Determinant of Profitability: Evidence of Government Bank in

Indonesia

K.M. Husni Thamrin, Mohamad Adam, Mukhlis Mukhlis, Anisa Melinda

Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

Keywords: CAMEL, Profitability, Bank

Abstract: The purpose of this study was to analyze the effect of profitability determinant factors on state-owned banks

in Indonesia. The sample in this study were four state-owned banks. This study uses secondary data

obtained from the documentation in the form of annual financial statements of State-Owned Enterprises

listed on the Indonesia Stock Exchange for the period 2007-2016. Data is quantitatively. Methodology using

multiple linear regression analysis. Hypothesis testing that has been done using the t-test shows that the

Capital Adequacy Ratio and Loan Deposit Ratio have a positive and insignificant effect on Return on

Assets. Non-Performing Loans and Operational Income Operating income has a negative and significant

effect on Return On Assets. Net Interest Margin has a positive and significant effect on Return on Assets.

1 INTRODUCTION

Banks are known as financial institutions that

have a very important role for the economy in

Indonesia. Based on the Republic of Indonesia Act

No. 10 of 1998, the Bank is a business entity, where

the bank must raise funds from the public in the

form of credit and other forms in order to improve

the standard of living of many people. The presence

of banks in Indonesia has a very significant role. It

happens because the need for capital and the storage

of money by the community has become

commonplace.

Banks operate more using funds from the public

than using their capital from shareholders. The

condition of financial performance is very influential

on public trust in banking. Therefore, banks must

always maintain and maintain the health of the bank,

because if the condition of the bank's healthy

financial performance will lead to public confidence

in the bank and vice versa if the condition of the

bank's financial performance decreases it will reduce

public confidence in the bank itself. (Lin & Smith,

2007). This trust is needed to expedite the activities

carried out by the bank. The smooth activities

carried out by banks will be very supportive in

achieving the welfare of stockholders and will

increase the value of the company (Sukarno &

Syaichu, 2006; Yuliani, Fuadah, & Thamrin, 2018).

The banking sector has an important role as a

major driver of economic growth in Indonesia.

Economic growth will affect the level of profitability

of a company. Some research shows that

profitability is the most important thing for the

company because profitability is the result of some

policies and decisions made by the company. A

healthy and stable bank (1) is a need for an economy

that wants to grow and develop well. If a bank can

grow and develop well, the bank is able to compete

(2) in collecting funds from the community and

redistributing it in the form of credit and banks can

maintain public trust (3) because in its operations

banks use more funds from the public compared to

their capital from the owner or shareholder.

There are still many rules that are violated in the

banking world, one of which is the precautionary

principle in providing credit which will affect the

profitability of a bank. The occurrence of a monetary

crisis in Indonesia since mid-1997 also had an

impact on the banking sector (4). It is very important

for us and the company to find out the negative

impact on the profitability of the company, one of

which is bad credit, and this negative impact is the

impact of the weak quality of the banking system.

The bank's financial statements are one of the

main sources of indicators as the basis for evaluating

the bank's financial performance because the bank's

financial statements show the overall financial

condition of the bank. (S. Nanik, 2013). The role of

Thamrin, K., Adam, M., Mukhlis, . and Melinda, A.

Determinant of Profitability (Evidence of Government Bank in Indonesia).

DOI: 10.5220/0008442205330539

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 533-539

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

533

financial statements is very important in the

decision-making process, especially decisions that

will have an impact on companies in the coming

period. Based on the bank's existing financial

statements, some financial ratios calculated as the

basis for research on corporate performance

(Purbaningsih, (2013); Thamrin, Syamsurijal,

Sulastri, & Isnurhadi, (2018).

The making of financial statements aims to fulfill

the interests of various parties, in addition to the

management and the owner of the company itself.

The interested parties are shareholders, government,

management, employees and the wider community.

(Baert, 2009). Financial reports issued by banks will

provide various benefits to various parties. Each

party has its interests and objectives for the financial

statements provided by the bank. The financial

statements presented contain several different

information needs. One important information in

financial statements is information about profits.

This information was important because profit

shows how the company is performing during a

period. The bank's financial ratio reflecting bank's

performance, such as the Capital Adequacy Ratio

(CAR), Non-Performing Loans (NPL), BOPO, Net

Interest Margin (NIM) and Loan to Deposit Ratio

(LDR).

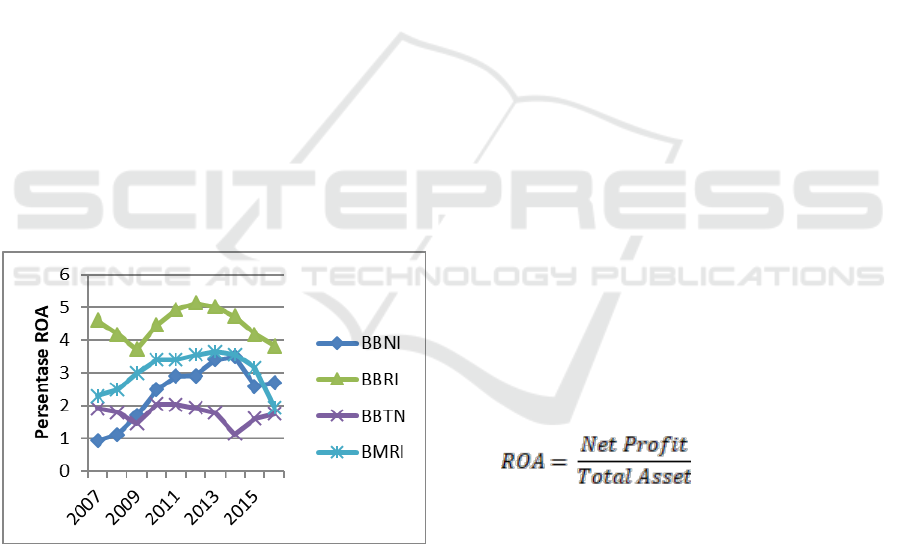

Figure 1: Movement of Return on Assets (ROA) of

BUMN Banks in Indonesia Period 2007-2016

Based on graph 1.1, BRI banks in 2007 to 2016

have a decrease in ROA value each year. When

compared to other banks, BRI has the highest ROA

rate. Bank BNI in 2007 to 2016 had an average ROA

value that increased every year, only experiencing a

decline in 2015. Bank Mandiri also had an average

ROA value that increased from 2007 to 2013 but

decreased in 2013 to 2016. At Bank, BTN shows the

average value of fluctuating ROA. The four banks

have an average ROA value that exceeds the

standard size of banks in Indonesia, which is 1.5%.

Some banks have ROA below standard, namely BNI

Bank in 2007 and 2008 with ROA values of 0.93%

and 0.96% and Bank BTN in 2014 with an ROA

value of 1.14%. It shows that there are factors that

affect the size of the ROA of a bank.

Based on the description and some of the

previous studies above, there is a research gap for

the variables CAR, NPL, BOPO, NIM, and LDR

studied. By these reasons, the researchers are

interested in re-researching and analyzing how the

research variables influence ROA. In this study,

researchers analyzed by taking a sample of research

on government banks in Indonesia in the period

2007-2016 with the title “Determinant Of

Profitability: Evidence Of State-Owned Enterprise

Bank In Indonesia.”

2 LITERATURE REVIEW

2.1 Return On Assets

Return on Assets (ROA) as a proxy of financial

performance. ROA shows the company's ability to

use all assets owned to generate profit before tax.

This ratio is important for management to evaluate

the effectiveness and efficiency of company

management in managing all company assets. The

greater the ROA means, the more efficient use of

company assets, or in other words, the same amount

of assets can generate greater profits or vice versa.

The formula of ROA:

2.2 Capital Adequacy Ratio (CAR)

The CAR ratio is used to measure the adequacy

of bank capital and shows the bank's ability to

provide funds for business development needs and to

accommodate the possible risk of losses caused by

bank operations. The higher the CAR, the stronger

the bank's ability to run the risk. If the high CAR

value by Bank Indonesia regulations (at 8%) means

that the bank can finance bank operations, and can

make a large contribution to the bank's profitability

(ROA) (Raharjo, Dwi Priyanto Agung; Setiaji,

2014).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

534

2.3 Non-Performing Loan (NPL)

The NPL ratio is used to measure how bank

management's ability to overcome and manage

problem loans. The higher the NPL or, the greater

the number of non-performing loans, the worse the

quality of bank credit because it will cause losses, on

the contrary, if the lower the NPL, the bank's profit

or profitability (ROA) will increase (Ayuningrum,

2011). By Bank Indonesia Regulation No. 17/11 /

PBI / 2015, Bank Indonesia sets the NPL ratio

criteria below 5% so that the value of the bank

remains good.

2.4 Operating Expenditures and

Operating Revenues (BOPO)

The BOPO ratio is used to measure the level of

efficiency and the ability of a bank to control

operational costs for its operating income. The

smaller the value of BOPO means the more efficient

the bank operates.

2.5 Net Interest Margin (NIM)

The NIM ratio is used to measure the bank's

ability to generate income from interest, by looking

at bank activities in channeling credit. Bank income

comes from the difference in interest on loans

disbursed with deposits received (Ayuningrum,

2011).

2.6 Loan to Deposit (LDR)

Loan to Deposit Ratio is a ratio to measure the

composition of the amount of credit given compared

to the amount of public funds and own capital used.

Bank Indonesia Regulation No. 17/11 / PBI / 2015

states that the LDR ratio is between 78% and 92%.

The higher the LDR the bank's profit will increase,

this is due to the amount of loans channeled and it is

assumed that the bank can channel its credit

effectively.

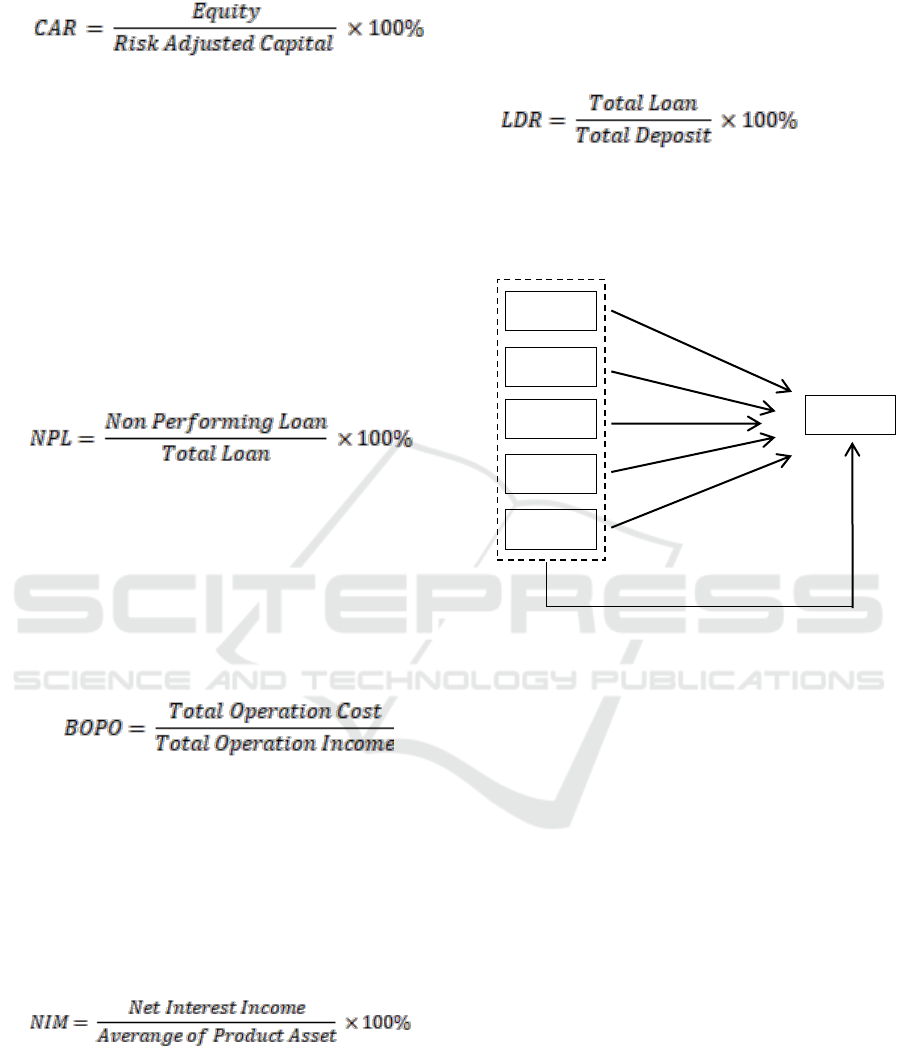

2.7 Framework

Based on the explanation above, a conceptual

mindset can be prepared as described below:

Figure 2: Framework

2.8 HYPOTHESIS

The hypothesis is a temporary conclusion that

reflects the relationship between the variables being

studied and formulates a hypothesis in the form of a

flow that equipped with a qualitative explanation.

The hypothesis is a statement that describes or

predicts relationships between two or more variables

(Sanusi, 2016). Based on the conceptual framework

above, the writer formulates the following

hypothesis:

H1 = CAR has a significant effect on ROA

H2 = NPL has a significant effect on ROA

H3 = BOPO has a significant effect on ROA

H4 = NIM has a significant effect on ROA

H5 = LDR has a significant effect on ROA

3 RESEARCH METHOD

3.1 Source Data

The data used in this study are secondary data in

the form of bank financial statements which include

H1

H2

CAR

NPL

BOP

O

NIM

LDR

ROA

H3

H4

H5

Determinant of Profitability (Evidence of Government Bank in Indonesia)

535

data on Capital Adequacy Ratio (CAR), Non-

Performing Loans (NPL), BOPO, Net Interest

Margin (NIM) and Loan To Deposit Ratio (LDR)

and Return on Assets (ROA). The data used in this

study obtained from the Indonesia Stock Exchange

in 2007-2016

3.2 Analysis Method

The purpose of the analysis of this method is to

interpret and draw a conclusion from the data

collected. Researchers used SPSS version 23

software to process and analyze research data. Data

analysis techniques used in this study are:

3.2.1 Normality Test

This normality test is conducted to see whether

the research data is normal distribution or not.

Research with a good regression model is research

that has a normal or near normal data distribution

(Ayuningrum, 2011).

3.2.2 Classical Assumption Test

This study uses secondary data. To get the

accuracy of the model to be analyzed, it is necessary

to test some of the classical assumption requirements

that underlie the regression model. The classical

assumption test divided into multicollinearity test,

heteroscedasticity test, and autocorrelation test.

3.2.3 Multiple Regression Test

This study uses multiple regression models in

analyzing data. This model is used to determine how

much influence the independent variable on the

dependent variable is the influence of working

capital turnover, current ratio and debt ratio on

return on assets. This test aims to determine whether

the independent variables simultaneously or partially

affect the dependent variable significantly.

4 RESULT

4.1 Regression Test

This study consists of dependent variables

namely return on assets and independent variables

which include Capital Adequacy Ratio (CAR), Non-

Performing Loans (NPL), Operating Expenditures

and Operating Revenues (BOPO), Net Interest

Margin (NIM), and Loan to Deposit ( LDR). This

test is used to create regression equations that are

useful for drawing research conclusions. In this

study regression test was used in its completion. The

following is the result of the parameter coefficient

significance test that has been carried out by the

researcher:

4.2 Partial Test

Table 1: Partial T-Test Result

Model

Unstandardized

Coefficients

T

Sig.

Beta

Constant

5,952

0,000

CAR

0,018

0,850

0,401

NPL

-0,345

-5,988

0,000

BOPO

-0,028

-4,577

0,000

NIM

0,404

11,329

0,000

LDR

-0,010

-1,516

0,139

a. Dependent Variable: ROA

4.3 Effect of Capital Adequacy Ratio

on Return on Assets

The t-test results obtained by the CAR regression

coefficient of 0.018 indicating that if the CAR

experiences a one-unit change assuming other

variables remain, then the ROA will increase by

0.018. The significance level of the CAR variable

has a value of 0.401 greater than the 0.05 level of

concluded that the

CAR used in this study has no positive influence on

the ROA of state-owned banks in Indonesia, so H1,

rejected.

The CAR is insignificant on ROA; this is

likely due to BI regulations which require each bank

to maintain CAR with a minimum requirement of

8%, resulting in banks trying to maintain their CAR

by BI regulations. Banks tend to invest their funds

carefully and put more emphasis on bank survival so

that CAR does not have much effect on bank

profitability.

4.4 Effect of Non-Performing Loans on

Return On Assets

The result of the t-test obtained by the NPL

regression coefficient of -0.345 shows that if the

NPL experiences a one-unit change assuming the

other variables remain, then the ROA will decrease

by 0.345. The level of significance, the NPL variable

has a value of 0.000 smaller than the significance

concluded that the

NPL used in this study has a significant effect on

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

536

ROA of state-owned banks in Indonesia, so H2 is

accepted.

It shows that the more the number of non-

performing loans makes banks do not dare to

increase lending. Moreover, the total third-party

funds received by banks are not optimal, thus

causing bank liquidity to disrupted. NPL is a ratio

that describes the comparison between non-

performing loans and the total credit provided by the

bank. The provision of credit to the public can create

risks that can cause losses to the bank, one of which

is non-performing loans.

4.5 Effect of Operating Expenditures

and Operating Revenues on Return

On Assets

T-test results obtained by the BOPO regression

coefficient of -0.028 indicates that if BOPO

experiences a one-unit change with the assumption

that the other variables remain, then ROA will

decrease by 0.028. The level of significance, BOPO

variable has a value of 0.000 smaller than the

concluded

that BOPO used in this study has a significant effect

on ROA of state-owned banks in Indonesia, so that

H3, accepted.

The high operating expenses (BOPO) will reduce

bank income (ROA) because they have to spend

more money to pay for the operating expenses. It is

because the level of bank efficiency in running its

operations affects the income generated by the bank.

If operational activities are carried out efficiently (in

this case the value of the BOPO ratio is low), then

the income generated by the bank will increase, or

the more efficient the operational performance of a

bank, the greater the profit gained by the bank

(Raharjo, Dwi Priyanto Agung; Setiaji, 2014)

4.6 Effect of Net Interest Margin on

Return on Assets

T-test results obtained by the NIM regression

coefficient of 0.404 indicates that if the NIM

experiences a one-unit change assuming the other

variables remain, then ROA will increase by 0.404.

The level of significance, the NIM variable has a

value of 0.000 smaller than the significance level of

concluded that the NIM used

in this study has a significant effect on ROA of

state-owned banks in Indonesia, so that H4 is

accepted.

It explains that any increase in NIM will increase

ROA. Every increase in net interest income, which

is the difference between the total interest cost and

total interest income, results in an increase in profit

before tax, which in turn increases ROA. It means

that the ability of the bank's management to generate

net interest affects the level of bank income for its

total assets.

4.7 Effect of Loan to Deposit Ratio on

Return on Assets

The results of the t-test obtained by the LDR

regression coefficient of -0.010 shows that if the

LDR undergoes a one-unit change assuming the

other variables remain, then the ROA will decrease

by 0.010. The level of significance, the LDR

variable has a value of 0.139 greater than the

, so it can

concluded that the LDR used in this study has no

significant effect on ROA of state-owned banks in

Indonesia, so H5, rejected.

The higher LDR, which means that lower

liquidity causes low profitability. It is due to the

presence of Non-Performing Loans which causes

disbursed loans not to produce results, which in turn

reduces profitability. Loan to deposit ratio (LDR)

does not have a significant effect on profitability due

to a lack of optimal credit distribution from the bank

so that banks must be more aggressive in increasing

their credit in order to increase profitability

(Suyitno, 2017).

4.8 F-test Result

Table 2: F-test Result

Model

Sig.

1

Regression

0,000

a. Dependent Variable: ROA

b. Predictors: (Constant), CAR, NPL, BOPO,

NIM, LDR

Based on the results of regression analysis it can

be seen that the linear regression model is feasible to

be used to explain the effect of independent

variables on variables. It is significant value 0,000

%).

Regression models with independent variables

namely CAR, NPL, BOPO, NIM, and LDR can be

used to predict the dependent variable, ROA.

Determinant of Profitability (Evidence of Government Bank in Indonesia)

537

4.9 Determinant Coefficient Result

(R2)

R square explains how much variation Y is

caused by X, from the calculation results obtained

R2 value of 0.922% or 92.2% means that 93.2%

ROA strongly influenced by the five independent

variables CAR, NPL, BOPO, NIM, and LDR.

Moreover, 7.8% is explained by other causes outside

the model.

5 CONCLUSION

The Capital Adequacy Ratio has no positive

influence and direction on Return on Assets on state-

owned banks in Indonesia for the period 2007-2016.

Non Performing Loans have a negative influence

and direction on Return on Assets on state-owned

banks in Indonesia for the period 2007-2016.

Operational Costs Operating income has a negative

influence on the return on assets of state-owned

banks in Indonesia for the period 2007-2016. Net

Interest Margin has a positive influence and

direction on Return on Assets in state-owned banks

in Indonesia for the period 2007-2016.

Loan Deposit Ratio has no positive influence and

direction on Return on Assets in state-owned banks

in Indonesia for the period 2007-2016. Multiple

linear regression models are feasible to be used to

measure the effect of Capital Adequacy Ratio, Non

Performing Loans, Operational Income Operating

Costs, Net Interest Margin, and Loan Deposit Ratio

on Return on Assets in BUMN banks in Indonesia

for the period 2007-2016.

5.1 Suggestions

Suggestions for research include the following.

1. BUMN companies are expected to anticipate

factors that can affect the Capital Adequacy

Ratio (CAR), Non Performing Loans (NPL),

Operating Income Operating Costs (BOPO), Net

Interest Margin (NIM), and Loan Deposit Ratio

(LDR), it because become one of the reference

criteria for financial health for banks. Banking

companies are expected to pay attention to other

factors that can affect the Return On Assets

(ROA) outside the research variables in order to

anticipate things that can affect the growth

potential and prospects of the company in the

future.

2. For further research using a longer period of

observation. The addition of research samples

with a wider observation period will provide a

greater possibility of obtaining results that are

close to actual conditions.

3. It is recommended to use other banking health

measurement methods by Bank Indonesia

regulations. In order to get the results of various

studies on the health assessment of banks in

Indonesia.

REFERENCES

Ayuningrum, A. P. (2011). Analisis Pengaruh CAR, NPL,

BOPO, NIM, dan LDR Terhadap ROA (Studi pada

Bank Umum Go Public yang Listed pada Bursa Efek

Indonesia tahun 2005-2009). Jurnal Ekonomi

Manajemen Sumber Daya.

Baert, L. (2009). Bank ownership , firm value and firm

capital structure in Europe. In Working Paper (pp. 1–

34). the European Commission (7th Framework

Programme, Grant Agreement No. 217266).

Lin, C. M., & Smith, S. D. (2007). Hedging, financing and

investment decisions: A simultaneous equations

framework. Federal Reserve Bank of Atlanta, 42(2),

191–209. https://doi.org/10.1111/j.1540-

6288.2007.00167.x

Purbaningsih, Y. P. (2013). The Effect of Liquidity Risk

and Non Performing Financing (NPF) Ratio to

Commercial Sharia Bank Profitability in Indonesia.

Journal STIE Ekuitas Indonesia, 73.

https://doi.org/10.7763/IPEDR.

Raharjo, Dwi Priyanto Agung; Setiaji, B. S. (2014).

Pengaruh Rasio CAR, NPL, LDR, BOPO, Dan NIM

Terhadap Kinerja Bank Umum di Indonesia. Jurnal

Ekonomi Manajemen Sumber Daya, 15, No. 2(DAYA

SAING), 7–12.

S. Nanik. (2013). Analisis Pengaruh Tingkat Kesehatan

Bank dan Faktor Fundamental Makro Ekonomi

Terhadap Nilai Perusahaan Pada Perusahaan

Perbankan Yang Tercatat Di Bursa Efek Indonesia.

Universitas Merdeka Malang, 1–27.

Sanusi, A. (2016). Metodologi Penelitian Bisnis. Jakarta:

Salemba Empat.

Sukarno, K. W., & Syaichu, M. (2006). Analisis Faktor-

Faktor Yang Mempengaruhi Kinerja Bank Umum Di

Indonesia. Jurnal Studi Manajemen & Organisasi,

3(2003), 46–58.

Suyitno, B. Y. (2017). Pengaruh NPL dan LDR melalui

Profitabilitas sebagai Variabel Intervening terhadap

Nilai Perusahaan. Jurnal Ilmu Dan Riset Manajemen,

6(2).

Thamrin, K. M. H., Syamsurijal, Sulastri, & Isnurhadi.

(2018). Dynamic Model of Firm Value : Evidence

from Indonesian Manufacturing Companies. Sriwijaya

International Journal of Dynamic Economics and

Business (SIJDEB), 2(2), 151–164.

https://doi.org/https://doi.org/10.29259/sijdeb.v2i2.151

-164

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

538

Yuliani, Fuadah, L., & Thamrin, K. M. H. (2018). THe

Mediation Effect of Financing Mix on Invesment

Opportunity Set and Profitability Relationship.

Ekspektra : Jurnal Bisnis Dan Manajemen, 2(1), 56–

67.

https://doi.org/http://dx.doi.org/10.25139/ekt.v2i1.740

Determinant of Profitability (Evidence of Government Bank in Indonesia)

539