The Effect of Employee Religiosity on the Islamic Bank Performance:

Its Implication for Religious Education

Aldy Mochammad Faiz Raksayudha

1

and Dwi Suhartanto

2

1

Postgraduate Program of Finance and Islamic Bank, Bandung State Polytechnic, Bandung, Indonesia

2

Department of Business Administration, Bandung State Polytechnic, Bandung, Indonesia

Keywords: Education, Religiosity, Job Satisfaction, Job Performance, Bank Performance.

Abstract: Islamic banking is a dynamic segment in the banking industry. However, although having enormous potential,

Islamic banks, especially micro banks, which have emerged only recently are perceived as less popular and

as less experienced than conventional banking. Therefore, they need a proper strategy to compete and have a

high performance compared to their competitors. This study is intended to assess the effect of religiosity on

bank performance through strengthening employee job satisfaction and employee job performance as well as

its implication on religion education. For this purpose, the data from 210 Islamic bank employees, was

gathered using a self-administered questionnaire from Islamic banks in West Java Province, Indonesia. The

data were analysed by using multiple regression. The result shows that religiosity significantly impacts bank

performance through strengthening job satisfaction and job performance. This finding suggests that religious

teaching should be included in their curriculum. From the point of view of Islamic managerial practice, this

finding helps the Islamic micro bank managers to develop a proper strategy to improve their bank

performance.

1 INTRODUCTION

The current industrial revolution 4.0 is known as

cyber-physical. Currently, all areas of the industry

begin to touch the virtual world, shaped by human

connectivity, machines and data: the internet of

things. In the current industrial environment, both

conventional and Islamic banks are competing in

providing the best service with sophisticated

technology. However, technological innovation

applied in the industry must be followed by qualified

human resources. The Islamic banking industry has a

high potential to attract Islamic customers to meet the

need for banking services that comply with the

religious obligations of Islam (Amin et.al, 2013).

Besides attracting Islamic customers, sharia banks

can also attract non-Islamic customers because they

apply the principles of sharing the benefits and risks.

Although opportunities are many, there are

significant challenges for Islamic banks, as they are

less popular and less experienced compared to

conventional banks (Souiden and Rani, 2015).

Further, in line with the industrial revolution 4.0,

the application of technology in the Islamic bank's

industry must be accompanied by qualified personnel.

In order to continue to grow and run the business

properly, Islamic banks must develop their employee

capability. For this reason, providing an excellent

education to equip qualified employees is a must.

Considering the important role of employee

performance, the latest literature has indicated the

role of employee religiosity (Osman et.al, 2013).

Religiosity is also seen as a factor affecting customers

in the context of Islamic banks (Souiden and Rani,

2015; Suhartanto et.al., 2018; Wahyuni and Fitriani,

2017). Although many researchers have highlighted

the importance of the influence of religiosity, no

studies have examined the impact of religiosity on the

performance of an Islamic bank and its employees.

Thus, it is not known how religiosity can affect the

performance of the Islamic bank and its employees.

Conducting such research allows Sharia bank

managers to develop their employee potential from

the religious perspective to enhance banking business

performance.

This study assesses the influence of religiosity on

job satisfaction and employee performance on the

performance of Islamic banks. This research was

conducted specifically to (1) examine the direct and

indirect influence of religiosity on bank performance

Raksayudha, A. and Suhartanto, D.

The Effect of Employee Religiosity on the Islamic Bank Performance: Its Implication on Religion Education.

DOI: 10.5220/0008679601890193

In Improving Educational Quality Toward International Standard (ICED-QA 2018), pages 189-193

ISBN: 978-989-758-392-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

189

through job satisfaction and job performance (2)

discuss the implication of such relationships on the

religious education in educational institutions where

graduates intend to work in Islamic banks or finance

firms. This study was conducted in the context of

Islamic banking, especially the Bank Pembiayaan

Rakyat Syariah (BPRS) of West Java due to three

reasons. First, the growth of Islamic banking tends to

be stagnant with a small asset base of only about 5%

of the national banking assets (BI, 2017). Second, the

growth in the number of employees of BPRS

experienced a significant increase from 4,704 in 2014

to 5,102 in 2015 (OJK, 2017). Third, the number of

BPRS assets in West Java is higher than in other

provinces, with assets reaching Rp3,001,429 million

(OJK, 2017). Thus, understanding the influence of

religiosity on Islamic bank employees is very

important for the development of human resources for

any Islamic Bank.

2 LITERATURE REVIEW

Religiosity and religion are often used

interchangeably to mean the same concept; namely

respect, devotion, and individual belief in the divinity

(Souiden and Rani, 2015). Religion is a gift to

followers of certain beliefs, rituals, values, and

communities (Mathras et.al., 2016). Shyan Fam et al.

argues that religion is the ideal for life, which is

reflected in the values and attitudes of each follower

(Shyan et.al, 2016). Religiosity will affect the ethical

level of a person’s life so that people who are highly

religious are expected to act more ethically. However,

it would be a mistake to generalize for all adherents,

because each has a different level of religiosity and

different depths of religious commitments.

Stark et al. established an indicator of the level of

religiosity, they suggest that a person's level of

religiosity can be seen from the individual's religious

activities (Stark and Glock, 1970). These indicators

are Religious Belief, Religious Practice, Religious

Feeling, Religious Knowledge, and Religious Effects.

Some studies show that Religiosity determines an

individual’s attitude. Souiden et al. explain that a

person's beliefs tend to be closely related to his

religion, either directly through scripture or indirectly

through individual cultures (Souiden and Rani, 2015).

Hence, a person's religious identity will affect

behavior and attitudes (Tang and Li, 2015).

According to Suhartanto, job satisfaction is an

employee’s pleasant emotional condition and the

consequences of the achievement of given work

standards (Suhartanto, 2018a). Lambert et al. (2007)

state that job satisfaction is an employee’s reaction

regarding his work and whether he enjoys the work

he does. Another study indicates that job satisfaction

influences the organization's goals because the

organization rewards and provides a comfortable

environment both physically and mentally (Gursoy

and Swanger, 2007).

Employee performance is the behavior of

individuals or employees who contribute to the

technical organization of their place of work.

Performance is essential in assessing the

effectiveness of individuals who contribute to the

organization (Suhartanto, 2018b; Yang and Hwang,

2014). To optimize employee performance,

companies should be able to motivate and satisfy their

employees. Furthermore, employee performance can

be thought of as having three factors, namely

individual, organization and work climate factors

(Liao and Chung, 2004).

Performance is the overall achievement of an

organization’s operational activities and strategies.

The performance measurement of an organization has

several objectives, namely, for accounting records, to

provide an overview of a strategy and as a benchmark

achievement of an organizational goal (Al-Hawari

and Ward, 2006). A performance measurement can

help to clarify managerial decisions. There are two

approaches to measuring financial performance. The

first measurement can be done subjectively based on

evaluation, expectations, and comparison with

existing competitors; then the second is objectively

based on financial ratios (Appiah-Adu and Singh,

1998).

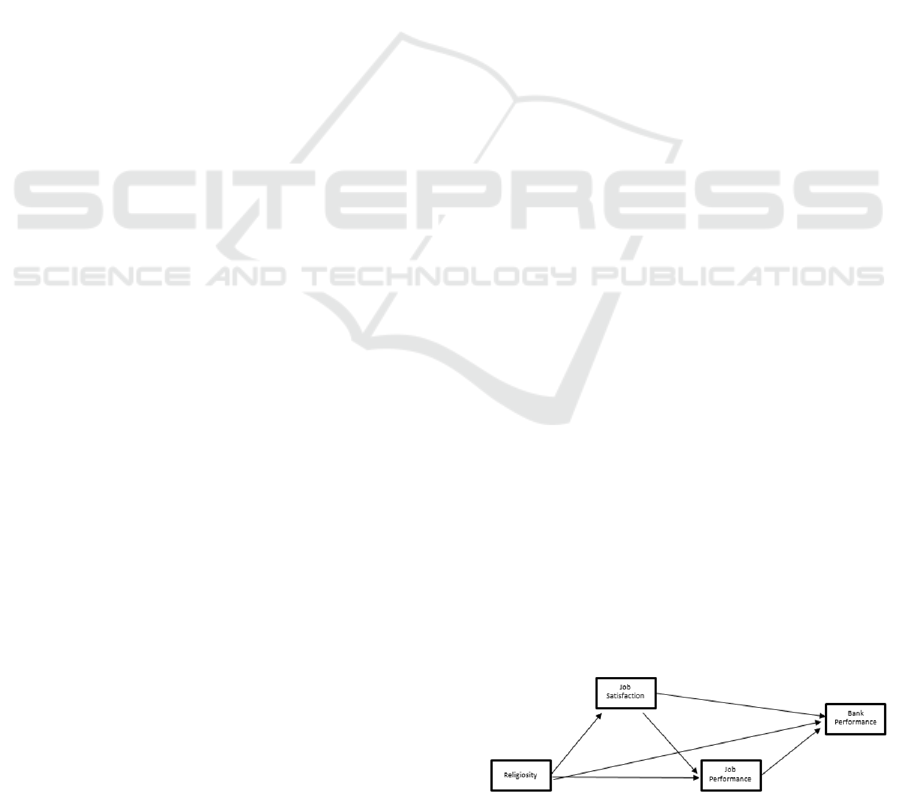

Based on the discussion above, the hypothesis was

formulated as follows:

H1: Religiosity positively affects Job

Satisfaction

H2: Religiosity positively affects Employee

Performance

H3: Religiosity positively affects bank

performance

H4: Job Satisfaction positively affects Employee

Performance

H5: Job Satisfaction positively affects Bank

Performance

H6: Employee Performance positively affects

Bank Performance

Figure 1: Research hypothesis.

ICED-QA 2018 - International Conference On Education Development And Quality Assurance

190

3 METHOD

This study focuses on the religiosity of Bank

Pembiayaan Rakyat Syariah employees so that the

variable of religiosity is used in the Islamic context.

The religiosity scale used is that of Stark et al. (Stark

and Glock, 1970). The application of the religiosity

scale is based on reliable and valid Islamic and

psychometric values. Data were obtained through

questionnaires distributed to 210 employees in Bank

Pembiayaan Rakyat Syariah of West Java Province

of whom 59.04 % were men and 40.96% women. The

majority of respondents were under 45 years of age

(94.28%) and the remainder above 45 years (5.72%).

Multiple linear regression analysis was used to test

the hypothesis. All variables were measured using the

Likert scale (from strongly disagree to agree

strongly).

4 RESULT

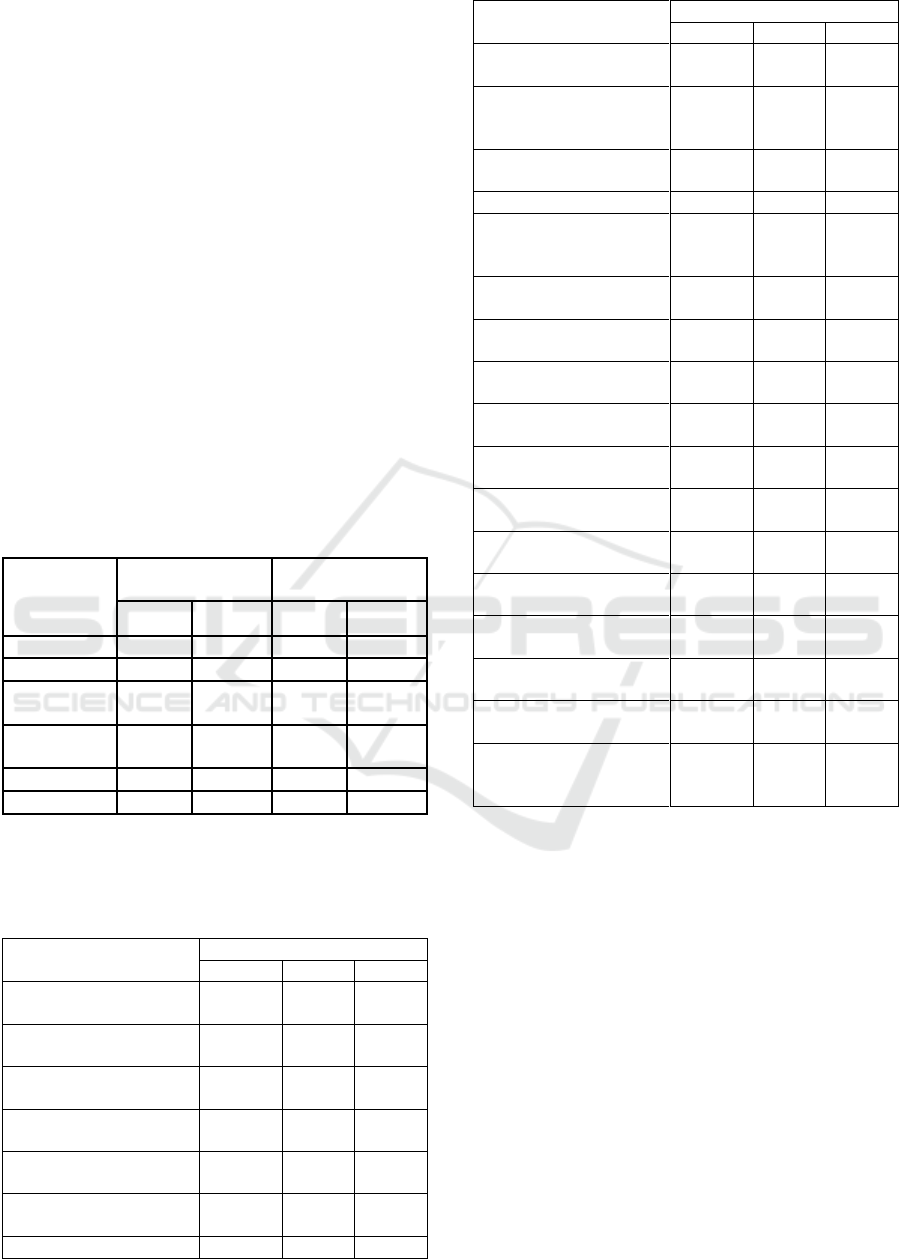

Table 1: The result of Multiple Linear Regression outputs.

Job Performance

Bank

Performance

t-Value

t-Value

(Constant)

1,773

7,066**

2,306

7,543**

Religiosity

0,205

3,061**

0,221

2,945**

Job

Satisfaction

0,295

7,29**

0,16

3,222**

Job

Performance

0,043

0,563

R²

0,347

0,191

F

55,052

16,163

Note: *significant at p<0.05, **significant at p<0.01

Table 2: Mean, Standard Deviation, Validity and Reliability

Check.

Construct/ Item

Loading

CR

AVE

Employee

Performance

0,848

0,529

- I always manage to

reach the target given

0,721

- I am often rewarded

for my performance

0,682

- I am always punctual

in doing the work

0,795

- In my work, I follow

the applicable rules

0,678

- Overall, I work very

well

0,752

Job Satisfaction

0,883

0,715

Construct/ Item

Loading

CR

AVE

- Overall, I am satisfied

with my work

0,805

- In the future, I want to

keep working in sharia

banking

0,859

- I never thought about

quitting my current job

0,872

Level of Religiosity

0,902

0,508

- I read the Qur'an every

day if there is no

obstruction

0,655

- I love reading books

about religion

0,672

- I like to follow Islamic

studies on TV

0,591

- I forgive the person

who hurt my heart

0,638

- I always try to be

honest

0,682

- I feel disappointed

when I leave prayer

0,791

- I pray regularly and I

feel relief

0,797

- I believe that God sees

everything I do

0,786

- God will grant my

prayer if I mean it

0,768

Sharia Bank

Performance

0,886

0,721

- Your bank’s Financial

Performance

0,839

- Your bank's ability to

satisfy customers

0,893

- Your Bank's

Competition with Other

Banks

0,814

In the hypothesis testing, the first tests conducted

were validity and reliability tests. The validity test is

conducted to measure the accuracy of the construct.

Meanwhile, the reliability test is to measure the

consistency of scores achieved, with a set of different

equivalent elements. Table 1 shows that all of the

constructs tested are valid and reliable. The result of

testing the hypotheses is depicted in Table 1

Based on the multiple linear regression, the equation

for job performance and bank performance were

formulated as follow:

(1)

Job Performance = 1,773 + 0,205 (Religiosity)

+ 0,295 (Job Satisfaction) + Error

(2)

Bank Performance = 2,306 + 0,221

(Religiosity + 0,160 (Job Satisfaction) + 0,043

(Job Performance) + Error

Then, the F-test was used to determine the effect

of the Religiosity Variable and Job Satisfaction

The Effect of Employee Religiosity on the Islamic Bank Performance: Its Implication on Religion Education

191

simultaneously on Job Performance in the first

equation. Based on the output of SPSS, F

Calculate

has a

value of 55.052 with a probability of p < 0.01 or p <

0.05. The test results show that Ho is rejected. So,

religiosity and job satisfaction have a significant

influence on job performance. Afterward, the F-test

was used to determine the effect of religiosity, job

satisfaction, and job performance on the bank

performance simultaneously. Based on the output of

SPSS, F

Calculate

has a value of 16,163 with the

probability of 0.000. The result shows that Ho is

rejected. Therefore, religiosity, job satisfaction, and

job performance have a significant influence on bank

performance.

At the t-test stage between religiosity and job

satisfaction has a value of t

Calculate

of 3.061 with a

probability of 0.000. The test results in 0.002 < 0.05,

so Ho is rejected. It indicates that religiosity has a

significant influence on Job Satisfaction.

Furthermore, in Job Satisfaction-Job Performance

(Y) has t

Calculate

of 7,290 with the probability of 0.000.

So, the test result shows 0.000 < 0.05, or Ho is

rejected. Therefore, Job Satisfaction has a significant

influence on Job Performance. Thus, job performance

is not a significant factor in determining the bank

performance.

5 CONCLUSIONS

The result of this study indicates the importance of

religiosity on bank performance as well as job

satisfaction. The effect of religiosity on bank

performance is not only direct but also indirect

through strengthening the employee job satisfaction.

This finding reinforces previous research which

suggests that religiosity and spirituality affect

employee performance [3]. As none of the previous

studies have explored such a relationship, this finding

indeed provides a significant input for business

practices for managing the Islamic banking industry.

For an Islamic banking manager, this study offers a

clue to improve their business performance through

strengthening their staff religiosity.

From an education perspective, although the

importance of religious education in Indonesia has

been well-reported (Parker, 2017), the importance of

religious education on job environment has never

been explored. The importance of religiosity on

Islamic bank performance offered from this study

provides a new understanding of the importance of

religious education. The current curriculum,

especially in the high school as well as in the

university, religious education is treated as an

essential subject to provide basic moral value for

guiding a person behavior. This subject also has a

small number of credits (normally between 2 or 3

credits). Thus the teaching of religion in those

education institutions is only superficial. Considering

the result of this study which highlights the

importance of religiosity, the religion curriculum,

especially for education institution which intendes

their graduate to work in Islamic banking (such as

Sharia Banking Study Program, Sharia Finance Study

Program etc.), needs to include more credit for

religion teaching. For those study programs, this

finding suggests that religion should not only be

treated as a peripheral subject but it should be treated

as important as any other main subject such as

Banking Management and Finance. The approach to

strengthening the religion education could also follow

scholars (Jackson and Everington, 2017; Yada and

Savolained, 2017) suggestion to use inclusive

religious education. Thus, religious values are

included and embedded in other subjects.

Although this study offers a meaningful

contribution for managing Islamic banks and for

improvement of education curriculum, this study

bears some limitations. The first limitation of this

research is related to data collection and the use of a

single administration cross-sectional design. This

design has limited ability to capture the dynamic

relationship between attitude and imaginary

constructs (employee performance and sharia bank

performance). So if the constructs tend to change over

time, the interpretation of the findings in this study is

limited. To overcome this limitation, future research

can use the old design and compare the results for

changes. The second limitation of this research is

related to the distribution of questionnaires, many

questionnaires distributed were not returned. Besides,

samples were selected only from Bank Pembiayaan

Rakyat Syariah. So, in further research, selected

samples could include staff from Bank Umum

Syariah, Unit Usaha Syariah, and Bank Pembiayaan

Rakyat Syariah to obtain a better number of

respondents easier.

REFERENCES

Amin, M., Z. Isa, and R. Fontaine. 2013. Islamic banks:

Contrasting the drivers of customer satisfaction on

image, trust, and loyalty of Muslim and non-Muslim

customers in Malaysia. International Journal of Bank

Marketing. 31(2): p. 79-97.

Al-Hawari, M. and T. Ward. 2006. The effect of automated

service quality on Australian banks' financial

performance and the mediating role of customer

ICED-QA 2018 - International Conference On Education Development And Quality Assurance

192

satisfaction. Marketing Intelligence & Planning. 24(2):

p. 127-147.

Appiah-Adu, K. and S. Singh. 1998. Customer orientation

and performance: a study of SMEs. Management

decision, 36(6): p. 385-394.

BI, Laporan Tahunan Bank Indonesia. 2017.

Gursoy, D. and N. Swanger. 2007. Performance-enhancing

internal strategic factors and competencies: impacts on

financial success. International Journal of Hospitality

Management, 26(1): p. 213-227.

Osman-Gani, A.M., J. Hashim, and Y. Ismail. 2013.

Establishing linkages between religiosity and

spirituality on employee performance. Employee

relations, 35(4): p. 360-376.

OJK. 2017. Statistik Perbankan Syariah.

Jackson, R. and J. Everington. 2017. Teaching inclusive

religious education impartially: an English perspective.

British Journal of Religious Education, 39(1): p. 7-24.

Lambert, E.G., N.L. Hogan, and M.L. Griffin. 2007. The

impact of distributive and procedural justice on

correctional staff job stress, job satisfaction, and

organizational commitment. Journal of Criminal

Justice. 35(6): p. 644-656.

Liao, H. and A. Chuang. 2004. A multilevel investigation

of factors influencing employee service performance

and customer outcomes. Academy of Management

journal. 47(1): p. 41-58.

Mathras, D., et al. 2016. The effects of religion on consumer

behavior: A conceptual framework and research

agenda. Journal of Consumer Psychology, 26(2): p.

298-311.

Parker, L. 2017. Religious environmental education? The

new school curriculum in Indonesia. Environmental

Education Research, 23(9): p. 1249-1272.

Shyan Fam, K., D.S. Waller, and B. Zafer Erdogan. 2004.

The influence of religion on attitudes towards the

advertising of controversial products. European

Journal of Marketing, 38(5/6): p. 537-555.

Souiden, N. and M. Rani. 2015. Consumer attitudes and

purchase intentions toward Islamic banks: the influence

of religiosity. International Journal of Bank Marketing,

33(2): p. 143-161.

Suhartanto, F.N., H., Muflih,M ., & Setiawan. 2018.

Loyalty Intention towards Islamic Bank : The Role Of

Religiosity, Image, and Trust. International Journal of

Economics and Management, 12: p. 137-151.

Suhartanto, D. and A. Brien. 2018. Multidimensional

engagement and store performance: The perspective of

frontline retail employees. International Journal of

Productivity and Performance Management, 67(5): p.

809-824.

Suhartanto, D. 2018. Tourist satisfaction with souvenir

shopping: evidence from Indonesian domestic tourists.

Current Issues in Tourism, 21(6): p. 663-679.

Stark, R. and C.Y. Glock. 1970. American piety: The

nature of religious commitment. Vol. 1.: Univ of

California Press.

Tang, G. and D. Li. 2015. Is there a relation between

religiosity and customer loyalty in the Chinese context?

International Journal of Consumer Studies, 39(6): p.

639-647.

Yada, A. and H. Savolainen. 2017. Japanese in-service

teachers’ attitudes toward inclusive education and self-

efficacy for inclusive practices. Teaching and Teacher

Education, 64: p. 222-229.

Yang, C.-L. and M. Hwang. 2014. Personality traits and

simultaneous reciprocal influences between job

performance and job satisfaction. Chinese Management

Studies, 8(1): p. 6-26.

Wahyuni, S. and N. Fitriani. 2017. Brand religiosity aura

and brand loyalty in Indonesia Islamic banking. Journal

of Islamic Marketing. 8(3): p. 361-372.

The Effect of Employee Religiosity on the Islamic Bank Performance: Its Implication on Religion Education

193