Analysis the Influence of Day of the Week, Monday, and Weekend

Effect of on Seasonal Anomaly in in Stock Return: Evidence of

Companies on LQ45 Indonesia in Indonesian Stock Exchange

Muslim A Djalil, Murkhana, M.Rizal Yahya, Qurratul Aini

Accounting Department, Faculty of Economic and Business,

Syiah Kuala University, Banda Aceh, Indonesia

Keywords: Day of the Week effect, Monday Effect, Weekend Effect, Return

Abstract: This study aims to determine the occurrence of day of the week effect, the occurrence of monday effect, the

occurrence of weekend effect, and the effect of day trading on the daily return of shares in the Indonesia

Stock Exchange. The sample used in this research is daily return data of company stock LQ 45 period of

February 2017 until January 2018 which amounted to 45 company. Data analysis technique used is one

sample t-test for day of the week effect, independent sample t-test for Monday effect and weekend effect,

and multiple linear regression statiscal tool is employed to find out the effect of trading day to daily stock

return. The results showed that there was no significant difference between daily stock return on trading

days in a week on the Indonesia Stock Exchange. Then, there is Monday Effect on the trading of shares in

Indonesia Stock Exchange, there is a weekend effect on stock trading in Indonesia Stock Exchange, and also

there is influence of trading day to daily return of shares in Indonesia Stock Exchange.

1 INTRODUCTION

The capital market is one of the alternative

means to collect long-term funds from the

community as investors in supporting the

development of a country. The community as an

investor will see a profit from every trading activity

that occurs in the capital market, while the company

can raise funds from the community to overcome

financial difficulties experienced. The capital

market, as well as a means to collect funds for the

company, either a container of investment for

investors. Therefore, for creating a good investment

climate and enforcement implementation and good

supervision then there must a institutions that

regulate (Putra and Ardiana, 2016).In capital market,

there is stock returnwhich is an advantage gained by

investors who invest their shares in the stock

exchange. The stock return can be the difference of

the acquisition price of the stock with the release

price of the stock. Usually shareholders want the

high stock returns, very high stock returns are

commonly termed with abnormal stock returns

(Kasdjan, Nazarudin, and Yusuf, 2017). While

according Hartono and Jogiyanto (2007), return is

the result that obtained from investment or level of

profits enjoyed by investor from his investment.

Thus, the stock return is the rate of return that will

be obtained by investors for their investment in a

company's stock.

Along with the wants and needs of shareholders

of this high stock return, the market will be affected.

As the legal concept of demand, where the demand

for an item is higher, then the price of the goods will

also be higher. Thus, there is a possibility of changes

in stock prices every day in a week. This leads to

differences in stock investment decisions in certain

days. This phenomenon is commonly termed the day

of the week effect. On the Indonesia Stock Exchange

there are 5 trading days (Monday, Tuesday,

Wednesday, Thursday, Friday) and 2 days without

trading (Saturday and Sunday), (Kasdjan,

Nazarudin, and Yusuf, 2017).In addition, the

influence of seasonal anomalies has also been

proven by one of the lecturers of the Faculty of

Economics, University of Riau, which proves the

existence of Monday effect on stock return JII in

Djalil, M., Murkhana, ., Yahya, M. and Aini, Q.

Analysis the Influence of Day of the Week, Monday, and Weekend Effect of on Seasonal Anomaly in in Stock Return: Evidence of Companies on LQ45 Indonesia in Indonesian Stock

Exchange.

DOI: 10.5220/0008443006030610

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 603-610

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

603

Indonesia Stock Exchange. From the regression

analysis obtained some conclusions. First, Monday's

return is different from any other day. Second, the

lowest return is concentrated in the second week at

the beginning of the month. Third, the negative

return on Monday is affected by the return on the

previous Friday. Fourth, the emergence of the

Monday effect is not the same throughout the time

of data observation (Azlina, 2009).

In stock return there are significant difference of

influence, which is proved by previous research

conducted by (Iramani and Mahdi, 2006), (Widodo,

2008), (Akbar, 2009), (Rita M. , 2009), (Ambarwati,

2009), (Maria and Syahyunan, 2013), (Lutfiaji,

2013), (Saputro, 2014) which found that trading day

had a significant effect on stock return. While

research conducted by (Prasetyo, 2006), (Pratomo,

2007), (Arieyani, 2011), (Wijaya dkk 2013) found

that trading days have no relationship to stock

returns.

Then, one of the strategies or techniques

commonly used by shareholders for decision-making

in stock investments is the market anomaly, which is

an unanticipated event or event and this offers the

shareholder an opportunity to earn an abnormal

share return (Kasdjan, Nazarudin, and Yusuf, 2017).

This market anomalies include Seasonal Anomalies,

Accounting Anomalies, Company Anomalies, Event

Anomalies.

In this research I chose Seasonal Anomalies as

an research object because according to Trisnadi and

Sedana (2016), the market anomaly violates the

hypothesis about the concept of capital market

efficiency that states investors can not expect price

and return based on stock prices in the past caused

by a random return, but can be predicted based on

the effect of certain calendars.

While seasonal anomalies is a seasonal market

which is seasonal, an anomaly that has the form of

deviation of efficient market hypothesis. Seasonal

anomalies or calender effect itself intends a market

anomaly or economic effect that appears related to

the calendar. These effects include different

behaviors of the stock market on different days of

the week, different times of the month, and different

time of year/season (Endarwati, 2017).

In general, efficient capital market situation

shows the relationship between market price and

market form. Later, the development of the

company's financial theory in this capital market

over the last few decades has been growing very

rapidly. Then later put forward the proposed

Efficient Market Hypothesis or better known as

Efficient Market Hypothesis which may be one of

the most famous breakthroughs proposed by Eugene

F. Fama in 1970 (Harijanto and Kurniawati, 2013).

The Efficient Market Hypothesis states that an

efficient market is a market where the prices of all

securities traded by investors have reflected all the

information. This information means the information

that comes from the past, present, or information

that is opinion or rational opinion circulating in the

market that can affect the price movement

(Tandelilin 2010). If a market is in an efficient state,

then the existing security prices should move at

random (Random Walk) and unpredictable

(Harijanto and Kurniawati, 2013).

Many of the findings suggest empirical evidence

that supports the concept of efficient capital markets.

In it, the conclusions obtained for each study show

varying results between each other (Harijanto and

Kurniawati, 2013)In his research, Dwi

Cahyaningdyah (2005) found the phenomenon of

Day of the Week Effect on the Jakarta Stock

Exchange, with the lowest return occurred on

Monday (Monday Effect) and the highest return

occurred on Friday (Weekend Effect). Then, Ricky

Chee-Jiun Chia dkk (2008), also found the

phenomenon of Day of the Week Effect in several

Capital Market in Asian Region like Capital Market

of Taiwan, Hong Kong, Singapore, and South

Korea. The study found that the rate of return for

each trading day differed significantly, including

Monday's tend to be negative and Friday's return

which tended to be higher than in other days.

Lutfur Rahman (2009) who conducted the

research on Dhaka Stock Exchange, found that

trading day had a significant effect on stock return

on Dhaka Stock Exchange. Rahman explained that

the schedule of news announcements related to

economic conditions affect investors' behavior in

conducting stock transactions, thus forming a daily

pattern of stock returns.After that, there is a testing

of January Effect that ever done by Wing-Keung

Wong, et al (2006) on the Singapore Stock

Exchange for the purpose of re-examining the

existence of Calendar Anomalies in the Singapore

Capital Market using the latest data divided into two

sub-periods, before the crisis and after the 1997

crisis. Through this research, it was found that the

anomaly phenomenon in the Singapore Capital

Market increasingly weakened its existence. The

study found that the January Effect phenomenon that

was positive in the pre-crisis period turned into a

negative value in the period after the crisis.

The objectives of this research are to investigate

the effect of difference of return that happened on

Day of the Week,the occurrence of Monday,

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

604

Weekend, and trading day on daily stock returns in

Indonesia Stock Exchange.

2 LITERATURE REVIEW AND

HYPOTHESIS DEVELOPMENT

2.1 Efficient Market Theory

According to Eugene Fama (1965) and Sahoo

(2018) The efficient markets hypothesis (EMH),

popularly known as the Random Walk Theory, is the

proposition that current stock prices fully reflect

available information about the value of the firm,

and there is no way to earn excess profits, (more

than the market overall), by using this information.

The term market efficiency is used to explain the

relationship between information and share prices in

the capital market literature.

2.2 Seasonal Anomalies

Seasonal anomaly is an anomaly to the calendar

pattern or time pattern in stock trading day (Kasdjan,

Nazarudin, and Yusuf, 2017). In financial theory

there are four kinds of Market Anomalies, namely

Company Anomaly, Seasonal Anomaly, Event

Anomaly and Accounting Anomaly according to

Levi (1996) in (Apriolita, Gumanti, and Swastika,

2011). Seasonal anomalies appear dependent on the

time. Stock prices on seasonally based companies,

such as trading or convection firms will tend to

increase on days when the season is busy.

2.2.1 Day of the Week Effect

The day of the week effect is the difference in

return between Monday and the other days of the

week significantly (Damodaran, 1996). Usually a

significant negative return occurs on Monday while

a positive return occurs on other days. The effect of

day trading on stock return is an interesting

phenomenon to be noticed. This phenomenon is part

of the anomaly of efficient market theory. In

efficient market theory states that stock returns are

not different on every trading day. But the day of the

week effect phenomenon states that there is a

difference of return for each trading day in a week

where on Monday tend to create a negative return.

2.2.2 Monday Effect

Monday effect is one part of The Day of the

Week Effect that is a seasonal anomaly (calendar

effect) that occurs in the financial market when the

stock return is significantly negative on Monday

Mehdian and Perry in (Budileksmana, 2005). The

anomaly violates the hypothesis of market efficiency

of weak form. The market efficiency hypothesis of

weak form considers that the information contained

in the historical stock price is fully illustrated in the

current stock price and the information can not be

used to obtain excess return Elton and Gruber in

(Budileksmana, 2005).

2.2.3 Weekend Effect

Weekend effect is a late Sunday effect resulting

in a symptom showing that stock returns on Friday

will be higher than other trading days, on the

contrary Monday will show a lower return

(Tandelilin, 2001). Weekend effect is a phenomenon

in financial markets where stock returns on Monday

are significantly lower than last Friday. Some

theories that explain the effect of attributes tendency

for companies to release bad news on Friday after

the market close to stock prices depressed Monday.

2.3 Stock Return

Stock Return is the rate of return (profit/loss)

on capital investment in the form of reward. Returns

in the form of profits earned by shareholders are

called capital gains, while the loss return is called

capital loss (Yatmi, Astuti, and Widarno, 2016).

Return is profit or an investment that is usually

expressed as annual percentage rate. Return of stock

represents the expected rate of return on stocks

invested in stocks or multiple stock groups through a

portfolio. This stock return can serve as an indicator

of trading activities in the capital market.

2.4 LQ45 Index

The LQ 45 or Liquid 45 index is the best

company of 45 stocks in Indonesia with large market

capitalization and high liquidity, where the shares

are actively traded by investors, thus making the LQ

45 index as a stock index sensitive to the presence of

information that entered into the market (Trisnadi

and Sedana, 2016).

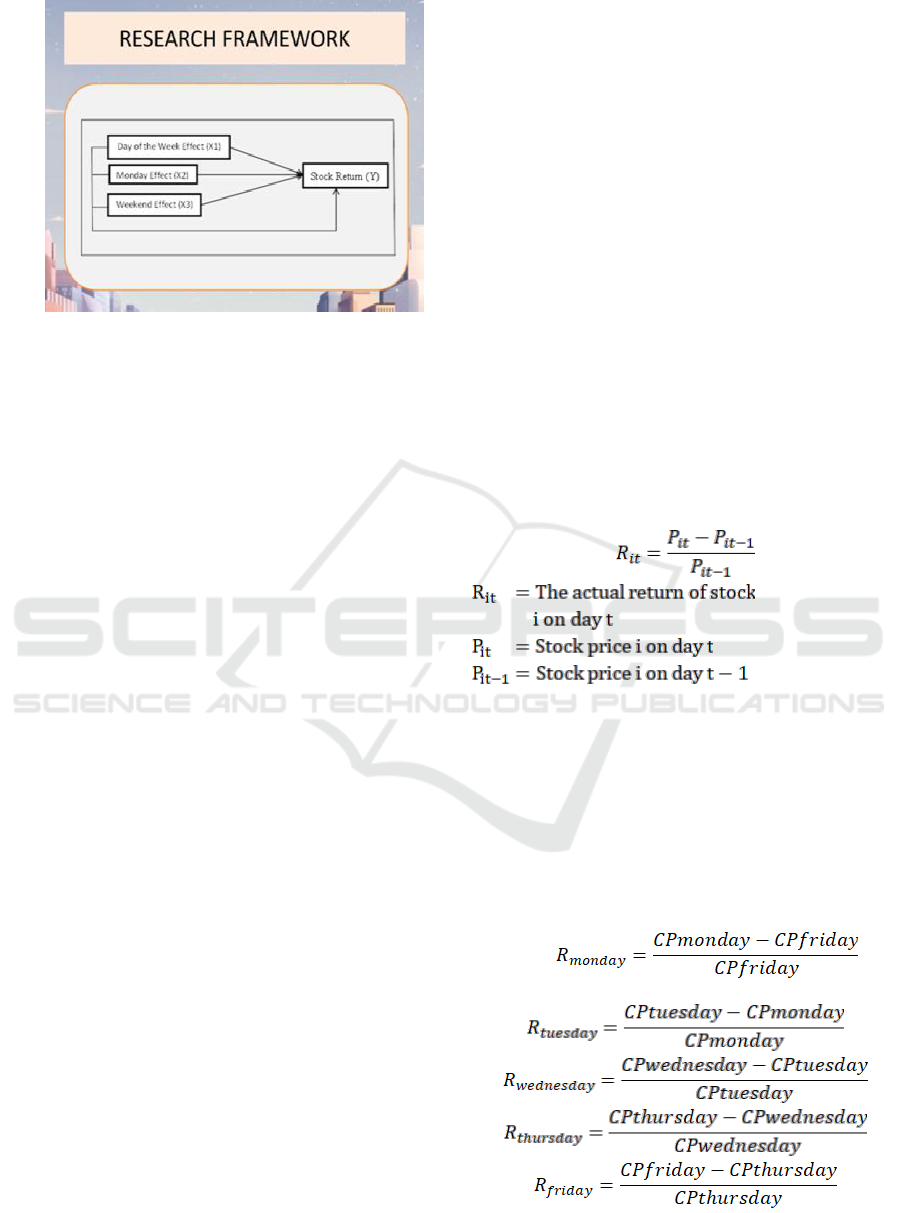

Based on previous research, it can be formulated

the following research framework as shown in

Figure 1 as follows:

Analysis the Influence of Day of the Week, Monday, and Weekend Effect of on Seasonal Anomaly in in Stock Return: Evidence of

Companies on LQ45 Indonesia in Indonesian Stock Exchange

605

Figure 1: Research Framework

The hypotheses of this research are that the

occurrence of monday, weekend, and trading day

have either simultaneous or partial effect on daily

stock returns in Indonesia Stock Exchange

3 RESEARCH METHODOLOGY

3.1 Research Design

The research design is defined as the process of

designing research in such way which requisite data

can be collected and analyze to get the solutions.

The various aspects of research design which

involve and related to decision are concerning to

purpose of study, study setting, type of investigation,

extent of researcher interference, unit analysis and

time horizon (Sekaran and Bougie, 2010).

3.2 Research Population and Sample

The Population of this research is all listed

companies that entered LQ45 Index for the period

February 2017 until January 2018. Population refers

to events, entire group or things of interest which

researcher desires to investigate (Sekaran and

Bougie, 2010). In order to guarantee the

representation of the variables to be tested, then the

sample are selected by the method of purposive

sampling. Criteria in sampling are companies that

remain/consistently listed in the LQ 45 Index in the

February 2017 to January 2018 period, which

amounted to 45 companies.

3.3 Source and Data Collection

The data used in this study is quantitative data

sourced from secondary data that has been published

by the Indonesia Stock Exchange that is in the form

of company data included in the LQ 45 index and

the closing price of daily stocks of companies

included in the LQ 45 index during the period

February 2017 until January 2018. Source of data

obtained from the website of Indonesia Stock

Exchange in www.yahoofinance.com. This research

is using documentation method. Data collection

begins with a preliminary research stage, which is to

study literature by studying books and literature,

economic and business journals, and other reading

related to the capital market. At this stage is also

done assessment of required data, availability of

data, and description how to obtain data.

3.4 Variable Operationalization

3.4.1 Dependent Variable (Y)

Return of stock used in this research is daily

stock return calculated on the basis of closing price

on every trading day. The formula is (Hartono J. ,

2000):

3.4.2 Independent Variable (X)

3.4.2.1 Day of the Week Effect

The value of the day of the week effect or

trading day stock return is done by calculating the

daily stock return from the sample of the company

(Sulistianingsih, 2016).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

606

3.4.2.2 Monday Effect

The reason of the Monday effect can be seen

from the side of investor’s psychology, where in

making investment decisions not only through

economic rational consideration and objective data,

but also influenced by several conditions such as

emotions, certain psychological conditions, and the

mood of each investor (Maulaya, 2016).

3.4.2.3 Weekend Effect

In some capital markets there is a tendency the

lowest return occurs on Monday and the return

increases on other days. This is because there is a

pattern of daily trading activity conducted by

individual investors. To calculate the return on the

weekend that is (Sulistianingsih, 2016):

4 RESEARCH RESULTS AND

DISSCUSSION

4.1 Research Results

4.1.1 Hypothesis Testing Result

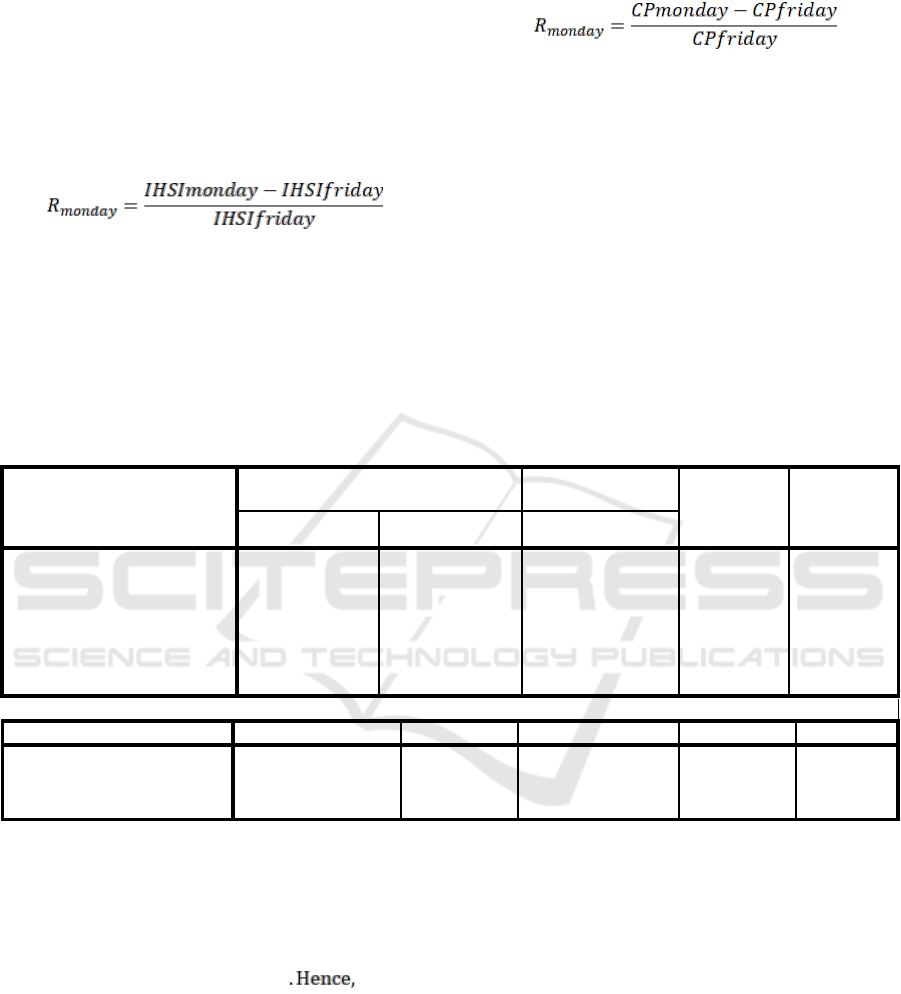

The output of hypothesis testing of

research data by using SPSS can be seen on

Table 1 as follows:

Table1: Output of Multiple Linear Regression Analysis

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

T

Sig.

B

Std. Error

Beta

1

(Constant)

,001

,001

1,391

,172

MONDAY

,372

,177

,302

2,094

,043

TUESDAY

-,005

,075

-,010

-,061

,952

WEDNESDAY

,026

,110

,039

,241

,811

THURSDAY

,195

,100

,308

1,953

,058

FRIDAY

-,009

,006

-,200

-1,366

,180

ANOVA

a

Model

Sum of Squares

Df

Mean Square

F

Sig.

1

Regression

,000

5

,000

2,382

,056

b

Residual

,001

39

,000

Total

,001

44

a. Dependent Variable: STOCK_RETURN

Source:Output of SPSS 23.0 (2018)

The results of t-test and f-test on thetable above

shows that the result of calculations with an error

rate (α) = 0.05; it is obtained the calculated f value is

2,382, and sig f is 0.056. The Ftest indicated that

since sig f is higher than 5 % overall,

variables of Monday, Tuesday, Wednesday,

Thursday and Friday have not a simultaneously

significant influence on stock return.

Additionally, from the table above also shows

that the results of T statistical test which is using

error rates α = 0.05 and degree of freedom (n - k),

where n = 225 and k = 5, it is obtained the t table

value is 1.971. It is therefore obtained the partial

hyphotesis testing as follows:

1). The value of t arithmetic Monday’s variable

is 2.094 (t count > t table). Since the value of t

count of the Monday’s variable is >the value t

table or sig t <5%, hence the Monday’s variable has

a partially significant effect on stock returns.

2). The value of t arithmetic Tuesday’s variable

is -0.061 (t count < t table). Because the value of t

count for Tuesday's variable is < than the value of t

table, it is therefore the Tuesday’s variable does not

have a partially significant effect on stock returns.

3). The value of t arithmetic Wednesday’s

variable is 0.241 (t count <t table). Due its value of t

arithmetic Wednesday’s variable is<thanthat the

value of t table or sig t < 5%,so that Wednesday’s

Analysis the Influence of Day of the Week, Monday, and Weekend Effect of on Seasonal Anomaly in in Stock Return: Evidence of

Companies on LQ45 Indonesia in Indonesian Stock Exchange

607

variable also does not have a partially significant

influence the stock returns.

4). The value of t arithmetic Thursday’s variable

is 1.953 (t count < t table). Because the value of t

arithmetic Thursday’s variable is <the value of t

table or sig t < 5%, as the result, thursday’s variable

does not have a partially significant effect on the

stock returns as well

5). The value of t arithmetic Friday’s variable

also has a same result which is -1.366 (t count <

ttable). Because Friday's variable calculation value is

or sig t < the t table value, or sig t <5%, Hence,

Friday's variable also does not have a partially

significant effect on stock returns.

From the result of calculations above, it indicated

that partially only on Monday that has an significant

effect on stock returns. Tuesday, Wednesday,

Thursday, and Friday each have no significant effect

on stock returns. Based on data analysis on daily

stock returns during the study period, the average

stock return on Monday is the highest which is -

0,0008122. This is because on that day most of the

stock prices increased, so the stock returns also

increase. Therefore, on Monday there are no deviant

data, so the regression results for Monday have a

significant effect on stock returns.

On other trading days (Tuesday, Wednesday,

Thursday and Friday), the min value is less than the

standard deviation. This means that there are deviant

data, so the regression results are not significant.

The highest stock return occurred on Friday, which

is 0.0242646 and the lowest occurred on Thursday,

which amounted to -0.0000513, hence this data

range shows quite big gap

4.2 DISCUSSION

4.2.1 Differences of Stock Return on Day of

the Week

The t table value at 95 percent confidence level

and degree of freedom (dk = 124) equal to 1,680. So

the value of t counts > t table (1,415> 1,680). This

means there is no significant difference between

daily stock returns on trading days within a week on

the Indonesia Stock Exchange. Thus, the first

hypothesis which states that there is a difference in

stock returns on Monday to Friday on the Indonesia

Stock Exchange, is not accepted. This research is in

line with (Werastuti, 2012), (Tansar, 2016), and

(Rita M. R., 2009) which found that there was no

significant difference between the daily stock returns

of companies included in LQ 45 on trading days

within a week on the Indonesia Stock Exchange.

4.2.2 Monday Effect on Stock Trading in

Indonesia Stock Exchange

Based on the results of descriptive statistical

analysis shows that average stock return on Monday

(-0.0029512) < average stock return Friday

(0.0242646). This indicates that stock returns on

Monday are negative or there is a decline in stock

prices on Monday, with an average is 0.29 percent.

Negative return at the beginning of the week

resulted in Monday effect, which mean the return on

the beginning of the week (Monday) tend to be

negative compared to return on other trading day.

The discovery of Monday effect phenomenon is in

line with (Werastuti, 2012) and (Islam and Sultana,

2015) research which found that where the lowest

return occurred on Monday (Monday effect). Thus

the second hypothesis which states Monday effect

on stock trading in Indonesia Stock Exchange

received.

4.2.3 Weekend Effect on Stock Trading in

Indonesia Stock Exchange

Based on the results of descriptive statistical

analysis shows that the average stock return Friday

is positive value of 0.0242646 larger than Monday

which is -0.0029512. This shows Friday's stock

return increased by an average of 0.02 percent. And

the highest average is Friday compared to other

trading days. Therefore, the third hypothesis which

states a weekend effect on stock trading on the

Indonesia Stock Exchange is accepted. Thus it is in

line with the research conducted by (Lestari, 2011)

and (Kurniawan, 2012) that found that where the

highest return occurs on Friday (weekend effect).

4.2.4 The effect of Trading Day on Daily

Stock Return in Indonesia Stock

Exchange

Based on the results of multiple linear regression

analysis using dummy variables, the results of

research for t test analysis showed that the day of

trading Monday partially have a significant effect on

daily stock returns of companies that entered in LQ

45 in Indonesia Stock Exchange. Based on the

results of F test analysis can be concluded that there

is the effect of trading days as a whole

(simultaneous) to daily stock returns of companies

that entered in LQ 45 in Indonesia Stock Exchange.

The results of this study consistent with the research

conducted by (Wulandari and Diana, 2018) and

(Kurniawan, 2012) that is the influence of trading

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

608

days as a whole (simultaneous) to the company's

daily stock return on the Indonesia Stock Exchange.

5 CONCLUSIONS

The conclusions of the research are 1). The

simultaneous test indicated that research variables

have no a simultaneously significant influence on

stock return. Similarly, tested partially, it is only the

occurrence Monday has a significant effect on daily

stock returns in Indonesia Stock Exchange; 2). There

is no significant difference between stock return on

trading days in a week in Indonesia Stock Exchange

in February 2017 until January 2018. 3). A Monday

effect on stock trading on the Indonesia Stock

Exchange results in a negative stock return at the

beginning of the week for the period of February

2017 up to January 2018; 4) Aweekend effects occur

on stock trading on the Indonesia Stock Exchange

which results in the highest positive stock returns on

weekends for the period February 2017 to January

2018

Despite its important finding, this research is not

without limitations.It has provided an adequate

argument about the factors that cause the day of the

week effect phenomenon in the LQ 45 index, but it

is still unable to explain whether the behavior of

individual investors or the behavior of institutional

investors has the biggest role as the cause of the

phenomenon, and has not given any argument about

any information that gives positive sentiment and

negative sentiment towards the movement of LQ 45

index which can bring up the Monday effect

phenomenon which can not be proven in this

research.

To the best of our knowledge, the paperis the

first focusing on research framework investigating

the cause and effect relationship between the

occurrence of day of the week, monday, and

weekend and Seasonal Anomaly in Stock Return in

the context of Companies listed on LQ45 of

Indonesian Stock Exchange.

In general, the outcome of research will enhance

the literature on financial management and stock

market; and in particular it will provide empirical

evidence regarding the behavior and pattern of

seasonal anomaly on stock return.

The future studies are expected to provide

arguments for the emergence of the phenomenon of

day of the week effect in the Indonesian capital

market, not merely revealed the existence of the

phenomenon but it can also reveal the role of

individual investors and institutional investors as

well as important information as causative factors

the emergence of such phenomena. The sample

chosen in this study which only uses the LQ 45

index has not been able to comprehensively reflect

the condition of the Indonesian stock exchange. The

period used is also relatively short at only one year,

starting in February 2015 until January 2016, so it

can not influence the variation observed between

time. Therefore, for the purpose of proving the

consistency of Monday effects existence

comprehensively, further studies can use the entire

population of the issuer, and the use of longer

periods is recommended for further research.

REFERENCES

Akbar, I. 2009. Efficient Market Anomaly Analysis on the

Indonesia Stock Exchange (Case Study of the Jakarta

Islamic Index Shares). Unpublished Paper. Jakarta,

Indonesia: Syarif Hidayatullah State Islamic

University.

Ambarwati, S. D. 2009. Testing Week - Four, Monday,

Friday, and Earning Management Effect on Stock

Returns. Journal of Finance and Banking. Vol.13,

No.1 January., 1-14.

Apriolita, M., Gumanti, T. A., & Swastika, D. L. 2011.

Announcement of Changes in Company Names and

Share Prices on the Indonesia Stock Exchange. STIE

Malangkucecwara, Indonesian Finance and Banking

Journal Vol. 13 No. June 1, 2011.

Arieyani, P. 2011). Market Anomaly Effects on LQ45

Company Stock Returns Listed on the Indonesia Stock

Exchange.Unpublised Paper. Surabaya, Indonesia..

Perbanas College of Economics.

Budileksmana, A. 2005. The Monday Effect Phenomenon

in Jakarta Stiock Exchange. Proceedingf of National

Accounting Symposium VIII. Solo, Indonesia.

Cahyaningdyah, D. 2005. Analysis of the Effects of

Trading Days on Stock Returns. Indonesian Journal of

Economics and Business. Vol 20, No.2, 175-186.

Chia, R. C.-J., & et al. 2008. Day of the Week effects in

selected East Asian Stock Market. MPRA Paper, No.

7299.

Endarwati, N. 2017, January 1. Economy. Picked January

15, 2017, from www.kompasiana.com:

https://www.kompasiana.com/ninaendarwati/influence

-seasonal-anomaly_58742c9d3893731b098b4568

Harijanto, C. A., & Kurniawati, S. L. 2013. Testing

Market Efficiency: Proof of Market Anomaly

Phenomena in the Strait Times Index on the Singapore

Stock Exchange. Journal of Business and Banking.

Volume 3, No. 2. STIE Perbanas Surabaya., 223 - 232.

Hartono, & Jogiyanto. 2010. Study Events: Test the

Capital Market Reactions Due to an Event, First

Edition. Yogyakarta, Indonesia .: BPFE.

Iramani, R., & Mahdi, A. 2006. Study of the Effects of

Trading Days on Stock Returns on the JSX. Journal of

Analysis the Influence of Day of the Week, Monday, and Weekend Effect of on Seasonal Anomaly in in Stock Return: Evidence of

Companies on LQ45 Indonesia in Indonesian Stock Exchange

609

Accounting and Finance. Vol. 8, No. 2, November, 63-

70.

Islam, R., & Sultana, N. 2015. Day of the Week Effect on

Stock Return and Volatility: Evidence from

Chittagong Stock Exchange. Bangladesh University of

Business and Technology (BUBT) European Journal

of Business and Management. ISSN 2222-1905.

Vol.7, No.3.

Kasdjan, A. M., Nazarudin, & Yusuf, J. 2017. Effect of

Market Anomalies on LQ-45 Company Stock Returns.

Accounting Study Journal, Vol 1, e2579-9991, p2579-

9975, 35-48.

Kurniawan, A. A. 2012. Analysis of the Influence of

Trading Days on the Returns of Telecommunication

Field Companies Registered on the Indonesia Stock

Exchange. Probusiness Journal. Vol 5., No. 2

Lestari, W. R. 2011. Effect of Weekend Effect on Stock

Returns on the Indonesia Stock Exchange. JMK. Vol.

9, No. 1.

Lutfiaji. 2013. The Day of the Week Effect, Week Four

Effect, and Rogalsky Effect Tests on Stock Returns on

the Indonesia Stock Exchange. Unpublihed Paper.

Malang, Indonesia: Brawijaya University.

Maria, M. & Syahyunan. 2013. The Influence of Trading

Days on LQ-45 Stock Returns on the Indonesia Stock

Exchange. Unpublished Paper. Medan, Indonesia:

University of North Sumatra.

Maulaya, W. G. 2016. Testing of Monday Effect and

Week Four Effect Phenomenon on Stock Returns in

Property and Real Estate Companies Registered in

Buy in 2015. Unpublihed Paper.Surabaya: Perbanas

Economics College.

Prasetyo, H. 2006. Analysis of the Effect of Trading Days

on Return, Abnormal Return and Volatility of Stock

Returns (Study in LQ-45 January 2003). Unpublihed

Thesis. Semarang, Indonesia: Diponegoro University.

Pratomo, A. 2007. January Effect and Size Effect on the

Jakarta Stock Exchange (JSX) Period 1998-2005.

Unpublihed Thesis. Semarang, Indonesia: Diponegoro

University.

Putra, I. K., & Ardiana, P. A. 2016. Analysis of The

Monday Effect on the Indonesia Stock Exchange. E-

Journal of Accounting, Udayana University. ISN:

2302-8556. Vol. 17.1., 591-614.

Rahman, L. 2009. Stock Market Anomaly: Day of the

Week Effect in Dhaka Stock Exchange. International

Journal of Business and Management, Vol. 4, No. 5.,

193-206.

Rita, M. R. 2009. Effect of Trading Days on Stock

Returns. Testing of Day of the Week Effect, Week-

Four Effect, and Rogalski Effect on the IDX. Journal

of Economics and Business, 121-134. No. 2.

Sahoo, D. R. 2018. Reaction of Indian Stock Market

during Weekend: An Empirical Study. International

Journal of Institutional & Industrial Research ISSN:

2456-1274, Vol. 3, Issue 1, Jan-April., 37-42.

Saputro, A. P. 2014. Day of the Week Effect and Month of

the Year Effect on the Market Return Index. Nominal

Journal, 3 (2)., 162–178.

Sekaran, U., & Bougie, R. 2010. Research Methods for

Business: A Skill. Building Approach, 5th Edition.

UK: John Wiley.

Tandelilin, E. 2001. Investment Analysis and Risk

Management, First Edition. Yogyakarta, Indonesia:

BPFE.

Tandelilin, E. 2010. Portfolio and Investment Theory and

Applications. First Edition. Yogyakarta, Indonesia:

Kanisius.

Tansar, I. A. 2016. Return on Stock in the Context of Day

of the Week Effect. Journal of Economics, Business &

Entrepreneurship, 60-75. No. 1. ISSN 2443-2121.

Trisnadi, M. M., &Sedana, I. B. 2016. Market Anomaly

Testing: Day of the Week Effect on the LQ-45 Stock

on the Indonesia Stock Exchange. E-Journal of Unud

Management, Vol. 5, No. 6. ISSN: 2302-8912., 3794-

3820.

Werastuti, D. Y. 2012. Market Anomalies in Stock

Returns: the Day of the Week Effect, Week Four

Effect, Rogalsky Effect, and January Effect. Scientific

Accounting Journal and Humanika. Vol 2, No. 1.

Singaraja. ISSN 2089-3310.

Widodo, P. 2008. Study of the Effect of Trading Days on

JCI Returns January 1997 to May 2008. Journal of

National Conference on Management

Research.Makassar.Indonesia

Wijaya, Hadi, Akbar, Dinnul, A., & Aprilia, R. 2013.

Analysis of the January Effect on the Manufacturing

Sector on the Indonesia Stock Exchange (IDX).

Journal of Management.

Wong, W.-K., & et al. 2006. The Disappearing Calendar

Anomalies in the Singapore Stock Market. The Lahore

Journal of Economics, Vol. 11, No. 2., 123-139.

Wulandari, F., & Diana, N. 2018. Monday Effect and

Friday Effect Analysis on Liquidity Index 45 on the

Indonesia Stock Exchange. Unpublihed Thesis.

Malang, Indonesia: Faculty of Economics and

Business, Islamic University of Malang.

Yatmi, M. S., Astuti, D. S., & Widarno, B. 2016. The

Influence of Accounting Profit and Good Corporate

Governance on Stock Returns of Participants of

Corporate Governance Perception Index. Accounting

Journal and Information Technology System. Vol. 12

No. June 2, 2016. 193-199.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

610