The Effect of Company Characteristics and Corporate Governance

on Corporate Social Responsibility Disclosure:

A Study on SRI-KEHATI Index Listed on Indonesia Stock Exchange

Dwita Puji Lestari

1

and Tita Deitiana

2

1

Trisakti School of Management, Siliwangi No 74, Rawa Lumbu, Bekasi, Indonesia

2

Trisakti School of Management, Kyai Tapa No 20 Grogol, Jakarta, Indonesia

Keywords: Corporate Social, Responsibility, Disclosure, Firm Size, Profitability, Leverage, Board of Commissioner,

Industry Type, Managerial Ownership, SRI-KEHATI Index.

Abstract: The purpose of this research is to empirically test and analyse the influence of firm size, profitability,

leverage, board of commissioner, industry type, and managerial ownership on corporate social responsibility

disclosure, and also to compare and to improve the results of prior researches. The objects used in the

research are companies listed in SRI-KEHATI index in Indonesia Stock Exchange over the 7-year period

2010-2016. The purposive sampling is used to obtain 8 companies listed in SRI-KEHATI index that meet

the criteria, and they are analysed using descriptive statistics and multiple linear regression to test the

hypotheses. The research finding can be summarized as follows; firm size, profitability, leverage, and board

of commissioner influence corporate social responsibility disclosure while industry type and managerial

ownership do not.

1 INTRODUCTION

In maintaining its existence, the company cannot be

separated from the community as its external

environment where there is a reciprocal relationship

between the company and the people who give and

need each other. The contribution and harmonization

of both will determine the success of nation

building. The company's commitment to contribute

to national development by paying attention to

financial or economic, social and environmental

aspects (triple bottom line) is the main issue of the

concept of corporate social responsibility (CSR).

Within the scope of Indonesia, Indonesian

Financial Accounting Standards do not require

companies to disclose social information which

results in the practice that company just voluntarily

disclose the information. Implicitly, the Indonesian

Accounting Standards (IAI) in the Statement of

Financial Accounting Standards (PSAK) Number 1

(revised 2009) paragraph 12 suggests that

responsibility for social problems should be

disclosed. In line with these developments, Law no.

40 of 2007 Article 74 concerning Limited Liability

Companies is issued, and it requires companies

whose fields of business are in the field or related to

the natural resource field to carry out the reporting

of social and environmental responsibilities. In

addition to Law no. 25 Year 2007 on Capital

Investment Article 15, it requires every investor to

carry out corporate social responsibility and report

it. Failing to do so will result in strict sanctions.

From the economic aspect, company must be

oriented towards profit whereas from the social

aspect, company must contribute directly to the

community. If corporate social responsibility is

properly designed and applied, it will be a useful

long-term social investment, both to enhance the

company's image as business strategies and to

control of corporate social risk. The disclosure of

CSR carried out by most companies in Indonesia is a

motivation to increase public confidence of efforts

to improve the environment around the company.

This research is a replication of the previous

research by Subiantoro and Mildawati, 2015. This

study does not examine the entire industry, but only

on companies listed in the SRI-KEHATI Index as a

population. The SRI-KEHATI (Sustainable

Responsible Investment-KEHATI) Index is an index

formed on the results of a cooperation between

Indonesia Stock Exchange (BEI) and the Indonesian

282

Lestari, D. and Deitiana, T.

The Effect of Company Characteristics and Cor porate Governance on Corporate Social Responsibility Disclosure: A Study on SRI-KEHATI Index Listed on Indonesia Stock Exchange.

DOI: 10.5220/0008491902820288

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 282-288

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Biodiversity Foundation (KEHATI) engaged in

conservation and biological use to create an

alternative investment product that is an index or

reflection of stock price movements. This served as

guidance for investors in which the index contains

shares of issuers that have considerations meeting

the various criteria leading to companies which have

been practicing CSR well. KEHATI has picked 25

selected companies considered eligible to meet SRI-

KEHATI Index criteria. The presence of those

companies will be evaluated twice a year, in April

and October, and the result will be publicized by

BEI.

Corporate Social Responsibility Disclosure

(CSRD) in this study is measured by an index based

on CSRD items in the third generation Global

Reporting Intiatives (GRI) standard (3) or GRI G.3.

These are used as guidelines in compiling corporate

sustainability reports in Indonesia, and it has been

regulated under Bapepam Regulation No. VIII.G.2

concerning annual reports suitable to be applied with

business conditions in Indonesia. GRI's

sustainability reporting guidelines provide reporting

principles, standard disclosures, and implementation

guidelines for the preparation of sustainability

reports by organizations, regardless of size, sector,

or location. The Code also provides international

references for all parties involved in disclosing the

governance approach and the performance, impact

of the organization's environmental, social and

economic. This guide is useful for preparing various

types of documents that require such disclosures.

2 LITERATURE REVIEW

2.1 Corporate Social Responsibility

The agency theory suggests the relationship between

the principal (owner) and the agent (manager) in

terms of corporate management where the principal

is an entity delegating the authority to manage the

company to the agent

(management). Agency theory

defines the contractual relationship between the

party delegating a

particular decision (principal/

shareholder) and the party receiving the delegation

(agent/management) (Wulansari, 2015).

According to Gitman dan Zutter (2015, 68)

“Agency problems is problems that arise when

managers place personal goals ahead of the goals of

shareholders”. The existence of this agency

problem arises when managers put personal interests

ahead of the interests of shareholders. The costs

arising from the agency problem are then called the

Agency Cost.

Theory of Legitimacy according to Mousa and

Hassan (2015) is “Legitimacy theory is one of the

most discussed theories to explain the phenomenon

of voluntary social and environmental disclosures in

corporate communication.”Consistent with the

theory of legitimacy, companies seek to obtain,

maintain or improve their legitimacy by using social

and environmental reporting.

Corporate social responsibility stated in Law no.

40 of 2007 regarding Limited Liability Company

article 1 point 3 mentioned that corporate social

responsibility is the company's commitment to

participate in sustainable economic development in

order to improve the quality of life and become a

useful environment for the company itself, local

communities, and surrounding communities.

Disclosure is the expenditure of information

intended for interested parties. The purpose of

disclosure of CSR is that companies can convey

social responsibility that has been implemented by

the company in a certain period. The CSR

application can be disclosed by the company in the

company's annual report.

2.2 Firm Size on Corporate Social

Responsibility Disclosure

According to Hartono (2013, 392), "The size of

assets (asset size) is measured as the total logarithm

of assets. Asset size is used as a proxy for the size of

the company." According to Subiantoro and

Mildawati (2015) "Firm size is a scale that serves to

classify the size of business entities". Furthermore

Purwanto (2011) said "The size of a company is the

size or the extent of the company in carrying out its

operation."

H1: There is an influence of firm size on corporate

social responsibility disclosure

2.3 Profitability on Corporate Social

Responsibility Disclosure

According to Weygant et al., (2015, 723),

"Profitability ratios measure income or operating

success of a company

for a given period of time".

Meanwhile, according to Brigham et al (2014, 111)

"Profitability reflect the net result of a number of

policies and decisions."

If the company has a high ROA, the company

will have sufficient funds to be allocated to social

and environmental activities so that the level of

The Effect of Company Characteristics and Corporate Governance on Corporate Social Responsibility Disclosure: A Study on SRI-KEHATI

Index Listed on Indonesia Stock Exchange

283

disclosure of social responsibility by the company

will be higher.

H2: There is an influence of profitability on

corporate social responsibility disclosure

2.4 Leverage on Corporate Social

Responsibility Disclosure

According to Saputra (2016), "Leverage is a tool

owned by stakeholders to know the ability of

companies in managing the source of funds,

especially debt and capital owned by the company."

Leverage reflects the financial risks of the company

which describes the company's capital structure and

also able to know the risk of uncollectible debt

(Wiyuda and Pramono, 2017).

If the company provides more comprehensive

information such as disclosure of corporate social

responsibility, it will require higher agency costs,

then companies with high leverage will reduce

information about the company as not to be the

spotlight of creditors or outside parties

H3: There is an influence of leverage on corporate

social responsibility disclosure

2.5 Board of Commissioner on

Corporate Social Responsibility

Disclosure

According to Subiantoro and Mildawati (2015):

"Board of Commissioners is a shareholder

representative within a company incorporated as a

limited liability company that serves to oversee the

management of the company carried out by

management". According to the Forum for

Corporate Governance in Indonesia (FCGI, 2001)

"Board of Commissioners – the bottom line of

corporate governance – is assigned to ensure the

implementation of corporate strategy, overseeing

management in managing the company, and

requiring accountability."

Thus, the size of the board of commissioners is

how many people are serving as the board of

commissioners where the main task is to exercise

control and oversight functions over the

management of the company, so the objective of the

company to gain legitimacy from stakeholders by

disclosing social responsibility will be obtained

because the existence of the board of commissioners

will provide control and supervision, especially in

the practice of corporate social responsibility.

H4: There is an influence of the size of the board of

commissioners on corporate social responsibility

disclosure.

2.6 Industry Type on Corporate Social

Responsibility Disclosure

According to Wiyuda and Pramono (2017) "Type of

industry is characteristic owned by companies

related to business, business risks, employees

owned, and environment." Industry type is measured

by differentiating high-profile and low-profile

industries. Thus, the type of industry is a

characteristic of the company in carrying out its

operational activities. High-profile companies

usually disclose corporate social responsibility more

widely than low-profile companies.

H5: There is an influence of industry type on

corporate social responsibility disclosure

2.7 Managerial Ownership on

Corporate Social Responsibility

Disclosure

Managerial ownership is a condition indicating that

managers within the company also become

shareholders of the company (Subiantoro and

Mildawati, 2015). Badjuri (2011) found that

managerial ownership succeeded in becoming a

mechanism for reducing agency problems from

managers by aligning the interests of managers with

shareholders. By increasing the number of

managerial ownership, management will feel the

direct impact on every decision they make because

they become owners of the company so that the

practice and disclosure of CSR tends to be more

prevalent and higher.

Ha6: There is an influence of managerial ownership

on corporate social responsibility disclosure.

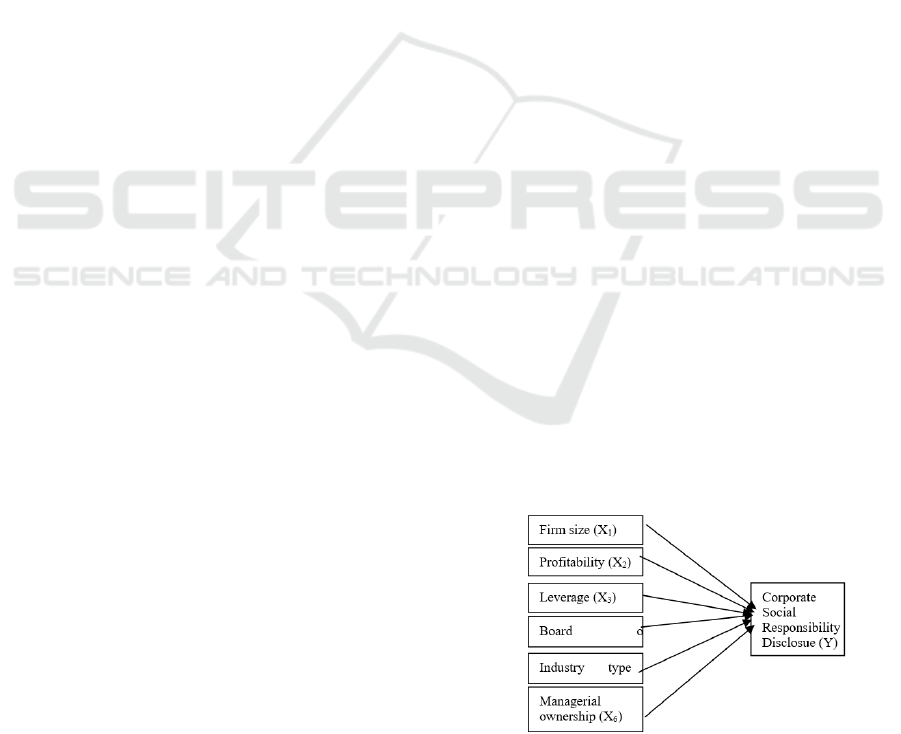

Figure 1: Research Model.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

284

3 RESEARCH METHODOLOGY

3.1 Sample and Data Collection

Procedures

The form of research used to examine the Corporate

Social responsibility Disclosure is causal study.

According to Sekaran and Bougie (2013, 98), “In a

causal study, the researcher is interested in

delineating one or more factors causing the

problem.” In this study there are six independent

variables, namely, firm size, profitability, leverage,

board, industry type, and managerial ownership. The

dependent variable is Corporate Social Responsibility

Disclosure. This research uses a panel data. Gujarati

and Porter (2009, 591) define that panel data or

pooled data (pooling of time and cross-sectional

observations) is a combination of time series and

cross-section data.

In this study, the object used are companies

registered in the SRI-KEHATI Index for the period

of 2010-2016. The sample selection method used is

purposive sampling. The sample selection procedure

can be seen in the following table

:

Sample Selection Criteria

Number

1. Companies registered in the SRI-KEHATI

Index continuously during the period 2010-

13

2. Companies in the SRI-KEHATI Index that do

not publish financial statements on a

continuous basis during the period 2010-2015.

(0)

3. Not using the rupiah currency in the

presentation of the company's financial

(0)

4. Companies in the SRI-KEHATI Index that

have no managerial ownership during 2010-

(5)

The number of companies in the SRI-KEHATI

Index chosen as sample

8

Number of study periods 7

Total data sampled 56

Analyzed data uses regression model and

methods uses SPSS 22 software.

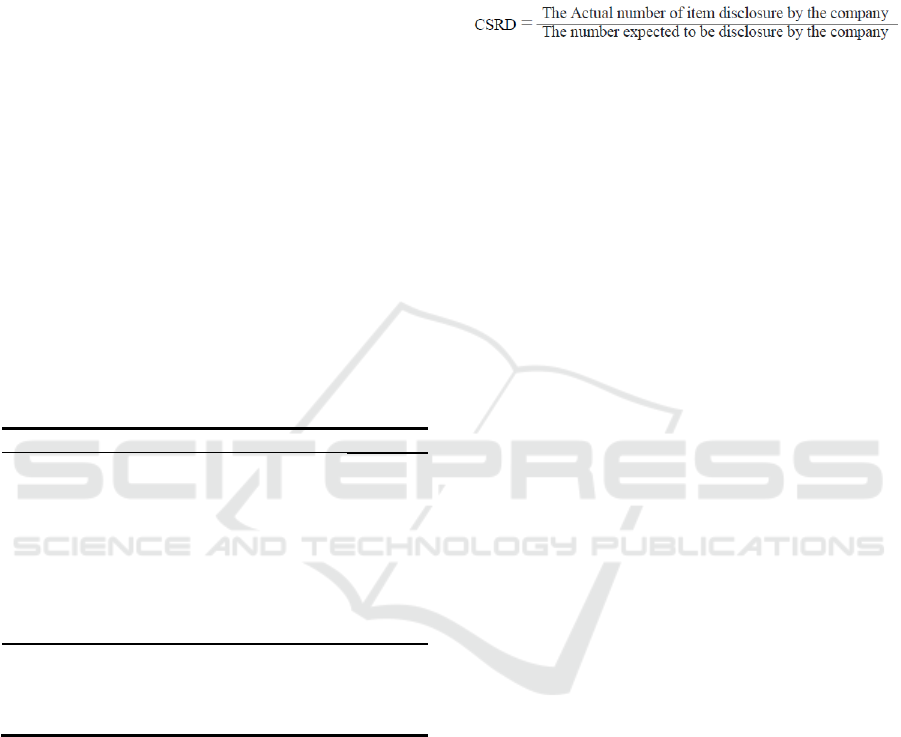

3.1.1 Corporate Social Responsibility

Disclosure

Corporate Social Responsibility Disclosure is the

disclosure of a form of corporate responsibility from

economic, social, and environmental aspects to all

stakeholders calculated under Bapepam Regulation

no. VIII.G.2 on the annual report. The report states

that there are 12 items of 90 disclosure items not

suitable to be applied to the conditions in Indonesia,

thus, it remains 78 items of disclosure. If the

disclosure item is present in the company's annual

report then it is given a score of 1, and if the

disclosure item is not present in the company's

annual report, it is given a score of 0 (Sembiring,

2005). CSRD index measurement is done with the

following formula (Subiantoro and Mildawati,

2015).

3.1.2 Firm Size

According to Subiantoro and Mildawati (2015), the

size of the firm is proxied by the total asset log, the

goal is to reduce the significant difference between

large firm size and small firm size so that the total

asset data can be normally distributed.

3.1.3 Profitabillity

Profitability is proxied by using return on assets.

Return on assets is a ratio that reflects a company's

ability to earn net income by using assets owned by

a company for its operations according to Gitman

and Zutter (2015, 130).

3.1.4 Leverage

Leverage is proxied by using Debt to Equity Ratio.

DER is the ratio used to determine the amount of

comparison between the amount of funds provided

by creditors with the amount of funds derived from

the owner of the company and what part of the

capital used as debt guarantees(Gitman, 2015).

3.1.5 Board of Commissioners

The size of the board of commissioners is the

number of persons who serve as board of

commissioners whether they are independent or not

within a company (Subiantoro and Mildawati,2015).

3.1.6 Industry Type

Type of industry is measured using dummy

variables (Subiantoro et al., 2015). Companies

included in the high profile industry include oil and

gas, forestry, agriculture, mining, fishery, chemical,

automotive, consumer goods, food and beverages,

paper, pharmaceutical, plastics and construction

industries.

High Profile = 1 Low Profile = 0

3.1.7 Managerial Ownership

Managerial ownership is the proportion of the

number of shares owned by the company's

The Effect of Company Characteristics and Corporate Governance on Corporate Social Responsibility Disclosure: A Study on SRI-KEHATI

Index Listed on Indonesia Stock Exchange

285

management compared to the total number of shares

of the company in circulation (Gitman,2015).

4 RESULTS AND ANALYSIS

4.1 Descriptive Analysis

Descriptive analysis used to analyze CSRD included

Size, ROA, DER, BOC and OW. CSRD variable has

a mean value of 0.769, maximum value of 0.923,

minimum value of 0.4743, and standard deviation of

0.1152. Firm size variable has a mean value of

13.933, maximum value of 14.833, minimum value

of 12.769, and standard deviation of 0.5176. ROA

variable has mean value of 0.090, maximum value

of 0.2339, minimum value of 0.013 and standard

deviation of 0.0568. DER variable has mean 2.0218,

maximum value of 8.498, and minimum value of

0.338 and standard deviation of 2.263. BOC variable

has a mean value of 6.93, maximum value of 12,

minimum value of 5, and standard deviation of

1.896. OWN variable has mean of 0.00069,

maximum value of 12, minimum value of 5, and

standard deviation of 0.00099.

Table 1: Descriptive statistics.

CSRD SIZE ROA DER UD

K

KM

Mean

0,769689 13,933463 0,090324 2,021850 6,93 0,00069331

Median

0,807692 13,990398 0,078409 0,932464 6 0,00015717

Maximum

0,923077 14,830421 0,233997 8,498066 12 0,00285092

Minimum

0,474359 12,769459 0,013495 0,338468 5 0,00000029

Std. Dev

0,115862 0,517038 0,056822 2,263627 1.896 0,00099491

Observations

56 56 56 56 56 56

Table 2: Descriptive Statistics of Type Industry.

Industry Type Frequency Percent

Low Profile 21 37,5

high Profile 35 62.5

56 100

Table 3: Model Summary.

Model R R Square

Adjusted

R Square

Std Error of

estimate

Durbin

W

atson

1 ,815

a

,663 0.622 ,101955517285071 1.593

Tabel 4: ANOVA.

Model

Sum of

Squares

df

Mean

Square

F Sig

Regression 1,004 6 ,167 16,101 ,000

Residual ,509 49 ,010

Total 1,514 55

a. Dependent Variable: CSRD

b

. Predictor:(Constant),KM,UDK,SIZE,TI,ROA,DER

Table 5: Result of Multiple Regression.

Variable B

Std.

Error

T Sig

(Constant) -4,795 1,566 -3,062 0,004

SIZE 1,880 0,617 3,049 0,004

ROA -0,087 0,035 -2,462 0,017

DER -0,249 0,046 -5,390 0,000

UDK -0,310 0,085 -3,639 0,001

TI 0.051 0,041 1,228 0,225

KM 0,005 0,010 0,501 0,619

Corporate Social Responsibility Disclosure = - 4,795 +

1,880SIZE - 0,087ROA - 0,249DER - 0.,310UDK + 0,051TI +

0,005KM + ε

4.2 Regression Analysis

Analysis of multiple regression was carried out to

access the statistical significance of the relationship

of variables for its model fit. It is also to discover the

impact of five independent variables on corporate

social responsibility disclosure (Table4). Table 3 and

4 show the multiple regression analysis for all the

variables of the study. The confidence level

established for the statistical analysis is 95%. The

analysis reported significant F change value of

0.000, hence it suggests that the model has

explanatory power between the variables and is fit

for analysis. The R

2

value of 0.663 indicates that

62% of the variance in CSRD can be predicted by

the five dependent variables. Based on the results of

research on 8 companies listed in the SRI-KEHATI

Index 2010-2016 period, it can be deduced that the

Company's Size, Profitability, Leverage, and Size of

Board of Commissioners have influence on

Corporate Social Responsibility Disclosure, while

Industry Type and Managerial Ownership do not

have an effect on Corporate Social Responsibility

Disclosure. The effect of Company Size on

Corporate Social Responsibility Disclosure

according to table 3 is a t value of 3.049 which is

greater than t-table 2.005 (df = nk-1 = 56-1-1 = 52, α

/ 2 = 0.05 / 2 = 0.025). Then, t-statistics located in

the rejection area of H0. In addition, it is supported

by a significant value of 0.004 which is smaller than

alpha 0.05. Thus, it can be concluded that H0 is

rejected and Company Size (SIZE) has a positive

effect on Corporate Social Responsibility

Disclosure. Associated with agency theory, the

greater a company, the greater the agency cost to

reduce agency costs, the more the company will

disclose information. Small companies may not

clearly demonstrate social responsibility because

companies that are in the mature and growing stage

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

286

will attract more attention from their environment

and need a more open response.

5 CONCLUSION

5.1 Conclusion

The results of this study are consistent with other

studies conducted by Habbash (2016), Al-Gamrh

and Al-Dhamari (2016) and Purwanto (2011).

However, it is contrary to previous research

conducted by Subiantoro and Mildawati (2015),

Saputra (2016), Isa and Muhammad (2015), and

Budiman (2015) which concluded that company size

did not affect corporate social responsibility

disclosure.

5.1.1 The Effect of Profitability on

Corporate Social Responsibility

Disclosure

According to table 5, the t-statistic has a value of -

2.462 which is greater than the 2.005 t-table, then

the t-statistic is located in the rejection area of H0. In

addition, it is supported by the results of a

significant value of 0.017 which is smaller than

alpha 0.05. Thus, it can be concluded that H0 is

rejected and Profitability (ROA) has a negative

effect on Corporate Social Responsibility

Disclosure. In terms of legitimacy theory,

profitability has a negative effect on corporate social

responsibility disclosure. This is supported by the

argument that when a company has a high level of

profit, the management considers it unnecessary to

report things that can disrupt information about the

company's financial success. Conversely, when the

level of profitability is low, they expect to report

users to read "good news" of company performance.

This result is consistent with Budiman's research

(2015) and Saputra’s (2016). However, contrary to

Subiantoro and Mildawati (2015) research, Habbash

(2016) and Purwanto (2011) concluded that

profitability does not affect corporate social

responsibility disclosure.

5.1.2 The Effects of Leverage on Corporate

Social Responsibility Disclosure

According to table 5, the t-statistic has a value of -

5.390 which is greater than the 2.005 t-table, then

the t-statistic is located in the rejection area of H0. In

addition, it is supported by the results of a

significant value of 0,000 which is smaller than

alpha 0.05. Thus, it can be concluded that H0 is

rejected and Leverage (DER) has a negative effect

on Corporate Social Responsibility Disclosure.

Companies with high Leverage ratios result in high

supervision carried out by debtholder against

company activities. In accordance with agency

theory, the management of companies with a high

level of Leverage will reduce the disclosure of social

responsibility that is made so as not to be the

spotlight of the debtholders. The results of this study

are consistent with the results shown in Saputra

(2016) and Habbash (2016). However, it is not

consistent with the results of Subiantoro and

Mildawati's (2015) research which shows that

leverage does not affect corporate social

responsibility disclosure.

5.1.3 Effect of Board of Commissioners' Size

on Corporate Social Responsibility

Disclosure

According to table 5, the t-statistic has a value of -

3,639 which is greater than t-table 2.005, so the t-

statistic is located in the rejection area of H0. In

addition, it is supported by the results of a

significant value of 0.001 which is smaller than

alpha 0.05. Thus, it can be concluded that H0 is

rejected and Board of Commissioners Size (UDK)

has a negative effect on Corporate Social

Responsibility Disclosure. The size of the board of

commissioners has a negative relationship direction,

a reason that can explain this is because the small

number of commissioners will have good

effectiveness towards the supervision of company

management. In addition, the large number of board

of commissioners has also become less effective

because the dominance of the board of

commissioners who prioritizes personal interests or

the interests of the group that overrides the interests

of the company. Therefore, the formation of a board

of commissioners should pay attention to the

composition, ability and integrity of members.

5.2 Research Limitations and Direction

for Further Research

The limitations in this study are the independent

variables used, which are limited only to 7 variables.

Then, this study is limited to companies listed in the

SRI-KEHATI Index, so it is still not representative

of all listed companies in the Indonesia Stock

Exchange. Additionally, this study took only a

sample of 7 years from in 2010 through 2016. The

data may not reflect fully the company's long-term

The Effect of Company Characteristics and Corporate Governance on Corporate Social Responsibility Disclosure: A Study on SRI-KEHATI

Index Listed on Indonesia Stock Exchange

287

conditions, and the CSRD variable indicator by

using GRI item G.3 has a list of items with less

extensive CSR disclosure.

REFERENCES

Al-Gamrh, Bakr Ali dan Redhwan Ahmed Al-Dhamiri.

2016. Firm Characteristic and Corporate Social

Responsibility Disclosure. International Business

Management.18(10) ; 4283-4291

Badjuri, Achmad. 2011. Faktor-Faktor Fundamental,

Mekanisme Coorporate Governance, Pengungkapan

Coorporate Social Responsibility (Csr) Perusahaan

Manufaktur Dan Sumber Daya Alam di Indonesia.

Dinamika Keuangan dan Perbankan. Vol. 3 No. 1l: 38

- 54

Brigham, Eugene F. and Ehrhardt, C. Michael. 2014.

Essentials of Financial Management. Singapore:

Cengage Learning.

FCGI. 2001.Seri Tata Kelola Perusahaan (Corporate

Governance). Edisi ke-2. Jakarta

Gitman, Lawrence J. and Chad J. Zutter. 2015. Principles

of Managerial Finance, Fourteenth Edition. United

States of America: Pearson Education.

Hartono, Jogiyanto. 2013. Teori Portfolio dan Analisis

Investasi. Yogyakarta: BPFE-Yogyakarta.

Mousa, Gehan. A dan Naser T. Hassan. Legitimacy

Theory and Environmental Practices: Short Notes.

International Journal of Business and Statistical

Analysis 2. No. 1, 41-53

Regulation No. VIII.G.2 concerning Annual Reports

Statement of Financial Accounting Standards (PSAK)

Number 1 (revised 2009)

Purwanto, Agus. 2011. Pengaruh Tipe Industri, Ukuran

Perusahaan, Profitabilitas, Terhadap Corporate

Social Responsibility. Jurnal Akuntansi &

Auditing.Volume 8/No. 1: 1-94

Saputra, Syailendra Eka. 2016. Pengaruh Leverage,

Profitabilitas Dan Size Terhadap Pengungkapan

Corporate Social Responsibility Pada Perusahaan Di

Bursa Efek. Journal of Economic and Economic

Education. Vol.5 No.1: 75-89

Sembiring, Eddy Rismanda. 2005. Karakteristik

Perusahaan dan Pengungkapan Tanggung Jawab

Sosial: Study Empiris Pada Perusahaan Yang

Tercatat Di Bursa Efek Jakarta. SNA VIII Solo, 15 –

16 September 2005

Subiantoro, Okky Hendro dan Titik Mildawati. 2015.

Pengaruh Karakteristik Perusahaan Terhadap

Pengungkapan Corporate Social Responsibility. Jurnal

Ilmu & Riset Akuntansi. Vol. 4 No. 9: 1-21.

Sustainability Reporting Guidelines: Global Reporting

Intiatives (GRI) version 3.

Undang-Undang No. 40 tahun 2007 pasal 74 tentang

Perseroan Terbatas

Undang No. 25 Tahun 2007 tentang Penanaman Modal

Wiyuda, Alang dan Hadi Pramono. 2017. Pengaruh Good

Corporate Governance, Karakteristik Perusahaan

Terhadap Luas Pengungkapan Corporate Social

Responsibility Pada Perusahaan Terdaftar di BEI.

KOMPARTEMEN. Vol. XV No.1.

Wulansari, Devita Dwi Septi. 2015. Faktor-Faktor Yang

Mempengaruhi Kebijakan Pengungkapan Tanggung

Jawab Sosial dan Lingkungan Perusahaan. Jurnal

Ilmu & Riset Akuntansi. Vol. 4 No. 12: 1-15.

Weygandt, Jerry J., Paul D. Kimel, and Kieso. 2015.

Financial Accounting, IFRS Edition 3e. New Jersey:

Willey International Edition.

Indonesian Biodiversity Conservation Trust Fund.

http://www.kehati.or.id/

Indonesia Capital Market Directory.

Indonesia Stock Exchange http://www.idx.co.id/

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

288