The Pattern Identification of Rice Pricing Determination in the Local

Farmer Level

Taufiq Marwa, Abdul Bashir, KMH. Thamrin

and Azwardi

Universitas Sriwijaya, South Sumatera, Indonesia

Keywords: Production Cost; Rice Prices; Rice Production; Rural Farmer.

Abstract: This study to pattern identification of rice pricing determination in the local farmer level of South Sumatera.

The data used are primary data as many as 400 respondents of farm households in South Sumatra. The method

used in this study is the qualitative descriptive analysis and the quantitative approach using the linear

regression model with the estimation of ordinary least square (OLS). The findings of this study indicated that

the pattern of rice price setting in the sub-district level of the relative is controlled by large traders, most of

whom have cooperated with milling owners in the rural level. The price formed at the sub-district level is the

sum of the purchase prices at the rural level plus the profit margins agreed upon by the wholesalers at the sub-

district level with the milling owners in the rural level. We found of this study that the defined profit margins

ranged from 16-36%. The model estimation result indicated that jointly the independent i.e. rice production,

input cost, labor cost, and dummy variable significantly affect the rice price at the rural level. Meanwhile,

partially the variables that significantly affect the rice price at the rural level are labor costs and districts

dummy variable (D1 and D2), while the rice production and input costs insignificant affect the rice price in

the local farm level (rural market).

1 INTRODUCTION

The implementation of food policy so far has only

focused on one side, namely on increasing rice

production to maintain rice self-sufficiency, while on

the other hand, food policy wants cheap rice prices.

These two policies are a source of problems that will

affect producers and consumers, from the producer

side will cause farmers to lack enthusiasm to produce,

while from the consumer side, rice is a staple food,

which will cause the population to depend on rice

(Marwa, 2001).

Meanwhile, in the central regions of rice

production will be fulfilled and the price level is low,

but in other places the availability of rice is

inadequate and the price level will be high. Therefore,

the distribution aspect that is closely related to the

availability of adequate transportation infrastructure

to ensure the mobilization of goods and people must

absolutely get the attention of all parties, especially

the government.

The consumption aspect, people will be able to

access rice, if they have purchasing power. The level

of people's purchasing power depends largely on the

income level and the rice price that applies in the local

market. The higher the level of rice prices prevailing,

the lower the community's ability to obtain sufficient

and quality rice. Price fluctuations in agricultural

products, especially rice must receive special

attention from the government, this is indicated by

policy interventions to maintain price stability.

Despite the special attention, the issue of price

fluctuations between time and place continues to

occur. Every harvest season, the price of rice at the

farmer level drops, even below the base price.

The price of rice in most rice-producing regions

in South Sumatra at the farm level often experiences

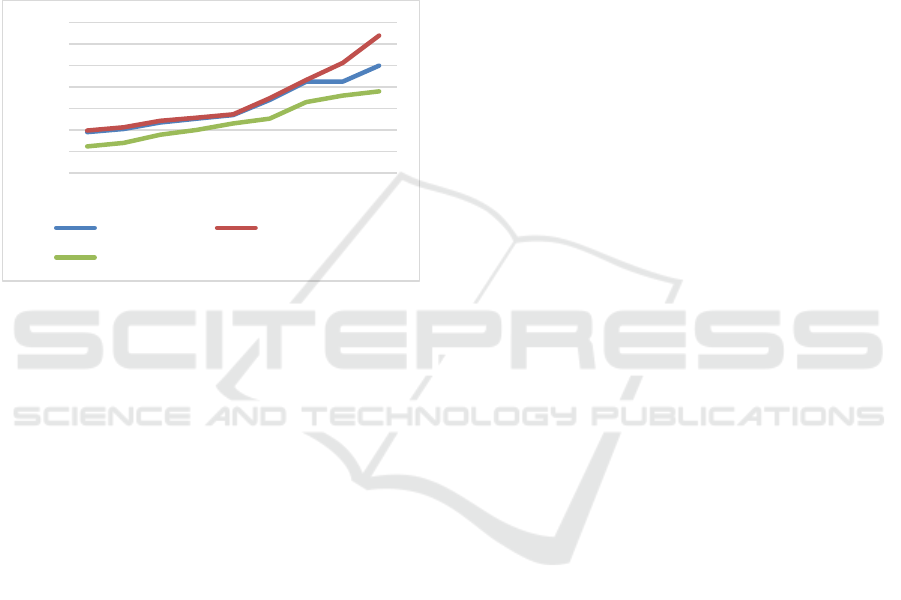

very large fluctuations. In Figure 1, shows the trend

of rice prices at the village level, retail prices, and

large base prices which continue to increase, but

when viewed from these data the basic of rice price

(the rice price of farmers level) has a large gap

compared to the rice price at rural level and retail

prices. Even though the price level has been regulated

by the government with the lowest price policy, the

price of rice at the farm level often experiences a

decline far below the lowest price of the government

regulation.

In addition, one of the causes of the asymmetric

transmission of prices between vertically connected

markets is the presence of uncompetitive behavior

510

Marwa, T., Bashir, A., Thamrin, K. and Azwardi, .

The Pattern Identification of Rice Pricing Determination in the Local Farmer Level.

DOI: 10.5220/0008441905100515

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 510-515

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

0

2000

4000

6000

8000

10000

12000

14000

2001 2003 2005 2007 2009 2011 2013 2015 2017

Rural Level Price Retail Price

Basic Price

between intermediary traders, especially if the

intermediary trader is in a concentrated market

(Vavra & Goodwin, 2005). Generally, the

intermediary trader will try to maintain the level of

profit and will not increase or decrease the price

according to the actual price signal. So that

intermediary traders will more quickly react to price

increases compared to price reductions, this condition

causes competition restraint on distribution channels

and imperfect price transmission between producer

and consumer levels. In the end, the farmers and

consumers markets are not integrated.

Figure 1: The trend of rice price in the level

(Source: BPS, South Sumatera in figure)

Meanwhile, the occurrence of price transmission

between two different market levels in one marketing

chain is caused by an uncompetitive market(Meyer &

Cramon-Taubadel, 2004and Palaskas & Harriss-

white, 1993). Even for agricultural commodities, it is

clearly stated that imperfect competition in the

marketing chain opens the space for the middleman

to abuse their market power. Therefore, there is a

possibility that there are two roles in the market; first,

the market facilitates trade and allows distribution

and allocation of resources in the community; second,

the market allows all traded goods and services to

evaluate in determine rice price (Azwardi, Bashir,

Adam, & Marwa, 2016; Chizari, Sani, & Kalashami,

2013).

Some previous studies have analyzed the factors

that influence rice prices with macroeconomic

assumptions such as study conducted by Azwardi,

Bashir, Adam, & Marwa (2016); Chizari, Sani, &

Kalashami (2013). Therefore, this study aims to

identify the rice prices determinants in the local

farmer level, and the factors that determine the rice

price such as rice production, input cost, labor cost,

and use dummy variable for the region of rice

production center in South Sumatra.. In the second

session, we will present a literature review. The third

session, we will present the analysis method used.

Next, in the fourth session, we present the findings

and discussion, and our last session presents

conclusions from the results of this study.

2 LITERATURE REVIEW

Food prices in each market are related to each other,

therefore, communication between producers and

consumers in each market will be intertwined through

price signals. So price is a form of communication

signals that serve many variations to coordinate

market decisions. The strength of market demand and

supply will shapes market prices. If the inter-market

has a link between the power of demand and supply,

so the inter-market price will integration (Cheung,

2008; Emokaro & Ayantoyinbo, 2014; Marwa, 2001)

Several studies show that the price of rice in the

region depends on market prices in other regions, as

the study the study conducted by Azwardi et al.

(2016) looking at the macro aspect, the impact of

government policies through subsidies on rice

production in Indonesia, the findings of this study

indicate that the subsidy policy determines the level

of rice consumption in Indonesia. Government policy

through subsidies is strongly influenced by the level

of rice prices. This condition shows that the

government is trying to maintain price stability

through subsidies and also efforts to build food

security in terms of demand and supply.

In addition, study conducted by Adam et al.

(2017) see more clearly how the marketing

distribution pattern of rice in South Sumatra, the

findings result of the distribution pattern of rice

commodity marketing in South Sumatra shows that

the marketing distribution channel of rice is still

going through a long stage, therefore is a need for the

role of government through BULOG as an absorbent

of farmers' production so that shortening the rice

distribution chain can also stabilize prices at the farm

level.

Nominally, the trading margin of rice traders' is

higher than the trading margin of farmers. However,

the rice trade margin ratio of farmers is higher than

trade margin ratio of traders. The result of this

findings indicates that farmers in South Sumatera

have the efficient categorized.

Furthermore, a study conducted by Timmer

(2004) the results of the study found that in the long

run, Indonesia has made improvements to food

security, these improvements have been driven by

successful economic growth and green revolution,

planted with superior types of rice, massive

infrastructure investment in the countryside,

including irrigation, and the availability of sufficient

The Pattern Identification of Rice Pricing Determination in the Local Farmer Level

511

fertilizer. In 1998, Indonesia experienced a financial

crisis which resulted in the destruction of domestic

rice prices which were far higher than the world price

of rice. Thus some productivity gains have favored

rice farmers. However, this will cause the loss of

consumers and also have a large impact on the

number of individuals living below the poverty line.

A study conducted by Marwa et al. (2017) the

findings result of the study indicated integration

between the price of rice at the producer level and the

price of rice at the consumer level. In addition, the

three sample regions have IMC value less than 1,

meaning that both markets have vertical integration in

the short run.

Another finding of this study is that the high price

difference at the local market level is due to the long

distribution of rice commodities in South Sumatera.

According to Marwa et al. (2017) efforts in form of

government intervention is particularly needed at the

local market-level on pricing policy by shortening the

distribution channels.

3 RESEARCH METHOD

The scope of this study is rice-producing regions in

South Sumatra such as East OKU, OKI, and

Banyuasin district. The sample in this study is farmer

households as many as 400 respondents. The

analytical method used is descriptive statistical

analysis, and the quantitative approach uses which is

the linear regression model to determine the factors

that effect on the rice price in the local farmer's level.

The variables used among another rice price (Pr),

total production (Qr), input costs (CI), and labor costs

(CL), and the category of central areas of production.

The results will be confirmed by the conditions that

occur in the field in this survey. The multiple linear

regression model with OLS estimation method is

presented in the equation as follows:

……………………….…….. (1)

Then, the equation (1) is presented in semi-natural

logarithm form in equation (2) as follows:

…………….……. (2)

where: Pr is the price of rice (dependent variable), and

the independent variable among other as Qr is rice

production; CI is the input cost (not including labor);

CL is labor costs; D1 is dummy variable with

category from East OKU district value = 1 and

another district with value = 0; and D2 is dummy

variable with category OKI district value = 1, while

another district is value = 0.

4 RESULT AND DISCUSSION

The type of agriculture in South Sumatra, especially

the small part of rice food crops, is technical

irrigation, especially in the East OKU area, while in

other areas it still applies rainfed systems such as

district OKI and Banyuasin. The district OKI has now

received attention by the regional government with

making irrigation, but still in certain areas as an

experiment. Based on information from the local

farmers that the district government of Banyuasin will

be making programmed to build irrigation for wetland

paddy.

Table 1: Description of agriculture system

District

Agriculture system

Total

Percentage

Irrigation

Rainfed

East OKU

131

15

146

36.50

OKI

77

117

194

48.50

Banyuasin

0

60

60

15.00

Total

208

192

400

100.00

Source: Authors calculation, 2017

Based on Table 1, the agricultural system in the

area that we observed, that East OKU district became

an area where most of the wetland paddy was the flow

of water sourced from rivers that entered the

irrigation that had been made so that during the rainy

season the water supply would be more.

Meanwhile, the OKI and Banyuasin districts still

apply the rainfed system as the water source which

flows to wetland paddy, meaning that the harvest

season for this region depends on the stored rainwater

supply. On the other side, the land area owned by

farm households in East OKU, OKI, and Banyuasin

regencies is quite diverse. Based on the survey

results, we found that most farm households had an

average of less than one hectare of wetland paddy.

This makes the farmers only benefit the harvest

for their daily needs. Meanwhile, we also get

information that most farm households still land rent

with the profit-sharing system with landowners.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

512

Table 2: Production, land area, and productivity

District

Total

Land

productivity

ton/ha

Production

(tons)

Land area

(ha)

East OKU

1.602

351

4,56

OKI

1.317

203

6,48

Banyuasin

640

122

5,27

Average

1.186

225

5,43

Source: Authors calculation, 2017

Meanwhile, based on the survey, we found that

most of the paddy harvested by farmers still ranged

from 0.6-19 tons per year, this indicated that most

farmers in South Sumatera still have the wetland

paddy small. From the survey results, we also get

information about 90.89% of farmers to produce less

than 20 tons per year with a range of land of only 0.5-

6 hectares, and with average harvest only two times

per year.

In terms of wetland productivity, the average

wetland productivity is 5.43 tons per hectare, the

results show that paddy production is still ideal. The

largest producer of wetland paddy is OKI District

with the value of 6.4 tons per hectare. Meanwhile,

Banyuasin district only reached 5.27 tons per hectare,

and the lowest was East OKU District which only

reached 4.56 tons per hectare. Based on the

information, yields in East OKU district experienced

a decline in yields, even this year the crop yields

failed due chemicals contained in excess soil and

more found of rat pest

Based on the survey results, we found that not all

paddy yields from farm households are all sold, some

are stored for consumption and some are used as

seeds for production in the next year. The proportion

of paddy harvested which sold from these three

districts averages around 80% of the total production.

We also found that each region had a different

proportion of the amount of rice sold. East OKU

district has the largest proportion of paddy harvested

which sold reaching 88% of total production. While

the OKI and Banyuasin district, the proportion of

paddy harvest that was sold only reached 77% and

73% of the total production.

Table 3 indicated that the production costs per

hectare in a year are quite diverse, but the highest

production costs are in the OKI district reaching 8.2

million per year per hectare. Meanwhile, East OKU

district only reached 4.2 million, while the lowest

production cost in Banyuasin district only reached 3.5

million per year per hectare. Thus, farmers still have

an advantage because the difference between total

revenue and total production costs shows a positive

value, this has provided evidence that most farmers in

these three regions are still benefiting from their sales.

Table 3: Components of production costs per ha

District

Total of production cost/year (Rp

000)

Production

cost

Landarea

(ha)

Cost per

(ha)

East OKU

1,486,029

351

4,231

OKI

1,679,927

203

8,265

Banyuasin

425,055

122

3,498

Average

1,197,003

225

5,331

Source: Authors calculation, 2017

Generally, we found that the average production

cost reached 41.3% of the total sales revenue of

farmers. While the average profit reaches 58.7% of

farmers' income because there is a portion of the

harvest that is still stored for consumption needs.

Table 4: Components of cost and Profit

District

Components of cost

(Rp. million)

Profit

per ha

TR

TC

Profit

East OKU

5,293

1,486

3,807

10,706

OKI

3,856

1,680

2,176

10,838

Banyuasin

1,869

425

1,444

11,883

Average

3,673

1,197

2,476

11,142

Source: Authors calculation, 2017

When viewed based on the benefits of farmers per

hectare per year presented in Table 4 shows that the

average profit of farmers per hectare per year reaches

11.1 million. The calculation results, the Banyuasin

district has the biggest profit reaching 11.8 million

per hectare per year.

Furthermore, OKUT district reached 10.8 million

per hectare per year, while OKI district amounted to

10.7 million per hectare per year. This result indicated

that farmers are still classified as efficient, but these

costs do not include other costs of this survey. The

pattern of determining rice prices at the farmer level

and sub-district level can be seen in the conditions of

paddy and rice price levels at the farmer level (rural

market) and at the sub-district level shown in Table 5

which are presented as follows

Table 5 indicates that the price of rice at the rural

level is relatively lower than the price of rice at the

sub-district level. The average price of rice at the rural

level is Rp.7,295 per kg, while the price of rice at the

sub-district level is Rp.9,242 per kg, we found that the

The Pattern Identification of Rice Pricing Determination in the Local Farmer Level

513

price level at the sub-district level was on average

27% higher than the price at the rural level.

Table 5: Price of dry paddy and rice at the rural and sub-

district Levels

District

Price of rural

level (Rp/Kg)

Price of sub-

district level

(Rp/Kg)

Dry

paddy

Rice

price

Rice price

East OKU

3,737

6,924

9,450

OKI

4,082

7,563

8,775

Banyuasin

3,993

7,399

9,500

Average

3,937

7,295

9,242

Source: Authors calculation, 2017

This condition indicates that traders take

relatively large profits in the process of distributing

rice from the producer level to the consumer level of

more than 20%. We also found that most farmers sell

paddy to the mill owners, so at the rural level farmers

sell in the form of paddy, not in the form of rice.

Farmers leave only a small portion of their crops for

seeds and supplies for consumption.

The pattern of pricing at the rural level is

relatively biased to buyers (milling owners), buyers

have greater power in determining prices than

farmers. Price agreements between buyers and sellers

at the rural level are dominated by buyers (milling

owners). The more dominant milling owners in

determining price levels are caused by (1) the high

dependence of farmers on milling plants to process

paddy into rice; (2) most farmers already have debts

to the mill owners; and (3) there is behaviour

monopsony nor oligopsony, which agreed among

buyers in the rural level.

The pattern of price setting of rice at the sub-

district level is relatively controlled by large traders,

most of whom have cooperated with milling owners

at the village level. The rice price formed at the sub-

district level is the sum of the purchase prices at the

rural level plus the profit margins agreed upon by the

wholesalers at the sub-district level and the milling

owners at the rural level. Based on the results of the

study it was found that the profit margins that were

set ranged from 16-36%.

The estimation results of the model to examine the

effect of rice production, input costs, labor costs, and

district dummy on rice prices at the local farmer level

are presented in Table 6. From Table 6 it can be seen

that jointly the variables of rice production, input

costs, labor costs, and the district dummy

significantly affects the price of rice in rural areas.

Table 6, indicated that partially, which

significantly affects the rice price (lnPr) at the rural

level is the labor cost (lnCL) and dummy variable of

the district (D1 and D2). Meanwhile, the rice

production and input costs insignificant affect the rice

price at rural level.

Table 6: The model estimation result

Variable

Coefficients

Tolerance

VIF

Constant)

8.039***

(0.086)

-

-

lnQr

0.007

(0.004)

0.306

3.263

lnCI

-0.007

(0.006)

0.301

3.325

lnCL

0.019***

(0.005)

0.523

1.911

D1

-0.076***

(0.007)

0.347

2.883

D2

0.020***

(0.006)

0.389

2.573

Obs

400

R

2

0.541

R-adjusted

0.535

F-test

94.244

DW-test

1.821

Source: Authors calculation, 2017

The variable of labor costs significantly affect the

rice price in the rural level and has the positive sign,

meaning that the higher the costs incurred to pay

labor, then the higher the rice price. This condition is

understandable because most of the activities in the

process of producing paddy or rice are depend on

labor, from preparing the planting to harvesting and

post-harvest. This component of labor costs includes

cleaning costs, planting costs, maintenance costs, and

harvest costs. Meanwhile, district dummy variables

can indicate whether there is a difference in the

average price level of rice in each district that is

sampled. Based on the results of the study, we found

that there were differences in average rice prices

between OKU Timur, OKI and Banyuasin district,

which one average on the rice price in East OKU

district is lower than average on the rice price in

Banyuasin district and OKI.

The variable of rice production (lnQr) and input

costs (lnCI) insignificant affect the rice price at the

farmer level (rural market). The insignificance of the

variable of rice production affect the rice price in the

rural level is caused by the price level that is formed

at the rural level is not determined by the market

mechanism but tends to be determined by the buyer,

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

514

in this case the milling owner, where the price set

tends to be below the government decree price.

Although the prices in the rural market are below the

government decree, farmers are forced to sell their

crops to the milling owners in the rural level, this

condition gives a strong indication that the structure

of the rice market in rural level tends to be

monopsony and or oligopsony which agreed.

Meanwhile, the insignificance of the input cost

variable (InCI) in influencing the rice price in the

rural level is caused by the relatively fixed and

unvaried input costs in the rice farming process. As

the result of the relatively fixed and varying input

costs, the rice price elasticity on input costs is very in-

elastic, this is indicated by the coefficient of rice price

elasticity to the input cost is -0.007 (Table 6).

5 CONCLUSIONS

The pattern of price fixing at the rural level is

relatively biased to buyers (milling owners), buyers

have greater power in determining prices than

farmers. Price agreements between buyers and sellers

at the rural level are dominated by buyers (milling

owners). The more dominant milling owners in

determining the price level are due to: (1) the high

dependence of farmers on milling plants to process

paddy into rice, (2) most farmers already have debts

to the mill owners, (3) there is behaviour monopsony

and or oligopsony behaviour which agreed among

buyers at the rural level.

Meanwhile, the pattern of rice price setting in the

sub-district level of the relative is controlled by large

traders, most of whom have cooperated with milling

owners in the rural level. The price formed at the sub-

district level is the sum of the purchase prices at the

rural level plus the profit margins agreed upon by the

wholesalers at the sub-district level with the milling

owners in the rural level. We found of this study that

the defined profit margins ranged from 16-36%.

The conclusion from the model estimation result

indicated that jointly the independent i.e. rice

production, input cost, labor cost, and dummy

variable significantly affect the rice price at the rural

level. Meanwhile, partially the variables that

significantly affect the rice price at the rural level are

labor costs and districts dummy variable (D1 and D2),

while the rice production and input costs insignificant

affect the rice price in the local farm level (rural

market).

REFERENCES

Adam, M., Marwa, T., Azwardi, -, Thamrin, K. M. H., &

Bashir, A. (2017). Analysis of Rice Distribution in

South Sumatera, Indonesia. International Journal of

Economics and Financial Issues, 7(3), 166–171.

Azwardi, Bashir, A., Adam, M., & Marwa, T. (2016). The

effect of subsidy policy on food security of rice in

Indonesia. International Journal of Applied Business

and Economic Research, 14(13), 9009–9022.

Cheung, S. (2008). The Price of Rice: Market Integration

in Eighteenth-Century China. (S. Pearce, Ed.) (1st ed.,

Vol. 29). Washington D.C.: Center for East Asian

Studies, Western Washington University.

Chizari, A. H., Sani, M. F., & Kalashami, M. K. (2013).

Investigating Market Integration and Price

Transmission of Different Rice Qualities in Iran.

International Journal of Agricultural Management and

Development, 3(4), 219–225.

Emokaro, C. O., & Ayantoyinbo, A. A. (2014). Analysis of

Market Integration and Price Variation in Rice

Marketing in Osun State, Nigeria. American Journal of

Experimental Agriculture, 4(5), 601–618.

Marwa, T. (2001). Respon Pelaku Pasar Komoditi Beras

Terhadap Perubahan Variabel Harga dan Bukan

Harga di Provinsi Sumatera Selatan. Universitas

Padjadjaran.

Marwa, T., Bashir, A., Adam, M., Azwardi, & Thamrin, K.

M. . (2017). Market Integration of Agricultural

Products. International Journal of Economics and

Business Administration, 5(2), 69–82.

Meyer, J., & Cramon-Taubadel, S. (2004). Asymmetric

Price Transmission: A Survey. Journal of Agricultural

Economics, 55(3), 581–611.

Palaskas, T. B., & Harris-white, B. (1993). Testing Market

Integration - New Approaches With Case Material

From the West-Bengal Food Economy. Journal of

Development Studies, 30(1), 1–57.

Timmer, C. P. (2004). Food Security in Indonesia : Current

Challenges and the Lon-Run Outlook (No. 48).

Working Paper. Washington, D.C.

Vavra, P., & Goodwin, B. K. (2005). Analysis of Price

Transmission Along the Food Chain. OECD Food,

Agriculture and Fisheries Working Papers, (3), 1–58.

The Pattern Identification of Rice Pricing Determination in the Local Farmer Level

515