!

!

!

!

The Influence of Pentagon Fraud on The Financial Statements of

Infrastructure Companies Listed in Indonesia Stock Exchange

Emylia Yuniarti, Rela Sari, Nilam Kesuma, and Fitri Damayani

Accounting Department, Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

Keywords: Financial statement fraud, pentagon fraud, fraud score model

Abstract: The purpose of this research is to examine empirically the influence of fraud pentagon on financial

statement fraud. Independent variables that used in this research are financial stability, financial target,

external pressure, managerial ownership, ineffective monitoring, nature of industry, change in auditor,

change in directors, and frequent number of CEO’s picture. Dependent variable is financial statement fraud.

Populations on this research are infrastructure companies that listed in Indonesian Stock Exchange (IDX)

during 2015-2017. By using purposive sampling method, there are 81 samples. The statistical method is

multiple linier regression analysis, with hypotheses testing of statistic t-tests, statistic F-tests, and coefficient

of determination. The result of this research shows that nature of industry has significant influence on

financial statement fraud. Whereas the other independent variables have no influence on financial statement

fraud. Simultaneous test result shows that independent variables simultaneously have influence on financial

statement fraud.

1 INTRODUCTION

Financial statements are summaries from

recording process and financial transactions which

occured during a certain period (Listyawati, 2016).

According to Indonesian financial accounting

standards No.1, the purpose of financial statements

is to provide information about financial position,

performance, and changes in financial position of an

entity that is beneficial to a large number of users in

making ekonomic decisions. These users can assess

the company’s performance through its financial

statement. Therefore, companies sometimes commit

acts of fraud to the financial statements in order their

performance gets a good assessment.

Financial statement fraud is a deliberate attempt

by companies to deceive and mislead users,

especially investors and creditors, by presenting and

falsifying the material value of financial statements

(Sihombing & Rahardjo, 2014). Fraud in financial

statements causes that financial statements become

not reliable due to dishonest presentation and there

are some factors that mislead the users in making

decision.

Fraud in Indonesia can take place in various

sectors such as public companies that often involved

in government procurement project. According to

kompas.com, government procurement of goods and

services project is the biggest area to commit fraud

like corruption. Almost 80 percent cases that

handled by Komisi Pemberantasan Korupsi (KPK)

are from that area. The companies that often

involved in that area are listed companies in

infrastructure sector like construction,

transportation, and telecommunication. A lot of

companies in those sectors have been classified as

blacklist in Lembaga Kebijakan Pengadaan Barang

dan Jasa Pemerintah (LKPP) (Aprillia et al., 2015).

If those companies commit fraud in their operation

activities, it doesn’t rule out the possibility that fraud

can be happened in their financial statements.

Survey from Association of Certified Fraud

Examiners (ACFE) at 2014 also showed that one of

those sectors, that is construction, is the most

frequent sector which commit financial statement

fraud.

One of theory that can be used to detect fraud is

fraud pentagon theory which developed by Jonathan

Marks. Five elements in this theory are pressure,

opportunity, rationalization, competence, and

arrogance.

Yuniarti, E., Sari, R., Kesuma, N. and Damayani, F.

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange.

DOI: 10.5220/0008442705730583

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 573-583

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

573

!

!

!

!

2 LITERATURE REVIEW

2.1 Agency Theory

Iqbal & Murtanto (2016) explain that agency

theory describes the relation between shareholder as

principal and management as agent. Management is

a party contracted by shareholders to work for their

interests. Therefore, management has to account the

performance to shareholders.

In company, management has authority in

making decision about certain matters that can affect

the condition of company. However, such decision

making sometimes is incompatible with the interests

of shareholders. This difference of interest causes

conflict of interest between the two parties so that

the company as an agent faces various conditions

that make them committing fraud (Sihombing &

Rahardjo, 2014).

One of media that can be used by management to

commit fraud is financial statements. The financial

statements serve as an intermediary between

management and shareholders regarding the

company’s performance through financial

information. Fraud pentagon theory can be a tool to

detect financial statement fraud performed by

management.

2.2 Financial Statement Fraud

Financial statement fraud is a deliberate attempt

by companies to deceive and mislead users,

especially investors and creditors, by presenting and

falsifying the material value of financial statements

(Sihombing & Rahardjo, 2014). According to

Aprilia (2017), financial statement fraud is

fraudulent by management of company in the form

of material misstatements in financial statements

presented by them and this is detrimental to

investors and other interested parties.

2.3 Fraud Pentagon Theory

Fraud Pentagon is one of theoryies that explain

the condition that cause fraud. This theory is

development of fraud triangle proposed by Cressey.

Fraud triangle consists of three elements namely

pressure, opportunity, and rationalization. This

theory was later developed by Jonathan Marks in

2009 (Vassiljev & Alver, 2016). There are two

additional elements that are incorporated into fraud

pentagon, those are competence and arrogance. The

representation of fraud pentagon theory is as

follows.

Figure 1: Crowe’s Fraud Pentagon Theory.

These are the explanation about those five

elements.

a. Pressure

Harahap et al (2017) explain that pressure is the

encouragement of the person who commit fraud.

Pressure can include almost everything like

lifestyle, economic demand, and financial or non

financial matters. One of pressure for company

or management to manipulate its financial

statement is when there is decline in financial

prospect (Elder et al., 2013).

b. Opportunity

Opportunity is the condition that give a chance

for management or employee to commit fraud

(Elder et al., 2013), such as boards of directors or

audit committees that are not effective in

overseeing financial reporting so that opportunity

arise.

c. Rationalization

Rationalization is a justification that arises in the

mind of management when fraud has occurred.

This thought will arise because they do not want

their action to be known so that they justify the

manipulation that has been done. This action is

done to keep them safe and free from punishment

(Aprilia, 2017).

d. Competence

Competence is an employee’s ability to override

internal controls, develop a sophisticated

concealment strategy, and to control the social

situation to his or her advantage by selling it to

others. (Crowe Horwarth, 2012). In short, Aprilia

(2017) explain that competence is management

or employee ability to go through the internal

control.

e. Arrogance

Arrogance is an attitude of superiority and

entitlement or greed on the part of a person who

believes that internal controls simply do not

Pressure

Crowe’s Fraud

Pentagon

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

574

!

!

!

!

personally apply (Crowe Horwarth, 2012).

Arrogance is also a boastful attitude from

someone who believes he or she is capable to

commit fraud and will not be known when fraud

has occurred (Aprilia, 2017).

2.4 Fraud Score Model

Fraud Score Model or F-Score consists of

description of data presented from the sum of

accrual quality and financial performance. The sum

of these two components can well predict the risk of

financial statement fraud seen from financial

statement perspective (Rini & Ahmad, 2012).

Accrual quality can be proxied with RSST

accrual created by Richardson, Sloan, Soliman, and

Tuna. RSST can describe all non-cash and non-

equity changes in company’s balance sheet as

accrual. Rini & Ahmad (2012) explain that accrual

basis in recording financial statements provides a lot

of flexibility for management to manipulate the

financial statements using discretionary accrual, ie

free accrual recognition, unregulated, and base on

management policy.

While financial performance is used to examine

whether managers misstate their financial statements

to mask deteriorating performance (Dechow et al.,

2010). Financial performance consists of change in

receivable, change in inventory, change in cash

sales, and change in earnings.

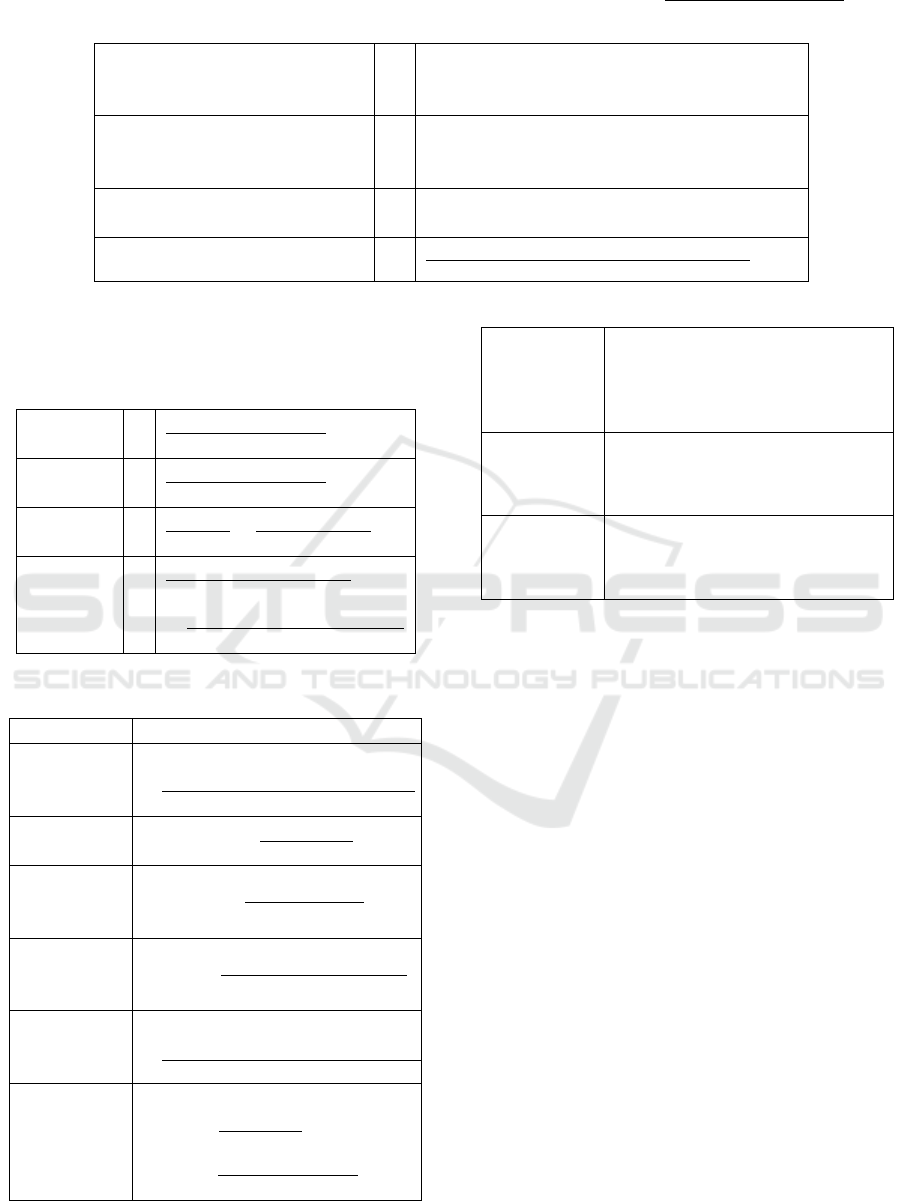

2.5 Research Framework

This research uses fraud pentagon theory to

detect financial statement fraud in a company. There

are five elements of fraud pentagon, ie pressure,

opportunity, rationalization, competence, and

arrogance. Pressure can be proxied with financial

stability, financial target, external pressure, and

managerial ownership. There are two proxies for

opportuniy, those are ineffective monitoring and

nature of industry. Rationalization is proxied with

change in auditor. Competence is proxied with

change in directors. The last is arrogance that can be

proxied with frequent number of CEO’s Picture. The

following below is research framework based on the

expalantion above.

Figure 2: Research Framework

2.6 Research Hypothesis

2.6.1 Financial Stability In Influencing

Financial Statement Fraud

According to SAS No. 99, managers face

pressure to commit financial statement fraud when

financial stability and/or profitability are threatened

by economic, industry, or entity operating conditions

(Skousen et al., 2008). Tessa & Harto (2016) explain

that the amount of total assets owned by company

become the main attraction for investors, creditors,

and other decision makers. When the total assets is

quite a lot, the company is considered capable of

providing the maximum return for investors.

The fraudulent that occurs for getting the well

seen financial stability is by manipulating the wealth

of assets in financial statements. The ratio of change

in total assets can be used to see an increase in the

company’s assets wealth. The research result of

Iqbal & Murtanto (2016) showed that financial

stability affects the financial statement fraud which

is the greater ratio the greater possibility of financial

statement fraud. Based on description above, the

PRESSURE

• Financial

Stability (X

1

)

• Financial

Target (X

2

)

•

External

Pressure (X

3

)

OPPORTUNITY

• Ineffective

Monitoring

(X

5

)

• Nature of

RATIONALIZATI

ON

• Change in

Auditor (X

7

)

COMPETENCE

• Change in

Directors (X

8

)

ARROGANCE

• Frequent

Number of

CEO’s Picture

(X

9

)

Financial

Statement

Fraud (Y)

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange

575

!

!

!

!

first hypothesis is: H

1

: Financial stability has

significant effect on financial statement fraud.

2.6.2 Financial Target In Influencing

Financial Statement Fraud

Management has a pressure to reach the financial

target that has been planned before. However,

sometimes there are inhibiting factors for the

management to achieve financial target so that it

cannot be fulfilled. Pressure to achieve this target

can lead to fraudulent management action to achieve

financial target and maintain financial performance

to look good. The company's financial target is

usually earnings that can be seen from return on

assets (ROA) (Tessa & Harto, 2016). ROA is used to

indicate how efficiently an asset has been used.

ROA is also often used in assessing the performance

of managers and determining bonus, wage increases,

and others. Therefore, management will attempt to

manipulate financial statements such as profit

manipulation to be considered capable of achieving

predetermined financial targets and get a big bonus.

Then the second hypothesis is:

H

2

: Financial target has significant effect on

financial statement fraud.

2.6.3 External Pressure In Influencing

Financial Statement Fraud

External pressure can be proxied by using

leverage ratio (LEV) i.e. The ratio between total

liabilities and total assets. Tessa & Harto (2016)

explain that companies with high leverage ratio are

considered to have large debts and high credit risk.

This makes creditors hesitant and worried about

lending to them. Thus, the companies try to make

creditors believe that they are able to repay the loan

by manipulating. The research result of Tiffani &

Marfuah (2015) showed a significant positive effect

on financial statement fraud. This means that the

greater pressure from external parties will increase

the potential for management to commit financial

statement fraud. Based on the explanation, the third

hypothesis is:

H

3

: External pressure has significant effect on

financial statement fraud.

2.6.4 Managerial Ownership in Influencing

Financial Statement Fraud

Tiffani & Marfuah (2015) explain that the

ownership of shares by management makes them

feel they have a claim right on the income and assets

of the company so that it will affect the company's

financial condition. Ownership of shares by

management leads them to use the company's funds

for personal interest. Personal interest that is the

pressure experienced by the management encourages

the occurrence of fraudulent financial statements.

The higher percentage of shares ownership by

management the higher risk of financial statement

fraud can occur. Based on the explanation, the fourth

hypothesis is:

H

4

: Managerial ownership has significant effect on

financial statement fraud.

2.6.5 Ineffective Monitoring In Influencing

Financial Statement Fraud

Ineffective monitoring is a condition where there

is no effective internal control system owned by the

company (Tessa & Harto, 2016). Management can

commit fraudulent actions due to opportunities

resulting from inadequate monitoring or ineffective

internal control system. Independent board of

commissioners are believed to increase the

company’s monitoring effectiveness. Thus, a

company with small number of board of

commissioners will lead to higher fraud. According

to the explanation, the fifth hypothesis is:

H

5

: Ineffective monitoring has significant effect on

financial statement fraud.

2.6.6 Nature Of Industry In Influencing

Statement Fraud

Tiffani & Marfuah (2015) explain that there are

certain accounts in the financial statements which

balances are determined by the company based on

an estimate, such as uncollected receivable account.

This is where an opportunity can arise to commit

financial statement fraud. Research conducted by

Sihombing & Rahardjo (2014) shows that nature of

industry proxied by change in receivable ratio

influence financial statements fraud significantly.

They explain that an increase in the amount of

receivable from the previous year can be an

indication that the company's cash flow is not good.

The number of receivable owned by the company

will reduce the amount of cash that the company can

use for its operational activities. Limited cash can be

an encouragement for management to manipulate

financial statements. Based on the description, the

sixth hypothesis is:

H

6

: Nature of industry has significant effect on

financial statement fraud.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

576

!

!

!

!

2.6.7 Change In Auditor In Influencing

Financial Statement Fraud

Change in auditor can be considered as a form to

remove the fraud trail found by the previous auditor.

This tendency encourages companies to replace their

independent auditor to cover up the fraud within the

company (Tessa & Harto, 2016). Not only to remove

traces of fraud, if company begins to be dissatisfied

with the performance of auditor that cannot be

intervened or influenced to manipulate the audit

results, the fraud tendency will be higher (Stice,

1991 in Sihombing & Rahardjo, 2014). On this

basis, the seventh hypothesis is:

H

7

: Change in auditor has significant effect on

financial statement fraud.

2.6.8 Change in Directors In Influencing

Financial Statement Fraud

The change in directors is not always good for

the company. A change in board of directors can be

an attempt to get rid of the directors who are deemed

to know the company's fraud (Devy et al., 2017). In

addition, more competent directors can make fraud

more likely to happen. Wolfe & Hermanson (2004)

explain that fraudulent can occur if done by

someone with the right ability to carry out the fraud.

Employees who have a certain intellect or ability are

considered capable of identifying opportunities and

committing acts of fraud in accordance with their

abilities. Therefore, the replacement of new directors

who are more competent is considered capable of

committing acts of fraud. Thus, the eighth

hypothesis is:

H

8

: Change in directors has significant effect on

financial statement fraud.

2.6.9 Frequent Number Of CEO’s Picture in

Influencing Financial Statement Fraud

Arrogance is an attitude of superiority and

entitlement or greed on the part of a person who

believes that internal controls simply do not

personally apply (Crowe Horwarth, 2012). Tessa &

Harto (2016) explain that the number of CEO’s

pictures emblazoned in the company's annual report

can present the level of arrogance or superiority that

CEO has. Yusof et al (2015) also explain that the

number of pictures show the way CEOs to be known

to the wide community and treat themselves as

celebrity because of their arrogant nature. This is

consistent with the explanation of Crowe Horwart

(2011) which mentions that one of character in

arrogance is to have big ego - CEO as celebrity -

factor of pride. Therefore, more and more CEO’s

pictures in the annual report allegedly will make the

arrogance higher so that he/she is able to commit

fraud without fear of internal control. Based on the

explanation, the ninth hypothesis is:

H

9

: Frequent number of CEO’s picture has

significant effect on financial statement fraud.

3 RESEARCH METHODOLOGY

3.1 Population and Sample

This study is a quantitative descriptive research

that reveals the magnitude of an influence or

relationship between variables expressed in

numbers. This study uses infrastructure companies

taken from construction, transportation, utilities and

infrastructure sectors listed on Indonesia Stock

Exchange 2015-2017. The data source in this

research is secondary data, ie annual reports

obtained from Indonesia Stock Exchange website

(www.idx.co.id) and the company's official website.

The population numbers are 74 companies.

Sampling technique used is purposive sampling. The

criteria used in the sampling of this study are:

a. The infrastructure companies listed on Indonesia

Stock Exchange during 2015 - 2017.

b. Companies that publish annual report that have

been audited in the company's website or BEI

website during 2015 - 2017 stated in Rupiah

(Rp).

c. The Companies are not delisted during 2015 -

2017.

d. The Companies have complete data relating to

research variables (all datas are available in

publication during 2015 - 2017).

e. The companies provide complete datas of

20154to be used as a comparison in 2015.

Based on those criteria, total samples that will be

used are 27 companies with three years observation

period.

3.2 Variable Operationaliazation

3.2.1 Dependent Variable

Dependent variable in this study is financial

statement fraud measured by F-Score model. F-

Score model is the sum of two variables: accrual

quality and financial performance. Accrual quality is

proxies with RSST accrual, while financial

performance is proxied with changes in receivable,

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange

577

!

!

!

!

changes in inventory, changes in cash sales, and

changes in earnings (EBIT).

𝐑𝐒𝐒𝐓$𝐀𝐜𝐜𝐫𝐮𝐚𝐥 =

𝚫𝐖𝐂 + $𝚫𝐍𝐂𝐎 + $𝚫𝐅𝐈𝐍

𝐀𝐯𝐞𝐫𝐚𝐠𝐞$𝐓𝐨𝐭𝐚𝐥$𝐀𝐬𝐬𝐞𝐭𝐬

WC (Working Capital)

=

(Current Assets – Cash and Short term

Investments) – (Current Liabilities – Debt in

Current Liabilities)

NCO (Non-Current Operating)

=

(Total Assets – Current Assets – Invesment and

Advances) – (Total Liabilities – Current Liabilities

– Long Term Debt)

FIN (Financial Accrual)

=

(Short Term Investment + Long Term Investment)

– (Short Term Debt + Long Term Debt)

ATS (Average Total Assets)

=

Beginning$Total$Assets + End$Total$Assets

2

Financial performance = change in receivable + change

in inventories + change in cash sales + change in

earnings

Change in

receivables

=

ΔReceivables

Average$Total$Assets

Change in

inventories

=

ΔInventories

Average$Total$Assets

Change in

cash sales

=

ΔSales

Sales$(t)

− $

ΔReceivables

Receivables$(t)

Change in

earning

=

Earnings$(t)

Average$Total$Assets$(t)

− $

Earnings$(t − 1)

Average$Total$Assets$(t − 1)

3.2.2 Independent Variables

Variable

Operational Variable Definition

Financial

Stability

(ACHANGE)

ACHANGE

=

(Total$Assets

Y

$– $Total$Assets

$Y[\

)

$Total$Aset

Y

Financial

Target (ROA)

ROA =

Net$Income

Total$Assets

External

Pressure

(LEV)

LEV =

Total$Liabilities

Total$Assets

Managerial

Ownership

(OSHIP)

OSHIP =

Total$Managerial$Shares

Total$Number$of$Shares

Ineffective

Monitoring

(BDOUT)

BDOUT

=

The$Number$of$Independent$Board$of$Commissioners

Total$Board$of$Commissioners

Nature of

Industry

(RECEIVAB

LE)

RECEIVABLE

= $

Receivable

Sales

− $

Receivable$(t − 1)

Sales$(t − 1)

Change in

Auditor

Change in auditor is dummy

variable. This variable is coded 1 if

there is change of Public Accounting

Firm during 2014 - 2016, and code 0

otherwise.

Change in

Directors

Change in directors is dummy

variable. This variable is coded 1 if

there is change of director during

2014 - 2016, and code 0 otherwise.

Frequent

Number of

CEO’s

Picture

This variable uses the number of

CEO’s pictures present in annual

report during 2014 - 2016.

3.3 Data Analysis Methode

This research begins with descriptive statistic

and classical assumption test consisting of normality

test, multicollinearity test, autocorrelation test, and

heteroscedasticity test, then hypothesis testing will

be done. The regression equation used in this

research is as follows:

F-Score = ß0 + ß1ACHANGE + ß2ROA + ß3LEV +

ß4OSHIP + ß5BDOUT +

ß6RECEIVABLE + ß7AUDCHANGE +

ß8DCHANGE + ß9CEOPIC + ε

F-Score

=

Financial statement fraud

ß0

=

Constant

ß1,2,3,4,5,6,7,8,9

=

Regression coefficient

ACHANGE

=

Change in total assets ratio

ROA

=

Net income per total assets ratio

LEV

=

Total liabilities per total assets

ratio

OSHIP

=

Managerial ownership ratio

BDOUT

=

Independent board of

commisioners ratio

RECEIVABLE

=

Change in receivables ratio

AUDCHANGE

=

Change in auditor

DCHANGE

=

Change in directors in company

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

578

!

!

!

!

CEOPIC

=

The number of CEO’s picture in

annual report

ε

=

Error

4 DATA ANALYSIS AND

DISCUSSION

4.1 Descriptive Statistic

Descriptive statistical analysis is used to provide

an overview of the minimum, maximum, mean, and

standard deviation of each research variable. The

results of descriptive statistical analysis are

presented in the following table.

Based on Table 4.1, it can be seen that the

average value of dependent variable (financial

statement fraud) which measured by F-Score is 0,

0448 indicates the average level of financial

statement fraud that occur in infrastructure

companies. Company with the lowest risk of

financial statement fraud is PT Arpeni Pratama

Ocean Line Tbk. in 2015 with a minimum value of -

1,2061 and the highest risk of financial statement

fraud is PT Leyand International Tbk. in 2016 with a

maximum value of 1,6432.

Table 4.1: Descriptive Statistic

N

Min

Max

Mean

Std. Dev

F-Score

81

-1,206

1,6432

,04481

,42416

ACHANGE

81

-,3871

,5861

,08387

,18488

ROA

81

-,4891

,2126

,03096

,09957

LEV

81

,0392

5,3653

,68304

,75505

OSHIP

81

,0000

,6640

,03579

,12577

BDOUT

81

,2500

,6667

,41053

,10594

RECEIV

81

-,0875

,3816

,02140

,07897

AUDCHANGE

81

0

1

,16

,369

DCHANGE

81

0

1

,38

,489

CEOPIC

81

0

26

5,01

4,440

Valid N (listwise)

81

4.2 Classical Assumption Test

The result of normality test using the

Kolmogorov-Smirnov test above shows a

significance value of 0,226. The value is greater than

0,05 so it can be concluded that the data tested in

this study is normally distributed. The result of

multicollinearity test shows that all tolerance values

are more than 0,10 and VIF values less than 10 so it

can be concluded that there is no correlation

between independent variables or no

multicollinearity problem in the data tested in this

study. Result of Autocorrelation Test test result

shows a significance value of 0,577. This value is

greater than 0,05 so it can be concluded that there is

no autocorrelation problem in the data tested in this

study.

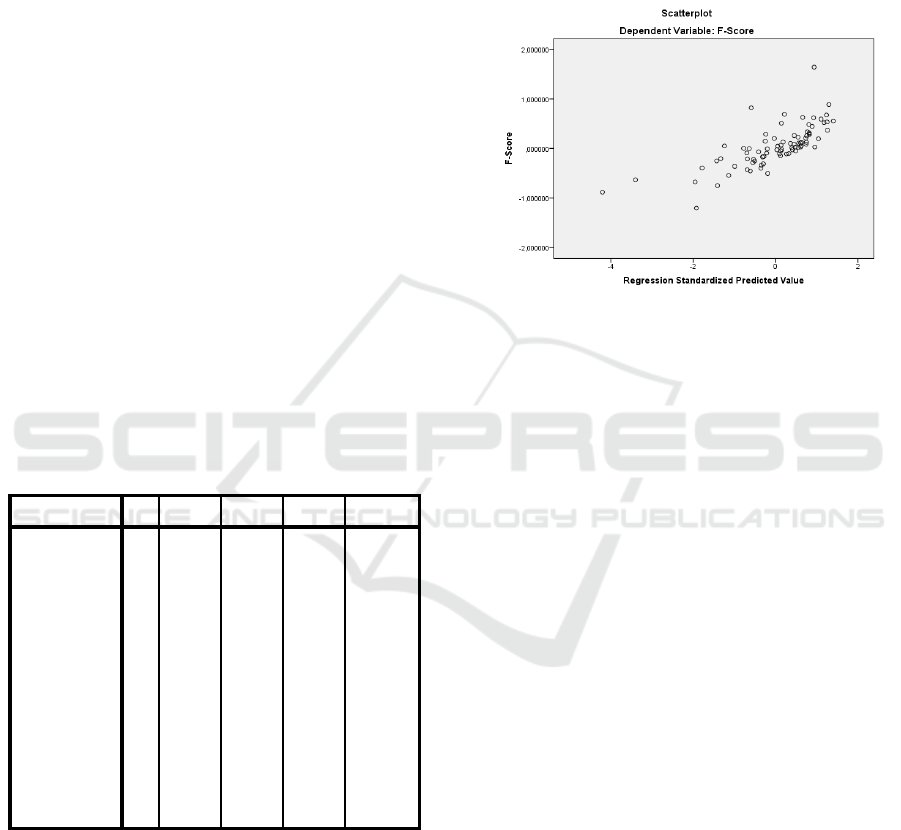

It can be seen from the picture that:

a. The data dots spread above and below or around

0.

b. Data dots do not gather just above or below only.

c. The spread of data dots does not form a wavy

pattern widened then narrowed and widened

again.

d. The distribution of data dots is not patterned.

Thus, it can be concluded that there is no

heteroscedasticity on the data tested in this study.

The result of classical assumption test consisting of

normality test, multicollinearity test, autocorrelation

test, and heteroscedasticity test show there are no

problems in data normality, multicollinearity,

autocorrelation, and heteroscedasticity so that the

data in this research can be used in multiple

regression analysis.

4.3 Hypothesis Test

4.3.1 Simultaneous Regression Coefficient

(F Test)

This test aims to show how far the influence of

independent variables individually explain the

dependent variable. The result of f test can be seen

in the table 4.2 following. This test aims to test

whether the independent variables affect the

dependent variable simultaneously. The result of F

test is presented in following table.

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange

579

!

!

!

!

Tabel 4.2: Hasil Uji Statistik F.

Model

Sum of

Square

s

Df

Mean

Square

F

Sig.

Regression

7,783

9

,865

9,289

,000

b

Residual

6,610

71

,093

Total

14,393

80

All independent variables are said to affect the

dependent variable simultaneously if the value of F

arithmetic > F table. The result of F test above

shows the value of F arithmetic is 9,289 with a

significance value of 0.000. F table is obtained from

(V1 = k, V2 = n - k - 1) (Sujarweni, 2016). From F

distribution table for α = 0,05, F table V1 = 9 and

V2 = 71 is 2,015. From these results can be seen that

F arithmetic of 9,289 exceed F table of 2,015 so it

can be concluded that all independent variables in

this study affect the financial statement fraud

simultaneously.

4.3.2 Partial Regression Coefficient (t Test)

This test aims to show how far the influence of

independent variables individually explain the

dependent variable. The result of t test can be seen in

the table 4.3.

Table 4.3: t Test Results

Model

Standardized

Coefficients

t

Sig.

ACHAN

GE

,044

,472

,638

ROA

,202

1,982

,051

LEV

-,024

-,256

,799

OSHIP

-,021

-,248

,805

BDOUT

-,032

-,383

,703

RECEIV

-,600

-7,082

,000

AUDCH

ANGE

-,148

-1,712

,091

DCHAN

GE

-,118

-1,386

,170

CEOPIC

,009

,109

,914

The result of t test shows that there are three

independent variables that have positive value. The

variables are financial stability (ACHANGE),

financial target (ROA), and frequent number of

CEO’s picture (CEOPIC). It means that the three

independent variables have positive relation to

financial statement fraud. While the other six

independent variables are negative, which mean that

those variables have negative relation to financial

statement fraud. Those six variables are external

pressure (LEV), managerial ownership (OSHIP),

ineffective monitoring (BDOUT), nature of industry

(RECEIV), change in auditor (AUDCHANGE), and

change in directors (DCHANGE). This result also

shows that only one independent variable which has

significant influence on financial statement fraud

that is nature of industry (RECEIV). A variable can

be classified to have significant effect if the value of

Sig. < 0,05, the significance value of RECEIV is

0,000 while the other eight independent variables do

not have significant effect on financial statement

fraud due to the value of Sig. which exceeds 0,05.

4.4 Discussion

4.4.1 The Influence Of Financial Stability

On Financial Statement Fraud

Table 4.3 shows that financial stability has no

effect on financial statement fraud. Loebbecke et al.

(1989) and Bell et al. (1991) in Skousen et al (2008)

explain that when company's growth is below the

industry average, management can manipulate

financial statements to improve the company's

prospect. The company’s growth cannot be

separated from the state of economy in Indonesia. In

the period 2014 - 2016, Indonesian economy is

weak. Even the economic growth of Indonesia in

2015 is the lowest for 6 years (Wisanggeni, 2016).

Weak economy creates low demand for goods and

services so that company’s earnings are reduced.

Nevertheless, the government intensively increases

infrastructure development to improve Indonesia's

competitiveness which has been lagging behind

other developing countries in other regions

(Simorangkir, 2017).

Based on data from the Ministry of Public Works

and People's Housing cited in finance.detik.com,

several achievements that have been achieved in

infrastructure development consist of construction of

new roads, border roads, toll roads, bridges, dams,

and housing. The impact of these infrastructure

developments lead to rapid growth, for example in

one of infrastructure sector i.e. construction in recent

years (Petriella, 2017).

4.4.2 The Influence Of Financial Target On

Financial Statement Fraud

Based on Table 4.3, financial target has no effect

on financial statement fraud. The test result of ROA

in accordance with cognitive dissonance theory. In

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

580

!

!

!

!

management accounting research, this theory

provides an explanation for how cognition or mental

representations mediate between budget goal

difficulty and performance (Jacob G, 2006). From

this theory can be concluded that someone who has

positive goal will not be disturbed by the act of fraud

because they will experience uncomfortable feelings

and it's not in accordance with their beliefs.

Companies that have individuals like this will reduce

the risk of fraud. Thus, higher corporate financial

target will increase employees' motivation to achieve

it with positive beliefs and behaviors.

4.4.3 The Influence Of External Pressure

On Financial Statement Fraud

The result shows that external pressure does not

affect the financial statement fraud. Richardson et al

(2004) explain that debt has high degree of

reliability, both short-term and long-term debt. Debt

accounts are company's liability against creditors or

suppliers that are recorded at nominal value. If the

company is going concern, then usually the

company must pay its debt in full. The only source

of subjectivity from debt account is discount

estimate for direct payments that suppliers may

offer. The amount of each discount is usually

verified by suppliers so the probability of error is

relatively small.

4.4.4 The Influence Of The Managerial

Ownership On Financial Statement

Fraud

The result indicates that managerial ownership

does not affect the financial statement fraud. Aprilia

(2017) explains that the less percentage of

managerial ownership in a company, the

management control will be smaller and this causes

the fraud higher. However, the higher percentage of

managerial ownership then fraud will be lower.

Company management will be more cautious about

financial statements if they have company shares as

it relates to their personal financial needs. Many

infrastructure companies in this study which their

shares are owned by management. In accordance

with the explanation, the more shares owned by

managerial then the company will be more careful

about the financial statements.

4.4.5 The Influence Of Ineffective

Monitoring On Financial Statement

Fraud

Based on table 4.3, ineffective monitoring does

not affect the financial statement fraud. Ineffective

monitoring is a condition where there is no effective

internal control system owned by company (Tessa &

Harto, 2016). Companies with small number of

independent board of commissioners will make

internal control ineffective and lead to increase

fraud. However, the result of this study measured

only by proportion rather than rules of function and

role of independent commissioners in minimizing

the risk of fraudulent financial statements as

described by Harahap et al (2017).

4.4.6 The Influence Of Nature Of Industry

On Financial Statement Fraud

The result shows that nature of industry affects

the financial statement fraud. Richardson et al

(2004) explain that receivable has low level of

reliability. It also involve subjective estimate of

uncollected receivable. In addition, receivable

account is the most commonly used accrual category

for manipulation. A low rate of change in receivable

indicates that the income received is also low and

the cash received will be small. This is what can

trigger the risk of financial statement fraud.

4.4.7 The Influence of Change in Auditor on

Finanial Statement Fraud

Based on table 4.3, The change in auditor does

not affect the financial statement fraud. Change in

auditor is not always related with fraud attempted to

be masked by the company. Article 22 in Peraturan

Pemerintah No. 20 of 2015 about the practice of

public accountant states that the limit of providing

audit services is 5 years. Auditor turnover can

happen because the limit period of public accounting

services provision has expired. In addition, auditor

turnover can be done as a result of companies that

are not satisfied with the performance of previous

independent auditor, for example from audited

results (Sihombing & Rahardjo, 2014).

4.4.8 The Influence of Change In Director

On Financial Statement Fraud

The result of this study shows that the change in

directors does not affect the financial statement

fraud. Change in directors is not always an

indication of the fraud occurring within the

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange

581

!

!

!

!

company. There are several factors that may

underlie the change in board of directors as specified

in the following rules or laws.

a. Article 105 paragraph 1 in Undang-Undang

Number 40 Year 2007 about Limited Liability

Company states that members of board of

directors may be dismissed at any time based on

the GMS decision by stating the reasons.

b. Article 8 paragraph 1 of Peraturan Otoritas Jasa

Keuangan No.33/POJK.04/2014 about Board of

Directors and Board of Commissioners of Issuers

or Public Companies states that members of

board of directors may resign from their

positions before their term of office expires.

c. Article 94 paragraph 3 in Undang-Undang

Number 40 Year 2007 regarding Limited

Liability Company states that members of board

of directors are appointed for a certain period and

can be reappointed. The term of board of

directors is contained in Article 3 paragraph 3 of

Peraturan Otoritas Jasa Keuangan

No.33/POJK.04/2014 which reads "1 (one)

tenure of board of directors no later than 5 (five)

years or until the closing of the Annual General

Meeting of Shareholders at the end of 1 (one)

tenure". This tenure makes the company through

GMS may appoint a new board of directors.

4.4.9 The Influence of Frequent Number of

CEO’s Picture on Financial Statement

Fraud

Table 4.3. shows that the frequent number of

CEO's picture does not affect the financial statement

fraud. Previously, Yusof et al (2015) explain that the

numbers of CEO's pictures show how he/she to be

known to the wider community and treat him/herself

as celebrity because of the arrogant nature. This

nature can be categorized as one of the

characteristics of narcissism. However, the number

of CEO's picture can be attributed to the positive

thing that is confidence. Confidence is built on the

success and achievement that has been achieved, the

life skills that have been mastered, the principles and

norms that are held firm, and the care shown to

others (Quamila, 2017).

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusion

Based on the background, theoretical basis,

hypothesis, and test results in this study, it can be

concluded that only nature of industry measured by

change in receivable ratio that affects financial

statement fraud. Other variables such as financial

stability, financial target, external pressure,

managerial ownership, ineffective monitoring,

change in auditor, change in directors, and frequent

number of CEO's picture have no influence on

financial statement fraud. However, these variables

simultaneously have significant influence on

financial statement fraud.

5.2 Suggestion

Next researchers are advised to use other

measuring tools of financial statement fraud such as

M-Score and Earning Management. Other variables

can also be used such as the quality of external

auditor, institutional ownership, and CEO politician.

Next researchers are also advised to expand the

population not only at infrastructure companies, but

other sectors like manufacturing and banking. While

investors and public are advised to perform an

analysis of the company's financial statements

before investing to avoid the loss, especially on

receivable because it has a big risk of fraud.

REFERENCES

Aprilia. (2017). The Analysis of the Effect of Fraud

Pentagon on Financial Statement Fraud Using

Beneish Model in Companies Applying the ASEAN

Corporate Governance Scorecard. Jurnal Akuntansi

Riset, 6(1), 96–126.

Aprillia, Cicilia, O., & Sergius, R. P. (2015). The

Effectiveness of Fraud Triangle on Detecting

Fraudulent Financial Statement: Using Beneish Model

and the Case of Special Companies. Jurnal Riset

Akuntansi Dan Keuangan, 3(3), 836–850.

Association of Certified Fraud Examiners. (2016). Report

to the Nation on Occupational Fraud and Abuse.

Birnberg, Jacob G, et al. (2006). Psychology Theory

in Management Accounting Research. Handbook

of Management Accounting Research. Elsevier.

Available in Academia:

http://www.academia.edu/18043953/Psychology_The

ory_in_Management_Accounting_Research

Crowe Horwarth. (2010). Playing Offense in a High-risk

Environment.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

582

!

!

!

!

Crowe Horwarth. (2011). Why the Fraud Triangle is No

Longer Enough.

Crowe Horwarth. (2012). The Mind Behind The

Fraudsters Crime: Key Behavioral and Environmental

Elements.

Dechow, Patricia M, et al. (2010). Predicting Material

Accounting Misstatements. Contemporary Accounting

Research Forthcoming; AAA 2008 Financial

Accounting and Reporting Section (FARS) Paper.

Available in SSRN: https://ssrn.com/abstract=997483.

Devy, K. L. S., Wahyuni, M. A., & Sulindawati, N. L. G.

E. (2017). Pengaruh Frequent Number of CEO’s

Picture, Pergantian Direksi Perusahaan Dan External

Pressure Dalam Mendeteksi Fraudulent Financial

Reporting (Studi Empiris Pada Perusahaan Farmasi

Yang Listing Di BEI Periode 2012-2016). E-Journal

S1 Ak Universitas Pendidikan Ganesha, 8(2).

Elder, Randal J, et al. (2013). Jasa Audit dan Assurance.

Jakarta: Salemba 4.

Harahap, D. A. T., Majidah, & Triyanto, D. N. (2017).

Pengujian Fraud Diamond Dalam Kecurangan

Laporan Keuangan (Studi Kasus Pada Perusahaan

Pertambangan yang terdaftar di Bursa Efek Indonesia

tahun 2011-2015). e-Proceeding of Management (Vol.

4, pp. 420–427).

Ikatan Akuntan Indonesia. (2015). Pernyataan Standar

Akuntansi Keuangan No. 1.

Iqbal, M., & Murtanto. (2016). Analisa Pengaruh Faktor-

Faktor Fraud Triangle Terhadap Kecurangan

Laporan Keuangan pada Perusahaan Property dan

Real Estate yang Terdaftar di Bursa Efek Indonesia.

Seminar Nasional Cendikiawan 2016 (p. 17.1-17.20).

Listyawati, Ika. (2016). Analisis Faktor yang

Mempengaruhi Financial Statement Fraud. Prosiding

Seminar Nasional Multi Disiplin Ilmu & Call For

Papers (Sendi_U) Ke-2 (pp. 659–665).

Peraturan Otoritas Jasa Keuangan No.33/POJK.04/2014

About Board of Directors and Board of

Commissioners of Issuers or Public Companies

Peraturan Pemerintah No. 20 Year 2015.

Petriella, Yanita. (2017). Pembangunan

Infrastruktur Menjadi Tantangan Pemerintah,

Kenapa?. http://industri.bisnis.com/

read/20171108/45/707136/pembangunan-

infrastruktur-menjadi-tantangan-pemerintah-kenapa-.

Accessed on February 27

th

2018.

Quamila, Ajeng. (2017). Bedanya Narsis dan Narcissistic

Personality Disorder.https://hellosehat.com/hidup-

sehat/psikologi/beda-narsis-dengan-narcissistic-

personality-disorder/. Accessed on February 12

th

2018.

Richardson, S. A., Sloan, R. G., Soliman, M. T., & Tuna,

I. (2004). Accrual Reliability, Earnings Persistence

and Stock Prices. Journal of Accounting and

Economics, Vol. 39, No. 3. Available in SSRN:

https://ssrn.com/abstract=521062.

Rini, V. Y., & Ahmad, T. (2012). Analisis Prediksi

Potensi Risiko Fraudulent Financial Statement

Melalui Fraud Score Model. Diponegoro Journal of

Accounting, 1(1), 1–15.

Sihombing, K. S., & Rahardjo, S. N. (2014). Analisis

Fraud Diamond Dalam Mendeteksi Financial

Statement Fraud : Studi Empiris pada Perusahaan

Manufaktur yang Terdaftar di Bursa Efek Indonesia

Tahun (BEI) Tahun 2010 - 2012. Diponegoro Journal

of Accounting, 3(2), 1–12.

Simorangkir, Eduardo. (2017). Dikebut Sejak 2014, Ini

Capaian Pembangunan Infrastruktur Jokowi.

https://finance.detik.com/berita-ekonomi-

bisnis/3585711/dikebut-sejak-2014-ini-capaian-

pembangunan-infrastruktur-jokowi. Accessed on

February 27

th

2018.

Skousen, C. J., Smith, K. R., & Wright, C. J. (2008).

Detecting And Predicting Financial Statement Fraud:

The Effectiveness of The Fraud Triangle And SAS No.

99. Available in SSRN:

http://ssrn.com/abstract=1295494.

Sujarweni, V. Wiratna. (2016). Kupas Tuntas Penelitian

Akuntansi Dengan SPSS. Yogyakarta: Pustaka Baru

Press.

Tessa, C., & Harto, P. (2016). Fraudulent Financial

Reporting: Pengujian Teori Fraud Pentagon Pada

Sektor Keuangan Dan Perbankan Di Indonesia.

Simposium Nasional Akuntansi XIX, Lampung, 1–21.

Tiffani, L., & Marfuah. (2015). Deteksi Financial

Statement Fraud Dengan Analisis Fraud Triangle

Pada Perusahaan Manufaktur yang Terdaftar di

Bursa Efek Indonesia. Jurnal Akuntansi dan Auditing

Indonesia, 19(2), 112–125.

Undang-Undang No. 40 Year 2007 About Limited

Liability Company.

Vassiljev, M., & Alver, L. (2016). Concept and

Periodisation of Fraud Models: Theoretical Review.

5th International Conference on Accounting, Auditing,

and Taxation (ICAAT 2016) CONCEPT (pp. 473–

480).

Wisanggeni, Haryo. (2016). Pertumbuhan Ekonomi

Indonesia 2015 Terendah Selama 6 Tahun.

https://www.rappler.com/indonesia/121425-

pertumbuhan-ekonomi-indonesia-2015. Accessed on

March 9

th

2018.

Wolfe, David T., and Dana R. Hermanson. (2004) The

Fraud Diamond: Considering the Four Elements of

Fraud. CPA Journal 74.12, 38-42.

Yusof K, M., Khair A.H, A., & Simon, J. (2015).

Fraudulent Financial Reporting: An Application of

Fraud Models to Malaysian Public Listed Companies.

The Macrotheme Review. A Multidisciplinary Journal

of Global Macro Trends, 4(3), 126-145.

The Influence of Pentagon Fraud on The Financial Statements of Infrastructure Companies Listed in Indonesia Stock Exchange

583