Modelling and Prediction of Rice Price in East Java using Approach

to the Multiplicative Time Series Analysis

Sediono and Satya Purnama

Department of Mathematics, Airlangga University, Surabaya, Indonesia 60115

Keywords: Rice Price, Bulog, Modelling, Prediction, Multiplicative Time Series, Arima.

Abstract: About 78% of Indonesia's population take a rice to meet daily carbohydrate intake. However, the fluctuating

of the rice price is one of the problems that should be faced by Bulog in East Java. Therefore, this research

aims to model and predict the rice price in East Java. We use the ARIMA Multiplicative Time Series

analysis to model and predict the rice price. The basis of the Multiplicative time series analysis is that the

factors affecting the pattern of the data set in the past and present tend to change little in the future. Thus,

the time series analysis can assist the researchers to make some decisions. The appropriate model for the

rice price data in East Java is ARIMA seasonal model. These are due to the harvest time. Based on the

smallest MSE, the result shows that the appropriate model for the rice price data in East Java from January

2008 to December 2016 is ARIMA(0,1,1)(0,1,1)12 or IMAISMA. There are no significant differences

between prediction price of rice in East Java for the period of January 2017 to August 2017 and sample

data.

1 INTRODUCTION

About 78% of Indonesia's population take a rice to

fulfill the carbohydrate intake (Prawira, 2013). Rice

becomes a very important food requirement for the

people of Indonesia and according to an article

released by International Rice Research Institute

(IRRI) in 2014 Indonesian’s rice consumption

reaches 125 Kilogram (Kg) per capita per year.

Therefore, the government established a logistics

agency called BULOG (Logistic Business Entity)

which plays an important role in regulating the

supply of rice, rice stock, minimum stock, rice price,

and others. East Java is one of the rice barns and

serves as a national food buffer. East Java is able to

supply more than 17 percent of the national rice and

supply rice in 15 other provinces through Bulog's

national distribution. Nationally, referring to Central

Bureau of Statistics (BPS) data, observed the

average price of rice in September 2014, grinding

rate for medium quality has increased price by 6.18

percent. Thus, the average medium price of rice at

the milling rate of 8,125.93 IDR increased by 1.45

percent. Central Bureau of Statistics (BPS) reported

inflation in September 2014 was quite low at 0.27

percent. Nevertheless, rice commodities returned to

be a contributing factor to inflation with a share of

0.02 percent. Previous research that discussed about

rice forecasting has been done is to predict the price

of rice in Perum BULOG East Java Division using

ARIMA method and double exponential smoothing.

Double Exponential Smoothing is used because the

data has a trend pattern but not seasonal. The results

show that interpretation of time series models is the

best method is ARIMA (Hartinungrum, 2012).

Therefore, in this study, we aim to make a model

forecasting rice price of milling in East Java using

time series analysis. The time series data is a set of

data in the form of numbers obtained within a

certain period of time. Time series data is usually in

the form of annual, semiannual, quarterly, monthly,

weekly, daily, and so on (Bisgaard & Kullahci,

2005; Wei, 2006). According to Santoso (2001) the

basis of time series data analysis is that the factors

that affect the pattern of the data set in the past and

now tend not to change much in the future. Thus, it

can be done time series data analysis to help

researchers in making decisions (Hartinungrum,

2012). Generally, the time series can be grouped into

two large chunks i.e. univariate and multivariate

time series, both seasonal and non-seasonal

(Santoso, 2001).

80

Sediono, . and Purnama, S.

Modelling and Prediction of Rice Price in East Java using Approach to the Multiplicative Time Series Analysis.

DOI: 10.5220/0008517500800084

In Proceedings of the International Conference on Mathematics and Islam (ICMIs 2018), pages 80-84

ISBN: 978-989-758-407-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 METHODOLOGY

Based on the purpose of the research, there are two

steps of analysis are as follows:

I. Modeling the rice price in East Java using

Multiplicative Time series analysis approach can

be done through the following steps:

Step1: Plot the data to see the stationary of mean

and variance. For non-stationary data, the

following process is performed: a) Box-

Cox Transformation: to stability in

variance b) Differencing: to stationary the

data in the mean.

Step 2: Estimation of ARIMA model with the

following steps: a) Plot ACF

(Autocorrelation Function) to identify

Moving Average model b) Plot PACF

(Partial Autocorrelation Function) to

identify the Autoregressive model.

Step 3: Diagnostic checking for phased models

with the following steps: a) Test the

significance of ARIMA model parameters

with t-test b) White noise test with L-Jung

Box test with hypothesis: H

o

: ρ

1

=ρ

2

=…=ρ

k

= 0 vs H

1

: there is at least oneρ

i

≠

0 where i=1,2..,k and c) The residual

normality test with plot is normalized

using Kolmogorov-Smirnov test with

hypothesis: H

o

: the residual is normally

distributed vs H

1

: residual is not normally

distributed. If not obtained the best model

then repeat step 3 to get the best ARIMA

model that has significant parameters,

meet the assumption of white-noise and

normality for residual.

II. Predicting and analyzing rice price in East Java

using Multiplicative time series analysis

approach can be done through the following step:

Step 1: Predict the price of grinding rice in East

Java from January to August 2017 using

the best ARIMA model.

Step 2: Creating plot data forecast and plot data

out sample.

Step 3: Comparing plot of predicted data with

plot of data out sample whether it has the

same trend.

Step 4: Analyzing the results of the prediction.

3 RESULT AND DISCUSSIONS

3.1 Description of Rice Price Data in

East Java from January 2008 to

December 2016

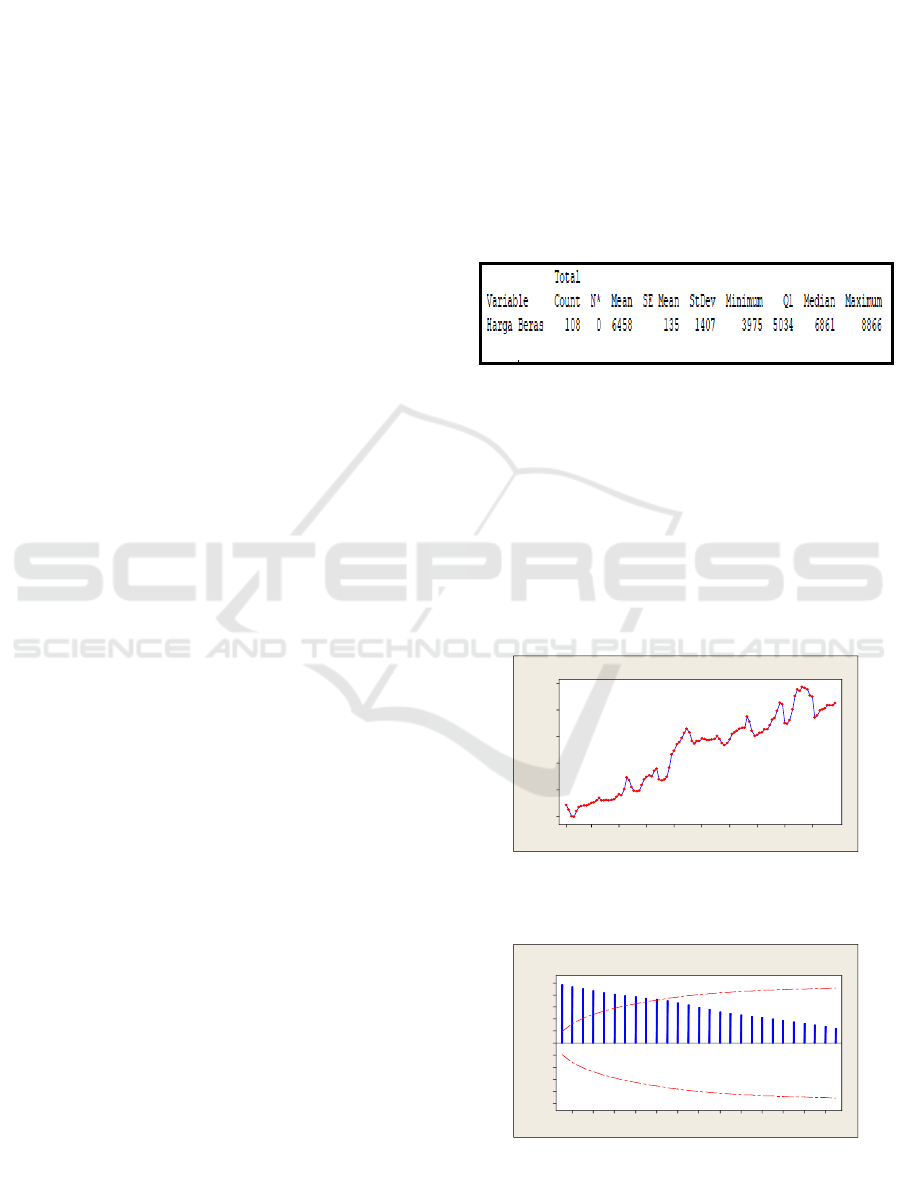

Based on data obtained from Bulog East Java from

January 2008 to December 2016, the average price

of rice in East Java is as follows:

Table 1: Description of Average Rice Price in

East Java from January 2008 – December 2016.

3.2 Modelling Price Rice in East Java

from January 2008 to December

2016 using Multiplicative Time

Series Analysis Approach

In the ARIMA process the first step that must be

done is checking the data stationarity by looking at

the time series plot, ACF plot, PACF plot, and Box-

Cox Plot of the data used.

9988776655443322111

9000

8000

7000

6000

5000

4000

Index

Rice Price

Time Series Plot of Rice Price

Figure 1: Time Series Plot of Rice Price Data in East

Java,January 2008 – December 2016.

2624222018161412108642

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Autocorrelation

Autocorrelation Function for Rice Price

(with 5% significance limits for the autocorrelations)

to

Figure 2: ACF Plot of Rice Price Data in East Java,

January 2008 – December 2016.

Modelling and Prediction of Rice Price in East Java using Approach to the Multiplicative Time Series Analysis

81

2624222018161412108642

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Partial Autocorrelation

Partial Autocorrelation Function for Rice Price

(with 5% significance limits for the partial autocorrelations)

Figure 3:PACF plot of rice price data in East Java,

January 2008 – December 2016.

5.02.50.0-2.5-5.0

220

200

180

160

140

120

Lambda

StDev

Lower CL Upper CL

Limit

Estimate 0.08

Lower CL -0.63

Upp er CL 0.88

Rounded Value 0.00

(using 95.0% confidence)

Lambda

Box-Cox Plot of Rice Price

Figure 4:Transformation Box-Cox of rice price data in

East Java, January 2008 – December 2016.

It can be seen from Figure 1, the data has a rising

trend and in Figure 4 shows that lambda (λ) = 0, so

the data is not stationary in variance, it is necessary

to do Box-Cox transformation so that the data is

stationary in variance.

After that, check whether the data used

statistically in the mean. Stationary in the mean can

be seen by looking at the graph of ACF function.

Here is a picture of an ACF chart pattern from the

Box-Cox transformed rice price data.

2624222018161412108642

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Autocorrelation

Autocorrelation Function for box-cox

(with 5% significance limits for the autocorrelations)

Figure 5: ACF plot of rice price data in East Java in

January 2008 – December 2016 after Box-Cox

Transformation.

From the Figure 5, it can be seen that the ACF value

drops slowly towards 0 which means that the data is

not stationary in the mean, it will be done

differencing.

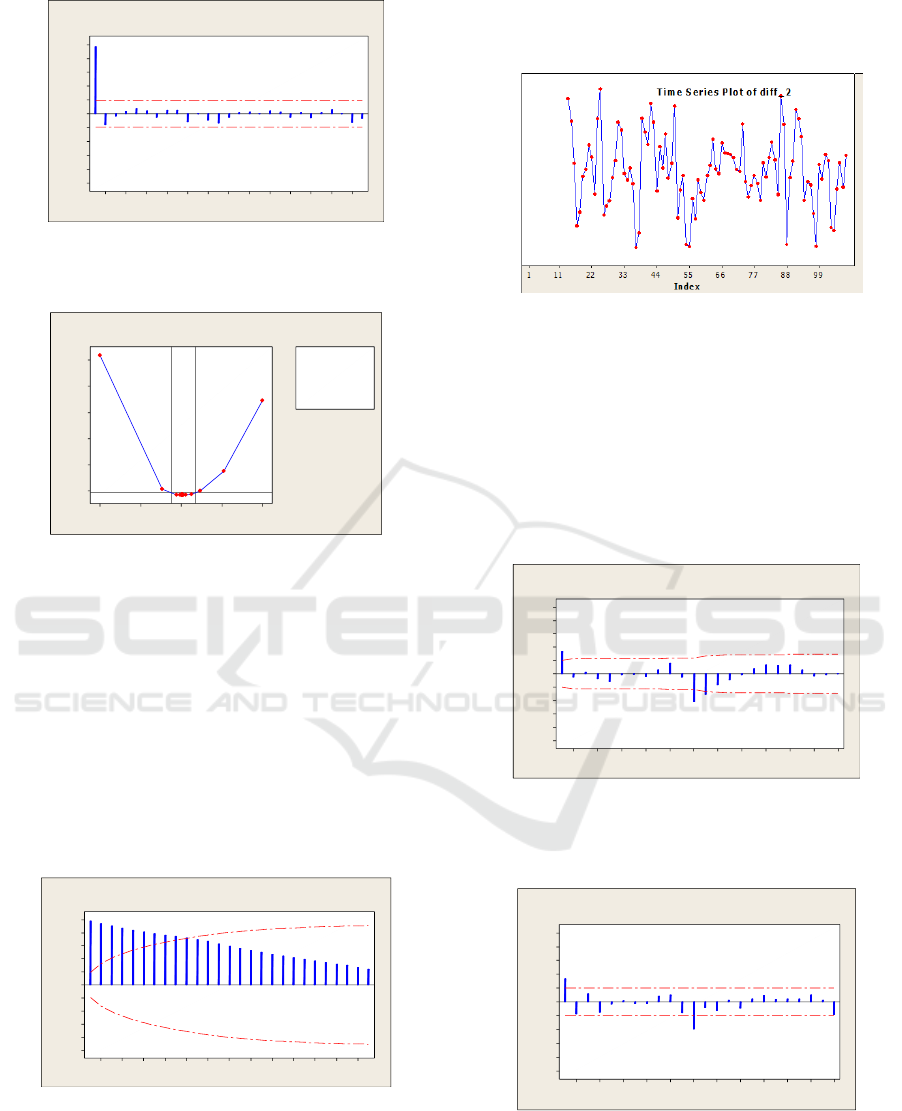

Figure 6: Time series plot of rice price data in East Java in

January 2008 – December 2016 after Box-Cox

transformation and differencing.

Based on Figure 6, it can be concluded that the data

has no trend so that the data is stationary in the mean

or variance and continued with ACF plot to see

whether the data used is statistically in the mean.

Here's an ACF plot for rice price data after Box-Cox

transformation and differencing.

24222018161412108642

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Autocorrelation

Autocorrelation Function for diff_2

(with 5% significance limits for the autocorrelations)

Figure 7: ACF plot of rice price data in East Java in

January 2008 – December 2016 after Box-Cox

transformation and differencing.

24222018161412108642

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Partial Autocorrelation

Partial Autocorrelation Function for diff_2

(with 5% significance limits for the partial autocorrelations)

Figure 8: PACF plot of rice price data in East Java in

January 2008 – December 2016 after Box-Cox

transformation and differencing

ICMIs 2018 - International Conference on Mathematics and Islam

82

It can be seen from Figure 7; the data is

stationary in the mean and there is an indication of a

seasonal pattern because the lag coming out of the

line is 1 and 12. Next PACF plot is done to see the

possible model for testing. Here's the PACF plot for

the price data of rice after Box-Cox transformation

and differencing.

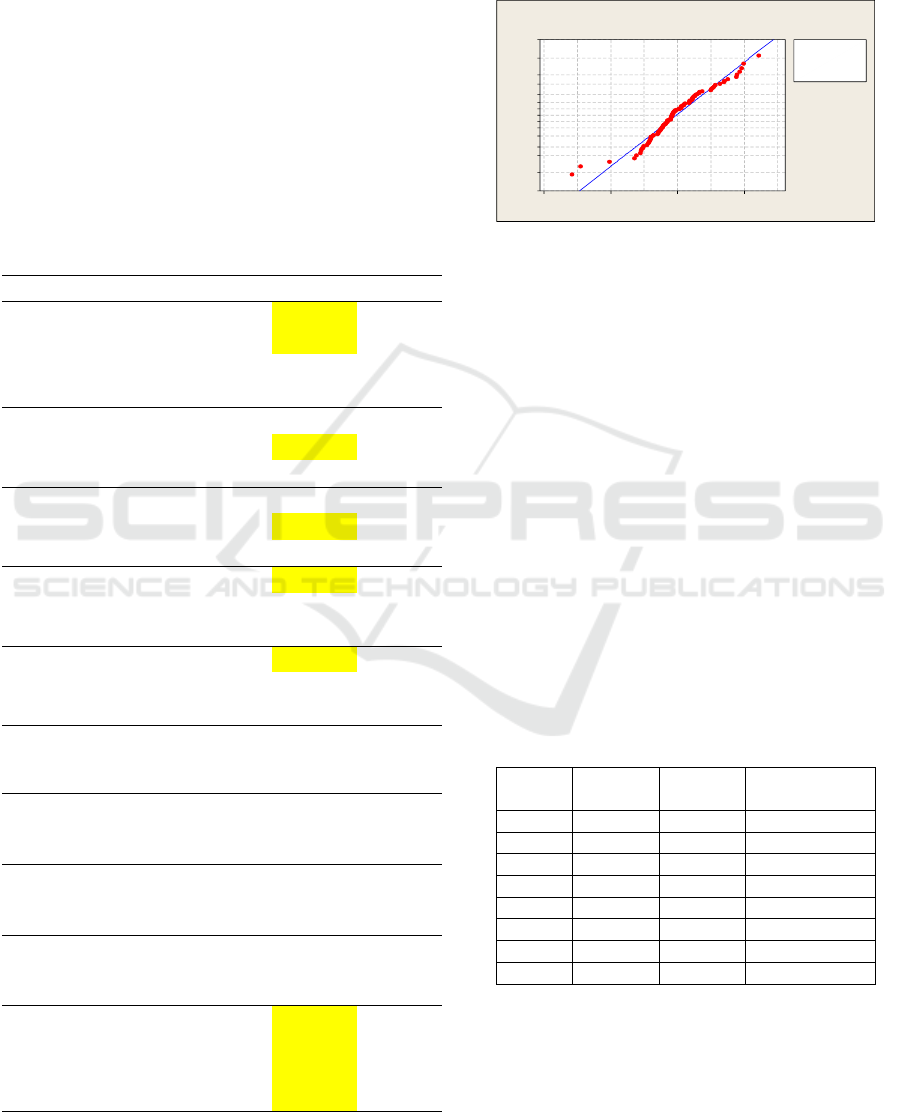

Based on Figures 7 and 8, the possible models

for testing are AR (1), SAR (1), MA (1), SMA (1)

and SMA (2). The requirements for the best model

of white noise, the parameters are marked by p-value

< α, have the smallest MSE, and the residual is

normally distributed. Table 2 is the summary results

for each possible model.

Table 2: ARIMA parameter estimation of rice data.

Model

Par

Estimates

p-value

MSE

ARIMA

(1,1,1)×

(1,1,1)

12

AR 1

-0.3436

0.212

0.0005282

MA 1

0.007

0.961

SAR 1

-0.6237

0.007

SMA 1

0.8369

0.000

ARIMA

(0,1,1) ×

(1,1,1)

12

MA 1

-0.3489

0.001

0.0005424

SAR 1

0.0478

0.757

SMA 1

0.8310

0.000

ARIMA

(1,1,0) ×

(1,1,1)

12

AR 1

0.2049

0.049

0.0005512

SAR 1

0.0270

0.857

SMA 1

0.8269

0.000

ARIMA

(1,1,1) ×

(0,1,1)

12

AR 1

-0.2826

0.265

0.0005489

MA 1

-0.6063

0.004

SMA 1

0.7453

0.000

ARIMA

(1,1,1) ×

(1,1,0)

12

AR 1

-0.2784

0.216

0.0006867

MA 1

-0.6444

0.000

SAR 1

-0.4587

0.000

ARIMA

(0,1,1) ×

(0,1,1)

12

MA 1

-0.3110

0.002

0.0005589

SMA 1

0.7320

0.000

ARIMA

(0,1,1) ×

(1,1,0)

12

MA 1

-0.4207

0.000

0.0006943

SAR 1

-0.4448

0.000

ARIMA

(1,1,0) ×

(0,1,1)

12

AR 1

0.2552

0.014

0.0005769

SMA 1

0.7229

0.000

ARIMA

(1,1,0) ×

(1,1,0)

12

AR 1

0.2725

0.008

0.0007225

SAR 1

-0.4582

0.000

ARIMA

(1,1,0) ×

(1,1,2)

12

AR 1

0.1989

0.058

0.0005410

SAR 1

-0.5167

0.887

SMA 1

0.3717

0.918

SMA 2

0.4919

0.880

Based on the smallest MSE, i.e. 0.0005589, the

appropriate model for the rice price data at the

milling level in East Java is ARIMA(0,1,1)(0,1,1)

12

or IMAISMA.

0.050.00-0.05-0.10

99.9

99

95

90

80

70

60

50

40

30

20

10

5

1

0.1

RESI1

Percent

Mean -0.0008984

StDev 0.02350

N 95

KS 0.089

P-Value 0.063

Probability Plot of RESI1

Normal

Figure 9: Normality test of the best model residual.

Based on Figure 9, the p-value for the normality

test is 0.063, this value is greater than α = 0.05,

which means that the model has met the normality

assumption.

3.3 Predicting Rice Price of Milling

Rate in East Java based on

ARIMA(0,1,1)(0,1,1)

12

or

IMAISMA model

Before to predicting the time series data, a

validation test is performed to ensure that the

forecast result of the data used is close to the actual

value, by comparing the actual data of the grinding

rice price in East Java in January to August 2017.

More details can be is described in table 3.

Table 3: Model validation results for January to August

2017.

Period

ln(Z

t

)

Z

t

Data Out

Sample

109

9,04150

8446,44

8360

110

9,02861

8338,26

8157

111

9,00689

8159,11

7812

112

8,95477

7744,75

7850

113

8,96342

7812,03

7965

114

8,98259

7963,23

7960

115

9,00685

8158,78

8078

116

9,02734

8327,68

8150

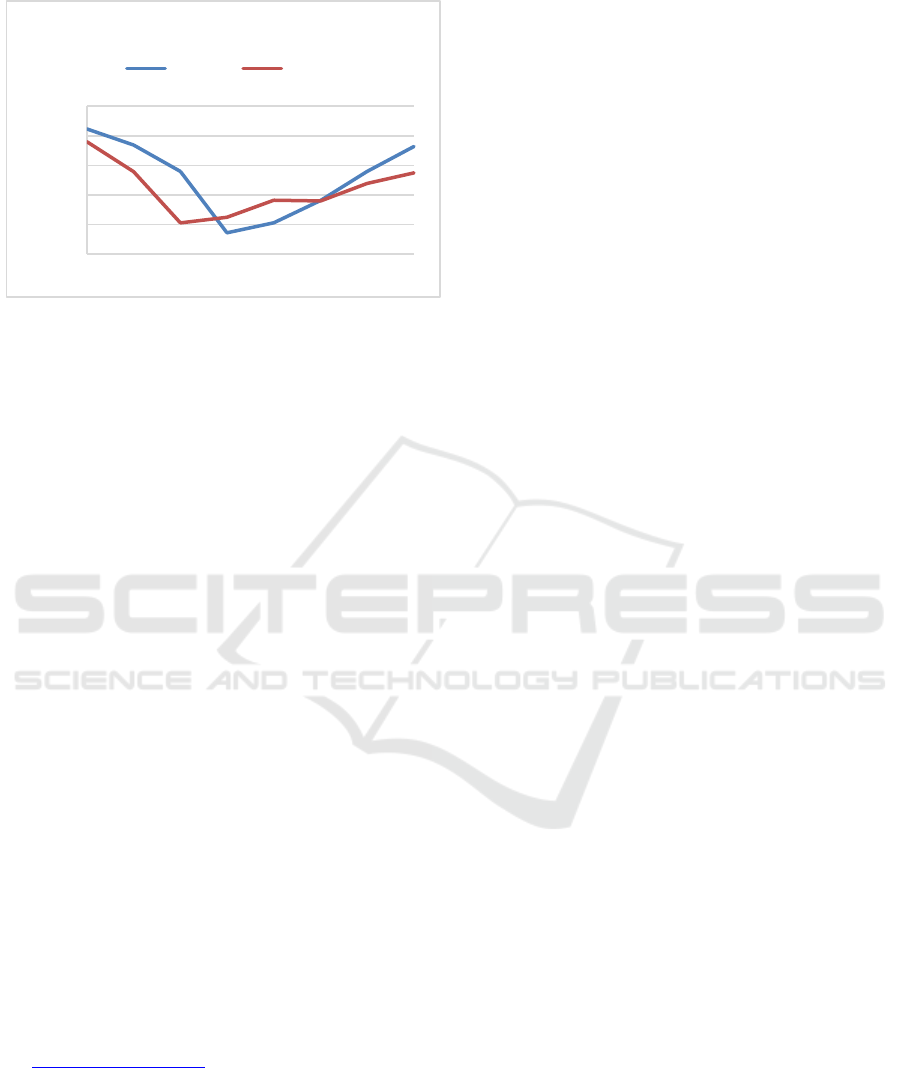

Based on table 3 and Figure 10 it can be seen that

the validity level of model forecasting trend is quite

appropriate. The forecast of the rice price of milling

in East Java for the period of January 2017 to

August 2017 is close to data sample.

Modelling and Prediction of Rice Price in East Java using Approach to the Multiplicative Time Series Analysis

83

Figure 10: Plot Comparison of Forecasting Data with Data

out sample.

4 CONCLUSIONS

Based on the results of the discussion, it can be

concluded:

1) The average price of grinding rice in East Java

from January 2008 to December 2016 is

6,458.00 IDR. The lowest rice price is 3.975.00

IDR, which occurred in April 2008, while the

highest rice price reached 8,866.00 IDR which

occurred in November 2015.

2) Based on the smallest MSE, the appropriate

model for rice price data of grinding rate in East

Java period January 2008 until December 2016 is

ARIMA(0,1,1)(0,1,1)

12

or IMAISMA.

REFERENCES

Bisgaard, S. and Kullahci, M., 2005. Interpretation

of time series models. Qual.Eng. 17(4):653–658.

Hartiningrum, W. M., 2012. Forecast to rice prices

in BULOG Divre East Java. Final Report. ITS.

Surabaya. Indonesia.

Prawira, A. E., 2013. Indonesians too Overrated if

You Eat Rice.

http://health.coverage6.com/read/521271/.

Indonesia.

Santoso, Singgih, 2001. Forecasting Methods of

Today’s Business with MINITAB and SPSS.

Jakarta: PT. Elex Media Komputindo.

Wei. W. W. S., 2006. Time series analysis univatiate

and mulivariate method 2

nd

Edition. Pearson

Addison Wesley,New York.

7600.00

7800.00

8000.00

8200.00

8400.00

8600.00

1 3 5 7

T I M E S E R I E S P L O T

Forecast Actual

ICMIs 2018 - International Conference on Mathematics and Islam

84