Concentration Ratio, Advertising Intensity, Sales Growth, The

Government’s Regulation and Profitability in Indonesian Cigarette

Industry

Yulia Saftiana, Bernadette Robiani, Syamsurijal, and Suhel

Faculty of Economic, Universitas Sriwijaya, Palembang, Indonesia

Keywords: concentration industry, advertising intensity, price cost margin, regulation, sales growth

Abstract: This study examined the effect of concentration ratio, advertising intensity, and the government’s regulation

on profitability in Indonesian cigarette industry. This study used secondary data of the cigarette industry in

Indonesia. It was from the Central Bureau of Statistics (BPS) and the Indonesia Stock Exchange (BEI). In this

study, the population is the manufacturing industry sector in Indonseia during the period 1993 to 2013.

Selection of this sample is based on the completeness of the data held. The results show Concentration,

advertising intensity, regulation, and sales growth have an effect on long-term earnings stronger than short-

term. The test results also show that Government Regulation No. 81 of 1999 has not significantly affected the

structure, conduct and performance of the cigarette industry. Despite the descriptive earnings of cigarette

companies listed on the Indonesia Stock Exchange tend to be smaller, but total sales are increasing. This

means that government policy has not been effective in reducing cigarette consumption. Law No. 32 of 2002

on broadcasting is statistically significant affecting price cost margin in a positive direction. However, the

descriptive ratio of earnings in cigarette companies listed on the Indonesia Stock Exchange tend to decline.

1 INTRODUCTION

The Indonesian cigarette industry contributes

significantly to the state income, in the form of

cigarette Excise. The following table shows the

contribution of excise to total domestic income of

cigarette is greater than the contribution of state

income from the share of SOE profits during the

period of 2007 to 2014. The contribution of the

cigarette industry during that period averaged 3 times

the contribution of income from the share of profit of

SOEs.

When compared with contributions from natural

resource income, from 2007 to 2015, contributions

derived from natural resource income were seen to

decline, initially 18.22% in 2007 and 22% in 2008,

down in 2014 to 15.58%. The contribution of the

cigarette industry to total domestic income was seen

to increase, by 6.33% in 2007 and down 5.23 in 2008

and then gradually increasing to 7.64% by 2014. This

shows that the state income from excise significant

enough to total state income. 2.61

Saftiana, Y., Robiani, B., Kadir, S. and Suhel, .

Concentration Ratio, Advertising Intensity, Sales Growth, The Government’s Regulation And Profitability In Indonesian Cigarette Industry.

DOI: 10.5220/0008444106930698

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 693-698

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

693

Table 1: The Contribution of Excise of Tax Income, Domestic Tax Income, Total Domestic Income in The Country

compared to The Contribution of Natural Resource Income and The Share of SOEs' Profits (in percentage)

Year

Contribution of

Excise on Total

Tax Income

Contribution

of Excise on

Total

Domestic Tax

Income

Contribution of

Excise on Total

Domestics

Income

Contribution

Natural

Resources

Income on

Total

Domestics

Income

Contribution of

SEOs’ Profit

onTotal Domestic

Income

2007

0.09

9.51

6.33

18.82

3.29

2008

7.78

8.24

5.23

22.92

2.97

2009

9.15

9.43

6.70

16.40

3.08

2010

9.15

9.53

6.67

17.01

3.03

2011

8.81

9.39

6.39

17.74

2.34

2012

9.69

10.21

7.13

16.95

2.31

2013

10.07

10.53

7.57

15.81

2.38

2014

10.30

10.70

7.64

15.58

2.61

Source: Processed from Realization of State Income (in million rupiah) 20072016http://www.bps.go.id

The development of the Indonesian Cigarette

Industry creates a dilemma. In one hand the cigarette

industry has contributed a substantial role of the

country's income, through cigarette taxes. Whereas,

cigarettes are harmful product for healthy, and can

cause death. The government should make efforts to

reduce cigarette consumption, but on the other hand

the government must maintain substantial income

from this industry (Muslim and Whardani, 2008).

Various efforts that have been done by the

government to reduce the level of cigarette

consumption and also maintain the contrys’ income

of this industry that affected on the number of

cigarette industry in Indonesia. The explanation of

Government Regulation No. 81 of 1999 on the

safeguarding of cigarettes for health article 2 stated

that smokers have a 2 to 4 fold risk for coronary

disease and a higher risk for death. Passive smokers

have a 30% greater risk of developing cancer than the

smokers themselves. Furthermore, the government

regulation also regulates the content of nicotine and

tar in the territory of Indonesia should not exceed 1.5

mg of nicotine and 20 mg of tar. To increase the role

of the government to maintain the role of the cigarette

industry sector to the national economy and to

increase public knowledge about the dangers of

smoking for healthy, it is necessary to analyze the

relationship between the basic condition, structure,

behavior and performance of the cigarette industry

with government-created regulations.

This study examines the effect of concentration

ratio, advertising intensity, price cost margin in the

long run compared to short-term using Price Cost

margin of the previous year (PCM t-1), government

regulation, sales growth on Price cost Margin in The

Indonesian cigarette industry.

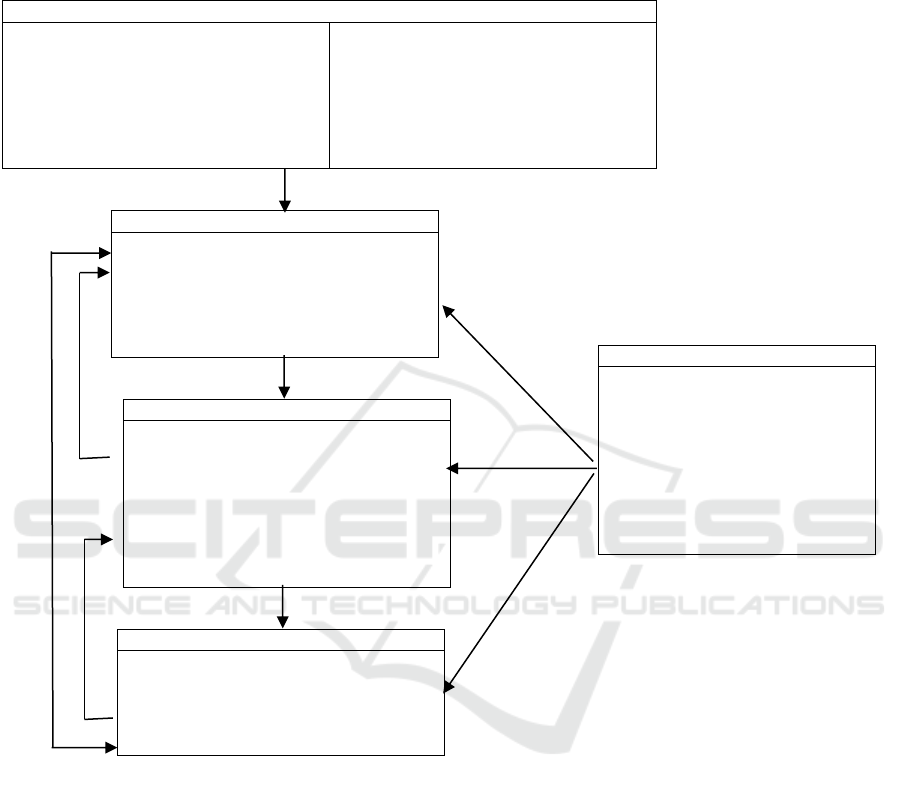

Structure-Behavior-Performance (S-C-P)

The basic approach of industrial economic

paradigm emphasizes the relationship between

market structure and business behavior in

determining market performance. This relationship

simply describes the causal relationship of market

structure to behavior that affects performance

(Clarke, 1990).

The simplest relationship of the three SCP

variables is the linear relationship of structure affects

behavior then behavior affects performance. In the

SCP, the relationships of the three components affect

each other including the presence of other factors

such as technology, progressiveness, strategy and

efforts to drive sales (Martin, 1994).

The SCP approach by Don E. Waldman and

Elizabeth J. Jensen (1998) focused on Performance

Behavior (SCP) industry (shown in figure 1). Under

SCP basic conditions, the demand side is explained

by price elasticity variables, sales growth, and sales

methods. On the supply side focuses on technology,

and product durability. The market structure is

explained by the variety of sellers and buyers, product

differentiation, diversification, vertical integration.

Attitudes focus on collusion, merger, legal strategy,

advertising, and pricing and performance strategies

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

694

measured by technological advances, and production

efficiency. Waldman and Jensen (1998) emphasize

that corporate policy actions are directly influenced

by government policies in the form of anti-trust

policies, regulations, taxes and other government

policies.

BASIC CONDITION

Demand Side

Price Elasticity

Subtitutes

Market growth

Type of good

Methode of purchase

Supply Side

Technology

Raw Material

Unionization

Product Durability

Unionization

MARKET STRUCTURE

Number of Sellers and buyers

Product Differentiation

Barriers to entry and exit

Vertical integration

Diversification

Cost Stuctures

CONDUCT

Pricing Strategies

Producttion Strategis

Advertising

Research and development

Plant investment

Collusion

Mergers

Legal Strategies

PERFORMANCE

Allocative Efficiency

Production Efficiency

Rate of technological advance

Quality and service

Equity

Figure 1: The Framework of Structure-Conduct-Performance (SCP)

Source: Don E. Waldman dan Elizabeth J. Jensen (1998)

2 LITERATURE REVIEW

Martin (1979) examined a system of equations

that explained profitability, market concentration and

ad intensity using a 4 digit SIC Indsutri U.S sample

in 1967. The results showed that the intensity of

advertising, concentration, concentration of sellers,

and profitability were determined simultaneously.

The seller's concentration is explained in long-term

dynamic adjustment, and profitability and advertising

depend on the current level of concentration and the

variable that measures the demand side of the market,

when the seller's concentration is explained at a long-

term adjustment level.

The Pagoulatos and Sorensen (1981) study used

data from 47 food industries with a 4-digit SIC census

in 1967 examining the simultaneous relationship of

concentration, behavior and industrial performance.

The results of Pagoulatos and Sorensen (1981)

showed that the advertising intensity affects

concentration and profitability. In the food processing

industry, the intensity of advertising acts as an

industry barrier. Industrial concentration and

profitability are proven to significantly affect the

intensity of advertisements according to the

previously hypothesized feedback relationships.

Result of Pagoulatos and Sorensen research

(1981) for profit margin equation found price

elasticity of demand (EL) is important variable

GOVERNMENT POLICIES

Antitrust policy

Regulation

Taxes and subsidies

Trade regulations

Price controls

Wage Regulations

Investment Incentives

Eployment Incentives

Macroeconomic Policies

Concentration Ratio, Advertising Intensity, Sales Growth, The Government’s Regulation And Profitability In Indonesian Cigarette Industry

695

determine profit margin. Ratio concentration

coefficient (CR), demand growth (GVS), asset

intensity (K / S) results are significant and direction

is as expected. The import variables M / S and X / S

only slightly affect the earnings of local companies

and their positive direction is not as hypothesized.

The export-oriented variable is negative as expected

but the effect is also insignificant.

Although some theories in industrial economics

textbooks mention the effect of regulation on

industrial structure, industrial behavior and industrial

performance, for example in the book Industrial

Organization written by Waldman and Jensen (1998),

but in the research of Performance Behavior Structure

(SCP) in industrial sector manufacturing that has been

in the previous study, no one uses the regulatory

variables in his research. This study uses dummy

variable Reg1 (Regulation no. 81 of 1999) on

safeguarding cigarette language and dummy Reg 2

(Act number 32 year 2002) about broadcasting.

Hypothesis

The hypothesis of this research is the ratio of

concentration, the intensity of advertisement, the

previous year's performance, the regulation and the

sales growth affect the performance of the cigarette

industry in Indonesia.

3 RESEARCH METHODOLOGY

The scope of this study is limited to issues related

to the behavioral structure, performance and

government regulation of the cigarette industry in

Inodnesia. The variables used in this study

concentration ratio using CR4 to measure the

industrial structure, the advertising intensity of 4

firms included in CR4 to measure promotional

behavior, , cigarette industry sales growth and profit

of 4 companies included in CR4 to measure industry

performance . Data required is data from 1990 to

2013. Data for 2014 is not yet available in the Central

Bureau of Statistics (BPS).

This study uses secondary data of the cigarette

industry in Indonesia sourced from the Central

Bureau of Statistics (BPS) and the Indonesia Stock

Exchange (BEI). In this study the population used as

the object of research is the cigarette manufacturing

industry sector in Indonseia during the period 1993 to

2013. Selection of this sample is based on the

completeness of the data held. Secondary data

available will be processed to obtain the basic

conditions, market structure, behavior and

performance of the cigarette industry in Indonesia.

The model of this research is :

PCM =

0

+

1

CR

4

+

2

PCM

t-1

+

3

Iklan +

4

Reg

1

+

5

Reg2 +

6

GVS + v

i

.

PCM = Price Cost Margin

Advertising = Advertising Intensity

CR4

t

= Concentration Ratio

PCM

t-1

= Price Cost Margin previous year

Reg 1 = PP No 81 Year 1999

Reg 2 = UU No. 32 Year 2002

GVS = Sales Growth

4 FINDINGS

The model test results show :

PCM = 0.142641 – 0.000536CR4 – 0.751464IKLAN – 0.019394REG

1

+

(0,0522) (0,00005) (0,5276) (0,01447)

0.067699REG

2

+ 0.109153GVS + 0.277654PCM

t-1

(0,0212) (0,062822) (0,1712)

The Value of R2 = 0,56329

F Count > F Table (131,564 > 2,70)

The determination value of Price Cost Margin

(PCM) is 0.56329. The estimation results show the

variation of the changes. Price Cost Margin (PCM)

can be explained by variations of Industrial

Concentration (CR4), Ad Intensity, Dummy

Government Regulation No. 81/1999 (Reg1),

Dummy Law No. 23 of 2002 (Reg2), Sales Growth (

GVS) and Price Cost Margin last year (PCMt-1) of

56.3%. The remaining of 43.7% is caused by other

factors.

The simultan test result (F test) with alpha 0,05

Fcount test result > from F table, that is (131,564>

2,70), it means all independent variables have

statistically significant affected to variable Price Cost

Margin cigarette industry in Indonesia.

Concentration of industry (CR4) affects Price

Cost Margin (PCM) with negative direction and very

small coefficient value (-0.000536). Statistically, its

effect has not significant at 10% confidence level

with probability value 0,2626. This means that the

higher Concentration of Industry, the Price Cost

Margin (PCM) will decrease with a very small effect.

The direction of this relationship is supported by data

on income statistic (Return on Sales / ROS) four (4)

companies listed on the Indonesia Stock Exchange for

several periods which have declined pattern, and

there are the periods that the ratio of

companies’earnings shows a negative value.

Advertising Intensity indicates a negative effect

on Price Cost Margin (PCM) with a large coefficient

value (- 0.751464) and in statistically, it is not

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

696

significant at 10% confidence level, but significant at

20% confidence level, as indicated by probability

value of 0.1607. The estimation results indicate that

the higher the Advertising Intensity of Cigarette

Industry, so Price Cost Margin (PCM) will decrease.

This estimation results conflict with advertising

goals, as Advertising Activity is expected to drive

demand that will increase sales. However, if an

increase in the Intensity of Advertising accompanied

by an increase in the average cost of production which

is bigger than an increase in the selling price of the

product, then this will tend to encourage a decrease in

profits.

Government regulation (Reg1) number. 81 of

1999 on the Security of Cigarettes for Health turned

out to be inversely (negative) with the level of profit

of cigarette Industry. Partial model test results (t test)

shows a confidence level of 5% or 10% statistically

affect government regulation no. 81 of 1999 that has

not been significant to Price Cost Margin (PCM), but

it is significant at 20% confidence level. This

indicates by a probability value of 0.1863. These

results indicate that regulation about the maximum

threshold of nicotine, tor and other substances in

cigarettes that are caution to health affects the

declining performance of the cigarette industry.

The government regulation (Reg2) number 32 of

2002 on broadcasting is proportional to the level of

profit of the cigarette industry. Partial model test

results (t test) shows that a 5% confidence level of the

effect of this regulation on Price Cost Margin (PCM)

that is statistically significant. This indicates by a

probability value of 0.0024.

Law number 32 of 2002 concerning the

broadcasting in article 46 letter 3c. Mentions that

commercials are prohibited from promoting cigarette

smoking. Estimation results indicate an increase in

Price Cost Margin (PCM) after the issuance of the

Law. Despite the descriptive earnings of cigarette

companies listed on the Indonesia Stock Exchange

tend to be smaller, but total sales are increasing. This

means that government policy has not been effective

in reducing cigarette consumption. Law No. 23 of

2002 on broadcasting is statistically significant

affecting price cost margin in a positive direction.

However, the descriptive ratio of earnings in cigarette

companies listed on the Indonesia Stock Exchange

tend to decline.

Sales Growth (GVS) has a positive effect on Price

Cost Margin (PCM). Statistically this relationship is

not significant at 5% confidence level, but it is

significant at 10% confidence level with probability

value of 0,0886. These results indicate that an

increase in sales growth, will slightly increase the

Price Cost Margin (PCM) with a coefficient of

0.10953.

Price Cost Margin years ago (PCMt-1) has

positive effect of current period of Price Cost Margin

variable (PCM), and in statistic, this effect is

significant at 5% confidence level with probability

value of 0.1113. The estimation results show that

earnings expectation in PCMt-1 is able to boost the

current profit increase (PCM). These results also

suggest that earnings in the long run are more affected

than in the short term.

5 CONCLUSION

Price cost margin is more affected by the

concentration variable, advertisement, regulation,

and sales growth in the long term than the short term,

in meaning that there is more possibility of companies

in the cigarette industry in making the adjustments in

the long run so that the effect of concentration,

advertising, regulation and sales growth on earnings

can be more flexible / elastic in the long run.

Law number 32 of 2002 concerning on

broadcasting has positive significant effect on price

cost margin. This indicates that there is an increase in

advertising costs due to the law, and also followed by

an increase in price cost margin even though

descriptively the ratio of earnings in cigarette

companies listed on the Indonesia Stock Exchange is

declining. This is because the Law is not only

focusing the cigarette industry but regulating the

broadcasting for all industries.

Government Regulation number 81 of 1999

affects Price Cost margin and concentration of

industry with negative direction, but statistically it

has not been significant. The goal of issuing this

regulation is to protect people from the dangers of

smoking.

The observations in this study show that

regulations made by the government have not been

able to reduce the rate of sales growth, It’s mean that

cigarette consumption continues to increase even

though the growth rate is getting smaller. The policies

made by the government, both the limit of advertising

and the increase in excise rates, are only able to

influence the cost of producing cigarettes,

consequently even though the volume of sales

increases but the profits of cigarette companies are

getting smaller. The results of this study can be taken

into consideration by the government to increase

cigarette excise rates, and make new, more effective

policies reduce the volume of cigarette consumption.

Concentration Ratio, Advertising Intensity, Sales Growth, The Government’s Regulation And Profitability In Indonesian Cigarette Industry

697

Test results of the effect of Advertising Intensity

on Price Cost margins have a negative direction that

is not significant. This result is contrary to the

purpose of advertising behavior. This article

examines the influence of advertising in the same

period on profits. the following research can consider

the effect of time to test the effect of advertising on

profit.

6 REFERENCES

Achadi. 2008, Regulasi Pengendalian Masalah Rokok di

Indonesia, Jurnal Kesehatan Masyarakat Nasional,

Vol 2. No 4.

Arterburn, Alfred. 1981, Advertising. Price Competition

and Market Structure, Shouther, Economic Journal

(pre-1986); Jan 1981; 47,3.

Azzam, Azzeddine M.1997. Measuring Market Power and

Cost-Efficiency Effect of Industrial Concentration, The

journal of industrial Economics Volume XVL,

December No. 4 hal 377-386.

Basri, Faisal. Industri-Kimia-Jadi-Andalan-Penciptaan-

Nilai-Tambah, http://www.neraca.co.id/article/24962.

Britton, Chris and Shepherd, Willliam G. 1990. The

economic of Industrial Organization, Prentice Hall, 3

rd

.

Clarke, Roger. 1990. Industrial Economics, fourth Edition

. basil Blackwell. Inc., Cambridge, Massachusets ,

USA.

Domowitz, Ian dan R. Glenn Hubbard, dan Bruce C

Pettersen. 1986, Business Cycles and The Relationships

Between Concentration and Price-Cost Margins, Rand

Journal of Economics Vol 17 No 1.

Dumairy. 2000. Perekonomian Indonesia. Jakarta :

Erlangga

Gisser, Micha. 1991. Advertising, Concentration and

Profitability in Manufacturing, Economic Inquiry; jan

1991;29,1; proquest pg 148.

Greer, Douglas. F. 1980. Industrial Organization and

Public policy. Second Edition. New York : Macmillan

Publishing Company.

Hasibuan, Nurimansah. 1993. Ekonomi Industri:

Persaingan, monopoli, dan regulasi. LP3ES.

Hirschey, Mark. 1982, Advertising and the Profitability of

Leading and Following Firms, Managerial and

Decicion Economics (pre-1986): Jun 1982;3,2

ABI/INFORM complete page 79.

Kata Data, 2014, Nilai penjualan empat perusahaan

rokok, http://katadata.co.id

Kelly, Trish dan Martin L Gosman. 2000, Increased

Buyer Concentration and Its Effects on Profitability in

Manufacturing Sector, Review of Industrial

Organization 17; page 41-59.

Kuncoro, Mudrajat. 2007. Ekonomika Industri Indonesia,

Menuju Negara Industri Baru, 2030. ANDI,

Yogyakarta.

Lee, Chang-Yang. 2002, Advertising, Its Determinants, and

Market Structure, Revie of Industrial Organization;

Aug2002;21,1;ABN/INFORM Complete pg 89.

Martin, Stephen. 1979. Advertising: Concentration, and

Profitability: The Simultaneity Problem. The Bell

Journal of Economics, Volume 10, Issue 2, Autum.

Martin Stephen. 1994. Industrial Economis; Economic

Analysis and Public Policy, second edition, New York.

Martin, Stephen. 2012, Market Structure and Market

Performance, Springer Science + Business Media,

LLC.

Muslim, Erlinda, dan Wardani,Anandita Laksmi.2008,

Analisis Struktur dan Kinerja Industri Rokok Kretek di

Indonesia dengan Pendekatan Struktur, Perilaku dan

Kinerja, Seminar Nasional Teknik Industri dan

Kongres BKSTI V Makasar, 16-17 Juli 2008.

Noita, Ourania dan Kostas Oustapassidis. 2001,

Profitability and Media Advertising in Greek Food

Manufacturing Industries, Review of Industrial

Organization; Feb 2001;18,1; ABI/INFORM Complete

pg 115.

Ndaghu AA, Taru V.B., dan Isah J.A, 2001,

___________________, Global Journals of Agriculture

Sciences 10.1 (hal 71-75).

Pagoulatos, Emilio dan Sorensen, Robert, A Simultaneous

Equation Analysis of Advertising, Concentration and

Profitability, Shourther Economic Journal (pre 1981);

Juli 1981.

Stevens, Jerry Lloyd. 1980, Bank Market Concentration,

Advertising Intensity, Price Cost Margin, and Cost of

Production: An Empirical Approach, Dissertation,

University of Illinois at Urbana Champaign.

Stricklend, Allyn.D dan Weiss, Leonard W. 1976.

Advertising, Concentration, and Price-Cost- Margin,

The Journal of Political Economy, Vol 84, No 5, (Okt,

1976) pp 1109-1122.

Stuebs Marty dan Li Sun. 2010, Business Reputation and

Labor Efficiency, Productivity, and Cost, Journal of

Business Ethics, springer.

Syukrillah, 2014, menimbang fatwa MUI tentang

Haramnya Rokok, https://syukrillah.wordpress.com

Tanudjaja. 2002, Kreatifitas Pembuatan Iklan Produk

Rokok di Indonesia, Nirvana Vol.4 No 1.

Vlachei.A dan K. Oustapassidis. 1998, Advertising,

Concentration, and Profitability in Greek Food

Manufacturing Industries, Agriculture Economics 18.

Wei SI and Xiuqing Wang. 2011, Productivity Growth,

Technical Efficiency, and Technical Change in China’s

Soybean Production, African Journal of agricultural

Reasearch vol 6 (25).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

698