Efficiency, Productivity and Stability of Islamic Banks in Indonesia

Aam S. Rusydiana

1

, Lina Marlina

2

and Solihah S. Rahayu

3

2

Siliwangi University Tasikmalaya. Email: linamarlina@unsil.ac.id

3

IAILM Tasikmalaya, Email: solihah.sr@gmail.com

aamsmart, solihah.sr (@gmail.com), linamarlina@unsil.ac.id

Keywords: Efficiency, Stability, Productivity, DEA, Islamic bank

Abstract: The Shariah banking industry is one of the main indicators of economic development of Islamic finance in

Indonesia. In the banking world including Shariah banking, the issue of efficiency and productivity

measurement are the two important things that should be noted. However, the determination of limitation

factor to be a benchmark of whether a company has been worked efficiently and productively becomes

problems itself. This study tried to analyze the CCR models as a basic model in DEA to see the efficiency

level of Shariah commercial banks in Indonesia during the period of 2011-2017. Then, this research also

examined the condition of efficiency stability of each bank which are presented in quadrant of 4 group

formed. The results showed that the average value of CRS (Constant Return to Scale) efficiency of a whole

Shariah commercial banks in Indonesia is relatively low at 68%, while the mean standard deviation is 0.12.

The results of the Malmquist Productivity Index of Islamic Commercial Banks in Indonesia showed a

decline in productivity growth (TFPCH), the reason for the decline was also caused by the level of

technological innovation of banking (TECHCH) and stagnation of changes in the level of efficiency

(EFFCH). Therefore Islamic banks need to carry out effective strategies in the current era of technological

disruption.

1 INTRODUCTION

The Islamic banking industry, being an object of

study that’s always interesting to be studied.

Especially if it is compared with the conditions of

the conventional banking industry that has already

existed before. For example, the results of research

conducted by Nurfalah et al (2018) which states that

Islamic banking is relatively more stable compared

to conventional banking in the face of shock both

internally and externally. This is an interesting

finding that needs to be proven through various

research in the future.

The development of Shariah banking industry in

Indonesia showed relatively good tendency,

although impressed slowly. Based on Shariah

banking statistics data on April 2018, the number of

Islamic banking has reached 13 Shariah Commercial

Banks, 21 Shariah Business Units and 168 Shariah

Rural Banks with the total office networking of

2,460 offices throughout Indonesia (Financial

Services Authority, 2018).

Meanwhile, according to Global Islamic Finance

Report 2017, Shariah financial industry in Indonesia

is ranked seventh world after Malaysia, Iran, Saudi

Arabia, UAE, Kuwait and Pakistan. The index score

of Indonesia's Shariah financial industry in 2017 is

24.21 on a scale of 100 and ranks 7th in the world

(GIFR, 2017).

Regardless of the data, the 2016 target

proclaimed by Bank Indonesia in achieving a 5%

market share has not been satisfactory. The growth

that occurs in Islamic banks is not much better when

compared with the increase market Shariah bank

itself. The target market shares of Shariah banks in

2016 that is not achieved becomes a separate

phenomenon to evaluate the level of efficiency

performance of Shariah banking in Indonesia as a

whole. Various kinds of obstacles such as

competition factor, the conversion of Shariah

business unit into Shariah commercial bank, so that

many investment value must be issued, consequently

566

Rusydiana, A., Marlina, L. and S. Rahayu, S.

Efficiency, Productivity and Stability of Islamic Banks in Indonesia.

DOI: 10.5220/0008442605660572

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 566-572

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

inefficiency become obstacle in their competition

with conventional banking.

The main goals for banking sector reform

include Shariah commercial banks is to encourage

the banking sector within the regulatory and legal

framework, monitoring and supervision, financing

risk management, liquidity management, auditing

and other important aspects. If the reform of the

banking sector is going well, then this will improve

the efficiency of the banking sector that affects

every aspect of bank operations. Efficient banks will

be able to reduce costs and impose relatively low

margins on customers. In the long run, the

achievement of efficiency will be able to increase

market share consistently in Shariah banking

industry.

This study has 2 main objectives. First to

measure the level of efficiency and productivity of

Islamic banks in Indonesia, in this case is the full

fledge Shariah Bank. Secondly, to see the level of

stability of the efficiency of Shariah banks that

become the object of research. This research will

analyze the efficiency by trying to create 2

dimensions based on efficiency matrix to assess the

ability of Shariah banks to remain competitive.

2 BACKGROUND

For a business entity, efficiency is very

important. The concept of efficiency is often defined

as doing the thing right. This is always associated

with how the company in achieving its objectives.

Therefore, the concept of efficiency is often seen

from the cost side as input and profit as output. The

business entity always tries to keep the cost level

down to a minimum level to produce a maximum

output level of output.

The concept of efficiency comes from the micro-

economic concept of producer theory.

Manufacturers' theory attempts to maximize profits

or minimize costs from the producer's point of view.

In the theory of producers there is a production

frontier curve which describes the relationship

between input and output of the production process.

This production frontier curve represents the

maximum output level of any input usage that

represents the use of technology from a company or

industry (Ascarya and Yumanita, 2007).

The Malmquist index is a bilateral index used to

compare production technologies of two economic

elements. The Malmquist index is based on the

concept of a production function that measures

the maximum production function with defined

input limits. In the calculation, this index consists of

several results: efficiency change, technological

change, pure efficiency change, economic scale

change and TFP change. In the first generation

model developed by Caves et.al (1982), there are 2

(two) Malmquist productivity index models (Bjurek,

1996). The first is 'Malmquist input quantity index'

and the second is 'Malmquist output quantity index'.

Malmquist input quantity index for a production

unit, at observation time t and t + 1, for tech

reference in period k, k = t and t + 1.

The Malmquist input quantity index measures only

the change in the quantity of inputs observed

between time t and t + 1.

As time goes by, the model of frontier efficiency

measurement has increased, both in theory and

practice concepts. In general, the efficiency level

measurement model is divided into two parts:

parametric and nonparametric.

Yudhistira (2003) conducted a study of 18

Shariah banks around the world during the period of

1997-2000 using the DEA approach and input-

output specifications based on the intermediation

approach. Based on the results of the study, the

overall efficiency of 18 Shariah banks observed was

slightly inefficient at a fair rate of 10% when

compared to conventional banks. This is because in

the period of 1998-1999 banks are experiencing a

global crisis affecting its performance. Small

Shariah banks tend to be uneconomical. Therefore, it

is recommended that banks with economies of scale

are still small to merge or acquisition.

Research on the efficiency of Islamic banks is

supported by Hasan (2003) that explain the cost,

profit, revenue, and X-efficiency of Islamic banks

around the world. First, the study made a stochastic

cost frontier approach to calculate the cost efficiency

of Islamic banks in the period of 1996-2002.

Second, calculate profit efficiency by focus on cost

and revenue. Third, determine the revenue efficiency

to find out whether Islamic banks are making

innovative banking products to increase their

income. Fourth, using the non-parametric Data

Envelopment Analysis (DEA) method to calculate

the overall efficiency, i.e. technical, pure technical,

allocative, and scale efficiency. The result is that on

average, the Islamic banking industry is relatively

less efficient than conventional banks.

The other thing that show the increased

efficiency of Islamic banks in Shariah Bank in

Malayasia, Sufian (2006) measure and analyze the

efficiency of Islamic banks both foreign and

domestic in Malaysia, during the period of 2001-

2004. DEA analysis method used in this study, with

Efficiency, Productivity and Stability of Islamic Banks in Indonesia

567

input variables consisting of total savings, labor

costs, and assets. Moreover, financing variable and

operating income as output. The results of this study

states that the efficiency of Shariah banks in

Malaysia has increased. This study reveals that

Shariah foreign banks are on average less efficient

than Shariah domestic banks during the year of

observation.

3 RESEARCH METHOD

Method used in this research is Data

Envelopment Analysis (DEA). DEA is a

nonparametric method that uses a linear

programming model to calculate the ratio of output

and input ratios for all comparable units. The

advantage of using this DEA is that this approach

does not require an explicit specification of the

functional form and requires only a few structures to

form the efficiency frontier. The weaknesses that

may arise are self identifier and near self identifier.

DEA was first developed by Farrel (1957) which

measures the efficiency of one input technique and

one output to multi input and multi output.

The productivity index is expressed by

the TFP index of Malmquist over a given period.

As the suggestion of Caves et.al (1982), this index is

defined using a distance function that permits multi-

input and multi-output use without the need to

involve explicit price information. The function

of this distance can be classified into a distance

function oriented to the input and output.

The input distance function seeks a minimal

proportional expansion of input vectors for a

constant output vector. In contrast, the output

distance function seeks a minimum proportional

expansion of the output vector for a constant input

vector.

Furthermore, the DEA method is widely used to

measure the technical, scale and economic efficiency

of the industry of banks and financial institutions

(Coelli et.al (2005), and Cooper (2010)) as Hadad et

at (2003), Rani et al (2017), Ozdemir (2013),

Shahreki (2012) and Tsolas and Dimitris (2012).

However, DEA is also widely used to measure the

efficiency of non-bank institutions, such as

hospitals, universities, tax offices, as well as

nonprofits (Rusydiana, 2013) such as zakat

institutions (Rusydiana et al., 2016).

The data used in this research are all Shariah

Commercial Banks in period of 2011-2017 that

amounted to 11 banks. Data of input and output

variables are obtained from the balance sheet and

income statement of each bank. Two inputs and two

outputs are used to measure efficiency and stability

of Shariah bank efficiency. As input variables are

Third Party Fund (X1) and Personnel Cost (X2).

Meanwhile, the output variables are Total Financing

(Y1) and Operating Income (X2). Use of DPK and

financing in input-output because this research uses

intermediation approach. Table 2 describes the

descriptive statistics of each of the input and output

variables used in this study.

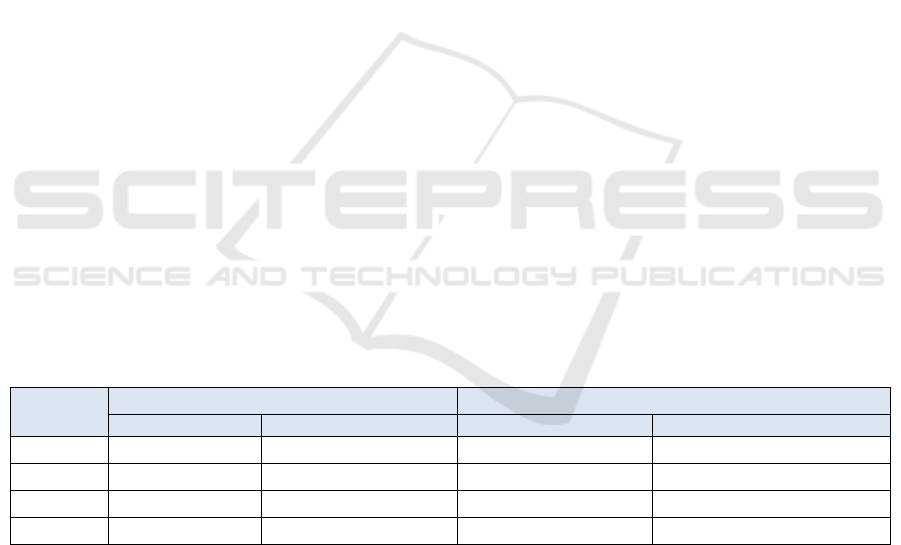

Table 2: Descriptive Statistics of Input-Output

Variable

Output (IDR Million)

Input (IDR Million)

Total Financing

Operating Income

Third Party Fund

Personalia Cost

Mean

9,084,978

1,179,864

10,067,346

221,309

Max

50,460,000

6,851,461

59,283,492

1,359,776

Min

1,614

404

4,556

1,871

Std.Dev

13,206,909

1,591,290

14,881,403

293,568

Analysis tool used in this research is Banxia

Frontier Analyst 3 to measure the efficiency level of

all DMU (Decision Making Unit) of Shariah bank

during 2007-2017. Furthermore, to make a plot of

Shariah bank group quadrant with 2 categories

(efficiency and stability) on x and y axis, SPSS 16

software is used as a tool. This grouping follows

research conducted by Rusydiana and Sanrego

(2018) and Rusydiana and Firmansyah (2017). The

first calculation of efficiency with the CRS

(Constant Return to Scale) or CCR (Constant Return

to Scale) approach introduced by Charnes et.al

(1978).

4 RESULTS & DISCUSSION

Table 3 (appendix) showed that the efficiency of

CRS on Shariah banks in Indonesia from 2007-2017

has fluctuated. The average value of the overall

efficiency of Shariah commercial bank in Indonesia

is relatively low at 68%, while the mean standard

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

568

deviation is 0.12. This indicates the poor

performance of Shariah banks in Indonesia.

The best performers based on efficiency levels

during the study period were Maybank Shariah with

an average of efficiency is 94% and standard

deviation is 0.06. The second best of Shariah

commercial bank is BMI with an average of

efficiency of 75% and standard deviation is 0.10.

BRI Shariah and Panin have the average efficiency

rating of 73% but with a fairly large standard

deviation of 0.14 and 0.29. Beyond that, other

Shariah commercial banks have only average

efficiency under 70%. Bank Mega Shariah (52%),

Victoria Shariah (55%) and BCA Shariah (56%) are

the three Islamic banks with the lowest average

efficiency compared to other Shariah commercial

bank.

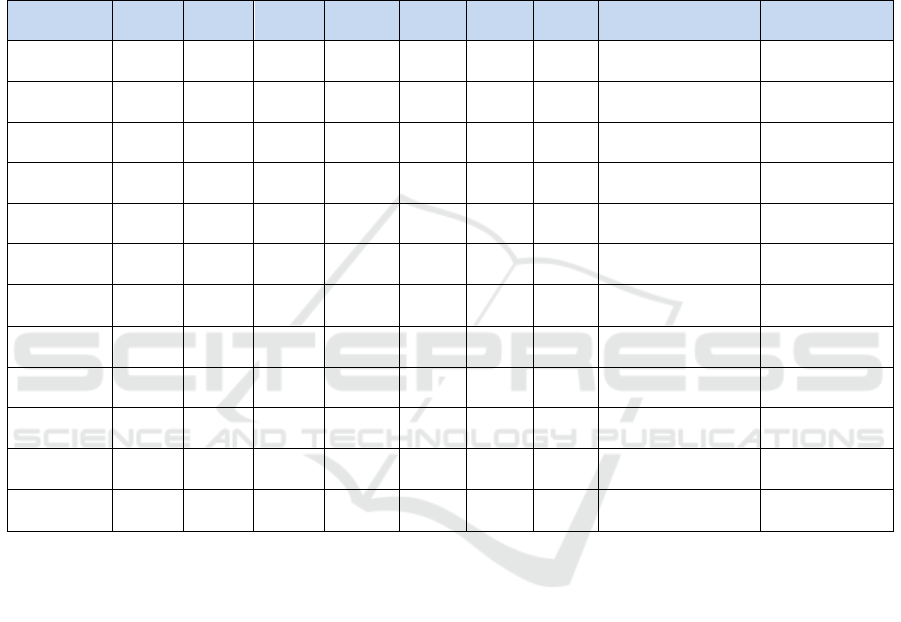

Table 3: Level of Efficiency of CRS and Shariah Commercial Bank Stability in Indonesia in the period of 2011-2017

DMU

2011

2012

2013

2014

2015

2016

2017

Mean

StD

BSM

0,64

0,73

0,68

0,61

0,65

0,71

0,66

0,67

0,04

BMI

0,71

0,81

0,80

0,69

0,62

0,66

0,63

0,75

0,10

BRIS

0,63

0,65

0,68

0,63

0,71

0,65

0,68

0,73

0,14

BNIS

0,54

0,53

0,56

0,53

0,77

0,79

0,81

0,65

0,11

Mega

0,40

0,49

0,53

0,47

0,53

0,58

0,49

0,52

0,13

Panin

0,66

1,00

0,82

0,88

0,85

0,92

0,88

0,73

0,29

BJBS

0,53

0,65

0,65

0,63

0,71

0,74

0,62

0,67

0,09

BSB

0,66

0,73

0,78

0,76

0,71

0,69

0,78

0,65

0,21

BCAS

0,49

0,53

0,61

0,68

0,62

0,61

0,58

0,56

0,07

Maybank

1,00

0,84

1,00

0,90

0,93

0,95

0,94

0,94

0,06

Victoria

0,42

0,45

0,55

0,65

0,68

0,53

0,54

0,55

0,10

MEAN

0,68

0,12

Shariah Commercial Banks Quadrant Based on

CRS Efficiency Level and Its Stability

Shariah Commercial Banks are grouped into 4

(four) quadrants based on the category of efficiency

level and its efficiency level stability, i.e. high and

low. Quadrant 2 includes Shariah banks which has

high efficiency and stability efficiency, so it can be

considered as the best Shariah banks compared to

other quadrant groups. On the other hand, Quadrant

4 is a group of Shariah banks with low efficiency

and high efficiency stability. This group can be

regarded as Shariah banks with low efficiency and

relatively persistent level of efficiency. That is, there

tends to be no increase in the level of efficiency it

achieves.

Quadrant 1 includes Shariah commercial banks

that have a high level of efficiency, but on the other

hand has a low level of efficiency stability. This

group can be considered as a Shariah bank with a

high efficiency but relatively unstable efficiency.

This means that the high efficiency of Shariah banks

in this quadrant is not persistently achieved, but

there is fluctuation (increase and decrease)

efficiency figures. Quadrant 3 includes groups of

Shariah commercial banks that have a low level of

efficiency, but on the other hand has a relatively

high level of efficiency stability. This group can be

considered as a Shariah bank with relatively low

efficiency and fluctuating value of its efficiency.

The good side is, the Shariah commercial banks

group in this quadrant is expected to achieve an

increase in efficiency level in the future.

Figure 1 showed the division of a group of

Shariah commercial banks based on the calculated

level of efficiency (CRS) and its efficiency stability,

based on two categories i.e. efficiency on the y-axis

Efficiency, Productivity and Stability of Islamic Banks in Indonesia

569

and the standard deviation value of the efficiency

figure during the study period, on the x-axis.

Figure 1: Four Shariah commercial bank Quadrants

Based on Level of Efficiency & Stability

Where:

Quadrant 1 (High Efficiency, Low Stability): BRIS

Quadrant 2 (High Efficiency, High Stability): BSM,

BMI, Maybank,

Quadrant 3 (Low Efficiency, Low Stability): Mega,

Panin, BSB

Quadrant 4 (Low Efficiency, High Stability):

Victoria, BCAS, BNIS, and BJBS

Figure 1 shows that during this period study,

there is 1 Shariah commercial bank that is in

quadrant 1, there are 3 Shariah commercial banks

located in quadrant 2, and 3 Shariah commercial

banks that enter into quadrant 3. Meanwhile there

are 4 Shariah commercial banks which are included

in quadrant 4.

Group of quadrant 1 is Shariah commercial bank

category that has high efficiency, but on the other

hand has low efficiency stability value. Shariah

commercial banks that fall into this category are BRI

Shariah. BRI Shariah has an average efficiency

rating of 73% and a standard deviation of efficiency

of 0.14. Therefore, BRI Shariah is included in

Shariah commercial bank with high efficiency but

relatively unstable efficiency value.

Group of Quadrant 2 is Shariah commercial bank

category that has high efficiency level and high

value of efficiency stability. There are 3 Shariah

commercial banks that include into this category,

i.e.: BSM, BMI and Maybank Shariah. BSM has an

average efficiency rating of 67% and a standard

deviation of efficiency of 0.04. BMI has a fairly high

average efficiency value of 75% and a standard

deviation of efficiency of 0.10. Maybank has the

highest efficiency rating of 94% and standard

deviation of efficiency of 0.06. This group is

deemed as shariah commercial banks with high

efficiency and relatively stable value of efficiency,

or the best compared to other quadrants.

Group of Quadrant 3 is shariah commercial bank

category that has an average of low efficiency and

low efficiency stability. There are 3 Shariah banks

that include into this category, i.e.: Bank Shariah

Mega Indonesia, Panin Shariah and Bank Shariah

Bukopin (BSB). Bank Mega Shariah has an average

efficiency rating of 52% and a standard deviation of

efficiency of 0.13. Panin Shariah has an average

efficiency rating of 73% and a standard deviation of

efficiency of 0.29. Meanwhile BSB has an average

efficiency rating of 65% and a standard deviation of

efficiency of 0.21. These groups of shariah

commercial banks in quadrant 3 are Shariah banks

with relatively low efficiency and fluctuating value

of its efficiency.

Quadrant 4 is a group of Shariah banks that have

low level of efficiency but on the other hand has

high efficiency stability value. There are 4 Shariah

banks that include into this category, i.e.: Victoria

Shariah, BCA Shariah, BNI Shariah and BJB

Shariah. Bank Victoria Shariah has an average

efficiency rating of 55% and a standard deviation of

efficiency of 0.10. BCA Shariah has an average

efficiency rating of 56% and a standard deviation of

efficiency of 0.07. BNI Shariah has an average

efficiency value of 65% and a standard deviation of

efficiency of 0.11. Meanwhile BJB Shariah has an

average efficiency value of 67% and a standard

deviation of efficiency of 0.09. This group can be

regarded as Shariah banks with low efficiency and

relatively persistent level of efficiency.

Productivity of Indonesia Shariah Banks

Table 4. Results of TFPCH of Islamic Banks

Periods

EFFCH

TECHCH

PECH

SECH

TFPCH

2011-2012

1.051

0.683

1.000

1.051

0.717

2012-2013

0.987

0.974

1.000

0.987

0.962

2013-2014

0.977

0.703

1.000

0.977

0.687

2014-2015

1.037

0.842

1.000

1.037

0.874

2015-2016

0.991

1.878

0.995

0.996

1.861

2016-2017

0.967

0.908

1.000

0.997

0.897

GeoMean

1.005

0.997

0.999

1.003

0.998

On table 4, it appears that for the duration of the

study is 2011 - 2017, Islamic Bank’s in Indonesia

show a decline in productivity growth, as indicated

by the value TFPCH of 0.998. The decline in this

TFPCH showed lower levels of productivity in the

banking sector in Indonesia. This is evidenced by the

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

570

decrease (Regress) TECHCH under 1 is (0.997) and

PECH (0.999), although there was a slight increase

in SECH (1.003) and EFFCH (1.005). In another

sense, a decrease in the level of productivity

of Islamic Banks in Indonesia contributed largely by

the low level of banking technology innovation or

technological change (TECHCH) and the efficiency

(PECH).

So, from the results of this research, we can state

that the average value of CRS (Constant Return to

Scale) efficiency of a whole Shariah commercial

banks in Indonesia is relatively low at 68%, while

the mean standard deviation is 0.12. The results of

the Malmquist Productivity Index of Islamic

Commercial Banks in Indonesia showed a decline in

productivity growth (TFPCH), the reason for the

decline was also caused by the level of technological

innovation of banking (TECHCH) and stagnation of

changes in the level of efficiency (EFFCH).

5 CONCLUSIONS

As part of the financial system, Shariah banks in

Indonesia have a role to play in economic growth in

general. Currently, the development of Shariah

banking industry in Indonesia is relatively stagnant

compared to neighboring countries. With the various

challenges faced, Shariah banks in Indonesia need to

maintain its existence.

One of the important issues in the analysis and

discussion of the banking industry, including the

Islamic banks, is related to efficiency and stability.

This paper focus in that area. This research tries to

describe the level of efficiency achieved by Shariah

Public Bank in the period of 2011 to 2017 and its

efficiency stability.

The average value of the overall CRS efficiency

of shariah commercial bank in Indonesia is relatively

low at 68%, while the mean standard deviation is

0.12. This indicates that the performance of Shariah

banks industry in Indonesia is lack in general.

Shariah banks that enter into groups with high

efficiency and stable value are: Maybank Shariah,

BMI and BSM. Then coupled with BRI Shariah on

the CRS approach. For this group of Shariah banks,

they need to maintain the achievement of efficiency

achieved. If performance increased, it will be better.

Meanwhile, shariah commercial bank that fall

into low efficiency and stable group in low

efficiency position are Victoria Shariah and BCA

Shariah. For these two banks, efforts to improve

efficiency are a priority, both in terms of the

effectiveness of existing inputs as well as increased

output such as the addition of total financing and

increase in operating income. Beyond that, the

fluctuating shariah commercial banks value of

efficiency and stability are: BNI Shariah, Mega

Shariah, BJBS, BSB and Panin Shariah. This group

of banks is quite vulnerable, both due to the

macroeconomic impacts as well as the internal

conditions and policies of each bank. Therefore, for

this last group, maintaining the stability of efficiency

value is the main goal. So the target achievement is

expected, able to achieve well and maximum.

The results of the Malmquist Productivity Index

of Islamic Commercial Banks in Indonesia showed a

decline in productivity growth (TFPCH), the reason

for the decline was also caused by the level of

technological innovation of banking (TECHCH) and

stagnation of changes in the level of efficiency

(EFFCH). Therefore Islamic banks need to carry out

effective strategies in the current era of

technological disruption. One of the limitation of

this study is the lack of complete data, especially

some DMU of Islamic banks in the initial period of

observation.

REFERENCES

Ascarya and Yumanita, Diana. 2007. “Analisis Efisiensi

Perbankan Syariah di Indonesia dengan Data

Envelopment Analysis”. TAZKIA Islamic Finance and

Business Review, Vol.1, No.2, pp. 1-32.

Banker, R.D., Charnes, A., and Cooper, W.W. 1984.

“Some Models for Estimating Technical and Scale

Inefficiency in DEA”, Management Science, 30 (9),

1078-92.

Bjurek, Hans. (1996). “The malmquist total factor

productivity index”, The Scandinavian Journal of

Economics, Vol. 98 (2).

Caves et.al. (1982). “The Economic Theory of Index

Number and The Measurement of Input, Output and

Productivity”. Econometrica, 50 (6).

Charnes, A., Cooper, W.W., and Rhodes, E. 1978.

“Measuring the Efficiency of Decision Making Units”,

European Journal of Operation Research, 2, 6, 429-

44.

Coelli.T.I, Rao, D.S.P. and Battese, G.E. 1998.

Introduction to Efficiency and Productivity Analysis,

Kluwer Academic Publisher, Boston.

Coelli, T.J, Rao, D.S.P., Prasada Rao, Christoper J.

O’Donnel and G.E. Battese. 2005. Introduction to

Efficiency and Productivity Analysis, (Second

Edition), Kluwer Academic Publishers, Boston.

Cooper, William W., Seiford, Lawrence M., and Tone,

Koru. 1999. A Comprehensive Text with Models,

Application, References and DEA-Solver Software,

Kluwer Academic Publisher, Boston USA.

Efficiency, Productivity and Stability of Islamic Banks in Indonesia

571

Cooper, et al. 2002. Data Envelopment Analysis. Kluwer

Academic Publisher, USA.

Cooper, William W, Lawrance M. Seiford and Joe Zhu.

2010. Handbook on Data Envelopment Analysis.

London: Springer.

Farrell, M.L. 1957. “The Measurement of Productive

Efficiency”, Journal of The Royal Statistical Society,

120, p.253-281.

Freixas, Xavier and Rochet, Jean-Charles.

Microeconomics of Banking 2

nd

Edition, The MIT

Press, Cambridge, Massachusetts, London, England,

2008.

Hadad, M., W. Santoso, E. Mardanugraha dan D. Ilyas.

2003. “Pendekatan Parametrik Untuk Efisiensi

Perbankan Indonesia”. Bank Indonesia, Jakarta.

Hadad, M.D., Santoso, W., Mardanugraha, E., & Illyas, D.

2003. “Analisis Efisiensi Industri Perbankan

Indonesia: Penggunaan Metode Nonparametrik Data

Envelopment Analysis (DEA)”. Biro Stabilitas Sistem

Keuangan Bank Indonesia. Research Paper, 7/5.

Hassan, Kabir. 2003. “Cost, Profit and X-Efficiency of

Islamic Banks in Pakistan, Iran and Sudan”.

Proceeding International Conference on Islamic

Banking : Risk Management, Regulation and

Supervision, Bank Indonesia, 30 September-2 Oktober

2003. Bank Indonesia. Jakarta.

Islamic Banker Association. 2017. Global Islamic Finance

Report 2017.

Nurfalah, I., Rusydiana, A.S., Laila, N., and Cahyono,

E.F. 2018, “Early warning to banking crises in the

dual financial system in Indonesia: The markov

switching approach”, JKAU: Islamic Economics,

Vol.31, No.2, pp.133-156.

Otoritas Jasa Keuangan. 2018. Statistik Perbankan

Syariah Indonesia April Tahun 2018.

Ozdemir, Asli. 2013. “Integrating analytic network

process and data envelopment analysis for efficiency

measurement of Turkish commercial banks”. Banks

and Bank Systems Volume 8 issue 2, 2013.

Ramanathan, R. 2003. An Introduction to Data

Envelopment Analysis: A Tool for Performance

Measurement. London: Sage Publications.

Rani, L., Rusydiana, A., and Widiastuti, T. 2017.

“Comparative analysis of Islamic bank’s productivity

and conventional bank’s in Indonesia period 2008-

2016”. In 1st International Conference on Islamic

Economics, Business and Philanthropy (ICIEBP

2017), pp. 118-123.

Rusydiana, A.S. dan Tim SMART Consulting. 2013.

Mengukur Tingkat Efisiensi dengan Data Envelopment

Analysis. Bogor: SMART Publishing.

Rusydiana, Aam S. 2018. “Indeks malmquist untuk

pengukuran efisiensi dan produktivitas bank syariah di

Indonesia”, Jurnal Ekonomi dan Pembangunan LIPI,

Vol.26, No.1, pp.47-58.

Rusydiana, Aam S., and Yulizar D. Sanrego, 2018.

“Mesuring the performance of Islamic banking in

Indonesia: An application of Maslahah efficiency

quadrant (MEQ)”. Journal of Monetary Economics

and Finance, Vol 3 Special Issue, pp.103-130.

Rusydiana, Aam S., and Irman Firmansyah, 2017.

“Efficiency versus Maqasid Shariah index: An

application on Indonesia Islamic bank”. Shirkah

Journal of Economics and Business, Vol 2 No 2, 2017.

Shahreki, Javad, Nazar Dahmardeh and Mohammad Ali

Ghasemi. 2012. “Efficiency Evaluation Bank Sepah

Branches in Sistan and Baluchestan Province Using

Data Envelopment Analysis”. Interdisciplinary

Journal of Contemporary Research in Business Vol. 4

No. 2, June 2012.

Sherman, H.D. and Gold. 1985. “Bank Branch Operating

Efficiency: Evaluation with Data Envelopment

Analysis”, Journal of Banking and Finance, 9, 279–

315.

Sufian, Fadzlan. 2006. “The Efficiency of Islamic Banking

Industry: A Non-Parametric Analysis with Non-

Discretionary Input Variable”. Islamic Economic

Studies Vol. 14, No. 1 dan 2.

Tsolas, Ioannis E. and Dimitris I. Giokas. 2012. “Bank

branch efficiency evaluation by means of least

absolute deviations and DEA”. Managerial Finance

Vol 38 No. 8, 2012.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

572