Company Financial Ratios, Company Ownership and Company

Conditions on Earnings Management

Indra Arifin Djashan and Ade Lawira

STIE Trisakti, Jl. Kyai Tapa No. 20, Grogol, Jakarta, Indonesia

Keywords: Earnings Management, Financial Ratio, Company Condition, Company Ownership, Operating Cash Flow,

Indonesia Stock Exchange.

Abstract: Recently, high-level scandals and financial crises that have occurred in several countries have brought issues

of corporate governance to the forefront of developing countries, emerging markets and transitional

economies. This scandal shook the integrity of accounting information and resulted in a decline in investor

confidence. This has made the company need to achieve significant progress to carry out corporate governance

to restore investor confidence in the quality of financial reporting. To achieve this, this paper proposes a

conceptual framework to investigate the relationship between financial ratios (profitability, leverage and

operating cash flow), ownership (Institutional ownership and managerial ownership), and company condition

(board size, firm size, sales growth) to earnings management among manufacturing companies listed on the

Indonesia Stock Exchange (IDX). Evidence from previous research shows that the company's financial ratios

(profitability) that have large profits and meet targets has very little chance of manipulating earnings.

1 INTRODUCTION

Perusahaan Terbatas (PT) is one of the most popular

business entities in the business world, and is widely

used by business actors in Indonesia as well as in

other countries. The company as an entity needs a

reference to evaluate the performance of the

management of the company over a period of time,

for which it is prepared and required a record called

the financial statements. PSAK No. 1 explains that

the financial statements are a record that presents the

financial condition of a company in a structured

manner in a given accounting period. The purpose of

the financial statements is to provide information

related to the financial condition and cash flows of a

company, beneficial to its users in terms of making an

economic decision (Financial Accounting Standards

Board, 2014).

Along with the advancement of technology and

information technology, business competition is

encouraged to happen more tightly. This is due to

price transparency and ease to obtain a product

quickly, for that the management to compete to obtain

the maximum profit possible. Earnings are often the

primary basis for assessing whether the company's

management has contributed to the best interests of

the company, leading to the birth of earnings

management practices by management.

Profit management is the way managers use to

systematically and systematically influence the rate

of profit by selecting accounting policies and certain

accounting procedures from existing accounting

standards and scientifically maximizing their utility

and / or market value (Scott, 2015). The Company

will determine whether the profits earned will be

allocated to shareholders or entirely retained for

reinvestment. The information asymmetry that

emerges between managers and shareholders

provides the flexibility for management to freely

determine the accounting methods and estimates used

in reporting corporate profits thus providing an

opportunity for earnings management (Indriani et al.,

2014).

To minimize the practice of earnings

management, Kusumawardhani (2012) explains that

the concept of Good Corporate Governance can be a

tool to monitor and control the actions taken by the

management company, so that the opportunistic

behavior of management to make earnings

management can be reduced. Implementation of the

concept of Good Corporate Governance can be seen

from the existence of parties such as managerial

ownership, institutional ownership, audit committee

44

Djashan, I. and Lawira, A.

Company Financial Ratios, Company Ownership and Company Conditions on Earnings Management.

DOI: 10.5220/0008487900440048

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 44-48

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and independent commissioner in a company that

emphasizes on management responsibility to

mechanism and guidance and company objective, to

protect shareholder's interest.

Jensen and Meckling (1976) explain the agency

relationship is an agreement between the principal

and the agent for a delegation of the authority of the

work. Principal acts as the party giving the authority

of the company's operational management to the

agent in order to achieve the goals of the entity. In

practice within the company, the investor who invests

his capital for the company acts as a principal. While

the management company acts as an agent, which is

responsible to investors to manage the company's

operational activities in accordance with the trust that

has been given to him (Godfrey et al., 2010).

Separation of functions between ownership and

management can lead to conflicting agencies, because

in the case of decision-making, managers sometimes

do not act in the interests of shareholders. The

existence of such a difference of interest encourages

the owner to exercise control in order to ensure that

management actions are in conformity with the

company's objectives and to reduce profit

manipulation (Aygun et al., 2014).

Management has more information when

compared with the investor. This is what causes

information asymmetry. In addition, this also causes

management to take actions that are profitable for him

and very difficult for the investor to control the action

so that management can implement certain policies

that are not known by the investors (Lisa, 2012).

2 THEORETICAL FRAMEWORK

AND HYPOTHESIS

DEVELOPMENT

The Signal Theory explains that the activities of a

company can signal to the public. The Company

strives to provide a positive signal to external parties,

with the aim of improving the company's

performance and reducing the occurrence of

information asymmetry.

According to Ross (1977) that the management

seeks to provide the best possible information to the

public, this can lead to information asymmetry

between companies and external parties company. If

the company has increased leverage then the public

will give a positive signal and if it publishes shares

then the public will give a negative signal. The basis

of this theory explains that the company is likely to

compile financial statements that can generate the

best possible profit but not necessarily show the real

condition of real corporate finance.

Scott (2015) identified the existence of four

patterns performed by the management to make

earnings management, which are: (1) Taking a bath is

done when there is a bad situation that is unprofitable

and can not be avoided, that is by recognizing the

costs in the period to be (2) Income minimization is

done when the company obtains high profitability in

order not to get political attention, (3) Income

maximization is done by maximizing the profit in

order to obtain bigger bonus. From positive

accounting theory, managers can engage in

maximized reported net income for bonus purposes,

(4) Income smoothing is done by increasing or

decreasing profits to reduce reported profit

fluctuations so that the firm looks stable and not at

high risk.

In addition, Ahmed and Belkaoui (2000) in

Handayani and Rachadi (2009) explain earnings

information has 5 main objectives for parties

interested in the company. First, profit is used as the

basis for the company to determine the policy of

dividends and bonuses for shareholders. Second, the

profit becomes the basis for calculating the tax

obligations of companies that must be deposited to

the government. Third, profit is used as a basis for

economic and investment decision making. Fourth,

earnings information is useful for assessing the

prospects of the company for the future, and fifth,

profit is used as the basis for the assessment of the

performance of the management during a certain

period of time. The importance of this profit

encourages the manipulation of profit.

Good corporate governance mechanisms

emphasize two important things: the investor must get

the information that is appropriate to the real situation

and delivery on time. The second thing is to

emphasize that company management must disclose

information to investors regarding the company's

performance in a transparent and timely manner

(Guna and Herawaty, 2010).

This research uses Discretionary Accrual model to

measure earnings management by management.

Discretionary Accrual is the utilization of accrual

components in accounting conducted by the

management company, through its interference with

the preparation of financial statements. This

intervention causes reported earnings do not reflect

actual company conditions (Guna and Herawaty,

2010).

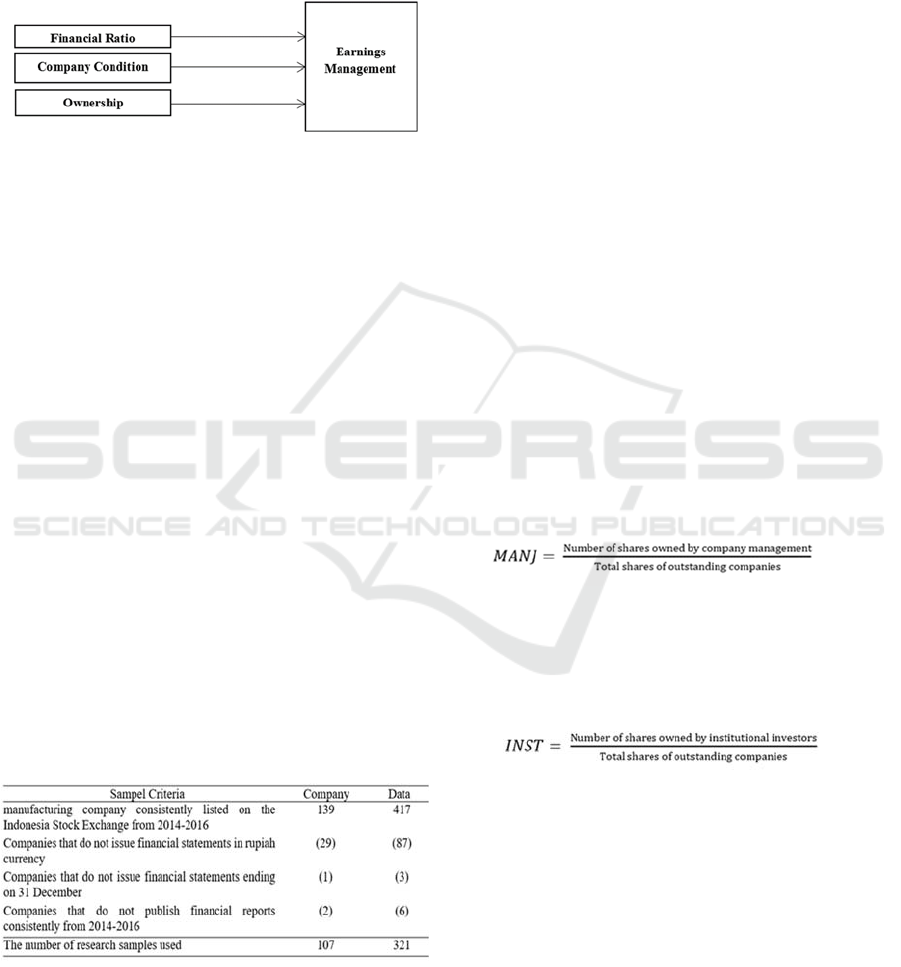

Researchers classify eight variables into three

major groups, namely the Financial Ratio, Ownership

company, and Company conditions. Financial Ratio

Company Financial Ratios, Company Ownership and Company Conditions on Earnings Management

45

consists of: profitability, leverage, and operational

cash flow. Ownership company comprised of

institutional ownership and managerial ownership

Company conditions consists of board size, company

size, and company growth. Based on the theoretical

description above, the research model formulated in

this research is as follows:

Figure 1: Research Model.

H1: Board size affects earnings management.

H2: Managerial ownership affects earnings

management.

H3: Institutional ownership affects earnings

management.

H4: Firm size affects earnings management.

H5: Profitability affects earnings management.

H6: Leverage affects earnings management.

H7: Operating cash flow affects earnings

management.

H8: Sales growth affects earnings management.

3 RESEARCH METHOD

The sample used in this research is a manufacturing

company consistently listed in Indonesia Stock

Exchange (BEI) in 2014 until 2016. The sample

selection is done by purposive sampling method that

is the selection of sample based on certain criteria

according to the purpose and research problem

(Sugiyono, 2012). The results of sample selection can

be seen in table 1 below:

Table 1: Sample Selection Procedure.

Earnings management is measured using the

discretionary accruals method, which is a modified

cross-sectional model of Jones, in absolutes as

research has been done by (Bassiouny et al., 2016).

The stages for obtaining a discretionary accrual value

are expressed in the following equation:

TA

t

= NI

t

-

N

CF

t

(1)

TA

it

/A

it-1

= β

1

(1/A

it-1

) + β

2

((∆REV

it

−∆REC

it

)/

A

it-1

) + β

3

(PPE

it

/A

it-1

) + εit

(2)

NDA

it

/A

it-1

= β

1

(1/A

it-1

) + β

2

((∆REV

i

t

−∆REC

i

t

)/A

i

t

-1

) + β

3

(PPE

i

t

/A

i

t

-1

)

(3)

DAC

it

= TA

it

/ A

it-1

- NDA

it

/ A

it-1

(4)

TAt Total Accruals in period t, NIt Net income t

period, NCFt Cash flow from operating activity

period t, NDAit Nondiscretionary accruals period t,

Ait-1 Total corporate assets i period t-1 ΔREVit

Changes in corporate income i from period t-1 to

period t, ΔRECit Changes of corporate receivables i

from period t-1 to period t, PPEit Gross property,

plant and equipment company i period t, εit residual.

Board Size is the number of members of the board

of directors and board of commissioners who are in a

company (Alzoubi 2016). Here are the

measurements:

BOD = Number of members of the board of

directors and board of commissioners of the

compan

y

(5)

Managerial ownership is the number of shares of the

company owned by the management of the company

personally and subsidiaries, as well as its affiliates

(Agustia, 2013).

(6)

Institutional ownership is the number of shares owned

by the institutional company (external), such as

investment companies, banks, insurance companies

and other institutions (Mahariana and Ramantha,

2014).

(7)

The size of a company is a small size of a company

that can be seen from several categories such as total

assets, total sales, average sales, market value of stock

companies, etc. but generally used is total assets

(Yuliana and Trisnawati, 2015).

F

_

SIZE = Ln (Total Aset) (8)

Profitability is the company's ability to earn an overall

profit. Profitability is measured by the proxy of ROA

measurement that is the ratio between net profit after

tax which is obtained with total assets of company

(Alzoubi 2016).

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

46

(9)

Leverage is the percentage of company assets

financed by using debt (Susanto, 2013).

(10)

Operating cash flows represent cash receipts and

disbursements from operating activities of the

company. Operating cash flow is an indicator of the

company's performance in generating cash flow for

operational activities (Yuliana and Trisnawati 2015).

(11)

Sales growth represents a change in total sales in year

t with total sales in the previous year compared to

total sales in the previous year (Savitri 2014).

1

1

(12)

4 RESEARCH RESULTS

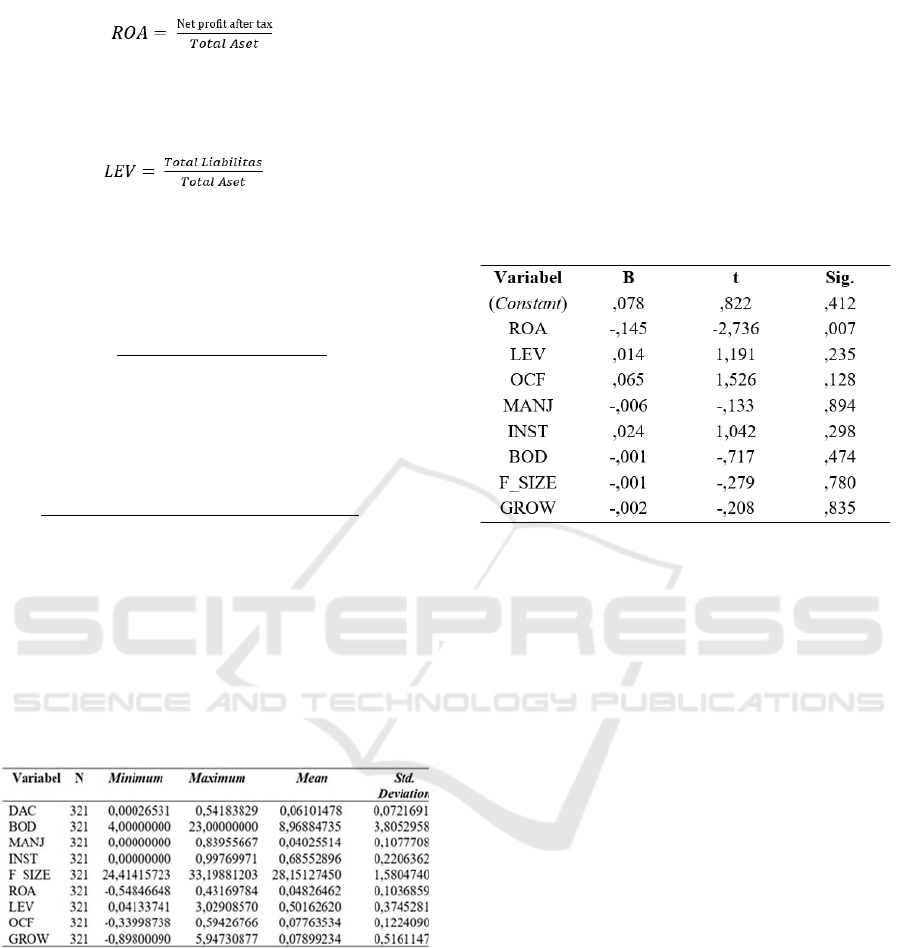

The results of descriptive statistics and hypothesis

testing results can be seen in table 2 and table 3

below:

Tabel 2: Descriptive Statistics.

Company Financial Ratio in Profitability (ROA)

has a Sig value. of 0.007 less than 0.05 which means

ROA is accepted. Profitability (ROA) has a

regression coefficient of -0.145 which indicates a

negative direction and a significant value (sig.) of

0.007. This means that profitability negatively affects

earnings management, this explains that firms that

have large profits and meet targets have very little

chance of profit manipulation. The results of this

study are consistent with research conducted by

Alzoubi (2016) and Abbadi et al., (2016). From the

results of the study, it was seen that company

ownership (institutional ownership and managerial

ownership) variables and company conditions (board

size, firm size and sales growth) did not have a

significant impact. As a result, it can be said that

companies having high asset returns are less likely to

manipulate their income. According to (Kothari et al.,

2005; Machuga and Teitel, 2007) managers intend to

increase profits obtained in other words manipulating

income upwards makes the company more attractive.

Tabel 3: t- Test result.

5 CONCLUSIONS

Based on the results of the research can be concluded

that profitability (ROA) affects earnings

management. While the board size, managerial

ownership, institutional ownership, firm size,

leverage, operational cash flow, and sales growth

have no effect on earnings management. A high rate

of return on assets will affect earnings management.

When the performance of the company is declining,

then management increases profit on the other hand

when the company is improving its performance then

management is not motivated to do earnings

management. This research has some limitations that

is the object of research only use manufacturing

companies so can not be generalized to the type of

industry others and the research period is relatively

short ie 2014-2016.

REFERENCES

Abbadi, Sinan S., Qutaiba F. Hijazi, dan Ayat S. Al-

Rahahleh. 2016. Corporate Governance Quality and

Earnings Management: Evidence from Jordan.

Australasian Accounting, Business and Finance

Journal, Vol.10 (2):54-75.

Alzoubi, Ebraheem Saleem Salem. 2016. Disclosure

quality and earnings management: Evidence from

Company Financial Ratios, Company Ownership and Company Conditions on Earnings Management

47

Jordan. Accounting Research Journal, Vol. 29, Iss 4 pp.

Aygun, Mehmed., Suleyman Ic, dan Mustafa Sayim. 2014.

The Effect of Corporate Ownership Structure and

Board Size on Earnings Management: Evidence from

Turkey. International Journal of Business and

Management, Vol. 9, No. 12: 123-132.

Bassiouny, Sara W., Soliman, Mohamed Moustafa, and

Ragab Aiman. 2016. The Impact Of Firm

Characteristics On Earnings Management: An

Empirical Study On The Listed Firms in Egypt. The

Business and Management Review, Vol 7, No 2.

Dewan Standar Akuntansi Keuangan. 2014. PSAK 1:

Penyajian Laporan Keuangan. Revisi 2013, Jakarta:

Ikatan Akuntan Indonesia.

Godfrey, Jayne., Allan Hodgson, Ann Tarca, Jane

Hamilton, dan Scott Holmes. 2010. Accounting Theory,

7

th

Australia: Wiley.

Guna, I Welven., dan Arleen Herawaty. 2010. Pengaruh

Mekanisme Good Corporate Governance, Independensi

Auditor, Kualitas Audit dan Faktor Lainnya Terhadap

Manajemen Laba. Jurnal Bisnis dan Akuntansi, Vol.

12, No. 1, April 2010: 53-68.

Gunawan, I Ketut., Nyoman Ari Surya Darmawan, dan I

Gusti Ayu Purnamawati. 2015. Pengaruh Ukuran

Perusahaan, Profitabilitas, dan Leverage Terhadap

Manajemen Laba Pada Perusahaan Manufaktur yang

Terdaftar di Bursa Efek Indonesia (BEI). E-Journal

Akuntansi Universitas Pendidikan Ganesha, Vol. 3,

No.1.

Handayani, Sri RR., dan Agustono Dwi Rachadi. 2009.

Pengaruh Ukuran Perusahaan Terhadap Manajemen

Laba. Jurnal Bisnis dan Akuntansi, Vol. 11, No. 1,

April 2009: 33-56.

Indriani, Poppy., Jaka Darmawan, dan Siti Nurhawa. 2014.

Analisis Manajemen Laba Terhadap Nilai Perusahaan

yang Terdaftar di Bursa Efek Indonesia. Jurnal

Akuntansi dan Keuangan, Vol. 5. No. 1, Maret 2014:

19-32.

Jensen, Michael C, dan W.H. Meckling. 1976. Theory of

The Firm: Managerial Behavior, Agency Cost and

Ownership Structure. Journal of Financial Economics.

Vol. 3, No. 4: 305 -360.

Kothari, S., Leone, A., & Wasley, C. 2005. Performance

matched discretionary accrual measures. Journal of

Accounting and Economics, 39(1), 163–197.

Kusumawardhani, Indra. 2012. Pengaruh Corporate

Governance, Struktur Kepemilikan, dan Ukuran

Perusahaan Terhadap Manajemen Laba. Jurnal

Akuntansi dan Sistem Teknologi Informasi, Vol. 9, No.

1, Oktober 2012: 41-54.

Lisa, Oyong. 2012. Asimetri Informasi dan Manajemen

Laba: Suatu Tinjauan Dalam Hubungan Keagenan.

Jurnal WIGA, Vol. 2, No. 1 Maret 2012: 42-49.

Mahariana, I Dewa Gede Pingga, dan I Wayan Ramantha.

2014. Pengaruh Kepemilikan Manajerial dan

Kepemilikan Institusional pada Manajemen Laba

Perusahaan Manufaktur di Bursa Efek Indonesia. E-

Jurnal Akuntansi Universitas Udayana 7.2: 519- 528.

Pradhana, Stephanus Wisnu., dan Felizia Arni Rudiawarni.

2013. Pengaruh Kualitas Audit Terhadap Earnings

Management pada Perusahaan Sektor Manufaktur yang

Go Public di BEI Periode 2008-2010. Jurnal Ilmiah

Mahasiswa Universitas Surabaya, Vol. 2 No. 1.

Qallap, Kholoud Daifallah Hmoud Al. 2014. Earnings

Management in Jordanian Public Shareholding Service

Companies and Influential Factors. Research Journal of

Finance and Accounting, Vol. 5, No. 12: 70-80.

Qi, Bao Lei., dan Tian Gao Liang. 2012. The Impact of

Audit Committees’ Personal Characteristics on

Earnings Management: Evidence from China. The

Journal of Applied Business Research, Vol. 28, No. 6.

Ross, Stephen A. 1977. The Determination of Financial

Structure: The Incentive-Signalling Approach

Author(s). The Bell Journal of Economics, Vol. 8, No.

1 (Spring, 1977), pp. 23-40

Sari, A.A Intan Puspita., dan I.G.A.M. Asri Dwija Putri.

2014. Pengaruh Mekanisme Corporate Governance

pada Manajemen Laba. E-Jurnal Akuntansi Universitas

Udayana 8.1 (2014): 94-104.

Savitri, Enni. 2014. Analisis Pengaruh Leverage dan Siklus

Hidup Terhadap Manajemen Laba Pada Perusahaan

Real Estate dan Property yang Terdaftar Di Bursa Efek

Indonesia. Jurnal Akuntansi, Vol. 3, No. 1, Oktober

2014:72-89.

Scott, R. William. 2015. Financial Accounting Theory,

Seventh Edition. Pearson Canada Inc, Toronto, Ontario.

Sugiyono. 2012. Metode Penelitian Kuantitatif Kualitatif

dan R&D. Bandung: Alfabeta.

Susanto, Yulius K. 2013. The Effect of Corporate

Governance Mechanism on Earnings Management

Practice. Jurnal Bisnis dan Akuntansi, Vol. 15, No. 2,

Desember 2013: 157-167.

Machuga, S., &Teitel, K. 2007. The effects of the Mexican

Corporate Governance Code on quality of earnings and

its components. Journal of International Accounting

Research, 6(1), 37–55.

Yuliana, Agustin., dan Ita Trisanawati. 2015. Pengaruh

Auditor dan Rasio Keuangan Terhadap Manajemen

Laba. Jurnal Bisnis dan Akuntansi, Vol. 17, No. 1, Juni

2015: 33-45.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

48