Regression for Trend-Seasonal Longitudinal Data Pattern:

Linear and Fourier Series Estimator

M. Fariz Fadillah Mardianto

1

, Sri Haryatmi Kartiko

2

and Herni Utami

3

1

Department of Mathematics, University of Airlangga, Surabaya, Indonesia

1

Ph.D. Candidate in Department of Mathematics, University of Gadjah Mada, Yogyakarta, Indonesia

2,3

Department of Mathematics, University of Gadjah Mada, Yogyakarta, Indonesia

Keywords: Longitudinal Data, Trend Seasonal Pattern, Regression, Linear Estimator, Fourier Series Estimator.

Abstract: Longitudinal data is a pattern that consists of time series and cross section data pattern. In a research with

longitudinal and panel data often be used combination between trend and seasonal or trend-seasonal pattern,

for example the relationship between profit and demand for seasonal commodities, in education insurance,

meteorology case and many more for many subjects. Recently, we develop Fourier series estimator to

approach curve regression for longitudinal data. Fourier series that be used, not only include trigonometric

Fourier series which usual be used in Mathematics, but also linear function. In this research we compare

performance of new estimator with linear estimator that often be used in panel data regression or parametric

regression for longitudinal data. The trend-seasonal data that be used in this analysis is gotten from

simulation process based on Box et.al., (1976). The Fourier series estimator gives better result with

goodness indicator smaller Mean Square Error (MSE) and greater determination coefficient than linear

estimator.

1 INTRODUCTION

Recently, longitudinal data analysis develops for

some Statistical method. Longitudinal data is a

pattern that consists of more than one subject. Each

subject is observed more than one time. Therefore,

in longitudinal data structure, consist of time series

and cross section data pattern (Weiss, 2005).

In regression analysis, one of statistical method

that be used to model the relationship between

responses and predictors, longitudinal data analysis

often be used. Panel data regression is one of the

linear regressions for longitudinal data. The

differences between longitudinal and panel data,

panel data is longitudinal data with the number of

observations and periods are same for every subject

(Baltagi, 2005).

Regression analysis that be developed is not only

regression with linear estimator, but also

nonparametric regression. Nonparametric regression

is a Statistical modeling that be used to overcome

the relationship between responses and predictors

which have unknown pattern. Nonparametric

regression is an alternative method that be used

when the result of regression analysis with certain

function, such as linear regression, cannot suitable

with goodness criteria of regression analysis

(Takezawa, 2006). The advantage of nonparametric

regression is having high flexibility. Flexibility

means that the pattern of data that presented on the

scatter plot can determine the shape of regression

curve based on estimators in the nonparametric

regression (Budiantara et.al., 2015). Based on plot,

we can identify the pattern of data, the pattern of

pairs data, a response versus a predictor variable

data, have trend, oscillation, uncertain pattern, and

combination pattern.

The pattern of data that often be found is

combination between trend and seasonal or trend-

seasonal data pattern. In research with longitudinal

and panel data this pattern often be encountered.

Some example like, the relationship between profit

and demand for seasonal commodities, in education

insurance, meteorology case and many more for

many subjects.

Trend – seasonal data pattern popular in time

series data analysis. This pattern will pass some

procedure when time series analysis be used, be-

because there are some assumptions must be

satisfied. Time series – regression approach is an

350

M. Fariz Fadillah Mardianto, ., Kartiko, S. and Utami, H.

Regression for Trend-Seasonal Longitudinal Data Pattern: Linear and Fourier Series Estimator.

DOI: 10.5220/0008521803500356

In Proceedings of the International Conference on Mathematics and Islam (ICMIs 2018), pages 350-356

ISBN: 978-989-758-407-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

alternative to forecast time series data (Bloomfield,

2000). Based on that concept, trend – seasonal data

pattern analysis is applied to longitudinal data, that

consist of time series and cross section data pattern.

Regression for longitudinal data pattern that be

discussed in this study based on linear and Fourier

series estimator. Linear estimator represents trend

pattern, and Fourier series represents seasonal

pattern. Bilodeau (1992) proposed combination

linear function and Fourier cosine series in his paper

to get smooth estimator for the relationship of a

response and predictors. In longitudinal analysis,

linear estimator often be used, especially in

regression, the most popular method is panel data

regression. However, that method is not suitable

when the variation of oscillation is large. So, we

propose new method based on the development of

Bilodeau (1992). The method is longitudinal data

regression based on Fourier series estimator that

consist of linear function, cosine and sine function.

Visually and mathematically, that estimator

accommodates trend-seasonal pattern that be

presented in scatter plot and time series plot for

longitudinal data.

In this paper, second part discuss about linear

estimator for longitudinal data regression. The third

part discuss about Fourier series estimator for

longitudinal data regression. Fourier series that be

used based on Fourier series estimator that consist of

linear function, cosine and sine function. Using

simulation data, we make comparison based on MSE

and determination coefficient value to make

conclusion which regression method that suitable to

be used for trend – seasonal longitudinal data

pattern. In the end of this part, given longitudinal

data structure in Table 1 as follows:

Table 1: The structure of longitudinal data that be used.

Subject

Response

Predictors

1

st

Subject

2

nd

Subject

n

th

Subject

2 LINEAR ESTIMATORS FOR

LONGITUDINAL DATA

REGRESSION

Linear estimator for longitudinal data regression is

analogue with common effect model in panel data

regression. Gujarati (2004) stated that general

approach that have similarity with generalized linear

model in panel data case is common effect model.

Consider pair of predictor and response

data

, with represents the

number of subjects,

represents the

number of observations for each subject, and

represents the number of predictors. The

structure of data pair has presented on Table 1.

Based on pair of data can be formed regression

model for longitudinal data based on linear approach

as follows:

(1)

with

is an intercept parameter for

subject,

is

parameter for

predictor and

subject. Random

error for

subject and

observation denoted by

that independent and identically normal

distributed with mean equals to 0 and variance

equals to

. An estimator for parameter which be

formed as vector for equation (1) can be determined

based on Weighted Least Square (WLS)

optimization (Weiss, 2005). The WLS optimization

result given as follows:

(2)

In this case

, that have

or with vector components that

correspond are

that have

.

is a matrix that has or

, and parameter vector defined by

Regression for Trend-Seasonal Longitudinal Data Pattern: Linear and Fourier Series Estimator

351

that has . In

addition, there is

as a weight matrix with

structure as follows:

,

where

,

with variance matrix

where . The

estimator for curve regression can be determined as

follows:

(3)

In regression for longitudinal data based on

linear estimator, inference Statistics for significant

test has been provided. There are unit root test using

Augmented Dickey Fuller (ADF), simultaneous and

partial significance test (Baltagi, 2005),

heteroscedasticity test for error using Lagrange

Multiplier (Greene, 2012) and normality test using

Jarque Bera test (Baltagi, 2005). The good estimator

is estimator with small MSE value, and big

determination coefficient value.

3. FOURIER SERIES ESTIMATOR

FOR LONGITUDINAL DATA

REGRESSION

Consider a longitudinal data structure that be

presented in Table 1. Based on Table 1, there are

pairs of data with form (

,

denotes

predictor variable for

observation in

subject.

Here, denote the number of subjects,

denote the number of observations for

each subject, and represents the

number of predictors. Response variable for

observation in

subject is denoted by

. The

pairs of data that be presented in Table 1, follows

nonparametric regression equation for longitudinal

data as follows:

, (4)

represents a regression curve.

Random error for

observation in

subject is

denoted by

that independent, identically normal

distributed with mean 0, and variance

. In this

case,

approached by Fourier series as

follows:

(5)

Equation (5) is substituted to equation (4), the result

is a nonparametric regression equation for

longitudinal data that be approached by Fourier

series. Based on equation 5,

is a component

that accommodates trend pattern,

denotes

parameter that be estimated for

predictor and

subject. The other component accommodates

seasonal pattern,

is an intercept parameter for

predictor and

subject,

is the parameter of

cosine basis for

predictor,

subject, and

oscillation parameter that be inputted,

is the parameter of sine basis for

predictor,

subject, and oscillation parameter

that be inputted.

An estimator for parameter which be formed as

vector for nonparametric regression equation with

longitudinal data that be approached by Fourier

series can be determined based on Weighted Least

Square (WLS) optimization. The WLS optimization

result given as follows:

The structure of vector is same with linear

estimator for longitudinal data regression in second

part. The matrix structure of

is given as

follows:

where

equals as follows:

.

Vectors that include regression parameters denoted

by

, where

ICMIs 2018 - International Conference on Mathematics and Islam

352

In addition, there is

as a weight matrix. In

this study, two kinds of weight are used based on

Wu and Zhang (2006). There are uniform, and

variance weighted. The structure of based on

uniform weight denoted as follows:

, (6)

where denotes the total of the observations

number for all subjects. An identity matrix for

subject is denoted by

. The structure of based on

uniform weight denoted as follows:

, (7)

with variance matrix

where . The

estimator for curve regression can be determined as

follows:

, (8)

with

.(9)

In regression for longitudinal data based on

Fourier series estimator, the good estimator is

estimator with optimal oscillation parameter, small

MSE value, and big determination coefficient value.

An optimal parameter oscillation can be determined

based on the smallest Generalized Cross Validation

(GCV) value that given as follows:

, (10)

where

and hat matrix is defined with

(Tripena and

Budiantara, 2006).

4 DISCUSSIONS

In this part we concentrate to application of either

linear or Fourier series estimator for longitudinal

data regression. There are four sub sections in this

part. The first sub section we discuss about the

simulation data. The second sub section we discuss

about application for linear estimator. The third sub

section we discuss about application for Fourier

series estimator. The last sub section we compare the

goodness of estimator result based on linear and

Fourier series estimator for longitudinal data.

4.1 About the Data

Consider simulation data that consist of one

response and two predictors. The response data used

represent monthly wind velocity data in 10 cities,

whereas the predictor data used represents the

monthly average temperature in 10 cities, and the

observation period. In this case study there are 10

cities each observed for 12 months. Based on the

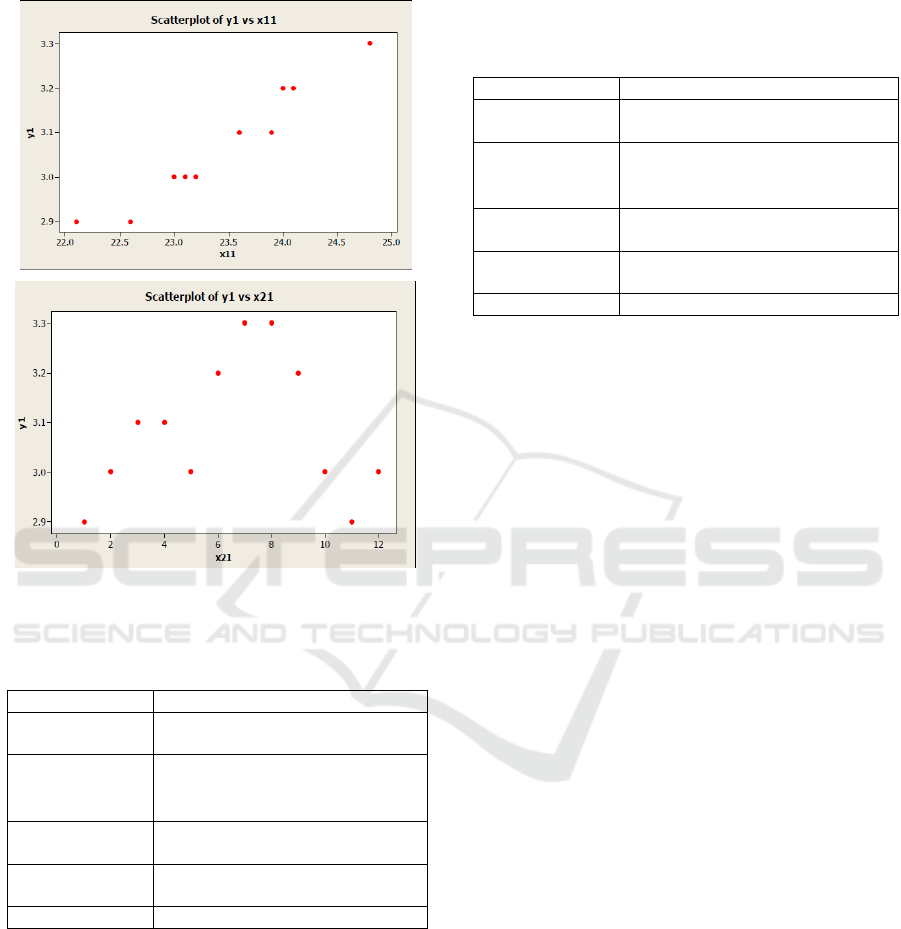

scatter plot between response and predictors, there

are trend – seasonal pattern.

Simulation processes have been constructed

based on the characteristics from equation (5) where

the function included of linear and trigonometric

parts. For this simulation, we concern to modified

data based on Box et al. (1976) with take

parameters. Two parameters represent trend

components and parameters represent seasonal

components that be related to trigonometric

function. This simulation based on an analogue from

the data that be presented on Box et al. (1976).

Figure 1 presents plot of data sample only for first

subject.

Based on Figure 1 it shows that there is a clear

trend pattern between the first predictor variable

with the response variable, and a clear seasonal

pattern between the second predictor variable and

the response variable. The pattern is same for the

other subject.

4.2 Linear Estimator Result

Based on simulation data, first we use two predictor

variables to estimate a response variable. The result

of the first linear regression estimation for

longitudinal data is as follows:

.

Regression for Trend-Seasonal Longitudinal Data Pattern: Linear and Fourier Series Estimator

353

The summary from the series of hypothesis test for

the first estimation is presented in Table 2.

Figure 1: Plot of data sample for first subject.

Table 2: The summary from the series of hypothesis test

for the first estimation.

Test

Result

Augmented

Dickey Fuller

Time series component stationer

Simultaneous

Parameter that be estimated affect

to response variable

simultaneously.

Partial

For second predictor (observation

period) does not significant

Lagrange

Multiplier

Heteroscedasticity is happened.

Jarque Bera

Error distribution is normal

Because of second predictor, observation period,

does not significant based on hypothesis test, so we

eliminate that predictor, and we use a predictor

variable, the first predictor, to estimate a response

variable. The result of the second linear regression

estimation for longitudinal data is as follows:

The summary from the series of hypothesis test for

the second estimation is presented in Table 3 as

follows:

Table 3: The summary from the series of hypothesis test

for the second estimation.

Test

Result

Augmented

Dickey Fuller

Time series component stationer

Simultaneous

Parameter that be estimated affect

to response variable

simultaneously.

Partial

Partially, predictor significant

based on hypothesis test.

Lagrange

Multiplier

Heteroscedasticity is happened.

JarqueBera

Error distribution is normal

The second regression model has a

determination coefficient value equals to 0.87241,

which means that the predictor can explain the

response of 87.241%. The MSE value equals to

0.1106. The determination coefficient value is big,

and the MSE value is small, so it can satisfy the

indicator of goodness estimator. However, the

weakness of the linear estimator for longitudinal

data regression in this study, the wind speed

estimation does not involve period variable, and

there are cases of heteroscedasticity in the error. The

resulting MSE value can be smaller, and the

resulting determination coefficient value can be

greater if using other approaches such as

nonparametric regression for longitudinal data.

4.3 Fourier Series Estimator Result

Furthermore, using the same data, applied to

nonparametric regression for longitudinal data based

on Fourier series estimator. The weighting types that

be used are uniform weighting and variance based

on Wu and Zhang (2006). The criterion of goodness

that be used is the small MSE value, and the large of

determination coefficient value. The optimal

oscillation parameter is determined based on

minimum GCV value. The Fourier series estimator

for nonparametric regression of longitudinal data is

determined based on equation (8). The GCV value is

calculated based on equation (10). The GCV values

based on uniform weighting for each oscillation

parameter are presented in Table 4. The GCV values

based on uniform weighting for each oscillation

parameter are presented in Table 5.

ICMIs 2018 - International Conference on Mathematics and Islam

354

Table 4: GCV value based on uniform weighting for each

oscillation parameters.

Oscillation

Parameter

GCV

Value

Oscillation

Parameter

GCV

Value

1

164,001.8

33

6,317.85

2

145,905.457

34

6,041.737

3

116,867.687

35

5,880.609

4

103,764.306

36

5,910.787

37

7,320.536

Table 5: GCV value based on variance weighting for each

oscillation parameters.

Oscillation

Parameter

GCV

Value

Oscillation

Parameter

GCV

Value

1

19,680,216

33

776,253.6

2

17,508,654.9

34

732,082.2

3

14,024,122.4

35

712,005.9

4

12,451,716.7

36

708,797.7

5

10,386,213.6

37

1,591,221.6

38

1,663,382

It can be seen from Table 4, based on uniform

weighting obtained the minimum GCV is 5,880.609.

That value is achieved by the Fourier series

estimator with an oscillation parameter of 35. Table

5 shows the result that the minimum GCV value is

708,797.7 based on the variance weighting. That

value is achieved by the Fourier series estimator

with an oscillation parameter of 36. However, based

on the comparison of GCV values that be generated

in Table 4 and Table 5, it is seen that the GCV

values for uniform weighting is always smaller than

the GCV values for variance weighting in each

oscillation parameter. In this case, it can be

concluded that the uniform weighting is more

optimal than the variance weighting. However, this

study does not guarantee uniform weighting is

always better than variance weighting.

The selected of Fourier series estimator for

longitudinal data nonparametric regression approach

based on uniform weighting. The estimator has a

small MSE value of 0.00214. The estimator has a

high determination coefficient value of 0.99766

which means that predictors can explain the

response of 99.766%.

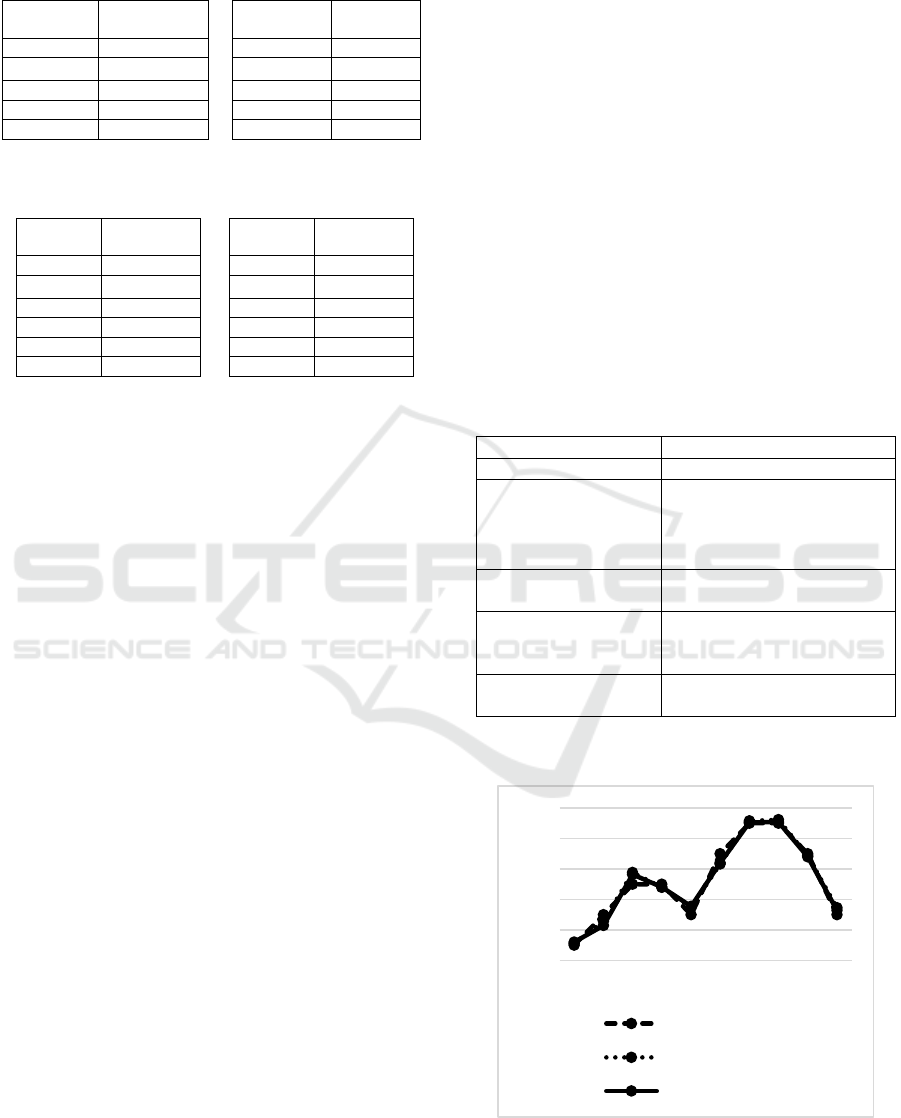

4.4 A Comparison

In this sub section we make comparison about the

result of regression for trend-seasonal data pattern

using linear estimator, the second estimator, and

Fourier series estimator, based on uniform

weighting. The comparison is presented on Table 6.

Based on Table 6, it should be noted that in the

goodness indicator of estimator, the Fourier series

estimator is better than the linear estimator for

regression that be used in case of trend – seasonal

longitudinal data pattern. The MSE for Fourier

series estimator is smaller than linear estimator. The

determination coefficient for Fourier series is greater

than linear estimator. In addition, the information

that be obtained based on the Fourier series

estimator is more complete than the linear estimator,

since the predictor that be contained in the model for

the Fourier series estimator are more complete.

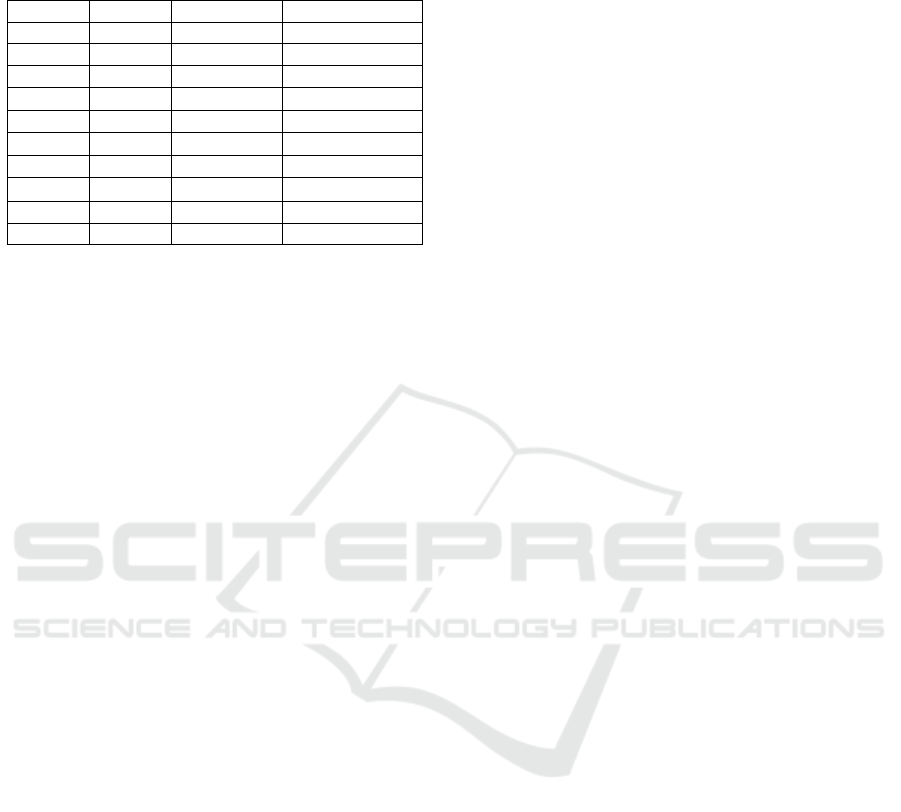

Table 7 presents estimation result for both of

estimator for first subject. Based on Table 7 can be

inferred that estimator value for Fourier series is not

much different from the original data and linear

estimator. The result is supported by plot that be

presented on Figure 2. It can be concluded that

Fourier series estimator can become an alternative

for regression, in this case for longitudinal data.

Table 6: The comparison between linear and Fourier series

estimator in regression for trend-seasonal longitudinal data

pattern.

Linear estimator

Fourier series estimator

Consist of a predictor

Consist of two predictors

Does not fulfill the

assumption of

homogeneity

It does not test the

assumption of homogeneity,

because there has been no

relevant inference study.

MSE value equals to

0.1106

MSE value equals to0.00214

Determination

coefficient value

equals to 87.241%

Determination

coefficient value

equals to99.766%.

Estimator form is

parsimony

Estimator form is more

complex

Figure 2: Plot of the comparison result based on estimator

value from linear and Fourier series estimator and original

data for first subject.

2.85

2.95

3.05

3.15

3.25

3.35

1 2 3 4 5 6 7 8 9 10

y data

y linear

y Fourier series

Regression for Trend-Seasonal Longitudinal Data Pattern: Linear and Fourier Series Estimator

355

Table 7: The comparison based on estimator value from

linear and Fourier series estimator and original data for

first subject.

obs.

y data

y linear

y Fourier series

1

2.9

2.90543

2.910106

2

3

2.97832

2.964548

3

3.1

3.13808

3.132132

4

3.1

3.08934

3.090152

5

3

3.02323

3.027406

6

3.2

3.16562

3.170019

7

3.3

3.308

3.302801

8

3.3

3.31139

3.303712

9

3.2

3.19316

3.189406

10

3

3.0228

3.014211

5 CONCLUSIONS

In modelling longitudinal data with trend - seasonal

pattern with regression analysis, not only linear

estimators are used, but also the Fourier series

estimator can become an alternative. Based on the

discussion, the Fourier series estimator has better

value for the indicator of goodness estimator than

the linear estimator. The MSE for Fourier series

estimator is smaller than linear estimator. The

determination coefficient for Fourier series is greater

than linear estimator. Nevertheless, inference for the

Fourier series estimator still needs to be developed

ACKNOWLEDGEMENTS

The authors offer this paper to some institution that

give support to us, like University of Airlangga in

Surabaya, University of Gadjah Mada in

Yogyakarta, and Lembaga Pengelola Dana

Pendidikan (LPDP), part of The Ministry of Finance

in Indonesia, for scholarship that be received by

corresponding author throughout undergoes doctoral

program. For all the people who contribute to

support the completion of this paper, the authors

give high appreciation.

REFERENCES

Baltagi, B.H., 2005. Econometrics Analysis of Panel Data.

John Wiley and Sons Ltd. Chicester, 3

rd

edition.

Bilodeau, M., 1992. Fourier Smoother and Additive

Models. The Canadian Journal of Statistics, 3,

257-269.

Bloomfield, P., 2000. An Introduction Fourier Analysis

for Time Series. John Wiley and Sons Inc. New York.

Box, G. E. P., Jenkins, G. M., and Reinsel, G. C., 1976.

Time Series Analysis: Forecasting and Control. John

Wiley and Sons, Inc. New York.

Budiantara, I. N., Ratnasari, V., Zain, I., Ratna, M., and

Mardianto, M. F. F., 2015. Modeling of HDI and

PQLI in East Java (Indonesia) using Biresponse

Semiparametric Regression with Fourier Series

Approach. ATABS Journal, 5(4), 21–28.

Greene, W. H., 2012. Econometric Analysis. Prentice Hall

International. New Jersey, 7

th

Edition.

Gujarati, D. N., 2004. Basic Econometrics. The Mc. Grew

Hill Companies. New York, 4

th

Edition.

Hardle, W., 1990. Applied Nonparametric Regression.

Cambridge University Press. New York.

Wu, H., and Zhang, J. T., 2006. Nonparametric

Regression Methods for Longitudinal Data Analysis.

John Wiley and Sons, Inc. New Jersey.

Takezawa, K., 2006. Introduction to Nonparametric

Regression. John Wiley and Sons, Inc. New Jersey.

Tripena, A., and Budiantara, I. N., 2006. Fourier Estimator

in Nonparametric Regression. Proceeding

International Conference on Natural Sciences and

Applied Natural Scienes Ahmad Dahlan University,

Yogyakarta.

Wu, H., and Zhang, J. T., 2006. Nonparametric

Regression Methods for Longitudinal Data Analysis.

John Wiley and Sons, Inc, New Jersey.

ICMIs 2018 - International Conference on Mathematics and Islam

356