Impact of Financial Literacy on Financial Inclusion

Nuryasman M. N. and Vincent

Department of Economic,Tarumanagara University, Jln.Tanjung Duren Utara, Jakarta Barat, Indonesia

Keywords: Financial Literacy, Financial Inclusion and Logistic Regression.

Abstract: This study was conducted with the aim to find out the impact of financial literacy and financial inclusion on

students of the Faculty of Economics, Tarumanagara University. Sampling method was done by stratified

random sampling using questionnaire with 472 respondents. Meanwhile, the data analysis technique used is

logistic regression analysis, with z-statistic test, F-test, and McFadden R-Square. The results of hypothesis

testing show that age has a significant influence on financial literacy, while gender, education, investment

experience, academic ability, and residence status have no significant effect on financial literacy. Other

findings are financial literacy and income have a significant effect on financial inclusiveness, while

financial information sources, distance to banks, and ownership of vehicles have no significant effect.

1 INTRODUCTION

In the current era of globalization, finance certainly

has a very important role for the development of a

country in both developing and developed countries.

For that, the public needs to understand about the

finance itself according to a survey conducted by the

Financial Services Authority (OJK) in 2013. OJK is

a state institution that aims to establish an integrated

regulatory and supervisory system for all activities

in the financial services sector, whether in the

banking sector, the market sector capital, and non-

banking financial services sector.

The survey conducted by the OJK shows that the

financial literacy of the society is divided into 4

categories, namely: well literate (21.84%), sufficient

literate (75.69%), less literate (2.06%), not literate

0.41%). The survey shows, there are still people of

Indonesia who do not understand about financial

literacy. There are only small amount of Indonesian

people who have an understanding of financial

literacy so that the financial literacy of Indonesian

people need to be improved again. The financial

literacy owned by the community will have an

impact on the banking sector and capital market.

According to a World Bank survey conducted in

2010, Indonesians who were accessing the formal

financial sector accounted for 49%, while Bank

Indonesia findings in Household Balance Survey

2011 found 48% of households placed their money

in informal or formal financial institutions, or

around 52% of Indonesian households do not access

the existing financial system. This shows that there

are still Indonesian people who do not use the

products and services provided by the state financial

services. This is due to the inadequate knowledge of

finances held by the public. To that end, the

understanding of finance in Indonesia needs to be

improved again, so that the people of Indonesia can

use and access these financial products and services

optimally.

Students as part of the community should have

sufficient knowledge and understanding related to

the financial system and its instruments and the

various factors that determine the level of

knowledge about the finance. Related to this matter,

the study focuses on various factors that determine

financial literacy and financial inclusion with the

respondents of faculty of economics students.

2 LITERATURE REVIEW

2.1 Financial Literacy

Cude et al., (2006) defines financial literacy as a

person's ability to read, analyze, manage, and

communicate about a person's financial condition

that affects material well-being.

Lusardi (2012) states that financial literacy is the

ability and knowledge of finances owned by a

person to manage or use some money. This is for

26

M.N., N. and Vincent, .

Impact of Financial Literacy on Financial Inclusion.

DOI: 10.5220/0008487600260031

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 26-31

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

improving their standard of living associated with

the behavior, habits, and influence of external

factors.

Mason and Wilson (2000) defined financial

literacy as the ability of an individual to acquire,

understand, and then evaluate the existing

information in making a decision by understanding

the financial risks that can be generated later on

when the decision is made.

From the above definitions, it can be concluded

that financial literacy is the ability of an individual

to read, understand, and analyze about the finances

used in making decisions and financial management

in certain situations in the future.

2.2 Financial Inclusion

Nasution et al., (2013) states that financial

inclusiveness is a process that ensures ease in access,

availability, and benefits of the formal financial

system for all economic actors.

According to Bank Indonesia (2014), inclusive

finance is also defined as a process of access to

financial services (savings, insurance, remittances,

and payments) and the timely and adequate credit

needed by small or low-income groups at an

affordable cost.

According to European Commission and World

Bank (2008) in Supartoyo and Kasmiati (2013),

financial inclusion is an activity that aims to

eliminate all barriers both in the form of price and

non-price to access the community in using and also

utilizing financial products and services.

From the above definitions, it can be concluded

that financial inclusion is a process or means to

facilitate the community in accessing and utilizing

financial services such as savings, insurance, etc.

Chen and Volpe (1998) in their study explained

that men are more understanding of financial literacy

than women. However, according to Krishna et al.,

(2007), it was found that women are more

understanding of financial literacy compared with

men. Meanwhile, according to research conducted

by Nidar and Bestari (2012) and Rita and Pesudo

(2014), one's gender does not affect one's literacy

about finances.

Meanwhile, according to Shaari et al., (2013) in

his study conducted on students in Malaysia with a

sample of 384 people, it was found that there was a

negative relationship between financial literacy with

age. Ansong and Gyensare (2012) found that age

affected the student's financial literacy.

According to Widayati (2012), university

learning has an important role in the process of

forming a student's financial literacy. Students living

in different economic environments have a different

understanding of finance, so an improvement in

financial education is required to minimize the

difference. Effective and efficient learning will help

students to have the ability to read, understand,

evaluate, and act in relation to their finances. The

early existence of good knowledge in the

management of finance expected students to have a

better and prosperous life in the future. Then, Nidar

and Bestari (2012) also explains that one's financial

knowledge affects one's financial literacy in the

future.

Chen and Volpe (1998) said that students who

had experience related to taxes, insurance, and

investment were able to apply the knowledge they

had well.

Cude et al. (2006) explained that students with

high GPA will have better financial literacy. Shaari

et al. (2013) explained that students with high GPA

have fewer financial problems than students with

low GPA. Krishna et al. (2007) found that students

with a GPA < 3 had a higher level of financial

literacy than students with a GPA > 3. The study

stated that the level of financial literacy was not

determined by intellectual ability (analogous to the

GPA score) but more determined by the educational

background. Their financial literacy is learned from

educational institutions.

Keown, (2011) found that people who live alone

have a higher level of financial literacy than those

living with their spouses or parents. This is because

people who are living alone have a responsibility for

their daily financial transactions and other financial

decisions. However, according to Nidar and Bestari

(2012), residence does not affect a person's financial

literacy.

Wachira and Kihiu, (2012) has conducted a study

on the effect of financial literacy on access to

financial services in Kenya in 2009. As a result,

access to financial services is not only influenced by

the level of financial literacy but also influenced

more by income level, distance from banks, age,

marital status, gender, size of household, and level

of education.

According to research conducted by Bhanot et

al., (2012) in north-eastern India, financial

information from a variety of sources helps in

increasing financial inclusion. Other findings

suggest that the distance from the post office is more

significant to the inclusion of finances than the

distance to the bank. This is because the people of

northeast India have low access to banks.

The research conducted by Bhanot et al., (2012)

Impact of Financial Literacy on Financial Inclusion

27

states that high income and high education have an

influence in improving the status of financial

inclusion, while ownership of vehicles has no

significant effect on financial inclusion.

Based on the literature review above, the

following questions can be asked: (1) do age,

gender, education, investment experience, academic

ability, and residence status affect a person's

financial literacy?, and (2) do financial literacy,

income, financial sources of information, distance to

the bank, and ownership of motor vehicles affecting

a person's financial inclusion?

3 RESEARCH METHODS

3.1 Population, Sample, and Data

The population in this study was all students of the

Faculty of Economics Tarumanagara University

registered in the odd semester of academic year of

2016/2017. The number of students recorded in the

odd semester was 4,193 consisting of 2,032 students

majoring in Management and 2,116 Accounting

majors as many as 2,116 students.

Sampling method that was chosen in this

research was stratified random sampling which was

part of probability sampling technique with total

sample of 472 respondents. After dividing the

sample according to the level, the division of the

questionnaire was done to obtain data.

3.2 Operational Definition of Variables

The independent variables used in this study consist

of age(AGE), gender (JKN), knowledge (EDU),

investment experience (EIN), grade point average

(GPA), residence (TTG), financial literacy (LKF)

income (INC), financial information sources (SFI),

distance to bank (DFB), vehicle ownership (VHC),

while the dependent variable are financial literacy

(LKF) and financial inclusion (INF).

3.3 Analysis Method

This study uses logistic regression analysis model to

find out what factors influence financial literacy and

financial inclusion through research equation as

follows.

12 3 4 5 6 7 1

ln

1

pLKF

a a AGE a JKN a EDU a EIN a GPA a TTG

pLKF

(1)

12 3 4 5 6 2

ln

1

pINF

bbLKFbINCbSFIbDFBbVHC

pINF

(2)

Several statistical tests were performed on the

models used in this study to answer the above

research questions, such as, partial test of each

independent variable through the z-test, F-test to see

the mutual influence of the independent variables on

the dependent variable, and to measure how much

the ability of the independent variables in explaining

the change of the tested variable by the coefficient of

determination (R

2

).

4 RESULTS AND DISCUSSION

Based on the results of data processing, there are

some characteristics of respondents. The largest

respondents came from students in 2014 as much as

27% of 472 students. The least respondents were

from students in 2009, 2010, 2011 and 2012 as many

as 8 students (2%). From the 472 respondents, 218

people (46%) were from the Accounting department

and the remaining 254 people (54%) came from the

Management department.

According to the age, the respondents were

dominated by students of 20 years old (about 27%).

There was one participant, who was at least 16 years

old, and the rest vary between the ages of 17-21

years, while as many as 4% aged over 21 years.

The number of male students is more dominant

than female students with a ratio of 1: 0.80.

Based on the knowledge of finance, 70% of the

students of the Faculty of Economics Tarumanagara

University have an average level of financial

knowledge, while only about 1% of students have a

low level of knowledge. The rest have a high

financial knowledge. Almost 77% of the respondents

had a GPA above 3.

Meanwhile, from 472 students, about 9% had

invested in stocks and the rest invested in other

forms such as savings.

Approximately 353 students (75%) still live with

their parents with average income or allowance each

month ranging from Rp1 million to Rp 5 million and

there are 15 (3%) who have income or allowance

every month above Rp 5 million.

The average distance from student residence to

bank is about 3 km. Only about 18% (86) of students

stay in residence that has more than 3 km distance

from bank. Whereas of the 472 students who made

as respondents, about 53% (251 people) have motor

vehicles in the form of two-wheeled vehicles or four

wheels.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

28

Looking at how or from which source the

respondent obtained financial information, about

48% (227 people) obtained financial information

from family, 3% from friends, about 33% (156

people) got it from lectures and 16% from printed

media. This reflects that more financial information

is obtained by students from word of mouth rather

than from the media. Therefore, it can be interpreted

that first, the socialization of finance for the

community, especially students through the media,

is not optimal. Second, the desire of the community

or students, especially in reading or seeking

information through the media, has not been

maximized. Thus, it will be more effective and

efficient if the information about finances is

disseminated through lectures or seminars and or by

word of mouth.

To know the various factors that determine the

financial literacy, especially among students of the

Faculty of Economics Tarumanagara University, an

analysis was conducted through logistic regression

with the following results.

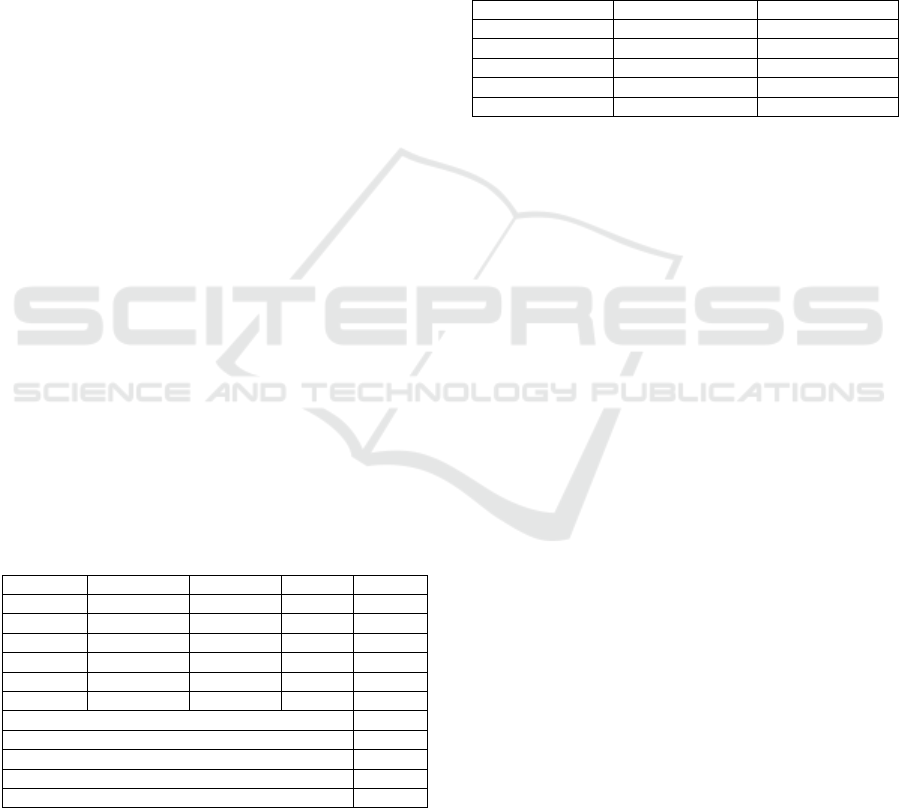

Table 1: Financial Literacy Logistic Regression Analysis.

Variable Coefficien

t

Std.Erro

r

z-Stat Prob.

C -6.234 1.607 -3.880 0.000

JKN -0.303 0.205 -1.480 0.139

AGE 0.238 0.077 3.082 0.002

GPA 0.308 0.197 1.561 0.118

TTG -0.007 0.224 -0.031 0.975

EIN 0.239 0.328 0.728 0.467

EDU 0.093 0.166 0.558 0.577

McFadden R-Squared 0.032

LR Statistic 20.170

Probability (LR Statistic) 0.003

Observation with Dependent Variable = 0 284

Observation with Dependent Variable = 1 188

From the results of table 1 above, it can be

explained that out of the 472 students of the Faculty

of Economics, about 188 students have understood

various things about finance. However, about 284

people have less understanding about finance. Thus,

it can mean that students, especially students of

Faculty of Economics Tarumanagara University,

still has limited understanding in various things

about finance, so it needs good action through

socialization through the media or lectures, and

information from mouth to mouth, so that their

understanding can be improved.

Other results that can be obtained from table 1

above is the financial literacy on the students of the

Faculty of Economics Tarumanagara University that

is determined by sex is opposite to each other, which

means that the understanding of students about

finance is lower for male students than female. This

finding is in line with the finding of Nidar and

Bestari (2012) and Rita and Pesudo(2014).

The same thing applies for the factor of

residence, where students who are living with

parents are more understanding about finance than

students who live alone. These results reinforce the

finding of Nidar and Bestari (2012). This condition

proves that the financial knowledge of students is

more dominantly obtained from parents than the

students themselves who seek it. This is contrary to

finding of Keown (2011), which states that people

who live alone are much more responsible in doing

financial transactions than when living with parents.

Age, GPA, investment experience and

knowledge have a positive effect on the

understanding of finance, which means that

increasing age, investment experience and

knowledge of a person will increase the

understanding of the financial or vice versa.

The higher the academic ability of a person

shown by the GPA increases his or her

understanding of finances or vice versa. The more

often a person engages in activities related to

investment, the more the understanding of finance

increases and the more knowledge an individual has

about the financial will increase his understanding as

well.

To find out how much influence of each factor

that determines one's financial literacy can be done

through the following table.

Table 2: Odd Ratio Determinants of Financial Literacy.

Variabel Coefficien

t

Odd Ratio

JKN -0.303 0.739

AGE 0.238 1.269

GPA 0.308 1.361

TTG -0.007 0.993

EIN 0.239 1.270

EDU 0.093 1.097

From table 2 above, a person of male sex has a

lower financial understanding of about 73.90%

compared to female sex. Although statistically this

result is not significant, it can be explained that

women have a tendency to be more careful than men

in making an investment decision. Thus, it will

encourage women to learn and understand finances

before making a decision.

The age factor shows a positive influence on a

person's understanding of finances, where an

increasing age of a person will increase his or her

understanding of finance by about 1.269 times. This

study proves the finding of Ansong and Gyensare,

(2012) and is in contrary to the finding of Shaari et

al., (2013). The same applies to improving one's

Impact of Financial Literacy on Financial Inclusion

29

academic ability, if an increase in academic capacity

will increase financial literacy by about 1,361 times,

investment experience and financial knowledge will

increase by about 1.270 and 1.097 respectively. This

finding is consistent with the findings of Chen and

Volpe(1998); Nidar and Bestari (2012 and Widayati,

(2012). Another factor that determines a person's

understanding of finances is with whom one is

living. The findings show that someone who lives

with parent's financial understanding of about

99.30% is more likely to live alone. This condition

means that the financial understanding is more than

just obtained from parents. It is more to someone

who is looking for the meaning themselves.

Although statistically some factors have no

influence in determining one's literacy to finance,

but together, all the factors that exist in this research,

statistically have a significant contribution to one's

financial literacy, especially students. This is proven

by probability value LR Statistic which is smaller

from 5% (See table 1).

About 3.20% of a person's understanding of

finance is determined by sex, age, academic ability,

residence status, investment experience and financial

knowledge, while almost 96.80% is determined by

other variables that are not studied in this research.

Decisions made by a person in what form and

where the money saved will be placed is commonly

known as financial inclusion. Financial inclusion,

which is influenced by financial literacy, is also

determined by other factors such as income, distance

from residence to bank and ownership of motor

vehicles.

The results of research on various factors that

determine financial inclusion are shown in the

following table.

Table 3: Financial Inclusion Logistic Regression Analysis.

Variable Coefficien

t

Std.Erro

r

z-Stat Prob.

C -2.193 1.021 -2.149 0.032

LKF 6.862 1.889 3.632 0.000

DFB -0.552 0.406 -1.358 0.175

SFI -0.256 0.248 -1.031 0.303

INC 1.448 0.338 4.282 0.000

VHC 0.574 0.345 1.662 0.097

McFadden R-Squared 0.148

LR Statistic 41.153

Probability (LR Statistic) 0.000

Observation with Dependent Variable = 0 41

Obse

r

vation with Dependent Variable = 1 431

Table 3 shows that 431 respondents (91.30%)

have banking accounts as financial means, so that it

can be interpreted almost all respondents have

utilized financial services, especially banking.

Overall financial literacy, distance to bank,

financial information, income, and motor vehicle

ownership have a statistically significant effect on

the utilization of financial services, as evidenced by

LR statistic probability values being smaller than 5%

at a 95% confidence level. But partially there are

several factors that are not statistically significant in

determining the utilization of financial services, such

as distance to banks and financial information.

How much influence each factor has on financial

inclusion can be shown in the following table.

Table 4: Odd Ratio Determinants of Financial Inclusion.

Variabel Coefficien

t

Odd Ratio

LKF 6.862 955.275

DFB -0.552 0.576

SFI -0.256 0.774

INC 1.448 4.255

VHC 0.574 1.775

Based on the results in table 4 above, the

financial inclusion of someone who has adequate

financial literacy is higher by 955,275 points than

those who have less adequate financial literacy. The

more you understand about finances, the person will

be better able to utilize various financial services in

financial management or vice versa. This finding is

in accordance with the result of Wachira and Kihiu,

(2012). Increasing one's income will further increase

the probability of someone taking advantage of

various financial services in managing their

finances. In this study, an increase in the probability

of using financial services will increase by about

4.255% if there is an increase in income. These

results are in line with the finding of Bhanot et al.

(2012). The influence of the financial information

factor in this study contradicts the findings of

Bhanot et al., (2012) where according to Bhanot,

financial information will make it easier for

someone to take advantage of various financial

services. However, in this study, financial

information negatively affects the use of financial

services. Similar results were also found for factors

of distance to banks and ownership of motor

vehicles to the use of financial services. In another

sense, the distance to the bank and the ownership of

a motor vehicle do not make a significant difference

to someone using financial services.

The utilization of financial services by a person

in this study, approximately 14.80% is determined

by financial literacy, distance to bank, financial

information, income and motor vehicle ownership,

while 85.20% is determined by other factors.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

30

5 CONCLUSIONS

The results of this study found several things, (1). A

person's age is statistically significant to financial

literacy, but gender, academic ability, residence

status, investment experience and financial

knowledge do not have a statistically significant

effect on one's understanding of finances, and (2).

Income and financial literacy are statistically

significant in determining the utilization of a

person's financial services, but factors such as

distance to the bank, financial information and

motor vehicle ownership have no statistically

significant effect on a person's financial inclusion.

6 RECOMMENDATIONS

This study suggests several things: (1) To improve

financial literacy, it is necessary to socialize various

things about finances such as understanding, types,

instruments and mechanisms and various positive

and negative impacts related to finance, so that

people feel more comfortable when making

decisions related to their finances, and (2) In relation

to financial inclusion, technology is needed to

provide convenience, comfort and security to the

community in placing its finances and increase the

number of financial institutions from the lowest

level to the highest that are easily accessible by the

community.

REFERENCES

Ansong, A., Gyensare, M.A., 2012. Determinants of

University Working-Students’ Financial Literacy at

the University of Cape Coast, Ghana. Int. J. Bus.

Manag.7, 126–133.

Bank Indonesia, 2014. Booklet Keuangan Inklusif,

Departemen Pengembangan Akses Keuangan dan

UMKM.

Bhanot, D., Bapat, V., Bera, S., 2012. Studying Financial

Inclusion in North‐East India. Int. J. Bank Mark.

30,465–484. Chen, H., Volpe, R.P., 1998. An Analysis

of Personal Financial Literacy Among College

Students. Financ. Serv. Rev. 7, 107–128.

Cude, B.J., Lawrence, F.C., Lyons, A.C., Metzger, K.,

LeJeune, E., Marks, L., Machtmes, K., 2006. College

Students and Financial Literacy: What They Know

and What We Need to Learn, in: Eastern Family

Economics and Resource Management Association.

pp. 102–109.

Keown, L.-A., 2011. The Financial Knowledge of

Canadians. Can. Soc. Trends 30–39.

Krishna, A., Sari, M., Rofaida, R., 2007. Analisis Tingkat

Literasi Keuangan Di Kalangan Mahasiswa dan

Faktor-Faktor yang Mempengaruhinya. Survey Pada

Mahasiswa Universitas Pendidikan Indonesia

(Financial Literacy Level Analysis Among Students

and Its Affecting Factors. Survey on Universitas Pend.

Lusardi, A., 2012. Numeracy, Financial Literacy , and

Financial Decision Making. Numer. Adv. Educ. Quant.

Lit. 5, 1–12.

Mason, C. L. J., Wilson, R. M.., 2000. Conceptualising

nancial literacy, Research Series Business School,

Loughborough University.

Nasution, L.N., Sari, P.B., Dwilita, H., 2013. Determinan

Keuangan Inklusif Di Sumatera Utara, Indonesia.

JESP J. Ekon. Stud. Pembang. 14, 58–66.

Nidar, S.R., Bestari, S., 2012. Personal Financial Literacy

Among University Students (Case Study at

Padjadjaran University Students, Bandung ,

Indonesia). World J. Soc. Sci. 2, 162–171.

Rita, M.R., Pesudo, B.C.A., 2014. Apakah Mahasiswa

Sudah Melek Keuangan? Din. Akuntansi, Keuang. dan

Perbank. 3, 58–65.

Shaari, N.A., Hasan, N.A., Mohamed, R.K.M.H., Sabri,

M.A.J.M., 2013. Financial Literacy: A Study among

the University Students. Interdiscip. J. Contemp. Res.

Bus. 5, 279–299.

Supartoyo, Y.H., Kasmiati, 2013. Branchless Banking

Mewujudkan Keuangan Inklusif Sebagai Alternatif

Solusi Inovatif Menanggulangi Kemiskinan: Review

dan Rekomendasi.

Wachira, M.I., Kihiu, E.N., 2012. Impact of financial

literacy on access to financial services in Kenya. Int. J.

Bus. Soc. … 3, 42–50.

Widayati, I., 2012. Faktor-faktor Yang Mempengaruhi

Literasi Finansial Mahasiswa Fakultas Ekonomi dan

Bisnis Universitas Brawijaya.

ASSETJurnal Akunt.

dan Pendidik. 1, 89–99.

Impact of Financial Literacy on Financial Inclusion

31