Capital Structure, Corporate Governance, and Agency Costs

Elsa Imelda and Dewi Ayu Patricia

Faculty of Economics, Tarumanagara University, Jakarta, Indonesia

Keywords: Capital Structure, Corporate Governance, General and Administrative Expense, Agency Cost.

Abstract: The purpose of this empirical research is to examine the impact of capital structure and good corporate

governance on agency cost. This research used 104 manufacturing companies which were listed on the

Indonesia Stock Exchange from 2014-2016 as sample. This research used fixed effect models from Eviews

9 as the program. The statistical method used to test the hypothesis is multiple linear regression. General

administrative expense ratio is used as a proxy to measure agency cost. Capital structure is measured by

debt to asset ratio and long term debt to asset ratio. Corporate governance mechanism is measured by

managerial ownership and board of director. The results showed that debt to asset ratio has a significant

effect on agency cost. The long term debt to asset ratio, managerial ownership, and board size do not have a

significant effect on agency cost.

1 INTRODUCTION

Agency costs are costs that are related to supervision

from shareholders to the board of directors with the

intention to optimize directors’ performance.

According to Yegon et al., (2014), agency costs

occur due to non-optimal performance of directors.

These behaviors include excessive corporate

consumption, ineffective investment decisions,

wrong asset management, and fraudulent actions on

company assets. Supervision costs are useful to

reduce the risks and losses that must be borne by

shareholders.

Many factors can influence agency costs,

including capital structure and corporate governance

mechanism. According to Truong (2006) and Zheng

(2013), the capital structure shows the proportion of

debt to finance the investment. Managers should

know the balance between the risks and the rate of

return on their investment. An optimal capital

structure can control the amount of agency costs

incurred because managers will tend to prioritize

payment of debt costs. Managers are also afraid of

the possibility of financial distress if debt obligations

are not met, so managers will prioritize payment of

debt obligations before using company assets for

their own purposes.

Another factor that can affect the agency costs is

good mechanism regarding corporate governance.

Good corporate governance can work as a tool to

achieve organizational goals and regulate

relationships between stakeholders including the

board of directors and shareholders. The agency

problem and the agency cost will automatically

decrease if there is good corporate governance

mechanism. This study aims to investigate the

relationship between corporate governance and

capital structure with agency problems leading to

increased agency costs among manufacturing

companies in Indonesia that went public.

2 THEORY AND HYPOTHESIS

According to agency theory of Jensen and Meckling

(1976), agency problems are characterized by

conflict of interests and information differences

between the company owner (principal) and the

agent (manager). One of the ways to minimize the

conflict and differences is to spend agency costs.

Agency costs are difficult to measure, so this

research will choose the ratio of general and

administrative expense to sales as represented by

agency costs (Ang et al., 2000). This ratio can show

if there is excessive consumption by the manager.

2.1 Capital Structure

Agency costs can be reduced by debt. This can be

explained by the Free Cash Flow Hypothesis.

Imelda, E. and Patricia, D.

Capital Structure, Corporate Governance, and Agency Costs.

DOI: 10.5220/0008490602030207

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 203-207

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

203

According to Ross et al., (2008), the free cash flow

hypothesis explains that managers have the authority

in the consumption of cash flows and often waste the

cash flow for the situation that will benefit

themselves. Jensen (1986) also said that high free

cash flow can make managers overconsume on

expenditure for the company. However, with the

existence of debt, it is believed that the waste of free

cash flow can be reduced, because the company

must pay interest on the debt. According to Gitman

and Zutter (2012), capital structure can be optimal if

there is a balance between benefits and costs of debt.

Several studies have shown that debt can reduce

agency costs, one of which is the research by Zheng

(2013) which shows that debt has an impact on the

decrease in agency cost. Debt can also be used to

control excessive use of free cash flow by the

management, thereby reducing worthless

investments. With increasing debt, the company has

an obligation to return the loan and pay interest

periodically. This condition causes managers to

work hard to increase profits so that they can meet

the obligations of using debt. Capital structure is

measured by debt to asset ratio (Ha1) and long term

debt to asset ratio (Ha2) in this research.

2.2 Corporate Governance

Agency costs can also be reduced by the presence of

good corporate governance. According to Sutedi

(2012), good corporate governance leads to a system

which regulates the relationship of the board of

directors and company executive staff with all

stakeholders and is responsible for improving

organizational performance and achieving company

goals. According to the National Committee on

Governance Policy (2012), the main principles of

Good Corporate Governance consist of

transparency, accountability, and independence. The

GCG used as a variable in this study are managerial

ownership and composition of the board of directors.

Managerial ownership is a condition where the

manager has a share in the ownership of the

company. Managerial ownership is believed to be

one way to overcome agency problems. Managers

who own shares in the company are expected to

have interests that are aligned with the shareholders.

Managerial ownership is measured by the proportion

of shares held by the company's directors at the end

of the year which are then expressed in percentages

(Yegon et al., 2014). Companies that have a large

number of shareholdings usually experience low

agency problems and low agency costs (Zheng,

2013). Ghasemipur (2014) also proved that the

larger number of shareholders can lower agency

costs.

The board of directors which consists of many

people is considered to not able to work effectively

because the larger number of directors, the more

opinions in decision making there are. This can

affect agency costs. Ineffective decision making can

harm the company and increase agency costs (Yegon

et al., 2014). Florackis (2004) said that a corporation

must have a good proportion of board of directors so

the decision making will be effective. Corporate

governance mechanism is measured by managerial

ownership (Ha3) and board of directors (Ha4).

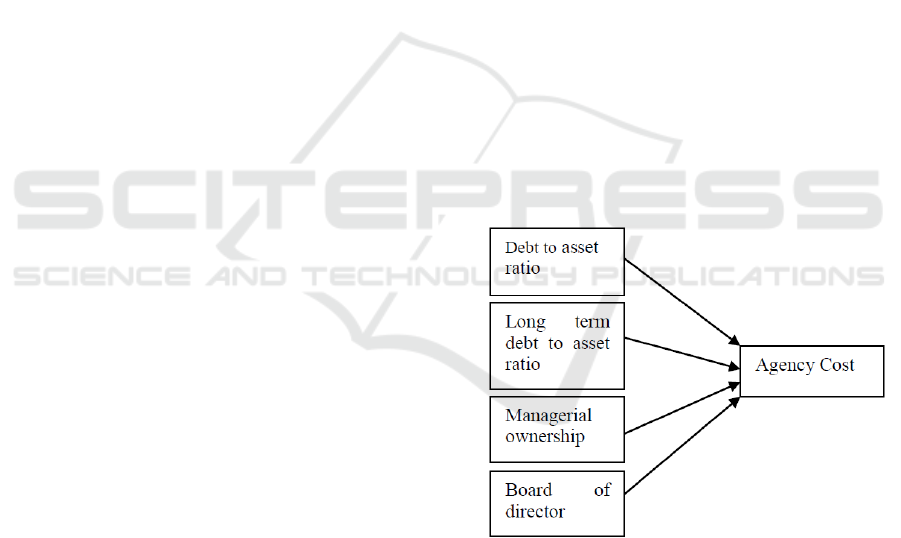

2.3 Hypotheses

The hypotheses of this research are as follows:

Ha1: Debt to asset ratio has a significant negative

effect on agency cost

Ha2: Long term debt to asset ratio has a significant

negative effect on agency cost

Ha3: Managerial ownership has a significant

negative effect on agency cost

Ha4: Board of directors has a significant negative

effect on agency cost

Research Model:

3 RESEARCH DESIGN

Subjects in this study were manufacturing

companies listed on the Indonesia Stock Exchange

in the 2014-2016 period. The total sample selected

was 104 companies with the company's

requirements as follows: (1) The manufacturing

companies were listed on the Indonesia Stock

Exchange in the year 2014 -2016 (2) The

manufacturing companies presented financial

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

204

statements during the period 2014 - 2016 (3) The

manufacturing companies presented financial

statements on December 31 (4) The manufacturing

companies used Indonesian Rupiah in their financial

reporting.

Operational variables in this study consist of

capital structure and good corporate governance as

independent variables and agency costs as the

dependent variable. The operational definitions of

each of the research variables are as follows :

Dependent variable is a variable that is

influenced by independent variable (X) and denoted

by symbol (Y). The dependent variable in this study

is the agency cost which is proxied by general and

administrative expenses (AC). This measurement is

in accordance with the research used by Zheng

(2013) and Yegon et al., (2014):

Table 1: Variable measurements.

No Variable Measurement

1. Agency cost (Y)

General&administrative

expenses/ sales

2.

Debt to asset ratio

(X1)

Total Debt / total asset

3.

Long term debt to

asset ratio(X2)

Total long term debt / total asset

4.

Managerial

ownership (X3)

Managerial ownership /shares

outstanding

5.

Board of directors

(X4)

Ln (number of directors on the

b

oard)

4 RESULTS AND DISCUSSION

This research used Eview 9 to test the hypotheses.

The statistics is shown on table 2 below:

Table 2: Statistic Descriptives.

X1 X2 X3 X4 Y

Mean 0.494 0.192 0.016 1.493 0.079

Median 0.460 0.192 0.000 1.386 0.056

Max 3.029 0.092 0.493 2.772 1.559

Min 0.018 0.001 0.000 0.693 0.005

Std dev 0.377 0.306 0.056 0.438 0.111

Mean value of X1 means 49.4% asset is financed

by debt. Mean value of X2 means 19.2% asset is

financed by long term debt. Mean value of X3

means managerial has 1.6% ownership of the

company. Mean value of X4 means there are, on

average, 1.4 persons on the board of directors in the

company. Mean value of y means agency cost is

7.9% of general and administrative expense to sales.

Before testing the hypotheses, the first step was

to determine which model of test was used. The

Likelihood Test was conducted to determine the

panel data research model that was better compared

to Pooled Least Square or Fixed Effect . Results

showed that fixed effects were better in this study.

The Hausman test was also conducted to determine

the panel data research model and test results also

show fixed effects were better. The results of

multiple regression analysis using fixed effect model

was:

Y

= 0.040736+ 0.177828 X1 + 0.030228 X2 -

0.079430 X3 - 0.036095 X4 + e

R-square value in Table 3 was used to determine the

influence of the independent variables (X) to the

dependent variable (Y). The adjusted R- square

value was 0.338313 which means 33.83% of general

variables and administrative expenses can be

explained by debt to asset ratio, long term debt to

asset ratio, managerial ownership and board size.

Whereas 66.17% was affected by other factors not

discussed in this study.

To find out whether the independent variables

together have a significant effect on the dependent

variable, the test was carried out together (F test).

The F test results can be seen in table 3. The prob

value was less than 0.05 which means that all the

independent variables can affect the dependent

variable. The result shows the Debt-Asset Ratio,

Long Term Debt-Asset Ratio, Managerial

Ownership and Board of Director Size together have

an influence on the Agency cost proxied by the

General and Administrative Expense Ratio.

Table 3: F-test Result.

The t-test to test the hypoteses are listed on table

4. If the probability value is <= 0.05, then Ho is

rejected and Ha is accepted. The results of the t-test

can be seen in the table below:

Table 4: t-test Result.

Variable Coefficien

t

Std erro

r

t

-stat Prob

Cons

t

0.040736 0.089079 0.457303 0.6479

X1 0.177828 0.083780 2.122553 0.0350

X2 0.030228 0.089228 0.338770 0.7351

X3 -0.079430 0.262285 -0.30283 0.7623

X4 -0.377242 0.054148 -0.66660 0.5058

The results of the t test indicate that the debt to

asset ratio (DAR) has a probability value of 0.0350

with a significance value <α = 0.05. This shows that

R-squared 0.613958 Mean dependent var 0.079112

Adjusted R-squared 0.400830 S.D. dependent var 0.129824

S.E. of regression 0.100492 Akaike info criterion -1.483768

Sum squared resid 0.969466 Schwarz criterion -0.399939

Log likelihood 165.2826 Hannan-Quinn criter. -1.043443

F-statistic 2.880706 Durbin-Watson stat 2.561072

Prob(F-statistic) 0.000003

Capital Structure, Corporate Governance, and Agency Costs

205

there is a significant positive effect between the debt

to asset ratio and the agency cost with a coefficient

of 0.1778. The long term debt to asset ratio,

managerial ownership, and board size do not have a

significant effect to agency cost with a probability

value of more than 0.05.

The result of the first hypothesis (Ha1) was

supported by Hastori et al., (2015) but was not

supported by Zheng (2013). The test result showed a

positive relationship and indicates that debt can

increase agency costs. This positive relationship can

be caused by the use of high debt in manufacturing

companies in Indonesia which can be seen from the

percentage of average debt (49.40%). This high debt

can cause a threat of bankruptcy to the owner

because of the possibility of financial distress. This

will encourage shareholders to spend more to

prevent defaults and can increase monitoring costs.

Additionally, it will increase agency costs.

The result of the second hypothesis (Ha2) did not

show any significant influence of long term debt to

asset ratio on Agency costs. This is in line with the

research conducted by Zheng (2013). Low average

debt ratio with a percentage of 19% indicates that

the company does not use a lot of long-term debt to

finance their assets, so there will be no significant

increase of agency cost.

The result of the third hypothesis (Ha3) indicates

that there is no significant effect of managerial

ownership on agency costs. This is in line with the

research conducted by Putri and Nasir (2006) and

Singh and Davidson (2003), but not in line with

Yegon, Sang, and Kirui (2004). The absence of a

significant effect can be caused by the low number

of managerial ownership in the Indonesia Stock

Exhange. The average managerial ownership in the

Indonesia Stock Exhange is only 1.65%.

The result of the fourth hypothesis (Ha4) was

that the board size variable shows no significant

effect on agency costs. The result of this study was

in accordance with the research proposed by Singh

and Davidson (2003), Kung’u and Munyua (2016),

and Flemming (2003). In its decision making both in

large and small sizes, the board of directors will

continue to experience conflicts of interest in order

to prosper themselves because of their position as

agents in the agency theory, so the board size cannot

have an impact in reducing agency costs.

5 CONCLUSION

From the results of this study, it can be concluded

that the debt of the company can prevent any

wasteful behavior by the manager for his personal

interests. Cash flow generated from the company's

business activities must be prioritized to pay interest

expense and company debt. Therefore, proper debt

and capital proportions are needed so that the agency

costs incurred by shareholders can be minimal.

Limitations in this study include: (1) the

population of data only includes companies engaged

in manufacturing industries listed on the Indonesia

Stock Exchange in the 2014-2016 period, (2) agency

cost is very difficult to measure so this study uses a

proxy ratio of general and administrative expense as

a proxy.

Based on the results and limitations that have

been explained, the suggestions that can be given to

further researchers are: (1) to add sectors other than

manufacturing companies as sample data and (2) to

use another measurement as a proxy of agency cost.

REFERENCES

Ang, J.S., R.A.Cole and J. Wuh Lin, (2000). Agency Cost

and Ownership Structure, Jounal of Finance, 55:81-

106

Fleming, G., Heaney, R., &McCosker, R. (2005). Agency

Costs and Ownership Structure in Australia. Pacific-

Basin Finance Journal, 13(1), 29–52.

Florackis, C., & Ozkan A. (2004). Agency Costs and

Corporate Governance Mechanisms: Evidence for UK

Firms. International Journal of Managerial Finance,

49(2), 139-58.

Ghasemipur, O. (2014). Assessing The Effects of

Corporate Governance and Ownership Structure on

Agency Costs in Listed Companies on Tehran Stock

Exchange.Journal of Current Research in Science,

2(2), 200- 202.

Gitman, L. J., & Zutter, C. J. (2012). Principles of

Managerial Finance: Thirteen Edition, England:

Pearson Education Limited.

Hastori, dkk. (2015). Tata Kelola, Konsentrasi Saham dan

Kinerja Perusahaan Agroindustri Indonesia. Jurnal

Manajemen Teknologi, 14 (2), 4-8.

Jensen, M. C. (1986). Agency Cost Free Cash Flow,

Corporate Finance, and Takeovers. American

Economic Review,76(2), 323–329

Jensen, M. C., & Meckling, W. H. (1976). Theory of firm:

Managerial Behavior, Agency Costs and Capital

Structure. Journal of Financial Economics, 3(4), 305–

360.

Komite Nasional Kebijakan Governance. (2012).

Pedoman Penerapan Manajemen Risiko Berbasis

Governance. Jakarta

Kung’u, J. N., & Munyua, J. M. (2016). Relationship

between Corporate Governance Practices and Agency

Costs of Manufacturing and Allied Firms Listed in

Nairobi Securities Exchange. IOSR Journal of

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

206

Economics and Finance, 7(2), 58-68.

Putri, I. F., & Nasir, M. (2006). Analisis Persamaan

Simultan Kepemilikan Manajerial, Kepemilikan

Institusional, Risiko, Kebijakan Hutang dan Kebijakan

Dividen Dalam Perspektif Teori Keagenan. Simposium

Nasional Akuntansi. Universitas Diponegoro, Padang.

Ross, S.A., Westerfield, R.W., Jaffe, J., & Jordan, B.D.

(2008). Modern Financial Management. New York:

McGraw-Hill/Irwin

Singh, M., & Davidson, W. N. (2003). Agency Costs,

Ownership Structure and Corporate Governance

Mechanism. Journal of Banking and Finance, 27(5),

793–806.

Sutedi, A. (2012). Good Corporate Governance. Jakarta:

Sinar Grafika.

Truong, T. T. (2006). Corporate Ownership, Equity

Agency Costs and Dividend Policy: An Empirical

Analysis. Business Portfolio. RMIT University,

Vietnam.

Yegon, C., Sang, J., & Kirui, J. (2014). The Impact of

Corporate Governance on Agency Cost: Empirical

Analysis of Quoted Services Firms in Kenya. Journal

of Finance and Accounting, 12(5), 145-154.

Zheng, M. (2013). Empirical Research of the Impact of

Capital Structure on Agency Cost of Chinese Listed

Companies. Journal of Economics and Finance, 10(5),

118-125.

Capital Structure, Corporate Governance, and Agency Costs

207