Free Cash Flow, Firm Characteristic, Corporate Governance on

Earnings Management

Yulius Kurnia Susanto

and Elizabeth Bosta

Trisakti School of Management, Jl. Kyai Tapa No. 20, Jakarta, Indonesia

Keywords: Earnings Management, Free Cash Flow, Profitability, Board Independence.

Abstract: The purpose of this research is to obtain empirical evidence about the influence of free cash flow, audit quality,

profitability, board of directors, board independence, growth opportunities, and managerial ownership on

earnings management. The population in this research is all manufacturing companies listed in Indonesia

Stock Exchange during 2014 to 2016. Samples are obtained through purposive sampling method, in which 60

manufacturing companies listed in Indonesia Stock Exchange meet the sampling criteria, which resulted in

240 data as samples. Multiple linear regressions and hypothesis testing are used as the data analysis methods

in this research. The result of this research shows that free cash flow, profitability and board independence

statistically have an influence on earnings management. On the other hand, audit quality, board of directors,

growth opportunities, and managerial ownership statistically do not have any influence on earnings

management. This research is expected to enhance the knowledge of management regarding the impacts of

misinterpretation of earnings information.

1 INTRODUCTION

The agents which are the managers have the

responsibility to report the firm performance in the

form of financial statements to the owners. The

financial information such as the earnings is often

used by stakeholders to make decisions (Nurdiniah

and Herlina, 2015). The existing investors and

potential investors will usually make investing

decisions based on the return that will be earned from

the firm. Thus, they will be more attracted to the firm

with higher return. This is why managers tend to

manipulate earnings to make the financial statements

look good for the investors (Nurdiniah and Herlina,

2015). The actions or strategies of adjusting the

earnings are known as earnings management. Bad

earnings management will reduce the investors’ trust.

The cash withdrawal will be done collectively, which

will lead to rush.

This research is the development of the research

conducted by Bassiouny (2016), and supported by

several researches conducted by some researchers.

The differences from previous researches include

several independent variables from other prior

researches. The study samples are all manufacturing

companies listed in Indonesia Stock Exchange (IDX)

for the period of 2013 to 2016.

The purpose of this research is to obtain empirical

evidence about the influence of free cash flow, audit

quality, profitability, board of directors, board

independence, growth opportunities, and managerial

ownership on earnings management.

1.1 Free Cash Flow and Earnings

Management

Free cash flow is the excess of cash that a firm owns

after financing positive net present value projects for

the operating activites aiming for firm expansion. In

allocating free cash flow, the principal and

management will have different interests. The

principal wants to maximize its wealth thus will

prefer the free cash flow to be distributed as dividend.

On the other hand, the manager will tend to use the

free cash flow to fund the investment to expand the

firm, even if the investment will generate negative net

present value. The choice for making poor

investments may reduce future earnings. When

management makes poor decision to invest in

negative net present value projects, the management

will tend to commit earnings management to show the

principal a good company performance. Thus, it will

reduce the likeliness of the principal for replacing the

directors and/or senior executives (Bukit and

Susanto, Y. and Bosta, E.

Free Cash Flow, Firm Characteristic, Corporate Governance on Earnings Management.

DOI: 10.5220/0008487300050010

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 5-10

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

Iskandar, 2009). Agustia (2013), Selahudin (2014),

Cardoso (2014), and Susanto et al., (2017) showed

that free cash flow had a relationship towards

earnings management. On the other hand, Yogi and

Damayanthi (2016), Bukit and Iskandar (2009), and

Bhundia (2012) had contradictory results. The

hypothesis is as follows:

H

1

: Free cash flow has an influence on earnings

management.

1.2 Audit Quality and Earnings

Management

The agency problems and information asymmetry,

which resulted from the separation of ownership and

control, create the demand for external audit (Lin and

Hwang, 2010). A firm audit quality is the audit

performance quality performed by public accounting

firms. Audit quality may ensure the accuracy and

reliability of financial information (Yasar, 2013).

Financial statements audited by outsiders may reduce

asymmetries between principles and agents. High

quality audit may detect and report errors and

regularities, thus becomes an effective barrier to

earnings management (Bassiouny, 2016). Big four

auditing firms will usually perform a high quality

audit because they have a large number of clients,

have better technology resources, have good training

programs and experience, and have good reputation

that might be lost if they do not report a misstatement

or a manipulation (Bassiouny, 2016). Researches

conducted by Bassiouny (2016), Yasar (2013), and

Susanto (2013) showed no relationship between audit

quality and earnings management. On the other hand,

Swastika (2013), Lin and Hwang (2010), and Bakht

et al., (2014) showed contradictory result. The

hypothesis is as follows:

H

2

: Audit quality has an influence on earnings

management.

1.3 Profitability and Earnings

Management

The financial statements that become a linking media

between management and the owners of the company

will not be able to fully reflect the real condition of

the company if the management ‘manipulates’

accounting numbers presented (Amertha, 2013). If a

firm performed badly or well, it will encourage the

manager to increase or decrease the income based on

the performance condition of the firm. If a firm

performed badly, the management will tend to

increase the income because investors will not invest

or lend some money to poor performance firm. In

addition, managers want to receive a bonus that is

often given based on the firms’ profit. On the other

hand, if the firm performed well, the management

will tend to decrease the income (Amertha, 2013).

Susanto (2013) showed that profitability has no effect

on earnings management, while Nurdiniah and

Herlina (2015), Aygun et al., (2014), and Amertha

(2013) showed that profitability has an effect on

earnings management. The hypothesis is as follows:

H

3

: Profitability has an influence on earnings

management.

1.4 Board of Directors and Earnings

Management

The role of board of directors is to supervise chief

executive management, who has the power of

controlling board of director minutes and meetings.

The board can be viewed as one of the important

internal monitoring mechanisms that may affect a

company’s earnings management (Aygun et al.,

2014). Jensen and Meckling (1976) showed that only

if the agents are monitored and only if they are given

appropriate incentives and rewards, the principals,

who are the company owners, can comfort

themselves that the agents will make the most

favorable decisions. A high monitoring by directors

in their duty will result in a lower manipulation of

earnings thus resulting in negative relationship

between board of directors and earnings management

(Iraya et al., 2015). Susanto (2013) showed that there

was no relationship between board of directors and

earnings management. While Abbadi et al., (2016),

Patrick et al., (2015), Aygun (2014), and Swastika

(2013) showed that board of directors affected

earnings management. The hypothesis is as follows:

H

4

: Board of directors has an influence on earnings

management.

1.5 Board Independence and Earnings

Management

The effect of board independence on earnings

management will be referring to non-executive

directors (Swastika, 2013). The primary role of the

non-executive director is to oversee the management

of a company and to protect the interests of its

shareholders. In order to fulfill its monitoring role,

directors and supervisors must be independent from

the firm’s management (Chen et al., 2008). The more

non-executive directors on the board, it is more

possible to improve the way that the firm discloses its

financial information. Therefore, they will show a

greater transparency in their reports because the

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

6

outside directors do not have any interest regarding

the shareholding of the firm and they are expected to

act in a manner that maximizes the value of the firm

in order to protect their reputation. A better

supervision on the executive managers will improve

their reputation (Hassan and Ahmed, 2012), and thus

will decrease the chances of earnings management.

Indriastuti (2012) showed that earnings management

had no relationship with board independence, while

Uwuigbe et al., (2014), Shah and Butt (2009),

Jatiningrum et al., (2016), and Hashim and Devi

(2008) showed contradictory results. The hypothesis

is as follows:

H

5

: Board independence has an influence on earnings

management.

1.6 Growth Opportunity and Earnings

Management

The firms with high level of growth opportunities are

expected to achieve higher profitability. The increase

in profitability increases both their political visibility

and political costs. The political cost hyphotesis

predicts that the probability of wealth transfer will

affect managers’ managerial behavior. Managers will

also try to decrease the reported income number

compared to the low growth opportunity and low

income number of firms in order to reduce the

likelihood and size of the wealth transfer (Watts and

Zimmerman, 1978). Besides that, firms with visible

profitability and high growth opportunities will face

political risk such as potential economic losses arising

as a result of governmental measures or special

situations that may limit the operational and

profitable activities of a firm. One way to limit the

potential of political risk is to reduce the reported

earnings number. Wibiksono and Rudiawarni (2015)

showed that growth opportunity does not affect the

practices of earnings management. On the other hand

Ngamchom (2015), Bakth et al., (2014) and AlNajjar

(2001) showed that growth opportunity affected the

practices of earnings management. The hypothesis is

as follows:

H

6

: Growth opportunity has an influence on earnings

management.

1.7 Managerial Ownership and

Earnings Management

One way to reduce the agency problem is by giving

incentives to managers in a form of share. As a result,

it will reduce the conflict between managers and

shareholders (Warfield et al., 1995). Managers'

accounting choices are systematically related to the

level of managerial ownership. The increase in the

accounting-based-constraints for firms with low

managerial ownership will impair the faithfulness of

determining accounting number. Then, the

informativeness of accounting number is predictably

positively related to the level of managerial

ownership (Warfield et al., 1995). When managerial

ownership is low, the magnitude of accrual

discretionary accounting adjustments is significantly

higher. Susanto (2013) showed that managerial

ownership did not affect earnings management.

While Aygun et al., (2014), Yang et al., (2008), and

Teshima and Shuto (2008) showed that managerial

ownership affected earnings management. The

hypothesis is as follows:

H

7

: Managerial ownership has an influence on

earnings management.

2 RESEARCH METHOD

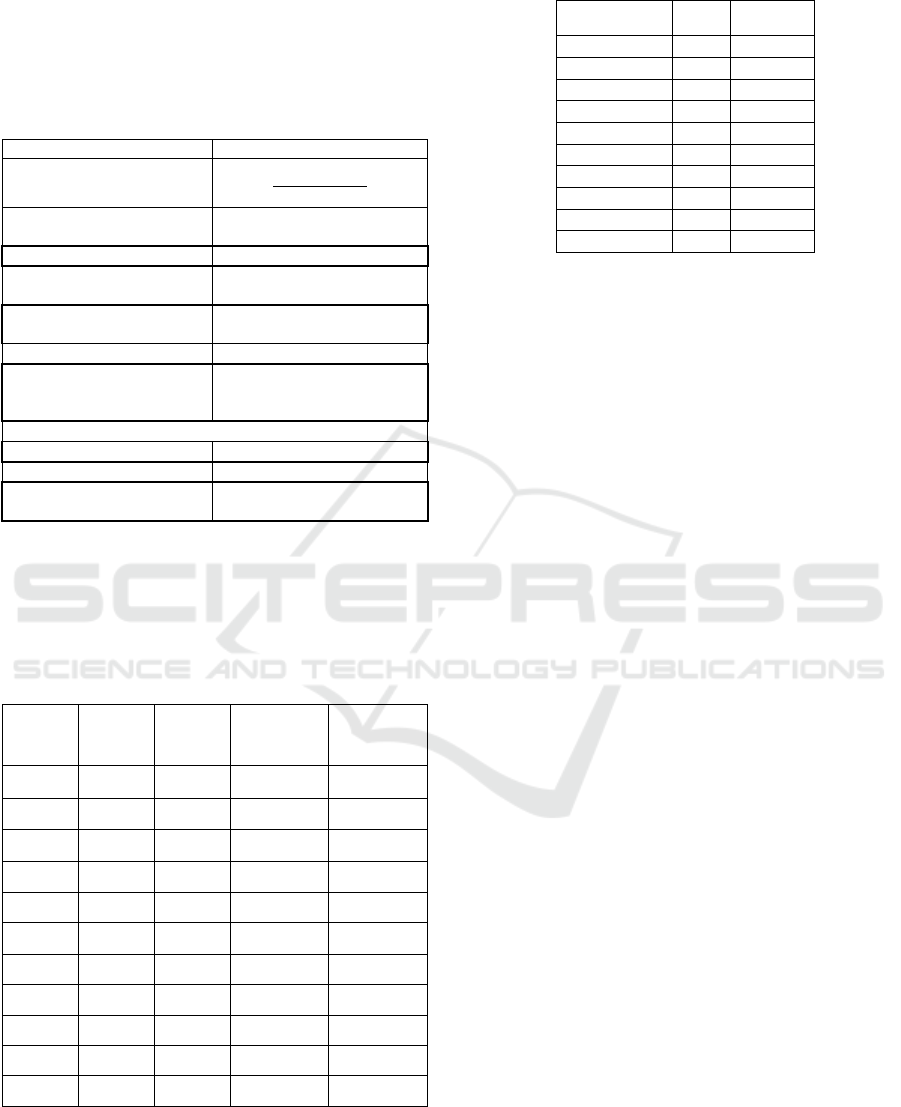

This research examines 240 data from 60

manufacturing firms listed in Indonesia Stock

Exchange from the year of 2013 to 2016. The samples

are selected using purposive sampling with criteria

summarised in the following table.

Table 1: Sample selection procedure.

Criteria Description Total Firms Total Data

Manufacturing firms consistently

listed in Indonesia Stock Exchange

from the year of 2013 to 2016

Manufacturing firms which do not

consistently use IDR currency in the

financial statements from 2013 to

2016

Manufacturing firms which do not

consistently publish financial

statements as of 31 December from

2013 to 2016

Manufacturing firms which do not

consistently earn profit from 2013 to

2016

129

(29)

(1)

(39)

516

(116)

(4)

(156)

Number of sample of firms used 60 240

The measurement of discretionary accruals is

calculated using modified Jones (1991) model

defined formally as:

β1j

1

β2j

– ARt

β3j

TACt shows total accruals in year t (net income

cash flows from operating activities), At-1 is the total

asset at the end of year (t-1), ΔREVt is the change in

revenue between year (t-1) and year t, ΔARt is the

Free Cash Flow, Firm Characteristic, Corporate Governance on Earnings Management

7

change in receivables between year (t-1) and year t,

PPEt is gross property, plant, and equipment in year

t, β1 - β3 are regression parameters, and εt is the error

term as discretionary accruals. The independent

variable measurements in this research are as follows:

Table 2: Variable measurement.

Variable Measurement

Free Cash Flow

CFO CFI

TotalAssets

Firm Audit Quality

1 = audited by big-4 firms, 0 =

otherwise

Profitability net Income ÷ total assets

Board of Directors

the number of directors on the

b

oards

Board Independence

the number of independent

commissione

r

Growth Opportunity market value:

b

ook value

Managerial Ownership

1 = has managerial ownership,

0= does not have managerial

ownership

Control variable

Firm Size ln(total assets)

Firm Financial Leverage total liabilities ÷ total assets

Firm Age

the number of years since the

firm’s foundation

3 RESEARCH RESULT

The statistical results are as follows:

Table 3: Descriptive Statistics.

Variable Min. Max. Mean Std. Deviation

DAC -.16523 .35817 -.0000003 .0741725

FCF -.19742 .55220 .15877 .12480

AUDIT 0 1 .45 .499

ROA .0004 .4018 .094294 .0858282

BOD 2 16 5.34 2.700

INDEP 0 4 1.68 .839

GROW .078 62.931 3.276 7.397

MO 0 1 .52 .501

SIZE 25.62 33.20 28.36 1.67

LEV .0735 .8809 .404879 .1746842

AGE 4 85 37.30 13.727

Table 4: Hypothesis test.

Variable B Sig.

FCF -.551 . 000***

AUDIT .004 .704

ROA .485 .000***

BOD .002 .205

INDEP -.011 . 090*

GROWTH .001 . 309

MO .003 . 680

SIZE .002 .566

LEVERAGE -.016 .519

AGE .000 .503

Adj. R

2

0.485.*10%, **5%, ***1%

The result shows that free cash flow has a

significance level of .000 which is under .05, which

means that H

1

is accepted. It means that free cash flow

has an influence on the earnings management. The

coefficient of free cash flow variable is -.551, which

can be interpreted as if the free cash flow is higher,

the earnings management will be lower and vice

versa. Firms with high free cash flow tend to not

committing earnings management. This is because

investors focus more on free cash flow information

that shows firms’ ability to share dividend (Agustia,

2013).

The result shows that audit quality has a

significance level of .704, which is above .05, which

means that H

2

is not accepted. It means that audit

quality has no influence on the earnings management.

This is because the institutional setting does not

motivate auditors to provide high-quality audits due

to lack of effective audit and oversight mechanism for

auditors. In such an institutional environment,

auditors may not constrain the earnings management

practices of client firms. Thus, there may be no

difference in audit quality between the Big four and

non-Big four auditors (Yasar, 2013).

The result shows that profitability has a

significance level of .000 which is under 0.05, which

means that H

3

is accepted. It means that ROA has an

influence on the earnings management. The

coefficient of ROA variable is .485 and can be

interpreted as if the profitability is higher, the

earnings management will be higher and vice versa.

This result shows that firms’ good or bad

performance will motivate manager to increase or

decrease the income in order to make firms’

performance is as expected by the management

(Amertha, 2013).

The result shows that board of directors has

asignificance level of .205, which is above .05, which

means that H

4

is not accepted. It means that the board

of directors has no influence on the earnings

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

8

management. This is because the size of board has no

effect on the ability of board to detect earnings

management committed by the management

(Susanto, 2013).

The result shows that board independence has a

significance level of .090, which is below .10, which

means that H

5

is accepted. It means that board

independence has an influence on the earnings

management. This is because the existence of

independent board of commissioners is effective in

reducing earnings management.

The result shows that growth opportunity has

significance level of .309, which is above .05, means

that H

6

is not accepted. It means that growth

opportunity has no influence on the earnings

management because growth opportunity does not

determine the amount of earnings management

(Wibiksono and Rudiawarni, 2015).

The result shows that managerial ownership has a

significance level of .680, which is above .05, which

means that H

7

is not accepted. It means that

managerial ownership has no influence on the

earnings management. This is because of only a

certain number of companies have managerial

ownership. In addition, managerial ownership is

unable to become one of the corporate governance

mechanisms to protect shareholders’ interest

(Susanto, 2013).

4 CONCLUSION

The result of this research shows that free cash flow,

profitability, and board independence statistically

have influences on earnings management. While

audit quality, board of directors, growth

opportunities, and managerial ownership do not have

influence on earnings management of listed

manufacturing firms in Indonesia. This research is

expected to enhance the knowledge of management

regarding the impacts of the misinterpretation of

earnings information.

There are some limitations that exist during this

research, which are: (1) This research period is

relatively short, which is only four years; (2) This

research population is relatively small focused only

on listed manufacturing firms. Based on the

limitations above, some recommendations that can be

used for further research are: (1) Further research is

expected to make longer period of research; (2)

Further research is expected to enlarge the research

population.

REFERENCES

Abbadi, Sinan S., Qutaiba F Hijazi, and Ayat S. Al-

Rahahleh. 2016. Corporate Governance Quality and

Earnings Management: Evidence from Jordan.

Australasian Accounting, Business and Finance

Journal, 10 (2): 54-75.

Agustia, Dian. 2013. Pengaruh Faktor Good Corporate

Governance, Free Cash Flow, dan Leverage Terhadap

Manajemen Laba. Jurnal Akuntansi dan Keuangan, 15

(1): 27-42.

AlNajjar, Fouad, and Ahmed Riahi-Belkaoui. 2001.

Growth Opportunities and Earnings Management.

Managerial Finance, 27 (12): 72 - 81.

Amertha, Indra Satya Prasavita. 2013. Pengaruh Return on

Asset pada Praktik Manajemen Laba dengan Moderasi

Corporate Governance. E-Jurnal Akuntansi Universitas

Udayana (Universitas Udayana ): 373-387.

Aygun, Mehmet, Suleyman Ic, and Mustafa Sayim. 2014.

The Effects of Corporate Ownership Structure and

Board Size on Earnings Management: Evidence from

Turkey. International Journal of Business and

Management , 9 (12): 123-132.

Bakht, Snor Khosh, Saeid Jabbarzadeh Kangarlouei, and

Morteza Motavassel. 2014. Corporate Governance and

Management Earning Forecast: The Case of Tehran

Stock Exchange. International Journal of Business

Analytics and Intelligence, 2 (1): 25-35.

Bassiouny, Sara W. 2013. The impact of firm

characteristics on earnings management: an empirical

study on the listed firms in Egypt. The Business and

Management Review: International Conference on

Globalisation, Entrepreneurship & Emerging

Economies, 10 (3): 34-45.

Bhundia, Dr. Amalendu. 2012. A Comparative Study

between Free Cash Flow and Earnings Management.

Business Intelligence Journal, 5 (1): 123-129.

Bukit, Rina Br. and Takiah Mohd Iskandar. 2009. Surplus

Free Cash Flow, Earnings Management, and Audit

Committee. International Journal of Economics and

Management, 3 (1): 204-223.

Cardoso, Fabricio Terci, Antonio Lopo Martinez, and

Aridelmo J. C. Teixeira. 2014. Free Cash Flow and

Earnings Management in Brazil: The Negative Side of

Financial Slack. Global Journal of Management and

Business Research: D Accounting and Auditing, 14 (1):

85-96.

Chen, Ken Y., Randal J. Elder, and Yung-Ming Hsieh.

2008. Corporate Governance, Growth Opportunities,

and Earnings Restatements: Effect of a Corporate

Governance Code: 2-46.

Hassan, Shehu Usman, and Abubakar Ahmed. 2012.

Corporate Governance, Earnings Management and

Financial Performance: A Case of Nigerian

Manufacturing Firms. American International Journal

of Contemporary Research, 2 (7): 214-226.

Hashim, Hafiza Aishah, and S. Susela Devi. 2008. Board

Independence, CEO Duality and Accrual Management:

Malaysian Evidence. Asian Journal of Business and

Accounting: University of Malaya, 1 (1): 27-46.

Free Cash Flow, Firm Characteristic, Corporate Governance on Earnings Management

9

Indriastuti, Maya. 2012. Analisis Kualitas Auditor dan

Corporate Governance terhadap Manajemen Laba.

Eksistansi, 4 (2).

Iraya, Cyrus, Mirie Mwangi, and Gilbert W. Muchoki.

2015. The Effect of Corporate Governance Practices on

Earnings Management of Companies Listed at The

Nairobi Securities Exchange. European Scientific

Journal, 11 (1): 169-178.

Jatiningrum, Citrawati, Mohamad Ali Abdul-Hamid, and

Oluwatoyin Muse Johnson Popoola. 2016. The Impact

of Disclosure Quality on Corporate Governance and

Earnings Management: Evidence from Companies in

Indonesia. International Journal of Economics and

Financial Issues: 118-125.

Jensen, Michael C., and William H. Meckling. 1976.

Theory of The Firm: Managerial Behavior, Agency

Costs and Ownership Structure. Journal of Financial

Economics, 3 (4): 305-360.

Lin, Jerry W., dan Mark I. Hwang. 2010. Audit Quality,

Corporate Governance, and Earnings Management: A

Meta-Analysis. International Journal of Auditing: 57-

77.

Ngamchom, Wasukarn. 2015. Impact of Board

Effectiveness and Shareholders Structure on Earnings

Management in Thailand. Review of Integrative

Business and Economics Research, 4 (2): 342-354.

Nurdiniah, Dade and Linda Herlina. 2015. Analysis of

Factors Affecting the Motivation of Earnings

Management in Manufacturing Listed in Indonesia

Stock Exchange. Research Journal of Finance and

Accounting, 6 (3): 100-107.

Selahudin, Nor Farhana et al. 2014.Remodelling the

Earnings Management with the Appearance of

Leverage, Financial Distress and Free Cash Flow:

Malaysia and Thailand Evidences. Journal of Applied

Sciences, 14 (21): 2644-2661.

Shah, Syed Zulfiqar Ali, and Safdar Ali Butt. 2009. The

Impact of Corporate Governance on the Cost of Equity:

Empirical Evidence from Pakistani Listed Companies.

The Lahore Journal of Economics, 14 (1): 139-171.

Susanto, Yulius Kurnia. 2013. The Effect of Corporate

Governance Mechanism on Earnings Management

Practice (Case Study on Indonesia Manufacturing

Industry). Jurnal Bisnis dan Akuntansi, 15 (2): 157-

167.

Susanto, Y. K., Pradipta, A., & Djashan, I. A. 2017. Free

Cash Flow and Earnings Management: Board of

Commissioner, Board Independence and Audit Quality.

Corporate Ownership and Control, 14 (4-1): 284-288.

Swastika, Dwi Lusi Tyasing. 2013. Corporate Governance,

Firm Size, and Earning Management: Evidence in

Indonesia Stock Exchange. Journal of Business and

Management, 10 (4): 77-82.

Teshima, Nobuyuki, and Akinobu Shuto. 2008. Managerial

Ownership and Earnings Management: Theory and

Empirical Evidence from Japan. Journal of

International Financial Management & Accounting, 19

(2): 1-37.

Uwuigbe, Uwalomwa, Daramola Sunday Peter, and

Anjolaoluwa Oyeniyi. 2014. The effects of corporate

governance mechanisms on earnings management of

listed firms in Nigeria. Accounting and Management

Information Systems: Covenant University, 13 (1):

159–174.

Warfield, Terry D., John J. Wild, and Kenneth L. Wild.

1995. Managerial Ownership, Accounting Choices, and

Informativeness of Earnings. Jouma! of Accounting and

Economics: 61-91.

Watts, Ross L., and Jerold L. Zimmerman. 1990. Positive

Accounting Theory: A Ten Year Perspective. The

Accounting Review, 65 (1): 131-156.

Wibiksono, Rosalia Anita, and Felizia Arni Rudiawarni.

2015. Pengaruh Premanaged Earnings dan Dividen

yang Diharapkan terhadap Praktik Manajemen Laba .

Jurnal Akuntansi dan Keuangan Indonesia, 12 (1): 1-

18.

Yang, Chi-Yih, Hung-Neng Lai, and Boon Leing Tan.

2008. Managerial Ownership Structure and Earnings

Management. Journal of Financial Reporting and

Accounting, 6 (1): 35 – 53.

Yogi, Luh Made Dwi Parama and I Gusti Ayu Eka

Damayanthi. 2016. Pengaruh Arus Kas Bebas, Capital

Adequacy Ratio dan Good Corporate Governance pada

Manajemen Laba. e-Journal Akuntansi Universitas

Udayana, 15 (2): 1056-1085.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

10