The Impact of Firm Characteristics on Mandatory Disclosure of

Companies Listed on the Indonesia Stock Exchange

Fitriasuri

1

, Didik Susetyo

2

, Inten Mutia

2

and Lukluk Fuadah

2

1

Bina Darma University, Palembang, Indonesia

2

Sriwijaya University, Palembang, Indonesia

Keywords: Impact, Firm Characteristic, Mandatory Disclosure. Z

Abstract: This study examines the impact of firm characteristics on mandatory corporate disclosures. The company

has an incentive to make mandatory disclosures. One is to show that the company has better performance

than other companies. This study aims to determine what characteristics of the company that influence the

mandatory disclosure. By using a sample of annual financial reports from 207 companies listed on the

Indonesian Stock Exchange (IDX) in 2017 and OLS analysis techniques this research was conducted. The

results prove that managerial ownership, foreign ownership, profitability and industry type affect the level

of mandatory corporate disclosure. Consistent with initial predictions, high managerial ownership

establishes management position and reduces public disclosure demands. As a result it reduces the level of

mandatory disclosure. On the other hand, high foreign ownership encourages management to make better

mandatory disclosures to meet the demands of foreign investors. A high level of profitability also

encourages better mandatory disclosure to show the performance to the market in order to get investors. The

demand for comprehensive reporting in the financial industry sector also encourages better mandatory

disclosure.

1 INTRODUCTION

The development of equity markets has increased

the demand for public disclosure by companies

(Choi and Meek, 2005). High disclosure is

considered as a form of protection for investors and

efforts to maintain value for shareholders. For this

reason, the quality of disclosures in financial

reporting is very valuable. In addition, the

development of equity markets also creates conflicts,

especially between managers who are known as

agents (company management) and principals or

shareholders. This has been stated long ago as

agency theory by Jensen and Meckling (1976).

Conflicts will arise when both the agent and

principal try to maximize their personal interests. As

a result, top management can take actions that are

not in accordance with the wishes of the capital

owner or even endanger the interests of the owner

(Kulik, 2005; Birjandi, Hakemi and Sadeghi, 2015).

This situation can lead to moral hazard within the

company (White, Lee and Tower, 2007). This can be

exacerbated by the existence of informational

asymmetry between agent and principle because the

agent as manager has more information than

principle (Beaver, 1989). One way to reduce the

superior position of management over information is

by providing public disclosure (Beaver, 1989).

The disclosure of financial statements consists of

two categories, namely mandatory disclosure

(mandatory disclosure) and voluntary disclosure

(voluntary disclosure). Mandatory disclosure is the

disclosure of certain elements of information

requested by parties that have authority over the

company while voluntary disclosure is additional

disclosure outside of mandatory disclosure (Popova

et al., 2013). Companies will tend to carry out

mandatory disclosures because they are asked by the

existing authorities. Nevertheless, the results of

previous studies show that the average disclosure of

mandatory companies in various countries does not

show a maximum level of disclosure. Mandatory

disclosure to companies in Germany, Australia,

France, Italy, the Netherlands and the United

Kingdom in 2004 to 2006 showed an average rate of

70% (Akman, 2011). Similarly, the level of

500

Fitriasuri, ., Susetyo, D., Meutia, I. and Fuadah, L.

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange.

DOI: 10.5220/0008441805000509

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 500-509

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

mandatory disclosure in Indonesia in manufacturing

companies listed on the Stock Exchange in 2009 to

2010 shows an average rate of 72% (Utami,

Suhardjanto and Hartoko, 2012).

The characteristics of the company in the

previous research are related to the level of

corporate disclosure. The underlying theory is

agency theory and signal theory (Haniffa and Cooke,

2002). According to agency theory which has been

explained previously, disclosure is a form of

accountability to owners in order to reduce conflict

and information asymmetry. Signal theory is also the

basis for understanding how two parties overcome

the limitations of information in a precontractual

context (Wells, Valacich and Hess, 2011). The

signal sender can choose what and how to

communicate to the other party (recipient) (Connelly

et al., 2011). Within the framework of signal theory,

information gaps are expected to be reduced and

recipients of information believe in the quality of the

product or service offered so that an expected

contract occurs (Wells, Valacich and Hess, 2011). In

accounting, signal theory is generally used to

explain the positive signal of management to the

market (McMillan, 2010). In this case superior

companies will display better information about

their activities to differentiate them from others so

that the trust and interest of investors increases

(Birjandi, Hakemi and Sadeghi, 2015). The

characteristics of the company are divided into three

categories, a) related to the structure (including size,

leverage, complexity, fixed assets and ownership

structure); b) Performance (profitability); and c)

related to markets (including industry type, auditor

type, age) (Haniffa and Cooke, 2002; Birjandi,

Hakemi and Sadeghi, 2015).

Until now the results of research on the impact of

firm characteristics on mandatory disclosure are still

being carried out because the results have not been

consistent. Although it succeeded in showing a

significant effect for several characteristic variables,

the direction of the relationship did not show the

same results. For industrial type variables, no

comparison has been made between the type of

financial industry and the type of non-financial

industry. For this reason, the author conducts

research on the impact of firm characteristics on

mandatory disclosure of companies in Indonesia.

2 LITERATURE REVIEW AND

HYPOTHESES

2.1 Company Size and Mandatory

Disclosure

Companies with large corporate size tend to

increase their mandatory disclosure because they

have the ability to allocate large resources in

collecting and presenting information and are highly

dependent on external financing in their operational

activities (Owusu-Ansah, 1998; Barako, Hancock

and Izan, 2006). In addition, large companies have

varied accounting activities and policy choices so

that disclosure is also higher and varied (Rahman,

Perera and Ganesh, 2002). Managers of large

companies are more aware of the benefits of

disclosure while managers of small companies tend

to feel that high disclosure can harm their

competitive position (Rouf, 2011; Elsakit and

Worthington, 2014). The cost of distributing

financial information to large companies is also

lower because large companies have more financial

expertise and resources than small companies

(Agyei-mensah, 2012). Owusu-Ansah (1998)

succeeded in proving that firm size has a positive

and significant effect on the mandatory disclosure

and reporting practices of companies.

H1. Company size has a positive effect on the

mandatory disclosure of the company.

2.2 Leverage and Mandatory

Disclosure

Leverage is the ratio of total debt to equity that is

considered to affect disclosure (Clemente and Labat,

2009; Iatridis, 2012; Murcia and Santos, 2012).

Based on signal theory, leverage can reduce

disclosure because high disclosure is more

emphasized for equity financing so that a high level

of leverage will reduce public pressure to disclose

(Ball, 1995; Meek, Roberts and Gray, 1995;

Rahman, Perera and Ganesh, 2002). Meanwhile

agency theory explains that companies with a large

proportion of debt have higher agency costs due to

increased wealth transfer potential to shareholders

and managers (Jensen and Meckling, 1976; Meek,

Roberts and Gray, 1995; Rahman, Perera and

Ganesh, 2002; Barako, Hancock and Izan, 2006;

Lopes and Rodrigues, 2007; Urquiza, Navarro and

Trombetta, 2010). In this case high debt levels

encourage increased disclosure to provide

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange

501

guarantees and to improve communication with

creditors (Watts and Zimmerman, 1990; Craig and

Diga, 1998; Clemente and Labat, 2009). High

disclosure is also needed to increase the opportunity

to obtain more funds from financial institutions

(Barako, Hancock and Izan, 2006; Agyei-Mensah,

2013).

H2. Leverage has a positive effect on the mandatory

disclosure of the company.

2.3 Complexity and Mandatory

Disclosure

Complexity is often interpreted as 'depth' or

'extent', of technology, products, processes and

administration (Wang and von Tunzelmann, 2000).

In companies with complex cases, the financial

statements also become complex and can have a

negative impact on the information environment

(Guay, Samuels and Taylor, 2016). Users tend to

have difficulty reading financial statements on

complex information so information asymmetry

tends to be high (Merkl-davies and Brennan, 2007).

For that disclosure of information outside of

financial statements is needed to minimize agency

conflicts and to increase the trust of investors

(Schwarcz, 2004). In companies with high

complexity, an effective management information

system is needed by encouraging increased

disclosure (Haniffa and Cooke, 2002; Alanezi et al.,

2012).

H3. Complexity has a positive effect on the

mandatory disclosure of the company

2.4 Assets in Place and Mandatory

Disclosure

Financial reporting is one way to reduce agency

problems (Jensen and Meckling, 1976; Healy and

Palepu, 2001). According to agency theory, large

corporate fixed assets have an impact on decreasing

agency costs. In conditions of low agency costs the

demands for disclosure are lower (Myers, 1977;

Haniffa and Cooke, 2002). Managers are more

difficult to misuse large fixed assets compared to

small fixed assets, thus reducing the company's

dependence on disclosure (Hossain and Hammami,

2009).

H4. Assets in place has a negative effect on the

mandatory disclosure of the company

2.5 Managerial Ownership and

Mandatory Disclosure

Management has an incentive to disclose

information to stakeholders in a number of different

ways (Donnelly and Mulcahy, 2008). Share

ownership by managers can motivate managers to

behave like shareholders and reduce managers'

desire to withhold information (Nikolaj Bukh et al.,

2005; Akhtaruddin et al., 2009). As a result, large

managerial ownership will increase disclosure

(Nagar, Nanda and Wysocki, 2003; Nikolaj Bukh et

al., 2005; Akhtaruddin et al., 2009). But on the other

hand additional managerial ownership can also

strengthen management positions so that disclosure

may decrease (Ajinkya, Bhojraj and Sengupta, 2005;

Donnelly and Mulcahy, 2008).

H5. Managerial Ownersip has a negative effect on

the mandatory disclosure of the company

2.6 Foreign Ownership and Mandatory

Disclosure

Ahmed & Nicholls (1994) revealed that differences

in disclosure rates occur between foreign-owned

companies and locally-owned companies because of

the need to disclose with different versions between

local regulations and regulations commonly known

by investors. The demands for presenting various

versions of disclosure will encourage high disclosure

(Craig and Diga, 1998). Foreign investors usually

agree to own companies with the belief that the

company will make a big profit. For this reason

foreign investors usually improve monitoring of

companies and companies will anticipate by

encouraging greater disclosure compliance (Bova

and Pereira, 2012). Therefore the demand for

disclosure will be greater when the proportion of

shares owned by foreigners is higher (Bradbury,

1991).

H6. Foreign Ownersip has a positive effect on the

mandatory disclosure of the company

2.7 Profitability and Mandatory

Disclosure

Profitability is a measure of operational

efficiency through the ratio of return on turnover or

the overall performance of a company through the

ratio of return on capital (Owusu-Ansah, 1998).

Companies that earn returns or profits have an

incentive to differentiate themselves from companies

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

502

that are less profitable in order to get capital from

existing choices (Meek, Roberts and Gray, 1995).

Therefore, companies with good performance are

more likely to make disclosures about potential

income in the future because it can affect potential

investors to invest in the company (Haniffa and

Cooke, 2002; Lokman, Mula and Cotter, 2011;

Agyei-mensah, 2012; Alanezi et al., 2012;

Balakrishnan, Li and Yang, 2014). Profitability is

also the result of investment, thus encouraging

companies to make higher disclosures as an

important signal that the owner's investment

decisions are appropriate (Li, Pike and Haniffa,

2008).

H7. Profitability has a positive effect on the

mandatory disclosure of the company

2.8 Industry Type and mandatory

disclosure

Corporate disclosure practices are usually

different for different industries, determined by the

type of product line or product diversity. For

example, companies with consumer products are

usually very concerned about their public image or

multi-product companies that have more information

than companies with one product (Owusu-Ansah,

1998; Haniffa and Cooke, 2002). In addition, certain

industries are more sensitive than others such as

banks that have great pressure to disclose (Craig and

Diga, 1998). Disclosure is also more comprehensive

in several industries such as utilities and the

financial services sector when compared to the

publishing industry due to different ownership costs

(Boesso and Kumar, 2007).

H8. Industry Type has an effect on the mandatory

disclosure of the company

2.9 Company Age and mandatory

disclosure

Many companies that have just joined the stock

market have low disclosure quality because they are

more oriented and concentrate on developing

technology, products or markets and assessing less

important accounting functions (Glaum and Street,

2003). On the other hand, a number of newly

registered companies want to increase additional

capital at the lowest cost so that they disclose more

information to increase the trust of investors

(Haniffa and Cooke, 2002; Li, Pike and Haniffa,

2008). Newly joined companies do not yet have

experience in terms of disclosure so often assume

that they will get competitive losses if they disclose

certain information such as research costs and will

spend large disclosure costs (Owusu-Ansah, 1998;

Hossain and Hammami, 2009; Popova et al., 2013).

H9. Company age has a positive effect on the

mandatory disclosure of the company

3 RESEARCH METHODE

3.1 Regression Models

Mand_Disc = β

0

+β

1

X

1

+β

2

X

2

+β

3

X

3

+β

4

X

4

+β

5

X

5

+β

6

X

6

+β

7

X

7

+β

8

X

8

+β

9

X

9

+e

1

(1)

Mand_Disc is level of mandatory disclosure

scaled by index of mandatory disclosure. In order to

measure the level of mandatory disclosure, a non-

weighted approach is used, which is an approach

that assumes that each item is equally important. A

score of one is given to items that are disclosed in

annual report and zero scores for undisclosed items.

Non-weighted index is the ratio of the number of

items with a score of one divided by total disclosure

or total disclosure (TD). This study uses a

mandatory disclosure index with a non-weighted

approach follows OJK Circular Letter No. 30 /

SEOJK.04 / 2016 concerning of 244 items of

disclosure. X

1

is the company size as measured by

the stock market capitalization value. X

2

is leverage

measured by a debt to equity ratio. X3 is complexity

as measured by the number of branches owned by

the company. X

4

is assets in place as measured by

the ratio of a company's fixed assets to total assets.

X

5

is managerial ownership as measured by the ratio

of managerial ownership to total shares. X

6

is

foreign ownership as measured by the ratio of

foreign ownership to total shares. X

7

is profitability

as measured by the return on investment ratio. X

8

is

type of industry dummy variables. Industrial

variables are measured with a value of 1 and 0

where the financial sector is given a value of 1 and

non-financial sector is given a zero value. X9 is

company age measured by the age of the company

listed on the stock exchange.

3.2 Sample Selection

The population of this research company listed

on the Indonesia Stock Exchange in 2017 was 559

companies (IDX, 2017). These companies are

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange

503

divided into sectoral classification systems called

Jakarta Stock Industrial Classification (JASICA).

The sample is determined by proportionate stratified

random sampling technique which is a sampling

technique where the population elements that have a

group are selected proportionally depending on the

amount in the group. This technique is used to

obtain samples that represent proportionally all

sector categories. Based on the sampling technique,

the minimum sample is 229 samples for a 5%

precision level.

4 RESULTS AND DISCUSSION

4.1 Descriptive Statistics

A number of 229 annual reports from the

IDX website have been collected. A number of

reports that cannot be used due to file damage. A

number of annual reports also have very poor

display quality so they cannot be used. Final results

obtained 207 reports that can be used. Table 1

presents descriptive results of a statistic. The table

presents the lowest, highest and average values for

each variable. Mandatory corporate disclosure

shows an average value of 0.67 or 67%.

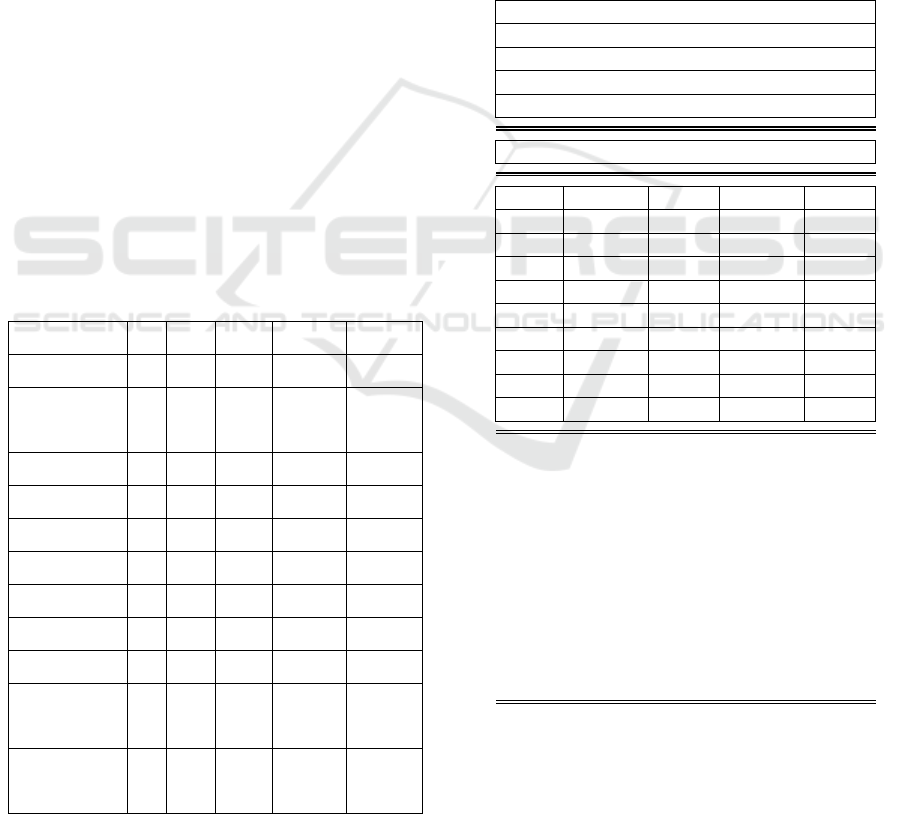

Table 1 : Descriptive Statistics

N

Min

Max

Mean

Std. Dev

Y(Mand_Disc)

207

.41

.94

.6685

.12051

X1

(Comp_Size)

207

.01

550.18

18.2374

62.94026

X2 (Leverage)

207

.01

82.38

2.2182

6.05353

X3 (Assets_IP)

207

1.00

213.00

8.9179

17.93159

X4 (Complex)

207

.00

.94

.2700

.24527

X5 (Mng_Own)

207

.00

.95

.0629

.15470

X6 (For_Own)

207

.00

.99

.3041

.31615

X7 (Profit)

207

-2.00

.85

.0658

.23470

X8 (Ind_Type)

207

.00

1.00

.1836

.38808

X9

(Comp_Age)

207

1

38

17.45

9.429

Valid N

(listwise)

207

The average value of the variables x1 and x3 is

much smaller than the standard deviation. This

condition shows that there is a very large difference

in the value of the sample used. This is because the

author takes a random sample and does not

differentiate the size of the company from the value

of the market capitalization of its shares and assets.

As a result, the sample is very diverse from small

category companies to very large companies.

4.2 Regression Results

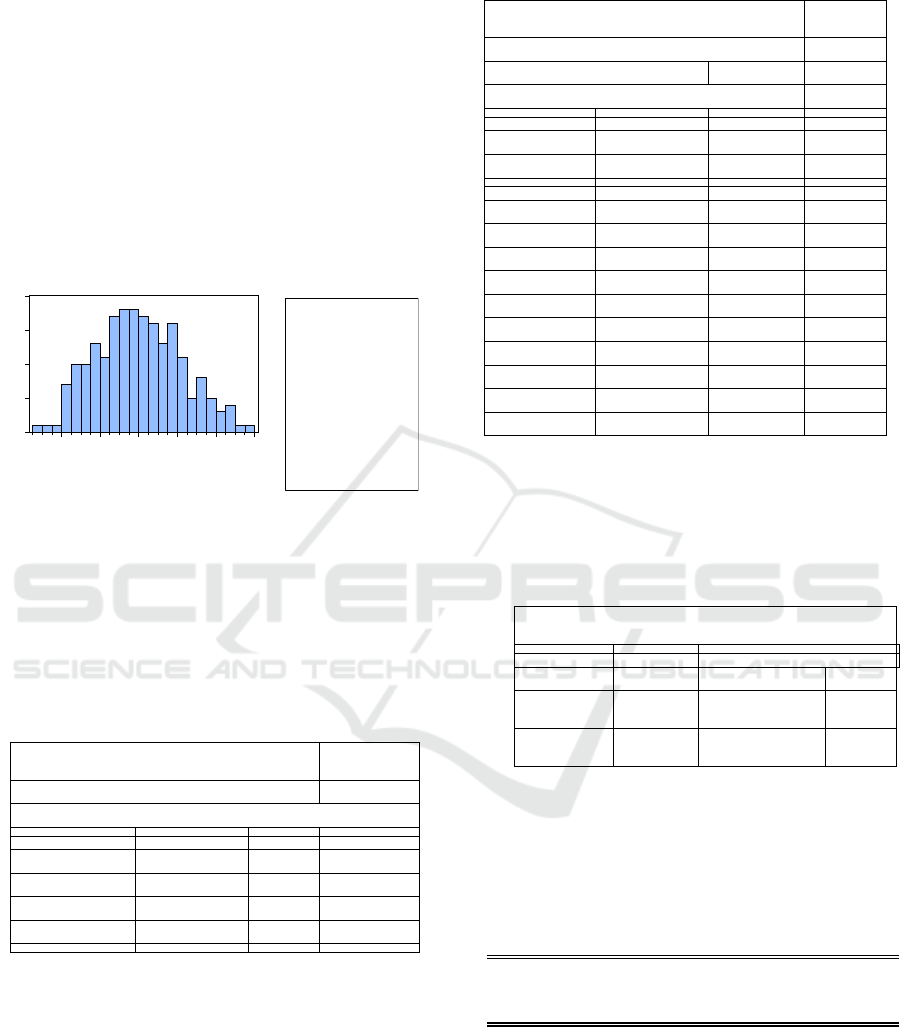

Regression analysis results can be seen in Table

2 below:

Table 2: Regression Results

Dependent Variable: Mand_Disc

Method: Least Squares

Date: 08/08/18 Time: 15:20

Sample: 1 207

Included observations: 207

Var

Coefficient

Std. Error

t-Statistic

Prob.

C

0.651453

0.022287

29.23044

0.0000

X1

0.000149

0.000137

1.088027

0.2779

X2

0.001293

0.001330

0.971883

0.3323

X3

0.000759

0.000477

1.589618

0.1135

X4

-0.002351

0.037167

-0.063248

0.9496

X5

-0.092826

0.052488

-1.768543

0.0785

X6

0.045446

0.027434

1.656555

0.0992

X7

0.108052

0.035051

3.082687

0.0023

X8

0.061668

0.023594

2.613742

0.0096

X9

-0.001227

0.000903

-1.358235

0.1759

R-squared

0.159428

Mean dependent var

0.668454

Adjusted

R-squared

0.121026

S.D. dependent var

0.120515

S.E. of

regression

0.112987

Akaike info criterion

-1.475986

Sum

squared

resid

2.514911

Schwarz criterion

-1.314985

Log

likelihood

162.7645

Hannan-Quinn criter.

-1.410878

F-statistic

4.151585

Durbin-Watson stat

1.809766

Prob(F-

statistic)

0.000064

From the results of calculations in Table 2. It

can be seen that the simultaneous testing obtained

the value of prob. F-statistic of 0.0000 smaller than

alpha 0.05. Thus the estimated regression model is

feasible to explain the effect of independent

variables on the dependent variable. This result also

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

504

shows that overall all independent variables affect

the mandatory disclosure of the company. In partial

testing the independent variable on the dependent

variable shows that partially only variables x5, x6,

x7 and x8 have a significant influence on the

variables of mandatory disclosure because of the

prob value. <alpha 0.05 for the level of significance

of 5% and 10%.

This multiple regression equation has through

the normality test, linearity test, multicollinearity

test, heteroscedasticity test and autocorrelation test.

The results can be seen in the following table and

figure.

0

5

10

15

20

-0.2 -0.1 0.0 0.1 0.2 0.3

Series: Residuals

Sample 1 207

Observations 207

Mean 7.98e-18

Median -0.006360

Maximum 0.299485

Minimum -0.272937

Std. Dev. 0.110491

Skewness 0.197751

Kurtosis 2.584910

Jarque-Bera 2.835224

Probability 0.242292

Figure 1 : Normality Test

The normality test is conducted using Jarque-

Bera Test. The results show that the Jarque-Bera

probability value is greater than alpha 0.05.

Therefore, it can be concluded that residuals are

normally distributed.

Table 3 : Linearity Test

Ramsey RESET Test

Equation: UNTITLED

Omitted Variables: Squares of fitted values

Value

df

Probability

t-statistic

0.940099

196

0.3483

F-statistic

0.883786

(1, 196)

0.3483

Likelihood ratio

0.931288

1

0.3345

Based on the results of calculations in Table 3.

Prob.F calculated value is 0.3483 greater than alpha

level 0.05 so that this regression model meets the

assumption of linearity.

Table 4: Multicollinearity Test

Variance Inflation Factors

Date: 08/08/18 Time: 15:22

Sample: 1 207

Included observations: 207

Coefficient

Uncentered

Centered

Variable

Variance

VIF

VIF

C

0.000497

8.053951

NA

X1

1.86E-08

1.292100

1.191571

X2

1.77E-06

1.187653

1.046464

X3

2.28E-07

1.477046

1.183023

X4

0.001381

2.974467

1.341014

X5

0.002755

1.240232

1.063583

X6

0.000753

2.341693

1.213949

X7

0.001229

1.178244

1.091935

X8

0.000557

1.700600

1.380197

X9

8.16E-07

5.203239

1.171080

Based on the calculation results in Table 4. The

VIF values of all independent variables are smaller

than 10 so it can be concluded that there is no

multicollinearity.

Table 5 : Heteroskedasticity Test

Based on the results of calculations in Table 5.

Prob.F calculated value is 0.3694 greater than alpha

0.05 so that there is no heteroscedasticity.

Table 6 : Autocorrelation Test

Based on the results of calculations in Table 6.

Prob.F value is 0.0967 greater than alpha 0.05 so it

can be concluded that there is no autocorrelation

problem. The results show that the regression model

tested has fulfilled all OLS assumptions so that the

resulting estimator has properties that are unbiased,

linear and have a minimum variance.

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic

1.093185

Prob. F(9,197)

0.3694

Obs*

R-squared

9.846337

Prob.

Chi-Square(9)

0.3631

Scaled

explained SS

7.067097

Prob.

Chi-Square(9)

0.6301

Breusch-Godfrey Serial Correlation LM Test:

F-statistic

2.363993

Prob. F(2,195)

0.0967

Obs*R-squared

4.900129

Prob. Chi-Square(2)

0.0863

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange

505

The results of multiple regression analysis show

that manager ownership negatively affects

mandatory disclosure with probable values. 0.078

And the coefficient shows a negative value of -

0.0928 at the level of significance of 10%. This

result is consistent with the initial hypothesis that

high managerial ownership of the company will

strengthen management positions and reduce

pressure to make high disclosures (Ajinkya, Bhojraj

and Sengupta, 2005; Donnelly and Mulcahy, 2008).

These results contradict the results found by Owusu-

Ansah (1998) which show that the management

structure of a company (corporate insider) has a

positive and significant relationship to the practice

of mandatory disclosure of companies.

Furthermore, the results of multiple regression

analysis also show that foreign ownership has a

positive effect on mandatory disclosure with

probable values. 0.099 and the coefficient shows a

positive value of 0.045. It also shows that foreign

capital will increase managers' motivation to make

extensive disclosures because foreign investors are

more interested in having companies that can show

potential future results (Bova and Pereira, 2012).

These results also show that the Company

anticipates investors' needs through increasing their

mandatory disclosures.

Furthermore, profitability proved to have a

positive influence on mandatory disclosure with

probable value. 0.0023 and a coefficient that shows

a positive value of 0.108. This result supports signal

theory and several previous studies which say that

companies with high profits have an incentive to

distinguish themselves from companies that are less

profitable (Meek, Roberts and Gray, 1995).

Companies with good performance are more likely

to disclose mandatory about potential income in the

future to attract investors (Haniffa and Cooke, 2002;

Lokman, Mula and Cotter, 2011; Agyei-mensah,

2012; Alanezi et al., 2012; Balakrishnan, Li and

Yang, 2014). It also supports agency theory which

says that management with good financial

performance seeks to increase compensation for

itself by increasing disclosure. Increased disclosure

will increase corporate value which is the basis of

management compensation and determines the value

of human capital in a competitive labor market

(Barako, 2007; Rouf, 2011).

Then the industry type is proven to influence

the mandatory disclosure with prob value. 0.0096

and the coefficient shows a positive value of 0.0616.

This variable uses a dummy value to distinguish

between the non-financial sector and the financial

sector. Probability value. 0.0096 shows this variable

is significant at the level of significance of 5%. In

this study the financial sector was given a value of 1

while the non-financial sector was given a value of

0. Regression coefficients with positive values

indicate that the financial sector tends to have

mandatory disclosure better than the non-financial

sector. These results support the results of previous

studies which say that industries that are politically

more sensitive than others such as banks have a

greater level of disclosure (Craig and Diga, 1998). In

addition in some industries such as utilities and

financial services, disclosure is also more

comprehensive (Boesso and Kumar, 2007). Besides

this result also supports signal theory which says

that companies try to convey information as an easy

way to distinguish themselves from other companies

in a variety of markets related to the characteristics

of the company (Healy and Palepu, 2001; Meng,

Zeng and Tam, 2013; Birjandi, Hakemi and Sadeghi,

2015).

5 CONCLUSION

The results of this study indicate that overall the

variables of the company's characteristics affect the

mandatory disclosure of the company. Managerial

ownership has a negative effect on mandatory

disclosure, which means that higher managerial

ownership will eliminate dependence on disclosure,

thereby reducing the level of mandatory disclosure.

Furthermore, foreign ownership and profitability

have a positive effect on mandatory disclosure,

which means that the higher the level of foreign

ownership and the level of profitability, the higher

the level of mandatory disclosure of the company.

Then the type of financial sector industry makes

mandatory disclosure higher than the non-financial

sector.

6 LIMITATION AND FUTURE

RESEARCH

The author realizes that there are many

limitations in this study, including the use of cross

section data for only one year of the annual report.

Besides that for mandatory disclosure authors have

not specifically separated the sub-sections / sub-

themes. For future research the authors propose that

research can be extended to the sub-section of the

themes of mandatory disclosure and use of panel

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

506

data for several years of annual reports so that

differences and changes can be described.

REFERENCES

Agyei-mensah, B. K. (2012) ‘Association between firm-

specific characteristics and levels of disclosure of

financial information of rural banks in the Ashanti

region of Ghana’, Journal of applied finance &

banking, 2(1), pp. 69–92.

Agyei-Mensah, B. K. (2013) ‘Adoption of International

Financial Reporting Standards (IFRS) in Ghana and

the Quality of Financial Statement Disclosures’,

International Journal of Accounting and Financial

Reporting, 3(2), pp. 269–286. doi:

10.5296/ijafr.v3i2.4489.

Ahmed, K. and Nicholls, D. (1994) ‘The impact of

non.financial company Characteristics on Mandatory

Disclosure Compliance in Developing Countries : The

Case of Bangladesh’, The International Journal of

Accounting, 19(3), pp. 62–77.

Ajinkya, B., Bhojraj, S. and Sengupta, P. (2005) ‘The

association between outside directors, institutional

investors and the properties of management earnings

forecasts’, Journal of Accounting Research, 43(3), pp.

343–376. doi: 10.1111/j.1475-679x.2005.00174.x.

Akhtaruddin, M. et al. (2009) ‘Corporate Governance and

Voluntary Disclosure in Corporate Annual Reports of

Malaysian Listed Firms’, Jamar, 7(1), pp. 1–20.

Akman, N. H. (2011) ‘The Effect of IFRS Adoption on

Financial Disclosure : Does Culture Still Play A

Role ?’, American International Journal of

Contemporary Research, 1(1), pp. 6–17.

Alanezi, F. S. et al. (2012) ‘Dual / joint auditors and the

level of compliance with international financial

reporting standards ( IFRS-required disclosure ) The

case of financial institutions in Kuwait’, Journal of

Economic and Administrative Sciences, 28(2), pp.

109–129. doi: 10.1108/10264111211248402.

Balakrishnan, K., Li, X. and Yang, H. (2014) Mandatory

Financial Reporting and Voluntary Disclosure :

Evidence from Mandatory IFRS Adoption, Wharton

School of Business.

Ball, R. (1995) ‘Making Accounting More International:

Why, How, and How Far Will It Go?’, Journal of

Applied Corporate Finance, pp. 19–29. Available at:

http://faculty.chicagobooth.edu/ray.ball/research/Paper

s/1995 Making Accounting More International.pdf.

Barako, D. G. (2007) ‘Determinants of voluntary

disclosures in Kenyan companies annual reports’,

African Journal of Business Management, 1(5), pp.

113–128.

Barako, D. G., Hancock, P. and Izan, H. Y. (2006)

‘Factors influencing voluntary corporate disclosure by

Kenyan companies’, Corporate Governance, 14(2),

pp. 107–125. doi: 10.1111/j.1467-8683.2006.00491.x.

Beaver, W. H. (1989) Financial reporting : an accounting

revolution. Second Edi. Englewood, NJ: Prentice-Hall

Inc.

Birjandi, H., Hakemi, B. and Sadeghi, M. M. M. (2015)

‘The study effect agency theory and signaling theory

on the level of voluntary disclosure of listed

companies in Tehran Stock Exchange’, Research

Journal of Finance and Accounting, 6(1), pp. 174–

184.

Boesso, G. and Kumar, K. (2007) ‘Drivers of corporate

voluntary disclosure’, Accounting, Auditing &

Accountability Journal, 20(2), pp. 269–296. doi:

10.1108/09513570710741028.

Bova, F. and Pereira, R. (2012) ‘The Determinants and

Consequences of Heterogeneous IFRS Compliance

Levels Following Mandatory IFRS Adoption:

Evidence from a Developing Country’, Journal Of

International Accounting Research, 11(1), pp. 83–111.

doi: 10.2308/jiar-10211.

Bradbury, M. E. (1991) ‘Characteristics of firms and

voluntary interim earnings disclosures: New Zealand

evidence’, Pacific Accounting Review, 3(1), pp. 37–

62.

Choi, F. D. and Meek, G. K. (2005) International

Accounting. Jakarta: Salemba Empat.

Clemente, A. G. and Labat, B. N. (2009) ‘Corporate

Governance Mechanisms And Voluntary Disclosure.

The Role Of Independent Directors In The Boards Of

Listed Spanish Firms’, International Journal of

Accounting Information Systems, 5, pp. 5–24.

Connelly, B. L. et al. (2011) ‘Signaling Theory: A Review

and Assessment’, Journal of Management, 37(1), pp.

39–67. doi: 10.1177/0149206310388419.

Craig, R. and Diga, J. (1998) ‘Corporate accounting

disclosure in ASEAN’, Journal of International

Financial Management and Accounting, 9(3), pp.

246–274. doi: 10.1111/1467-646X.00039.

Donnelly, R. and Mulcahy, M. (2008) ‘Board structure,

ownership, and voluntary disclosure in Ireland’,

Corporate Governance, 16(5), pp. 416–429. doi:

10.1111/j.1467-8683.2008.00692.x.

Elsakit, O. M. and Worthington, A. C. (2014) ‘The Impact

of Corporate Characteristics and Corporate

Governance on Corporate Social and Environmental

Disclosure : A Literature Review’, International

Journal of Business and Management, 9(9), pp. 1–15.

doi: 10.5539/ijbm.v9n9p1.

Glaum, M. and Street, D. L. (2003) ‘Compliance with the

Disclosure Requirements of Germany ’ s New

Market : IAS Versus US GAAP’, Journal of

International Financial Management and Accounting,

14(1), pp. 64–100.

Guay, W., Samuels, D. and Taylor, D. (2016) ‘Guiding

Through the Fog : Financial Statement Complexity

and Voluntary Disclosure’, Journal of Accounting and

Economics, 62(2), pp. 234–269.

Haniffa, R. M. and Cooke, T. E. (2002) ‘Culture ,

Corporate Governance and Disclosure in Malaysian

Corporations’, 38(3), pp. 317–349.

Healy, P. M. and Palepu, K. G. (2001) ‘Information

asymmetry, corporate disclosure, and the capital

markets: a review of the empirical disclosure

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange

507

literature’, Journal of Accounting and Economics,

31(1), pp. 405–440.

Hossain, M. and Hammami, H. (2009) ‘Voluntary

disclosure in the annual reports of an emerging

country: The case of Qatar’, Advances in Accounting.

Elsevier Ltd, 25(2), pp. 255–265. doi:

10.1016/j.adiac.2009.08.002.

Iatridis, G. E. (2012) ‘Voluntary IFRS disclosures :

evidence from the transition from UK GAAP to

IFRSs’, Managerial Auditing Journal, 27(6), pp. 573–

597. doi: 10.1108/02686901211236409.

IDX (2017) IDX Fact Book 2017. Edited by R. and D.

Division. Jakarta: PT Bursa Efek Indonesia.

Jensen, M. C. and Meckling, W. H. (1976) ‘Theory of the

Firm : Managerial Behavior , Agency Costs and

Ownership Structure’, Journal of Financial

Economics, 3, pp. 305–360. doi: doi:10.1016/0304-

405X(76)90026-X.

Kulik, B. W. (2005) ‘Agency Theory , Reasoning and

Culture at Enron : In Search of a Solution’, Journal of

Business Ethics, 59(4), pp. 347–360. doi:

10.1007/s10551-004-7308-2.

Li, J., Pike, R. and Haniffa, R. (2008) ‘Intellectual capital

disclosure and corporate governance structure in UK

firms’, Accounting and Business Research, 38(2), pp.

137–159. doi: 10.1093/bjsw/bcs140.

Lokman, N., Mula, J. M. and Cotter, J. (2011) ‘Corporate

governance quality and voluntary disclosures of

corporate governance information: Practices of listed

Malaysian family controlled businesses’, in Family

Business Research and Education Symposium (Family

Business Australia), pp. 1–21.

Lopes, P. T. and Rodrigues, L. L. (2007) ‘Accounting for

financial instruments: An analysis of the determinants

of disclosure in the Portuguese stock exchange’,

International Journal of Accounting, 42(1), pp. 25–56.

doi: 10.1016/j.intacc.2006.12.002.

McMillan, B. (2010) An Empirical Examination Of The

Effects Of Ethics, Disclosure, And Signal Theory On

Disciplinary Actions Within The Accounting

Profession. Louisiana Tech University. doi:

10.1142/S1084946711001896.

Meek, G. K., Roberts, C. B. and Gray, S. J. (1995)

‘Factors Influencing Valuntary Annual Report

Disclosures by US, UK and Continential European

Multinational Corporations’, Journal of International

Business Studies, pp. 555–572. doi:

10.1057/palgrave.jibs.8490186.

Meng, X. H., Zeng, S. X. and Tam, C. M. (2013) ‘From

Voluntarism to Regulation: A Study on Ownership,

Economic Performance and Corporate Environmental

Information Disclosure in China’, Journal of Business

Ethics, 116(1), pp. 217–232. doi: 10.1007/s10551-

012-1462-8.

Merkl-davies, D. M. and Brennan, N. M. (2007)

‘Discretionary disclosure strategies in corporate

narratives : incremental information or impression

management ? ’, Journal of Accounting Literature, 26,

pp. 116–196. Available at:

http://hdl.handle.net/10197/2907.

Murcia, F. D. R. and Santos, A. Dos (2012)

‘Discretionary-based disclosure: Evidence from the

Brazilian market’, BAR - Brazilian Administration

Review, 9(1), pp. 88–109. doi: 10.1590/S1807-

76922012000100006.

Myers, S. C. (1977) ‘Determinants of corporate

borrowing’, Journal of Financial Economics, 5(2), pp.

147–175. doi: 10.1016/0304-405X(77)90015-0.

Nagar, V., Nanda, D. and Wysocki, P. (2003)

‘Discretionary disclosure and stock-based incentives’,

Journal of Accounting and Economics, 34(1–3), pp.

283–309. doi: 10.1016/S0165-4101(02)00075-7.

Nikolaj Bukh, P. et al. (2005) ‘Disclosure of information

on intellectual capital in Danish IPO prospectuses’,

Accounting, Auditing & Accountability Journal, 18(6),

pp. 713–732. doi: 10.1108/09513570510627685.

Owusu-Ansah, S. (1998) ‘The impact of corporate

attribites on the extent of mandatory disclosure and

reporting by listed companies in Zimbabwe’, The

International Journal of Accounting, 33(5), pp. 605–

631. doi: 10.1016/S0020-7063(98)90015-2.

Popova, T. et al. (2013) ‘Mandatory Disclosure and Its

Impact on the Company Value’, International

Business Research, 6(5), pp. 1–16. doi:

10.5539/ibr.v6n5p1.

Rahman, A., Perera, H. and Ganesh, S. (2002)

‘Accounting Practice Harmony, Accounting

Regulation and Firm Characteristics’, Abacus, 38(1),

pp. 46–77. doi: 10.1111/1467-6281.00097.

Rouf, A. (2011) ‘Corporate characteristics, governance

attributes and the extent of voluntary disclosure in

Bangladesh’, African Journal of Business

Management, 5(19), pp. 7836–7845. doi:

10.5897/AJBM10.1180.

Schwarcz, S. L. (2004) ‘Rethinking the disclosure

paradigm in a world of complexity’, University of

Illinois Law Review, (1), pp. 1–37. doi:

dx.doi.org/10.2139/ssrn.336685.

Urquiza, F. B., Navarro, M. C. A. and Trombetta, M.

(2010) ‘Disclosure theories and disclosure measures’,

Revista Espanola de Financiacion y Contabilidad,

39(147), pp. 393–415. doi:

10.1080/02102412.2010.10779686.

Utami, W. D., Suhardjanto, D. and Hartoko, S. (2012)

‘Investigasi Dalam Konvergensi IFRS Di Indonesia :

Tingkat Kepatuhan Pengungkapan Wajib Dan

Kaitannya Dengan Mekanisme Corporate

Governance’, in Simposium Nasional AKuntan di

Banjarmasin, pp. 20–23. doi:

10.1017/CBO9781107415324.004.

Wang, Q. and von Tunzelmann, N. (2000) ‘Complexity

and the functions of the firm: breadth and depth’,

Research Policy, 29(7–8), pp. 805–818. doi:

10.1016/S0048-7333(00)00106-2.

Watts, R. L. and Zimmerman, J. L. (1990) ‘Accounting

Year Theory : Ten Perspective’, Review Literature

And Arts Of The Americas, 65(1), pp. 131–156. doi:

10.2307/247880.

Wells, J. D., Valacich, J. S. and Hess, T. J. (2011) ‘What

Signals Are You Sending? How Website Quality

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

508

Influences Perceptions of Product Quality and

Purchase Intentions.’, MIS Quarterly, 35(2), pp. 373–

396. doi: Article.

White, G., Lee, A. and Tower, G. (2007) ‘Drivers of

voluntary intellectual capital disclosure in listed

biotechnology companies’, Journal of Intellectual

Capital, 8(3), pp. 517–537. doi:

10.1108/14691930710774894.

The Impact of Firm Characteristics on Mandatory Disclosure of Companies Listed on the Indonesia Stock Exchange

509