Corporate Governance, Tax Planning and Firm Value

Silvy Christina and Nico Alexander

Trisakti School of Management, Jakarta, Indonesia

Keywords: Corporate Governance, Tax Planning, Firm Value.

Abstract: This study examined the influence of corporate governance and tax avoidance on firm value and moderating

effect of corporate governance on the relationship between tax planning and firm value. The data cover 37

manufacturing companies listed in Indonesia Stock Exchange (BEI) for the period of 2014 to 2016.

Empirical analyses are conducted using multiple regression and path analysis to identify the presence of

moderating variable. The result shows that corporate governance has a positive effect on firm value, which

means the greater the corporate governance in companies, higher the firm value. Tax planning has a

negative effect on firm value, which means the higher tax expense the lower the firm value. For moderating

effects, the result shows that corporate governance does not moderate the relationship between tax planning

and firm value.

1 INTRODUCTION

The purpose of establishing a company is to make a

profit. The greater the profit generated by the

company, the higher the value of the company seen

in the company's stock price. Therefore management

tries to increase company profits. In addition to

increasing the value of the company, large profits

also show management's performance in managing

its assets to generate profits. If the resulting profit

gets smaller, then the management performance is

considered bad and vice versa: if the resulting profit

is higher the management performance is considered

good. Many methods are attempted by a

management to increase company profits with one of

them making efficiency in tax payments. According

to Nike et al., (2014), there are several ways to

reduce the tax burden that must be paid, namely tax

planning, tax avoidance, and tax evasion. Tax

planning and tax avoidance is a fairly safe way to do

it because it does not violate taxation rules. This is

different from tax evasion which actually violates

the prevailing tax rules. According to Suandy

(2011), tax planning is an effort made to save and

minimize tax payments legally without violating

applicable rules. In addition to tax planning, to

increase the value of the company, companies can

implement good corporate governance. Better

corporate governance provides protection to

shareholders against manipulating financial

statements so as not to harm investors.

Based on several research results such as Nike et

al., (2014), Wahab and Holland (2012), Winanto and

Utoyo (2013) state that tax planning does not affect

the value of the company, because tax planning

activities are considered as practicing earnings

management so as to not increase the value of the

company. However, according to Fajrin et al.,

(2018), Oyeyemi and Babatunde (2016), Zemzem

and Ftouhi (2016), and Zemzem and Ftouhi (2013),

tax planning has a negative effect on firm value

which means that the smaller the tax payment the

higher the value of the company. According to the

results of research by Zemzem and Ftouhi (2016) the

existence of corporate governance will increase the

value of the company. Because the results of

research on tax planning and corporate governance

on the value of the company produce results that are

inconsistent, and investors are now starting to invest

a lot of money in companies. Therefore the value of

the company must be increased to attract investors,

one way to do that is with tax planning and

corporate governance. So, this is the motivation of

this research, and this research also looks at whether

corporate governance moderates the influence of tax

planning with firm value.

Christina, S. and Alexander, N.

Corporate Governance, Tax Planning and Firm Value.

DOI: 10.5220/0008491102330237

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 233-237

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

233

1.1 Agency Theory

In agency theory, the parties involved are the

management of a company, acting as agents, and the

investors, acting as principals. The agent and the

principals have different interests, and the principal

relies on the agent to protect those interests (Godfrey

et al., 2010). Jensen and Meckling (1976) stated that

the separation between the owners and managers of

a company may cause agency problems or conflicts.

Because the agent and the principal have different

interests, the principal have to spend on the costs of

agency, including: (1) the monitoring expenses

incurred by the principal to supervise the behavior of

agents, (2) the bonding expenses incurred by the

agent to ensure that the agent will not act in a way

that harms the principals interests, and (3) the

residual loss in the form of decreased levels of well-

being, for both parties.

1.2 Tax Planning and Firm Value

According to Pohan (2013) tax planning is the

process of organizing personal and corporate

taxpayer businesses by utilizing loopholes that can

be taken by companies in the corridor of the

provisions of taxation regulations. Thus, the

company can pay taxes in the minimum amount.

According to Zemzem and Ftouhi (2016), Oyeyemi

and Babatunde (2016), Zemzem and Ftouhi (2013),

Fajrin et al., (2018) stated that tax planning

negatively affect firm value. This shows that the

smaller the payment of corporate taxes the higher

the value of the firm. If a company is able to reduce

tax payments it will make the profits generated by

the company greater so investors will be interested

in buying company shares.

Based on the explanation

above, the hypothesis built is:

H

1

: Tax planning negatively affects firm value

1.3 Institutional Ownership and Firm

Value

Institutional ownership is the ownership of company

shares by institutions (pension funds, investment

companies, banks and others). According to Parrino

et al., (2003), Ferreira and Matos (2008), Alfaraih et

al., (2012), Fazlzadeh et al., (2011) and Uwuigbe

dan Olusanmi (2012), institutional ownership

positively affects firm value. The greater the

institutional ownership, the higher the value of the

company will be. According to Chung et al., (2002),

institutional ownership has an important role in

monitoring management so as not to take

opportunistic actions for personal interests so the

value of the company will increase. Based on the

explanation above, the hypothesis built is:

H

2:

Institutional ownership positively affects firm

value

1.4 Board of Director and Firm Value

In this study the board of directors is a supervisor in

the company or also called the board of

commissioners, where the board of commissioners is

an organ in corporate governance that oversees

management in managing the company. According

to Andres and Vallelado (2008), the board of

directors has a positive effect on firm value. This

shows that the more the number of board of directors

in the company the higher the value of the company

because it will improve supervision, governance,

and increase returns (Andres and Vallelado 2008).

Based on the explanation above, the hypothesis built

is:

H

3:

Board of director positively affects firm value

1.5 Independent Board and Firm Value

The independent board is a member of the Board of

Commissioners who has no relationship with the

company. According to Trisnantari (2010) and

Amyulianthy (2012), the independent board has a

positive effect on firm value. This shows that the

greater the number of independent boards, the higher

the value of the company, because the independent

board is able to carry out the monitoring function to

oversee the policies and activities carried out by the

directors. The existence of an independent board in

the company can provide an effective contribution in

the process of preparing more high quality financial

statements (Muryati and Suardika 2014). Based on

the explanation above, the hypothesis built is:

H

4:

Independent board positively affects firm value

1.6 Corporate Governance Moderates

the Relationship between Tax

Planning and Firm Value

In this study, we also wanted to test whether

corporate governance moderates the influence of tax

planning with firm value. Based on the results of

Zemzem and Ftouhi (2013), Nike et al., (2014),

Wahab and Holland (2012) and Winanto and Utoyo

(2013), corporate governance is able to strengthen

the negative influence of tax planning on firm value.

This is because companies that have good

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

234

governance coupled with minimum tax payers will

increase the value of the company. Based on the

explanation above, the hypothesis built is:

H

5

: Corporate governance strengthens negative

effect of tax planning on firm value

2 METHODOLOGY

The paper employs a panel set data of manufacturing

firm listed in Indonesia Stock Exchange during the

period 2014-2016. The data taken uses purposive

sampling and consists of 37 manufacturing

companies. Below is a sample selection table.

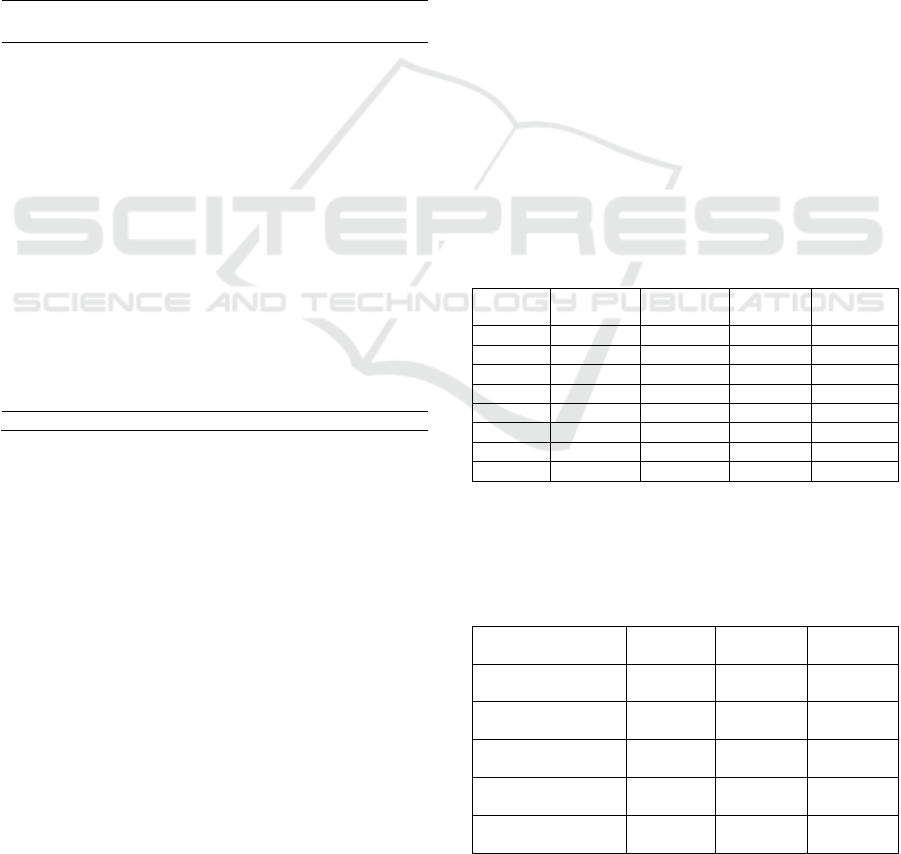

Table 1: Sample procedure selection.

Description

Number of

companies

Number

of data

Manufacturing companies that are

consistently listed on the Indonesia

Stock Exchange during the 2014-2016

period

Manufacturing companies that do not

issue annual reports and financial

statements for the period 2014-2016

Manufacturing companies that do not

present financial statements that ended

on December 31 during the 2014-2016

period

Manufacturing companies that do not

present financial statements in Rupiah

currency for the period 2014-2016

Manufacturing companies that do not

have a positive profit during the 2014-

2016 period

Manufacturing companies that do not

have institutional ownership

ETR greater than 1

137

17

16

25

33

5

4

411

51

48

75

99

15

12

Total 37 111

3 MODEL SPECIFICATION

This study is an empirical analysis of the effect of

corporate governance, tax planning on firm value

and moderating effect of corporate governance on

tax planning and firm value. The regression model

is:

ROA

it

= β

0

+ β

1

ETR

it

+ β

2

IO

it

+ β

3

BOD

it

+

β

4

IND

i

t

+ β

5

SIZE

i

t

+ β

6

CR

i

t

+ ε

(1)

To assess the potential impact of tax planning on

firm value the above regression is modified by

changing the ETR to CashETR.

ROA

it

= β

0

+ β

1

CashETR

it

+ β

2

IO

it

+ β

3

BOD

it

+ β

4

IND

i

t

+ β

5

SIZE

i

t

+ β

6

CR

i

t

+ ε

(2)

A third regression tests whether the relationship

between tax planning and firm value is moderated

by corporate governance.

ROA

it

= β

0

+ β

1

ETR

it

+ β

2

ETR*IO

it

+

β

3

ETR*BOD

it

+ β

4

ETR*IND

it

+ β

5

IO

it

+

β

6

BOD

i

t

+ β

7

IND

i

t

+ β

8

SIZE

i

t

+ β

9

CR

i

t

+ ε

(3)

Where:

ROA = Return on Assets = net income / total assets

ETR = Effective Tax Rate = income tax / income

before tax

CashETR = Cash Effective Tax Rate = cash tax paid

/ income before tax

IO = Institutional Ownership = % of share owned by

institutional

BOD = Board of Director

IND = Independent Board = % of independent

board

SIZE = Natural Logarithm of total assets

CR = Current Ratio = current assets / current

liabilities

4 RESULT AND DISCUSSION

Below is presented descriptive statistics for each

variable.

Table 2: Descriptive Statistics.

Variable Minimum Maximum Mean

Std.

Deviation

ROA 0.0000665 0.401838 0.099841 0.081357

ETR 0.001470 0.727738 0.252391 0.091429

CETR 0.042839 0.881081 0.294666 0.128127

IO 0.297900 0.981800 0.686309 0.173832

BOD 2.000000 12.00000 4.547009 2.036290

IND 0.125000 1.000000 0.400426 0.121633

SIZE 25.61948 33.19881 28.68814 1.782535

CR 0.605632 8.088936 2.548071 1.599937

Below is presented result of each model to test

the effect of corporate governance, tax planning and

firm value.

Table 3: Regression Model.

Dependent variable:

ROA

Model (1) Model (2) Model (3)

ETR

-0.1129

(-1.6292)

0.2445

(-3.269)

CETR

-01029

(-2.052)*

IO

0.1215

(3.305)*

0.1136

(3.1069)

0.1188

(0.8157)

BOD

-0.0074

(-1.6989)

-0.0059

(-1.3651)

-0.0028

(-0.2552)

IND

0.1585

(2.975)

0.1489

(2.8170)*

0.3257

(1.7932)

Corporate Governance, Tax Planning and Firm Value

235

Table 3: Regression Model. (cont.)

Dependent

variable: ROA

Model (1) Model (2) Model (3)

ETR*IO

0.0266

(0.0506)

ETR*BOD

-0.0214

(-0.4538)

ETR*IND

-0.6378

(-0.9618)

SIZE

0.0161

(0.0018)*

0.01446

(2.8249)*

0.0170

(3.2799)*

CR

0.0255

(6.3128)*

0.0238

(5.8033)*

0.0252

(6.1786)*

Constanta -0.5136 -0.4561 -0.6316

Adj. R

2

0.3255 0.3347 0.3156

F value 10.3332* 10.7292 6.9940

* indicate significance at 5%

Based on the test results it can be concluded that

tax planning, if measured by the cash effective tax

rate has a negative influence on the value of the

company, and if using an effective tax rate, planning

has no influence. Corporate governance

(institutional ownership and independent board) has

a positive effect on the value of the company. From

the third model 3, it can be concluded that corporate

governance does not moderate the influence of tax

planning on firm value.

5 CONCLUSION

The purpose of this research is to get empirical

evidence the effect of corporate governance, tax

planning on firm value and to get empirical evidence

of moderating effect of corporate governance on tax

planning and firm value. The result shows that tax

planning has a negative effect on firm value, this

result is consistent with Zemzem and Ftouhi (2016),

Oyeyemi and Babatunde (2016), Zemzem and

Ftouhi (2013), Fajrin et al., (2018). The smaller the

payment of corporate taxes the higher the value of

the firm will be. If a company is able to reduce tax

payments it will make the profits generated by the

company greater, so investors will be interested in

buying company shares.

Corporate governance has a positive effect on

firm value, this result is consistent with Parrino et

al., (2003), Ferreira and Matos (2008), Alfaraih et

al., (2012), Fazlzadeh et al., (2011) and Uwuigbe

dan Olusanmi (2012) Andres and Vallelado (2008)

Trisnantari (2010) and Amyulianthy (2012). The

more effective corporate governance in the company

the higher the value of the company will be. This

isbecause it will improve supervision, governance,

and increase returns. However, corporate

governance corporate does not moderate the

influence of tax planning on firm value. This study

provides an overview to companies that minimal tax

payments coupled with good governance will

increase the value of the company, which will attract

investors to invest their money in the company, and

help investors in determining the criteria for

investing if they want to get a higher rate of return.

6 LIMITATION

This study has several limitations, namely the use of

sample manufacturing companies that do not

represent the company population in Indonesia, tax

planning calculations that have not used temporary

differences and permanent differences or tax books

difference, and the use of ROA in measuring the

value of a company that may be replaced by Tobin q

or price to book ratio.

REFERENCE

Alfaraih, M. Alanezi, F. and Almujamed, H., 2012. The

Influence of Institutional and Government Ownership

on Firm Performance: Evidence from Kuwait.

International Business Research. Vol. 5.No. 10. 192-

200.

Amyulianthy, Rafriny., 2012. Pengaruh Struktur

Corporate Governance Terhadap Kinerja Peusahaan

Publik Indonesia. Jurnal Universitas Pancasila.

Jakarta.

Andres, P. & Vallelado, E., 2008. Corporate Governance

in Banking: the Role of the Board of Directors.

Journal of Banking and Finance 32, 2570-2580.

Chung, R. M., Firth, M. and Kim, J., 2002. Institutional

monitoring and opportunistic earnings management.

Journal of Corporate Finance, Vol. 8 No. 1, pp. 29-

48.

Fajrin Ainia, Nur Diana and M. Cholid Mawardi, 2014.

Pengaruh Perencanaan Pajak terhadap Nilai

Perusahaan dengan Transparasi Perusahan sebagai

Variabel Pemoderasi (studi kasus pada perusahaan

manufaktur di BEI periode 2013-2016). Junal Riset

dan Akuntansi. Vol 7, No. 02.

Fazlzadeh, A., Hendi, A., &Mahboubi, K., 2011. The

Examination of the Effect of Ownership Structure on

firm Performance in listed firms of Tehran Stock

Exchange based on the Type of the industry.

International Journal of Business and Management,

6(3), 249-266.

Ferreira, M.A. and Matos, P., 2008. The colors of

investors’ money: the role of institutional investors

around the world. Journal of Financial Economics,

Vol. 88, pp. 499-533.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

236

Godfrey, Jayne, Allan Hodgson, Ann Tarca, Jane

Hamilton, Scott Holmes. (2010). Accounting Theory.

7th edition. John Willey & Sons Australia Ltd.

Jensen, Michael C and William H. Meckling. (1976).

Theory of the Firm: Managerial Behavior, Agency

Costs and Ownership Structure. Journal of Financial

Economics, Vol. 3, 1976, 305-360.

Muryati, Ni Nyoman T.S., Suardika, I Made S., 2014.

Pengaruh Corporate Governance Pada Nilai

Perusahaan. e-Jurnal Akuntansi Universitas Udayana.

No 9. Vol 2. 2014. Halaman 411-429.

Nike, Yulisma, Zaitul, Yunilma, 2014. Pengaruh

Perencanaan Pajak dan Corporate Governance

terhadap Nilai Perusahaan. Jurnal Fakultas Ekonomi,

Vol. 4. No. 1.

Oyeyemi, Grace Ogundajo and Babatunde, Onakayo

Adegbemi, 2016. Tax Planning and Financial

Performace of Nigerian Manufacturing Companies.

Advance Academic Research Social & Management

Sciences. Vol. 2, Issues 7.

Parrino, R., Sias and Starks, L., 2003. Voting with their

feet: Institutional ownership changes round forced

CEO turnover. Journal of financial economics. Vol.

68, No. 1, pp. 3-41.

Pohan, Chairil Anwar, 2013. Manajemen Perpajakan

“Strategi perencanaan pajak dan bisnis”. Jakarta: PT

Gramedia Pustaka Utama

Suandy, Erly, 2011. Perencanaan Pajak. Jakarta: Salemba

Empat.

Trisnantari, Ayu Novi. 2010, Pengaruh Corporate

Governance Pada Hubungan Pergantian Chief

Executive Officer dengan Kinerja Perusahaan. Tesis.

Universitas Udayana. Denpasar.

Uwuigbe, U., & Olusanmi, O., 2012. An Empirical

Examination of the Relationship between Ownership

Structure and the Performance of Firms in Nigeria.

International Business Research, Vol. 5, no. 1.

Wahab, Nor Shaipah Badul and Kevin M. Holland, 2012.

Tax Planning, Corporate Governance and Equity

Value. British Accounting Review. Vol. 44. No. 2. Il.

Winanto and Utoyo Widayat, 2013. Pengaruh

Perencanaan Pajak dan Tata Kelola Perusahaan

terhadapNilai Perusahaan. Simposium Nasional

Akuntansi XVI Manado.

Zemzem, Ahmend and Khaoula Ftouhi, 2013. Moderating

Effect of Board of Directors on Relationship between

Tax Planning and Bank Performace: Evidence from

Tunisia. European Journal of Business and

Management. Vol. 5. No. 32.

______________ and _____________, 2016. External

Corporate Governance, Tax Planning, and Firm

Performance. Corporate Ownership & Control. Vol.

13. Issue 3.

Corporate Governance, Tax Planning and Firm Value

237