Financial Crisis Model in Indonesia Based on Indonesia Composite

Index (ICI) and Dollar (US) Exchange Rates to Rupiah Indicators

Sugiyanto, Isnandar Slamet, Sri Subanti, Etik Zukhronah and Winita Sulandari

Study Program of Statistics, Universitas Sebelas Maret Surakarta, Indonesia

Keywords: Crisis, ICI, Dollar Exchange Rates to Rupiah, SWARCH.

Abstract: An open economy is a new order of the world economic system that has provided space for all countries to

interact and have integrity with one another. The economy facilitates the entry of foreign investors, but it also

impacts the threat of financial crisis that is transmitted through increasingly open trade relations. The

movement of the Indonesia Composite Index (ICI) and the dollar (US) exchange rates to rupiah are used to

compile a model of the financial crisis in Indonesia. Crisis occurs due to high volatility and changing

conditions. Volatility models are used to explain volatility, while changes in conditions can be explained

through Markov switching. Therefore combining the volatility and Markov switching models is the best

solution to explain the crisis. The goal of this research is to find the model of the financial crisis in Indonesia

based on ICI and dollar (US) exchange rates to rupiah. The data that users are monthly data from 1990 to the

2017 year. The result showed that for ICI indicator the combining model is MS(2)-ARCH(1) or

SWARCH(2,1) model with a conditional average of AR (2). While based on the dollar (US) exchange rates

to rupiah indicator, SWARCH (3.3) model with conditional average of AR(1).

1 INTRODUCTION

The open economy system has presented challenges

to developing countries such as Indonesia, with the

integration of the country's financial sector. But on

the other hand, it can facilitate the spread of crises

between countries, as happened in 1997 when the

value of the Thailand currency fell sharply, and the

impact spread to various countries. The crisis is a

disruption of financial system stability in the

economic order. To maintain this stability, it is

necessary to monitor the occurrence of crisis, so that

prevention and crisis recovery efforts can be carried

out as early as possible.

Banking and capital markets in Indonesia become

indicators of financial systems that continue to

increase every year. This has caused the development

of capital market developments and the growth of the

banking sector because transactions in the capital

market are carried out through the banking system.

The higher the investment, the greater the savings and

the opportunity to provide funds which will

ultimately accelerate economic growth. The

Indonesia Composite Index (ICI) and the dollar

exchange rates to rupiah have a vulnerability to

economic stability shocks, this causes these indicators

to fluctuate and condition changes. In anticipation,

Hamilton and Susmel (1994) introduced the

Autoregressive Conditional Heteroscedasticity

Markov Switching (SWARCH) model which is a

combination of volatility and Markov switching

models as an alternative time series data modeling by

observing fluctuations and changes in conditions in

the data. Sugiyanto et al. (2017) through the

SWARCH model has shown that the bank deposits,

real exchange rates and terms of trade indicators can

explain the crisis of 1997, 1998 and 2008. Sugiyanto

et al. (2018) through the SWARCH model has shown

that the output real, domestic credit per GDP, and ICI

indicators can explain the crisis of 1997, 1998 and

2008. In this study a combination of volatility and

Markov switching models was formed which

corresponded to the ICI indicator and the dollar

exchange rates to rupiah to detect the financial crisis

in Indonesia.

46

Sugiyanto, ., Slamet, I., Zukhronah, E., Subanti, S. and Sulandari, W.

Financial Crisis Model in Indonesia Based on Indonesia Composite Index (ICI) and Dollar (US) Exchange Rates to Rupiah Indicators.

DOI: 10.5220/0008517000460051

In Proceedings of the International Conference on Mathematics and Islam (ICMIs 2018), pages 46-51

ISBN: 978-989-758-407-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

2.1 Autoregressive Moving Average

(ARMA) Model

The ARMA (p, q) model has a general form

(1)

where r

t

is the transformation value in the t-period,

0

is a constant,

p

is the parameter for AR,

is the

parameter for MA and

is the T-period of residual

of ARMA (p, q) model (Tsay, 2002).

2.2 Autoregressive Conditional

Heterocedasticity (ARCH) Model

ARCH (m) model can be written as

for

and

,

(2)

where

is the standardized residual volatility model,

ψ

t-1

is the set of all period information (t-1)

th

, m is the

order of the ARCH model, α

0

is the constant of ARCH

model, α

i

is the parameter of ARCH model, and σ

t

2

is

T-period residual variance (Tsay, 2002).

2.3 Generalized Autoregressive

Conditional Heterocedasticity

(GARCH)Model

If the order of the ARCH model is too high, then the

GARCH (m, s) model is used in the form

for

and

where β

j

is the parameter of GARCH model (Tsay,

2002).

2.4 Exponential Generalized

Autoregressive Conditional

Heterocedasticity (EGARCH)

Model

If there is a leverage effect in the GARCH model,

EGARCH (m, s) model is used in the form

for

and

,

where γ

i

is the EGARCH model parameter (Henry,

2007).

2.5 SWARCH Model

The SWARCH model according to Hamilton and

Susmel (1994), can be written as

,

(3)

where μ

st

is a conditional average in a state and σ

t,st

2

is the residual variance in a t-period state.

2.6 Smoothed Probability

In the Markov chain, the next state only depends on

the current state. The Markov chain process can be

written as

where p

ij

is the transition probability that the process

of being in state i at time t will go to state j at time t+1

or it can be said that the state undergoes a transition

from state i to state j. The one-step transition

probability matrix for infinite states is given as

where p

ij

≥ 0 for i, j = 1,2, ... and

∞

for i

= 1,2, ….

According to Kim and Nelson (1999), the value

of smoothed probability

can be formulated as

where

is a collection of all information in the

observation data until the T-time.

Financial Crisis Model in Indonesia Based on Indonesia Composite Index (ICI) and Dollar (US) Exchange Rates to Rupiah Indicators

47

3 METHODS

This study is a case study using the ICI monthly data

and the dollar exchange rates to rupiah taken from

1990 to 2017. The data used was obtained from Bank

Indonesia and the Central Statistics Agency.

Calculation and estimation of the model is done with

software R. The following steps are taken to achieve

the research objectives on each indicator:

1. Making a data plot then perform Augmented-

Dickey Fuller (ADF) test to determine the

stationary of data. If it is not stationary, then the

data is transformed.

2. Plotting the autocorrelation function (ACF) and

the partial autocorrelation function (PACF) of the

transformation data to form the ARMA(p,q)

model, then testing of independency, normality,

and heteroscedasticity of the residual ARMA

models using the Ljung-Box test, Kolmogorov-

Smirnov test, and the Lagrange Multiplier (LM)

test respectively.

3. Establish and conduct diagnostic tests on the best

model of volatility.

4. Clustering the residual value of the ARMA model.

5. Form a combination of volatility and Markov

switching models based on the number of clusters.

6. Calculating the value of smoothed probability to

detect the occurrence of a crisis in the past.

4 RESULTS AND DISCUSSION

4.1 Plot of Data

Plot of ICI indicator and dollar (US) exchange

rates to rupiah indicators can be seen in Figure 1.

Figure 1 shows that the data fluctuates from time to

time so that it is indicated that the data is not

stationary. Then the ADF test was conducted to see

the stationary data. Based on ADF testing, the

probability values are 0.6934 and 0.2793 for the ICI

and the dollar exchange rates to rupiah indicators is

greater than α = 0.05, which means that the data is not

stationary.

According to Tsay (2002), economic indicators

tend to fluctuate from time to time so transformation

needs to be done. The most suitable transformation

for the ICI indicator and the dollar exchange rates to

rupiah is the log return. Then the ADF was tested on

the transformation data and obtained the probability

values of 0.01 and 0.01 respectively, so it was

concluded that the ICI and the dollar exchange rates

to rupiah indicators of transformed data were

stationary.

Figure 1: (a) ICI Data (b) Dollar exchange rates to rupiah

Data

4.2 Form of ARMA(p,q) Model

The ARMA (p, q) model can be identified using ACF

and PACF plots from the transformation data of each

indicator. Based on the ICI indicator, using equation

(1) it was obtained the best model was ARMA (1, 0)

and written as

.

While the best model for the dollar exchange rates

indicator was ARMA (2, 0), which can be written as

Furthermore, the feasibility test of the ARMA

model includes the independence test, normality test

and heteroscedasticity test on the residues of the

ARMA model for each indicator. Heteroscedasticity

effect test can be done using the Lagrange Multiplier

(LM) test, and it was obtained the probability values

for ICI and dollar exchange rates to rupiah indicators

of 0.0000 and 0.0000 respectively so that it can be

concluded that there was an effect of

heteroscedasticity on the residual of ARMA model of

each indicator.

4.3 Form of Volatility Models

The estimation results for the ICI indicator using

equation (2) are the best volatility model, ARCH(1),

can be written as

ICMIs 2018 - International Conference on Mathematics and Islam

48

For the dollar exchange rates to rupiah indicator, the

best volatility model is ARCH (3), that can be written

as

Furthermore, diagnostic tests were carried out on

standardized residues of ARCH(1) model for ICI and

dollar exchange rates to rupiah indicators. Based on

Ljung-Box statistics, the probability value were 0.892

and 0.9936 which means that there was no residual

autocorrelation. Based on LM test, it was obtained the

probability of 0.07197 and 0.9936 respectively which

means that there was no effect of heteroscedasticity

in the residue. Based on the Kolmogorov-Smirnov

test, probability is 0.6 and 0.2222 which means that

the residue is normally distributed. Based on

diagnostic tests that have been carried out on the two

indicators, it can be concluded that the ARCH (1)

model is good to use.

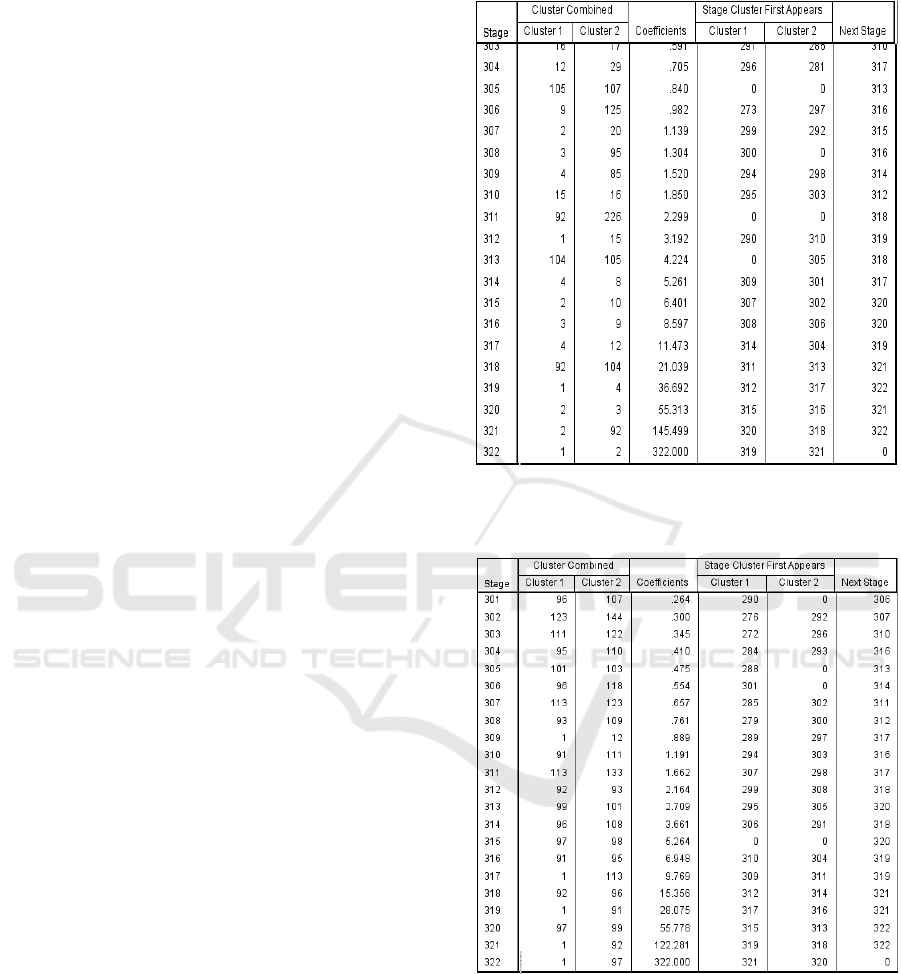

4.4 Cluster Analysis

Cluster analysis uses the ward hierarchy method to

determine the number of cluster of volatility

clustering that will be used in the Markov switching

model and in determining the value of smoothed

probability. The result of cluster analysis of ICI

indicator can be seen in Table 1.

In column 1 Table 1, it can be seen that at stage

320

th

has coefficient 55.313 (column 4) and at stage

321

st

has 145.499. The increase of coefficient is not

drastic, but the first drastic surge of 176,501 occur in

the 321

st

and 322

nd

stages, from 145,499 to 322 this

occurred when the agglomeration process produced

two clusters for the ICI. The result of cluster analysis

of dollar exchange rates to rupiah indicator can be

seen in Table 2.

In column 1 Table 2, it can be seen that at stage

320

th

has coefficient 55.778 (column 4) and at stage

321

st

has 122.281 where this is the first drastic surge

of the coefficient that is 66,503. It occurred when the

agglomeration process produces three clusters.

Furthermore, the formation of SWARCH models

with 2 states for ICI indicators and 3 states for dollar

exchange rates indicators.

Table 1: Results of cluster analysis of ICI.

Table 2: Results of cluster analysis of dollar exchange rates

to rupiah.

4.5 Form of Markov Switching and

Volatility Models

In the Markov model, switching condition changes

are considered as an unobservable random variable

called state. To model changes in these conditions can

be formed transition probability matrix. The

Financial Crisis Model in Indonesia Based on Indonesia Composite Index (ICI) and Dollar (US) Exchange Rates to Rupiah Indicators

49

conditions intended in this study are conditions of low

and high volatility. The transition probability matrix

for the ICI indicator is written as follows

Based on the P transition probability matrix, the

probability value to survive in low volatility is

0.98389655 and high volatility is 0.94222905. While

the probability transition matrix for the dollar

exchange rates to rupiah indicator is written as

follows

Based on the Q transition probability matrix

obtained the probability value to withstand low

volatility of 0.95802949, the probability value to

withstand moderate volatility of 0.980435796 and the

probability value to withstand high volatility of

0.976919050.

The best combination of volatility and Markov

switching models for ICI indicators using equation

(3) is SWARCH (2, 1) with conditional averages and

conditional variances for each state are

and

The best model for the dollar exchange rates to

rupiah indicator is SWARCH (3, 3) with conditional

averages and conditional variances for each state

respectively

and

4.6 Determination of Crisis

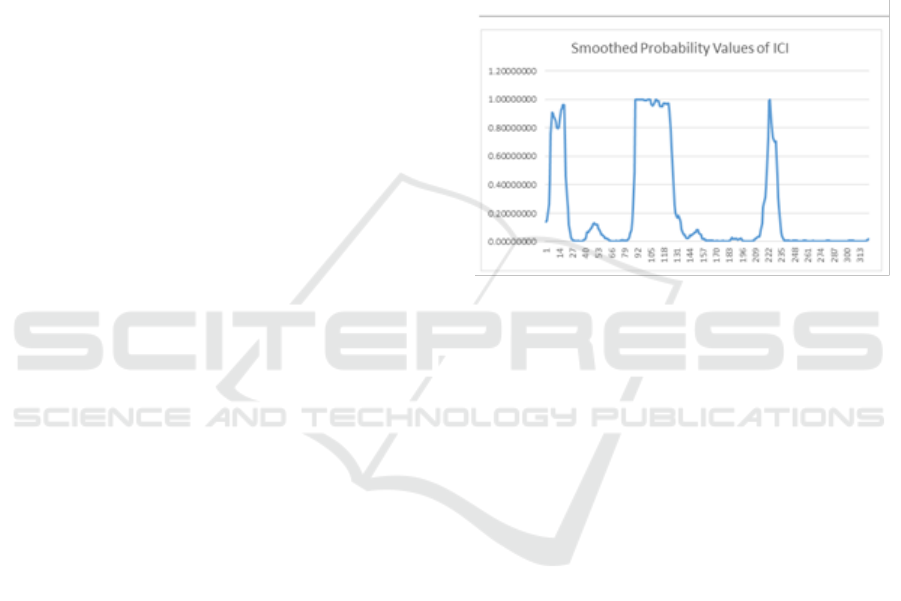

Figure 2 shows the plot of smoothed probability from

the SWARCH (2,1) model for the ICI indicator that

calculated using equation (4).

If the value of smoothed probability is less than

0.4708 so the condition is stable, while the crisis is

when the smoothed probability value is more than

0.4708. From figure 2, it can be seen that in March to

June 1990, August 1990 to October 1991, July 1997

to August 2000, and July 2008 to April 2009 were

detected to be a crisis.

Figure 2: Smoothed probability for ICI.

Figure 2 shows the value of the smoothed probability

of the dollar (US) exchange rates to rupiah. The crisis

occurs when the value of the smoothed probability is

greater than 0.9024 and prone to the crisis if the value

of smoothed probability is between 0.4086 and

0.9024, while the state is stable if the value of

smoothed probability is less than 0.4086. Based on

this limit, the crisis was detected in July 1997 to

October 2000, March 2001 to September 2001, and

October 2008 to April 2009.

5 CONCLUSIONS

Based on the results and discussion, it was obtained

findings as follows:

1. The ICI and dollar exchange rates to rupiah

indicators can be modeled by SWARCH (2,1) and

SWARCH (3, 3), and can capture the crisis that

occurred in 1997, 1998 and 2008.

2. Indicator of the dollar (US) exchange rates to

rupiah is more sensitive than ICI to explain crisis

conditions in accordance with facts.

ICMIs 2018 - International Conference on Mathematics and Islam

50

REFERENCES

Hamilton, J. D. and Susmel, R., 1994. Autoregressive

conditional heteroscedasticity and changes in regime.

Journal of Econometrics, vol. 64, pp. 307 – 333.

Henry, O. T., 2007. Between the rock and a hard place:

regime switching in the relationship between short-term

interest rates and equity returns in the UK. Research

Paper Number 1019, Department of Economics, the

University of Melbourne.

Kim, C. J. and Nelson, C. R., 1999. State space models with

regime switching, classical, and Gibs sampling

approaches with applications. MIT Press.

Sugiyanto, Zukhronah, E. and Aini, N. A., 2017. Models

for financial crisis detection in Indonesia based on bank

deposits, real exchange rates and terms of trade

indicators. Journal of Physics: Conf. Series

943(012024), pp. 1 – 6.

Sugiyanto, Zukhronah, E. and Setianingrum, M., 2018. The

detection of financial crisis using combination of

volatility and Markov switching models based on real

output, domestic credit per GDP, and ICI indicators.

Journal of Physics: Conf. Series 1025(012115), pp.1 –

6.

Tsay, R.S., 2002. Analysis of financial time series. John

Wiley and Sons, Canada.

Financial Crisis Model in Indonesia Based on Indonesia Composite Index (ICI) and Dollar (US) Exchange Rates to Rupiah Indicators

51