Measuring Financial Performance of State-Owned Enterprises under

Aviation in Indonesia:

Case Study: PT. Angkasa Pura I and PT. Angkasa Pura II

Wiwiek Mardawiyah Daryanto

LPPM, Sekolah Tinggi Manajemen IPMI, Jl. Rawajati Timur I/1, Kalibata, Jakarta 12750, Indonesia

Keywords: Financial Performance, Financial Ratios, SOEs, VIWI, Aviation.

Abstract: Visit Wonderful Indonesia (VIWI) 2018 is the government program with targets of 17 million tourists and

18 destinations across Indonesia. An excellent performance of State-Owned Enterprises (SOEs) under

aviation is mandatory. This study aims to measure the financial health conditions of the two SOEs under

aviation i.e PT Angkasa Pura I (AP I) and PT Angkasa Pura II (AP II) in 2011-2015. The Decree No.KEP-

100/MBU/2002 of Indonesia Ministry of SOEs on June 2002 provides the mandatory of measuring and

rating the financial health condition of SOEs. The results of eight financial ratios investigating; 1) return on

equity, 2) return on investment, 3) cash ratio, 4) current ratio, 5) collection period, 6) inventory turnover, 7)

total asset turnover, 8) total equity to total asset, then to be validated by the said Ministry of SOEs Decree to

conclude the yearly financial health conditions of each SOEs The result shows that in 2011 - 2015, both

SOEs achieved healthy financial condition levels, although AP II was better in performance than AP I as

shown in the rating as follows; AP I (BBB, BBB, BBB, A, and A); and AP II (AA, AA, A, A, and A).

However, AP I was successfully achieved the highest levels in 2014 and 2015, from B to A levels. This

study has added the knowledge in the financial literature. It also gives a strong insight for managers in

aviation industry about the financial performance. Therefore, the managers could make decisions to increase

both market share and profitability.

1 INTRODUCTION

Arief Yahya as the Indonesia Minister of Tourism,

stated that in 2015, tourism sector contributed 10%

of GDP, which is the highest nominal in ASEAN, or

USD 82.4 B. The number of tourists was

10,406,759, while in Thailand was 29,881,091 with

contribution to GDP was only USD 81.6 B

(Khumaedy, 2017 available at

http://setkab.go.id/penerbangan-menuju-destinasi-

pariwisata). The development of tourism sector will

significantly affect the growth of air lines business

and drive the increase of foreign income of the

country, due to the average spending of a foreign

tourist about USD 1,100 – 1,200 per visit (Central

Bureau of Statistic, 2016). In addition, the area of

Indonesia that lies between the Indian Ocean and the

Pacific Ocean make Indonesia’s position very

strategic

, and also consists of thousand islands from

Sabang to Merauke. In supporting the aviation

industry, right now Indonesia has two companies

under aviation, 1) PT Angkasa Pura I (Persero), or

AP I; and 2) PT Angkasa Pura II (Persero), AP II.

AP I and AP II are the State-Owned Enterprises

(SOEs) in the Ministry of Transportation

environment that are engaged in airport services and

airport related services in Eastern and Western parts

of Indonesia respectively. The functions of both

companies are managing airport businesses and

airport related services by optimizing the utilization

of their potential resources, especially to support the

VIWI 2018. AP I and AP II are the State-Owned

Enterprises (SOEs) in the Ministry of

Transportation environment that are engaged in

airport services and airport related services in Eastern

and Western parts of Indonesia respectively.

The Government of Indonesia decides that it is

mandatory to the company under the Ministry of

SOEs that they should implement financial ratio to

measure the level of financial health condition. The

previous research about financial performance has

been discussed in many sectors such as hospital,

bank, and small business. Edmister (1972) stated

that financial ratio is really useful to measure the

Daryanto, W.

Measuring Financial Performance of State-Owned Enterprises under Aviation in Indonesia: Case Study: PT. Angkasa Pura I and PT. Angkasa Pura II.

DOI: 10.5220/0008488800990104

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 99-104

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

99

performance of small business and it can be used to

predict the failure. Washington (2001) stated that

research on the ability of financial models to provide

an early warning of corporate failure is favourable.

The users of business information are often

stakeholders who rely heavily on financial reports.

Lan (2012) stated that ratio analysis is one of the

most widely used fundamental analysis techniques.

Ratio analysis is a tool that was developed to

perform quantitative analysis on numbers found on

financial statements. Ratios help link the three

financial statements together and offer figures that

are comparable between companies and across

industries and sectors.

However, the literature about financial

performance in aviation industry is very limited.

Therefore, this study investigates the association

between financial performances of both aviation

SOEs, AP I and AP II for the periods of 2011-2015,

which then the results to be validated by the decree

of the Ministry of SOEs No. KEP-100/MBU/2002.

This study is beneficial for academician because it

extends the knowledge of financial ratio in the real

practice. Besides that, it could help students and

lecturers to understand financial ratio more

effectively. In addition, this study is also important

for managers because it can help them to analyse the

company’s situation and guide them to make

decisions.

Research Questions

1. How healthy was the financial performance of

the two aviation industries based on the decree of

the Ministry of SOEs No. KEP-100/MBU/2002)?

2. What was the difference of financial

performance between both aviation SOEs, AP I

and AP II?

2 LITERATURE REVIEW

2.1 Previous Research on Financial

Ratio

Financial ratio is a good evaluation method to

measure the company performances (Megaladevi,

2015). Company usually uses this method to

compare their performance with other competitors.

There have been a large number of empirical studies

on financial ratio on different industries around the

world (Yeh, 1996; Webb, 2003; Lacewell, 2003;

Halkos and Salamouris, 2004; Tarawneh, 2006).

However, there are limited resources which evaluate

the financial performance of Estate Palm Oil

Enterprises in Indonesia. According to Tarawneh

(2006), the financial ratio analysis (FRA) has been

applied in Banking industry to examine, evaluate,

and ranked based on their performance. Based on the

study in Oman Commercial Banks, financial

performance has relationship with asset

management, size and operational efficiency. There

are two methods to measure the financial

performances which are accounting and market

measurement. There are many researchers who

prefer to use accounting measurement (Waddock

and Graves, 1997; Cochran and Wood, 1984), rather

than market measurement (Alexander and Buchholz,

1978; Vance, 1975), and some of them adopt both

methods (McGuire et al., 1988). There are few

differences between accounting and market

measurement methods. In accounting, company uses

the historical aspects to measure their financial

performance (McGuire et al., 1986) and it contains

a bias which lead to managerial manipulation. On

the other hand, market measurement method is

straight forward, focuses on performance and

represents the ability of a company to generate

future income (McGuire et al., 1988).

2.2 The Decree of Ministry of SOEs

Based on the Decree of Ministry SOEs No. KEP-

100/MBU/2002 about financial health assessment of

SOEs, the growth of business should be supported

by good infrastructure and evaluation system to

measure the efficiency and level of competition

among SOEs. This financial evaluation applies to all

state-owned enterprises in the financial and non-

financial industry. In non-financial industry, the

companies are divided into infrastructure and non-

infrastructure. This evaluation method consists of

three aspects which are financial, operational, and

administration. In a financial aspect, the total weight

score for infrastructure is 50 and non-infrastructure

is 70. There are eight indicators to measure the

financial health such as return on investment (ROI),

return on equity (ROE), cash ratio, current ratio

(CR), collections period (CP), inventory turnover

(ITO), total asset turnover (TATO), and total equity

to the total asset (TETA).

3 RESEARCH METHODOLOGY

Descriptive financial ratios were used to measure,

describe, analyse, and evaluate the financial health

conditions of two state owned cement enterprises

under the Ministry of Industrial, AP I and AP II,

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

100

because those companies are state owned enterprises

in non-financial services which qualified in the

decree of the Ministry of State Owned Enterprises

No.KEP-100/MBU/2002 about financial health

assessment of SOEs. All variables used are ratio

measurement scales were taken from the decree. The

data were collected from their Annual Report

(audited) between 2011 and 2015. In addition, this

decree was used to validate the financial health

condition level of those enterprises whether in the

levels of very healthy level (AAA, AA, A), or

healthy level (BBB, BB, B), or unhealthy level

(CCC, CC, C).

The selection of the Financial Ratio Analysis

(FRA) method for this study is motivated the

researchers’ knowledge due to limited literature

review on aviation industry in Indonesia. In addition,

financial ratios can be used to identify a company’s

specific strengths and weaknesses as well as

providing detailed information about company

profitability, liquidity, activity and solvency

(Hempel et al., 1994: Dietrich, 1996). Although

accounting data in financial statements is subject to

manipulation and financial statements are backward

looking, they are the only detailed information

available on the company’s overall activities

(Sinkey, 2002). Furthermore, they are the only

source of information for evaluating management’s

potential to generate satisfactory returns in the future

(Kumbirai and Webb, 2010). Oil business requires

high capital, high technology, high risks, long-term

commitment, but may be high returns (Daryanto,

2018). Dozens of ratios can be computed from a

single set of financial statement (Anthony et al.,

2011). Analyzing financial statements involves

evaluating three characteristics: a company’s

liquidity, profitability, and solvency (Kieso et al.,

2016) The company are encouraged to maintain their

profitability by increasing its activity ratios

(Daryanto, 2018).

4 ANALYSIS AND DISCUSSIONS

4.1 Profitability Analysis of AP I

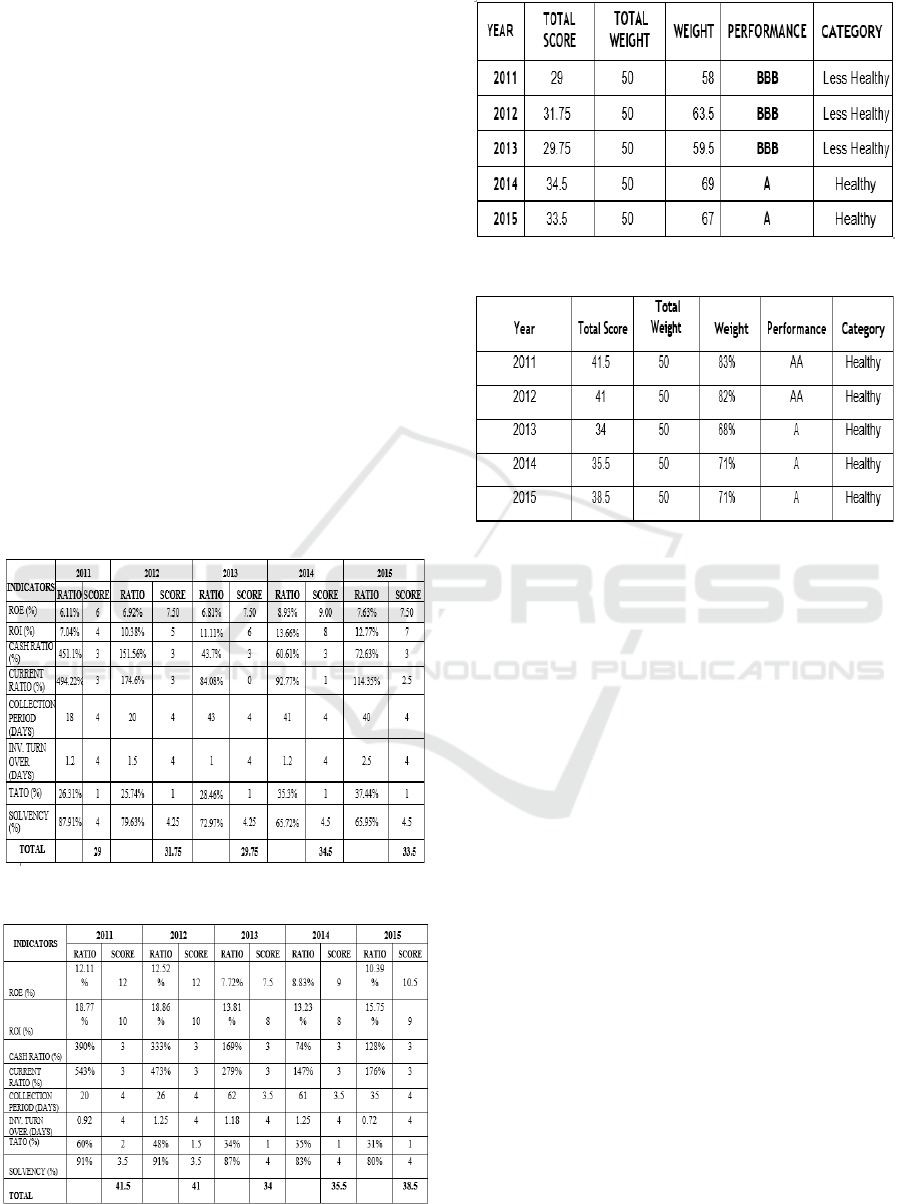

Table 1 shows information about the percentage of

return on equity (ROE) and return on investment

(ROI) of AP I for 2011 – 2015, which was based on

its Annual Reports. Basically, the percentage of ROI

increased along with the percentage of ROE. The

percentage of ROI was slightly increased around

3.34% from 7.04% in 2011 to 10.38% in 2012. Yet,

between 2014 and 2015 the percentage of ROI was

decreased from 13.66% to 12.77%. Overall, the

percentages of ROE of 2011-2015 of AP I were

6.11%, 6.92%, 6.81%, 8.93%, and 7.63%, as

shown in Table 1.

While the percentages of ROI,

7.04%, 10.38%, 11.11%, 13.66%, and 12.77%

respectively.

4.2 Profitability Analysis of AP II

Table 2 gives information about the percentages of

return on equity (ROE) and return on investment

(ROI) of AP II for 2011-2015, which was based on

its Annual Reports. In 2011, ROI of AP II could

reach 19%. And in 2015, it decreased to 16%.

Overall, it shows the percentages of the ROI of AP

II, 18.77%, 18.86%, 13.81%, 13.23%, and 15.75%

respectively. Although the percentages ROI of AP II

was higher than AP I, both companies were in good

profitability conditions, in which the ability of funds

invested in assets could generate good profits. The

same with the trend of ROE figures, the percentages

of ROE of AP II was also higher than of AP I in

2011-2015, as shown in Table 1 and Table 2. In fact,

the economy of Western Indonesia is more advance

compared with Eastern Indonesia. Overall, the

percentages of ROE 2011-2015 of PT AP II,

12.11%, 12.52%, 7.72%, 8.83%, and 10.39%.

While the percentages of ROI of AP II, 18.77%,

18.86%, 13.81%, 13.23%, and 15.75% respectively

for 2011-2015, as shown in Table 2.

4.3 Liquidity Analysis of AP I

Table 1 shows the percentage of cash ratio and a

current ratio of AP I from 2011 to 2015. Overall,

there was a sharp decrease in the percentage of cash

ratio and current ratio; cash ratios (451.1%;

151.56%; 43.7%; 60.61%; and 72.63%); current

ratios (494.22%; 174.6%; 84.08%; 92.77%, and

114.35%). In the horizontal analysis, the average

current ratio for the past five years was 192.004%

which means that IDR 1,-of current liability were to

be guaranteed by IDR 1.92 of a current asset.

Between 2011 and 2013, the percentage of current

ratio was decline from 494.22% to 84.08% and then

it begun slightly increase to 114.35% in 2015. In

cash ratio, the percentage decreased sharply from

415.10% in 2011 to 43.70% in 2013. But then it

started raise from 60.61% in 2014 to approximately

72.63% in 2015.

4.4 Liquidity Analysis of AP II

Table 2 shows the trend of cash ratio and current

Measuring Financial Performance of State-Owned Enterprises under Aviation in Indonesia: Case Study: PT. Angkasa Pura I and PT.

Angkasa Pura II

101

ratio of AP II 2011- 2015. In the horizontal analysis,

the average current ratio for the past five years

was 323.6% which means that IDR 1, - of current

liability were to be guaranteed by IDR 3.236 of a

current asset. Between 2011 and 2014, the

percentage of current ratio was declined from 543%

to 147% and then it begun slightly increased to

176% in 2015. In cash ratio, the percentage

decreased slightly from 333% in 2012 to 169% in

2013. But then it started to raise from 74% in 2014

to approximately 128% in 2015. Overall, there was a

sharp decrease in the percentage of cash ratio and

current ratio; cash ratios (390%; 333%; 169%; 74%;

and 128%); current ratios (543%; 473%; 279%;

147%, and 176%). As shown in Tables 1 and 2, the

liquidity ratios of AP I and AP II have already

decreased, not too liquid, still above the standard

ratios of minimum 100%. In general, the liquidity

ratios of both companies were very good.

4.5 Activity Analysis of AP I and AP II

Table 1 shows in detail of days’ receivable of AP I

in 2011-2015; 18, 20, 43, 41, and 40 days

respectively. Table 2 shows in detail of days’

receivable of AP II in 2011-2015; 20, 26, 62, 61and

35 days respectively. Both SOEs experienced

increase in the ratios, or inefficient in the collection

of receivables. This was due to lack of discipline in

the payments of the partners of against the

commitments contained in the agreed contract.

However, based on the said Decree, it can be

concluded that the ratios were in good condition and

the management of the receivable ran efficiently.

Figure 6 shows the trend of ITO of AP I and AP II in

2011-2015. Table 1 shows in detail of the ITO of AP

I; (1.2, 1.5, 1, 1.2, and 2.5) days respectively. While

the Table 2 shows in detail of the ITO of AP II;

(0.92, 1.25, 1.18, 1.25, and 0.72) days respectively.

Both SOEs were very efficient in managing their

inventory. In detail, the TATO ratios of AP I were

26.31%, 25.74%, 28.46%, 35.3%, and 37.44%, as

shown in Table 1. The ratios were increase

slightly from 26.31% in 2011 to 37.44% in 2014.

Table 2 shows the TATO ratios of AP II; 60%,

48%, 34%, 35%, and 31% respectively in 2011-

2015. The ratios were decrease significantly, 60% in

2011 to 31% in 2015. It shows that the company less

efficient in managing the asset employed to generate

revenues.

4.6 Solvency Analysis of AP I and AP

II

Overall, there were decrease in the ratios of AP I,

(87.91%, 79.63%, 72.97%, 65.72%, and 65.95%), as

shown by Table 1. While Table 2 presents the

percentage of TETA ratios in 2011-2015 of AP II.

Overalls, the TETA ratios were stable; 91%, 91%,

87%, 83%, and 80%. Both companies were in

solvent conditions, they have no problem in

repayment their long- term obligations, because all

ratios were above the standard of 50%, or in low

risks conditions. It means that, more than 50% of

their assets were financed by equity, not liability.

5 VALIDATION TESTING

To examine the level of financial assessment for

both SOEs under aviation enterprises whether in

healthy or less healthy or unhealthy position for

2011-2015, the decree of Ministry of SOEs No.

KEP- 100/MBU/2002 is employed to test the

validation. Overall, based on Table 1, there was a

slight increase in the total score of AP I. It increased

slightly from 29 in 2011 to 31.75 in 2012. Then,

decreased to 29.75 in 2013; and increased again to

34.5 in 2014; and decreased slightly to 33.5 in 2015.

Next, the total score converted to the total weight

with the calculation formula (total score/weight)

multiplied by 100. The highest weight score was 69

in 2014 with level A which considered as healthy

financial condition. The lowest weight score was 58

in 2011 with level BBB that considered as less

healthy financial condition, as shown in Table 3. As

data shown in Table 2, there were decreases in the

total score in 2011- 2015. It decreased slightly from

41.50 in 2011 to 41 in 2012, and 34 in 2013. Then, it

increased to 35.5 in 2014, and 38.5 in 2015. Next,

the total score was converted to the total weight with

the calculation formula (total score/weight)

multiplied by 100. AP II got financial healthy levels

of AA, AA, A, A, and A respectively in 2011-2015,

as shown in Table 4.

6 LIMITATION

This study has expanded the literature about

financial performance in the real working world.

Since the focus is on one industry, it is worth to

explore it on a wider scale and find out if different

company yields the same result. In addition, the

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

102

study only focuses on financial aspects. It is

suggested to measure the financial performance of

SOEs in other aspects such as operational and

administration.

7 CONCLUSION &

RECOMMENDATION

The study shows the financial performance of

aviation industry in 2011-2015, and was based on

the decree of the Ministry of SOEs No. KEP-

100/MBU/2002 about financial health assessment of

SOEs. The study concerns about four classifications

of ratio measurement that includes liquidity,

solvency, profitability, and activity ratios. The

outcome shows that PT. AP I and PT. AP II

experienced stable financial performance in the

period. This was caused by the effort done by both

SOEs to achieve a target of VIWI 2018, which was

set up by the government. The result shows that

during the five years period, 2011 to 2015, both

SOEs have achieved healthy financial condition

levels and rating as follows; AP I (BBB, BBB, BBB,

A and A); and AP II (AA, AA, A, A, and A). In the

last two years, AP I has achieved an excellent level

of financial health, although in the first three years

were only BBB, or less healthy levels respectively.

On the other hand, AP II has achieved excellent A

level for the period, although it was decreased

slightly during the last two years, from double AA to

single A only. It can be concluded that AP II has

better performance compared to AP I. However,

it was proven that both SOEs supported the

government program of developing excellent

services in the aviation industry. A similar study has

been done by Pratama (2017) for SOE in

Telecommunications industry for 2011-2015, with

results of financial health levels of A, A, A, A, and

BBB. Daryanto (2017) carried out the similar study

as well in three SOEs of Palm Oil Agroindustry

2011-2015. This study has added the knowledge

in the financial literature. It also gives a strong

insight for managers in cement industry about the

financial performance. Therefore, the managers can

make a better decision with the purpose to increase

the market share and the profitability.

REFERENCES

Alexander, G. J., and Rogene A. Buchholz (1978)

“Corporate social responsibility and stock market

performance.” Academy of Management Journal, 21

(3): 479-486.

Annual Reports 2011 – 2015 of PT. Angkasa Pura I

(Persero).

Annual Reports 2011 – 2015 of PT. Angkasa Pura II

(Persero).

Anthony, R.N; Reece, J.S. and Hertenstein, J.H. 2011.

Accounting: Text and Cases, 13th Edition. Irwin,

Chicago.

Daryanto, Wiwiek M (2017). Financial Performance

Analysis and Evaluation of Palm Oil Agroindustry: An

Indonesia Experience. Jurnal Ilmiah Manajemen dan

Bisnis. Vol. 3, Nomor 1, Maret 2017. ISSN 2460

8424, pp 108-126.

Daryanto, Wiwiek M., Primadona A. (2018). Capital

Budgeting Model and Sensitivity Analysis of the

Conventional Oil Production Sharing Contract (PSC)

Fiscal Systems: Empirical Evidence from Indonesia.

International Journal of Engineering & Technology, 7

(3.21): 5-9.

Daryanto, Wiwiek M., Nurfadilah D. (2018). Financial

Performance Analysis Before and After the Decline in

Oil Production: Case Study in Indonesia Oil and Gas

Industry. International Journal of Engineering &

Technology, 7 (3.21): 10-15.

Daryanto, Wiwiek M., Samidi S. (2018). Measuring the

Financial Performance of Enterprises Under Ministry

of Energy and Mineral Resources (EMR) an Indonesia

Experience. International Journal of Engineering &

Technology, 7 (3.21): 16-23.

Edmister, R.O. (1972). An empirical test of financial ratio

analysis for small business failure prediction. Journal

of Financial and Quantitative Analysis, 7(2), 1477-

1493.

Hempel, G., Simonson, D., and Coleman, A. (1994). Bank

Management: Text and Cases. 4th

Edition, John Wiley

& Sons, Inc.

Kementerian Badan Usaha Milik Negara. Salinan

Keputusan Menteri Badan Usaha Milik Negara

Nomor: KEP-100/MBU/2002. Retrivied on 30

November 2016 from http://www.bumn.go.id/

Khumaedy 2017, available at http://setkab.go.id/

penerbangan-menuju-destinasi-pariwisata

Kumbirai, M., Webb, R. (2010). A Financial Ratio

Analysis of Commercial Bank Performance in South

Africa. African Review of Economics and Finance 2

(1), pp 30-53.

Lan, Joe. (2012). 16 Financial Ratios for Analyzing a

Company’s Strengths and Weaknesses. Retrieved

from http://www.aaii.com/journal/article/16-financial-

ratios-for-analyzing-a-companys-strengths-and-

weaknesses.touch

McGuire, J. B., A. Sundgren, and T. Schneeweis (1988)

“Corporate social responsibility and firm financial

performance.” Academy of Management Journal, 31

(4): 854- 872.

Megaladevi, P. (2015). A study on financial performance

analysis of the selected paper company with special

reference to Tamil Nadu Newsprint and papers

limited. International Journal of Recent Research

Measuring Financial Performance of State-Owned Enterprises under Aviation in Indonesia: Case Study: PT. Angkasa Pura I and PT.

Angkasa Pura II

103

Aspects, 2(4), 22-24.

Pratama, Sasotya. (2017). Measuring Financial

Performance of PT. Pos Indonesia during The E-

Commerce Booming. IPMI International Journal of

Business Studies 1 (1), 29-37.

Sinkey, J. (2002). Commercial Bank Financial

Management: In the Financial-Services Industry 6th

Edition Prentice Hall, Upper Saddle River, NJ.

Vance, S. C. (1975) “Are socially responsible corporations

good investment risks?” Management Review, 64: 18-

24.

Waddock, S. A., and Samuel B. Graves (1997) “The

corporate social performance- financial performance

link.” Strategic Management Journal, 18 (4): 303-319.

Washington, H. Lee. (2001). Financial distress reporting:

Bringing a user focus to business reporting.

Weygandt, Jerry J.; Kimmel, Paul D.; and Kieso, Donald

E. (2015). Accounting Principles, 12

th

Edition. John

Wiley & Sons,Pte Ltd.

ProQuest Dissertations. Retrieved from

http://search.proquest.com/docview/304780186/previe

wPDF/A1EC841B&B764CF0PQ/ 1?accountid=31562

APPENDIX

Tabel 1: Test Results for PT. Angkasa Pura I.

Tabel 2: Test Results for PT. Angkasa Pura II.

Tabel 3: Summary of Test Results of PT. Angkasa Pura I.

Tabel 4: Summary of Test Results of PT. Angkasa Pura II.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

104