Tbk, PT. Jasuindo Tiga

Perkasa Tbk, PT. Media Nusantara Citra Tbk, PT.

Tempo Inti Media Tbk. While companies that are in

the category of bankruptcy and gray areas from 2012

- 2015 are PT. Mahaka Media Tbk and PT. MNC

Sky Vision Tbk. The company is in the healthy

category and the bankrupt category is PT. Visi

Media Asia Tbk, while companies that fluctuate or

are in the category of healthy, gray areas and go

bankrupt, namely PT. First Media Tbk.

5.2 Suggestion

Investors, using the Altman Z-Score analysis

investors can assess and evaluate the company's

financial condition and provide consideration in

determining which Advertising, Printing and Media

companies will be chosen to invest.

For Company Management. The management of

the company still needs to maintain and increase the

size of the ratio, both the working capital ratio,

retained earnings ratio, earnings before interest and

tax ratios and the ratio of book value of equity to the

book value of debt. This is because the size of the

value of the ratio will provide an overview of the

company's business continuity in the future.

For Academic/Researchers. This research still

has limitations, namely this study is related to the

number of variables used only for quantitative

research, so that further research can also consider

qualitative aspects such as economic, social,

technological factors, and changes in government

regulations that cause the bankruptcy of a company.

REFERENCES

Algifari, (2013), Inductive Statistics for Economics and

Business, Yogyakarta: YKPN College of Management

Baran, Stanley J, (2012, Introduction to Mass

Communication. Jakarta: Erlangga

Damayanti, Maya, (2014), Prediction of Sharia Insurance

Company Bankruptcy Based on the Altman Z-Score

Method, Undergraduate Thesis, Jakarta: Syari'ah

Faculty and Law, Hidayatullah State Islamic

University

Hanafi, Mahmud M. Halim, Abdul, (2016), Financial

Report Analysis, Yogyakarta: UPP STIM YKPN

Analysis of the Method of Altman Z-Score to Predict the Potential of Bankruptcy in Advertising, Printing and Media Companies Listed on

the IDX

235

Harahap, Sofyan Syafari, (2011), Critical Analysis of

Financial Statements, Jakarta: Raja Grafindo Persada

Kasmir, (2008), Financial Report Analysis, Jakarta:

Kencana Media Group

Kieso, Donald E, (2007), Intermediate Accounting,

Jakarta: Erlangga

Morissan, (2010), Integrated Advertising Marketing

Communication. Jakarta: Kencana Prenadamedia The

group

Munawir, (2010), Analysis of Financial Statements,

Yogyakarta: Liberty Yogyakarta

Prastowo, Dwi, (2015), Analysis of Financial Statements

(Concepts and applications, editions third),

Yogyakarta: YKPN College of Management

Prihadi, Toto, (2010), Financial Report Analysis, Jakarta:

PPM Rajawali Press

Subramanyam, K. R. John J. Wild, (2010), Analysis of

Book Financial Statements Dua, Jakarta: Salemba

Empat

Suci, Ivida Dewi Amrih and Poesoko Herowati, (2016),

Bankruptcy Law, Yogyakarta: Laksbang

Grafika.

Tristantyo, Yoga Rhesana, Altman Z-score Model

Analysis in predicting Bankruptcy of a national

foreign exchange private banking company that goes

public at BEI, thesis, University Widyatama,

Bandung: 2013.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

236