The Impact of Capital Structure Determinant on Investment

Opportunity: Evidences from Manufacturing Companies in ASEAN

Countries

I Gede Adiputra

1

and Atang Hermawan

2

1

Faculty of Economics, Tarumanagara University, Jakarta, Indonesia

2

Faculty of Economics and Business, Pasundan University, Bandung, Indonesia

Keywords: Capital Structure, Investment Opportunity, Manufacture.

Abstract: The purpose of this research is to obtain the result that determines the capital structure that consists of: firm

size, financial risks, profitability, and debt policy on investments opportunity in fiveASEAN countries:

Indonesia, Malaysia, Singapore, Thailand, and Philippines. The subject of this research is the manufacturing

companies that are listed on the stock exchange market between the year of 2011 to the year of 2016. Data

analysis method that is used in this research is Simultaneous Regression and panel. The result of this research

proved that firm size had a positive and significant influence on Investment Opportunity in Indonesia,

Malaysia and Singapore but not significant in Thailand and Philippines. The financial risk had no influence

on Investment Opportunity in five ASEAN countries. Profitablity had a positive and significance influence

on Investment Opportunity in Singapore, Phillipines, and Thailand. The debt policy had negative and

significance influence in Indonesia, Thailand, and Phillipines. The currency rate plays a significant role for

Investment Opportunity in Indonesia, Malaysia, and Singapore. Altogether, the capital structure had

significant influence on Investment Opportunity. In Singapore, it gave no significance but instead had

significant influence in the other four ASEAN countries.

1 INTRODUCTION

1.1 Research Background

Investment is a stimulus economic growth for every

country. The more amount of investments means a

greater chance for an economic growth as it also

increases the prosperity of the people. The foreign

direct investment inflow of ASEAN countries are

counted as high. This proved that South East Asia

became a hotbed of the economic growth of the

world. The only matter becomes a concern is that the

spread of its investments is not as equal as every

ASEAN country received. Singapore takes on

majority of receiving 50% of foreign investments,

while Indonesia receiving 15%, Thailand 11%, and

Malaysia 10% (ASEAN investment report 2007).

ASEAN Economic Community is the biggest

integration that exists among developing countries.

AEC takes the role as an integrated economic power

that empowers ASEAN countries globally.

The size of the firm itself means that the small

or large the company will be seen on its amount of

equity or the total active results of the company

itself (Subekti, 2001). Based on Riyanto (2001), a

large scale companies usually has a set of

investment opportunity and are more likely to be

trusted by investors compared to smaller

companies. Trusted by the investors, a large

company would gain easier access to loan or

fundings for expansion as well as having its own

expansion policy.

Financial risks are the large amount of spread

between the expected return and the actual return.

The bigger spread means more risk will be taken. If

the risk determines as the amount that could deviate

from the expected value, the increased level of

investment risks will determine the decrease in the

IOS. This is due to the increase in risk that means the

increase in the rate of return deviation that will cause

the decreased chances of investment based on the

price proxy (Subchand and Sudarman, 2010).

The previous profitablity rate of a company will

determine or play a crucial role on the company’s

Adiputra, I. and Hermawan, A.

The Impact of Capital Structure Determinant on Investment Opportunity: Evidences from Manufacturing Companies in ASEAN Countries.

DOI: 10.5220/0008488901050112

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 105-112

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

105

capital structure. High rate of profitabilities will give

a good signal of capital growth in the future. The

result of Subchan and Sudarman (2010) research

states that companies with high profitability rate had

a better Investment Opportunitys compared to other

companies with low profitability rate.

Debt policy had a relation with capital structure in

which the debts are part of capital structure.

Composition of a company is marked as risky if it

possesses a large amount of debts on the capital

structure. But if the debt could earn a profit, then

those debts will increase the value of the firm itself

(Hidayat, 2013). The usage of debts will determine

the price of the company share. A company with a

high debt rate will earn high Earning Per Share (EPS)

which will increase the chance of investments. Based

on Larry Lang et al., (2006) and Ferdinand A Gul

(2000), a debt that is proxied using DER is found to

have a negative and significant DER against the

investment policy.

IOS (IOS) is a chance of future investments that

determines the active growth of the company or

project that has a positive net present values so that

IOS had an important role for a company due to the

investment decision that combines the asset in place

and the future available investment options in which

the IOS will influence the company value (Pagalung,

2002).

The capital structure of the company has a strong

connectivity in every factor that forms the Capital

Structure. Voulgaris (2002) stated that Capital

Structure Determinant is a company’s characteristic

that consists of the company measurement, chances

of growth, stock turnover, profitability, tangibility,

and liquidity. In this research, the variable of capital

structure that is used by the writer is the firm size,

financial risk, profitability, and Debt Equity Ratio

(DER). The purpose of this research is to test the

influence of certain factors of capital structure that

will affect the Investment Opportunities. In specific,

the purpose of this study is to answer the question of

this research: How massive is the effect of company

capital structure that consists of the firm size,

business risk, profitability, and debt policy on the

investment opportunity of manufacturing companies

in five ASEAN countries?

2 LITERATURE STUDY,

CONCEPTUAL FRAMEWORK,

AND HYPHOTESIS

2.1 Literature Study

2.1.1 Investment Opportunity Set

(IOS)

Myers (1977) stated that company is a mix between

active asset in a place and future investment options.

This future investment options are later known as IOS

(IOS).

Investment option is a chance for a company to

expand and grow, but often many companies didn’t

have a chance to conduct such investment

opportunity. The value of Investment Opportunity is

the current marks that consist of investment

alternatives for a company to invest in the future.

Gaver and Gaver (1993) stated that a future

investment option is not only based on a company

projects that is supported by research activities and

its development, but also from the company’s ability

to exploit the chances of profit compared to other

companies in their product segments.

Smith and Watts (1992) stated that an IOS is a result

of choices for future investments. This set of

Investment Opportunities shows the company’s

abilities to make a profit from the growth prospects.

This research will be using a market value to book

value of equity (MVE/BVE) as the IOS proxy.

Systematically, market value to book value of equity

(MVE/BVE) formula is stated as follows:

MVE/BE =

2.1.2 Firm Size

A large scale company had an easier access to loan

due to its large amount of assets and the higher trust

it earns from the bank that makes it easier for the

company to create investment. Therefore, in this

research, investment is a variable on the scale of the

company itself. Titman (1988), Homaifar (1994), and

Gilson (1995) measured the firm size variable with

the logarithm of total assets. Burgman (2002) and

Moh’d et al., (2005) measure the variable of the firm

size based on the sales logarithms.

Peasnell,

Pope, and Young (2008) point that there

is a negative relationship between the firm size and

profit management in England. Thus, it is concluded

that the company manager that leads a larger

company has a smaller chances in manipulating the

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

106

profits compared to that from a small scale company.

Albrecth and Richardson (1990) and Lee and Choi

(2002) discovered that a large scale company had a

direction to stabilize its profit compared to other

smaller companies due to the large company is

considered more critical by the foreign investments.

On the other hand, if the profit management is

proven to be efficient, the investment rate will be

bigger as well. The size of the firm also symbolizes

the prosperity level for the company (Fraser, 2006).

The variable measured using

natural log of sales

(moh’d Perry and Rimbey, 2005).

2.1.3 Financial Risk

Financial Risk is a profit variable that is received by

the shareholders. The financial leverage is one of

factors that affects the financial risks. The higher

usage of financial leverage means higher capital cost

and a higher financial risk. The higher the degree of

financial leverage (DFL) is, the higher the financial

risk will be.

The studies conducted by Chaplinsky (2004), Lee

and Kwok (1988), Mao (2003), Law and Chen (1999)

stated that a business risk had a negative relation to

the debt ratio. This proved that a company with a high

risk business had a small debt ratio. The higher the

business risk, the usage of debt rates will result in

difficulties for the company to pay their debts. As an

implication, the large business risk company will use

small debts if compared to a business with a low risk.

Based on the research conducted by Herwono Indra

Saputra and Njo Anastasia (2013) over all investation

that is provided, only an investment group of cash,

deposits, and mutual funds had a connection with the

respondent profiles. That is known as the portfolio as

the group of cash, deposits, and mutual fund that is

measured in a formula as:

Risk =

2.1.4 Profitability

Profitability shows the company’s ability to make a

profit resulted from the capital or aktivas that is

utilized on a given time. The fulfilments of the funds

on the condusive macro economic conditions are best

fulfilled through debt due to the tax saving.

Higher profitabilities mean higher Investment

Opportunities (Baskin, 1983 on Saputro and

Hindasah, 2007). Company with bigger funds had

bigger management that could take a decision in

investing its resources for a profitable results that

would increase the company value. Based on the

research by Ahmed Riahi and Belkaoui (2001) on 100

manufacturing companies in America from the year

1987 to 1992, it is found that profitabilities had a

significant positive impact against the investment

policy.

In this research, profitability is measured using the

return on asset (ROA), which means an ability of the

total asset invested on the whole active to earn a profit

counted as a nettor profit after tax cuts of the total

aktiva. The ROA ratio could be define as a formula

of:

2.1.5 Debt Policy

Debt policy is a company policy to fund all of the

operations using the company loans. This financial

loans are intended to fund all the companies activities

either operation process or investments. The

combination of loan and equity on the company will

be counted as the main topic of capital structure

decision. An efficient capital would press the cost of

capital that will increase the economic nettoreturn and

increase the Value of the firm.

In its measurement of the debt policy, this

research will be proxied by DER (Debt Equity Ratio).

Debt to equity ratio is a part of rasio leverage or a

comparison of the total debts (short, middle or long

terms) against the company’s capital. Debt to Equity

Ratio (DER) shows the company’s ability to fulfill its

obligation that points out at the personal apital to pay its

debts.

Lang et al., (2006) state that there is a negative

relation between the leverage and the company

growth that possesses a limited growth chances. Gull

and Jaggi (1999) found that a relation between the

free cash flow and the debt policy shows

differences between the company that has a low

IOS with the company that possesses high IOS.

Smith a n d Watts (1992) by empiric found that there

is a proof that a company might have a bigger chance

to possess a low debt to equity ratio in terms of capital

structure due to the equity financing that decreases

the agency problems that associate with the

company’s free cash flow. Based on this matter, it is

stated that the influences of the IOS against the debt

policy is negative. Debt Equity Ratio based on

Sukirni (2012) ratios are measured on formula:

DER =

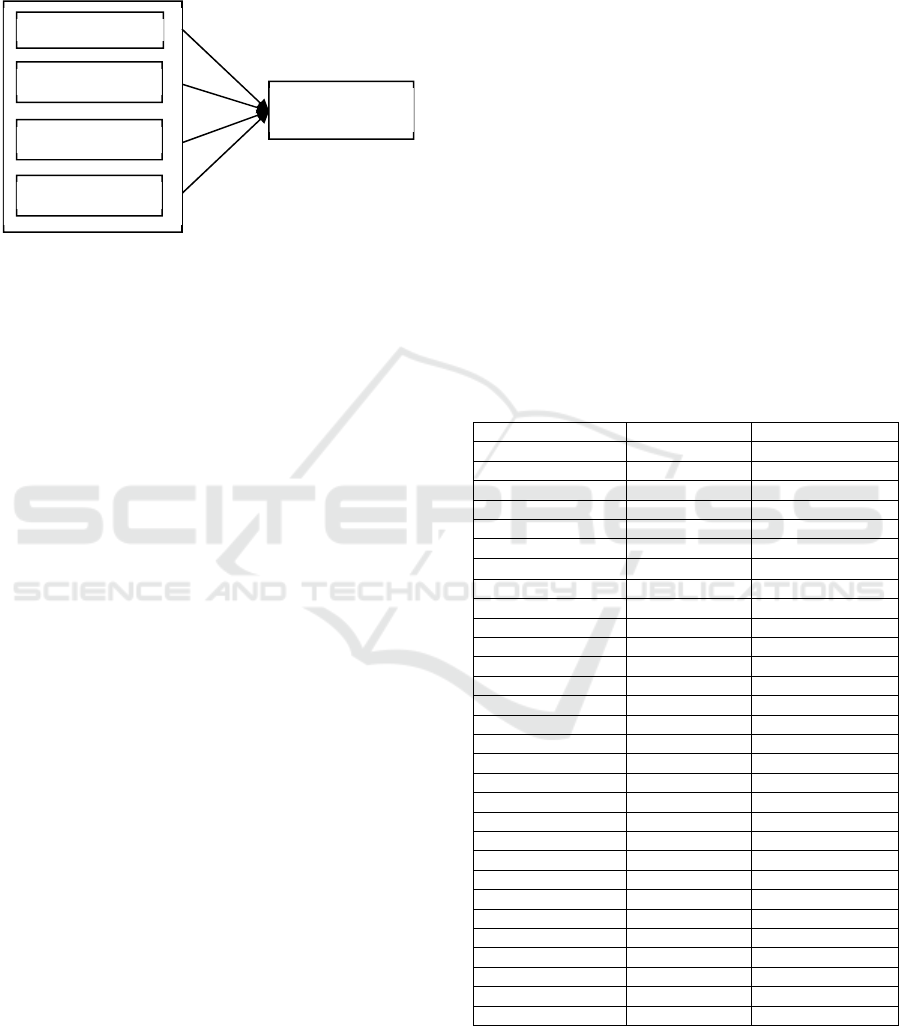

2.2 Conceptual Framework

The construct of this research is that the firm size, the

The Impact of Capital Structure Determinant on Investment Opportunity: Evidences from Manufacturing Companies in ASEAN Countries

107

financial risks, profitability, and debt policy had a

chance to affect the Investment Opportunity that is

measured by the IOS. It could be seen on this body

construction graph:

Figure 1: The Efects of Firm Size, Financial risks,

Profitability, and Debt Ratio Against the Investment

Opportunity.

2.3 Hypothesis

H1: There is an effect in the firm size againsts the

investment opportunity set.

H2: There is an effect of financial risks againsts the

investment opportunity set

H3: There is a profitability effect againsts the

investment opportunity set

H4: There is an effect between the Debt policy and

the investment opportunity set

3 RESEARCH METHODOLOGY

3.1 The Method of Data Collection

The data used for this research consist of secondary

data in a form of cross – sectional data panel and time

series of ASEAN-5 countries. To earn the variable

numbers from this research, a yearly report of each

country based on 35 high capital manufactured

companies was utilized. This research will observe

the financial report of the companies that are recorded

in the Stock Exchange of ASEAN-5 countries:

Indonesia, Malaysia, Singapore, Thailand, and

Phillipines from the year 2011 – 2016.

3.2 Design Analysis and Testing

Hypothesis

The regression asumption test will be conducted

using regression model panel and the simultan that

had passed the general terms as stated:

On the regression data panel there will be 3 types

of approach that consist of pooled least square, fixed

effect, and random effect. Pooled Least Square

approach is a model that is obtained through a

combination of retreiving all cross section data and

time series data. This model will be estimated using

Ordinary Least Square as below:

ititit

Xy

(1)

where,

idetermines unit cross-section (i= 1,….,n)

tdetermines the time range(t = 1,…., t).

3.3 Research Results

The outcomes of this research will analyze the

difference of the effect of the firm size, the financial

risks, the profitability, and the debt policy against the

IOS (IOS) of each of the ASEAN-5 Countries.

Table 1: The Effects of Structural Factor of The Company’s

Capital Against the IOS (IOS) on Share Manufacturs of

Each ASEAN-5 Countries.

Variable coefficient Prob

Indonesia

1. Firm size -0.041990 0.0098***

2. Ris

k

0.010723 0.7124

3. ROA 0.006163 0.7187

4. DER -0.021115 0.0255**

Prob(F-statistic) 0.016782**

Malaysia

1. Firm size 0.140813 0.0128**

2. Ris

k

0.000135 0.5451

3. DPR -2.24E-05 0.4774

4. DER -0.100258 0.0747*

Pro

b

(F-statistic) 0.000000***

Singapore

1. Firm size -0.006195 0.9807

2. Ris

k

-5.57E-05 0.1280

3. DPR -4.88E-06 0.9087

4. DER -0.000650 0.0496**

Prob(F-statistic) 0.846553

Thailand

1. Firm size 0.050301 0.5622

2. Ris

k

-9.69E-05 0.3140

3. DPR -1.60E-06 0.3663

4. DER -0.137351 0.0001***

Prob(F-s

t

atistic) 0.000072***

Philippines

1. Firm size -0.159804 0.0450**

2. Ris

k

0.000501 0.4517

3. DPR 0.000536 0.0394**

4. DER -0.023347 0.0001***

Prob(F-statistic) 0.000000***

Note: *** Significant at 1%; ** significant at 5%; *

significant at 10%.

From the table above, it is stated that:

Profitabilities

Risk

DebtPolicy

FirmSize

Investment

O

pp

ortunit

y

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

108

3.3.1 Indonesia

The firm size shows positive effects on the

Investment Opportunity. This results show that the

larger the firm size means the higher the IOS is. The

measurement of the large company defines as a

company that possesses large assets that could be

used for investments, and easier access to compete

and dominate the market.

All Najjar and Riahi-Belkaoui (2001) also

empowers that the firm size had a positive impact on

IOS. They state and argue that a small scale company

is potential to limitations or difficulties in restricting

their own assets, while the bigger companies

dominate the market and their industries.

Research results of Dhanaraj and Bearnish (2003)

also state that a large company had bigger quantum

resources of the availability of managerial resources.

Risks do not affect the IOS. Thus, the business

risk cannot be used to determine the investment

chances. This proves that this research shares a

common ground with Cassar and Holmes (2003),

even though its research found that a business risk

showed no true effect on leverage, but its studies

showed that consistency of efficient of business risks

against the IOS was proven to be negative. This

proved that a company with higher business risks

tends to have a low IOS. When it possesses higher

business risk with a higher debt usage, it will result in

complication for a company to pay its debts. Brigham

et al., (2001) put his opinion based by Modigliani and

Miller (1959) where an addition in debts where the

variable return condition is high will result in

bankruptcy. That causes a high capital but low value

that will result in a failed investments.

Profitabilities show a positive and unsignificant

result against the IOS. This proves that profitabilities

play an undominant role in determining the IOS. The

higher profitabilities allows the company to exist in

selecting their industries. The profitability rates

represent the results that show the bigger profits the

business had for their companies (Keown et al.,

2002). Next, the higher the company’s profitabilities

it had, the bigger chances for its profit to be defended

for investment.

Debt equity ratio shows a negative effect on the

IOS. This shows that the bigger the DER leads to

lower IOS. The companies with a higher financial

leverage will possess a risk of high default due to their

inability to pay the interest and the debts given

(Angeline, 2016). The same thing applies to the

payment of interests and the debts that may increase

the potential loss of the investment due to the higher

rate interests and payment over profits and

investments.

The usage of company structural leverage gave a

barrier in investments due to its barriers and debt

regulations (negative border). The loan makers

define the deadlines of the payment and ensure the

payment will commence with interests. Francis et al.,

(2013) shows that a financial leverage indicates a risk

and a higher leverage that cause an external expenses.

And thus, the high leverage company will possess a

higher financial risks compared to a low leverage

company and they tend to reduce the business risk

through a lower IOS.

Therefore, leverage had a negative effect against

IOS (Gaver and Gaver, 1993; Gul, 1999; Al Najjar

and Riahi-Belkaoui, 2001).

3.3.2 Malaysia

The firm size shows a positive influence on the IOS.

The bigger the firm size usually gave a larger asset

that could be used for investment that could lead to an

easier chance for a company to compete and dominate

the market based on Gaver and Gaver (1993). The

more prosperous and larger scale company is, the

more active the company to increase its investment

values through various forms like differentiating its

products to produce a barrier, economic scale, and

copyrights (Chung and Charoenwong 2001). Bolino

and Blood good et al. (2002) also stated that a large

scale company tends to employ more skilled and

professional manager compared to smaller

companies. Therefore, a large company possesses a

large capacity to dung growths compared to small

company.

Similar to Indonesia, the risk had no effects on the

IOS, and therefore, the risk couldn’t be used to

determine the IOS. In a situation that the way of the

business risks against the IOS is proven to be

negative, this means that the company that possesses

a high business risk and the higher debt usage will

complicate the company to pay its debts.

Profitability does not affect the IOS. This proves

that profitabilities are not dominant in determining

the IOS. Debt equity ratio had a negative and

insignificant result on the IOS. In addition, larger

DER means a decreased in the IOS. The negative

value proved that this research is based on Francis et

al., (2013) statement that says financial leverage

indicates the high leverage and high risk in the

company, which cost and access external fundings.

Therefore, higher leverage of a company means

higher financial risk. It is compared to the low

leverage that causes a low IOS. Thus, the leverage

points on a negative value on the IOS (Gaver and

The Impact of Capital Structure Determinant on Investment Opportunity: Evidences from Manufacturing Companies in ASEAN Countries

109

Gaver, 1993; Gul, 1999; All Najjar and Riahi-

Belkaoui, 2001).

3.3.3 Singapore

The firm size had a positive remark on IOS. The

bigger the firm size means the bigger asset they could

use for investments. In addition, it will be easier for a

company to compete and dominate the market based

on Gaver and Gaver (1993). A large elite company

had an active role in increasing the investments in

using any methods, such as product differentiation to

create a barrier, economic scales, and copyrights

(Chung and Charoenwong, 2001)

Risk had no effect in determining the IOS, and

therefore, risk factor could not be used to determine

the IOS in Singapore. The bigger the business risk it

had, and the higher debt it gets will complicate the

company in repaying its debts.

Profitability had a positive effect on the IOS. This

proved that a dominant profitability will determine

the IOS in Singapore. By having higher

profitabilities, the IOS will be high as well. The larger

the company profitability it had, the bigger its

chances for profit for the companies’ investment.

Thus, the investment chance is all based on the

company profitabilities by Boedie et al., (2009) and

(Riahi – Belakoui, 2002).

The Debt Equity Ratio had shown a negative

remark and had no effect on IOS. This proved that

DER isn’t dominant in determine the IOS in

Singapore. This negative remark proved the

researches conducted by Smith and Watts (1992),

Gaver and Gaver (1993), and Skinner (1993) and Gul

(1999), which state that a company with a high

leverage will have a chance of giving a low

investment. This will be resulting in an avoidance of

bankruptcy cost that is created from the high debt

amounts that are resulted in a decreased chance of

investments in Singapore.

3.3.4 Thailand

Unsignificant size of the firm against the IOS had

shown that the measurement could not be used to

determine the IOS in Thailand.

Risk factors do not affect the IOS in Thailand. As

the trade off implicates the theory from Brigham et

al., (1999), which states that a company with a high

business risk is better to use a lower debt compared to

other companies with a low business risk.

Profitabilities had affect and shown a positive

rates on the IOS, which shows that profitability is

dominant in determining the IOS in Thailand.

3.3.5 Philippines

Measurement had no effect on an IOS. This proved

that a measurement could not be used to determine

the investment chance in the Philippines. A negative

mark showed that Philippines’ investments are

against the theory of Gaver and Gaver (2003), All

Najjar and Riahi – Belakoui (2001), Dhanaraj and

Bearnish (2003) and Bolino (2002), that state the

bigger the size of the firm means a higher IOS.

The risk does not influence the IOS, and therefore,

the risk does not determine the IOS in Philippines.

Profitabilities have shown a positive

determination with the chance of investments, which

proves the profitability domains in determining the

investment in Philippines.

4 CONCLUSION AND

DISCUSSION

1. Debt Equity Ratio (DER) had a negative impact

and significant against the Investment

Opportunity on ASEAN-5 countries. This showed

that the more DER = decreased in Investment

Opportunity. This is because of the bigger the

debts means more rates that are resulted in

bankruptcy due to the debt payments + interests

that are resulted in decreasing investment rates.

2. The risk did not have significant effects on the

Investment Opportunity. This means that

investments are not done through high risk

companies due to its risk of bankruptcy.

3. Insignificant profitabilities of all ASEAN

countries are not domain in determining the

Investment Opportunity in each of these

countries. These countries did not consider the

profit based on the activeness of the Investment

Opportunity.

4. The effects of the firm size on the Investment

Opportunity for Indonesia, Malaysia and

Singapore have resulted in negative connections.

This proves that the bigger the size of the firm

means the lower chances of investment it has.

REFERENCES

Ahmed Riahi-belkaoui dan R. D. Picur. 2001. The IOS

dependence of Dividend Yield and Price Earning Ratio.

Managerial Finance, Vol. 27 No. 3, 65-71.

Aldaba, M. Rafaelita dan Josef, T. Yap, 2009. ‘Investment

and Capital Flows: Implication of the ASEAN

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

110

Economic Community’. Philippine Institute for

Development Studies.

Albrecht, W.D., and F, M. Richardson, “Income Smoothing

by Economic Sector”, Jurnal Of Business and finance,

Vol.17 No.5, Winter, h. 713-730, 1990.

All Najjar, Fouad, K dan Ahmed Riahi-Belkaoui, 2001.

empirical validation of a General Model of growth

opportunities. Managerial finance, Vol. 27 no. 3, 72-88.

Angelina, K. I., & Mustanda, I. K. (2016). Pengaruh ukuran

perusahaan, pertmbuhan penjualan dan profitabilitas

pada struktur modal perusahaan. e-Jurnal Manajemen

Unud, Vol. 5, No. 3.

Bambang Riyanto, 2001, Dasar-Dasar Pembelanjaan

Perusahaan, Edisi Keempat, Cetakan Ketujuh,

Yogyakarta: BPFE.

Boedie, Z., Kane, A., and Alan, M.J., 2009, Investment,

Second dition, Von Hoffman Press Inc. USA.

Bolino, M.C., Turnley, W.H., dan Bloodgood, J.M. 2002.

―Citizenship Behavior and the Creation of Social

Capital in Organizationǁ. Academy of Management

Journal, Vol. 7, No. 4, 2002 pp. 502 – 522

Brigham, Eugene F. and Joel F. Houston.2001.

Fundamentals of Financial management, Eight Edition.

Burgman, T. A., 2002. An empirical examination of

multinational corporate capital structure. Journal of

International Business Studies,27, 553–570.

Cassar, G. & Holmes, S., 2003. Capital Structure and

Financing of SMEs: Australian evidence. Accounting

and Finance, 43, 123-147.

Chaplinsky, S. 2004, The Economic Determinants of

Leverage: Theories and Evidence, Unpublished Ph.D.

Dissertation, University of Chicago.

Chung, Kee H, and Charoenwong, Charlie, 2001.

“Investment Options, Assets in Place, and the Risk of

Stocks”. Financial Management Vol. 20, No. 3

(Autumn, 1991), pp. 21-33. UK & USA. Blackwell

Publishers Ltd.

Dhanaraj, Charles dan Beamish, Paul W. (2003). ”A

Resource-Based Approach to the Study of Export

Performance”, Journal of Small Business Management;

Jul. Vol.41, no.3.

Ferdinand, A. Gul, 2000, Government Share Ownership,

Invesment Opportunity Set and Corporate Policy

Choices in China, Pasific Basin Finance Journal. no

7(2000)157-172.

Francis, J. dan K. Schipper, 2013, “Have Financial

statements Lost Their Relevance?”. Journal of

Accounting Research, Autumn: pp. 319-352.

Fraser, E.D.G., Dougill, A.J., Mabee, W., Reed, M.S.,

McAlpine, P.,2006. Bottom up and top down: analysis

of participatory processes for sustainability indicator

identification as a pathway to community

empowerment and sustainable environmental

management. Journal of Environmental Management

78, 114 –127.

Gaver, JJ And Keneth M Gaver.1993. “Additional Evidence

on The Association Between The Investment

Opportunity Stand Corporate Financing, Dividendand

Compensation Policies, Journal of Accounting an

economics, Vol.1, p. 233-265.

Gilson, Stuart, 1995, Investing in distressed situations: A

market survey,” Financial Analysts Journal,

November/December 8-27.

Gull and Jaggi B, 1999, An Analysist of Joint Effecs of IOS,

Free Cash Flow And Size on Corporate Debt Policy.

Review of Quantitative and Accounting 12, Hal 371.

373

Herwono Indra Saputra dan Njo Anastasia, 2013, Jenis

Investasi Berdasarkan Profil Risiko, Jurnal FINESTA

Vol. 1, No. 2, (2013) 47-52.

Hidayat, Azhari. 2013. Pengaruh kebijakan hutang dan

kebijakan dividen terhadap nilai perusahaan. Jurnal

Akutansi 1 (3): 1-27.

Homaifar (1994), Firm Size and Capital Structure:

Evidence from Taiwan Developed Indrustries, Journal

of Chinese Management Review, Vol 5 No 3.

Gull and Jaggi B, 1999, An Analysist of Joint Effecs of IOS,

Free Cash Flow and Size on Corporate Debt Policy.

Review of Quantitative and Accounting 12, Hal 371.

373.

Keown J Arthur, David Scott F, Jhon Martin D, William

Petty J, 2002, “Foundations of Finance: The Logic and

Practice of Financial Management” (6th Edition),

Amaon Try Prime.

Larry Lang, Eli Ofek dan Rene M. Stulz, Laverage,

Invesment and Firm Growth, Journal of Financial

Economic, 40 (2006) 3-29

Law J.R. and Chen, R. Carl dan Steiner, T. 1999.

“Managerial Ownership and Agency Conflicts: A

Nonlinear Simultaneous Equation Analysis of

Managerial Ownership, Risk Taking, Debt Policy, and

Dividend Policy”, Financial Review, Vol.34

Lee Heeseok, Byounggu Choi, (2002). Knowledge

management strategy and its link toknowledge creation

process, Expert Systems with Applications 23 (2002)

173–185

Lee, K. dan Kwok, C.Y.1988, Multinational Coprporations

vs. Domestic Corporations: International

Environmental Factor and Determinants of Capital

Structure, Journal of International Business Studies,

19,195-217.

Modigliani, F. And M.H Miller, 1959, The Invesment

Opportunity set and Corporate Financing, Dividend,

and Compentations policies, Review 53,433-433.

Myers, Stewart C. 1977. Determinant of Corporate

Borrowing, Journal

of

Financial Economics5. pp.

147-

175.

Moh'd, M.A., Perry, L.G., and Rimbey, J.M., 2005, "An

Investigation of Dynamic Relation Beetwen Theory and

Dividend", The Financial Review, Vo1.30, No.2 May.

Pagalung,Gagaring.(2002). Pengaruh Kombinasi

Keunggulan dan

Keterbatasan

Perusahaan terhadap

Set Kesempatan Investasi(IOS), Jurnal

Riset

Akuntansi Vol.6. Hal.

249-263

Peasnell,

Pope, dan Young (2008) Corporate Governance in

Less Developed and Emerging Economies, Emerald

Group Publishing

Saputro, Adi, akhmad, Hindasah, Lela, 2007, Analisis

Pengaruh Kebijakan pendanaan, Deviden, dan

Profitabilitas, terhadap Set Kesempatan Investasi

The Impact of Capital Structure Determinant on Investment Opportunity: Evidences from Manufacturing Companies in ASEAN Countries

111

(IOS), Jurnal Akuntansi dan Investasi, Vol 8, No1, hal

52-62

Skinner, Douglas J. 1993. The IOS and Accounting

Procedure Choicc. Journal of Accounting and Olwmks,

Vol. 16.407-445

Smith Jr, Clifford W. dan RossL.Watts.1992. The

Invesment Opportunity Set and Corporate Financing,

Dividend, and Compensation Policies, Journal of

Financial Economics 32:263-292

Subchan dan Sudarman. 2010. Pengaruh Kebijakan Utang,

Kebijakan Dividen, Risiko Investasi, dan Profitabilitas

Perusahaan Terhadap Set Kesempatan Investasi. Jurnal

Bisnis dan Ekonomi.

Subekti, Imam and Indra Kusuma.2001. Asosiasi antara Set

Kesempatan Investasi dengan Kebijakan Pendanaan

dan Dividen Perusahaan, serta Implikasinya pada

Perubahan Harga Saham. Jurnal Riset Akuntansi

Indonesia, vol 4(1). Hal 44-63.

Titman, S., dan Wessels, R. 1988. “The Determnants of

Capital Structure Choice.” Journal of Finance, vol 43,

pp:1-9.

Voulgaris, D. 2002. Capital Structure, Asset Utilization,

Profitability and Growth in the Greek Manufacturing

Sector. J. Applied Econ., No.34, pp.1379-1388.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

112