The Mechanism of Zakat Productive Fund Management and Its

Effect On The Income of Recipient of Zakat in Palembang City

Ichsan Hamidi, Suhel, Nurkadina Novalia

Department of Economic Development, Faculty of Economics, Universitas Sriwijaya

Keywords: Zakat Productive, Income, Recipient of Zakat

Abstract: This study aims to find out how the management mechanism for zakat productive fund and how they affect

the income of recipient of zakat in Palembang. This study uses qualitative and quantitative approaches,

while data collection techniques use questionnaires and also through interview, observation and

documentation. The population in this study is all recipient of zakat which receives zakat productive fund

from BAZNAS SUMSEL such as 187 recipients. In taking a sample, 81 random sampling techniques are

used. Data analysis using multiple regression analysis model, then performed a classic assumption deviation

test. The results of this study indicate that the mechanism of zakat productive fund management consists of

regional feasibility studies, program socialization, recipient of zakat feasibility studies, distribution of zakat

productive fund, provision of training, establishment of local community institutions to the program

evaluation stage. This study also found that the variables of zakat productive fund, length of business and

training have a positive effect on the income of recipient of zakat. So that it can be concluded that the

implementation of zakat productive can be more increased so that the recipients of zakat can become the

giver of zakat in the future.

1 INTRODUCTION

In Islam there is one social economic system

which is used to help other Muslims who are in

conditions of poverty and income inequality, namely

zakat which is a system where someone has more

assets so that they can and are willing to share a

portion of their wealth to help fellow Muslims,

especially the poor people. Zakat is the third pillar of

Islam, which zakat should give a good contribution

in improving society's welfare (Ibrahim and Ghazali,

2014).

Nowadays,The development of zakat

empowerment in the world has begun to improve

and is widely used as a foundation in helping the

economy of its people. In 2010 Malaysia collected

zakat funds in the amount of RM 1,363,772,682 and

distributed in the same year was RM 1,176,487,212

or 86% of the collected funds. The Amil Zakat

Institute in Malaysia has also begun to distribute

zakat funds in productive forms (Nadzri et al, 2012).

In 2010-2011 in Pakistan, zakat funds collected

amounted to RS2.82 billion from 36 provinces. The

funds are allocated for RS.1,585 billion for

subsystem allowances, education scholarships,

patient care, for marriage, and benefits on Eid al-

Fitr. In the allocation of zakat funds which become

obstacle is the lack of zakat funds collected in the

amil zakat institute of Pakistan. This is due to the

lack of giver of zakat trust to the amil zakat institute

because of lack of transparency in the management

of the zakat funds (Tarar and Riyaz, 2012).

In order to make the role of zakat become better

in improving the economy of recipient of zakat

zakat, the zakat experts begin to develop ideas to

improve productivity of zakat funds, so the thought

arises to distribute zakat funds in the form of

productive zakat capital to the recipient of zakat who

have expertise in opening micro, small and medium

enterprise (MSME) and have expertise in trading

(Asnaini, 2008).

Sartika (2008) conducted a study in Solo, and

found that the use of zakat productive in LAZ Solo

Peduli Surakarta Foundation which distributed in the

form of livestock affected the income of recipient of

zakat by 10.2%. This result is significantly affected

by the amount of zakat productive funds capital

Hamidi, I., Suhel, . and Novalia, N.

The Mechanism of Zakat Productive Fund Management and Its Effect On The Income of Recipients of Zakat in Palembang City.

DOI: 10.5220/0008443706590668

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 659-668

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

659

distributed to the recipient. As in the North Aceh

regency from 2007 to 2010 have given a subsidy to

poor people Rp. 885,000,000, with the number of

recipients of zakat totaling 533 people and the

results of the study showed that after receiving zakat

productive in the form of business capital there was

an increase in the average income of 19% before

receiving productive zakat (Rusli et al. 2013).

Rumah Makmur BAZNAS (RMB) in Semarang

has also carried out zakat productive in the form of

small micro-enterprise modal assistance, thus

encouraging increased profits. Increased profits

before getting capital assistance ranged from an

average of 43% and after getting capital assistance

profits increased by 57%. Although the average

increase which occurred was not so large, but every

recipient of zakat business encounter an average

increase of up to 14%. Meanwhile, Rumah Makmur

BAZNAS (RMB) until September 2013, has provided

business capital to 2,414 recipients, with total

business capital assistance amounting to Rp.

2,222,195,800 (Wulansari and Setiawan, 2014).

The optimal implementation of zakat productive

is also attempted by Baitul Mal in North Aceh

Regency, this was revealed by Nasrullah (2015). The

Baitul Mal determines the various schematic models

adjusted to the needs of recipient of zakat, starting

from the Qardh Alhasan scheme, then also

providing a mudharabah scheme even to the sale

and purchase scheme with a murabahah contract.

This makes a very positive enthusiasm from the

recipient of zakat to lead a better standard of living.

The positive results from the usage of zakat

productive were also found by Djayusman (2011)

which his study revealed that Baitul Maal Desa

Dompet Dhuafa in Yogyakarta manages zakat funds

by procuring and managing productive assets by and

for dhuafa such as land redistribution, agricultural

development, rural industrialization, integrated

agriculture and rice marketing. Zakat Productive

funds are managed to finance land rent, procurement

of inputs, fertilizer, seedlings and capital goods

investments. This was conducted because Dompet

Dhuafa saw that the recipient of zakat had the

potential and expertise in agriculture. This study also

revealed a significant difference between income

before and after participating in BMD agriculture

programs. The increase in dhuafa income of farm

labors after participating in the BMD agriculture

program amounted to Rp210,584.00 or an increase

of 77.12% from the previous average income. This

is because the majority of recipient of zakat are

farmers, so they have experienced, so that it helps

for making the zakat funds management effective.

In order to get maximum results in the

application of zakat productive among the recipients

of zakat, the good mechanism is needed in the

management of zakat productive funds which under

the recipients authority. As expressed by Toriquddin

and Rauf (2013) that the management of zakat

productive funds at the Ash Shahwah Foundation

(YASA) Malang consists of good planning, after

being well planned, the next stage is proper

organizing then proceed with appropriate

implementation methods with initial planning, after

being implemented, it is necessary to have a

continuous and good supervision from YASA. Zakat

productive funds management can be better with this

mechanism. The same thing is also found in the

community caring justice post (PKPU) Makassar by

Hidajat (2017), that the planning, organizing,

implementation and monitoring stages are things

that must be well-done.

Nopiardo (2016) found that the mechanism of

zakat productive management in BAZNAS Tanah

Datar is well organized, from the determination of

how the distribution pattern to the recipient, and the

mechanism of proposing the recipients and also

reviewing how to assign assistance to them also not

to miss from BAZNAS Tanah Datar attention to how

the mechanism of funds allocation until the process

of handing over assistance to the recipients, and also

to produce the expected results, there must be proper

and sustainable guidance. This is similar to what was

expressed by Ansori (2018) that the distribution

system of zakat productive funds at LAZISNU

Ponorogo begins with accurate data collection by

submitting proposals by prospective of recipient of

zakat to LAZISNU and identifying the recipient by

amil. It followed by grouping them, then amil gives

a training in the form of skills, management of

marketing capital in doing business. The final stage

is the provision of zakat funds by LAZISNU

Ponorogo to recipient of zakat. In addition, zakat

productive funds are only given to those who are

strong working and productive age.

South Sumatra is a province which has good

zakat potential. Based on the population in

Palembang, the zakat potential can be collected to

reach Rp 2.3 trillion annually, this was expressed by

BAZNAS SUMSEL (2017). Meanwhile, according

to the financial report of the National Zakat Agency

(BAZNAS) in South Sumatra in 2017, zakat funds

received by South Sumatra BAZNAS amounted to

Rp 40 billion. This shows that the giver of zakat

awareness for distributing zakat to BAZNAS is still

very less, so it needs to be given better planning

from BAZNAS and other amil zakat institutions.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

660

BAZNAS Sumsel has a community empowerment

program which is called the "Rumah Makmur"

program. The ideals of family economic

independence are realized through the roll out of

working capital for dhuafa productive businesses in

various regions including vegetable traders,

hawkers, grocery traders, handicraft businesses,

workshops, and pempek traders. Various village

community empowerment programs are carried out

with a focus on managing local resources. BAZNAS

South Sumatra has several guided which are now

quite successful, and are also able to create jobs for

others in the surrounding environment.

The existence of "Rumah Makmur" program

indicates that zakat productive can be accepted by

recipient of zakat, even giving a positive impact. If

one recipient can provide work for others, how if

most of the recipients who get zakat productive can

provide employment for others? Of course

unemployment in South Sumatra will decrease, the

poverty rate will also decrease. This goal is expected

from the establishment of zakat in Islamic religion.

In order to achieve this goal, it is necessary to

manage zakat productive by amil zakat, the giver of

zakat and the recipient of zakat, so that they can

contribute maximally to the recipient. This is what

motivate this study to be done. In order the society

can know better how the mechanism of managing

zakat productive funds in BAZNAS SUMSEL and

how it affects the income of the recipient of zakat in

Palembang, so that it can attract other Muslims to

prefer BAZNAS SUMSEL as a place to distribute

their zakat.

2 LITERATURE REVIEW

2.1 Zakat

Islam is the second largest religion in the world,

with almost more than one billion followers in the

world (Tarar and Riyaz, 2012). In the Al-Qur’an

which is the main law foundation of Islam often

mention about zakat accompanied by prayer. It can

be concluded that zakat is obligatory like prayer, so

that all Muslims in the world must heed Allah's

order to pay zakat. Allah says in Surah Al-Baqarah

verse 267 which means: "O you who have believed,

spend from the good things which you have earned

and from that which We have produced for you from

the earth. And do not aim toward the defective

therefrom, spending [from that] while you would not

take it [yourself] except with closed eyes. And know

that Allah is Free of need and Praiseworthy".

The verse of the Al-Qur’an above concludes that

zakat is not only giving, but how to give the best to

those who need, not giving the bad. Yusoff (2008)

said that zakat is not only giving something to others

on the basis of good deeds, rather the assumption

that zakat is an important pillar in Islam and also a

form of Muslim worship to Allah SWT.

One of the reasons for the creation of zakat is for

humans to help each other. Because humans are

social beings, which means that humans cannot live

alone without the help of others. Zakat also teaches

Muslims to respect each other, so that a life of peace

and harmony is created (Abdullah and Suhaib,

2011).

The meaning of zakat in terms of language

comes from zaka which means: blessing, growing,

clean, holy and good. Some of these meanings are

indeed very compatible with the true meaning of

zakat. It is said as a blessing, because zakat will

bring blessings to the wealth of someone who has

done zakat. It is said as holy, because zakat can

purify the owner of the wealth from the nature of the

greedy, shirk, miserly and immoral. It is said to be

growed, because zakat will multiply the merit for the

giver and help the difficulties of the recipient

(Asnaini, 2008).

It called the word zakat, as revealed in the word

of Allah SWT in Surah An-nur verse 56 which

means: "And establish prayer and give zakat and

obey the Messenger - that you may receive mercy".

2.2 Position and Function of Zakat

In the Al-Qur’an many verses that clearly state

the implementation of zakat. Allah's order to

implement zakat is often in tandem with the order of

prayer. This shows how important the role of zakat

in the Muslims live. The verse contained the word

zakat and accompanied by the word prayer. For

example the word of Allah SWT in Surah Al-baqarah

verse 43 and Surah Al-Haj verse 78 which means:

"And establish prayer and give zakah and bow with

those who bow [in worship and obedience]".

According to Mu'iz (2011) Zakat is primarily the

maliyah worship and prayer is primarily badaniyah

worship. Therefore, we are not wondered that all

scholars stipulate that: "denying the law of zakat

(denying its obligation) is punished by kufr, out

from Islam. Muhammad (2011) also said that Zakat

can be used for social purposes, especially for those

who belong to the recipients of zakat which has been

determined in the Al-Qur’an because of the roles

and functions contained in zakat so that it is seen as

a religious levy which must be set aside by a

The Mechanism of Zakat Productive Fund Management and Its Effect On The Income of Recipients of Zakat in Palembang City

661

Muslims or institution owned by Muslims in

accordance with religious provisions. Zakat in living

can prevent society from the social gap between the

rich and the poor. Zakat can also foster and develop

the stability of social, economic life, grow a sense of

social responsibility. Helping, reducing and lifting

the poor people from economic and social

difficulties, fostering and growing brotherhood

among human beings, and developing individual

responsibility for the society and public interests.

Hafidhuddin (2006) said that through eight asnaf

financed by zakat as determined by the Al-Qur’an,

zakat can can be used social function as a tool of

social security and unifying the community in

fulfilling the basic needs of each individual,

eradicating poverty and waste against fellow

Muslims, then as a heart softener and a tool for

spreading Islam. Is not zakat among others used for

muallaf who are persuaded by their hearts, which

means the muallaf who are persuaded by their hearts

are those who deserve to be given zakat as a softener

of their hearts or the hearts of their people, or to

strengthen Islam in their hearts.

As the population increases and the potential for

zakat arises new problems, that is how to make zakat

so can be functioned as a worship and also as a

social concept. This is the meaning of zakat

utilization. Based on observations and studies so far,

the Indonesian Ministry of Religion (2002) draws

conclusions that the use of zakat can be classified

into four forms. The first form is "Traditional

Consumptive", that is zakat distributed to recipient

of zakat to be distributed directly. The second form

is "creative consumptive", that is zakat which is

realized in other forms from the original goods, such

as given in the form of school tools, scholarships,

hoes and so on. A third form is "traditional

productive" where zakat is given in the form of

productive goods such as goats, cows, shavers,

carpentry and others. The fourth form is "creative

productive", that is zakat which is realized in the

form of rolling capital for social capital projects or

for helping increase the capital of small traders /

entrepreneurs. The usage of zakat in the third and

fourth forms is to approach the meaning of

utilization, which we must develop, so that the

meaning of sharia zakat both in terms of worship

and social functions can be achieved as expected.

2.3 Allocation of Zakat Funds

The allocation of zakat funds is devoted to eight

groups or commonly referred to the recipients of

zakat. This is in accordance with the provisions of

Allah in his word in Surah At-Taubah verse 60

which means: "Zakah expenditures are only for the

poor and for the needy and for those employed to

collect [zakah] and for bringing hearts together [for

Islam] and for freeing captives [or slaves] and for

those in debt and for the cause of Allah and for the

[stranded] traveler - an obligation [imposed] by

Allah . And Allah is Knowing and Wise."

In the verse mentioned above, the poor people

are the top priority of the 8 groups who are entitled

to receive zakat. The aim is to eradicate poverty and

destitution of Muslims. Asnaini (2008) revealed that

groups including the poor are, people who have no

wealth at all, people who have wealth or business

but not enough for themselves and their families,

people who have assets and business but can only

meet half of their own needs and their families. In

giving this zakat, it should be sufficient, meaning

that this zakat should be given until the recipient of

zakat can suffice for its life. For example, a poor or

poor person who is good at trading is given a large

amount of capital which can produce sufficient

profits for his life (Prihatini et al, 2005).

2.4 Zakat Productive

In the Decree of the Minister of Religion RI No.

581 of 1999 about the Implementation of Zakat

stated that the types of zakat fund utilization

activities are divided into two parts: First, the

utilization of social-based zakat that is the

distribution of zakat funds in the form of

compensation for consumptive needs which called

compensation program (charity) or consumptive

grant.

Second, the usage of zakat based on economic

development is the distribution of zakat in the form

of providing business capital to those who have the

right to receive directly or indirectly, whose the

management may involve or not involve target

recipient of zakat. The distribution of zakat funds is

directed to productive economic enterprises, which

are expected to result in increasing a level of public

welfare.

Al-Masyiqah (2007) said that zakat productive or

zakat investment based on the term is looking for the

acquisition of wealth by doing business with zakat.

Zakat investment can be divided into three parts.

First, the zakat investment by the recipient itself.

Secondly, the zakat investment carried out by the

recipient. Third, the zakat investment carried out by

the ruler or the institution of amil zakat.

Farah (1997) also revealed that zakat productive

as an inclusion of zakat funds separately or with

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

662

other funds in sectors which generate profits

(profitable). The benefits of zakat investment are

intended for the benefit of the recipient of zakat in

the short and long term while still keep guided to the

principles of sharia.

At first, the scholars differed on the law of zakat

investment. However, in the end the scholars who

did not allow the zakat investment made several

provisions which allowed the zakat investment to be

carried out with several considerations, such as; pay

attention to the needs of the poor people; investment

can really bring benefits; hasten to collect zakat

when there is a need; investments are made by

government or their representatives, both from

departments, social organizations or donor agencies;

this investment is consulted with experienced and

trustworthy people; the investment is carried out on

businesses that are permitted according to sharia and

not a prohibited business (Al-Masyiqah (2007).

The results of zakat may be used for productive

purposes, such as providing financial assistance in

form of business capital to the poor who have certain

skills and are willing to try / work hard, so that they

can regardless of poverty and dependence on others

and be able to be independent. In addition, the

results of zakat can also be used to establish

factories and profitable projects and the results for

zakat recipients in need. Factories and other projects

financed with the results of zakat must prioritize the

recruitment of their workforce to the poor who have

been selected and have been given skills education

in accordance with the available employment, Zuhdi

said in the masail fiqhiyah book (1997)

Farah (1997) revealed several things that become

guidelines in investing zakat funds, that is: Zakat

investment is a tools of supporting the

implementation of zakat, not as a substitute for the

existing zakat mechanism, zakat investment must

run according to sharia rules, such as not related to

usury or bank interest, Zakat investment managers

are chosen based on competence, trustworthy and

noble character, Zakat investment strategy is

designed with the aim to increase the income of the

poor, protect livelihoods and realize their welfare,

the zakat investment institution is the representative

or extension of the recipient of zakat in order to

manage their wealth, zakat investment must

prioritize business activities which provide benefits

directly to the recipient of zakat, zakat investment

institutions must maintain trust in their performance

by conducting an audit of their administration.

Based on research background, problem

formulation, research objectives, theoretical review,

and conceptual framework carried out by

researchers, the Research hypothesis can be

formulated as follows:

H1: Allegedly productive zakat capital, length of

business and training positively affected on the

income of recipients of zakat in Palembang.

3 METHODS

This study looks at how the mechanism carried

out by BAZNAS of South Sumatera in managing

productive zakat so that it can have an important role

in economic empowerment of recipient of zakat This

study also wants to see the effect of zakat productive

on the income of recipient of zakat. This study uses

the recipients as an objects which receive zakat

productive from the Zakat Amil Agency (BAZNAS)

of South Sumatra.

The type of data used to support this study is

primary and secondary data. The primary data used

were the results of interviews conducted with the

amil zakat institutions in Palembang and also the

existing of the recipients. In addition to the

BAZNAS, interviews will also be conducted with

other interviewees who substantially have direct

involvement in the process of managing zakat

productive.

To obtain primary data, researchers will

distribute questionnaires, especially to recipient of

zakat who receive productive zakat capital

assistance by BAZNAS of South Sumatra.

Researchers will also conduct interviews with

several parties which directly or indirectly involved.

In addition to the primary data obtained through

selected informants, this study also uses secondary

data, secondary data that is used such as books about

zakat, especially productive zakat, phenomenons

that exist in the society and also the reports in the

National Amil Zakat Agency (BAZNAS) of South

Sumatra. The usage of secondary data is intended to

support primary data obtained from questionnaires

and interviews.

In order to get relevant data so that it can be used

as a basis for the analysis process, the authors use

data collection methods which commonly used in

qualitative and quantitative studies, that is

interviews, document analysis, archival records, and

observation. Data collection was carried out in

natural conditions, primary data sources, and more

data collection techniques on participant

observation, questionnaires and in-depth interviews

(Sugiyono, 2012).

For this study, the author uses data collection

techniques in the form of library research and field

The Mechanism of Zakat Productive Fund Management and Its Effect On The Income of Recipients of Zakat in Palembang City

663

research. The instrument in this study uses

interviews, questionnaires, and documentation. In

this study, interviews were conducted with the

management of Amil Zakat Institution which was

chosen by researchers, namely BAZNAS of South

Sumatera to find out the form and management of

productive zakat carried out by the amil zakat

institution. Questionnaires are given to the poor

people are registered as recipients of zakat

productive. Furthermore, documentation is obtained

from reports on zakat productive in amil zakat

institution.

The population that become the object in this

study were all recipient of zakat which received

productive zakat assistance. As for the number of the

recipients population who received zakat productive

assistance from BAZNAS of South Sumatera as

much as 187 recipient of zakat.

For sampling to recipient of zakat, a random

sampling technique is used. This technique is used if

the population is assumed to be homogeneous

(containing one characteristic) so that the sample can

be taken randomly. In random sampling, each

subject has the same opportunity to be used as a

research sample (Idrus, 2013). The researcher uses

random sampling technique in sampling because all

the recipient who receive zakat productive funds are

assumed to be the same, so that the data obtained

from each sample can indicate the same thing for

others. The samples obtained are 81 samples

The analysis technique used is multiple

regression estimation technique with the method

used the least squares (OLS). As for the regression

analysis equation model of this study as follows.

Y = α + β1X1+ β2X2 + β3X3 + e

(1)

Explanation:

Y = Income of recipients of zakat

X1 = Zakat Productive Fund

X2 = Length of Business

X3 = Training

β = Regression Coefficient

α = Constant

e = Error

4 FINDINGS

4.1 Mechanism of Zakat Productive Fund

Management in BAZNAS of South

Sumatera

Empowerment of zakat productive funds

initiated by BAZNAS of South Sumatera in the form

of a program called "Rumah Makmur" which is an

elaboration of the concept of recipients

empowerment program in managing the zakat funds

it receives. This program combines poverty

mapping, surveys, determining strategic partners,

launching and implementing programs, also

monitoring and evaluating programs. The "Rumah

Makmur" program stands on five pillars, i.e: system,

humanitarian value, law and justice, economy and

welfare, and institutional building (these five pillars

are taken from the maqasid as-syariah Islamic

purpose of regulating social life). This program

explicitly strives to humanize human beings, the

target community becomes a subject not an object,

where mentoring applies as a caliph who bears the

mandate of the natural regulator of his creation.

This program works to build a work system

which appreciates local wisdom (aware of local

resources), entrepreneurial capacity, facilitates

access to economical improvement based on life

wisdom. One of the reinforcement is the

establishment of a strong social institution so that

the empowerment of assisted communities can be

sustainable. The poor are educated to be aware of

their rights, especially in accessing resources to

improve their lives. Here, the justice principle

guards the growth of the assisted community.

Based on this discussion, the researchers found

that the mechanism of zakat productive fund

management at BAZNAS of South Sumatera

consisted of several stages from planning to

controlling phase to recipient of zakat. All of this are

carried out with expectation in order the zakat funds

received by the recipients can improve their standard

of living and in the future they can become a giver.

The stages are in the form of:

a. Regional Feasibility Study

The Regional Feasibility Study is the first stage

in determining the program area, in this stage aims

to determine the suitable area for the implementation

of the "Rumah Makmur" program. This is conducted

in several places to see if the region has the potential

for this program to take place as desired by

BAZNAS of South Sumatera. The regional

feasibility study is carried out by looking at the

potential and character of the society who live in the

region, because in this program it takes the character

of society who have good moral, spiritual and

mental characteristics, thus helping the smooth and

successful program in helping to increase the income

of recipient.

b. Program Socialization

Program socialization, is a program explanation

to the society before they join to be the recipients

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

664

who receive zakat productive funds from BAZNAS

of South Sumatera. This socialization is conducted

in order the recipient candidates can better

understand the nature and purpose of this program.

So that in the future this program can run well

without any misunderstanding from them.

c. Partner Feasibility Study

Partner Feasibility Study, is a detailed data

collection for citizens who are interested in

following the "Rumah Makmur" program. For

partners who meet the criteria, they will proceed to

the next stage.

The criteria that must be met in selecting

beneficiaries are as follows:

Head of family or family member classified as

poor (Recipient of zakat)

1. Productive age (18-60 years) or married

2. Having experience and willingness in

business.

3. Stay (domiciled) in one program target area.

4. Follow and obey the rules in implementing the

program.

d. Distribution of zakat productive zakat funds to

the recipients

The distribution of zakat productive funds to the

recipient in the "Rumah Makmur" program is

distributed through mosques in the targeted areas

and appointed by BAZNAS of South Sumatera as an

intermediary in distributing this zakat productive

fund which is called as "Baitul Qiradh". In

Palembang itself there are several Baitul Qiradhs

that have been operating, such as in plaju, Kertapati,

Kuto, Sako National Housing Authority area. The

duty of Baitul Qiradh is as an intermediary in

distributing zakat productive funds to the recipient

of zakat around the mosque area. Because the

mosque is believed to be a gathering place for

Muslims to worship, discuss and help each other, a

Baitul Qiradh institution was established in the

mosque.

The distribution of zakat productive funds to the

recipients is given in benevolent loan form with a

Qardh contract, so that although in essence the

recipient of zakat are entitled to the zakat fund and

do not need to return it, but in this program,

BAZNAS of Souh Sumatera wants to educate the

recipient to not be consumptive in managing the

zakat funds which they receive, so they are trained

to make the zakat funds they receive become

productive. The amount of productive zakat funds

received by the recipients ranges between Rp.

1,000,000 to Rp. 3,000,000.

e. Training Provision and Program Understanding

This training provision aims to improve the

characteristics, skills and motivation of each

individual of recipient of zakat, and also to stay in

touch between recipient and the management of

Baitul Qiradh. In this training, the recipient can ask

for solutions of the problems experienced in

managing the zakat productive funds they receive,

so that the business they run can be even better. This

training is also intended to foster cohesiveness and

friendship between the recipients who both receive

this zakat productive fund. So that therecipient can

share their experiences and expertise so that the

desire to help each other better get stronger. Because

Islam will be strong when it works together.

f. Formation of Community Local Institutions

The implementation of this zakat productive

program aims to make the recipient become

independent, in this case the BAZNAS of South

Sumatera only run their duties as a distributor of

zakat funds to the recipient. So when the zakat

productive funds have distributed to them through

Baitul Qiradh, the BAZNAS of South Sumatera will

not intervene in terms of its management, all of them

are handed over entirely to Baitul Qiradh and

recipient who receive the zakat productive funds, but

they still supervise so this program still run as it

should.

So Baitul Qiradh itself acts as a driver and coach

in this program. As mentioned before, the recipients

must return the zakat productive funds they receive

in installments every month, because they are worn

to a Qardh contract. When the zakat funds which

they borrowed have been fully returned, they can

make loans again to Baitul Qiradh which has been

trusted by BAZNAS of South Sumatera. Or the

zakat funds they return can be used to provide zakat

productive funds to other recipient who want to join

this "Rumah Makmur" program. In this case, Baitul

Qiradh institution which acts as a local community

institution that is trusted to manage and run this

productive zakat program.

g. Evaluation

This evaluation is carried out to find out the

deficiency of the recipient in managing this zakat

productive, so that the recipient can improve it in the

future. This evaluation was also conducted to find

out the business development of recipient and also

the effect of this program existence on the income of

them.

The Mechanism of Zakat Productive Fund Management and Its Effect On The Income of Recipients of Zakat in Palembang City

665

4.2 The Effect Of Zakat Produktif on The

Income Of Recipients of Zakat in

Palembang City

The results of the study have obtained

quantitative data during the interview and

observation process. The data obtained were

analyzed by multiple regression methods and

calculated from the three independent variables,

there are the productive zakat funds received, length

of business and training. Based on the data obtained

by the researcher, multiple regression equations can

be arranged as follows:

The results of the multiple regression equation

above show that the beta value of the productive

zakat fund variable is 0.957, this shows that in this

study capital has a positive relationship to the

dependent variable, this positive relationship shows

that the zakat productive funds that received by the

recipient of zakat have so far provided good

influence and enough to help the recipient of zakat

in improving its economy.

Where as for the lenght of business variable

shows the beta value is 0.247 which means that the

length of business and income of the recipient have a

positive relationship. This is in accordance with the

theory which says that if the business owner has

good experience, the income receives will increase.

Besides being seen from the length of business, to

improve the expertise, it is necessary to provide

trainings related to improving the recipients

expertise in run the business.

In the regression equation above it is shown that

the beta value of the training variable is 0.756. This

shows that the training and income of recipient

variables have a positive relationship. This indicates

that the training provided by BAZNAS or other

parties whose purpose is to develop businesses

owned by recipient has an important role in

increasing the income, which in turn will make the

recipient can become a giver at a later time.

The results of the constant are -3.195, which

means that without all these independent variables,

the income of recipient of zakat variable has a

negative value, so it is concluded that all the

independent variables used by the researcher are

very important in increasing the income of recipient.

The independent variables used in this study should

be expected to be assistants and drivers in increasing

the income of recipient in Palembang. Multiple

regression estimation results using statistical tools

are as shown in the table below:

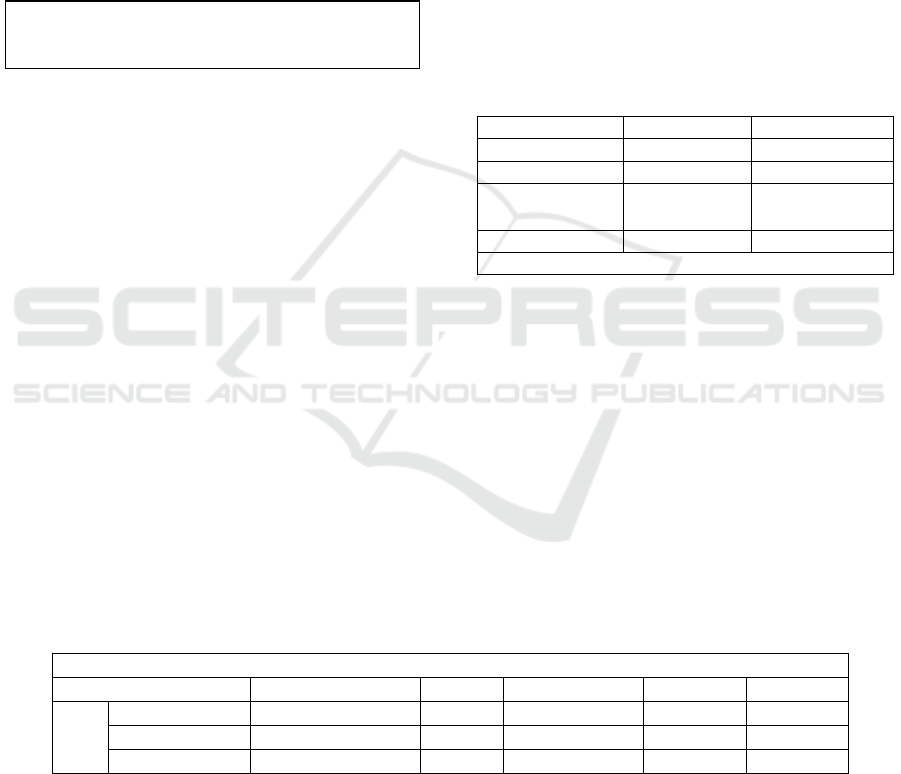

Tabel 1: Multiple Regression Estimation Results

Variable

Variable

Significance

Constant

-3,195

0.002

Funds

0,957

0.000

Length of

bussiness

0,247

0.011

Training

0,756

0.000

R-Square : 0.894 F Value : 216,425 (sig = 0.000)

Source : Data Process Result

Based on the estimation table above, it can be

concluded that the R-Square value is 0.894, it can be

concluded that the variable zakat productive funds

received by recipients, length of business and

training affect 89.4% of the income of recipients of

zakat in Palembang, while 10.6 % is influenced by

variables that are not examined by researchers. This

shows that the independent variables used by

researchers have a considerable influence on the

dependent variable, namely the income of recipient

of zakat.

Tabel 2: F Test

Model

Sum of Squares

Df

Mean Square

F

Sig.

1

Regression

19,704

3

6.568

216,425

.000

b

Residual

2,337

77

.030

Total

22,041

80

Source : Data Process Result

From the results of the above table it can be seen

that independent variables have a significant effect

on the dependent variable. This can be proven by

looking at the significance value of ANOVA f table,

which is equal to 0.000b or smaller than the

significance level determined by the researcher,

which is 0.05 or 5%, then the regression

transformation model can be used to predict the

zakat productive funds, length of businesses and

training together affect the income of recipient of

zakat in Palembang, so that it can be concluded that:

H0: Zakat productive funds received, length of

business and training for the recipients not

Y = -3,195 + 0.957

Funds

+ 0,247

Length of business

+ 0.756

Training

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

666

significantly affected the income of recipient

simultaneously rejected, and

Ha: Zakat productive funds received, length of

business and training for the recipients not

significantly affected the income of recipient

simultaneously received.

Looking at the test results above it can be said

that simultaneously the independent variables have a

positive effect on the dependent variable, which

means that if the zakat productive zakat funds

received by the recipient are higher, the length of

business increases and the training given to the

recipient is increased, the income of recipient in

managing zakat productive will increase.

The results of data analysis show that zakat

productive funds have a significant influence on the

income of recipient in Palembang, and have a

positive relationship to the income. Based on data

obtained by researchers while in the field by giving

questionnaires to the recipient and also observations

during the study it can be found that this zakat

productive program receives positive responses from

the community, because many of the recipient need

financial assistance to run their businesses. The

recipient had previously made loans to cooperatives

or debt collectors, so they had difficulty in paying

their debts due to the interest applied in the return

period.

This zakat productive assistance program is

given to recipient with a loan system without interest

or in Islamic economics called the Qardh and

Qardhul Hasan contracts. The recipient who get this

loan must return the loan money within 10 months

(10 x pay) which the money collected from the

return will be channeled back to another recipients.

So in essence BAZNAS South Sumatera will not ask

for back the zakat productive funds that have been

given to recipient, because this is one program that

is devoted to the recipient who need financial

assistance in running their business. The return

system applied is only for the education process

given to recipient of zakat so that it can be more

responsible in managing the funds and not

consumptive.

The results above also show that the length of

business has a significant influence on the income of

recipient of zakat in Palembang and has a positive

relationship. Analysis of the data above also shows

that training also has a significant influence on the

income of recipient in Palembang and has a positive

relationship. Overall the results of the above analysis

show that the zakat productive funds received, the

length of business and training have a significant

influence on the income of recipient in Palembang.

From this result, it can be concluded that this zakat

productive zakat needs to be increased again in order

to get the desired value.

5 CONCLUSION

From the results of this study, it was found that

in the mechanism of zakat productive funds

management for recipient in the Palembang was

good enough, because BAZNAS of South Sumatera

had tried to implement the planning, organizing,

implementation and supervision stages. Beginning

from the regional feasibility study, then continued

with the program socialization, and then the

feasibility study of the partners to be right on target,

and continued with the handover of productive zakat

funds to recipient of zakat, after which were given

some training and refinement, which is expected to

later create a local community institution and end

with the holding of program evaluations to create a

better zakat productive program. This is expected to

help improve the welfare of recipient of zakat in

Palembang.

The results of the analysis in this study also

concluded that the zakat productive funds received

by recipient, the length of business and training

together affect the income of the recipient

significantly, this is indicated by the significance

value of 0,000 and the F value of 216,425. So this

can be used as a reference that this zakat productive

program can continue to be developed and improved

again, so that it can become a superior program to

apply the values expected from the existence of

zakat, namely to improve the welfare of the recipient

of zakat.

6 REFERENCES

Abdullah, Muhammad dan Abdul Quddus Suhaib. (2011).

The Impact of Zakat on Social life of Muslim Society.

Pakistan Journal of Islamic Research Vol 8(1), 85-91

Al-Masyiqah, Khalid Bin Ali. (2007). Fikih Zakat

Kontemporer (Contemporary Zakat Jurisprudence),

Cet. 1, Terjemahan oleh: Aan Wahyudin Yogyakarta.

Samudra Ilmu

Al-Quran Al-karim

Ansori, Teguh. (2018). Pengelolaan Dana Zakat Produktif

untuk Pemberdayaan Mustahik pada LAZISNU

Ponorogo (Management of zakat Productive Funds

for Mustahik Empowerment at LAZISNU Ponorogo).

Muslim Heritage, 3(1), 165-182

The Mechanism of Zakat Productive Fund Management and Its Effect On The Income of Recipients of Zakat in Palembang City

667

Asnaini. (2008). Zakat Produktif Dalam Perspektif

Hukum Islam (Zakat Productive in the Perspective of

Islamic Law). Yogyakarta: Pustaka Pelajar.

Buletin BAZNAS Edisi 2017 M/1439 H

Departemen Agama RI.(2002). Pedoman Zakat 9 Seri

(Zakat Guidelines 9 Series). Jakarta. Bagian Proyek

Peningkatan Zakat dan Wakaf.

Djayusman, Royyan Ramdhani. (2011). Investasi zakat

dan pengaruhnya terhadap peningkatan pendapatan

dan produktivitas Dhuafa buruh tani (studi kasus

baitul maal desa dompet dhuafa kabupaten bantul

DIY Yogyakarta tahun 2010) (Investment of zakat

and its influence on increasing income and

productivity of Dhuafa farm laborers (case study of

Baitul Maal wallet village of Dhuafa Yogyakarta

Bantul district in 2010)). IJTIHAD. 2 (2), 14-26.

Farah, Abdul Fatah Muhamad. (1997). At-taujih Al-

Istitsmaar lizzakah Dirosah Iqtishodiyyah Fiqhiyah

Tahliliyah Muqoronah. Cet Pertama.Bank Dubai Al-

Islami. Dubai Daulah Al-Imaraat Al-‘Arabiyah Al-

Muttahidah.

Gujarati, Damodar (2013), Ekonometrika Dasar (Basic

Econometric), Edisi Bahasa Indonesia, Penerbit

Erlangga, Jakarta.

Hafidhuddin, Didin. (2006). Zakat dalam perekonomian

Modern (Zakat in the Modern economy). Depok.

Gema insani.

Hidajat, Rachmat. Penerapan Manajemen Zakat Produktif

dalam Meningkatkan Ekonomi Umat di PKPU (Pos

Keadilan Peduli Umat) Kota Makassar (The

Implementation Zakat Productive Management in

Improving the Economy of the People in PKPU (Post

of Justice Concerning People) Makassar City). Milah:

Jurnal Studi Agama, 17(1), 63-84

Ibrahim, Patmawati dan Ruziah Ghazali. 2014. Zakah As

An Islamic Micro-Financing Mechanism To

Productive Zakah Recipients. Asian Economic and

Financial Review, 4(1), 117-125

Idrus, Muhammad. (2013). Metode Penelitian Ilmu social

Pendekatan Kualitatif dan Kuantitatif (Social

Sciences Research Methods Qualitative and

Quantitative Approaches). Yogyakarta. Erlangga.

Mu’iz, Fahrur. (2011). Zakat A-Z Panduan Mudah,

Lengkap, Dan Praktis Tentang Zakat (Zakat A-Z

Easy, Complete, and Practical Guide to Zakat). Solo.

Tinta Medina.

Muhammad Dan Abu Bakar. 2011, Manajemen

Organisasi Zakat Perspektif Pemberdayaan Umat

Dan Strategi Pengembangan Organisasi Pengelola

Zakat (Management of Zakat Organizations

Perspective of People Empowerment and

Development Strategy of Zakat Management

Organizations). Malang. Madani.

Nadzri, Farah Aida Ahmad At All. (2012). Zakat and

Poverty Alleviation: Roles of Zakat Institutions in

Malaysia. International Journal of Arts and

Commerce 1(7), 61-72.

Nasrullah. (2015). Regulasi Zakat dan Penerapan Zakat

Produktif Sebagai Penunjang Pemberdayaan

Masyarakat (Studi Kasus pada Baitul Mal Kabupaten

Aceh Utara) (Zakat Regulation and Application of

Productive Alms as Supporting Community

Empowerment (Case Study on Baitul Mal North

Aceh District)), INFERENSI, Jurnal Penelitian Sosial

Keagamaan, 9(1), 1-24

Nopiardo, Widi. (2016). Mekanisme Pengelolaan Zakat

Produktif pada Badan Amil Zakat Nasional Tanah

Datar (Mechanism of zakat Productive Management

in Tanah Datar National Board of Alms). JEBI

(Jurnal Ekonomi dan Bisnis Islam), 1(2), 185-196

Prihatini, Farida dkk. (2005). Hukum Islam Zakat dan

Wakaf Teori dan Prakteknya di Indonesia (Islamic

Law of Alms and Endowments Theory and Practice

in Indonesia). Jakarta. Papas Sinar Sinanti.

Rusli dkk. (2013). Analisis Dampak Pemberian Modal

Zakat Produktif Terhadap Pengentasan Kemiskinan

Dikabupaten aceh Utara (Impact Analysis of Zakat

productive Capital on Poverty Alleviation in North

Aceh Regency). Jurnal Ilmu Ekonomi Pascasarjana

Universitas Syiah Kuala 1(1), 56-63

Sartika, Mila. (2008). Pengaruh Pendayagunaan Zakat

Produktif terhadap Pemberdayaan Recipient of zakat

pada LAZ Yayasan Solo Peduli Surakarta (Effect of

zakat Productive Utilization on Recipient of zakat

Empowerment at LAZ Surakarta Solo Care

Foundation). Jurnal Ekonomi Islam La Riba 2(1), 75-

89

Sugiyono. (2012). Metode Penelitian Pendekatan

Kuantitatif, Kualitatif dan R & D (Research Methods

Quantitative, Qualitative and R & D Approaches).

Bandung: Alfa Beta .

Tarar, Ayesha dan Madiha Riyaz. (2012). Impact of Zakat

on Economic : Structure and Implementation In

Pakistan. Journal of Economics and Sustainable

Development. 3(10), 151-155

Toriquddin, Moh., & Abd Rauf. (2013). Manajemen

Pengelolaan Zakat Produktif di Yayasan Ash

Shahwah (YASA) Malang (Management of zakat

Productive Zakat at Ash Shahwah Foundation

(YASA) Malang). de Jure Jurnal Syariah dan

Hukum, 5(1), 29-41

Wulansari, Sintha Dwi dan Achmad Hendra Setiawan.

(2014). Analisis Peranan Dana Zakat Produktif

Terhadap Perkembangan Usaha Mikro Recipient of

zakat (Penerima Zakat) (Studi Kasus Rumah Zakat

Kota Semarang) (Analysis of the Role of zakat

Productive Funds on the Development of Recipient of

zakat Micro Enterprises (Zakat Recipients) (Case

Study of Semarang City Zakat Houses)). Diponegoro

Journal Of Economics, 3(1), 1-15

Yusoff, Wan Sulaiman bin Wan. (2008). Modern

Approach Of Zakat As An Economic And Social

Instrument For Poverty Alleviation And Stability Of

Ummah. Jurnal Ekonomi dan Studi Pembangunan,

9(1), 105 ‐ 118

Zuhdi, Masjfuk. (1997). Masail Fiqhiyah. Jakarta. Pt.

Toko Gunung Agung. Cetakan Kesepuluh.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

668